Finance > QUESTIONS & ANSWERS > Financial Planning and Insurance Rutgers University, Newark FINANCE 390:341 Midterm Study Guide (All)

Financial Planning and Insurance Rutgers University, Newark FINANCE 390:341 Midterm Study Guide

Document Content and Description Below

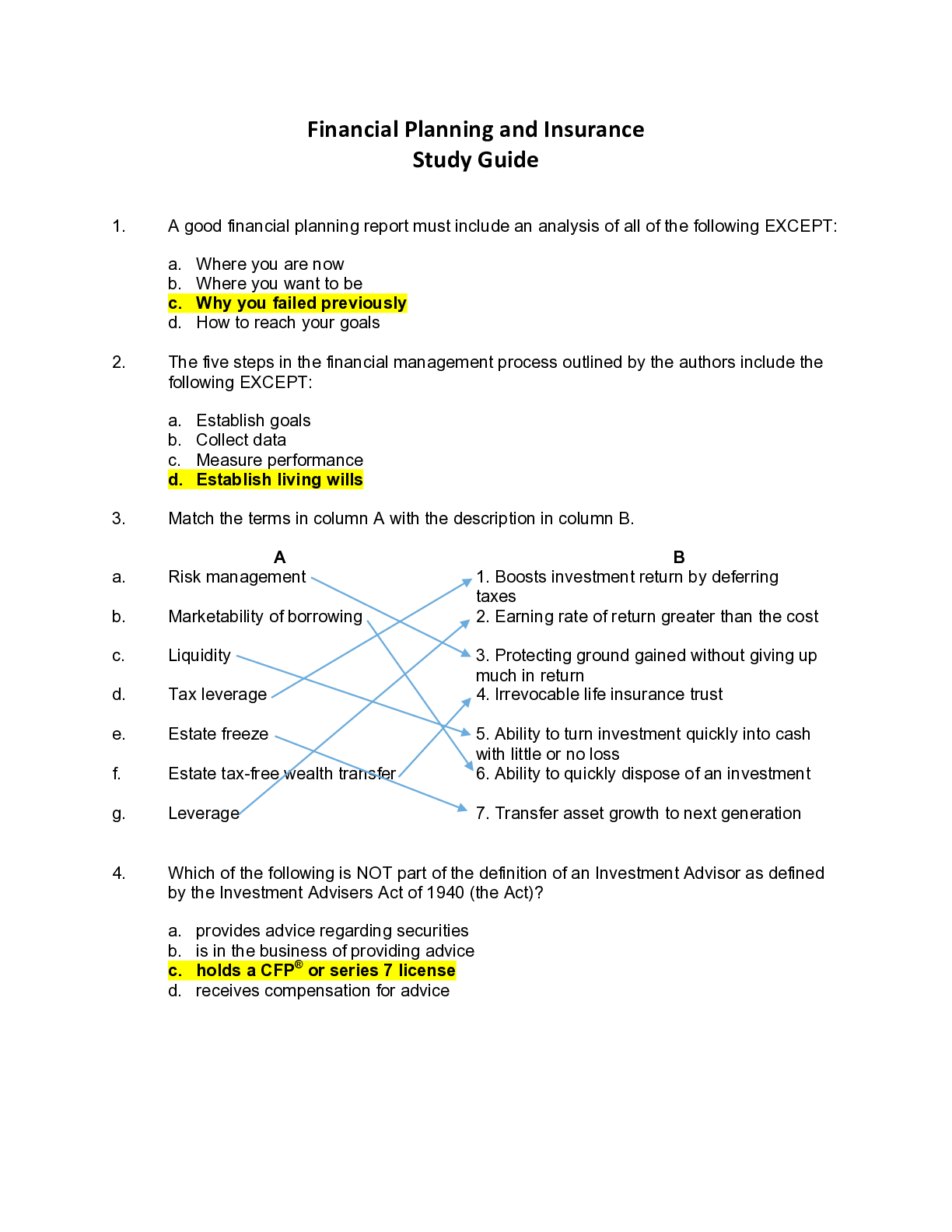

Financial Planning and Insurance Study Guide 1. A good financial planning report must include an analysis of all of the following EXCEPT: a. Where you are now b. Where yo... u want to be c. Why you failed previously d. How to reach your goals 2. The five steps in the financial management process outlined by the authors include the following EXCEPT: a. Establish goals b. Collect data c. Measure performance d. Establish living wills 3. Match the terms in column A with the description in column B. A B a. Risk management 1. Boosts investment return by deferring taxes b. Marketability of borrowing 2. Earning rate of return greater than the cost c. Liquidity 3. Protecting ground gained without giving up much in return d. Tax leverage 4. Irrevocable life insurance trust e. Estate freeze 5. Ability to turn investment quickly into cash with little or no loss f. Estate tax-free wealth transfer 6. Ability to quickly dispose of an investment g. Leverage 7. Transfer asset growth to next generation 4. Which of the following is NOT part of the definition of an Investment Advisor as defined by the Investment Advisers Act of 1940 (the Act)? a. provides advice regarding securities b. is in the business of providing advice c. holds a CFP® or series 7 license d. receives compensation for advice5. The Act defines compensation as a. Commission only b. Fees only c. Receipt of any economic benefit d. 12(b) 1 fees only. 6. Which of the following is NOT exempt from the definition of an investment advisor? a. Publisher of the local newspaper, the Daily Beagle b. Insurance agent who advises clients about no load mutual funds c. Those who advise clients solely about U.S. treasury obligations d. Local attorney who occasionally advises clients about setting up investment accounts for their jury awards 7. The “brochure rule” requires that the investment adviser do which of the following? a. Provide the client with an audited financial statement of the adviser’s net worth. b. Deliver a written disclosure document (such as part II of form ADV) to each client c. Provide a copy of part I of form ADV to each client d. Provide clients with copies of the adviser’s marketing brochure. 8. The anti-fraud provisions of the Act applies to: a. All investment advisors, even those who are exempt from registration b. Only those who must register with the SEC or the states c. Only situations where security transactions take place. d. Only advisors of pension plans 9. Which of the following statements about the definition of “security” under the Investment Advisor Act is CORRECT? a. The act defines the term “security” in the broadest possible fashion b. The act defines the term narrowly, to include only stocks, bonds and certificates of deposit c. The SEC periodically holds hearings to define the term d. The definition is left to the NASD 10. Financial advisor John Smith manages investment accounts for clients mostly in his home state of Ohio. He should register with the Ohio division of securities if: a. He has any clients outside Ohio b. The assets under his management exceed 30 million c. Assets under his management are less than 25 million d. He is not a CFP® certificant11. If John Smith is registered as an investment advisor with the SEC, which of the following designations is permitted under the Act? a. John Smith, RIA b. John Smith, certified RIA c. John Smith, Investment Counsel d. John Smith, Registered Investment Advisor 12. Recent rules issued by the SEC require investment advisors to do the following EXCEPT: a. Adopt a code of ethics b. Designate a chief compliance officer c. Adopt policies for disaster recovery d. Accept only U.S. citizens as clients 13. The following are the disciplinary actions that the CFP Board may take against a financial advisor who is in violation of the Code of Ethics EXCEPT: a. Private censure b Lawsuit against the advisor in Federal Court c. Public letter of admonition d. Suspension 14. Which of the following uses of the CFP® marks are PROHIBITED