Economics > QUESTIONS & ANSWERS > Chapter 10 Residential Mortgage Types and Borrower Decisions. (All)

Chapter 10 Residential Mortgage Types and Borrower Decisions.

Document Content and Description Below

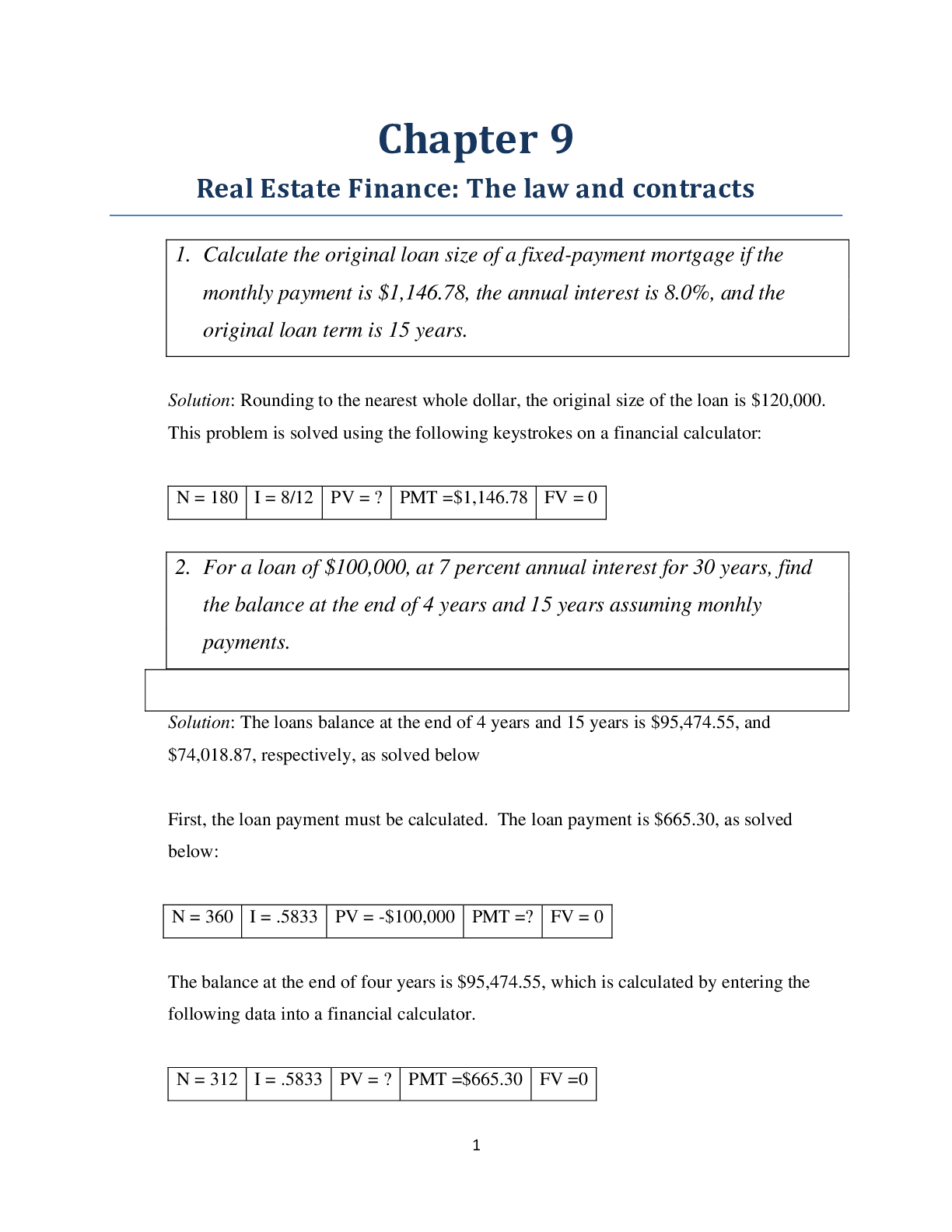

Chapter 10 Residential Mortgage Types and Borrower Decisions Multiple Choice Questions 1. Mortgage originators can either hold loans in their portfolios or sell them to investors. When a m... ortgage originator decides to sell mortgages to an institution, for example, this transaction occurs in what is commonly referred to as the: A. primary mortgage market B. secondary mortgage market C. over-the-counter market D. loan origination market 2. Which of the following types of institutions has historically been the largest purchaser of residential mortgages? A. Commercial banks B. Savings and Loans C. Government sponsored enterprise D. Mortgage banking companies 3. Considered the most common type of home loan, which of the following refers to any standard home loan that is not insured or guaranteed by an agency of the U.S. government? A. Conventional home loan B. Federal Housing Administration loan C. Veterans Affairs loan D. Section 203 loan 4. Created by Congress to promote an active secondary market for home mortgages, Fannie Mae and Freddie Mac purchase loans that meet specific underwriting standards such as loan size, documentation, and payment to income ratio. The loans that Fannie Mae and Freddie Mac are eligible to purchase are referred to as: A. conventional loans B. conforming conventional loans C. nonconforming conventional loans D. jumbo conventional loans 5. Since conforming loans can be much more readily bought and sold in the secondary mortgage market, they carry a _______ interest rate than comparable nonconforming loans. A. higher B. equal C. lower D. more volatile 6. Mortgage originators often offer many types and forms of available residential loans as part of their mortgage menu. However, the predominant form of prime conventional mortgage remains the: A. (fixed-rate) level payment mortgage (LPM) B. adjustable rate mortgage (ARM) C. subprime mortgage D. alt-A mortgage 7. Lenders generally require private mortgage insurance (PMI) for conventional loans over 80 percent of the value of the security property. PMI protects a lender against which of the following? A. Losses due to default on the loan B. Legal threat to the lender's mortgage claim C. Physical hazards D. Changes in the index rate associated with an adjustable rate mortgage 8. Mortgage insurance rates vary with the perceived riskiness of the loan. Which of the following scenarios would result in a higher mortgage insurance premium? A. Lower loan-to-value ratio B. Shorter loan term C. Stronger credit record of the borrower D. A "cash-out" refinancing loan 9. The Federal Housing Administration (FHA) insures loans made by private lenders that meet FHA's property and credit-risk standards. Which of the following statements concerning FHA insurance is true? A. The insurance is paid by the lender and protects the lender against loss due to borrower default. B. The insurance is paid by the borrower and protects the lender against loss due to borrower default. C. The insurance is paid by the lender and protects the borrower against loss due to lender default. D. The insurance is paid by the borrower and protects the borrower against loss due to lender default. 