Accounting > EXAM > ACCT 349 Week 4 Midterm Exam Answers,2021 LATEST WITH CORRECT ANSWERS. (All)

ACCT 349 Week 4 Midterm Exam Answers,2021 LATEST WITH CORRECT ANSWERS.

Document Content and Description Below

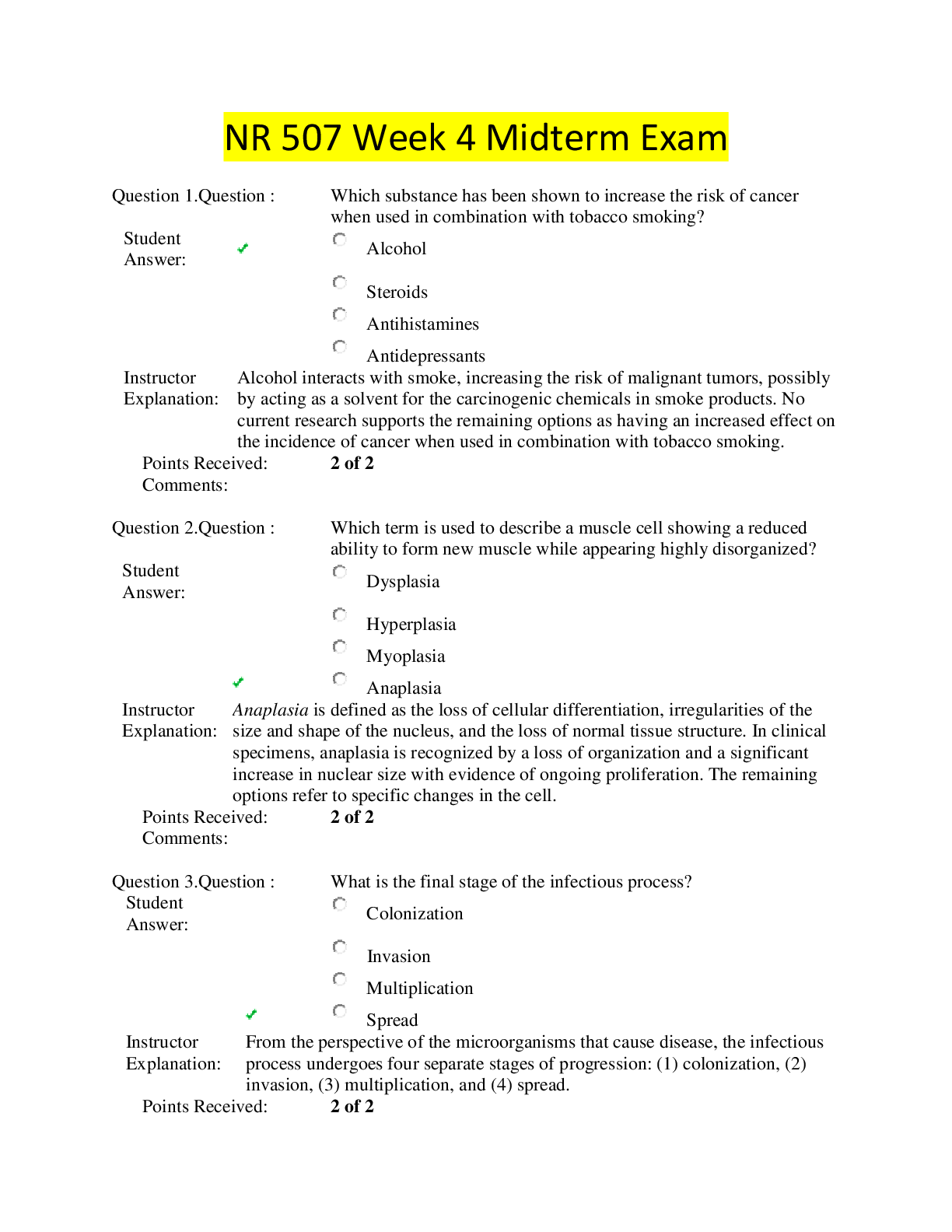

1.(TCO 5) Jordan Fracus, Inc. evaluates manufacturing overhead in its factory by using variance analysis. The following information applies to the month of June. Actual Budgeted Number of frames m... anufactured 19,000 20,000 Variable overhead costs $4,100 $2 per direct labor hr. Fixed overhead costs $22,000 $20,000 Direct labor hours 2,100 hrs. 0.1 hr. per frame What is the fixed overhead spending variance? (Points : 11) $1,000 favorable $1,000 unfavorable $2,000 favorable $2,000 unfavorable Question 2.2. (TCO 5) In an activity-based costing system, what should be used to assign a department’s manufacturing overhead costs to products produced in varying lot sizes?(Points : 11) A single cause-and-effect relationship Multiple cause-and-effect relationships Relative net sales value of the products A product’s ability to bear cost allocations Question 3.3. (TCO 1) Daisy Bakes Order Co. applied the high-low method of cost estimation to customer order data for the first 4 months of the year. What is the estimated variable order-filling cost component per order? Month Number of Orders Costs January 1,200 $3,120 February 1,300 $3,185 March 1,800 $4,320 April 1,700 $3,895 (Points : 11) $2.00 $2.42 $2.48 $2.50 Question 4.4. (TCO 1) Serendipity Co. uses regression analysis to develop a model for prediction overhead costs. Two different cost drivers (machine hours and direct materials weight) are under consideration as the independent variable. Relevant data were run on a computer using one of the standard regression programs, with the following results. Machine hours Coefficient Y intercept 2,500 B 5.0 r-squared = .70 Direct materials weight Y intercept 4,600 B 2.6 r-squared = .50 Which regression equation should be used? (Points : 11) y = 2.500 + 5.0x y = 2500 + 3.5x y = 4,600 + 2.6x y = 4,600 + 1.3x Question 5.5. (TCO 2) Relevant or differential cost analysis (Points : 11) takes all variable and fixed costs into account to analyze decision alternatives. considers only variable costs as they change with each decision alternative. considers the change in reported net income for each alternative to arrive at the optimum decision for the company. considers all variable and fixed costs as they change with each decision alternative. Question 6.6. (TCO 2) McConnell is a manufacturer of industrial components. One of its products that is used as a subcomponent in auto manufacturing is JC-46. This product has the following financial structure per unit. Selling price $150 Direct materials 20 Direct labor 15 Variable manufacturing overhead 12 Fixed manufacturing overhead 30 Shipping and handling 3 Fixed selling and administrative 10 Total costs $ 90 McConnell has received a special, one-time