by the CFP Board? a. Jane Smith is a CFP® graduate b. Jane Smith is a CFP® c. Jane Smith has a CFP® d. All of the above 15. Which of the following are PROHIBITED uses of the CFP® marks? a. www. CFP Advisors.com b. CFP Advisors, Inc. c. All Star CFPs, Inc. d. All of the above 16. Under the CFP Board’s Code of Conduct and Professional Responsibility, a financial planner who has reason to suspect illegal conduct in his or her organization must: a. Disclose the information to his or her supervisor b. Alert regulatory authorities if the organization does not take suitable action to remedy the situation c. Not use the process to harass another planner d. All of the above17. An important requirement that is common to the SEC rules for investment advisors and the CFP Board’s Code of Ethics is: a. Full Disclosure of all material information to clients b. A ban on accepting commissions c. A ban on “soft dollars” d. Rules for custody of assets under management 18. Under the Code of Ethics and Professional Responsibility, a CFP® practitioner may not generally disclosed confidential information obtained from a client. A CFP® practitioner may, however, disclose such information in the following situations EXCEPT: a. The client sues the practitioner b. The client files a complaint against the practitioner with the NASD or the CFP Board c. The client consents to the disclosure d. The client’s bank requests information in connection with a mortgage application 19. According to the Code of Ethics and Professional Responsibility, a CFP® practitioner who gives a brochure to clients disclosing information about his or her firm must include all of the following EXCEPT: a. The identity of insurance companies that the firm represents and any commission arrangements with those companies b. A statement of whether the firm’s compensation will include commissions or fees only c. Resumes of the firm’s employees who will provide financial planning services to the client d. The identity of the bank or other institution where the firm maintains a checking account 20. The Principle of Objectivity in the Code of Ethics and Professional Responsibility of the CFP Board of Standards requires that a CFP® practitioner a. Must disclose in writing any conflicts of interest that might compromise the adviser’s objectivity or independence prior to establishing a relationship with the client. b. Has the burden of proving, by clear and strong evidence that any business transactions with or for the client are arms-length transactions c. Shall act with prudent professional judgment and in the best interest of the client d. All of the above 21. The CFP Board Financial Planning Standards are designed to accomplish all of the following EXCEPT: a. Advance professionalism in financial planning b. Facilitate the weeding out of incompetent financial advisors c. Enhance the value of the financial planning process d. Establish certain norms of practice for CFP® practitioners22. Tuition at the Home State University is currently $10,000 per year, increasing on the average of 6% per year. What is the lump sum needed at the beginning of the freshman year of college to fund an 8-year old child’s college education for 4 years starting at age 18, if the investment return is expected to be 4%? a. $65,778 b. $67,706 c. $73,727 d. $69,502 23. What is the (constant) annual payment needed to fund the above lump sum, if the parents start investing now, and continue until the beginning of the freshman year, and the annual investment return is 8%? a. $5,905 b. $4,712 c. $5,277 d. $6,565 24. The Hope Scholarship Credit is characterized by all of the following EXCEPT: a. It can be claimed only for the first two years of a post-secondary education b. There is no requirement that the student pursue a degree c. The maximum annual credit amount is $1,650 per student d. The credit is phased out between income ranges of $40,000 to $50,000 as indexed (single) and between $80,000 to $100,000 as indexed (joint) 25. The following statements about “529 plans” for funding college educational expenses are true EXCEPT: a. Withdrawals from 529 plans for qualified educational expenses are tax-free b. Parents can retain some control over the funds, including ability to change beneficiaries c. Contributions are not eligible for