Finance > STUDY GUIDE > Financial Planning and Insurance Final Exam Study Guide (All)

Financial Planning and Insurance Final Exam Study Guide

Document Content and Description Below

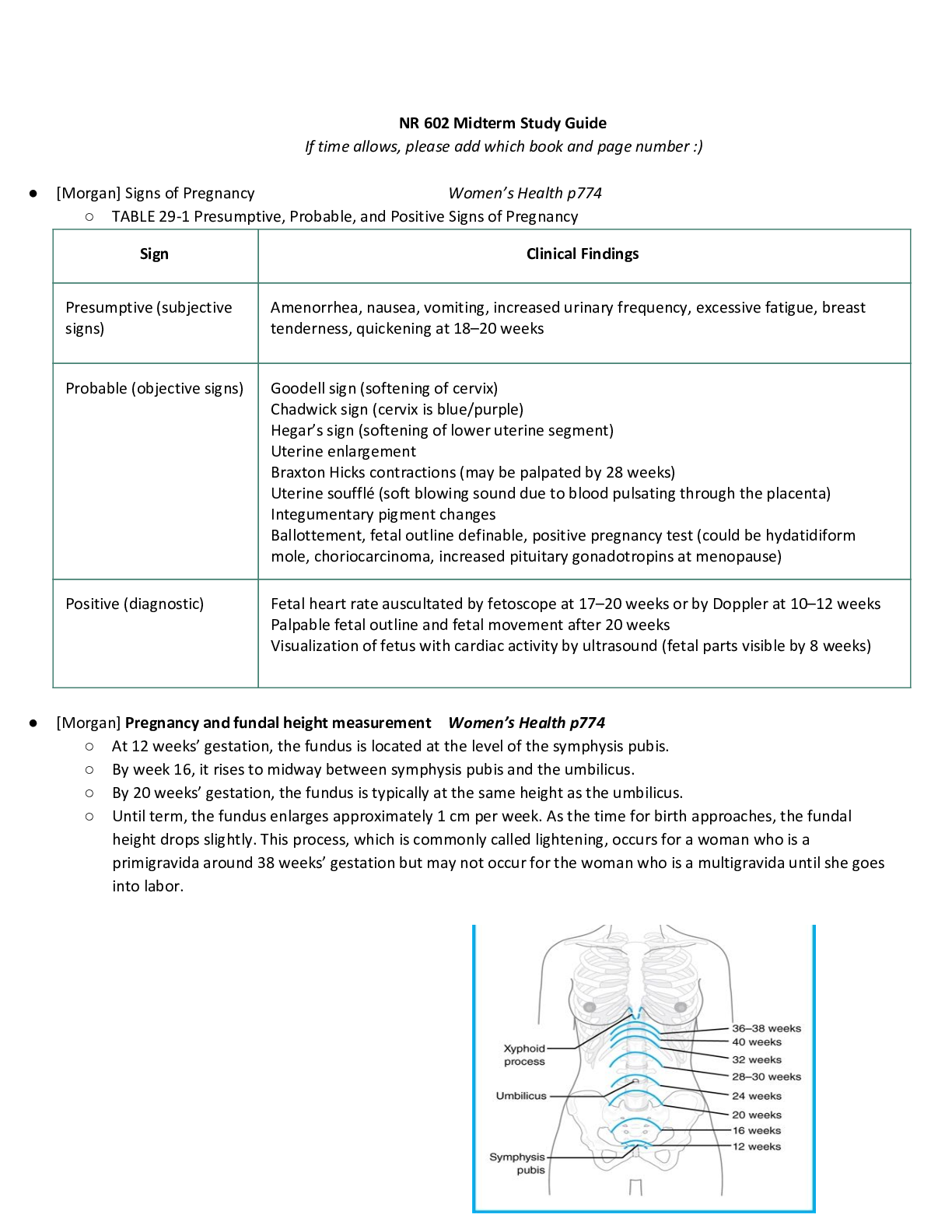

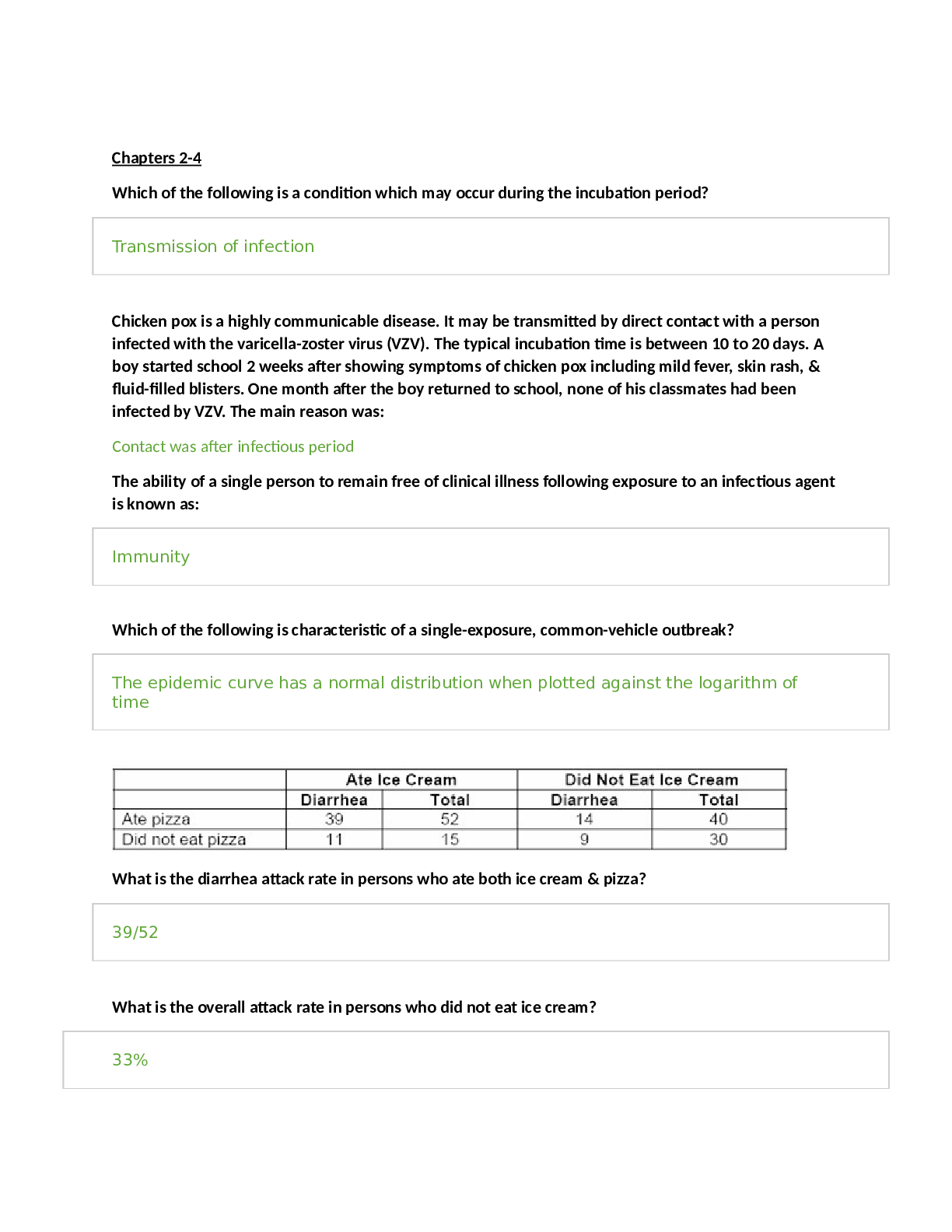

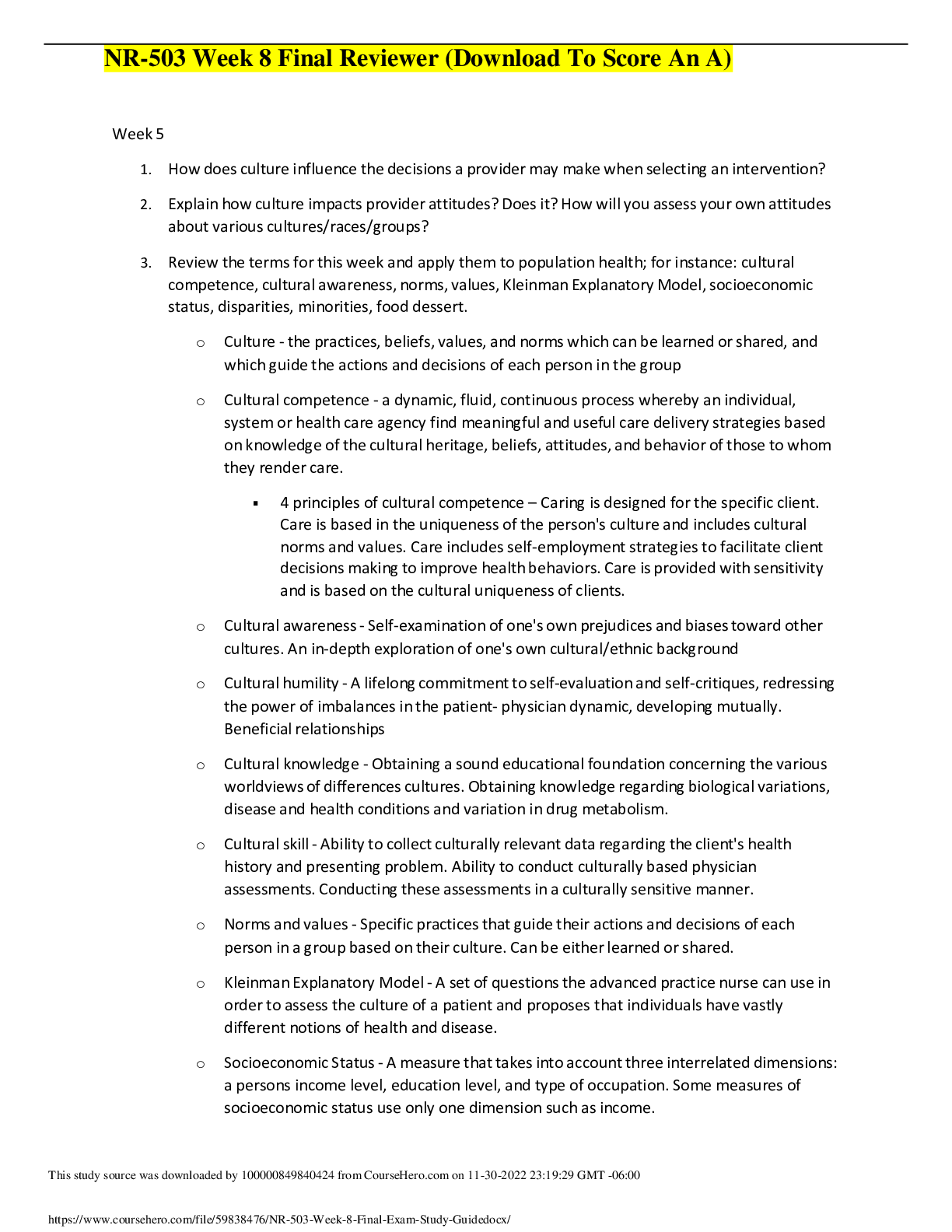

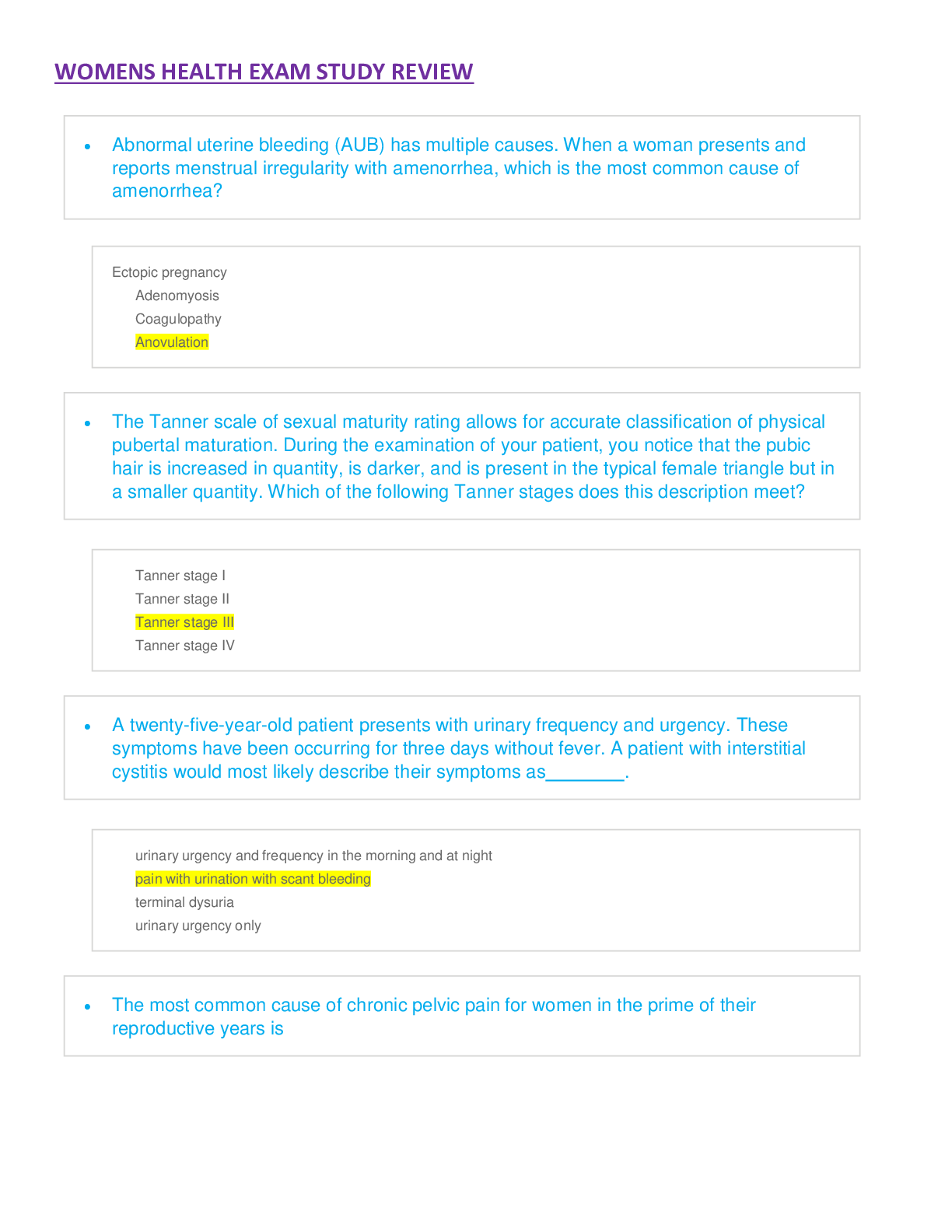

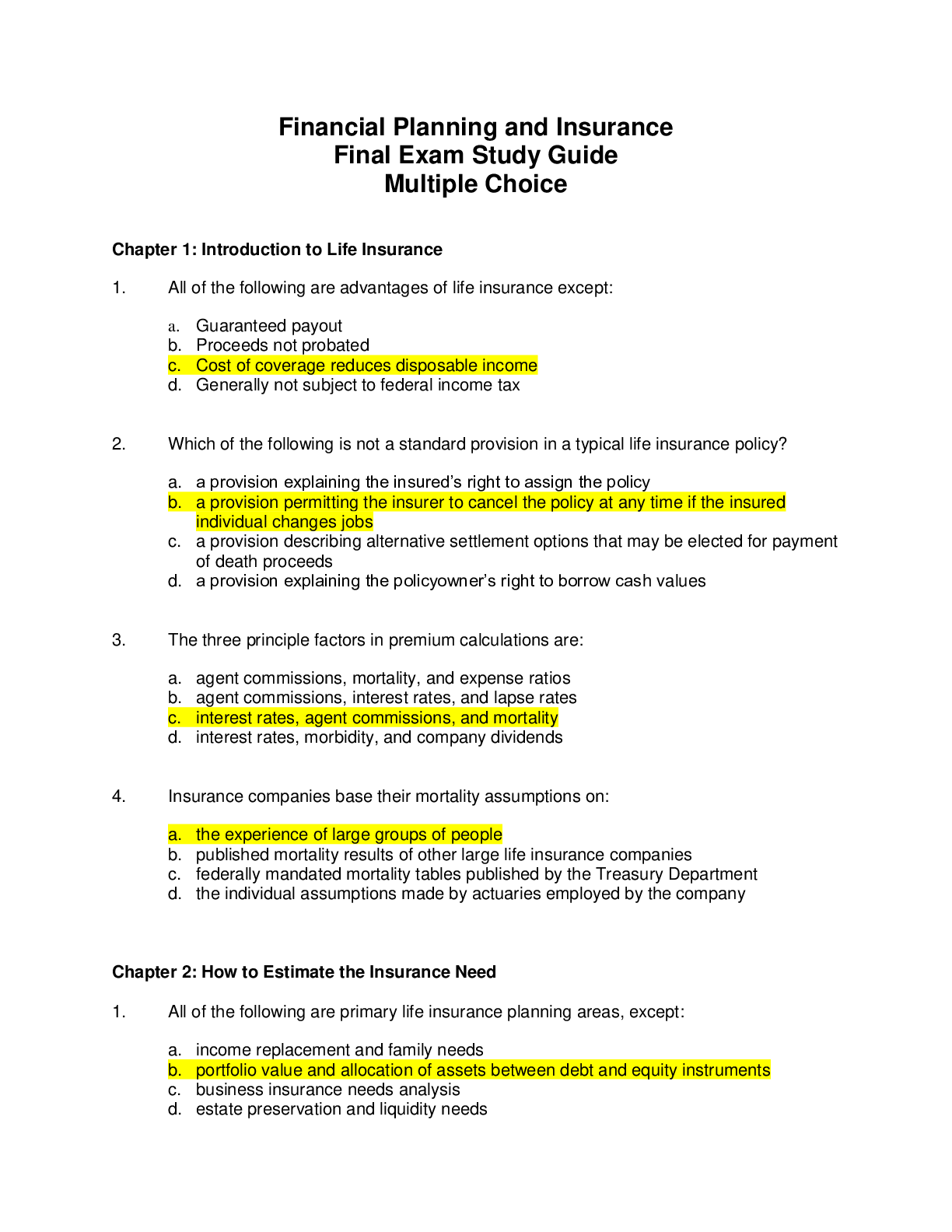

Financial Planning and Insurance Final Exam Study Guide Multiple Choice Chapter 1: Introduction to Life Insurance 1. All of the following are advantages of life insurance except: a. Guaranteed pa... yout b. Proceeds not probated c. Cost of coverage reduces disposable income d. Generally not subject to federal income tax 2. Which of the following is not a standard provision in a typical life insurance policy? a. a provision explaining the insured’s right to assign the policy b. a provision permitting the insurer to cancel the policy at any time if the insured individual changes jobs c. a provision describing alternative settlement options that may be elected for payment of death proceeds d. a provision explaining the policyowner’s right to borrow cash values 3. The three principle factors in premium calculations are: a. agent commissions, mortality, and expense ratios b. agent commissions, interest rates, and lapse rates c. interest rates, agent commissions, and mortality d. interest rates, morbidity, and company dividends 4. Insurance companies base their mortality assumptions on: a. the experience of large groups of people b. published mortality results of other large life insurance companies c. federally mandated mortality tables published by the Treasury Department d. the individual assumptions made by actuaries employed by the company Chapter 2: How to Estimate the Insurance Need 1. All of the following are primary life insurance planning areas, except: a. income replacement and family needs b. portfolio value and allocation of assets between debt and equity instruments c. business insurance needs analysis d. estate preservation and liquidity needs2. The “multiples-of-salary” method of estimating the amount of a family’s insurance needs is a. a rule of thumb method that determines insurance need by looking at the number of children in the family b. a method that was repealed by the Taxpayer Relief Act of 1997 c. a method combining a simple rule of thumb method with elements of income replacement and needs analysis d. a method that can be used only by individuals who are properly licensed with the FAA 3. The income replacement approach to determining a family’s insurance needs is based primarily on? a. the earnings growth rate of long-term U.S. Treasury securities b. regulations issued by the Department of Health and Human Services c. the current balance in the accumulated adjustment account d. the human life value concept 4. A conceptually sound approach to valuing key employees should a. Ignore the financial consequences of the timing of lost employee contributions b. Discount for trends in employee contributions c. Recognize that most, if not all, the value of key employe contributions will be recovered over time through change or adapting Chapter 