order for 1,000 JC-46 parts. Assume that McConnell is operating at full capacity, and that the contribution of the output would be displaced by the special order is $10,000. The minimum price that is acceptable for this one-time special order must be greater than (Points : 11) $60. $70. $87. $100. Question 7.7. (TCO 5) Janice Foeld Company manufactures part Z for use in its production cycle. The costs per unit for 10,000 units of part Z are as follows. Direct materials $3 Direct labor 15 Variable overhead 6 Fixed overhead 8 TOTAL $32 Baloney Company has offered to sell Janice Foeld 10,000 units of part Z for $30 per unit. If Janice Foeld accepts Baloney’s offer, the released facilities can be used to save $45,000 in relevant costs in the manufacture of part A. In addition, $5 per unit of the fixed overhead applied to part Z would be totally eliminated. The total relevant costs to buy part Z are (Points : 11) $320,000. $300,000. $290,000. $255,000. Question 8.8. (TCO 2) Bieber Company has excess capacity on two machines, 24 hours on Machine 105 and 16 hours on Machine 107. To use this excess capacity, the company has two products, known as Product D and Product F, that must use both machines in manufacturing. Both have excess product demand, and the company can sell as many units as it can manufacture. The company’s objective is to maximize profits. Product D has an incremental profit of $6 per unit, and each unit utilizes 2 hours of time on Machine 105 and then 2 hours of time on Machine 107. Product F has an incremental profit of $7 per unit, and each unit utilizes 3 hours of time on Machine 105 and then 1 hour of time on machine 107. Let D be the number of units for Product D, F be the number of units for product F, and P be the company’s profit. The equations 2D + 3F < 24, D > 0, and F > 0 are (Points : 11) objective functions. inequalities. deterministic functions. constraints. Question 9.9. (TCO 4) Using the balanced scorecard approach, an organization evaluates managerial performance based on (Points : 11) a single ultimate measure of operating results, such as residual income. multiple financial and nonfinancial measures. multiple nonfinancial measures only. multiple financial measures only. Question 10.10. (TCO 6) The market share variance equals (Points : 11) actual units x (budgeted weighted-average unit contribution margin for planned mix – budgeted weighted-average UCM for actual mix). (actual units – master budget units) x budgeted weighted-average UCM for the planned mix. budgeted market share percentage x (actual market size in units – budgeted market size in units) x budgeted weighted-average UCM. (actual market share percentage – budgeted market share percentage) x actual market size in units x budgeted weighted-average UCM. Question 11.11. (TCO 6) The following are relevant data for calculating sales variances for Lumber Co., which sells its sole product in two countries. John Quincy