federal income tax deduction d. Donor can exercise day to day control over investment management 26. The following features of an UTMA account set up in a child’s name by a parent to pay for the child’s college education are true EXCEPT: a. The parent loses control of the account when the child reaches the age of majority (18 or 21, depending upon the state) b. The child may qualify for less financial aid in college c. Investment income is taxable to the parent until the child is 19 years old d. If child chooses not to go to college, The parent can revoke the account27. Bobby Ayala’s sons are attending the local 4-year college. James is a senior, and Todd is a freshman. Bobby paid $8000 each for their tuition this year. His AGI for 2007 is $80,000, and he is in the 25% tax bracket. Which of the following options provides MAXIMUM tax benefits for the educational expenses paid by Bobby? a. Claim a Lifetime Learning credit for both students b. Claim a Lifetime Learning credit for James, a Hope credit for Todd c. Claim a Tuition and Fees deduction for both d. Claim a Tuition and Fees deduction for James, a Hope credit for Todd 28. All of the following factors need to be considered in assessing the adequacy of funds needed to fund a client’s income needs during retirement EXCEPT: a. inflation b. investment returns c. spending levels d. living trust funds 29. The most important documents that a terminally ill person should have are the following EXCEPT: a. Healthcare power of attorney b. Living will c. Power of attorney/Durable power of attorney d. Charitable remainder trust 30. The following are the required elements of a valid will EXCEPT: a. Nomination of executor/executrix b. Competent testator/testatrix c. Signature, witness and attestation clause d. Appointment of trustee/successor trustee 31. A durable power of attorney allows a designated person to make decisions for the client regarding his or her: a. Financial affairs b. Medical treatments c. Medical and financial matters d. Organ donation 32. The probate process ensures the following EXCEPT: a. Court scrutiny of the executor’s actions b. No contesting of the will by any beneficiaries or potential beneficiaries c. Payment of debts, taxes, etc. from the estate d. Bequests to beneficiaries according to the terms of the will33. The following statements about a person dying without a will are true EXCEPT: a. It is called dying “intestate” b. Beneficiaries who are not blood relatives of decedent may be disinherited c. The probate court will divide the estate based on petitions from potential beneficiaries d. The probate court will appoint someone to oversee the estate 34. According to the authors, the three C’s of credit include the following EXCEPT: a. Character b. Competence c. Collateral d. Capacity 35. Consumers may obtain copies of their credit history from one of the following major reporting agencies EXCEPT: a. Experian b. Equifax c. Equitable d. TransUnion 36. You can improve your Fair Isaac Credit Score (FICO) by all of the following EXCEPT: a. Paying bills on time b. Keeping balances on credit cards low c. Not opening credit accounts indiscriminately d. Paying bills before they are posted to your account 37. Ron’s bankruptcy filing under Chapter 7 was approved by the bankruptcy court. Which of the following obligations will he be allowed to discharge? a. Alimony owed to his ex-wife b. Loans used to pay for his college education c. Unpaid federal taxes from over 3 years d. Unpaid condo fees 38. Which of the following statements about Chapter 13 bankruptcy filing are TRUE? a. It is available to debtors who are unemployed b. It allows debtors to discharge all their debts after non-exempt assets are liquidated c. It is the preferred route for debtors with steady income and some non-exempt assets. d. None of the above39. The “Truth in Lending” Act provides all of the following EXCEPT: a. Lenders must disclose the annual percentage rate (APR) of the loan b. Consumers must be given credit regardless of their credit history c. Liability for lost or stolen credit cards is limited to $50 d. Borrowers may cancel within 3 days of signing if their home is used as collateral 40. Which of the following is NOT an example of financial leverage? a. Obtaining a mortgage to purchase a house b. Buying 100 