3: How to Determine the Right Company 1. The most important factors that should be considered in choosing an insurance company include all of the following, except: a. the quality of the company’s policy illustrations b. the company’s financial stability c. the company’s reputation for service and fairness to policyholders d. the availability of products that meet the needs of the customer 2. Which of the following items should not be taken into account when performing a “due care” analysis? a. assessing the general characteristics and financial information of the company b. reviewing profitability, leverage and liquidity tests c. looking at the company’s ratings by the major rating services d. inspecting the company’s marketing materials3. Life insurance companies with better mortality experience than other companies tend to have a. higher underwriting standards b. nonqualified deferred compensation plans for general agents c. a mutual holding company structure d. a 401(k) matching program for employees 4. Mutual life insurance companies have all of the following advantages except: a. No conflict of interest between shareholders and policyholders b. Lower profit goals than stock companies c. Long-term management view d. Limited ability to raise capital through stock issuance Chapter 4: How to Determine the Right Policy 1. For families with young children or couples with a living standard that is relatively high for their income, the amount of insurance needed will be high. As a result, a. the priority should be to provide the most possible permanent insurance b. the priority should be to provide adequate death protection c. the couple should be encouraged to save for several years until they can afford to purchase permanent insurance d. a combination of term and permanent insurance should always be recommended regardless of how little the client can afford 2. The two policy comparison methods that compute the rates of return, or the prices of protection, for all years, or any subset of years the policies may be in force were developed by: a. Linton and Baldwin b. the National Association of Insurance Commissioners c. Joseph Belth d. A.M. Best 3. The easiest policy comparison method to understand and use is the a. interest-adjusted net payment cost index b. traditional net cost method c. Baldwin method d. equal outlay method4. Financial services professionals should examine policy illustrations with emphasis on: a. Surrender charges b. Cash value projections c. Policy loans and dividends d. All of the above Chapter 8: Annuities 1. Which of the following features represents an advantage of an annuity over a mutual fund investment? a. greater participation in favorable market performance b. stepped up basis in the hands of a beneficiary after the owner's death c. tax deferred growth d. lower fees for acquisition 2. If the annuitant dies after annuity benefit payments have started under a “pure life annuity” settlement option a. the payments cease b. the payments continue to his beneficiary for at least five years c. the payments continue to his beneficiary for at least ten years d. the payments cease during the Social Security blackout