Business > CAPSTONE SIMULATION > Entrepreneurial Finance StreetShares, Inc. Fintech Platform Lending Business A Case Study of Early S (All)

Entrepreneurial Finance StreetShares, Inc. Fintech Platform Lending Business A Case Study of Early Stage Venture Capital

Document Content and Description Below

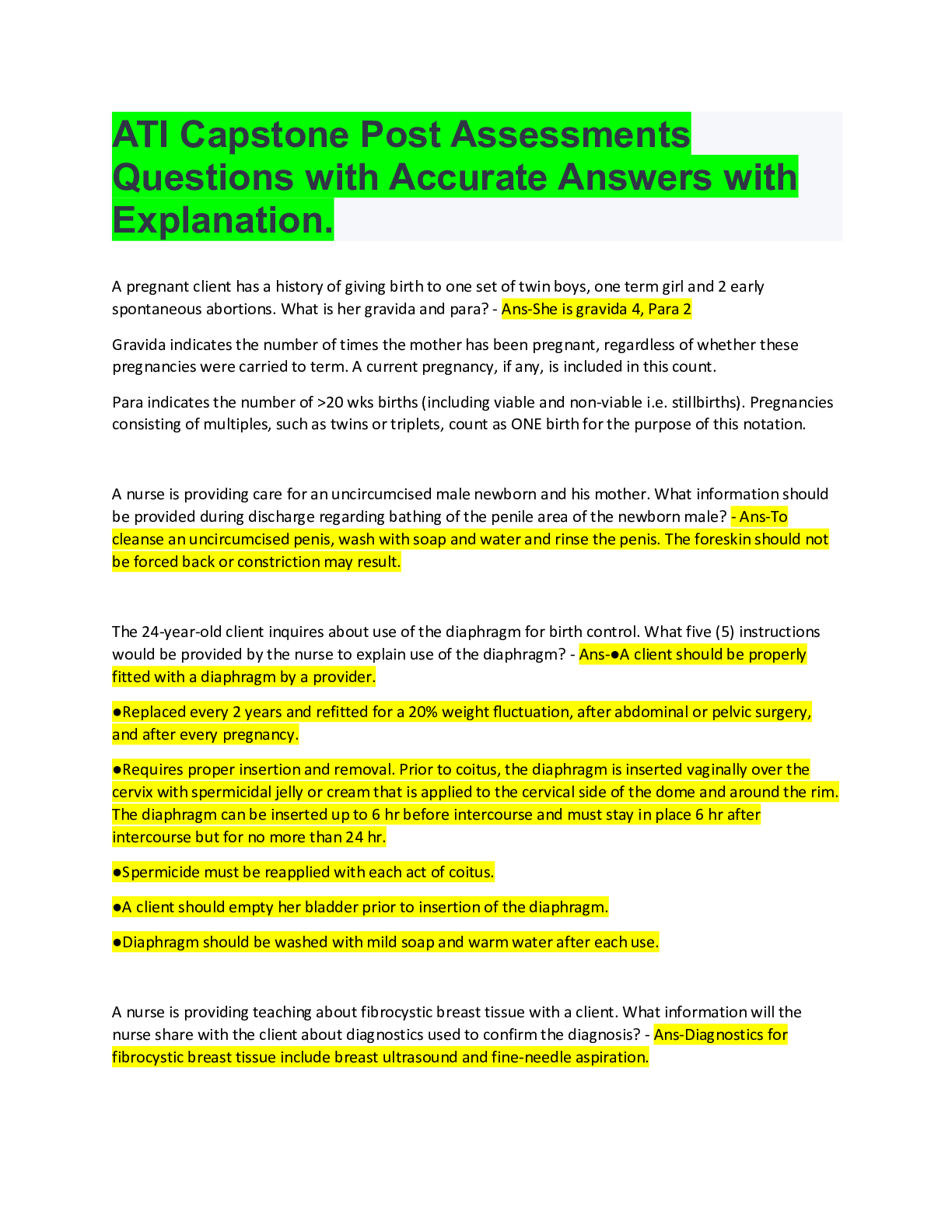

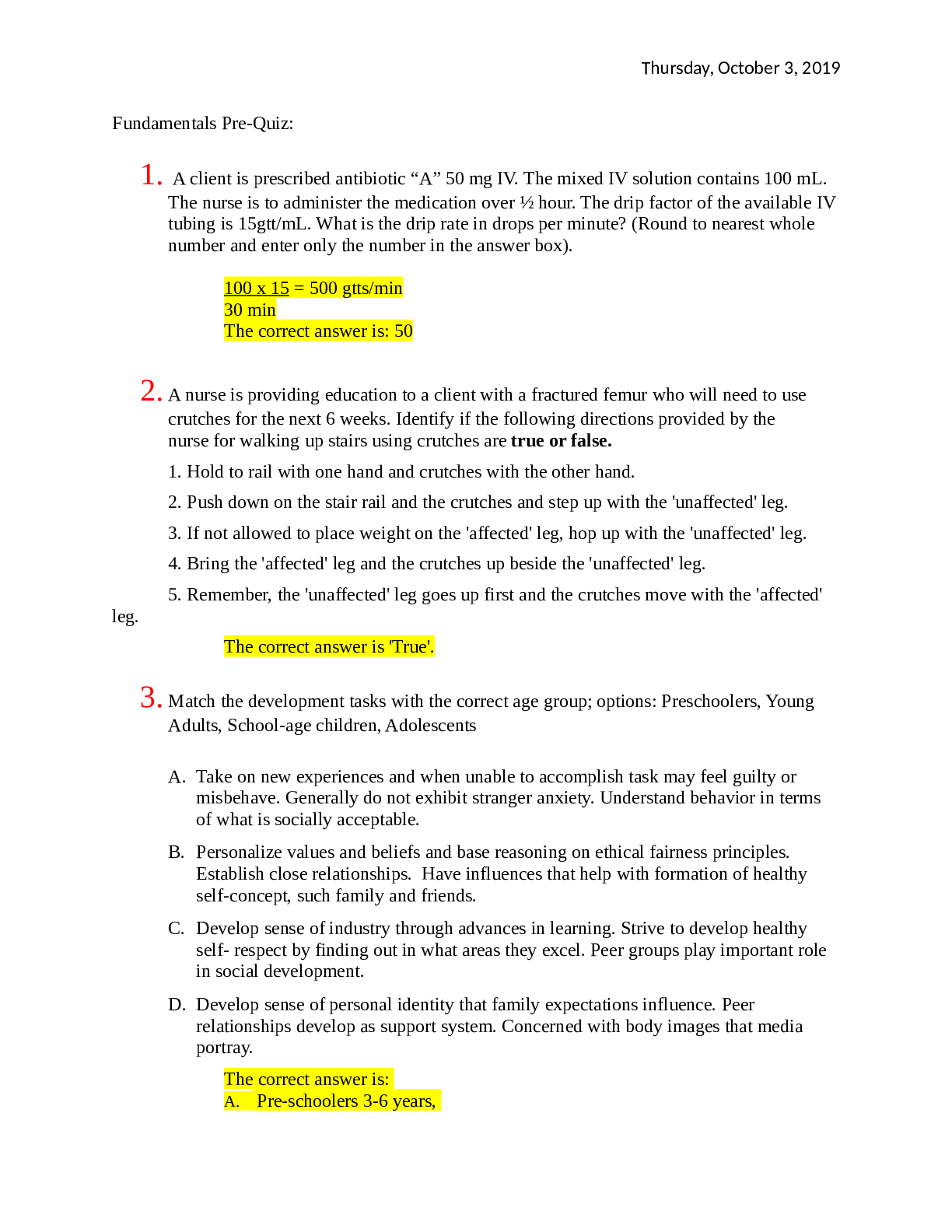

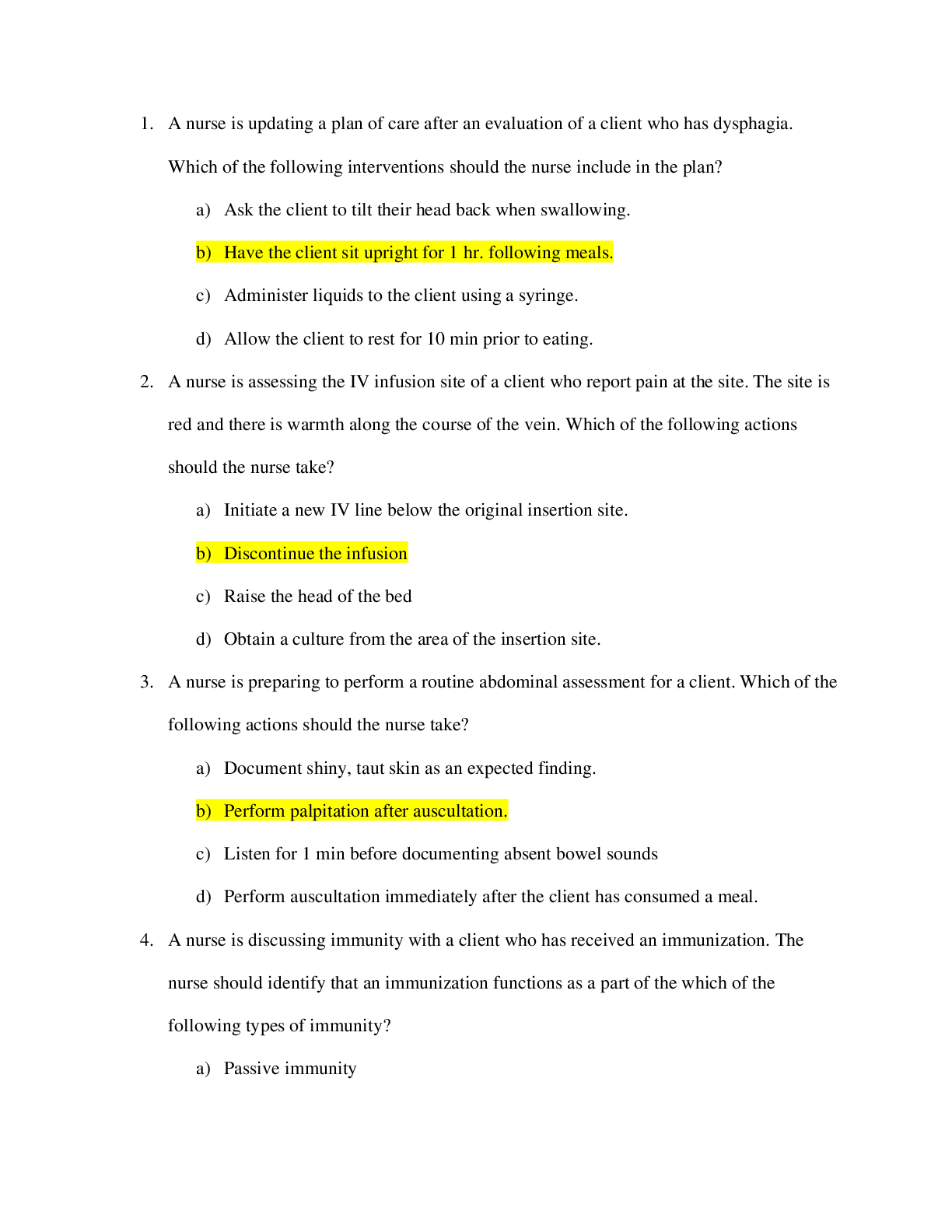

Entrepreneurial Finance StreetShares, Inc. Fintech Platform Lending Business A Case Study of Early Stage Venture CapitalBackground to StreetShares: Drivers of Bank Profitability Loan Portfolio... X Interest Spread + Fees – Provision for Credit Loss Pass-through Loans + X Servicing Fees Operating Expenses -Background to StreetShares Conventional Banks vs. Fintech Lenders Conventional Banks Fintech Lenders (in general) Type of