Accounting > STUDY GUIDE > Liberty University ACCT 301 - 301assuming the customer made the correct payment (All)

Liberty University ACCT 301 - 301assuming the customer made the correct payment

Document Content and Description Below

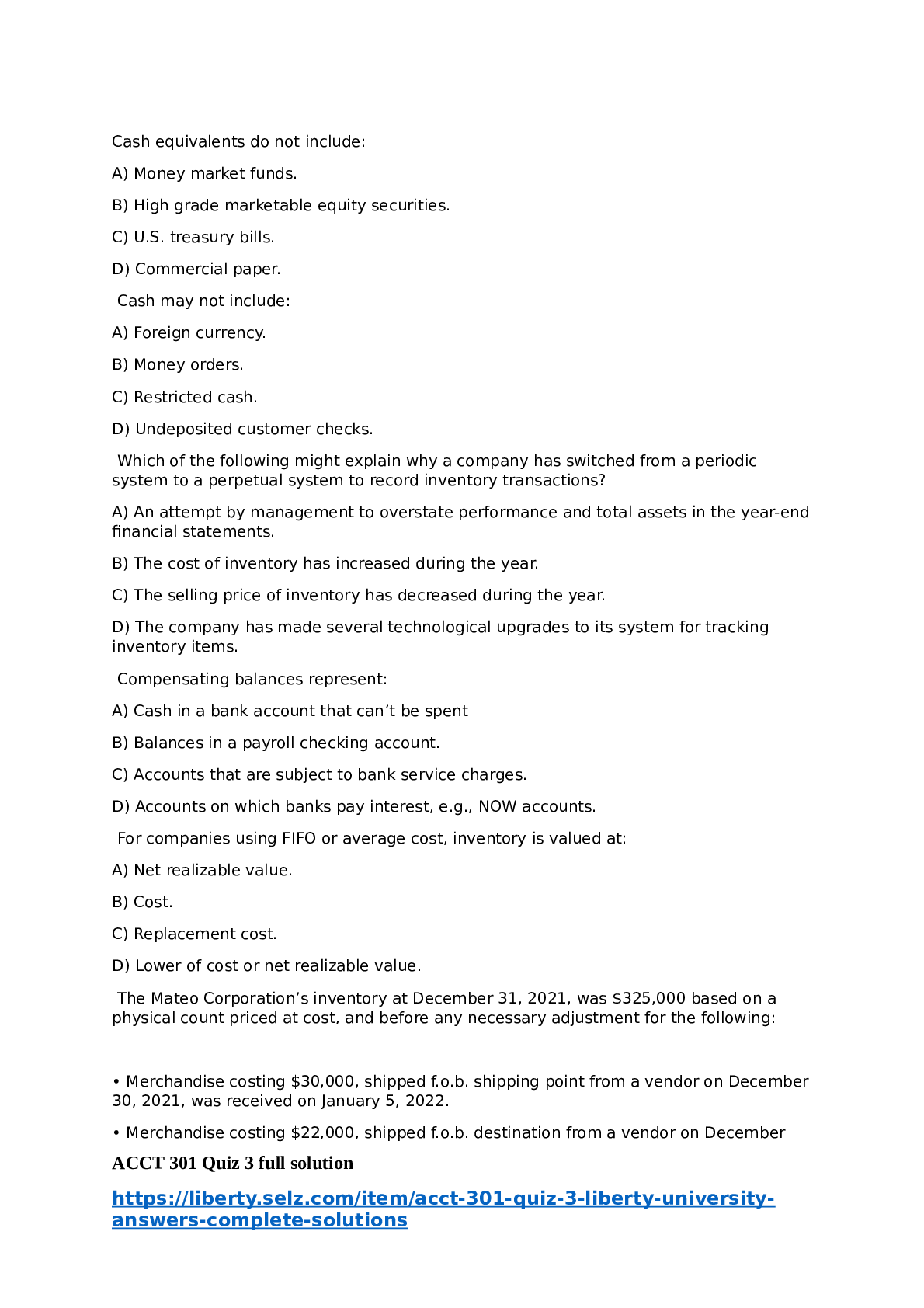

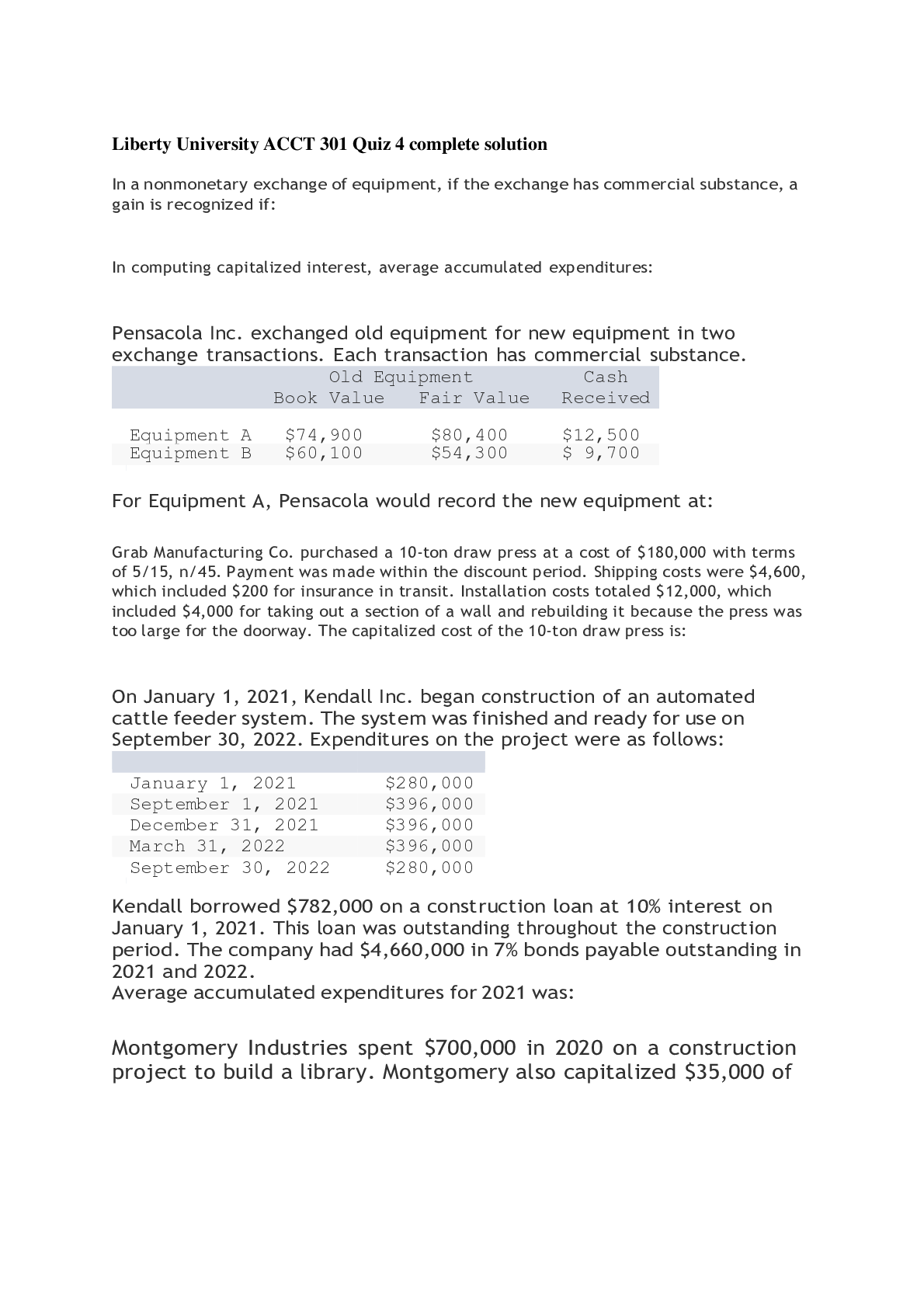

Cash equivalents do not include: A) Money market funds. B) High grade marketable equity securities. C) U.S. treasury bills. D) Commercial paper. Cash may not include: A) Foreign currency. B) M... oney orders. C) Restricted cash. D) Undeposited customer checks. Which of the following might explain why a company has switched from a periodic system to a perpetual system to record inventory transactions? A) An attempt by management to overstate performance and total assets in the year-end financial statements. B) The cost of inventory has increased during the year. C) The selling price of inventory has decreased during the year. D) The company has made several technological upgrades to its system for tracking inventory items. Compensating balances represent: A) Cash in a bank account that can’t be spent B) Balances in a payroll checking account. C) Accounts that are subject to bank service charges. D) Accounts on which banks pay interest, e.g., NOW accounts. For companies using FIFO or average cost, inventory is valued at: A) Net realizable value. B) Cost. C) Replacement cost. D) Lower of cost or net realizable value. The Mateo Corporation’s inventory at December 31, 2021, was $325,000 based on a physical count priced at cost, and before any necessary adjustment for the following: • Merchandise costing $30,000, shipped f.o.b. shipping point