shares of a stock using cash c. Using a “no interest till 2005” offer to buy a TV d. Buying 100 shares of a stock on margin 41. Which of the following is the CORRECT definition of a jumbo loan? a. A loan to build houses that are larger than average b. A loan whose amount exceeds the guidelines of agencies like Fannie Mae c. A loan whose term is longer than 30 years d. A loan with additional points charged to cover closing costs 42. In the opinion of the authors, the best way to assess whether refinancing a loan is advantageous is to: a. Compare the total payments for the two loans over the same period b. Compare the present value of the payments at the two discount rates c. Compare the points being charged on the two loans d. Compare the closing costs of the two loans 43. If a family’s annual gross income is $120,000 and the front-end ratio limit of the lender is 0.33, the maximum monthly housing expenses for the family under the lender’s guidelines will be: a. $3960 b. $3300 c. $6600 d. $1200 44. The official source of the index of leading, lagging, and coincident indicators is: a. The U.S. Dept. of Labor b. The U.S. Dept. of Commerce c. The Conference Board d. The U.S. Chamber of Commerce 45. A rise in the index of Leading Economic Indicators can be a predictor of all EXCEPT: a. Rising interest rates b. More favorable mortgage rates in the immediate future c. Expanding economy d. Rising stock market46. Inflation is measured by Consumer Price Index, Producer Price Index, and the GDP implicit price deflator. Which of the statements about inflation are CORRECT? a. CPI uses retail prices and the cost of many services b. PPI does not include the cost of any services c. GDP deflator reflects the broadest measure of economic activity d. All of the above 47. The Index of Leading Economic Indicators (LEI) consists of the following indicators, EXCEPT: a. Inventories to sales ratio b. S&P 500 index c. Average weekly claims for unemployment insurance d. Money Supply (M2) 48. The peak to contraction phase of the business cycle is likely to be affected by which factors? a. Reduced working hours for workers b. Psychological factors, such as consumer sentiment, workers’ fear of layoffs, contagious pessimism, etc. c. Realization by businesses that they have expanded too far d. All of the above 49. The term “M2” refers to which definition of the money supply? a. Coins and currency in circulation, plus checking accounts, plus savings accounts and money market accounts b. Coins and currency in circulation, plus checking accounts, plus savings accounts and money market accounts, plus large denomination time deposits c. Coins and currency in circulation, plus checking accounts, plus savings accounts d. Coins and currency in circulation, plus checking accounts 50. The term “free reserves” refers to which of the following? a. The banks’ reserves on deposit with the Fed b. The difference between the banks’ excess reserves and their borrowings c. The difference between the banks’ reserves on deposit with the Fed and the minimum they are required to keep d. Amount of pending loans at the banks 51. Which of the following leads to higher bank reserves, increased money supply, and expansion of the economy? a. The Fed sells U.S. Govt. Securities b. The Fed buys U.S. Govt. Securities c. The FOMC of the Fed meets to discuss discount rates d. The Fed raises the reserve requirements52. Choose the policy description that best fits Keynesian philosophy: a. Monetary policy, in addition to fiscal policy, should be used to influence the economy by stimulating demand b. It is more important to stimulate the economy’s ability to supply or produce more goods than to enhance demand c. Low tax rates should be used an incentive for entrepreneurs and for boosting output d. Balancing the budget should be a top priority 53. Decisions made by the Federal Reserve are part of: a. Fiscal Policy b. Monetary Policy c. Tax Policy d. Budget Policy 54. Rahul and Miranda want to make a lump-sum investment for their newborn’s college education, and their goal is to accumulate $80,000 in 18 years. What is the amount they must invest today to reach their goal if the annual rate of return is 8%? a. $20,020 b. $22,789 c. $14,782 d. $23,291 55. Troy wants to accumulate $40,000 in 10 years to purchase a