period but begin again when the beneficiary reaches age 65 3. A fixed annuity might be a good choice when a. safety of principal is paramount b. a guaranteed interest rate is wanted c. a conservative complement to other investment vehicles is desired d. all of the above 4. The process of selecting the best fixed annuity includes a. Comparing costs and features b. Comparing total outlay with total annuity payments c. Comparing relative financial strengths of companies d. All of the aboveChapter 10: Group Life Insurance 1. Group life insurance is a welfare benefit plan. As a result: a. coverage may not exceed $50,000 per employee b. an equal amount of coverage must be provided to all employees c. it is subject to securities regulations d. it is subject to ERISA 2. Approximately what percentage of all life insurance in force in the United States is on a group basis? a. 15% b. 30% c. 40% d. 55% 3. Which one of the following is not an advantage of group term life insurance? a. It provides insurance at standard rates for those who might otherwise be insurable at only an increased premium. b. It is can be used as a standard investment option under the employer's 401(k) plan. c. It provides a death benefit to employees at a relatively low cost. d. It typically enables terminated employees to convert to individual policies without submitting evidence of insurability. 4. An employee does not have to report any income with respect to what amount of group term life insurance coverage (assuming the plan is not discriminatory)? a. zero b. $50,000 c. $100,000 d. $125,500 Chapter 13: Ordinary Level-Premium Whole Life Insurance 1. In which of the following situations would a level-premium whole life insurance policy be appropriate? a. To provide a fund needed only if death should occur within a short period of time after purchase b. When the policyowner desires to control the investments of the cash value of the policy c. When the policyowner desires to vary the death benefit depending upon life circumstances d. To provide funds for the continuation of a business through a “buy-sell” agreement2. Which of the following is a characteristic of a level-premium non-participating whole life insurance policy? a. In the early years of the policy, the amount of protection is higher relative to premium spent than term insurance. b. Federal income tax must be paid on cash value accumulations. c. There is a periodic adjustment of premium and death benefit. d. There is a schedule of guaranteed cash values. 3. Advantages of ordinary level-premium whole life include all of the following except a. Fixed and known annual premium b. Interest on policy loans is generally non deductible c. Tax-free, or tax-deferred, accumulation of cash values d. Policy cash values can be borrowed at low net cost 4. Level-premium whole life insurance policies allow policyowners to borrow amounts under the policy. Typical loan provisions include which of the following requirements? a. Policy loans must be approved by the insurer's loan committee. b. If the policy is terminated the cash surrender value is reduced by any outstanding policy loans and unpaid interest. c. On the death of the