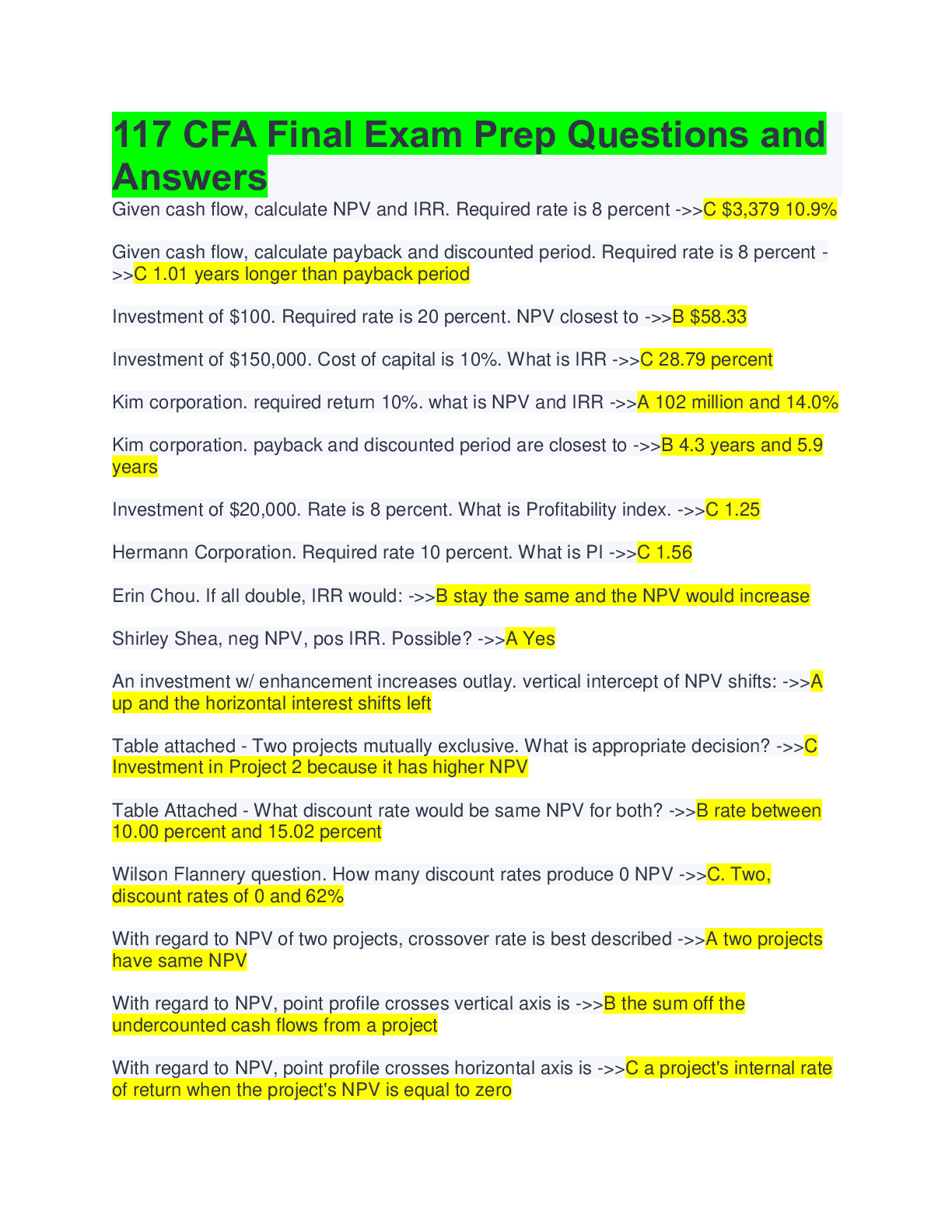

117 CFA Final Exam Prep Questions and Answers

Document Content and Description Below

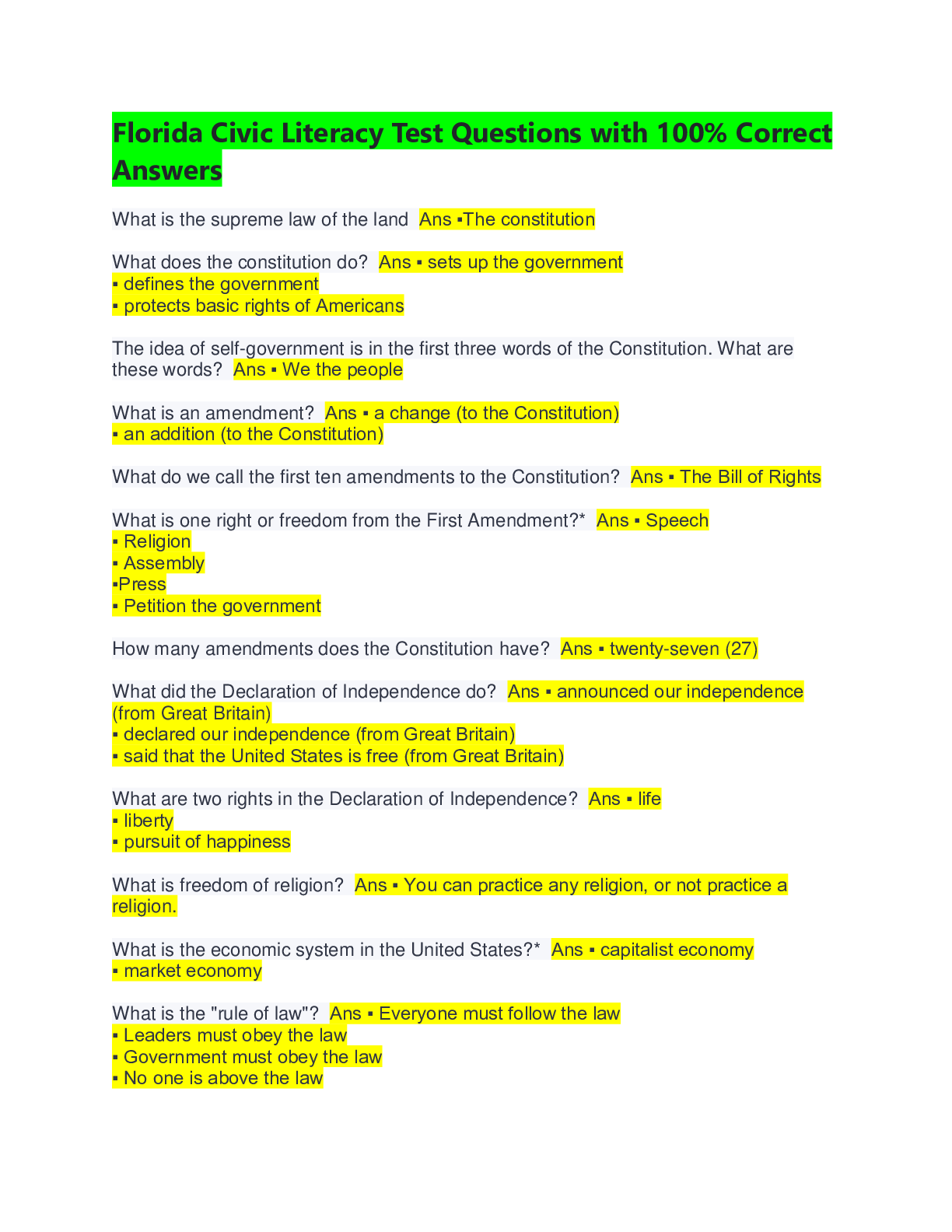

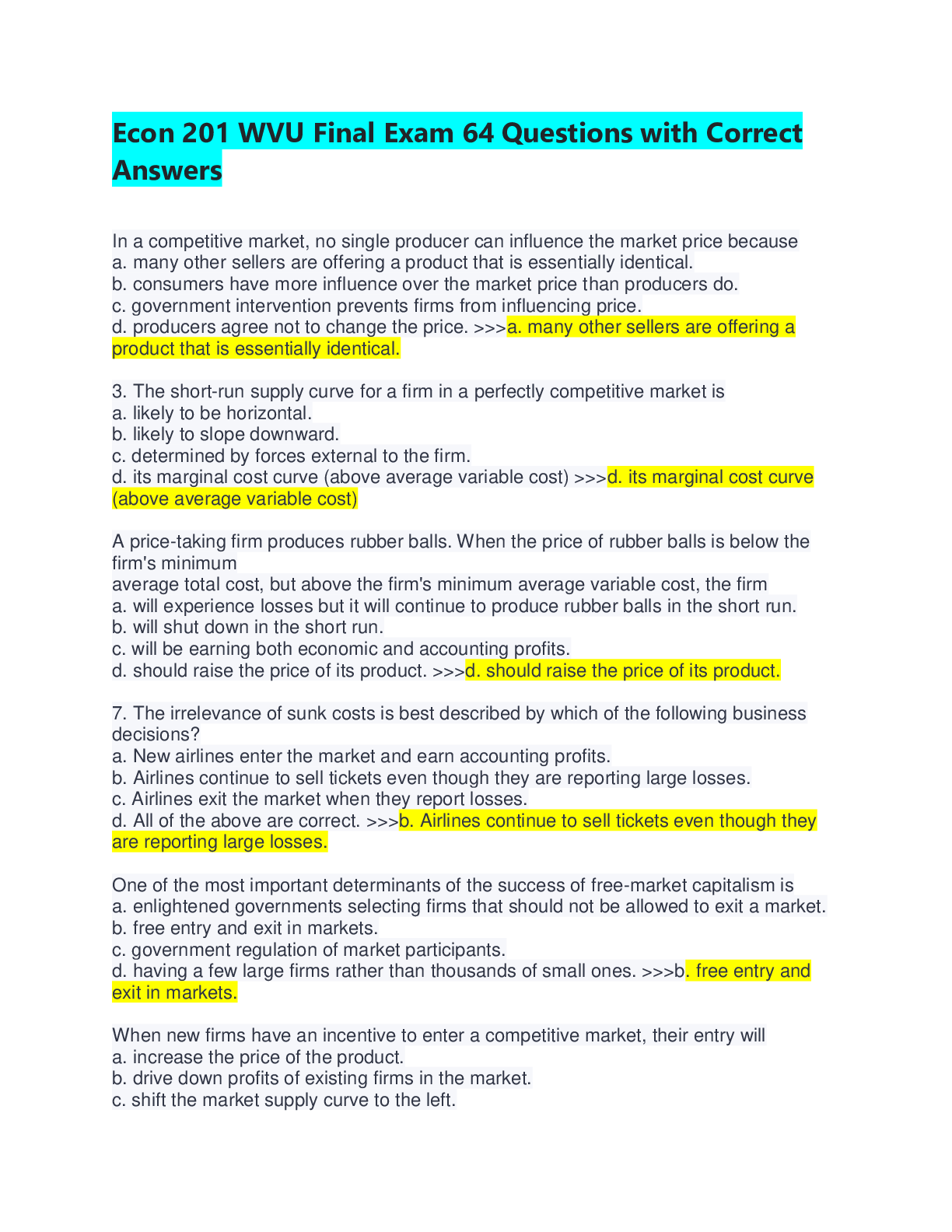

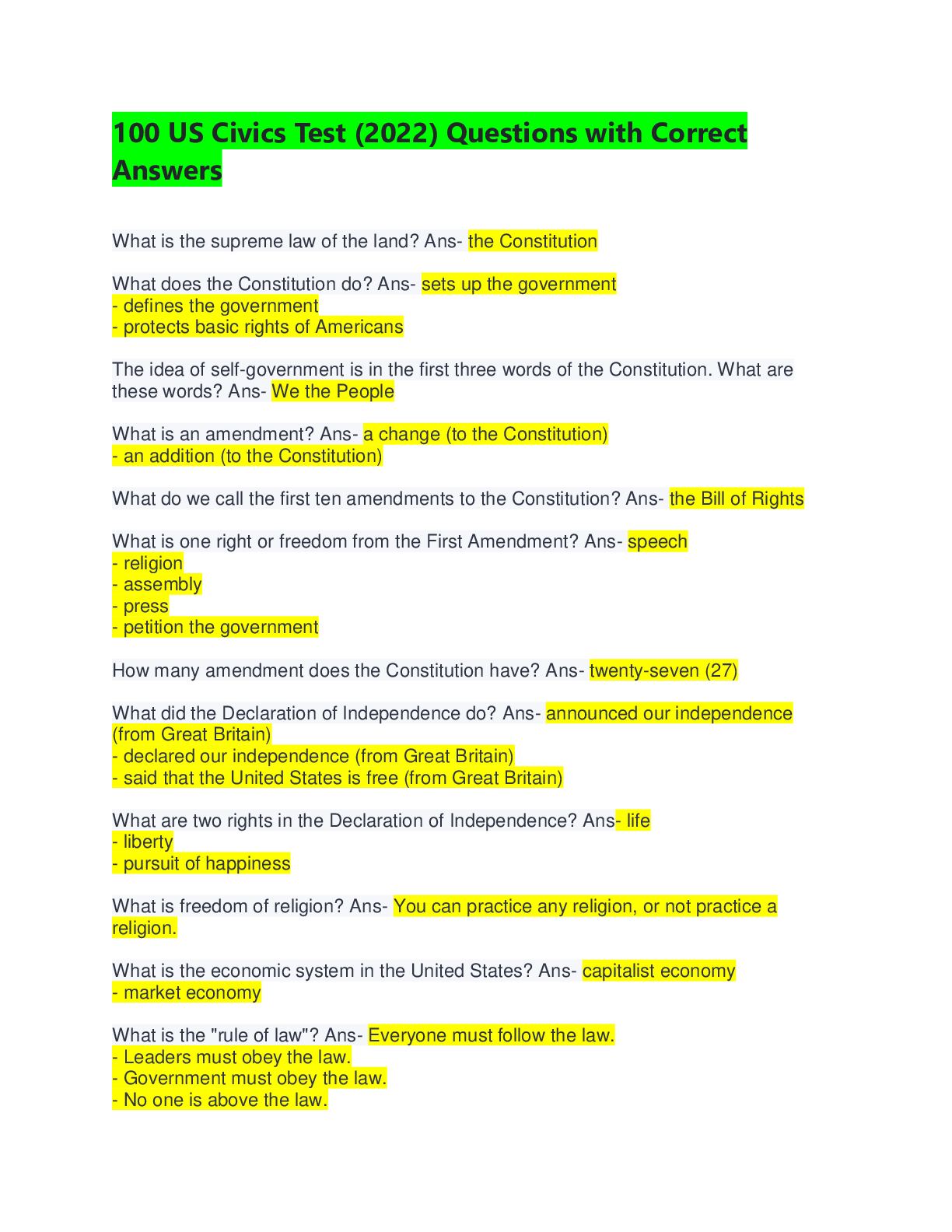

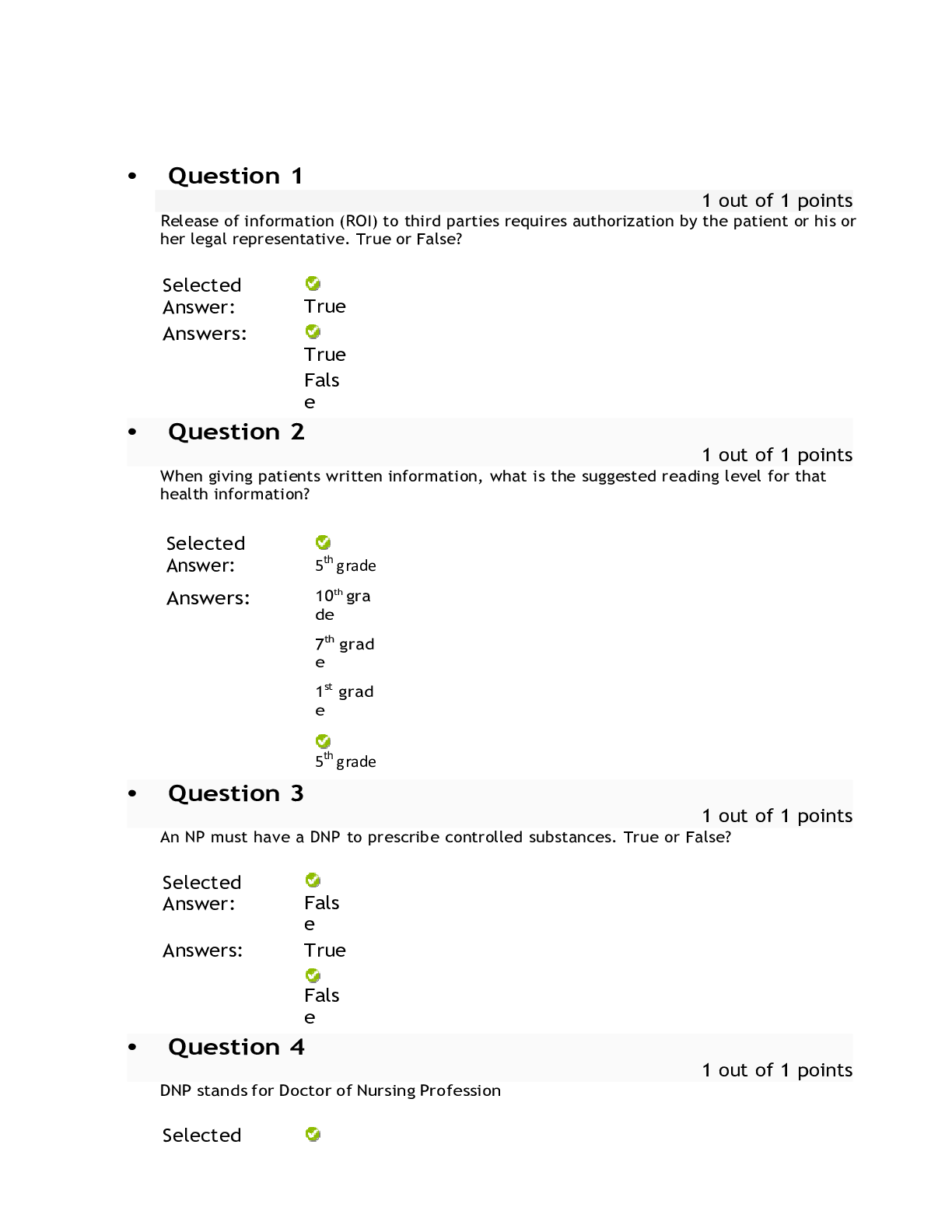

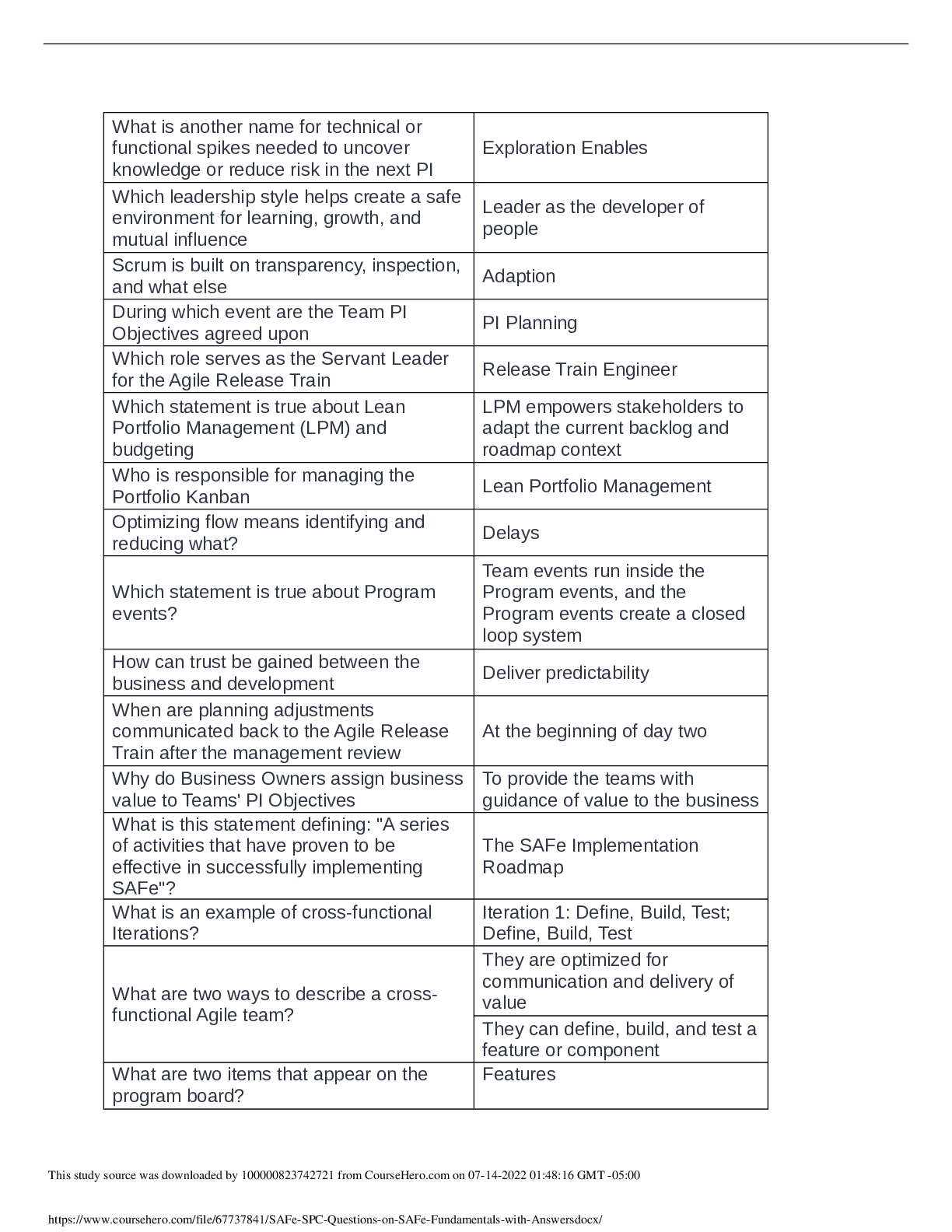

117 CFA Final Exam Prep Questions and Answers Given cash flow, calculate NPV and IRR. Required rate is 8 percent ->>C $3,379 