Loans Larger commercial loan Generally lower risk with stronger collateral. Smaller commercial loans that are difficult to securitize Type of Borrowers Diversified Higher Risk Lending Rates Lower High (up to 20%) Funding Costs Normally lower with Large Deposit Base, Access to Capital Markets High as it relies on institutions funding and PE Regulation Higher Lower (shadow banking) Process of Loan Application Slower Faster Operating Leverage Lower HigherBackground to StreetShares Examples of Publicly Traded Fintech Lenders in Canada • Versabank (VB on TSX) – Founded in 1993—world’s first branchless bank – Achieved highest net interest margins among publicly traded Canadian banks by securing over 40% of its deposits (at essentially 0% interest rate) from professional insolvency firms who use Versabank’s software. – Funds low risk loans (point-of-sale financing supported with cash holdbacks that cover credit losses) • TIMIA Capital (TCA on TSX Venture) – Provides 20% IRR loans to Sass companies (whose revenues are between $2 and $10 million) and whose repayment is tied directly to revenue. – Financing loans through LPs and earns a feeBackground to StreetShares Examples of Private Fintech Lenders in Canada • Lending Loop (private early stage company) – Operates a platform that matches small business borrowers with individual investors (earns a fee) • LEDN (private early stage compay) – Bitcoin backed loans – Bitcoin savings accounts [Show More]

Last updated: 1 year ago

Preview 1 out of 16 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 17, 2021

Number of pages

16

Written in

Additional information

This document has been written for:

Uploaded

May 17, 2021

Downloads

0

Views

109

.png)