insured, the death benefit is reduced by any unpaid interest but not by any outstanding policy loan. d. The amount of the loan is limited to the amount of the death benefit. Chapter 16: Term Insurance 1. Advantages of term life insurance include all of the following, except: a. it allows a person to acquire the greatest death benefit for the lowest premium when the policy is first issued b. death proceeds are generally exempt from income tax c. it is the most cost effective when the duration of the needed protection is over 15 years d. a high degree of flexibility can be made available by combining term insurance riders with permanent insurance2. If a term policy is convertible it means the policy: a. gives the policyholder a contractual right to change the term policy for some other type of life insurance policy without evidence of insurability b. offers a flexible feature that allows the policyholder to set up a customized pattern of premiums and face amounts even after issue, within limits c. offers renewal premiums based on rates comparable to premiums for newly issued policies provided that the insured continues to show evidence of insurability at periodic intervals d. provides for automatic cost-of-living increases in the death benefit 3. An increasing premium, level death benefit term policy to age 65 is: a. mortgage insurance b. usually offered as a rider to another basic policy, and is commonly called a “returnof-premium” benefit c. a one-year term policy, renewable to age 65 d. a term policy offered during open enrollment periods, which offers to repay premiums if the insured dies within the first few years but pays no death benefit until the insured has survived the first few years of the policy 4. Disadvantages of term insurance include all of the following except a. no tax-free automatic savings b. premiums increase with age c. no loan values d. proceeds are not part of a probated estate unless the estate is a named beneficiary. Chapter 17: Universal Life 1. Which of the following statements regarding universal life insurance is not true? a. The policyowner can easily track the policy's different elements. b. It is generally best suited to long term coverage needs. c. If the policyowner skips a premium payment the policy will not lapse. d. The policy is not susceptible to inadvertently becoming a modified endowment contract.2. Which of the following problems could be caused by the flexibility offered by a universal life insurance policy? a. Increases in the death benefit within in the first five policy years can cause the death benefit to become taxable income to the beneficiary. b. Skipping even one premium payment will cause the policy to lapse. c. A death benefit reduction may cause the policy to be classified as a modified endowment contract. d. The coverage of a key employee's life by a corporation will cause a transfer for value problem. 