vacation home. What is the annual investment rate of return that Troy must obtain if he deposits $250 at the end of every month for 10 years? a. 6.75% b. 5.56% c. 9.25 % d. 7.75 % 56. Samantha just won a settlement with an insurance company, which entitles her to receive payments of $20,000 at the beginning of each year for the next 20 years. Her financial advisor recommended to her that she consider accepting a lump-sum payment now, using a discount rate of 7%. What is the amount that she should accept in this scenario? a. $205,234 b. $211,880 c. $226,712 d. $182,76557. Omar wants to make a gift of $10,000 in today’s dollars to his parents at the end of each of the next 10 years. If the annual rate of return is 8% and inflation is 3%, what is the value of the funds he must have in hand today to meet this need for the 10-year period? a. $81,541 b. $77,766 c. $76,251 d. $82,713 An investment that Kevin is considering offers the following cash flows. Year 1 Initial investment of $10,000 Year 2 Inflow of $2,000 Year 3 Inflow of $1,500 Year 4 Additional investment of $5,000 Year 5 Inflow of $1,200 Year 6 Inflow of $2,200 Year 7 Inflow of 1,500 Year 8 Inflow of $1,000 Year 9 Inflow of $1,200 Year 10 Sale proceeds of $17,000 58. What is the internal rate of return (IRR) that this investment offers if all cash flows occur at the end of each period? a. 10.10% b. 10.87% c. 9.24% d. 9.74%. 59. What is a reasonable purchase price for an investment that offers the following cash inflows at the end of each period? Assume an interest rate of 7%. Year 1 $2,000 2 $2,200 3 $1,700 4 $2,000 5 $1,500 6 $2,000 7 $1,400 8 $14,000 a. $18,792 b. $19,224 c. $19,787 d. $18,12660. Jim took out a 30 year, $200,000 mortgage on his home with an annual interest rate of 5.5%, compounded monthly. The following statements are true EXCEPT: a. The monthly payments will be: $1,136 b. After the 12th payment, the total interest payments will be $10,933 c. After the 12th payment, the total principal payments will be $2,694 d. After the 12th payment, the mortgage balance will be $194,360 61. Ramon and Mia want to invest $2500 at the end of this year into an investment account. They plan to invest 10% more next year, and will continue to increase their contributions 10% from each year to the next. Assuming the annual investment rate of return is 8%, what will be the value of the investment at the end of 20 years? a. $42,237 b. $258,318 c. $114,405 d. $366,570 62. What will be the future cash value of an account that has the following cash flow where the deposits are made at the end of the period and the annual investment rate of return is 7%? a. $18,174 b. $24,321 c. $10,578 d. $14,114 63. Donovan bought a painting 5 years ago for $10,000. Two years ago, he spent $1500 to have it restored. This year, he sold it for $18,000. What is the internal rate of return on his investment? a. 12.21% b. 10.10% c. 11.23% d. 9.65% Year 1 $2,000 deposit 2 $2,500 3 $1,200 4 $2,400 5 $1,500 6 $1,700 7 $1,400 8 $1,10064. Sharda bought a $1000 corporate bond this year at a discount for $975. The bond pays $80 of interest at the end of each of the next 5 years, at which time it will mature at its face value. If her required rate of return is 8.25%, what is the net present value of the investment? a. $15.08 b. $13.93 c. -$12.80 d. –$35.23 65. Tony’s son, Mark is 12 years old and Tony expects him to start college in 6 years. Tuition costs $20,000 today, increasing at an annual rate of 7%. Tony wants to earn 10% annually on his investments. If he makes an initial investment one year from now, and annual additions at the end of each year until Mark starts college, what is the size of the annual (level) investments he must make to fund 4 years of Mark’s college education? a. $10,268.08 b. $12,192.77 c. $11,294.89 d. $14,935.39 66. National banks are regulated by: a. FDIC b. Comptroller of the Currency c. Federal Reserve d. Federal Office of Thrift Supervision 67. The independence of the Federal Reserve is assured through the following EXCEPT: a. Longer tenure for the Board of Governors than senators or the President b. No dependence on Congress for its budget c. Staggered terms for the Fed Board of Governors d. Fed Chairman chosen by regional Fed directors 68. The following entities protect the business owner