Financial Accounting > QUESTIONS & ANSWERS > Strayer University - ACC 556week 1 quiz. 100% Correct. (All)

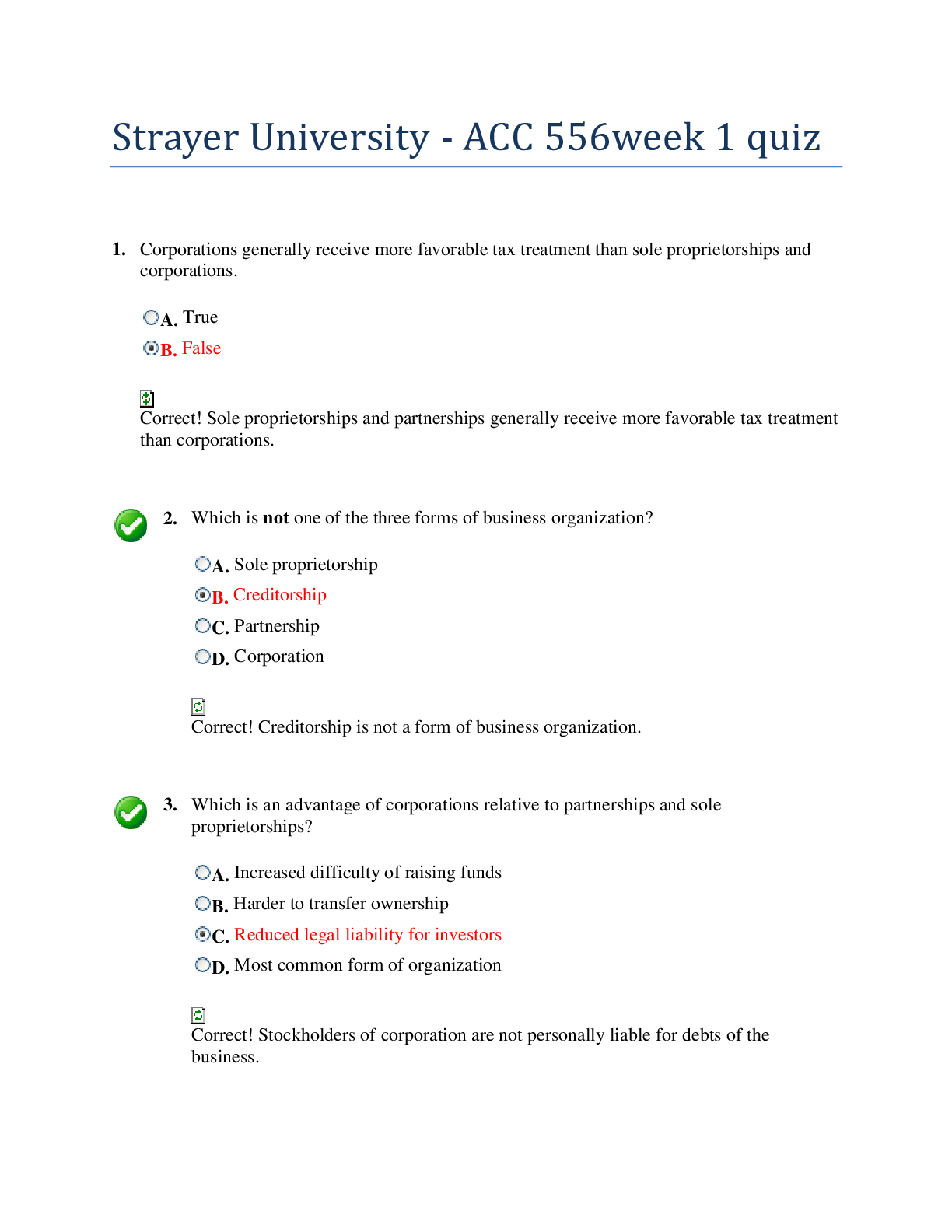

Strayer University - ACC 556week 1 quiz. 100% Correct.