3. Which of the following statements regarding universal life insurance is true? a. Because they are not reported separately, elements of the policy such as interest credits, mortality charges, and death benefits are difficult to track. b. Universal life allows policyowners to participate in favorable investment, mortality and expense experience of the company. insurance policies. c. Annual increases in cash value are taxable due to the unique nature of the universal life contract. d. Because universal life is a current-assumption policy universal life is a security and a prospectus must be provided before each sale. 4. Which of the following is true regarding the interest credited to universal life policies? a. “Portfolio” rates are generally more responsive to changing market interest rates than “New Money” rates. b. The rate used is based on the return on investments selected by the policyholder and held in a segregated asset account. c. Insurance companies are no longer allowed complete freedom in interest crediting due to some companies abusing such discretion in the past. d. The rate used may be linked to a well-known index of yields if it exceeds a minimum rate guaranteed in the policy. Chapter 18: Variable and Variable Universal Life 1. A key feature of variable life insurance is a. the dividends are guaranteed b. there is no guaranteed minimum cash value c. death benefit claims are always paid in shares of company stock rather than in cash d. it can be sold only by registered traders on the New York exchange2. Which item is not a key factor to be weighed in choosing the best variable life or variable universal life policy? a. policy loadings and expenses b. the amount of the cash value guarantees c. suitability and variety of investment options d. relative performance of the insurance company's alternative investment account 3. Which of the following statements about variable universal and variable life insurance death benefits is not true? a. The certainty of death benefit levels is greater under variable universal life than variable life, as long as premiums are paid at necessary levels. b. The death benefit under a variable universal life policy is adjustable, within limits and subject to insurability requirements, at the discretion of the insured. c. Variable universal life offers greater certainty of death benefit levels than variable life as long as premiums are paid at the level necessary to maintain the death benefit. d. Variable Life and Variable Universal Life bear no mortality or expense risk. 4. Which of the following statements about the tax aspects of ownership of variable life insurance is false? a. Transfers of investment assets from one fund to another are tax-free. b. Gains received are taxable at capital gains rates. c. Investment earnings within the policy are tax deferred. d. Death benefits are usually paid free of federal income tax. Chapter 19: Modified Endowment Contracts 1. A modified endowment contract is a life insurance policy that has failed a. the test for life insurance b. the seven-pay test c. the transfer for value rule d. the rule against perpetuities 2. Which of the following items are NOT treated as income-first when distributed from a modified endowment contract? a. dividends retained by the insurer to premiums or other consideration for the contract b. cash dividends c. policy loans to pay premiums and for all other purposes d. withdrawals3. A policy that originally is not