Economics > QUESTIONS & ANSWERS > REAL ESTAT 3403 CHAPTER 10: Residential Mortgage Types and Borrower DecisionsChapter 10 (University (All)

REAL ESTAT 3403 CHAPTER 10: Residential Mortgage Types and Borrower DecisionsChapter 10 (University of Florida) All Answers Provided and Explained. The quick read you need minutes to exam.

Document Content and Description Below

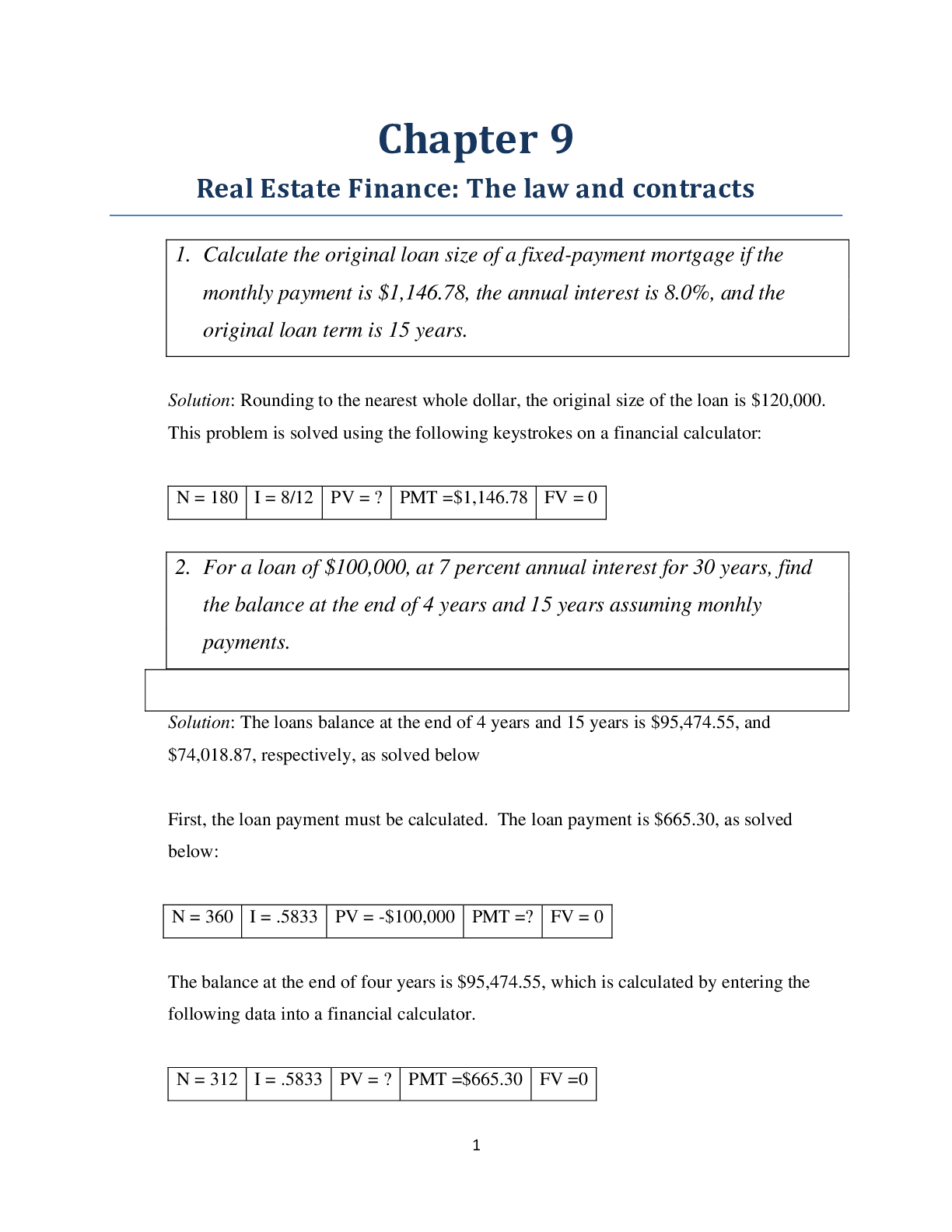

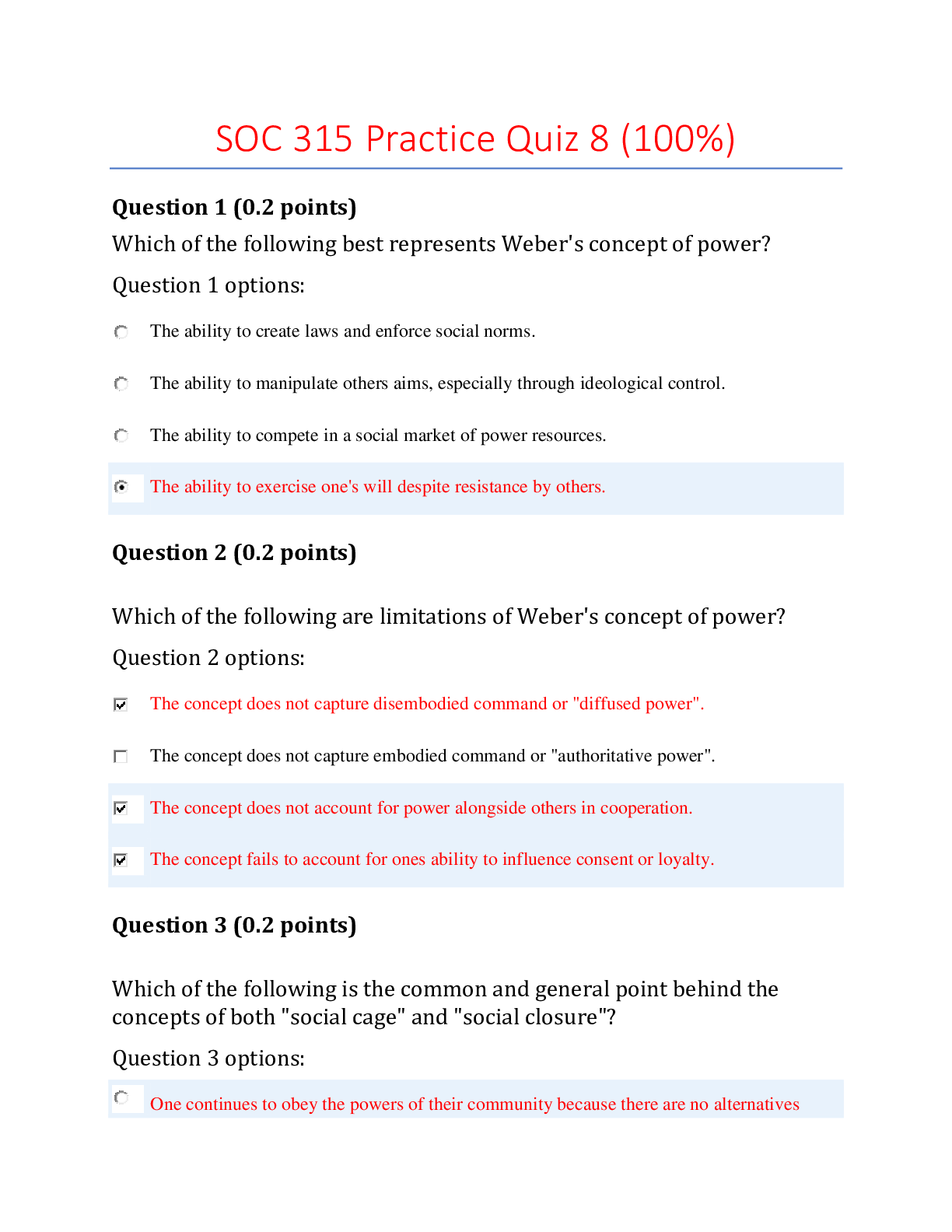

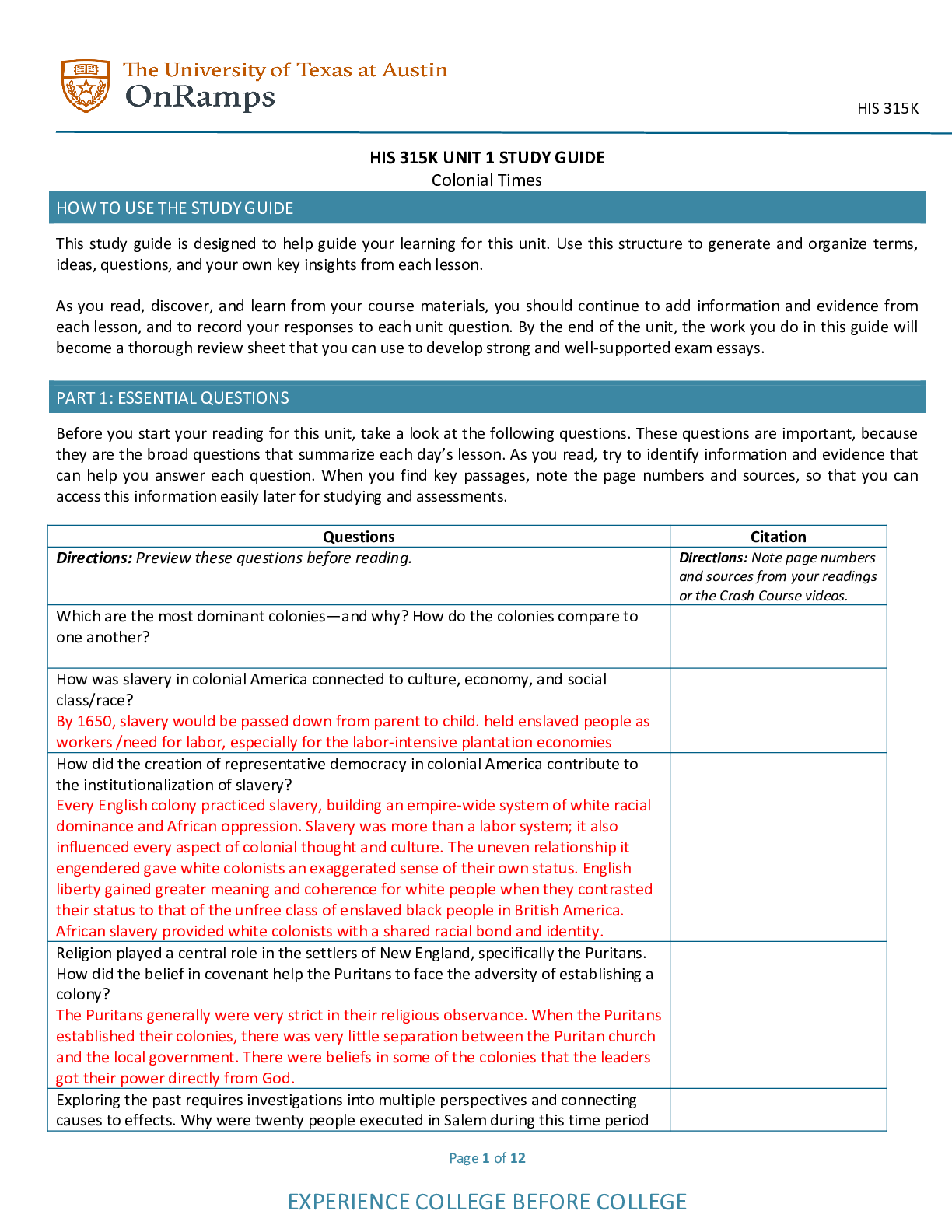

CHAPTER 10 Residential Mortgage Types and Borrower Decisions Test Problems 1. Private mortgage insurance (PMI) is usually required on loans with loan- to-value ratios greater than _ percent.... 2. The type of mortgage loan that best fits the asset-liability mix of most depository institutios is a(n): 3. Which of the following mortgage types has the most default risk, assuming the initial loan-to-value ratio, contract interest rate, and all other loan terms are identical? 4. A mortgage that is intended to enable older households to “liquify” the equity in their home is the: 5. A jumbo loan is: 6. The maximum loan-to-value ratio for an FHA loan over $50,000 is approximately: 7. The maximum loan-to-value ratio on a VA