Document Content and Description Below

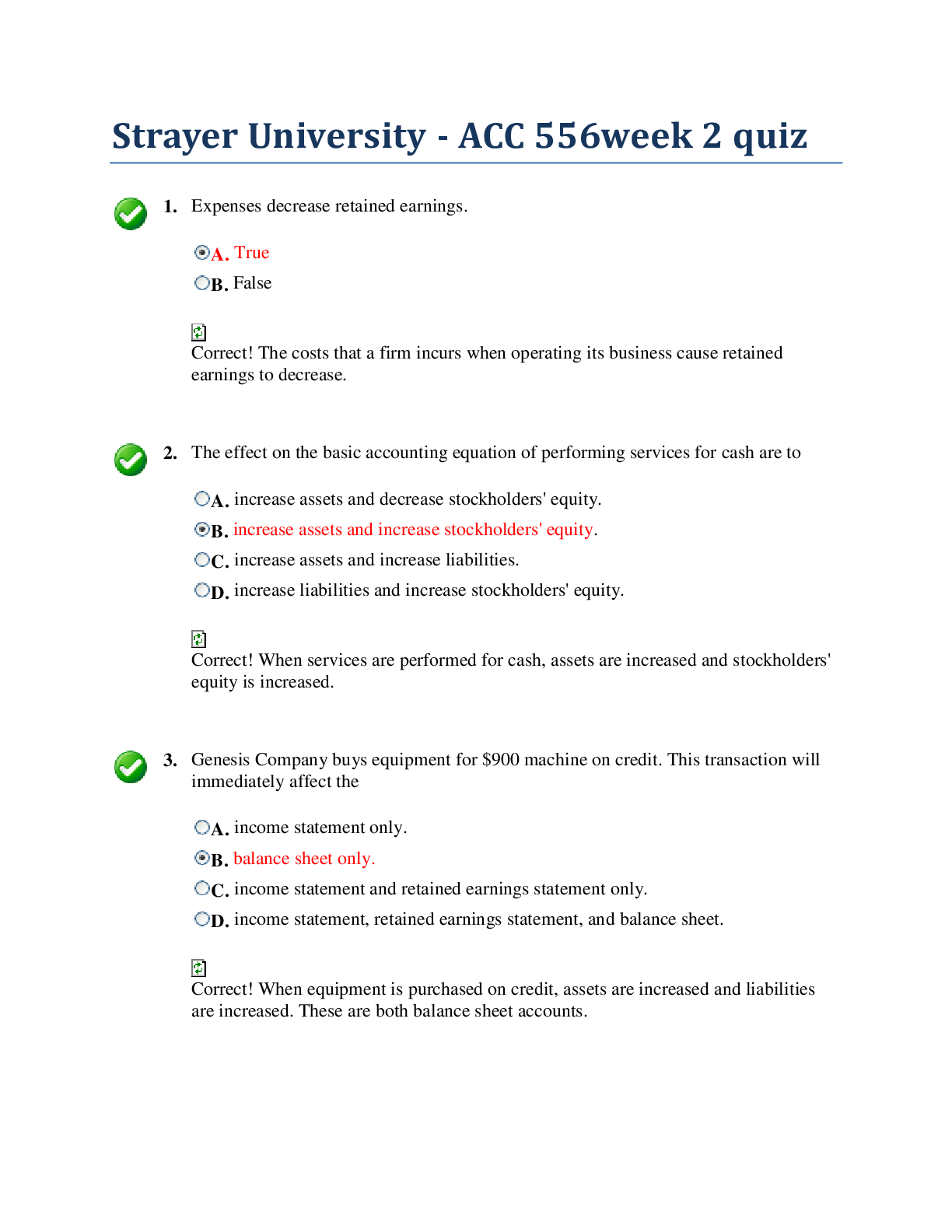

1. Corporations generally receive more favorable tax treatment than sole proprietorships and corporations. A. True B. False 2. Which is not one of the three forms of business organi... zation? A. Sole proprietorship B. Creditorship C. Partnership D. Corporation 3. Which is an advantage of corporations relative to partnerships and sole proprietorships? A. Increased difficulty of raising funds B. Harder to transfer ownership C. Reduced legal liability for investors D. Most common form of organization 4. Easy transfer of ownership is a characteristic of which form of business organization? A. Sole proprietorship B. Partnership C. Corporation D. All of the answer choices are correct 5. In which forms of business organization are the owners personally liable for all the debts of the business? A. Sole proprietorships and corporations B. Sole proprietorships and partnerships C. Partnership and corporation D. All of the answer choices are correct 6. The sole proprietorship form of business organization A. must have at least two owners in most states. B. generally receives favorable tax treatment relative to a corporation. C. combines the records of the business with the personal records of the owner. D. is classified as a separate legal entity. 7. Which forms of business organization are considered to be separate accounting entities? A. Sole proprietorships and partnerships only B. Partnerships and corporations only C. Only corporations D. Sole proprietorships, corporations, and partnerships 8. Internal users of accounting information include a company's stockholders. A. True B. False 9. To which of the following questions will internal users want answers? A. What selling price for our product will maximize the company's net income? B. Which product line is most profitable? C. Is cash sufficient to pay dividends to stockholders? D. All of the answer choices are correct. 10. Which of the following is not an external user of accounting data? A. Labor unions B. Customers C. Economic planners D. Chief Financial Officer 11. Which statement about users of accounting information is incorrect? A. Management is considered an internal user. B. Taxing authorities are considered external users. C. Present creditors are considered external users. D. Regulatory authorities are considered internal users. 12. Which of the following did not result from the Sarbanes-Oxley Act? A. Top management must now certify the accuracy of financial information. B. Penalties for fraudulent activity increased. C. Auditors cannot provide non-audit services to the same client. D. Tax rates on corporations increased. 13. Which of the following is the most appropriate definition of accounting information? A. The information system that identifies, records, and communicates the economic events of an organization to interested users B. A means of collecting information C. The interconnected network of subsystems necessary to operate a business D. Electronic collection and organization of vast amounts of financial information 14. Which of the following is required as a result of SOX? A. Public companies must present audited financial statements. B. Companies that go bankrupt must repay shareholders for loss investments. C. All shareholders now have an oversight role of the company's financial activities. D. Top management must certify the financial statements for their company. 15. Interest expense is classified under operating activities on the statement of cash flows. A. True B. False 16. Paying interest expense and receiving interest revenue are examples of A. Operating activities. B. Financing activities. C. Investing activities. D. Delivery activities. 17. The payment of dividends is an example of a(n) A. Operating activity. B. Financing activity. C. Investing activity. D. Delivery activity. 18. Which of the following is not one of the three primary business activities? A. Financing B. Operating C. Advertising D. Investing 19. Which of the following is an example of a financing activity? A. Issuing shares of common stock B. Selling goods on account C. Buying delivery equipment D. Buying inventory 20. Resources owned by a business are referred to as A. stockholders' equity. B. liabilities. C. assets. D. revenues. . 21. In terms of the principal types of business activities, paying salaries expense is an example of A. operating activities. B. financing activities. C. investing activities. D. advertising activities. 22. What kind of classification is cost of goods sold? A. Asset B. Expense C. Liability D. Revenue 23. Which of the following would not appear on the income statement? A. Service revenue B. Interest expense C. Net income D. Dividends paid 24. Which of the following would not appear on the retained earnings statement? A. Beginning retained earnings balance B. Dividends C. Service revenue D. Net income 25. Net income will result during a time period when A. assets exceed liabilities. B. assets exceed revenues. C. expenses exceed revenues. D. revenues exceed expenses. 1. The financial statements for Harold Corporation contained the following information: Accounts receivable $ 5,000 Sales revenue 75,000 Cash 15,000 Salaries and wages expense -20,000 Rent expense -10,000 How much was Harold's net income? A. $60,000 B. $15,000 C. $65,000 D. $45,000 2. The balance sheet reports assets and claims to those assets at a specific point in time. A. True B. False 3. The statement of cash flows reports net income, investing, and financing activities. A. True B. False 4. In which of the following sequences are the financial statements usually prepared? A. Income statement, balance sheet, retained earnings statement, and statement of cash flows B. Balance sheet, retained earnings statement, statement of cash flows, and income statement C. Balance sheet, statement of cash flows, income statement and retained earnings statement D. Income statement, retained earnings statement, balance sheet, and statement of cash flows 5. Saira's Maid Service began the year with total assets of $120,000 and stockholders' equity of $40,000. During the year the company earned $90,000 in net income and paid $20,000 in dividends. Total assets at the end of the year were $215,000. How much was stockholders' equity at the end of the year? A. $130,000 B. $110,000 C. $150,000 D. $135,000 6. Which statement presents information as of a specific point in time? A. Income statement B. Balance sheet C. Statement of cash flows D. Retained earnings statement 7. How is the issuance of common stock reported on the statement of cash flows? A. Financing activity B. Investing activity C. Operating activity D. Marketing activity 8. What section of a cash flow statement shows the cash spent on new equipment during the past accounting period? A. The investing section B. The operating section C. The financing section D. The cash flow statement does not give this information. 9. Which financial statement reports assets, liabilities, and stockholders' equity? A. Income statement. B. Retained earnings statement. C. Balance sheet. D. Statement of cash flows. 10. The ending retained earnings balance appears on A. The retained earnings statement only. B. The balance sheet only. C. The income statement and the retained earnings statement. D. Both the retained earnings statement and the balance sheet. 11. Saira's Maid Service began the year with total assets of $120,000 and stockholders' equity of -($40,000. During the year the company earned $90,000 in net income and paid -$20,000) in dividends.(= ending stockholders' equity) Total assets at the end of the year were +$215,000. How much are total liabilities at the end of the year? A. $80,000 B. $90,000 C. $110,000 D. $105,000 . 12. The balance sheet A. summarizes the changes in total equity for a specific period of time. B. reports the changes in assets, liabilities, and stockholders' equity over a period of time. C. reports the assets, liabilities, and stockholders' equity at a specific date. D. presents the revenues and expenses for a specific period of time. 13. If total liabilities decreased by $15,000 and stockholders' equity increased by $5,000 during a period of time, then total assets must change by what amount and direction during that same period? A. $20,000 increase B. $10,000 decrease C. $10,000 increase D. $15,000 decrease 14. Stockholders' equity represents A. claims of creditors. B. economics resouces to be used in the future. C. the difference between revenues and expenses. D. claims of owners. 