a modified endowment contract will be subject to re-testing if there is a “material change” in the contract. Which of the following would likely be a material change? a. A cost-of-living increase in the death benefit based on the consumer price index. b. Increases in death benefits because of premiums paid for the policy to support the first seven contract years of benefits. c. An exchange of one policy for another policy in a 1035 exchange. d. A death benefit increase inherent in the policy design due to crediting of interest or other earnings. 4. Which of the following could never be treated as a modified endowment contract? a. A single-premium policy that was entered into on June 1, 1988. b. A single premium policy entered into after July 1, 1988. c. A single-premium policy that was entered into on June 1, 1988 that is exchanged for another policy in 1997. d. A policy that initially passes the seven-pay test. Chapter 20: Section 1035 Exchanges 1. Which of the following would NOT be a valid exchange under Section 1035? a. A life insurance contract for an annuity contract b. An endowment contract for an annuity contract c. After 2009, an annuity contract for a life insurance contract d. After 2009, a life insurance contract for a qualified long-term care contract. 2. An individual owns a life insurance policy that is intended to be exchanged in a 1035 exchange. The individual has paid a total of $75,000 in premiums into the policy and the policy is now worth $100,000. When the exchange is complete, what will the investment in the contract of the new policy be? a. $0 b. $25,000 c. $75,000 d. $100,0003. An individual owns a life insurance policy with investment in the contract of $35,000 and a cash value of $60,000. He exchanges the policy for a new one that will have a cash value of $55,000 and will also receive $5,000 in cash in the exchange. How much gain will the individual recognize on this transaction? a. $0 b. $5,000 c. $20,000 d. $25,000 4. Which of the following would NOT be a consideration when considering a 1035 exchange? a. A higher rate of return is available on the new policy. b. The death benefit of the new product is higher with the new product. c. The new policy has lower premiums due to improved mortality tables and other factors. d. The old policy is a modified endowment contract (MEC) and the new policy will not be a MEC. Chapter 21: Taxation of Benefits 1. What of the following items are included in a life insurance contract’s investment in the contract? a. Interest paid on policy loans b. The economic benefit reportable income from term insurance in a qualified plan c. Premiums for accidental death benefits d. Premiums for disability income 2. An individual owns a life insurance policy with an investment in the contract of $75,000 and a cash value of $125,000. Over time, the individual withdraws $85,000 from the contract. How much of the withdrawal will the individual be required to recognize for income-tax purposes. a. $0 b. $10,000 c. $50,000 d. $85,0003. A life insurance policy is owned in the beneficiary’s qualified retirement plan. A total of $50,000 was paid in premiums and at the insured’s death it had a cash