guaranteed loan is: 8. Conforming conventional loans are loans that: 9. Home equity loans typically: 10. A simple but durable method of determining whether to refinance is to use: 11. Probably the greatest contribution of FHA to home mortgage lending was to: Study Questions 1. On an adjustable rate mortgage, do borrowers always prefer smaller (i.e. tighter) rate caps that limit the amount the contract interest rate can increase in any given year or over the life if the loan? Explain why or why not. . 2. Explain why a home equity mortgage loan can be a better source of funds for household needs than other types of consumer debt. 3. Distinguish between conforming and nonconforming residential mortgage loans and explain the importance of the difference. 4. Discuss the role and importance of private mortgage insurance in the residential mortgage market. 5. Explain the maturity imbalance problem faced by savings and loan associations that hold fixed-payment mortgages as assets. 6. Suppose a homeowner has an existing mortgage loan with these terms: Remaining balance of $150,000, interest rate of 8%, and remaining term of 10 years (monthly payments). This loan can be replaced by a loan at an interest rate of 6 percent, at a cost of 8% of the outstanding loan amount. Should the homeowner refinance? What difference would it make if the homeowner expects to be in the home for only five more years? Solution a, using net benefit analysis: Solution b, using net present value 7. Assume an elderly couple owns a $140,000 home that is free and clear of mortgage debt. A reverse annuity mortgage (RAM) lender has agreed to a $100,000 RAM. The loan term is 12 years, the contract is 9.25%, and payments will be made at the end of each month. a. What is the monthly payment on this RAM? b. Fill in the following partial loan amortization table: Month Beginning Balance Monthly Payment Interest Ending Balance 1 2 3 4 5 c. What will be the loan balance at the end of the 12-year term? d. What portion of the loan balance at the end of year 12 represents principal? What portion represents interest? 8. Eight years ago you borrowed $200,000 to finance the purchase of a $240,000 house. The interest rate on the old mortgage is 6%. Payment terms are being made monthly to amortize the loan over 30 years. You have found another lender who will refinance the current outstanding loan balance at 4% with monthly payments for 30 years. The new lender will charge two discount points on the loan. Other refinancing costs will equal $6,000. There are no prepayment penalties associated with either loan. You feel the appropriate opportunity cost to apply to this refinancing decision is 4%. a. What is the payment on the old loan? b. What is the current loan balance on the old loan (five years after origination)? c. What should be the monthly payment on the new loan? d. Should you refinance today if the new loan is expected to be outstanding for five years? Answer based on net benefit analysis: Answer based on net present value: The PV of payment reductions is $16,079.10 (202,187.81 – 186,108.71). The cost of refinancing is $6,000 plus 3,510.89 (0.02 x 186,108.71), or $9,722.17. The NPV of refinancing the loan is $6,356.93 (16,079.10 – 9,722.17). Therefore, you should refinance today if the new loan is expected to be outstanding for five years. [Show More]

Last updated: 1 year ago

Preview 1 out of 5 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 12, 2020

Number of pages

5

Written in

Additional information

This document has been written for:

Uploaded

Sep 12, 2020

Downloads

0

Views

68

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)