Economics > QUESTIONS & ANSWERS > REAL ESTAT 3403 Chapter 15 Mortgage Calculations and Decisions Test Problems (University of Florida (All)

REAL ESTAT 3403 Chapter 15 Mortgage Calculations and Decisions Test Problems (University of Florida) All Answers Provided and Explained. The quick read you need minutes to exam.

Document Content and Description Below

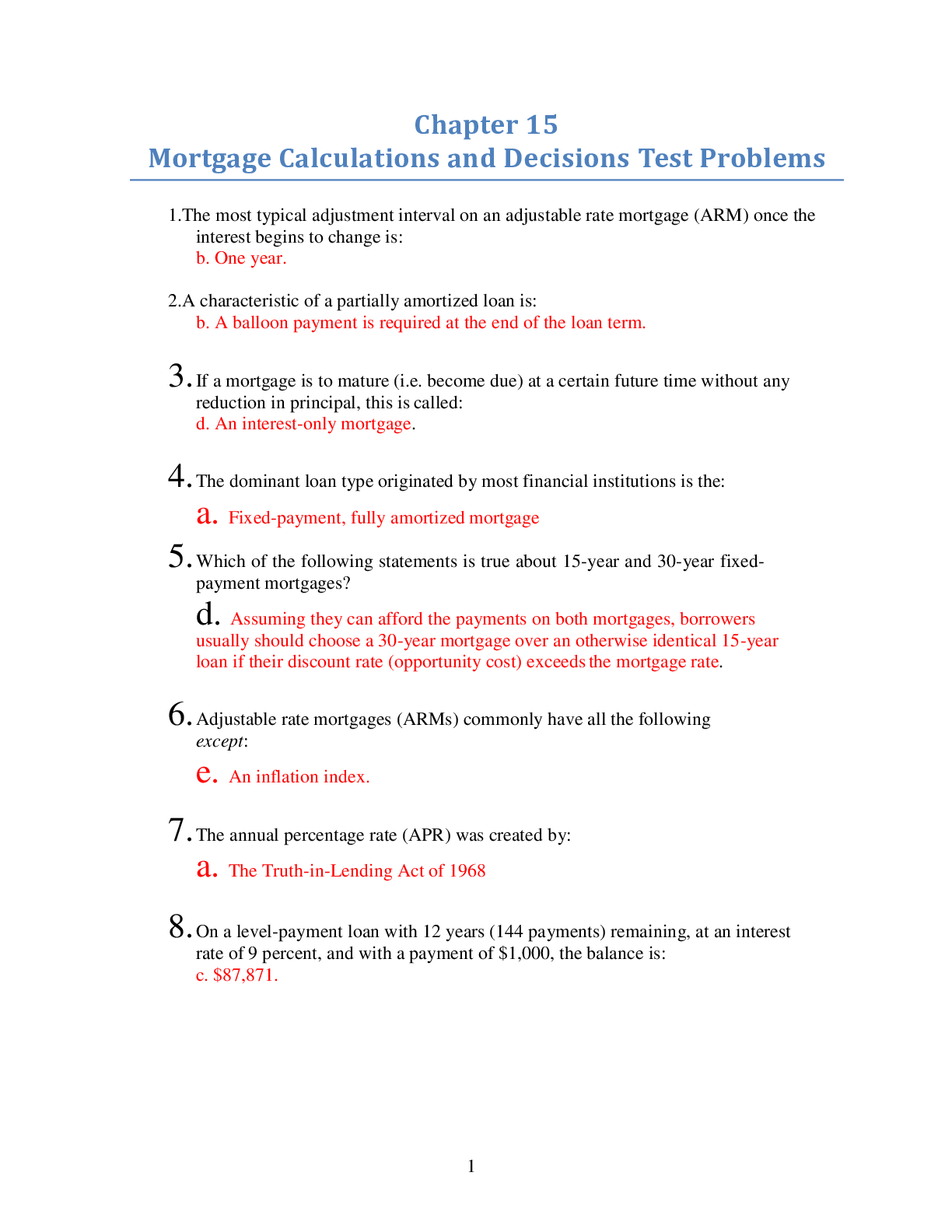

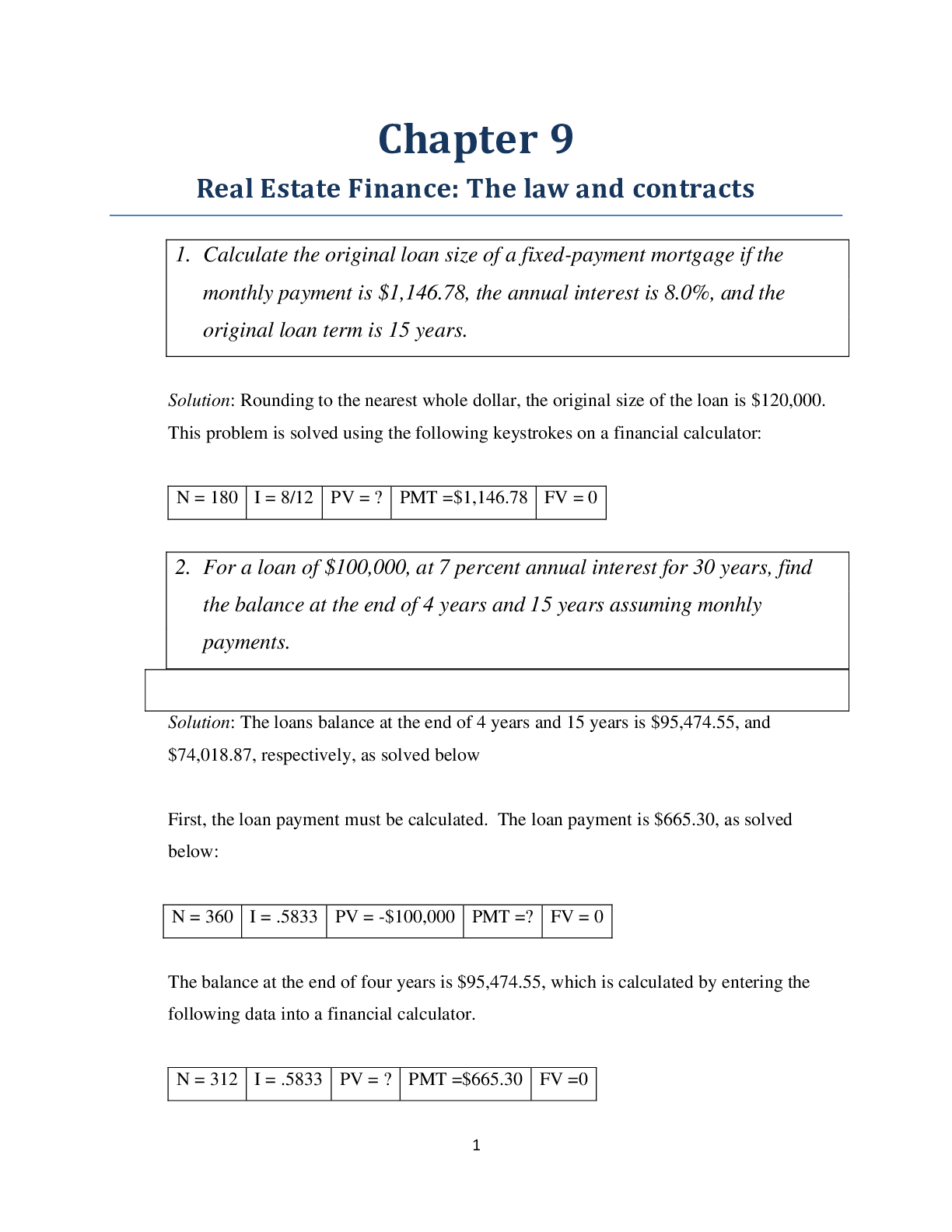

REAL ESTAT 3403 Chapter 15 Mortgage Calculations and Decisions Test Problems (University of Florida) All Answers Provided and Explained. The quick read you need minutes to exam. Chapter 15 Mortg... age Calculations and Decisions Test Problems 1.The most typical adjustment interval on an adjustable rate mortgage (ARM) once the interest begins to change is: 2.A characteristic of a partially amortized loan is: 3. If a mortgage is to mature (i.e. become due) at a certain future time without any reduction in principal, this is called: 4. The dominant loan type originated by most financial institutions is the: 5. Which of the following statements is true about 15-year and 30-year fixed-payment mortgages? 6. Adjustable rate mortgages (ARMs) commonly have all the following except: 7. The annual percentage rate (APR) was created by: 8. On a level-payment loan with 12 years (144 payments) remaining, at an interest rate of 9 percent, and with a payment of $1,000, the balance is: 9. On the following loan, what is the best estimate of the effective borrowing cost if the loan is prepaid in six years? Loan: $100,000 Interest rate: 7 percent Term: 180 months Up-front costs: 7 percent of loan amount 10. Lender’s yield differs from effective borrowing costs (EBC) because: Study Questions 1. Calculate the original loan size of a fixed- payment mortgage if the monthly payment is $1,146.78, the annual interest is 8.0%, and the original loan term is 15 years. 2. For a loan of $100,000, at 7 percent interest for 30 years, find the balance at the end of 4 years and 15 years. 