10. Federal Housing Administration (FHA) loans differ from conventional loans in a number of ways. All of the following statements regarding FHA loans are true EXCEPT: A. FHA loans are targeted toward first-time homebuyers who are in slightly weaker financial circumstances than the typical prime conventional borrower. B. FHA loans are more tolerant in terms of qualifying debt-to-income ratios. C. FHA loans require higher credit scores than are needed for prime conventional loans. D. FHA loans contain lower limits on their maximum size than are available through conforming conventional loans. 11. It would be hard to overstate the importance of the Federal Housing Administration (FHA) in the history of housing finance. Which of the following instruments created by the FHA is considered the single most important financial instrument in modern housing finance? A. Level-payment, fully amortizing loan B. Adjustable rate mortgage C. Partially-amortizing balloon loan D. Subprime mortgage loan 12. Many older, retired households are considered "house poor." Which of the following forms of loans has been designed to help mitigate this problem by offering additional monthly income to these homeowners in exchange for a portion of their housing equity? A. Purchase-money mortgage (PMM) B. Package mortgage C. Home equity loan D. Reverse mortgage 13. In recent years, home equity loans have become a popular form of second mortgage. Their popularity has been a result of all of the following EXCEPT: A. Lower interest rates than other consumer debt B. Shorter terms than other consumer debt C. Tax-favored status D. Aggressive marketing by lenders 14. In contrast to conventional home loans, the interest-only balloon loan requires the borrower to pay off the loan with a "balloon" payment equal to the original balance after: A. 1-5 years B. 5-7 years C. 7-15 years D. 15-30 years 15. The hybrid ARM attempts to balance the fixed payment desire of a borrower with the lender's desire to increase interest rates if market rates rise in the future. In its most common form, known as a 2-28, the hybrid ARM will have a fixed-interest rate for: A. 1 year B. 2 years C. 26 years D. 28 years 16. Mortgage loans made to borrowers with normal credit quality, but who lack the necessary documentation needed to meet conforming mortgage standards would most likely be considered: A. subprime loans B. option ARM loans C. hybrid ARM loans D. alt-A loans 17. Since mortgages typically have multiple costs associated with them, a borrower may attempt to reduce these costs into a single measure in order to compare two or more mortgages. Which of the following measures is a popular tool for comparing the cost of several mortgages? A. Upfront fees B. Contracted interest rate C. Annual percentage