Accounting > Quiz > ACCT-212 Week 2 Quiz – 100% Correct Answers – Graded An A+ (All)

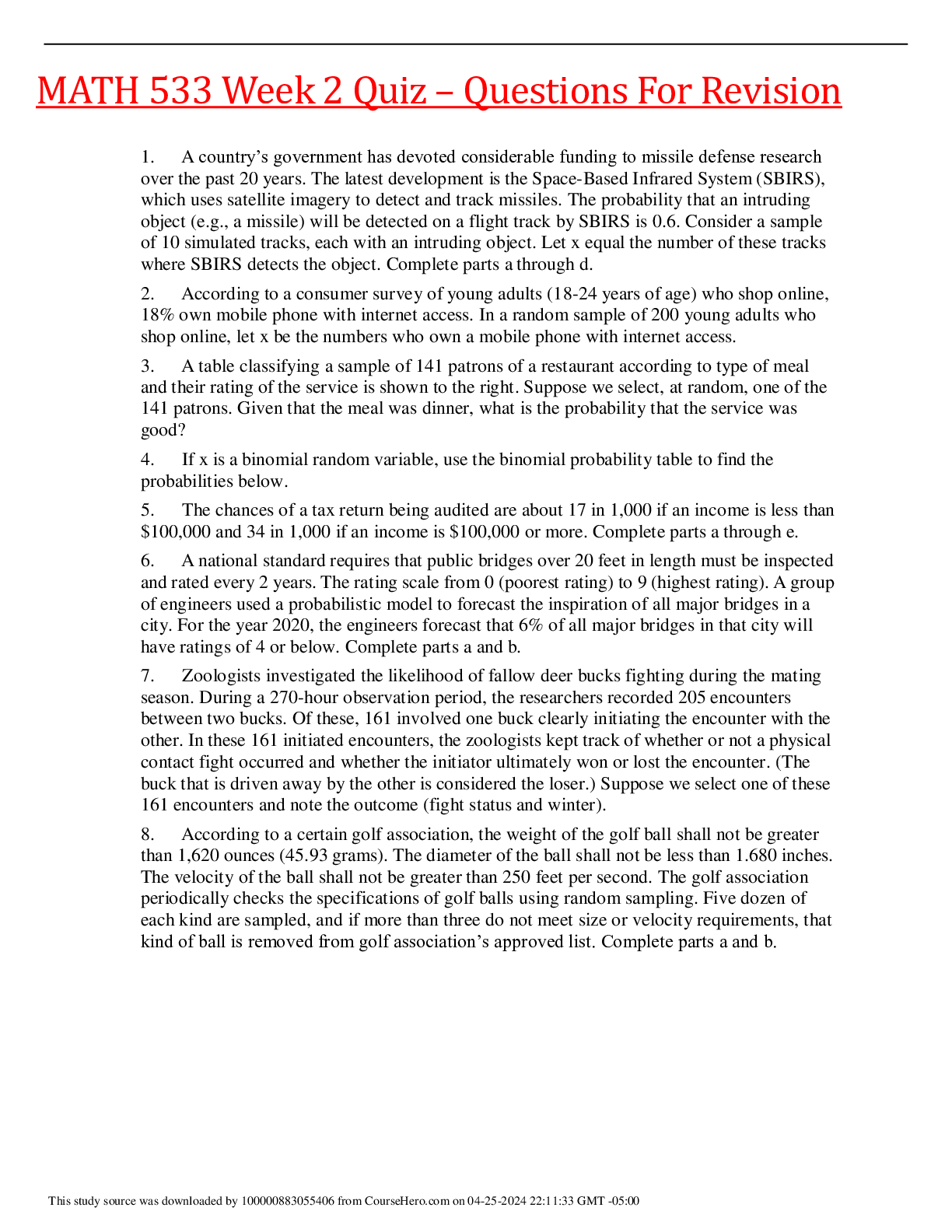

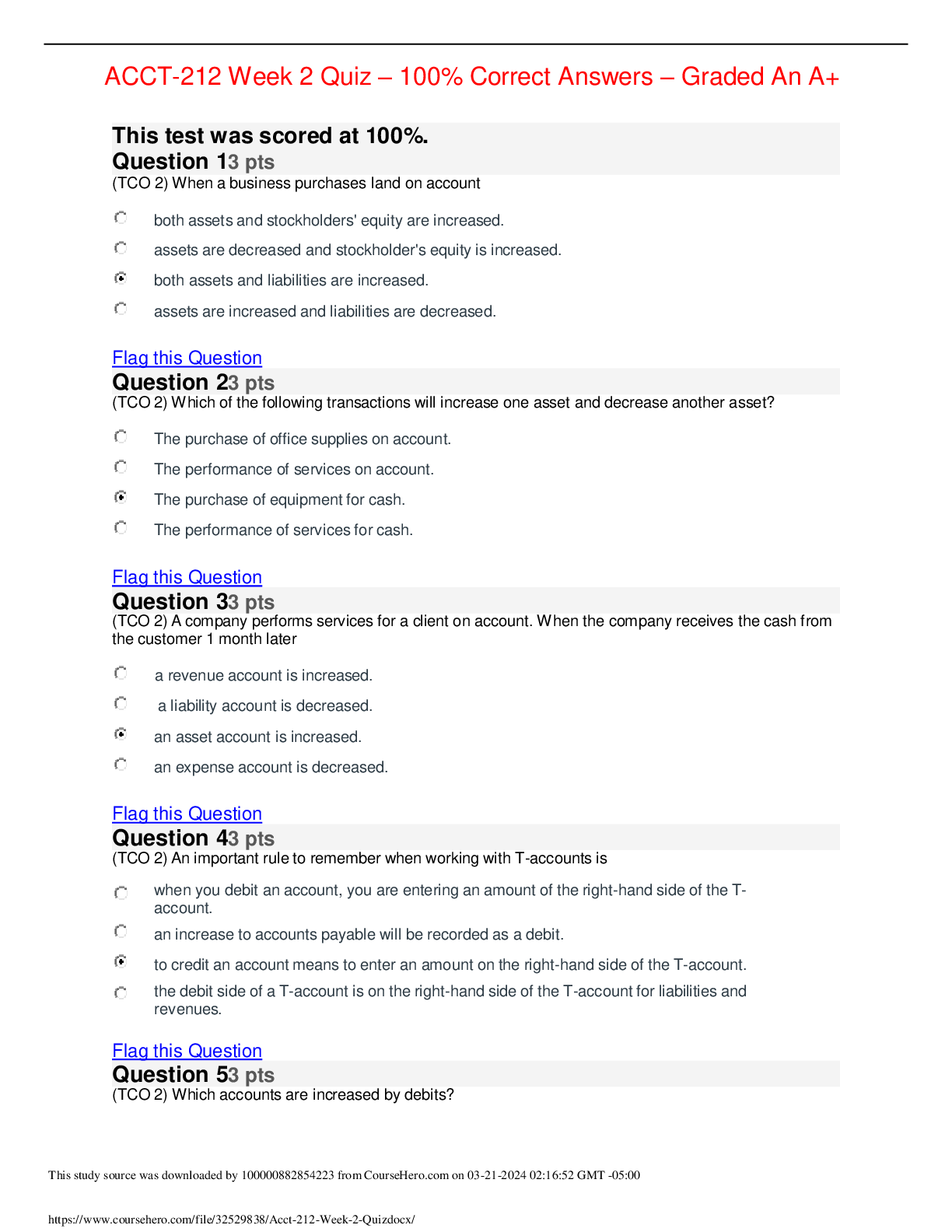

ACCT-212 Week 2 Quiz – 100% Correct Answers – Graded An A+

Document Content and Description Below

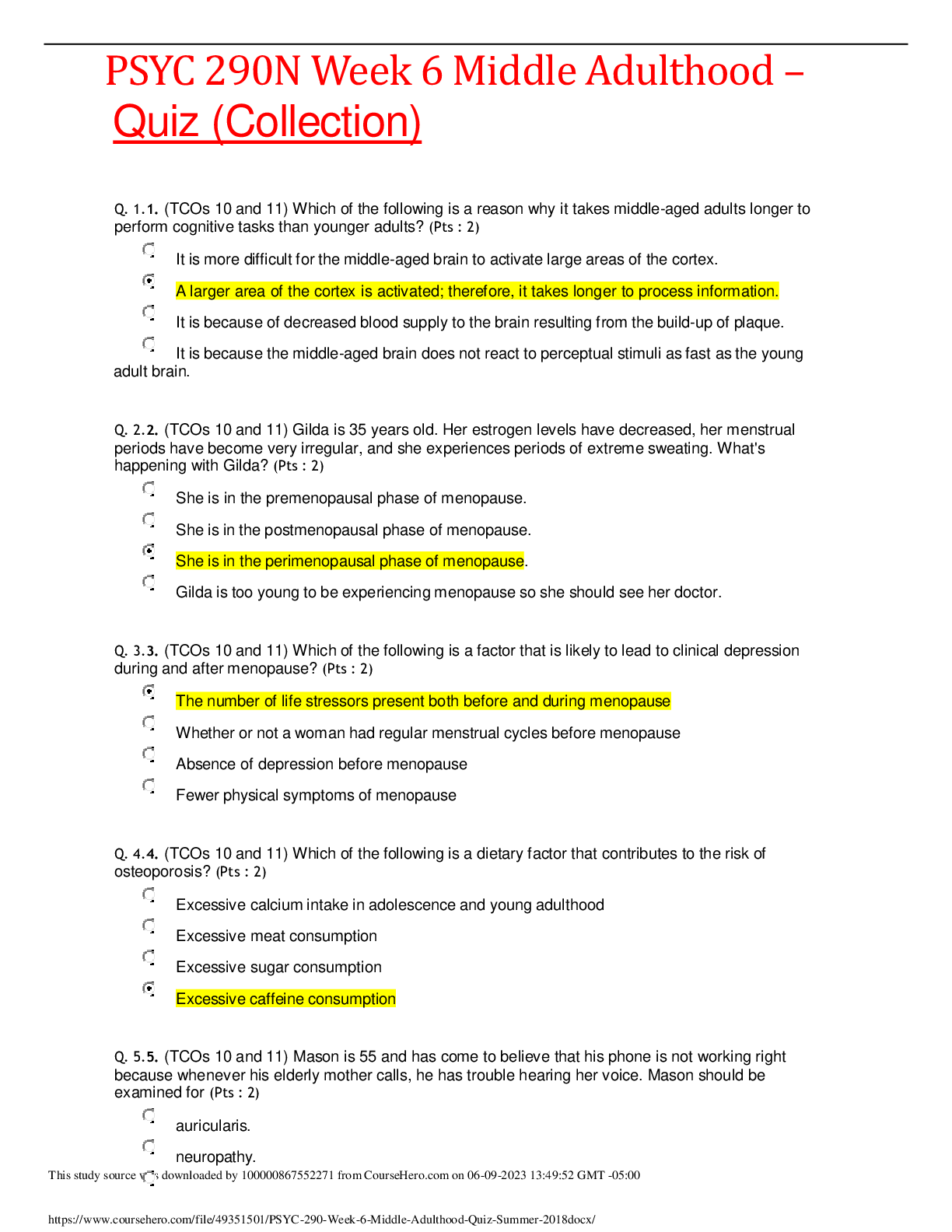

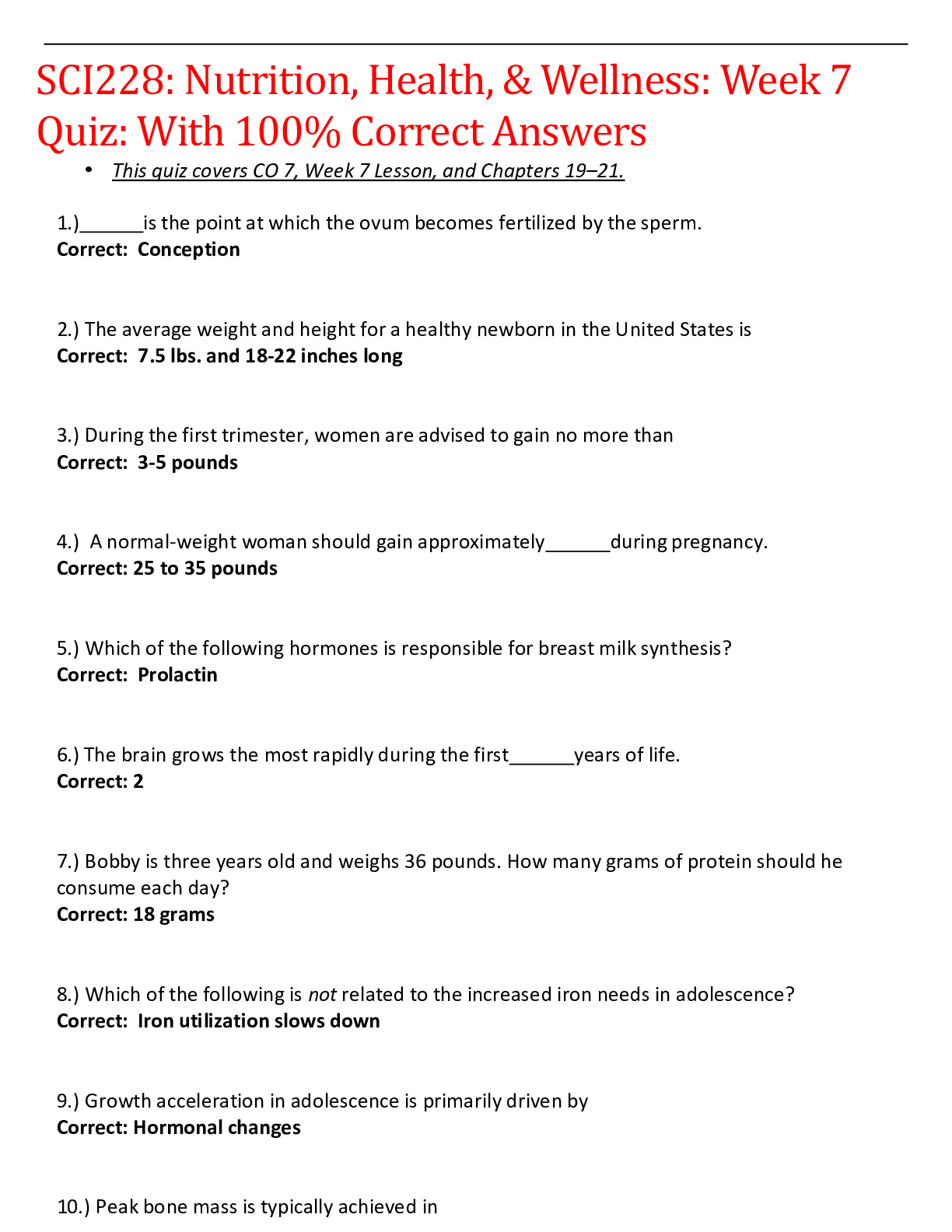

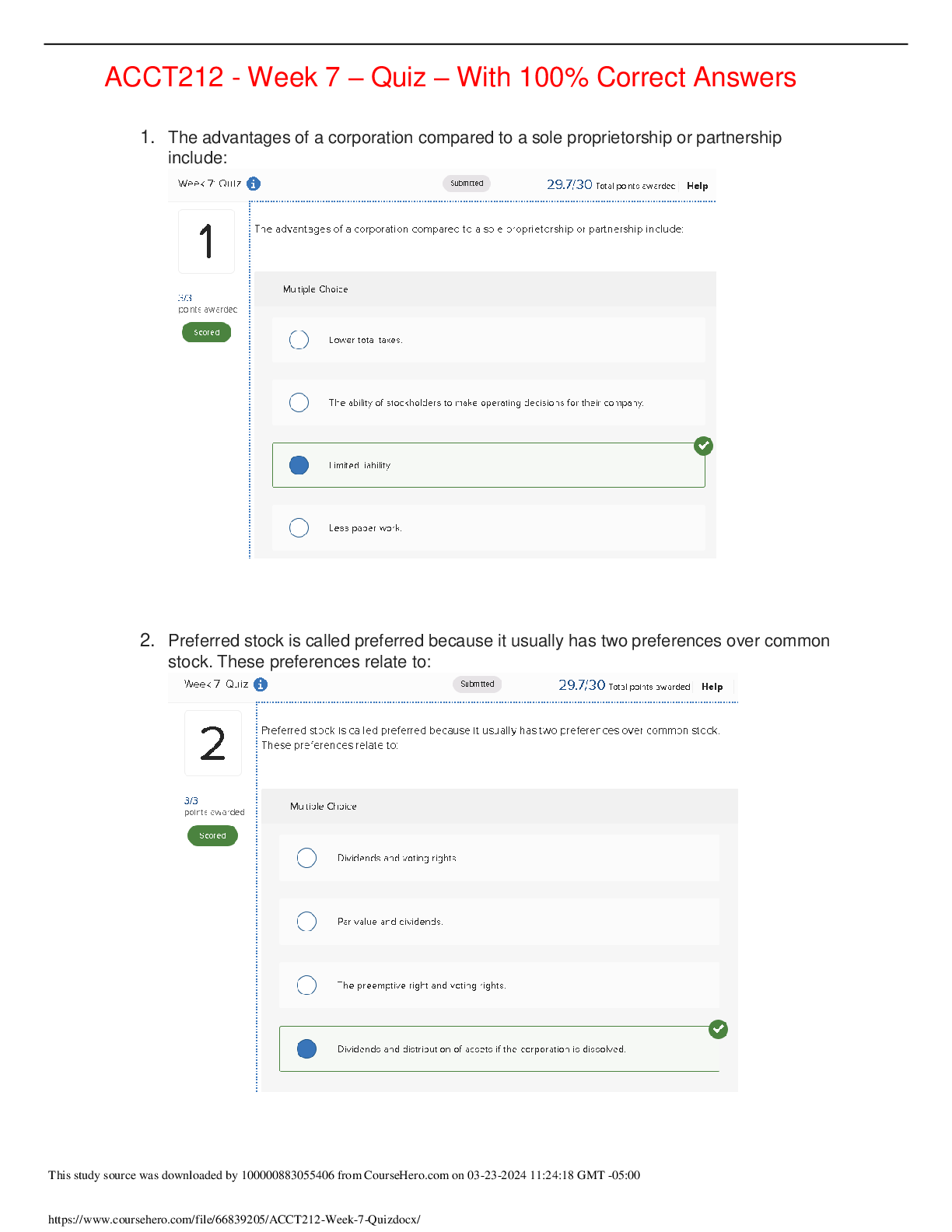

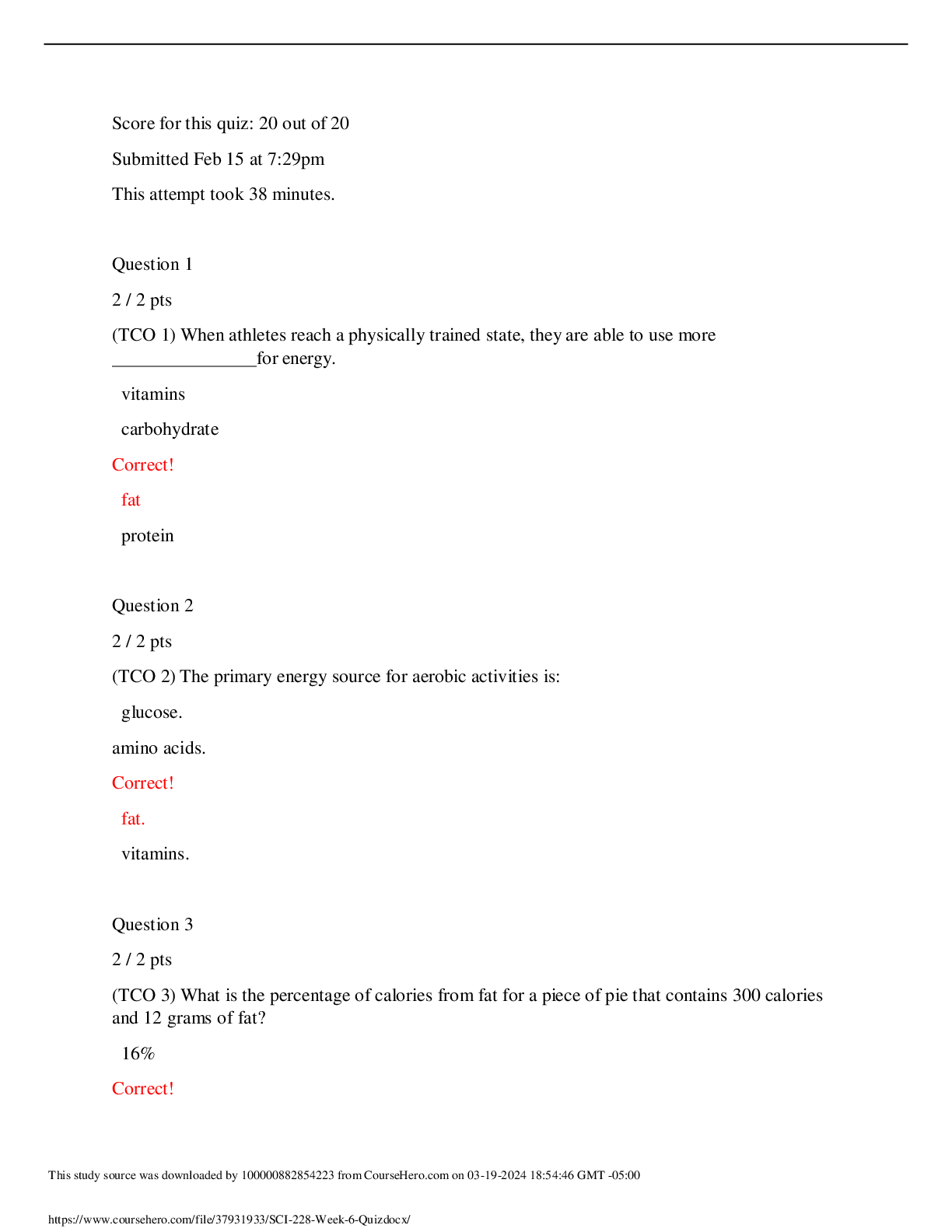

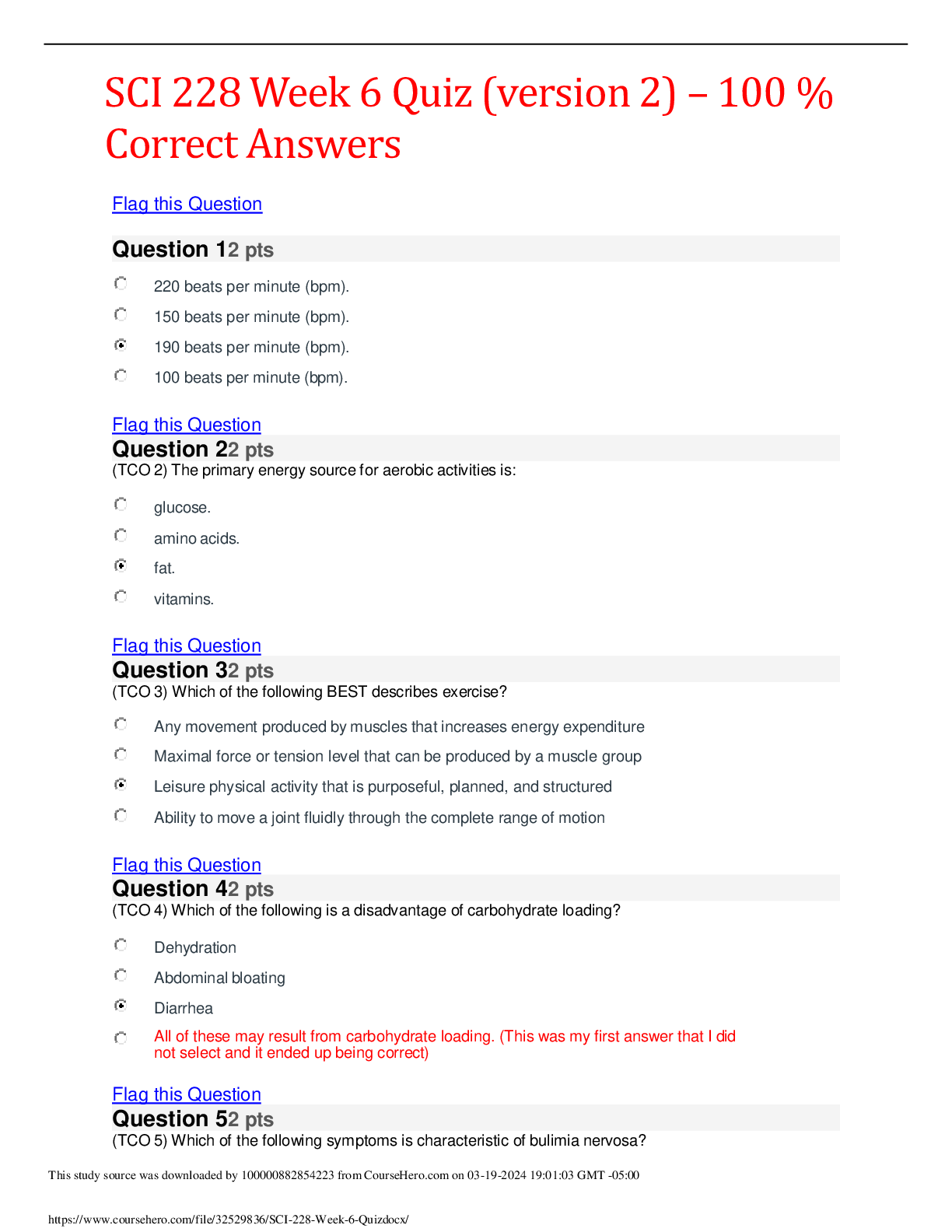