15. As of December 31, 2014, Stoneland Corporation has assets of $3,500 and stockholders' equity of $2,000. How much are the liabilities for Stoneland Corporation as of December 31, 2014? A. $1,500 B. $1,000 C. $2,500 D. $2,000 16. The notes to the financial statements are not required if a company presents all 4 financial statements. A. True B. False 17. Only Certified Public Accountants may perform audits. A. True B. False 18. The segment of a corporation's annual report that describes the corporation's accounting methods is the A. notes to the financial statements. B. management discussion and analysis. C. auditor's report. D. income statement. 19. The segment of the annual report that presents an opinion regarding the fairness of the presentation of the financial position and results of operations is/are the A. income statement. B. auditor's opinion. C. balance sheet. D. financial statements. 20. When the auditor is satisfied that the financial statements provide a fair representation of the company's financial position and results of operation in accordance with generally accepted accounting principles, the auditor will express A. a qualified opinion. B. a disclaimer of opinion. C. unqualified opinion. D. an adverse opinion. 21. An annual report includes all of the following except A. a management discussion and analysis section. B. notes to the financial statements. C. an auditor's report. D. a listing of all of the stockholders. 22. Which section of the annual report presents highlights of favorable or unfavorable trends and identifies significant events and uncertainties affecting a company's ability to pay near-term obligations, and a company's ability to fund operations and expansion? A. Financial statements B. Management discussion and analysis C. Notes to the financial statements D. Auditor's report 23. Which of the following are not considered to be primary users of financial statements in countries outside the U.S.? A. Private investors B. Tax authorities C. Economic advisors D. Central government planners 24. The most common description of IFRS as contrasted to GAAP is that A. GAAP is principles based and IFRS is rules based. B. GAAP is principles based and IFRS is concepts based. C. GAAP is rules based and IFRS is rules based. D. GAAP is rules based and IFRS is principles based. 25. IFRS stands for: A. International Financial Regulatory Schema. B. International Financial Reporting Standards. C. International Fiscal Regulatory Standards. D. International Finance Regulatory Stipulations. 26. Which of the five elements of financial statements does the IASB's definitional structure recognize? A. Assets, Liabilities, Equity, Income, Expenses B. Assets, Lending balances, Equity, Investments, Expenses C. Accumulated income, Liabilities, Equity, Income, Financing D. Assets, Liabilities, Earnings, Income, Expenses 1. Current assets are economic resources that are expected to be converted to cash or used up by the business within one year or the normal operating cycle, whichever is shorter. A. True B. False 2. In a classified balance sheet, how are assets usually classified? A. Current assets; long-term assets; property, plant, and equipment; and intangible assets B. Current assets; long-term investments; property, plant, and equipment; and common stock C. Current assets; long-term investments; tangible assets; and intangible assets D. Current assets; long-term investments; property, plant, and equipment; and intangible assets 3. In what order are current assets listed? A. By liquidity B. By importance C. By longevity D. Alphabetically 4. The correct order of presentation in a classified balance sheet for the following current assets is A. accounts receivable, cash, prepaid insurance, inventories. B. cash, inventories, accounts receivable, prepaid insurance. C. cash, accounts receivable, inventories, prepaid insurance. D. inventories, cash, accounts receivable, prepaid insurance. 5. A company purchased a tract of land on which it expects to build a production plant on in approximately five years. During the five years before construction, the land will be idle. In what classification should the land be reported? A. Property, plant, and equipment B. Land expense C. A long-term investment D. An intangible asset 6. Which of the following is not classified as a current asset? A. Prepaid expenses B. Accounts receivable C. Patents D. Inventory 7. Which of the following is the correct order for listing current assets on the balance sheet? A. Cash, accounts receivable, prepaid expenses, inventories, short-term investments B. Cash, short-term investments, inventories, prepaid expenses, accounts receivable C. Cash, accounts receivable, inventories, short-term investments, prepaid expenses D. Cash, short-term investments, accounts receivable, inventories, prepaid expenses 8. Which of the following is an example of an intangible asset? A. Accounts receivable B. Trademarks C. Prepaid expenses D. Property, plant, and equipment 9. Which of the following is considered property, plant, and equipment on a classified balance sheet? A. Supplies B. Investment in Intel Corporation stock C. Land D. Copyright 10. Current liabilities are $10,000, long-term liabilities are $20,000, common stock is $50,000, and retained earnings totals $70,000. How much is total stockholders' equity? A. $150,000 B. $140,000 C. $120,000 D. $70,000 11. Which one of the following is not an alternate means of expressing a ratio? A. Proportion B. Rate C. Percentage D. Dollar amount 12. Earnings per share is computed by dividing net income A. by the average common shares outstanding. B. by the ending common shares outstanding. C. less preferred stock dividends by the average common shares outstanding. D. less preferred stock dividends by the ending common shares outstanding. 13. Which is an indicator of profitability? A. Current ratio B. Earnings per share C. Debt to total assets ratio D. Free cash flow 14. For 2014, Stoneland Corporation reported net income, $24,000; net sales, $400,000; and average shares outstanding, 6,000. There were no preferred stock dividends. How much was the 2014 earnings per share? A. $4.00 B. $0.06 C. $16.67 D. $66.67 15. Net income is $200,000, preferred dividends are $20,000, and average common shares outstanding are 50,000. How much is earnings per share? A. $4.00 B. $3.60 C. $0.28 D. $0.25 16. Which of the following does not properly reflect a financial ratio? A. 18.4% B. 7:1 C. $0.60 per dollar D. $7,200 17. The following balances and amounts were taken from the financial statements of Ortiz, Inc. The data are presented in alphabetical order. Accounts payable $35,000 Cash provided by operations $90,000 Accounts receivable 37,500 Net income 36,000 36,000 Average common shares 20,000 Salaries and wages payable 8,000 Average current liabilities 110,000 Stockholders' equity 240,000 Average and total assets 600,000 Total current assets 300,000 Average total liabilities 320,000 Total current liabilities 120,000 Cash 100,000 How much is earnings per share? A. $0.15 B. $0.56 C. $1.80 18. At December 31, 2014, Shorts Company had retained earnings of +$2,184,000. During 2014, the company issued stock for $98,000, and paid dividends of +$34,000. Net income for 2014 was -$402,000. How much was the retained earnings balance at the beginning of 2014? A. $2,552,000 B. $1,816,000 C. $1,914,000 D. $2,454,000 19. Issuing new shares of common stock will A. increase retained earnings. B. decrease retained earnings. C. increase common stock. D. decrease common stock. 