Accounting > COURSE NOTES > ACCT 3100 Fin Acc - Baruch College_ Ch 16: Accounting for Income Taxes-Deferred Tax Assets/Liabiliti (All)

ACCT 3100 Fin Acc - Baruch College_ Ch 16: Accounting for Income Taxes-Deferred Tax Assets/Liabilities, pre-tax accounting income and taxable income, Deferred Tax Liabilities/Assets, Valuation Allowance, Tax rate, and Net Operating Losses (NOL)

Document Content and Description Below

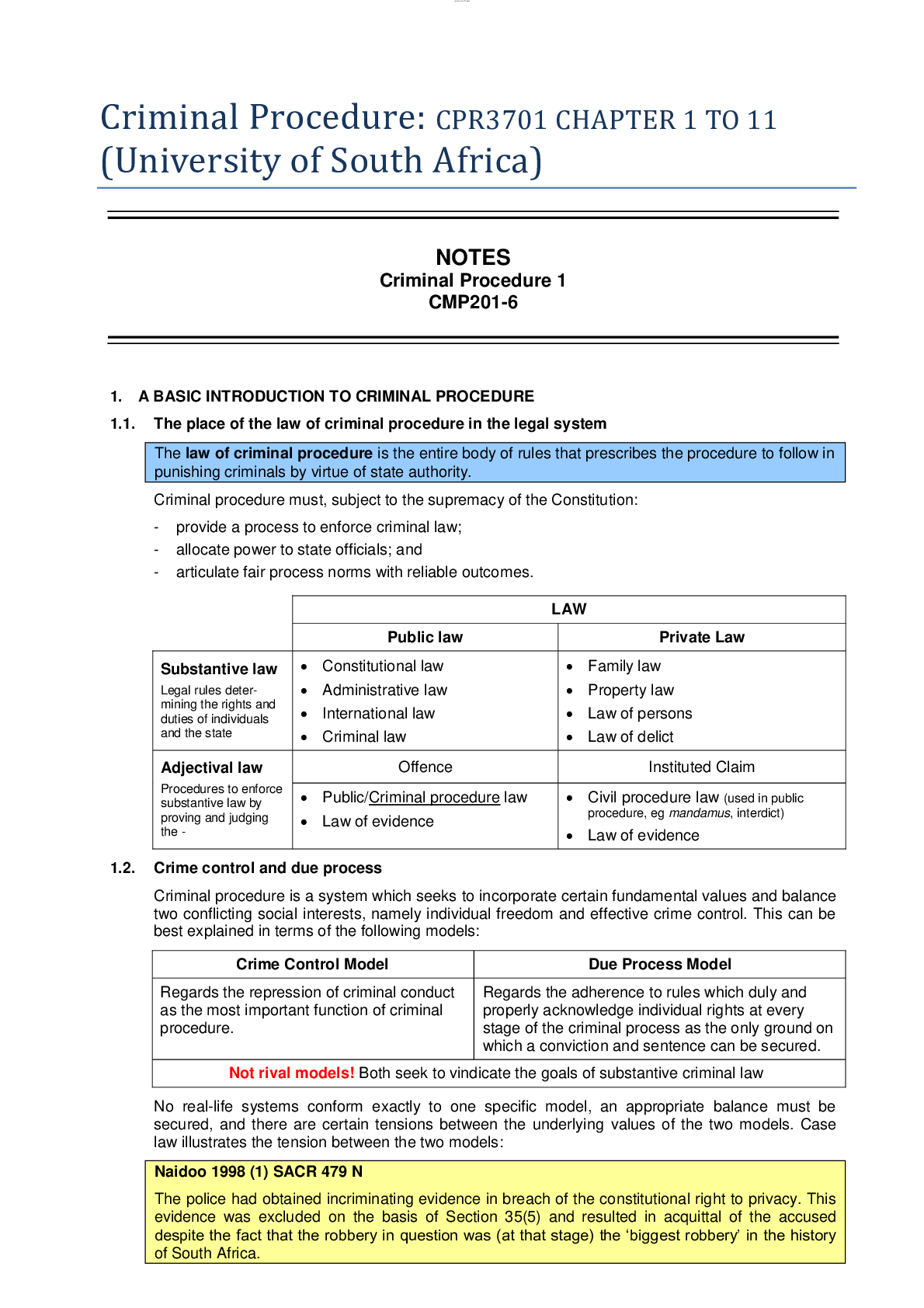

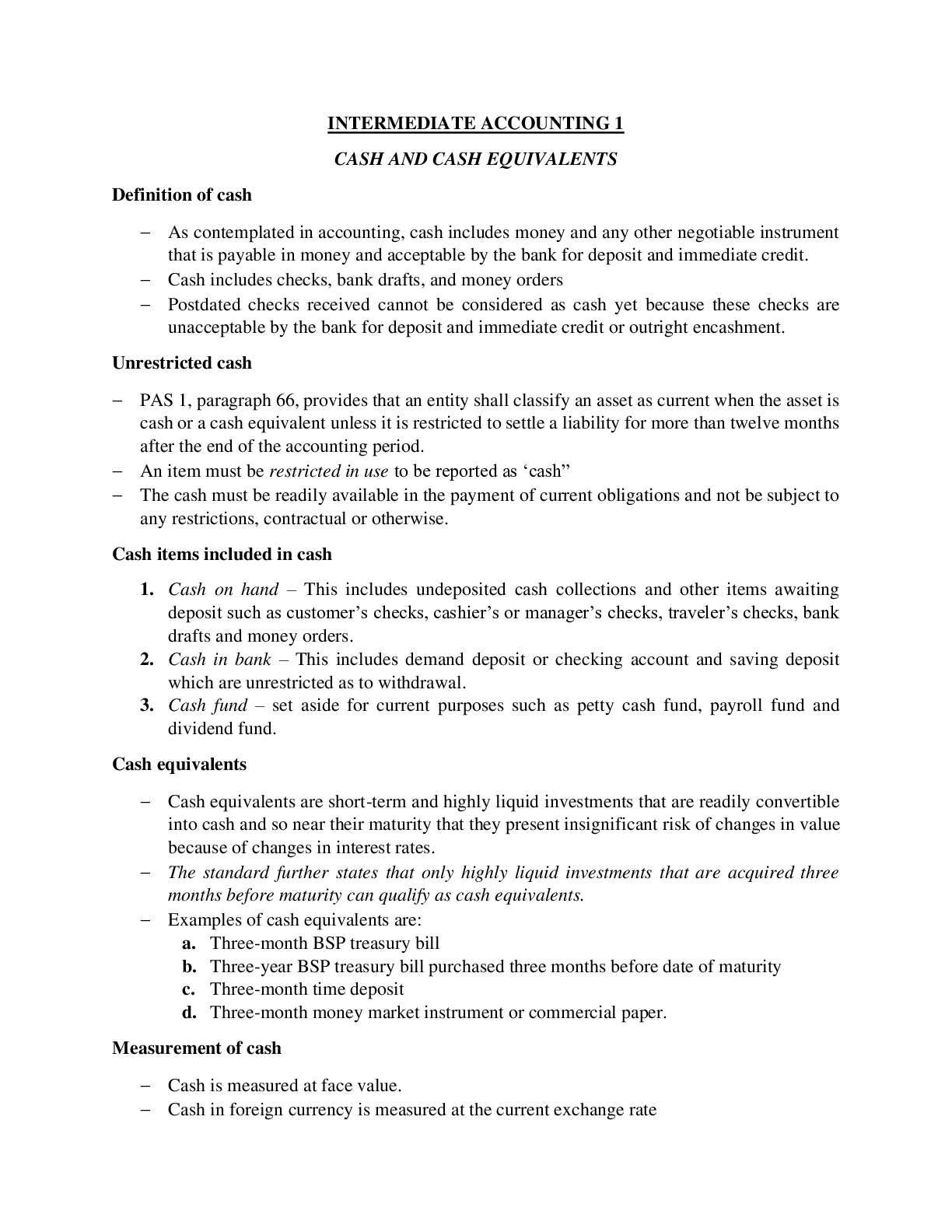