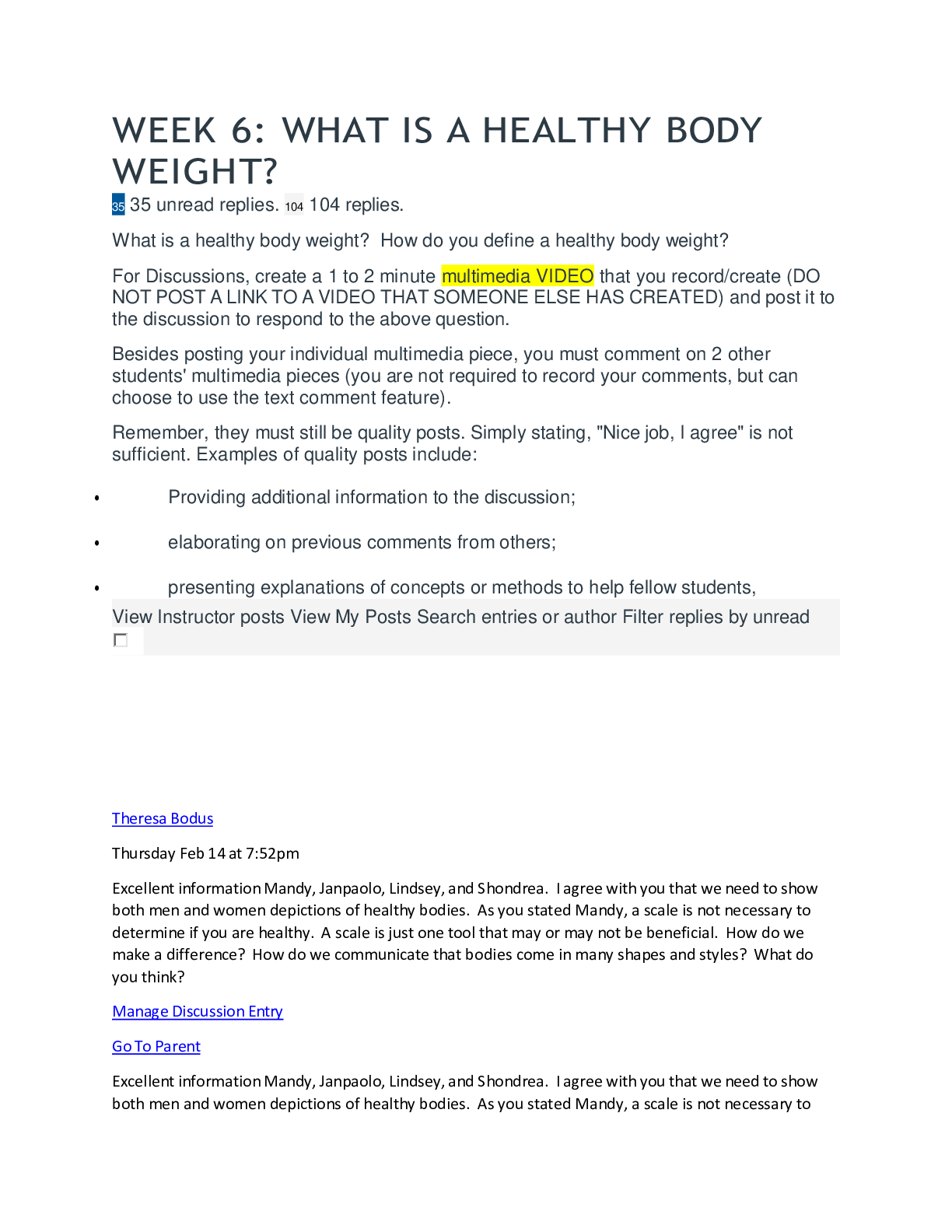

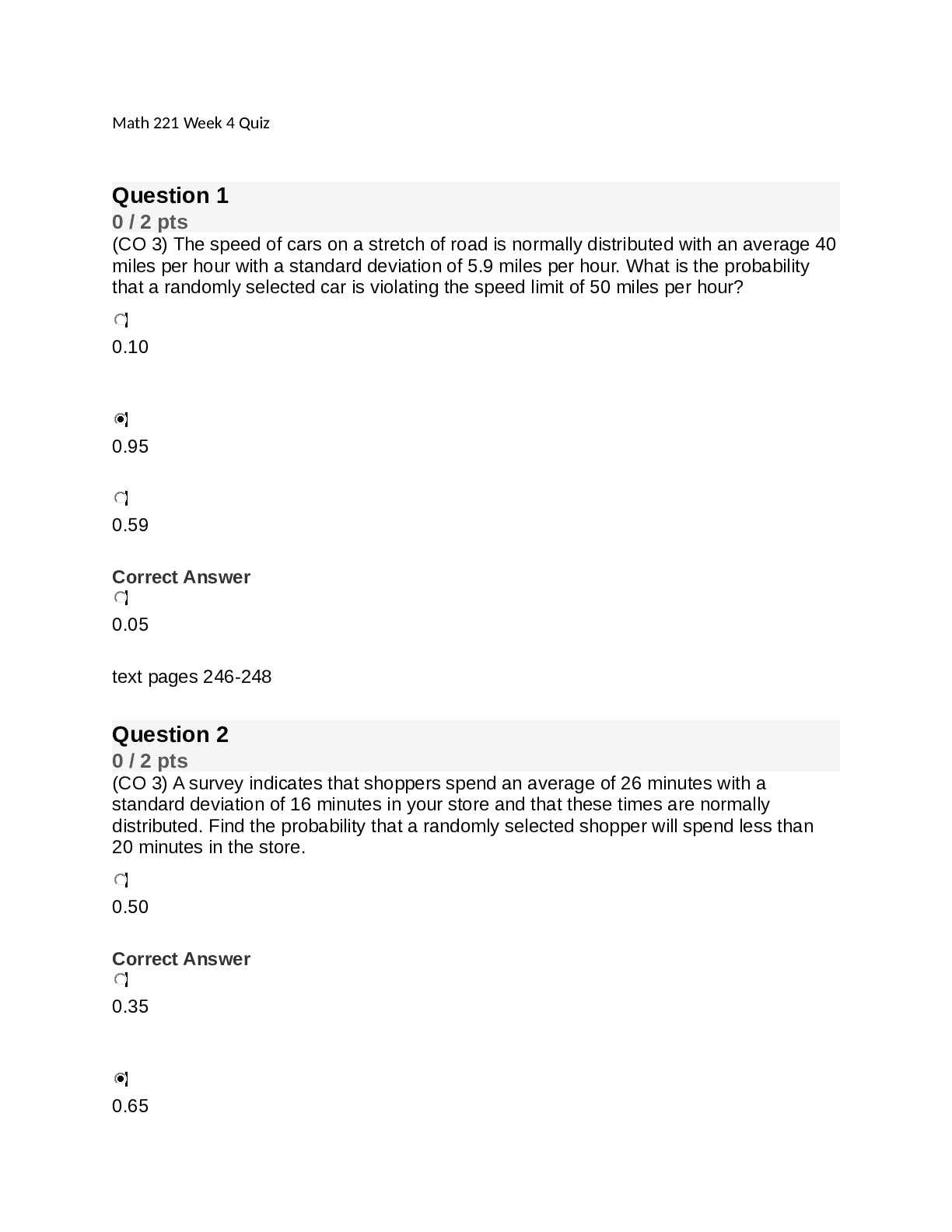

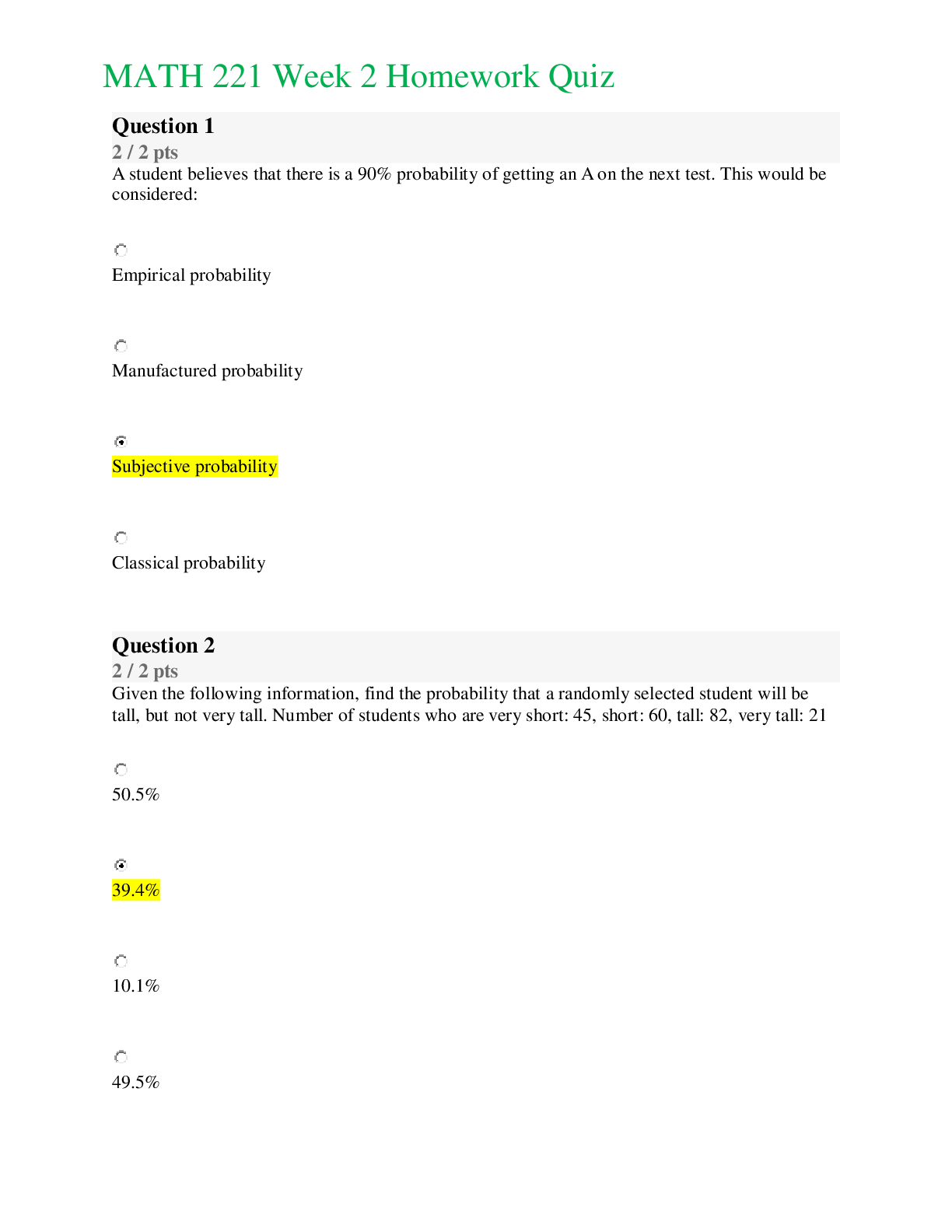

ACCT-212 Week 2 Quiz – 100% Correct Answers – Graded An A+ (TCO 2) When a business purchases land on account both assets and stockholders' equity are increased. assets ... are decreased and stockholder's equity is increased. both assets and liabilities are increased. assets are increased and liabilities are decreased. Flag this Question (TCO 