Total Budgeted selling price per unit $6.00 $10.00 NA Budgeted variable cost per unit 3.00 7.50 NA Budgeted contribution margin per unit $3.00 $ 2.50 NA Budgeted unit sales 300 200 500 Budgeted mix percentage 60% 40% 100% Actual units sold 260 260 520 Actual selling price per unit $6.00 $9.50 NA The sales mix variance for John and Quincy is (Points : 11) $156 U. $26 U. $56 F. $150 F. Question 12.12. (TCO 4) Nonfinancial performance measures are important to engineering and operations managers in assessing the quality levels of their products. Which of the following indicators can be used to measure product quality? I. Returns and allowances II. Number and types of customer complaints III. Production cycle time (Points : 11) I and II only I and III only II and III only I, II, and III Question 13.13. (TCO 6) Which of the following statements regarding the difference between a flexible budget and a static budget is true? (Points : 11) A flexible budget primarily is prepared for planning purposes, whereas a static budget is prepared for performance evaluation. A flexible budget provides cost allowances for different levels of activity, whereas a static budget provides costs for one level of activity. A flexible budget includes only variable costs, whereas a static budget includes only fixed costs. Variances will always be larger with a flexible budget than with a static budget. Question 14.14. (TCO 5) Yourtube Company uses a standard cost system and prepared the following budget at normal capacity for the month of January. Direct labor hours 24,000 Variable factory overhead $ 48,000 Fixed factory overhead $108,000 Total factory overhead per DLH $6.50 Actual data for January were as follows: Direct labor hours worked 22,000 Total factory overhead $147,000 Standard DLH allowed for the capacity attained 21,000 Using the two-way analysis of overhead variances, what is the budget (controllable) variance for January? (Points : 11) $3,000 $13,500 unfavorable $9,000 favorable $10,500 unfavorable Question 15.15. (TCO 1) Which of the following may be scheduled in production planning by the use of learning curves? (Points : 11) Purchase of materials Subassembly production Delivery dates of finished products All of the answers are correct. 1. (TCO 3) What are life cycle budgeting and life-cycle costing, and when should companies use these techniques? (Points : 15) 2. (TCO 2) Explain the opportunity-cost concept and why it is relevant in decision making. (Points : 35) 3. (TCO 1) Outline the six steps involved in estimating a cost function using quantitative analysis. (Points : 35) [Show More]

Last updated: 1 year ago

Preview 1 out of 60 pages

.png)

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 30, 2021

Number of pages

60

Written in

Additional information

This document has been written for:

Uploaded

Apr 30, 2021

Downloads

0

Views

42

– Chamberlain College of Nursing.png)

– Chamberlain College of Nursing.png)