Financial Accounting > Final Exam Review > Baruch College, CUNY ACCT 3100 Fin Acc Final Exam Review of Problems and Solutions (All)

Baruch College, CUNY ACCT 3100 Fin Acc Final Exam Review of Problems and Solutions

Document Content and Description Below

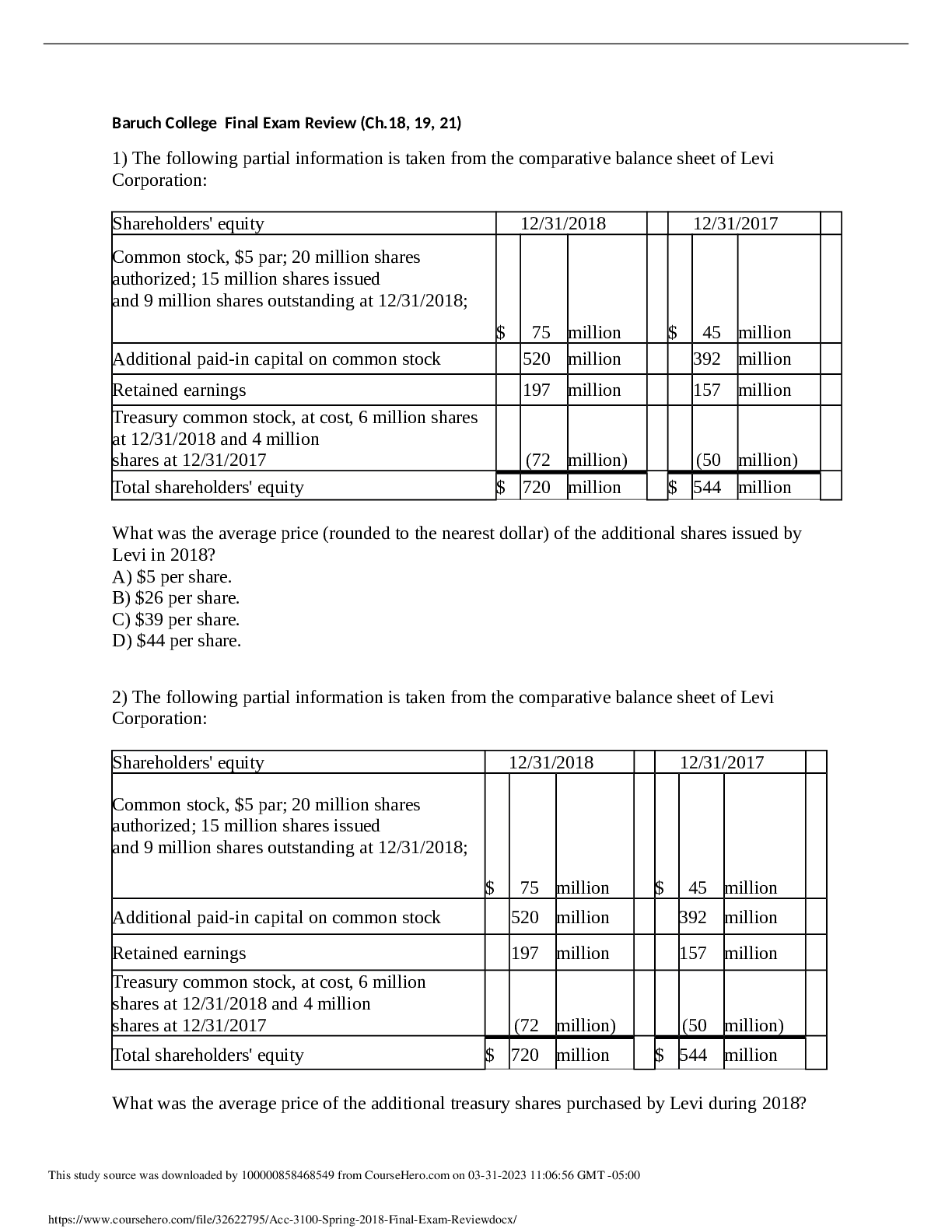

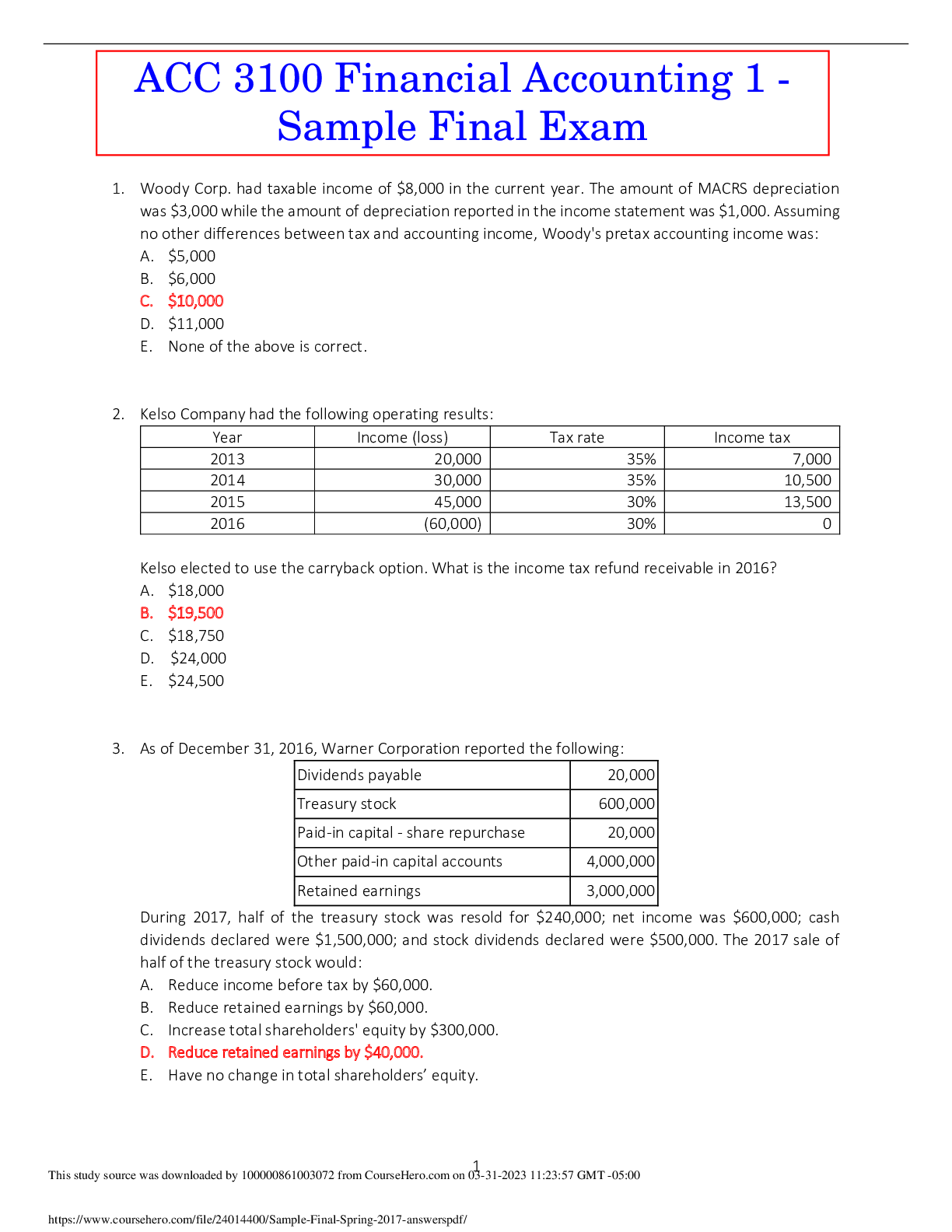

Baruch College, CUNY ACCT 3100 Final Exam Review of Problems and Solutions ACC 3100 Section TTRA (17636) Review of Problems and Solutions for the Final Examination Spring Semester... , 2021 . Chapter 12 Investments and Financial Instruments Class Exercise No. 1 A. Hammond, Inc. purchased NOLA Corp. 6% mortgage bonds for cash on December 16, 2019, at their face amount of $100,000. The bonds will mature on June 30, 2031. The initial journal entry was: Investment in NOLA bonds ……………100,000 Cash ………………………………………………..100,000 As of December 31, 2019, the market value of these bonds had increased to $130,000. Provide the journal entry that would be necessary for this bond investment at December 31, 2019, under each of the following alternatives: Alternative 1: Hammond intends to hold the bonds for an unspecified period, hopefully to take advantage of an increase in market value. However, Hammond will be ready to bonds when “the time is right” (i.e., as an investment held available for sale). sell the Alternative 2: Hammond intends to hold the bonds to maturity. B. On August 8, 2020, Hammond sold the NOLA bonds, as described above, for $135,000. Provide the journal entries that would be required for this transaction under both Alternatives 1 and 2 in A above. C. Assume that, instead of acquiring NOLA Corp bonds, Hammond had instead purchased NOLA Corp. common stock, as a trading security, on December 16, 2019, for $100,000. Likewise, the market value of the NOLA stock at December 31, 2019 increased to $130,000. What journal entry would Hammond make for the sale of the NOLA stock for $135,000 on August 8, 2020? Solutions to