2) Which of the following transactions will increase one asset and decrease another asset? The purchase of office supplies on account. The performance of services on account. The purchase of equipment for cash. The performance of services for cash. Flag this Question (TCO 2) A company performs services for a client on account. When the company receives the cash from the customer 1 month later a revenue account is increased. a liability account is decreased. an asset account is increased. an expense account is decreased. Flag this Question (TCO 2) An important rule to remember when working with T-accounts is when you debit an account, you are entering an amount of the right-hand side of the T- account. an increase to accounts payable will be recorded as a debit. to credit an account means to enter an amount on the right-hand side of the T-account. the debit side of a T-account is on the right-hand side of the T-account for liabilities and revenues. Flag this Question (TCO 2) Which accounts are increased by debits? Cash and accounts payable Salaries expense and common stock Accounts receivable and utilities expense Accounts payable and service revenue Flag this Question (TCO 2) When journalizing and posting transactions in the books the rules of debit and credit are followed to increase or decrease each account. the credit side of the transaction is entered on the left margin. it is not necessary to use both the journal and the ledger. debits in the journal can be posted as credits in the ledger. Flag this Question (TCO 3) Under accrual accounting, revenue is recorded when the cash is collected, regardless of when the services are performed. when the services are performed, regardless of when the cash is received. either when the cash is received or the sale is made. only if the cash is received at the same time the services are performed. Flag this Question (TCO 3) The event that triggers revenue recognition for the sale of goods is the date a contract is signed. date cash is received. transfer of control of the goods to the purchaser. completion of the services. Flag this Question (TCO 3) The balance sheet reports assets, liabilities and stockholders' equity. the changes in retained earnings. assets, liabilities, revenues and expenses. revenues and expenses. Flag this Question Question 103 pts (TCO 3) After the closing entries are prepared all asset accounts will have a zero balance. the Retained Earnings account will have the correct ending balance. the temporary accounts will have debit balances. all liability accounts will have a zero balance. [Show More]

Last updated: 1 month ago

Preview 1 out of 3 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 21, 2024

Number of pages

3

Written in

Additional information

This document has been written for:

Uploaded

Mar 21, 2024

Downloads

0

Views

16

.png)