from personal liability in actions by creditors of the business EXCEPT: a. Corporation b. Limited liability company c. Limited partnership d. Sole proprietorship 69. Which of the following statements apply to S-Corporations? a. They allow income to pass through to shareholders, avoiding double taxation b. The number of shareholders is limited to 100 c. The liability of shareholders is limited—same as for C corporations d. All of the above70. Limited liability companies offer business owners all of the following advantages EXCEPT: a. They allow flow-through of income, just like partnerships b. They can be formed by as few as one person c. They offer protection for personal assets from the creditors of the business d. They can be set up without filing any paperwork with the state 71. Hector wants his business to continue for generations. Which of the following has infinite life? a. Sole proprietorship b. Partnership c. Corporation d. Limited Liability Company 72. Which of the following forms of ownership allow property transfer at death without the probate process? a. Joint tenancy with right of survivorship b. Community property c. Sole ownership d. Tenancy in common 73. Jim and Mary live in a community property state, and purchased a home for $100,000 in 1983, which was valued at $300,000 immediately prior to Jim’s death in 2007. If Mary sells the home for $300,000, what is the taxable gain that she must declare for income tax purposes? a. $150,000 based on the value of Mary’s half of the home b. $100,000 based on the step-up in basis of Jim’s half of the home c. None, since the entire home receives a step-up in basis on Jim’s death d. $200,000 based on the appreciation on the value of the home 74. Which of the following statements about property owned in a community property state is TRUE? a. The will of the decedent (the deceased person) will dictate how his or her half of the property will transfer at death b. The decedent’s half of the property will automatically transfer at death to the surviving spouse without going through probate c. The marital deduction is available for estate tax purposes, regardless of who receives the decedent’s half of the property d. None of the above75. Which of the following statements about sole ownership of property is INCORRECT? a. If the owner shifts income from the property to another person, the owner can reduce his own income taxes b. Upon the owner’s death, the property will transfer by terms of the will c. If spouse is not bequeathed a share of the property according to the terms of the owner’s will, spouse may elect against the will d. Owner needs no one’s permission to dispose of property 76. The following statements about joint tenancy with rights of survivorship (JTWROS) are true EXCEPT: a. Husband and wife, father and son, or even unrelated persons can own property in JTWROS form b. When co-owners are not a married couple, the entire value of property will be included in the estate of the first owner to die, unless the survivor can prove contribution to basis c. For married couples, the decedent’s half of the property receives a step up in basis d. At the death of the first owner, the entire property receives a step up in basis 77. All of the following statements about tenancy in common are true EXCEPT: a. Multiple owners, including unrelated parties can share ownership of property b. One owner’s fractional interest can be transferred without the permission of the other owners c. Transfer at death occurs without the probate process d. The property receives step up in basis at death for the owner’s fractional interest 78. The following statements about joint tenancy w/ rights of survivorship (JTWROS) and tenancy in the entirety (TIE) are true EXCEPT: a. TIE is permitted in some states, and only between husband and wife b. One spouse can’t dispose of TIE property without the consent of the other c. TIE property is a probate asset, but JTWROS property is not d. Valuation of TIE property may be different from JTWROS property 79. The following statements about joint tenancy with rights of survivorship (JTWROS) are true EXCEPT: a. Ownership interests are deemed to be equal; so is income b. Conversion from sole ownership to JTWROS may trigger gift tax c. Marital deduction for estate tax is not allowed