Financial Accounting > EXAM > Sophia accounting milestone 2,100% CORRECT (All)

Sophia accounting milestone 2,100% CORRECT

Document Content and Description Below

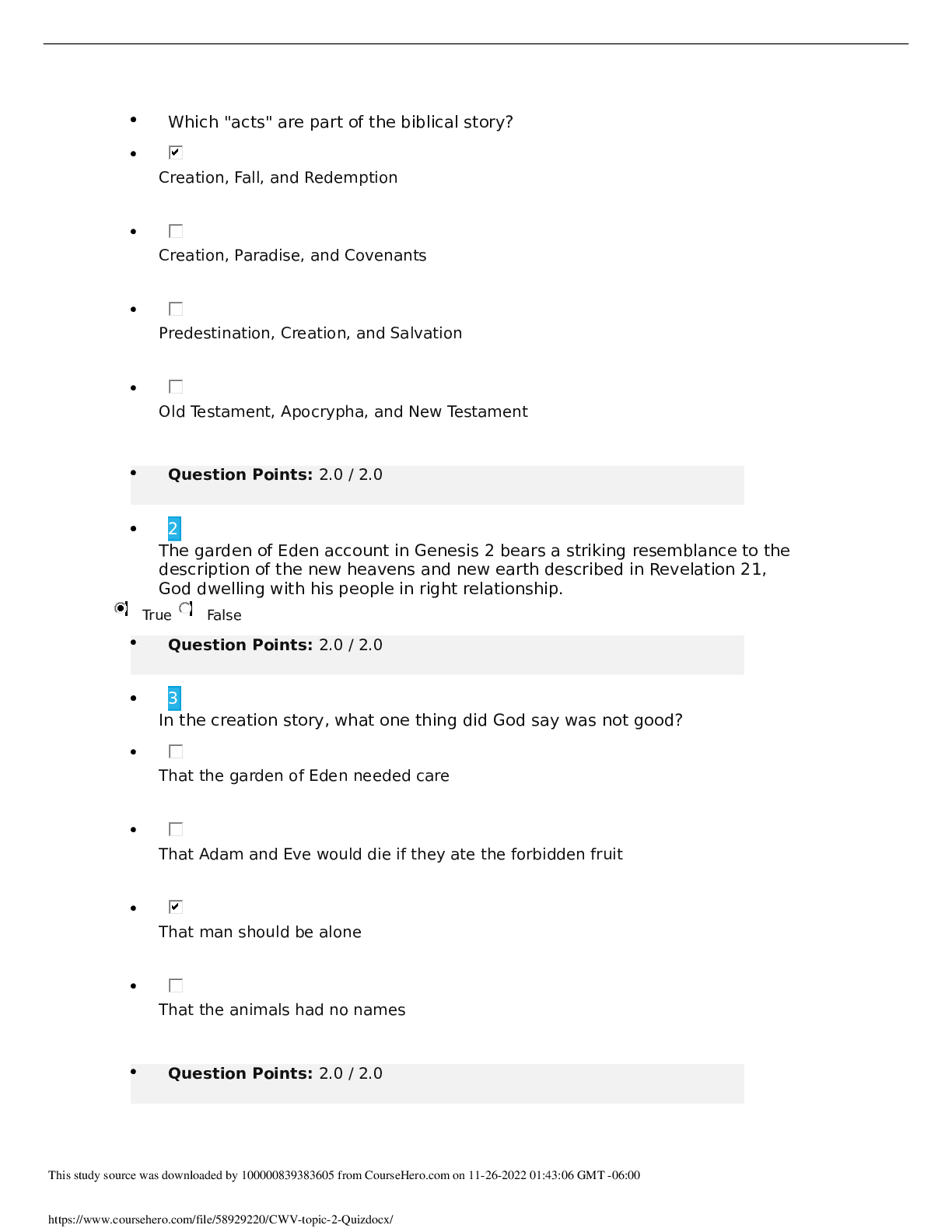

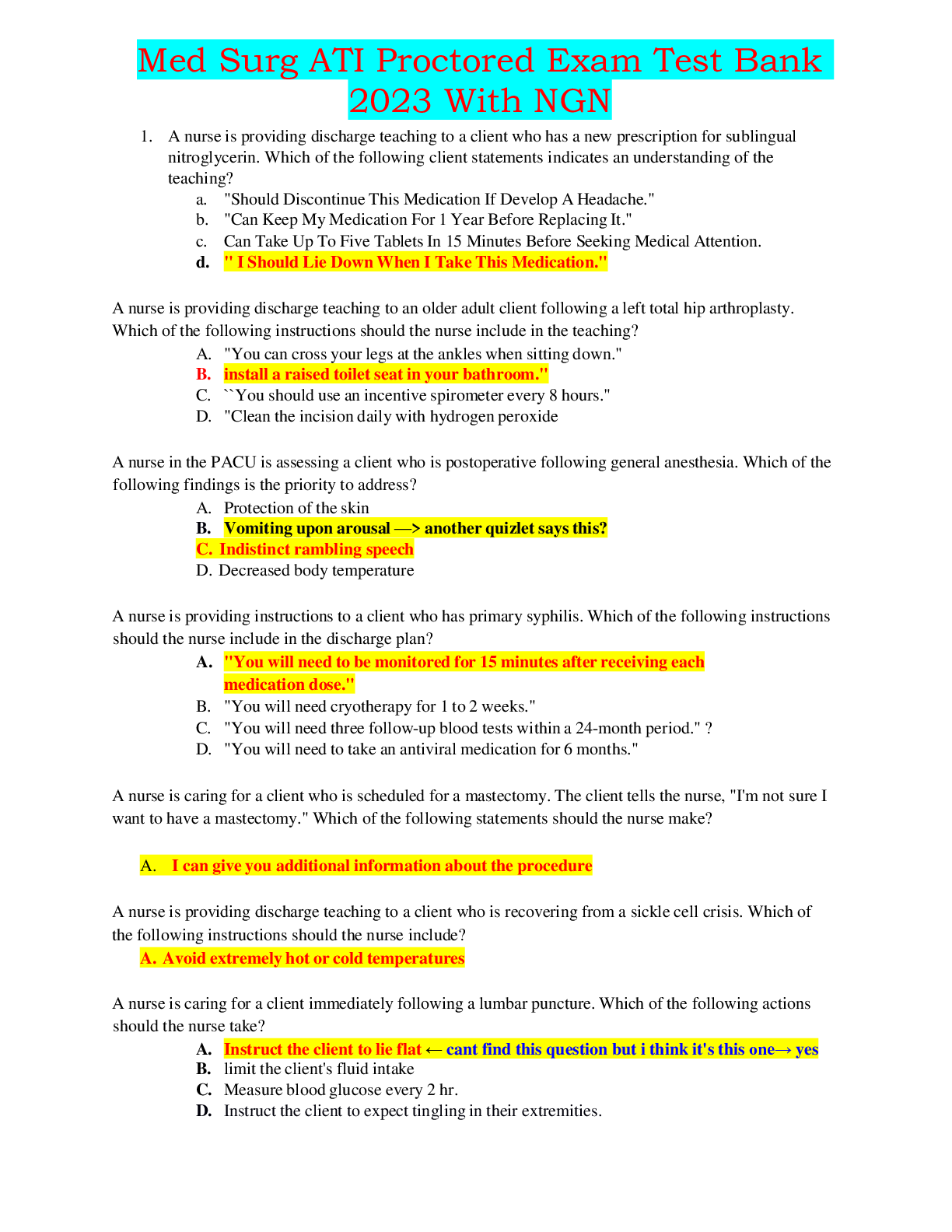

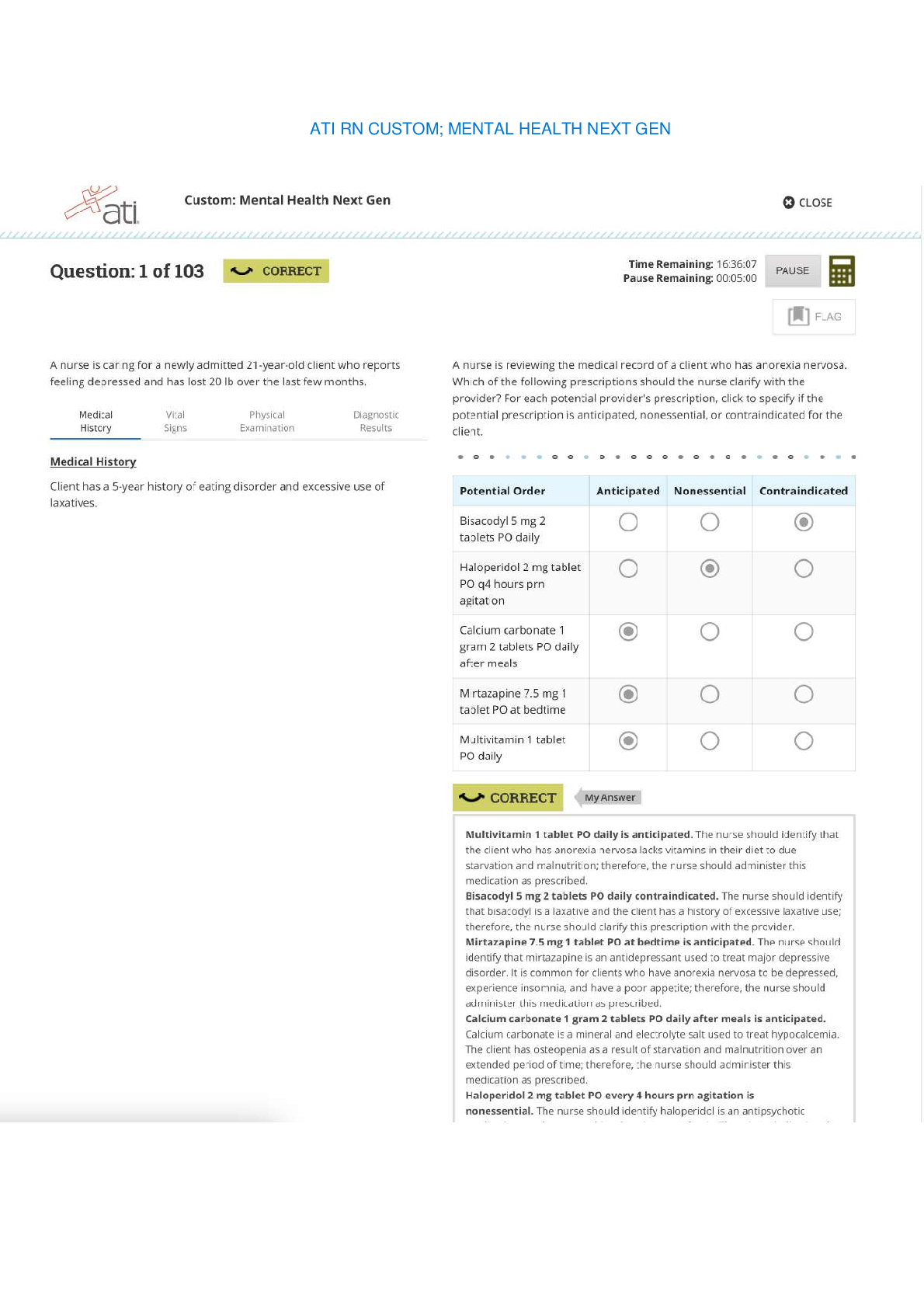

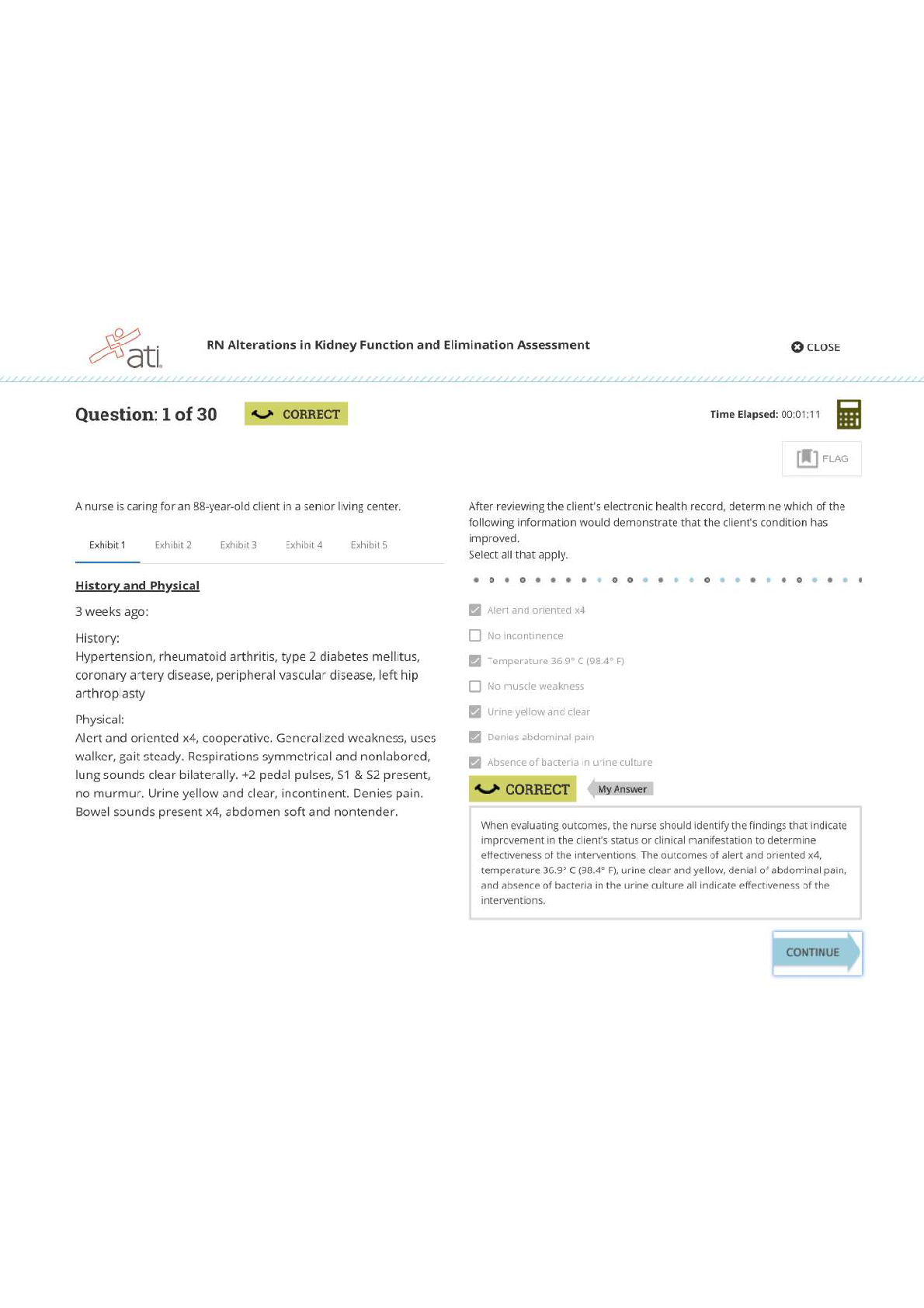

If Megan has completed the drawing closing entry, which of the following will she complete next in the closing process? • Prepare the balance of the income summary account • Prepare an ear... nings summary • Prepare a post closing trial balance of the account • Prepare a revenue closing entry 2 The statement of changes in owner's equity is a financial statement _______________ that provides information about changes to the equity of a business for ___________________. • prepared third, a given time period • prepared second, a given time period • prepared first, a specific date • prepared third, a specific date 3 What is Bill’s ending owner’s equity on a statement of changes in owner's equity if his records