from a vendor on December 30, 2021, was received on January 5, 2022. • Merchandise costing $22,000, shipped f.o.b. destination from a vendor on December ACCT 301 Quiz 3 full solution https://liberty.selz.com/item/acct-301-quiz-3-liberty-universityanswers-complete-solutions 28, 2021, was received on January 3, 2022. • Merchandise costing $38,000 was shipped to a customer f.o.b. destination on December 28, arrived at the customer’s location on January 6, 2022. • Merchandise costing $12,000 was being held on consignment by Traynor Company. What amount should Mateo Corporation report as inventory in its December 31, 2021, balance sheet? A) $367,000. B) $427,000. C) $405,000. D) $325,000. An argument against use of the lower of cost or net realizable value rule is its lack of: A) Relevance. B) Reliability. C) Consistency. D) Objectivity. Cash that is restricted and not available for current operations is reported in the balance sheet as: A) Equity. B) Investments. C) Liabilities. D) A separate section between liabilities and equity. Ending inventory is equal to the cost of items on hand plus: A) Items in transit sold f.o.b. shipping point. B) Purchases in transit f.o.b. destination. C) Items in transit sold f.o.b. destination. D) None of these answer choices is correct. A company implements the following policy regarding inventory in transit: Goods purchased are included in inventory records, while goods sold are not included in inventory records. Management feels this policy is reasonable because it assigns inventory in transit to the party that initiated the transactions. Which of the following concepts is management not considering in implementing this