Economics > QUESTIONS & ANSWERS > University of Arizona: ECON 332 Final Exam. Scored 97% (All)

University of Arizona: ECON 332 Final Exam. Scored 97%

Document Content and Description Below

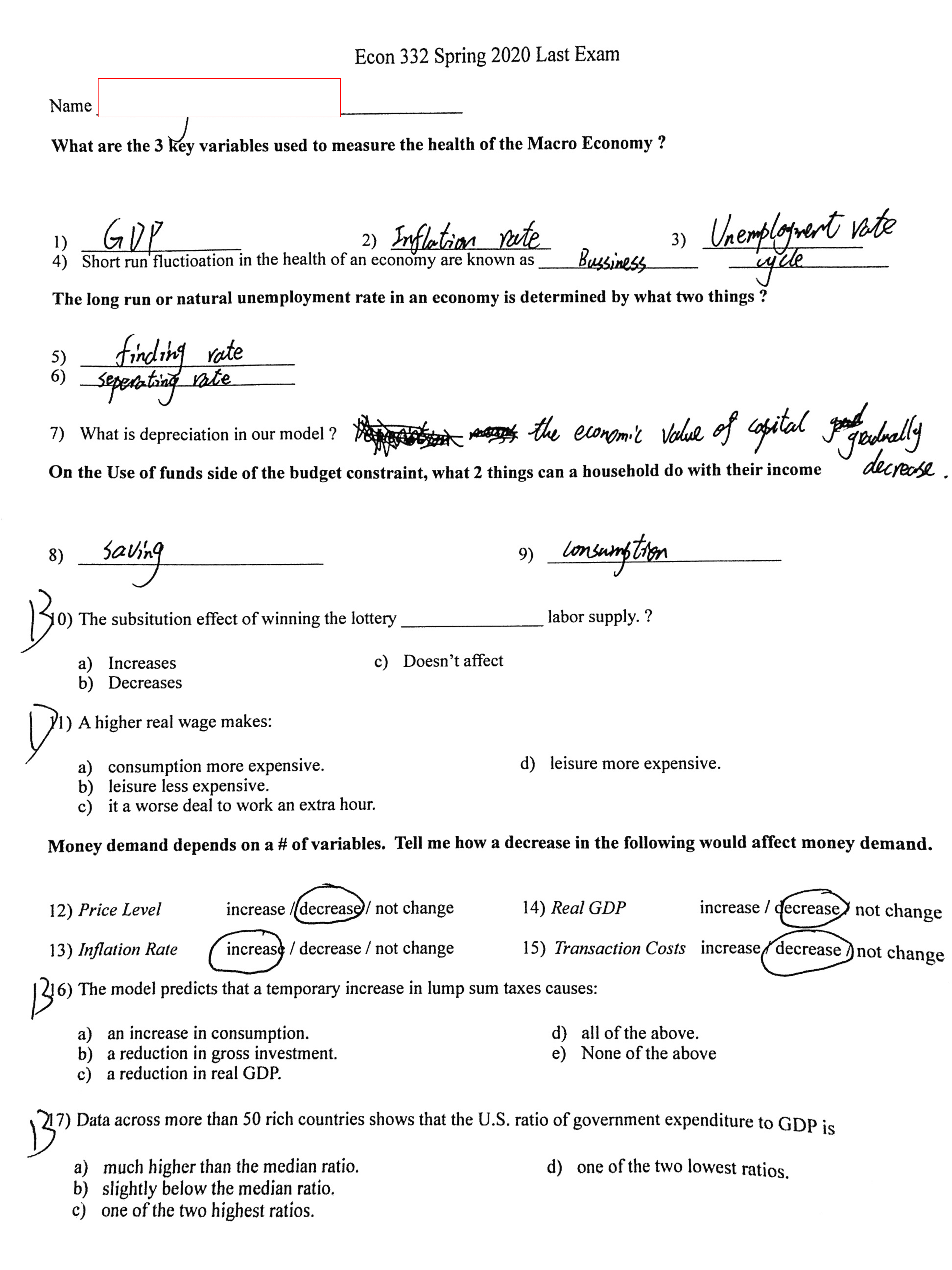

Name _________________________________________ What are the 3 key variables used to measure the health of the Macro Economy ? 1) __________________ 2) __________________ 3) _________________... _ 4) Short run fluctioation in the health of an economy are known as __________________ __________________ The long run or natural unemployment rate in an economy is determined by what two things ? 5) ________________________ 6) ________________________ 7) What is depreciation in our model ? On the Use of funds side of the budget constraint, what 2 things can a household do with their income 8) ___________________________ 9) __________________________ 10) The subsitution effect of winning the lottery ________________ labor supply. ? a) Increases b) Decreases c) Doesn’t affect 11) A higher real wage makes: a) consumption more expensive. b) leisure less expensive. c) it a worse deal to work an extra hour. d) leisure more expensive. Money demand depends on a # of variables. Tell me how a decrease in the following would affect money demand. 12) Price Level increase / decrease / not change 13) Inflation Rate increase / decrease / not change 14) Real GDP increase / decrease / not change 15) Transaction Costs increase / decrease / not change 16) The model predicts that a temporary increase in lump sum taxes causes: a) an increase in consumption. b) a reduction in gross investment. c) a reduction in real GDP. d) all of the above. e) None of the above 17) Data across more than 50 rich countries shows that the U.S. ratio of government expenditure to GDP is a) much higher than the median ratio. b) slightly below the median ratio. c) one of the two highest ratios. d) one of the two lowest ratios. Why might an decrease in tax rates on Labor Raise Capital Utilization rates? 18) 19) 20) The U.S. federal income-tax structure is designed so that a) all citizens pay a flat marginal tax rate. b) the marginal tax rate generally rises with income. c) the average tax rate falls as income rises. d) all citizens pay a flat average tax rate. 21) An open-market operation in which the Federal Reserve purchases bonds will a) increase the money supply and increase the price level. b) decrease the money supply and decrease real GDP. c) decrease the money supply and increase the price level. d) decrease the money supply and increase real GDP. Ricardian Equivalence says a cut in your lump sum taxes of $1000 paid for by the Federal Government selling bonds will: 22) Change Consumption by a) +1000 b) -1000 c) + but less than 1000 d) – but less than 1000 e) 0 You are born with nothing and you will die with nothing. You will live for 3 periods. Your before tax labor income is 100 in each period. 23) Write out the 3 period budget constraint using the income numbers above and notation for consumption and interest rate. 24) 25) Now assume lump sum taxes in each period of 10 and an interest rate of 10%. What is the present value of your life time consumption under this situation. 26) 27) Now what if the government only has taxes in period 3 but still spends the same amount each period, plus in period 3 it needs to pay back the borrowing from periods 1 & 2. What is the present value of your life time consumption under this situation. 28) 29) If you consume your entire aftertax income in each period . 30) How much is C1 _____________ 31) C2 _____________ 32) C3 33) 34) Draw the Money Market before and after the Corona Virus Recession. Assume the Federal Reserve Takes no action. 