10.9% Given cash flow, calculate payback and discounted period. Requir... ed rate is 8 percent ->>C 1.01 years longer than payback period Investment of $100. Required rate is 20 percent. NPV closest to ->>B $58.33 Investment of $150,000. Cost of capital is 10%. What is IRR ->>C 28.79 percent Kim corporation. required return 10%. what is NPV and IRR ->>A 102 million and 14.0% Kim corporation. payback and discounted period are closest to ->>B 4.3 years and 5.9 years Investment of $20,000. Rate is 8 percent. What is Profitability index. ->>C 1.25 Hermann Corporation. Required rate 10 percent. What is PI ->>C 1.56 Erin Chou. If all double, IRR would: ->>B stay the same and the NPV would increase Shirley Shea, neg NPV, pos IRR. Possible? ->>A Yes An investment w/ enhancement increases outlay. vertical intercept of NPV shifts: ->>A up and the horizontal interest shifts left Table attached - Two projects mutually exclusive. What is appropriate decision? ->>C Investment in Project 2 because it has higher NPV Table Attached - What discount rate would be same NPV for both? ->>B rate between 10.00 percent and 15.02 percent Wilson Flannery question. How many discount rates produce 0 NPV ->>C. Two, discount rates of 0 and 62% With regard to NPV of two projects, crossover rate is best described ->>A two projects have same NPV With regard to NPV, point profile crosses vertical axis is ->>B the sum off the undercounted cash flows from a project With regard to NPV, point profile crosses horizontal axis is ->>C a project's internal rate of return when the project's NPV is equal to zero With regard to capital budgeting, estimate least likely to include ->>interest costs Equity equals ->>A Assets - Liabilities Shareholders' equity most likely differs from market value because ->>B some factors that affect the generation of future cash flows are excluded All of the following are current assets except ->>B goodwill The most likely costs included in inventory, plant, equipment are ->>C delivery costs debt due within one year is ->>A Current [Show More]

Last updated: 1 year ago

Preview 1 out of 8 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 11, 2022

Number of pages

8

Written in

Additional information

This document has been written for:

Uploaded

Aug 11, 2022

Downloads

0

Views

79

.png)