policy? A) The likelihood that inventory purchased or sold will be returned. B) The quantity of the inventory involved in the transaction. C) The party who has title to the inventory while in transit. ACCT 301 Quiz 3 full solution https://liberty.selz.com/item/acct-301-quiz-3-liberty-universityanswers-complete-solutions D) The materiality of shipping costs. Logistics Company had the following items listed in its trial balance at 12/31/2021: Balance in checking account, Bank of the East $ 442,000 Treasury bills, purchased on 11/1/2021, mature on 1/30/2022 20,000 Loan payable, long-term, Bank of the East 300,000 Included in the checking account balance is $50,000 of restricted cash that Bank of the East requires as a compensating balance for the $300,000 note. What amount will Logistics include in its year-end balance sheet as cash and cash equivalents? A) $412,000. B) $462,000. C) $392,000. D) $442,000. Management has adopted a policy of reporting its unsold inventory at the end of each year at the lower of FIFO cost or the most recent selling price of that inventory in the current year. Which of the following statements is correct? A) Management should instead choose the higher of the two amounts to report inventory. B) Management should instead compare the inventory’s cost to an estimate of its selling price in the next year. C) Management’s policy is acceptable. [Show More]

Last updated: 1 year ago

Preview 1 out of 21 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 21, 2021

Number of pages

21

Written in

Additional information

This document has been written for:

Uploaded

Aug 21, 2021

Downloads

0

Views

36

.png)

.png)

.png)

.png)