20. Which statement is used by most corporations instead of the retained earnings statement? A. Statement of owners' equity B. Statement of cash flows C. Statement of stockholders' equity D. Balance sheet 21. Which one of the following does not affect retained earnings? A. Net income B. Net loss C. Issuance of common stock D. Dividends 22. The current ratio is a liquidity ratio that is computed as current assets divided by current liabilities. A. True B. False 6 23. The following ratios are available for Leer Inc. and Stable Inc. Current Ratio Debt to Assets Ratio Earnings per Share Leer Inc. 2:1 75% $3.50 Stable Inc 1.5:1 40% $2.75 Compared to Stable Inc., Leer Inc. has A. higher liquidity, higher solvency, but profitability cannot be compared based on information provided. B. lower liquidity, higher solvency, and higher profitablility. C. higher liquidity, lower solvency, and higher profitability. D. higher liquidity and lower solvency, but profitability cannot be compared based on information provided. 24. Which of these measures is an evaluation of a company's ability to pay current liabilities? A. Earnings per share B. Current ratio C. Both earnings per share and current ratio D. None of these answer choices are correct 25. What is measured by current assets minus current liabilities? A. Solvency B. Working capital C. Profitability D. Cash flow 26. The following balances and amounts were taken from the financial statements of Ortiz, Inc. Accounts payable $35,000 Cash provided by operations $90,000 Accounts receivable 37,500 Net income 36,000 Average common shares 20,000 Salaries and wages payable 8,000 Average current liabilities 110,000 Stockholders' equity 240,000 Average and total assets 600,000 Total current assets 300,000/ Average total liabilities 320,000 Total current liabilities 120,000 Cash 100,000 How much is Ortiz's current ratio? A. 2.38 B. 3.27 C. 2.50 D. 3.40 1. Which of the following ratios measures the ability of the company to survive over a long period of time? A. Current ratios B. Liquidity ratios C. Profitability ratios D. Solvency ratios 2. The following balances and amounts were taken from the financial statements of Ortiz, Inc. Accounts payable $35,000 Cash provided by operations $90,000 Accounts receivable 37,500 Net income 36,000 Average common shares 20,000 Salaries and wages payable 8,000 Average current liabilities 110,000 Stockholders' equity 240,000 Total assets 600,000 Total current assets 300,000 Average total liabilities 320,000 Total current liabilities 120,000 Cash 100,000 How much is the debt to assets ratio? A. 60% B. 40% C. 30% D. 20% 3. If a company has the ability to pay obligations that are expected to become due within the next year or operating cycle whichever is longer, what is the term that describes this measure? A. Working capital B. Profitability C. Solvency D. Liquidity 4. The following balances and amounts were taken from the financial statements of Ortiz, Inc. Accounts payable $ 35,000 Cash provided by operations $ 90,000 Accounts receivable 37,500 Net income 36,000 Average common shares 20,000 Salaries and wages payable 8,000 Average current liabilities 110,000 Stockholders' equity 240,000 Average and total assets 600,000 Total current assets 300,000 Average total liabilities 320,000 Total current liabilities 120,000 Cash 100,000 How much is working capital? A. $180,000 B. 2.50 C. $280,000 D. None of the answer choices are correct 5. The following balances and amounts were taken from the financial statements of Ortiz, Inc. Capital expenditures $55,000 Cash provided by operations $ 90,000 Cash 100,000 Net Income 80,000 Cash dividends paid 20,000 How much is free cash flow? A. $25,000 B. $15,000 C. $35,000 D. $5,000 6. For what purpose might a company use free cash flow? A. Pay additional dividends B. Acquire property, plant, and equipment C. Pay off debts D. All of the answer choices are correct 7. Cash flows from operating activities are $200,000; cash flows from financing activities are $150,000; capital expenditures are $90,000; and dividends are $20,000. How much is free cash flow? A. $180,000 B. $110,000 C. $90,000 D. $40,000 8. In 2014, Bombay Corporation had cash receipts of $21,000 and cash disbursements of $12,000. The company's ending cash balance at December 31, 2014 was $33,000. What was the beginning cash balance? A. $24,000 B. $30,000 C. $45,000 D. $42,000 9. What are generally accepted accounting principles? A. A set of accounting rules and practices that have authoritative support B. Usually established by the Internal Revenue Service C. The guidelines used to resolve ethical dilemmas D. Fundamental truths that can be derived from the laws of nature 10. What organization issues International Financial Reporting Standards? A. International Accounting Standards Board B. Financial Accounting Standards Board C. International Auditing Standards Committee D. IFRS 11. What is the primary accounting standard-setting body in the United States? A. Financial Accounting Standards Board B. IFRS C. Securities and Exchange Commission D. Public Company Accounting Oversight Board (PCAOB) 12. What are the accounting rules that have substantial authoritative support and are recognized as a general guide for financial reporting purposes in the U. S.? A. General accounting principles B. Generally accepted auditing principles C. Generally accepted accounting standards D. Generally accepted accounting principles 13. Going concern is the qualitative characteristic of accounting information that allows a statement reader to compare a company's performance from one year to the next. A. True B. False 14. Consistency means that a company uses the same accounting principles and methods as the other companies in the same industry. A. True B. False 15. The monetary unit assumption assures that all important information needed by investors, creditors, and managers is contained in the financial statements. A. True B. False 16. The historical cost principle requires that if a company buys a building for $2,000,000 in 2012 that increases in value to $2,900,000 in 2014, the company will have to report the building at $2,000,000 in the balance sheet for 2014. A. True B. False 17. Which of the following is not a characteristic of relevance? A. Verifiability B. Materiality C. Confirmatory value D. Predictive value 18. Which of the following is not a fundamental quality of useful accounting information? A. Verifiability B. Relevance C. Neutrality D. Faithful representation 19. Which of the following are constraints that allow a company to modify generally accepted accounting principles without jeopardizing the usefulness of the financial statements? A. Consistency and comparability B. Relevance and faithful representation C. Timeliness and neutrality D. Cost constraint 20. An item is ________ if it is likely to influence the decision of an investor or creditor. A. consistent B. faithful representation C. comparable D. material 21. A company can change to a new method of accounting if management can justify that the new method results in terms of A. more meaningful financial information. B. a higher net income. C. a lower net income for tax purposes. D. less likelihood of clerical errors. 22. What is the primary criterion by which accounting information can be judged? A. Consistency B. Predictive value C. Usefulness for decision making D. Comparability 23. Verifiability is an ingredient of Faithful Representation Relevance a) Yes Yes b) No No c) Yes No d) No Yes A. a B. b C. c D. d 24. Under IFRS, which of the following current assets section would be presented correctly in accordance with IFRS standards? A. Short term notes receivable, Accounts receivable, Cash B. Marketable securities, Land, Cash C. Cash, Intangibles, Short term notes receivable D. Short term investments, Cash, Land Current assets are presented in reverse order of liquidity under IFRS. 25. Under IFRS, what is the label used for common stock? A. Share common stock B. Common shares C. Share capital D. Ordinary shares 26. What will vary between countries when statements are prepared using IFRS? A. The number of shares outstanding B. Accounting time period C. The monetary unit D. Faithful representation . 