show $8,000 in investment by owner, $25,000 in net income, $9,000 in expenses and $4,000 in owner drawings? • $24,000 • $38,000 • $46,000 • $29,000 4 Which of the steps in preparing a trial balance worksheet (below) will Joe complete next if he has already prepared an adjusted trial balance and an income statement? • Close out temporary accounts • Prepare a balance sheet • Determine net income for the period • Make adjusting entries 5 As she performs the closing process, which step did Lily complete directly before determining the balance of the income summary account? • Preparing an earnings summary • Making the revenue closing entry • Making the drawing closing entry • Preparing a post closing trial balance 6 If James' records show $70,000 in revenue, $34,000 in liabilities, $90,000 in assets and $19,000 in equity, which of the figures should be included on his income statement? • $19,000 • $70,000 • $90,000 • $34,000 7 As she prepared financial documents to be discussed at her company's annual shareholders' meeting, Linda added an appendix to the financial overview that details all financial transactions in the last fiscal year. Which of the accounting principles below is she observing? • Full Disclosure Principle • Matching Principle • Measurement Principle • Time Period Principle 8 What type of adjustment will Kyle make to his trial balance worksheet for $2,500 he was paid on October 12, for work that he will start on December 1? • Depreciation • Unearned revenue • Supplies • Accrued revenues 9 Which image below correctly shows a trial balance worksheet? • • • • 10 Jennifer has a truck that she uses to deliver goods sold by her business. At the end of the year, Jennifer will record $6,000 for depreciation of the truck. What two types of accounts will be affected by this adjusting entry? • A liability account and an owner's equity account • An expense account and a liability account • An asset account and an expense account • A payable account and an asset account 11 What is the total of Tim’s liabilities if he has recorded $50,000 in assets and $40,000 equity on