value of $100,000 and a death benefit of $250,000. How much of the death benefit will be subject to income tax? a. $0 b. $50,000 c. $100,000 d. $250,000 4. Which of the following is NOT a requirement to have death proceeds from employerowned life policies issued after August 2006 received income-tax free? a. A notice to the insured must state the policy owner will be the beneficiary. b. The insured must have been an employee of the beneficiary. c. The insured must pay the premiums. d. The insured must be given notice of the maximum amount that the employer will insure the insured’s life for. Chapter 23: Estate Taxation of Life Insurance 1. An owner of an insurance policy on the life of another person dies. What is includible in the deceased owner’s estate? a. the face value of the life insurance policy b. replacement cost of the life insurance policy c. the sum of premiums paid d. nothing is includible 2. Life insurance proceeds would be considered payable for the benefit of a decedent’s estate if used to pay for which of the following? a. state inheritance taxes b. medical bills owed by the decedent’s estate c. income taxes owed by decedent’s estate d. all of the above 3. Which of the following rights is generally considered an incident of ownership of life insurance? a. the right to terminate a spouse’s interest in a policy by obtaining a divorce b. to remove or change a trustee of a trust that owns a policy on the insured’s life c. to amend a trust that owns a policy on the insured’s life d. to amend a trust that is beneficiary of a policy on the insured’s life4. The replacement cost of a life insurance policy is generally equal to the policy’s interpolated terminal reserve plus: a. the sum of premiums paid b. the policy’s face value c. the policy’s cash value d. the unearned premium Chapter 24: Gift Taxation of Life Insurance 1. A gift of life insurance to an irrevocable life insurance trust can make all of the following results possible, except: a. state death taxes savings b. federal estate tax savings c. estate liquidity d. continued control and ownership of the life insurance policy 2. What amount is potentially taxable as a gift of a life insurance policy to another individual? a. the sum of premiums paid b. the interpolated terminal reserve c. the replacement cost of the policy d. the face value of the policy 3. A life insurance policy that has been given as a gift can be includible in the donor’s gross estate if: a. the donor’s spouse is named as beneficiary b. someone other than the donor’s spouse is named as beneficiary c. the grantor dies within three years of the transfer d. the grantor dies within five years of the transfer 4. Who is potentially liable for the gift tax on a completed gift of life insurance? a. neither the donor nor the donee b. the donor only c. the donee only d. both the donor and the doneeChapter 27: Buy-Sell Agreements 1. If stockholders are subject to restrictions on the sale of stock under a buy-sell agreement, why should the certificates be marked with a legend stating the existence of the restrictions? a. To make the agreement binding on the parties to the agreement b. To reduce the estate tax