27. Under IFRS, which of the following selections properly refer to what GAAP signifies as a “balance sheet”? A. Statement of balance B. Statement of financial position C. Statement of financial resources D. Statement of financial wherewithal ACC556 Wee 1 Chapter 1 Slide 1 Introduction Welcome to Financial Accounting for Managers. In this lesson we will discuss the Introduction to Financial Statements. Slide 2 Topics The following topics will be covered in this lesson: Forms of business organizations; Users and Uses of Financial Information; Business Activities ; and Communicating with Users Slide 3 Forms of Business Organizations There are three main forms of business organizations. The first is known as a sole proprietorship. This type of organization is typically owned and controlled by one person. Many small businesses fall into this category. The second type is known as a partnership. This type of organization typically has more than one owner operating the business. Many professional service companies choose this type of organization as a means to pool their resources; both financial and intellectual property. The third and most common type of organization is known as a corporation. Investors in a corporation purchase shares of stock that represent their ownership portion of a company. Buying stock in a corporation is often more attractive than investing in a partnership because shares of stock are easy to sell and provide protection from the liability. Slide 4 Users and Use of Financial Information Let’s now turn our discussion towards users and use of financial information. There are two types of users of financial statements; internal and external. Internal users of accounting information are typically the managers who run the day to day operations of the business. There are several types of external users of accounting information. The first type includes investors, or shareholders. Shareholders may use accounting information to buy, hold, or sell stock. The second type is creditors. Creditors typically use accounting information to evaluate the risks of selling on credit or lending money to a business. Other external users include taxing authorities, customers, and regulators. Good financial reporting practices rely on sound ethics in financial reporting. In an attempt to impose stronger ethical behavior on companies, U.S. regulators and lawmakers passed the Sarbanes-Oxley Act of 2002 also known as SOX, to reduce unethical corporate behavior and decrease the likelihood of future corporate scandals. SOX was passed after several major financial accounting scandals including Enron and WorldCom. Slide 5 Business Activities There are three main types of business activities. These three include financing, investing, and operating activities. Financing activities include debt financing and selling shares of stock in to raise capital. Claims against a company differ between creditors and stockholders. Creditors have a legal right to be paid and in the event of default, they may be able to force the company to pay its debts. Creditor claims are paid before stockholder claims. Stockholders can receive a financial benefit from a company in the form of cash payments, which are known as dividends. After a company raises cash through financing activities, that cash is then used in investing activities. Investing activities include purchasing of the resources the company needs to operate on a day to day basis. If a company has excess cash in its possession, they may choose invest that cash in stocks or bonds of other companies. After a company has acquired the assets it needs to get started, it begins operating activities. Operating activities are simply the day to day operations of the business, which includes purchases of goods or equipment from suppliers, and the sales of goods or services to customers. Slide 6 Communicating with Users Let’s go over several important financial statements which are used with communicating with users. The first form is the income statement. This shows a company’s revenues and expenses, which results in net income or loss for a specific period of time. Investors would most likely be interested in a company’s current and past net income as it provides information that can help them predict future net income. This assists investors in making purchase or sale decisions in the company’s stock. Next, the retained earnings statement is simply the net income retained in the corporation. The retained earnings statement illustrates the amount of changes in retained earnings for a specific time period. The time period is the same as that covered by the income statement. Retained earnings are important as they can show future dividend payment potential. Another way of communicating with users is the balance sheet which shows assets and claims to assets at a specific point in time. Creditor claims are shown as liabilities on the balance sheet. The shareholder claims are known as stockholders equity on the balance sheet. The accounting equation for the balance sheet is calculated as; assets equal liabilities plus stockholders equity. A fourth form is the statement of cash flows. The purpose of a statement of cash flows is to provide financial information about the cash receipts and cash payments of a company for a specific period of time. The statement of cash flows reports the cash effects of a company’s operating, investing, and financing activities. It also demonstrates the financial health of a company as to how liquid they are and how they are able to meet their debt obligations. The last form of communication that we are going to discuss is the annual report. All publicly traded companies must provide their shareholders with this report. The annual report contains all the statements we just discussed as well as other elements. These include, management discussion and analysis; notes to the financial statements; and the auditor’s report, which is prepared by an independent outside auditor and provides the auditor’s opinion as to the fairness of the presentation of the financial position and results of operations and their conformance with generally accepted accounting principles. Slide 7 Short-Story Scenario Now let’s take a look at a short-story scenario that will help you understand the concepts in the lesson better. Imagine you are the Chief Executive officer of a large publicly traded company. Your Chief Operating Officer comes to you and informs you that a creditor is taking the company to court to collect on a loan the company got, but stopped paying on. What steps might you take and which financial statements would you request in order to get to the bottom of the problem and find a resolution? How would you prevent this type of situation in the future? Think about it for a moment. When you’re ready, click the play button and listen to all the choices. After you listened to all the choices, choose the best answer to the scenario Choice A: As the CEO you are not responsible for the financial statements of the company. That charge goes to the Chief Financial Officer, who is responsible for preparing and communicating financial information to both creditors and shareholders. Choice B: As the CEO you must be prepared to understand your financial statements and actively monitor them. Having regular meetings with the CFO and other key staff is essential to heading off these types of situations. To that end, you should take a close look at the liquidity ratios, short term asset balances, short-term debt balances, and ask questions as to how the company got into that situation. The next prudent step would be to ask the CFO and their team for a recommendation as to how they would solve the problem. Several possibilities would be to issue stock and pay the debt of, or reduce it, negotiate better terms for paying off the debt, and at ways to increase revenues in the short and longer term. Remember that as the CEO you are responsible to the company shareholders for the financial health of the company, and also must sign off on the financial statements along with the CFO certifying that they reasonably represent the financial position of the company. This makes you personally liable for those financial statements. Get involved and manage the numbers. Choice C: As the CEO you report to the board of directors who are directly responsible for your actions and the financial reporting requirements of the