3. On an adjustable rate mortgage, do borrowers always prefer smaller (tighter) rate caps that limit the amount the contract interest rate can increase in any given year or over the life of the loan? 4. Consider a $75,000 mortgage loan with an annual interest rate of 8%. The loan term is 7 years, but monthly payments will be based on a 30-year amortization schedule. What is the monthly payment? What will be the balloon payment at the end of the loan term? 5. A mortgage banker is originating a level- payment mortgage with the following terms: Annual interest rate: 9percent Loan term: 15years Payment frequency: monthly Loan amount: $160,000 Total up-front financing costs (including discount points): $4,000 Discount points to lender: $2,000 a. Calculate the annual percentage rate (APR) for Truth-in-Lending purposes. b. Calculate the lender’s yield with no prepayment. c. Calculate the lender’s yield with prepayment is five years. d. Calculate the effective borrowing costs with prepayment in five years. a. The APR is approximately 9.43 percent as solved below: b. The lender’s yield to maturity is 9.22 percent c. In order to calculate the lender’s yield, the loan balance remaining at the end of year five must first be calculated” The remaining balance is $128,108.67. With this information, the lender’s yield is 9.34 percent as calculated below: d. The effective borrowing cost with prepayment in five years is 9.69 percent. 6. Give some examples of up-front financing costs associated with residential mortgages. What rule can one apply to determine if a settlement (closing) cost should be included in the calculation of the effective borrowing costs? 7. A homeowner is attempting to decide between a 15-year mortgage loan at 5.5 percent and a 30-year loan at 5.90 percent. What would you advise? What would you advise if the borrower also has a large amount of credit card debt outstanding at a rate of 15 percent? 8. Suppose a one-year ARM loan has a margin of 2.75, an initial index of 3.00 percent, a teaser rate for the first year of 4.00 percent, and a cap of 1.00 percent. If the index rate is 3.00 percent at the end of the first year, what will be the interest rate on the loan in year two? If there is more than one possible answer, what does the outcome depend on? 9. Assume the following for a one-year rate adjustable rate mortgage loan that is tied to the one-year Treasury rate: Loan amount: $150,000 