value of the stock c. To make the restrictions enforceable against a transferee d. To avoid the transfer-for-value rule 2. Which of the following statements is true regarding buy-sell agreements? a. Premiums for life insurance used to fund a redemption buy-sell agreement are taxdeductible for a corporation, but not for a partnership or an individual. b. In a cross purchase buy-sell agreement, the corporation agrees to purchase the business interest upon the occurrence of the triggering event. c. If a corporation pays premiums for a policy owned by one shareholder on the life of another shareholder, this payment will likely be considered a dividend. d. If a shareholder dies, the policies owned by the other shareholders will be included in the decedent's estate for federal estate-tax purposes. 3. Which of the following is required for a buy-sell agreement to establish the estate tax value of closely-held stock subject to the agreement? a. The agreement must provide for the purchase of additional insurance as the value of the stock increases. b. The stock certificates must bear a legend stating their sale is subject to restrictions and where the restrictions can be found. c. The agreement must explain how and when the purchased stock will be delivered. d. The estate must be obligated to sell the stock at a price that is determinable by a reasonable formula or a method contained in the agreement. 4. Advantages of using life insurance funding in a buy-sell agreement include all of the following except: a. the event that creates the need for cash also results in the cash becoming available b. the cost is relatively low c. premiums to keep the coverage in effect are deductible as a business expense d. survivors of the deceased shareholder can be freed from financial dependence on a business that has just lost a key employeeChapter 28: Charitable Uses of Life Insurance 1. An employee can name a charity as the sole beneficiary of group term life insurance and avoid any income tax on the economic benefit for coverage over what amount? a. $20,000 b. $30,000 c. $40,000 d. $50,000 2. Which of the following gifts of less than the client's entire interest in property would not generate an income tax deduction? a. a charitable gift annuity b. a remainder interest in a qualified charitable remainder trust c. a charitable gift of the cash surrender value of a policy of which his son is the beneficiary d. an annuity or unitrust interest in a charitable lead trust 3. The annual payout from a charitable remainder annuity trust (CRAT) to a noncharitable beneficiary may not exceed what percentage of the initial fair market value of the property contributed to the trust? a. 10% b. 25% c. 50% d. 75% 4. A qualified appraisal must be obtained for a taxpayer to claim a deduction for a gift of life insurance of a. $100 or more b. $500 or more c. $1,000 or more d. $5,000 or more [Show More]

Last updated: 1 year ago

Preview 1 out of 15 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 12, 2021

Number of pages

15

Written in

Additional information

This document has been written for:

Uploaded

Sep 12, 2021

Downloads

0

Views

57

.png)

Rasmussen College.png)