company. You as CEO, will work directly with the external auditors to determine the financial position of the company. You will then report those findings to the board and get authorization for the external auditors to issue their opinion on the financial statements. Slide 8 Check Your Understanding Slide 9 Check Your Understanding Slide 10 Summary We have reached the end of our lesson. Let’s take a look at what we have covered. We started off discussing the users and uses of financial information. We learned about the various forms that business organizations can be. We then learned about internal and external users of financial information and the differences for each type of user. We then discussed ethics in financial reporting, which is a real hot button in today’s society. Next we discussed the various business activities that companies perform. We discussed financing activities, which is where companies raise capital to run their companies. Next we discussed investing activities, which is how companies invest the capital they raised during their financing activities. We then discussed operational activities, which are the day to day operations of a company. Lastly, we talked about communicating with financial statement users. Those forms of communication included the following statements: The Income Statement; The Retained Earnings Statement; The Balance Sheet; The Statement of Cash Flows; and The Annual Report. This completes this lesson. ACC556 Week 1 Chapter 2 Slide 1 Introduction Welcome to Financial Accounting for Managers. In this lesson we will take A Further Look at Financial Statements. Slide 2 Topics The following topics will be covered in this lesson: The Classified Balance Sheet; Using the Financial Statements; and Financial Reporting Concepts. Slide 3 The Classified Balance Sheet A balance sheet is a snapshot of a company’s financial position at a particular point in time. It includes assets, liabilities, and stockholders equity. In an effort to make it easier for a user of a financial statement to better understand the company’s financial position; many companies will use a classified balance sheet instead. Classified balance sheets group similar assets, and liabilities, by using standard classifications and sections. This is helpful as these similar items in a group have similar economic characteristics. Let’s go over each of these groups. Current assets are assets that a company may convert to cash or use within one year or its operating cycle, whichever is longer. For most businesses, the classification as a current asset is one year from the balance sheet date. Having said that, some companies may use a period longer than one year because they have an operating cycle longer than one year. Current assets typically include cash, investments, accounts receivable, inventory, and numerous prepaid expenses. Long-term investments are made up of investments in stocks and bonds of other corporations that are held for more than one year. Property, plant, and equipment include assets with long useful lives that are currently used in operating the business. These assets typically include equipment, land, and buildings among other items. Property, plant, and equipment are generally depreciated or expensed over their useful lives rather than being expensed in the year they are purchased in order to match the expenses with the revenues they generate. Companies may have assets that are not physical in nature, but still maintain value. These are called intangible assets. Intangible assets can include such items as patents, copyrights, and trademarks. Sometimes these intangible assets can contain more value than many of the other physical assets that a company owns. For example, Apple and Google have brand names that are worth more than most of their physical assets. Current liabilities are obligations that the company is to pay within the next year or their operating cycle, whichever is longer. Some examples of current liabilities are accounts payable, salaries, notes, interest, and income taxes. Long-term liabilities are obligations that a company expects to pay after one year. Long-term liabilities can include bonds, notes, and pensions. Stockholders’ equity is comprised of two parts. The first is common stock. Common stock represents the investment in the business by stockholders. The second is retained earnings. Retained earnings represent income the company retains for use in the business. Slide 4 Using the Financial Statements When using the financial statements, there are many tools that can be used to analyze financial statements. The first tool is known as ratio analysis. Ratio analysis depicts the relationship among financial statement data elements. The ratio categories are profitability, liquidity, and solvency ratios. Each of these categories measures the financial health, or lack thereof, of a company. Profitability ratios measure the income of a company for a specific period of time. Liquidity ratios measure the ability of the company to pay its obligations and meet its cash requirements. Solvency ratios measure the ability of a company to remain a going concern. The second tool is Earnings per share or EPS. This is the net income earned on a per share basis of common stock. EPS is calculated by dividing net income minus preferred dividends by the average number of common shares outstanding. When comparing earnings per share of a single company over time, an investor can evaluate its earnings performance on a per share basis. The third tool is Stockholders’ equity which is made up of two parts. They are retained earnings and common stock. Stockholders’ equity changes for several reasons that include, changes in retained earnings, issuing more common stock, and retiring common stock through a repurchase on the open market. The statement of stockholders equity illustrates the changes to stockholders equity for a particular period, including changes in retained earnings. The fourth tool is Liquidity. This is the company’s ability to pay obligations due within the next year or operating cycle. When evaluating liquidity, it is critical to review the relationship of its current assets to current liabilities. One measure of liquidity is working capital, which is the difference between the amounts of current assets and current liabilities. In analyzing working capital, it is important to note whether working capital is positive or negative. When working capital is positive they should be able to meet their current obligations. When working capital is negative, that could mean that the company will be unable to meet their current obligations. Liquidity ratios measure the short-term ability of a company to pay its maturing obligations and needs for cash. One important liquidity ratio is the current ratio. The current ratio is calculated as current assets divided by current liabilities. The current ratio is also a more reliable indicator of liquidity than working capital. The last tool we will discuss is Solvency which is a company’s ability to make interest payments as they come due. It is also the company’s ability to pay their debt obligations as they mature. Solvency ratios measure the ability of the company to remain a going concern over time. Debt to assets ratio is an important measure of solvency. This is calculated by dividing total liabilities by total assets. It measures the percentage of total financing provided by creditors, and not stockholders. Slide 5 Financial Reporting Concepts The standard setting environment is utilized by the accounting profession to get accounting guidance from accounting standards known as generally accepted accounting principles or GAAP. Standard setting authorities work with the accounting profession and the business community to determine accounting standards. One of the authorities that oversee the accounting industry is the Securities and Exchange Commission or SEC. The SEC is an agency of the U.S. government that is responsible for U.S. financial markets and accounting standard-setting bodies. Another authority is the Financial Accounting Standards Board or FASB. The FASB is the main accounting standard-setting body in the