tax law complete Exam Questions and Answers 2022/2023

Document Content and Description Below

1. CHAPTER 1UNDERSTANDING AND WORKING WITH THE FEDERAL TAX LAW Que Many states have balanced budgets because laws or constitutional amendments preclude deficit spending. *a. True b. False 2. ... CHAPTER 1UNDERSTANDING AND WORKING WITH THE FEDERAL TAX LAW Q 2 The U.S. Federal government has a provision in the Constitution which precludes deficit spending. a. True *b. False 3. CHAPTER 1UNDERSTANDING AND WORKING WITH THE FEDERAL TAX LAW Q 3 Revenue-neutral tax laws reduce deficits. a. True *b. False 4. CHAPTER 1UNDERSTANDING AND WORKING WITH THE FEDERAL TAX LAW Q 4 Longer class lives for depreciable property and the required use of straight-line method of depreciation should dampen the tax incentive for purchasing capital assets. *a. True b. False 5. CHAPTER 1UNDERSTANDING AND WORKING WITH THE FEDERAL TAX LAW Q 5 The Internal Revenue Code is a compilation of Federal tax legislation that appears in Title 28 of the Internal Revenue Code. a. True *b. False 6. CHAPTER 1UNDERSTANDING AND WORKING WITH THE FEDERAL TAX LAW Q 6 Income from patents can qualify for capital gain treatment. *a. True b. False 7. CHAPTER 1UNDERSTANDING AND WORKING WITH THE FEDERAL TAX LAW Q 7 Saving leads to capital formation and thus makes funds available to finance home construction and industrial expansion. *a. True b. False 8. CHAPTER 1UNDERSTANDING AND WORKING WITH THE FEDERAL TAX LAW Q 8 The corporate tax rate of 34 percent applies only to taxable income in excess of $75,000. *a. True b. False 9. CHAPTER 1UNDERSTANDING AND WORKING WITH THE FEDERAL TAX LAW Q 9 The earned income tax credit is refundable. *a. True b. False 10. CHAPTER 1UNDERSTANDING AND WORKING WITH THE FEDERAL TAX LAW Q10 The deduction for charitable contributions can be explained by social considerations [Show More]

Last updated: 1 year ago

Preview 1 out of 865 pages

.png)

Reviews( 0 )

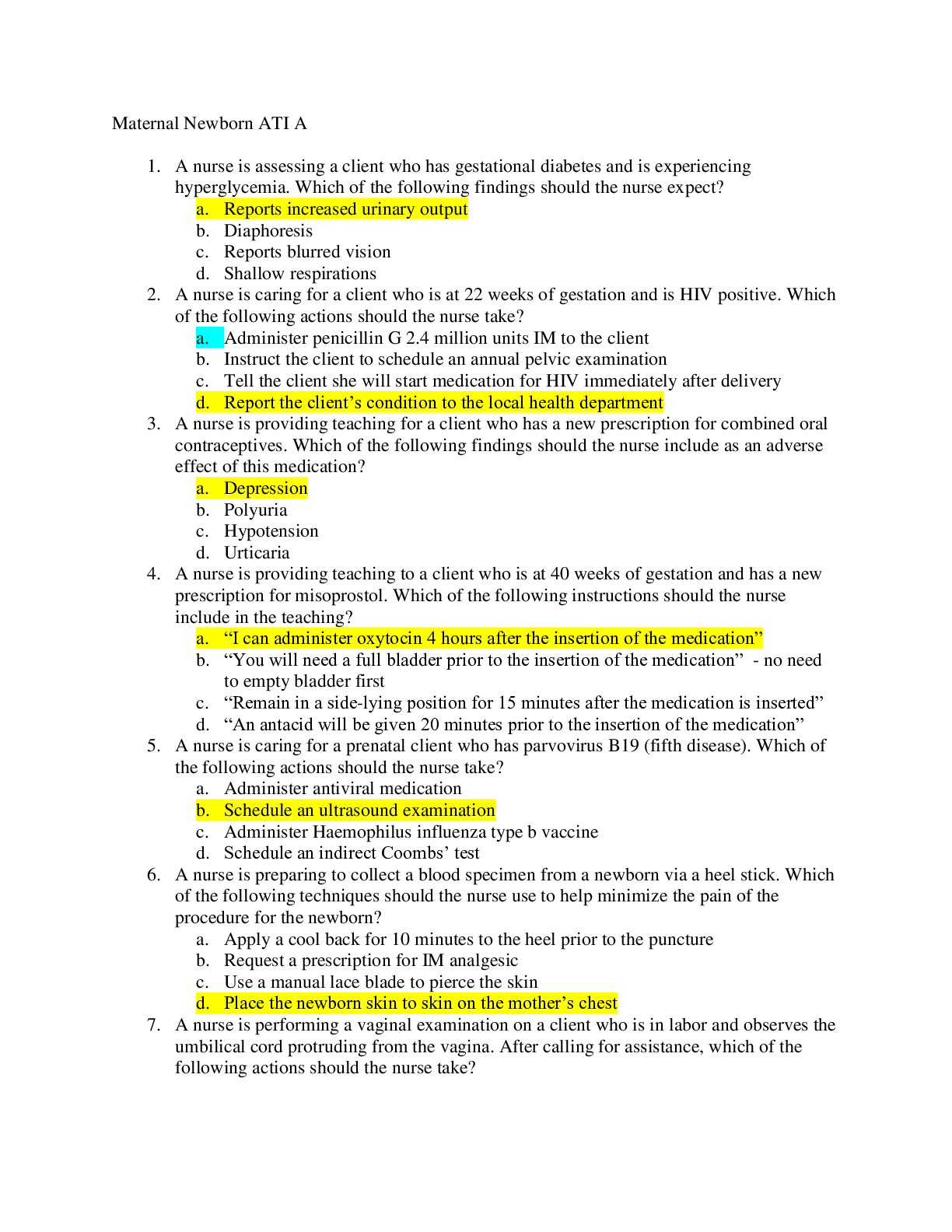

Document information

Connected school, study & course

About the document

Uploaded On

Oct 01, 2022

Number of pages

865

Written in

Additional information

This document has been written for:

Uploaded

Oct 01, 2022

Downloads

0

Views

180

ORGMED ORGANIC PHARMACEUTICAL PHARMACY.png)