rate D. Teaser rate 18. A common criticism of the annual percentage rate (APR) is that it usually understates the true cost of borrowing. The APR may understate the cost of borrowing because it assumes: A. interest rates will always rise B. the loan always goes to maturity C. the actual life of the loan is shorter than maturity D. upfront fees should be ignored 19. The refinancing decision is sometimes oversimplified into a few "rules of thumb" that a borrower uses in order to gauge its potential benefits. Which of the following methodologies is criticized for its inability to account for a variation in refinancing benefits due to cost or holding period differences? A. Payback period approach B. Net benefit approach C. Interest rate spread D. Net present value approach 20. With the arrival of subprime mortgages in recent years, a new kind of "trigger" event became apparent in leading households to default. Which of the following trigger events is primarily associated with most defaults that have occurred during the most recent subprime mortgage crisis? A. Death in the family B. Divorce C. Unemployment D. Mortgage payment spikes 21. Suppose a buyer agrees to purchase a tract of land for $40,000. The buyer is only able to obtain a mortgage for $32,000. Rather than let the deal fall through, the seller agrees to accept $4,000 in cash and a note from the buyer for the remaining $4,000. This type of transaction is commonly referred to as a: A. conventional loan B. home equity mortgage C. purchase money mortgage D. reverse mortgage 22. Suppose a homeowner is reluctant to refinance until he is reasonably sure that interest rates are not going to fall appreciably from where they currently are. In this case, the homeowner appears to be concerned about which of the following costs associated with refinancing? A. Opportunity cost B. Tax consequences C. Default risk D. Upfront fees 23. When personal property items such as a range, refrigerator, and household furnishings may be included in the home loan, which usually carries a longer term and lower interest rate than if the borrower had financed these items with a separate consumer loan, this is referred to as a: A. Purchase-money mortgage (PMM) B. Package mortgage C. Home equity loan D. Reverse mortgage 24. Assume that a veteran decides to purchase a house for $150,000 using a VA loan. If the buyer defaults on the loan, what is the maximum amount that the VA guarantees the lender? A. $15,000 B. $60,000 C. $75,000 D. $150,000 25. Considering the following information, what is the NPV if the borrower refinances the loan? Expected holding period: 15 years, Current loan balance: $100,000, Current loan interest: 9 %, New loan interest: 7.5 %, Cost of refinancing: $4,250 A. -$5,003 B. -$1,014 C. $5,163 D. $9,413 [Show More]

Last updated: 1 year ago

Preview 1 out of 6 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 11, 2020

Number of pages

6

Written in

Additional information

This document has been written for:

Uploaded

Sep 11, 2020

Downloads

0

Views

113

.png)

.png)

.png)

.png)

.png)

.png)

.png)