United States. On the global front, the International Accounting Standards Board or IASB issues standards known as International Financial Reporting Standards or IFRS. Many foreign countries have adopted IFRS standards. Currently, the FASB and IASB are working together to integrate and create one set of standards. As a result of the Sarbanes-Oxley Act, another standard setting body known as the Public Company Accounting Oversight Board PCAOB was created. The PCAOB is responsible for determining auditing standards and reviewing the performance of auditing firms. With respect to the qualities of useful information, the FASB, determined that useful information should possess two fundamental qualities, relevance and faithful representation. The FASB maintains that accounting information has relevance if it makes a difference in a business decision. Faithful representation means that information accurately reflects what is being presented. In addition to those two, the FASB and IASB identified other qualities of useful information. Those qualities include comparability, consistency, verifiability, timeliness, and understandability. In order to develop accounting standards, the FASB relies on some key assumptions in financial reporting. These include assumptions about what monetary unit is being used, economic entity, periodicity, and going concern. GAAP generally uses one of two measurement principles in financial reporting. The first is the historical cost principle. The second is the fair value principle. The historical cost principle requires companies to record assets at their original cost. The fair value principle requires companies to report assets and liabilities at fair value, which is the price received to sell an asset or pay off a liability. Lastly, the full disclosure principle requires companies to disclose all circumstances and events that would impact the financial statement users. Providing information is expensive. When deciding whether companies should be required to provide certain types of information, accounting standard-setters consider the cost constraint. The cost constraint weighs the cost of providing the information to the benefit the information would provide. Slide 6 Short-Story Scenario Now let’s take a look at a short-story scenario that will help you understand the concepts in the lesson better. Imagine you are an investor and are looking to invest in one of three stocks. The first stock known as GIP Inc. has grown its earnings by 1% a year and has current assets that are two times its current liabilities. The second stock, WHIP Inc. has grown earnings by 2% a year and has current assets that are equal to their current liabilities. The third stock, WAGS Inc. has grown earnings by 3% a year and does not have enough current assets to cover its current liabilities. Which stock would be best to invest in and why? Think about it for a moment. When you’re ready, click the play button. GIP has grown earnings slower than the other two stocks, but has a healthy ability to meet its current liabilities. Growing earnings more slowly could simply mean they are investing in the company and will grow earnings a lot more in the future. While it is true that WHIP has grown their earnings by 2%, they are barely able to cover their current liabilities. This could be a warning sign of a disaster waiting to happen. It is true that WAGS has grown earnings more than the other 2 stocks, but is in danger now because they can’t meet their current obligations. This is a huge red flag that there are serious problems with the company. So from the information about each stock that we just talked about, GIP would be the best stock to invest in. Slide 7 Check Your Understanding Slide 8 Check Your Understanding Slide 9 Summary We have reached the end of our lesson. Let’s take a look at what we have covered. We started off discussing the classified balance sheet. We learned that the classified balance sheet was made up of the following items: Current Assets; Long Term Investments; Property, Plant, and Equipment; Intangible Assets; Current Liabilities; Long Term Liabilities; and Stockholders’ Equity. Next we discussed the use of financial statements. We learned that there are a variety of tools that can be used to interpret the financial statements such as ratio analysis, earnings per share, the statement of stockholders’ equity, liquidity and solvency measures. Lastly, we discussed some financial reporting concepts. We learned about the standard setting environment, financial reporting assumptions, financial reporting principles, and cost constraints for reporting financial information. This completes this lesson. ACC556 Week 1 Chapter 2 Slide 1 Introduction Welcome to Financial Accounting for Managers. In this lesson we will take A Further Look at Financial Statements. Slide 2 Topics The following topics will be covered in this lesson: The Classified Balance Sheet; Using the Financial Statements; and Financial Reporting Concepts. Slide 3 The Classified Balance Sheet A balance sheet is a snapshot of a company’s financial position at a particular point in time. It includes assets, liabilities, and stockholders equity. In an effort to make it easier for a user of a financial statement to better understand the company’s financial position; many companies will use a classified balance sheet instead. Classified balance sheets group similar assets, and liabilities, by using standard classifications and sections. This is helpful as these similar items in a group have similar economic characteristics. Let’s go over each of these groups. Current assets are assets that a company may convert to cash or use within one year or its operating cycle, whichever is longer. For most businesses, the classification as a current asset is one year from the balance sheet date. Having said that, some companies may use a period longer than one year because they have an operating cycle longer than one year. Current assets typically include cash, investments, accounts receivable, inventory, and numerous prepaid expenses. Long-term investments are made up of investments in stocks and bonds of other corporations that are held for more than one year. Property, plant, and equipment include assets with long useful lives that are currently used in operating the business. These assets typically include equipment, land, and buildings among other items. Property, plant, and equipment are generally depreciated or expensed over their useful lives rather than being expensed in the year they are purchased in order to match the expenses with the revenues they generate. Companies may have assets that are not physical in nature, but still maintain value. These are called intangible assets. Intangible assets can include such items as patents, copyrights, and trademarks. Sometimes these intangible assets can contain more value than many of the other physical assets that a company owns. For example, Apple and Google have brand names that are worth more than most of their physical assets. Current liabilities are obligations that the company is to pay within the next year or their operating cycle, whichever is longer. Some examples of current liabilities are accounts payable, salaries, notes, interest, and income taxes. Long-term liabilities are obligations that a company expects to pay after one year. Long-term liabilities can include bonds, notes, and pensions. Stockholders’ equity is comprised of two parts. The first is common stock. Common stock represents the investment in the business by stockholders. The second is retained earnings. Retained earnings represent income the company retains for use in the business. Slide 4 Using the Financial Statements When using the financial statements, there are many tools that can be used to analyze financial statements. The first tool is known as ratio analysis. Ratio analysis depicts the relationship among financial statement data elements. The ratio categories are profitability, liquidity, and solvency ratios. Each of these categories measures the financial health, or lack thereof, of a company. Profitability ratios measure the income of a company for a specific period of time. Liquidity