when one spouse’s interest passes exclusively to the other d. JTWROS property does not avoid inclusion in decedent’s estate 80. The following are the essential elements of a contract EXCEPT: a. Offer and acceptance b. Consideration c. Legal object/purpose d. Right of rescission81. When a contract is drafted by one party (such as an insurance company) and signed by the other party (such as a client), matters of ambiguity in the contract will be judged in favor of: a. The party that drafted the contract b. The party that signed the contract c. According to state law d. Neither party 82. All of the following descriptions apply to torts EXCEPT: a. A public wrong, which is a violation of the laws that govern an individual’s relationship with the rest of society b. A private wrong, which is an infringement of the rights of another individual c. Intentional acts, such as defamation, invasion of privacy, assault, etc. d. Unintentional acts, such as negligence 83. Vicky is helping a client decide whether to receive a personal injury settlement in a lump sum or as a structured series of periodic installments. Which of the following is a reason to choose a structured settlement? a. The full amount of a lump sum payment is tax-free b. Future investment earnings on a lump-sum settlement are tax-free c. The full amount of qualified structured settlement payments, including implicit earnings, is tax-free d. A structured settlement offers the potential for greater investment returns 84. Chris is helping an ailing client decide whether to accept a viatical settlement on a life insurance policy. Which federal Act established guidelines on the tax-free treatment of viatical settlements? a. The Periodic Payment Settlement Act of 1982 b. The Health Insurance Portability and Accountability Act of 1996 c. The Life Settlement Act of 1988 d. The Consolidated Omnibus Budget Reconciliation Act of 1986 85. Sheila's client has asked her advice on a possible life settlement of a life insurance policy. Which of the following is NOT a typical requirement for a life settlement? a. Life expectancy of the insured is less than 12 years b. The insured has had a change in health since the policy was issued c. The policy must be at least 2 years old d. The insured must generally be in good health 86. Which of the following is NOT a valid defense against negligence? a. Assumption of risk b. Contributory negligence c. Last clear chance d. Negligence per se87. Keith purchased a home with $20,000 down payment and a $180,000 mortgage. What is his basis in the home? a. $20,000 b. $180,000 c. $200,000 d. $160,000 88. Lucy’s grandmother purchased 100 shares of GE stock priced at $10/share in 1970. Lucy inherited the stock when her grandmother passed away this year. On the date of death, the stock was valued at $70/share. Lucy sold the stock 3 months later for $73/share. What is the amount of the gain must Lucy report on her tax return (ignoring trading costs)? a. $6300 b. $300 c. $7300 d. $7000 89. In the scenario above, what is the nature of the gain reported by Lucy? a. Short-term capital gain b. Ordinary income c. Long-term capital gain d. Qualified dividend 90. In the scenario described in question # 2, what is Lucy’s basis in the inherited stock? a. $70/share b. $10/share c. $63/share d. $73/share 91. If Lucy’s grandmother had gifted the stock to Lucy the day before she died (the stock price was $70/share), what would be Lucy’s basis in the GE stock? a. $70/share b. $10/share c. $63/share d. $73/share 92. If Lucy had received the stock by gift as described above, and Lucy had sold the stock 3 months later for $73/share, what is the amount of the gain Lucy must report on her income tax return? a. $6300 b. $300 c. $7300 d. $700093. Marcus purchased 100 shares of Yahoo for $200/share a few years ago. He transferred the stocks to his nephew Tony as a gift when the stock was priced at $25/share. If Tony sells the stock for $35/share, what is the gain (or loss) that he must report on his income tax return? a. A loss of $16,500 b. A gain of $1,000 c. A loss of $17,500 d. No gain or loss 94. Kiran purchased a plot of land for $10,000. Two years later, it was valued at $25,000, and he gifted it to his son. He also paid a gift tax of $4,900 as he had used up his unified credit. The tax basis