Class Exercise No. 1 A. Entry for Alternative 1 (AFS) on December 31, 2019: Debit Credit Fair value adjustment – Investment in NOLA bonds 30,000 Unrealized holding gain on investment 30,000 No entry for Alternative 2 (HTM) B. Entry for Alternative 1 (AFS) on August 8, 2020: Cash 135,000 Unrealized holding gain on investment 30,000 Fair value adjustment – Investment in NOLA bonds 30,000 Investment in NOLA bonds 100,000 Realized gain on sale of bonds 35,000 Entry for Alternative 2 (HTM) on August 8, 2020: Cash 135,000 Investment in NOLA bonds 100,000 Realized gain on sale of bonds 35,000 C. Entry for Investment in Stock (TS) rather than Bonds on August 8, 2020: Cash 135,000 Investment in NOLA stock 100,000 Fair value adjustment – Investment in NOLA stock 30,000 Realized gain on sale of stock 5,000 Class Exercise No. 2 Prior to 2021, The Givemgreef Company’s investments were limited to short-term U.S. government securities. On January 2, 2021, Givemgreef bought a 25% interest in the Nelson Corporation for $820,000. On October 1, 2021, Nelson paid a total dividend of $60,000 to all its shareholders. At December 31, 2021, the market value of Givemgreef’s investment in Nelson was $860,000. Nelson’s net income for 2021 was $220,000. During 2022, Nelson had significant business reversals, and its net loss for the year was $1,000,000. The total market value of all of Nelson’s stock at December 31, 2022 was $2,800,000. On March 1, 2023, when Nelson’s net income for the first two months of the year was $40,000, Givemgreef sold its investment in Nelson for $590,000. Provide all the journal entries relating to Givemgreef’s investment in Nelson during the years 2021- 2023. Solutions to Class Exercise No. 2 [Show More]

Last updated: 1 year ago

Preview 1 out of 76 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 31, 2023

Number of pages

76

Written in

Additional information

This document has been written for:

Uploaded

Mar 31, 2023

Downloads

0

Views

84