ratios measure the ability of the company to pay its obligations and meet its cash requirements. Solvency ratios measure the ability of a company to remain a going concern. The second tool is Earnings per share or EPS. This is the net income earned on a per share basis of common stock. EPS is calculated by dividing net income minus preferred dividends by the average number of common shares outstanding. When comparing earnings per share of a single company over time, an investor can evaluate its earnings performance on a per share basis. The third tool is Stockholders’ equity which is made up of two parts. They are retained earnings and common stock. Stockholders’ equity changes for several reasons that include, changes in retained earnings, issuing more common stock, and retiring common stock through a repurchase on the open market. The statement of stockholders equity illustrates the changes to stockholders equity for a particular period, including changes in retained earnings. The fourth tool is Liquidity. This is the company’s ability to pay obligations due within the next year or operating cycle. When evaluating liquidity, it is critical to review the relationship of its current assets to current liabilities. One measure of liquidity is working capital, which is the difference between the amounts of current assets and current liabilities. In analyzing working capital, it is important to note whether working capital is positive or negative. When working capital is positive they should be able to meet their current obligations. When working capital is negative, that could mean that the company will be unable to meet their current obligations. Liquidity ratios measure the short-term ability of a company to pay its maturing obligations and needs for cash. One important liquidity ratio is the current ratio. The current ratio is calculated as current assets divided by current liabilities. The current ratio is also a more reliable indicator of liquidity than working capital. The last tool we will discuss is Solvency which is a company’s ability to make interest payments as they come due. It is also the company’s ability to pay their debt obligations as they mature. Solvency ratios measure the ability of the company to remain a going concern over time. Debt to assets ratio is an important measure of solvency. This is calculated by dividing total liabilities by total assets. It measures the percentage of total financing provided by creditors, and not stockholders. Slide 5 Financial Reporting Concepts The standard setting environment is utilized by the accounting profession to get accounting guidance from accounting standards known as generally accepted accounting principles or GAAP. Standard setting authorities work with the accounting profession and the business community to determine accounting standards. One of the authorities that oversee the accounting industry is the Securities and Exchange Commission or SEC. The SEC is an agency of the U.S. government that is responsible for U.S. financial markets and accounting standard-setting bodies. Another authority is the Financial Accounting Standards Board or FASB. The FASB is the main accounting standard-setting body in the United States. On the global front, the International Accounting Standards Board or IASB issues standards known as International Financial Reporting Standards or IFRS. Many foreign countries have adopted IFRS standards. Currently, the FASB and IASB are working together to integrate and create one set of standards. As a result of the Sarbanes-Oxley Act, another standard setting body known as the Public Company Accounting Oversight Board PCAOB was created. The PCAOB is responsible for determining auditing standards and reviewing the performance of auditing firms. With respect to the qualities of useful information, the FASB, determined that useful information should possess two fundamental qualities, relevance and faithful representation. The FASB maintains that accounting information has relevance if it makes a difference in a business decision. Faithful representation means that information accurately reflects what is being presented. In addition to those two, the FASB and IASB identified other qualities of useful information. Those qualities include comparability, consistency, verifiability, timeliness, and understandability. In order to develop accounting standards, the FASB relies on some key assumptions in financial reporting. These include assumptions about what monetary unit is being used, economic entity, periodicity, and going concern. GAAP generally uses one of two measurement principles in financial reporting. The first is the historical cost principle. The second is the fair value principle. The historical cost principle requires companies to record assets at their original cost. The fair value principle requires companies to report assets and liabilities at fair value, which is the price received to sell an asset or pay off a liability. Lastly, the full disclosure principle requires companies to disclose all circumstances and events that would impact the financial statement users. Providing information is expensive. When deciding whether companies should be required to provide certain types of information, accounting standard-setters consider the cost constraint. The cost constraint weighs the cost of providing the information to the benefit the information would provide. Slide 6 Short-Story Scenario Now let’s take a look at a short-story scenario that will help you understand the concepts in the lesson better. Imagine you are an investor and are looking to invest in one of three stocks. The first stock known as GIP Inc. has grown its earnings by 1% a year and has current assets that are two times its current liabilities. The second stock, WHIP Inc. has grown earnings by 2% a year and has current assets that are equal to their current liabilities. The third stock, WAGS Inc. has grown earnings by 3% a year and does not have enough current assets to cover its current liabilities. Which stock would be best to invest in and why? Think about it for a moment. When you’re ready, click the play button. GIP has grown earnings slower than the other two stocks, but has a healthy ability to meet its current liabilities. Growing earnings more slowly could simply mean they are investing in the company and will grow earnings a lot more in the future. While it is true that WHIP has grown their earnings by 2%, they are barely able to cover their current liabilities. This could be a warning sign of a disaster waiting to happen. It is true that WAGS has grown earnings more than the other 2 stocks, but is in danger now because they can’t meet their current obligations. This is a huge red flag that there are serious problems with the company. So from the information about each stock that we just talked about, GIP would be the best stock to invest in. Slide 7 Check Your Understanding Slide 8 Check Your Understanding Slide 9 Summary We have reached the end of our lesson. Let’s take a look at what we have covered. We started off discussing the classified balance sheet. We learned that the classified balance sheet was made up of the following items: Current Assets; Long Term Investments; Property, Plant, and Equipment; Intangible Assets; Current Liabilities; Long Term Liabilities; and Stockholders’ Equity. Next we discussed the use of financial statements. We learned that there are a variety of tools that can be used to interpret the financial statements such as ratio analysis, earnings per share, the statement of stockholders’ equity, liquidity and solvency measures. Lastly, we discussed some financial reporting concepts. We learned about the standard setting environment, financial reporting assumptions, financial reporting principles, and cost constraints for reporting financial information. This completes this lesson. [Show More]

Last updated: 1 year ago

Preview 1 out of 55 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 29, 2020

Number of pages

55

Written in

Additional information

This document has been written for:

Uploaded

May 29, 2020

Downloads

1

Views

64

.png)

.png)

.png)

.png)

.png)

.png)