a balance sheet? • $90,000 • $10,000 • $20,000 • $100,000 12 Susan is the owner of a company in which she originally invested $10,500. On her most recent balance sheet her liabilities total $3,000 and her assets total $19,000. Which of the following is the correct total of Susan’s equity? • $7,500 • $16,000 • $22,000 • $13,500 13 Which of the following correctly shows a balance sheet? • • • • 14 If Lyle has $4,000 in liabilities, $12,000 in assets, $2,000 in expenses and $17,000 in equity, which figure should he include on his income statement? • $2,000 • $4,000 • $17,000 • $12,000 15 If Karla spent $200 on Wednesday to have the windows in her building washed, recorded the accounting event that afternoon and on Friday paid $550 for a repair to the water heater and recorded that event on Friday evening, which of the accounting principles below is she following? • Full Disclosure Principle • Expense Recognition Principle • Time Period Principle • Cost Principle 16 If Andrea recorded $56,000 as liabilities and $43,000 as equity in her balance sheet, which of the following shows the correct total of Andrea’s assets? • $56,000 • $43,000 • $13,000 • $99,000 17 The employees of Catherine's business earned $22,800 in wages during December, but the next payday is not until January 2nd. When Catherine makes an adjustment on her December 31st trial balance worksheet to account for these wages, what two types of accounts will be affected? • An expense account and a payable account • Owner's equity and a payable account • A payable account and a revenue account. • An asset account and an expense account 18 Japeth's statement of changes in owner's equity shows net income of $25,000, owner's drawings of $5,000 and an ending balance of $65,000. What was Japeth's beginning balance? • $70,000 • $95,000 • $65,000 • $45,000 [Show More]

Last updated: 1 year ago

Preview 1 out of 5 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 24, 2020

Number of pages

5

Written in

Additional information

This document has been written for:

Uploaded

Oct 24, 2020

Downloads

0

Views

410