Annual rate cap: 2% Life-of-loan cap: 5% Margin : 2.75% First-year contract rate: 5.50% One-year Treasury rate at end of year 1: 5.25% One-year Treasury rate at end of year 2: 5.50% Loan term in years: 30 Given these assumptions, calculate the following: a. Initial monthly payment b. Loan balance end of year 1 c. Year 2 contract rate d. Year 2 monthly payment e. Loan balance end of year 2 f. Year 3 contract rate g. Year 3 payment Solution: a. The loan balance at the end of year one is $147,979, as shown below: b. Assuming the annual cap applies to the teaser rate, the interest rate in year two is 5.50 plus 2.00, or 7.50 percent. c. With a remaining term of 29 years, interest rate of 7.5 percent and a balance of $147,979.41, the new payment in year 2 is $1,044.32, calculated on a financial calculator with the following keystrokes. d. The loan balance at the end of year two is $146,496: e. The year three contract interest rate is index plus margin, or 8.25 percent. f. The year three payment, based on a balance of $146,496, remaining term of 28 years and an interest rate of 8.25 percent, is $1,129. 10. Assume the following: Loan Amount: $100,000 Interest rate: 10 percent annually Term: 15 years, monthly payments a. What is the monthly payment? b. What will be the loan balance at the end of nine years? c. What is the effective borrowing cost on the loan if the lender charges 3 points at origination and the loan goes to maturity? d. What is the effective borrowing cost on the loan if the lender charges 3 points at origination and the loan is prepaid at the end of year 9? Solution: a. The loan balance at the end of 9 years is $58,006. b. The effective borrowing cost of the loan, with financing costs of 3 discount points, that is held to maturity and is 10.54 percent: c. The effective borrowing cost of the loan, with financing costs of 3 points, that is prepaid at the end of year nine and is 10.61 percent: [Show More]

Last updated: 1 year ago

Preview 1 out of 11 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 12, 2020

Number of pages

11

Written in

Additional information

This document has been written for:

Uploaded

Sep 12, 2020

Downloads

0

Views

61

.png)

.png)

.png)

.png)