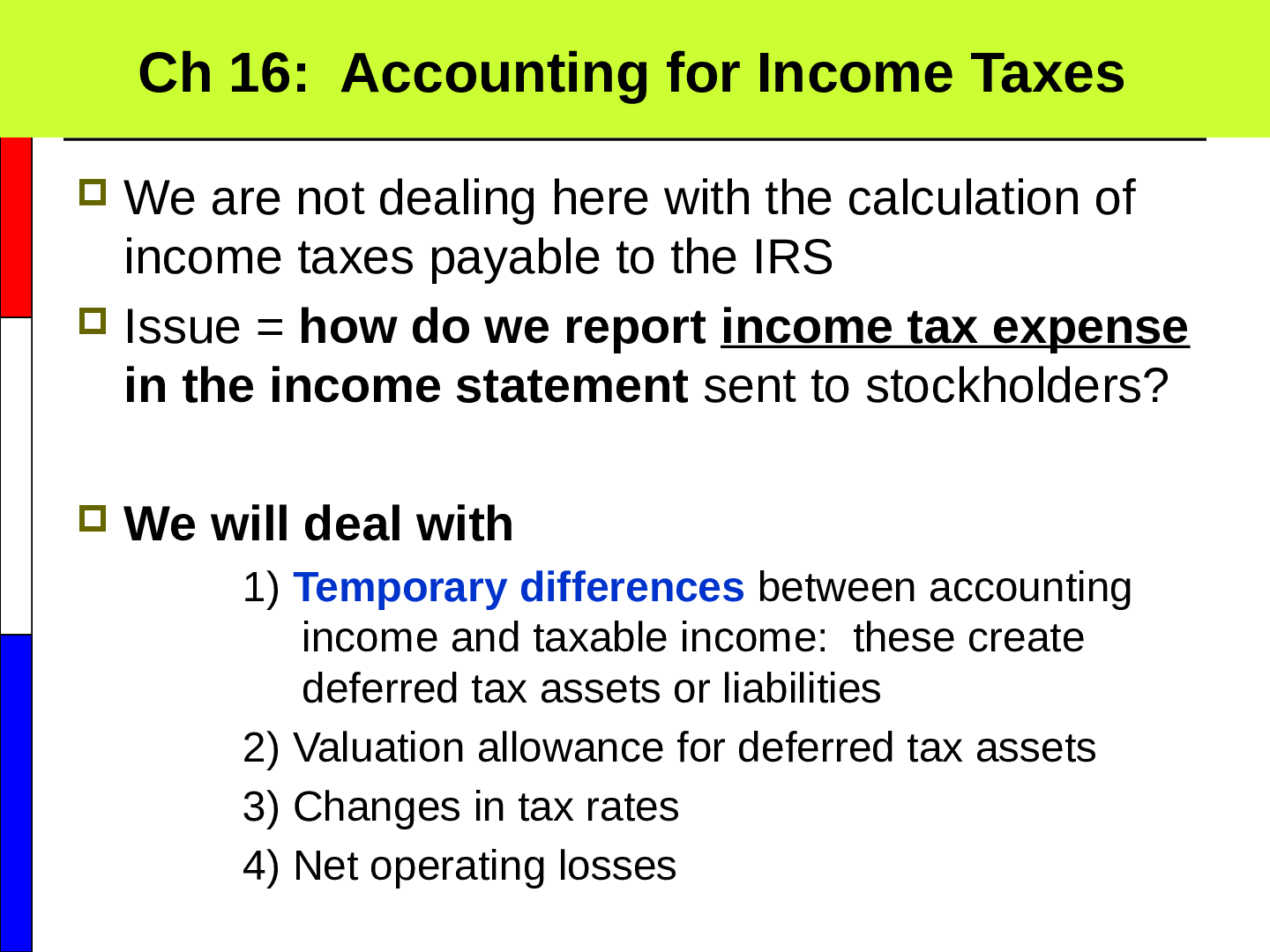

1 Chapter 16: Accounting for Income Taxes We are not dealing here with the calculation of income taxes payable to the IRS Issue = how do we report income tax expense in the income stateme... nt sent to stockholders? We will deal with 1) Temporary differences between accounting income and taxable income: these create deferred tax assets or liabilities 2) Valuation allowance for deferred tax assets 3) Changes in tax rates 4) Net operating losses Deferred Tax Assets/Liabilities Uses straight-line depreciation for financial reporting Uses accelerated depreciation for income tax reporting. X-Off’s tax rate is 30%. Compute X-Off’s income tax expense and income tax payable. [Show More]

Last updated: 1 year ago

Preview 1 out of 23 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 07, 2023

Number of pages

23

Written in

Additional information

This document has been written for:

Uploaded

Apr 07, 2023

Downloads

0

Views

41