35) 36) Production function Y=2*(K*L).5; Kapital K = 625; Labor Supply = (real wage)^2 37) What is the equilibrium real wage? 38) 39) 40) What is Equilibrium L (a number) 41) 42) What is total output? (a number) 43) 44) What is the rental price of capital? (a number) 45) A positive income effect (income goes up) will cause 46) Labor supply to Increase / Decrease / Not Change 47) Labor demand to Increase / Decrease / Not Change 48) Capital demand to Increase / Decrease / Not Change 49) Consumption to Increase / Decrease / Not Change If Y = A*(K*L)^.5 and The growth rate of capital per worker = s*(y/k) – s*–n 50) What is the equation for the steady state capital per worker k* in terms of savings rate deprectation rate population growth rate and technology? SHOW YOUR WORK. 51) 52) 53) If technology doubles how much does the steady state of capital increase by? 54) Ignoring income effects an increase in taxes on wage rate will cause 55) Labor supply to Increase / Decrease / Not Change 56) Labor demand to Increase / Decrease / Not Change 57) Capital demand to Increase / Decrease / Not Change Given the production function: Y = 8*(K*L).5 (with K = 16) The demand curve for L= 256/(wage^2) With Taxes on labor income: Labor Supply = [(1-wage tax rate)*w/P]^2 If Tax rate on Labor income is 0%: 58) What is the equilibrium wage? 59) 60) 61) What is total Labor Input 62) If Tax rate on Labor income is 20%: 63) What is the equilibrium wage? 64) 65) 66) What is the aftertax wage? 67) 68) What is new Equilibrium Labor Input? 69) What is the economic argument for the 2017 tax cuts on savings income being also good for workers? 70) 71) 72) 73) The real rate of return on capital = (R/P)*cu - .1*cu^2: where cu is the capacity utilization rate. The production function: Y = A*(K.5*L.5). Household wish to maximize the real rate of return on capital. Derive an equation for cu as a function of L & K that maximizes the real return to capital. 74) 75) 76) 77) If A = 2 and K=2500 and L = 25 what should the capacity utilization rate be? 78) 79) Imagine 2 countries have the same natural unemployment rate of 5%. Country A has a very “fluid” labor market with lower search costs & easy to hire & easy to fire policies. Country B has a more “ridged” labor market. It is harder to fire people but also harder to find a job once unemployed. 80) If the separation rate in Country A is 5% per month: what is the finding rate? 81) 82) If the separation rate in Country B is 1% per month: what is the finding rate? 83) You live 2 periods. You are born with nothing and you must die with nothing. In period 1 you have labor income of L1. In period 2 you have labor income of L2 You may consume (C1 and C2) as well as buy or sell bonds (B1). Write out period 1’s budget constraint using the notations ABOVE 84) 85) Write out period 2’s budget constraint using the notations ABOVE 86) 87) DERIVE the 2 period budget constraint, expressed as the present value of consumption & labor income. 88) 89) 90) Asuume Labor of L1 = 220 & L2 = 22. The interest rate is 10%. Finally assume people want to smooth consumption so C1= C2. How much do people consume in each period? 91) 92) 93) 94) What is the value of B If A decreases in our model – say because a drop in productivity caused by a pandemic. What happens to (increase, decrease, or no change) 95) Y _______________________ 96) MPL _______________________ 97) Labor Demand _______________________ 98) MPK _______________________ 99) Real Wages _______________________ 100) Real interest rate _______________________ [Show More]

Last updated: 1 year ago

Preview 1 out of 9 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 13, 2020

Number of pages

9

Written in

Additional information

This document has been written for:

Uploaded

May 13, 2020

Downloads

2

Views

158

.png)

.png)

.png)

.png)