of the property in the hands of his son will be: a. $10,000 b. $25,000 c. $14,900 d. $12,940 95. Jenny purchased 100 shares of Dell for $30/share on January 10, 2004. She sold the stock on Dec 20, 2004 for $22/share. On January 5, 2005, she repurchased 100 shares of Dell at $24/share based on positive news about the company. What is the amount of loss she can claim on her 2004 income tax return? a. $800 b. $600 c. $200 d. None 96. Ricardo owns an apartment complex that generates $10,000 of monthly rents. He wants to shift some of the income to his son Ricky, 16, who is in a low tax bracket. He has directed some of his clients to pay the rent directly to Ricky. Each month, $3,000 of rental income is being shifted to Ricky. What are the tax implications of the shift of income? a. Income shifting is illegal; the IRS will impose penalties b. The entire rental income will be taxable to Ricardo; he is also making a taxable gift to Ricky. c. $3000/month is taxable to Ricky; $7000/month to Ricardo d. Income shifting is allowed only if specified in the client leases. 97. Curly manages all the affairs of a rental real estate business that he owns. In 2004, his share of the losses amounted to $40,000. Curly and his wife expect to have an AGI about $80,000. How much of the losses are deductible on their 2004 income tax return? a. $40,000 b. $3,000 c. $25,000 d. None98. The three retirement income sources that form the basis of traditional views of retirement security are the following EXCEPT: a. Social Security b. Personal savings c. Part-time employment d. Employer-sponsored retirement plans 99. Ramon, 62 and Julia, 61 are planning to retire when Ramon turns 65. They are worried about outliving their retirement funds. Which of the following methods of calculating longevity would you advise them to use? a. Average life expectancy, based on Ramon’s and Julia’s individual life expectancies b. The longer of Ramon’s and Julia’s individual life expectancies c. Ramon’s and Julia’s joint life expectancy d. Individual life expectancies + 5 years 100. Teresa’s employer offers a retirement plan which includes a 401(k) plan and a profit sharing plan. Employer contributions have a 5-year cliff vesting schedule. Teresa starts participating in the plan this year. If Teresa leaves the company’s employment in 4 years, what percentage of the total employer contributions is she vested in, and thus can withdraw and roll over into her own IRA? a. 75% b. 50% c. 0% d. 100% 101. In the above example, if Teresa was contributing 10% of her salary to the 401(k) plan, what percentage of her total contributions is she vested in, and thus can roll over into her own IRA? a. 75% b. 50% c. 0% d. 100% 102. Ralph has several traditional IRAs containing both pre-tax and after-tax contributions. When he withdraws the funds after reaching age 59 ½, the income taxation of the distribution will be as follows: a. Pre-tax contributions are deemed to be withdrawn first, then the after-tax contributions b. After-tax contributions are deeded to be withdrawn first, then the pre-tax contributions. c. The non-taxable portion is proportional to the ratio of the total after-tax contributions to the total value of the IRAs d. Pre-tax contributions will be taxed at capital gains rates.103. Lena’s AGI for 2006 was $60,000. She donated to the Red Cross a $75,000 bank CD when it matured during the year. The maximum amount that she can deduct on her 2006 federal income tax return is: a. $30,000 b. $60,000 c. $75,000 d. $22,500 104. Mariah purchased a painting in 1990 for $10,000. In December 2006, it was valued at $30,000 and she donated it to the local art museum. What is the maximum charitable deduction that Mariah may claim in 2006 if her AGI was $80,000? a. $10,000 b. $30,000 c. $24,000 d. $16,000 105. In the scenario above, if the painting had been purchased in January, 2006, what is the maximum charitable deduction that Mariah may claim in 2006? a. $10,000 b. $30,000 c. $24,000 d. $16,000 [Show More]

Last updated: 1 year ago

Preview 1 out of 20 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 12, 2021

Number of pages

20

Written in

Additional information

This document has been written for:

Uploaded

Sep 12, 2021

Downloads

0

Views

62

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)