Economics > LECTURE NOTES > Lecture 6 The economy: 2 September 2019 Monetary policy (introduction) (All)

Lecture 6 The economy: 2 September 2019 Monetary policy (introduction)

Document Content and Description Below

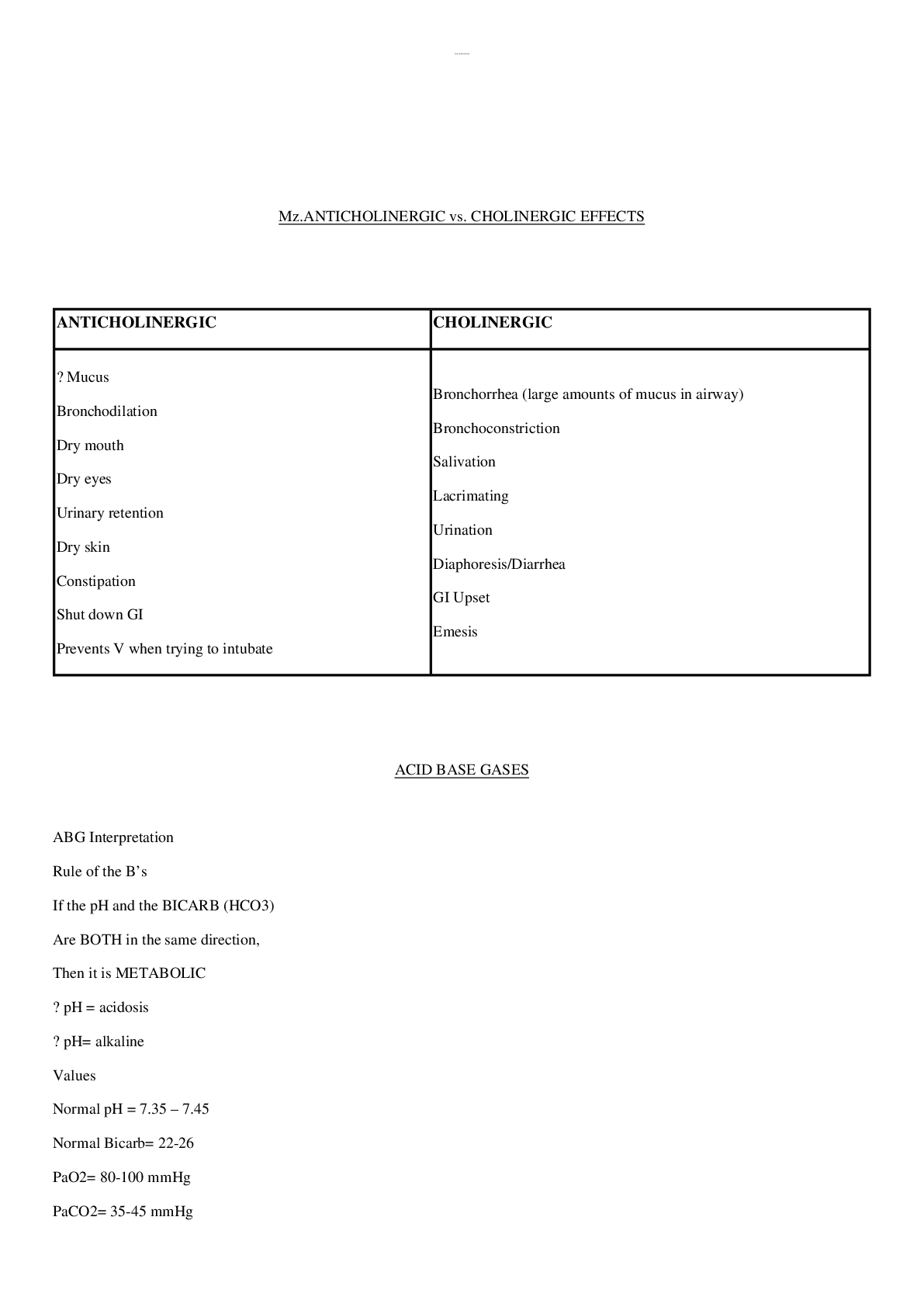

Money, prices and the Reserve Bank The financial system: the allocation of saving to productive uses The role of banks: Financial intermediation Stand between savers and investors Asymmetric infor... mation Help identify productive borrowers Pool saving of small savers; only need to evaluate each large loan request once. Provide access to credit that may otherwise be unavailable (e.g. to a small business) Easy to make payments. Bonds Bond prices and interest rates Bonds can be sold before maturity. Bond prices and interest rates are inversely related … why? Example: A 5-year bond, with a principal amount of 1000 and with a 5% coupon rate, paid annually issued and bought on Jan 1, 2010: Pays $50 on Jan 1 2011, 2012, 2013, 2014 Pays $1050 on Jan 1, 2015. Bond prices and interest rates (cont.) Say bondholder sells their bond on Jan 1, 2013 (i.e. after 3 years) when the current interest rate on an alternative investment is 15% per annum. How much will buyer will be willing to pay? Existing bond will return $50 on Jan 1 2014 and $1050 on Jan 1, 2015 $1100 in total. Alternative investment returns (1.15)2 x $1000 = $1322.5. So original bond worth < $1000. Bond prices and interest rates Thus, buyer will be willing to pay: P x (1.15)2 = $1100 P = $831.76 If current interest rates are 5%: P x (1.05)2 = $1100 P = $997.73 If current interest rates are 2%: P x (1.02)2 = $1100 P = $1057.29 NB: If r > 0, P < $1100. r ↓ P ↑ Interest, bond prices and bond yields Multiply the bond's coupon rate by its par value (or face value) to determine its annual interest. In this example, multiply 5 percent, or 0.05, by $1,000 to get $50 in annual interest. Divide the bond's annual interest by its price to convert the price to a yield. In this example, divide $50 by $831 to get 0.0601 or 6.01%. This means the bond’s annual interest equals 6.01 percent of its market price. The higher the current interest rate, the lower the bond price The lower the bond price the higher the yield Bond yields reflect interest rates expectations Australian bond yields Australia yield curve Australia bond spread US yield curve – August 2019 The stock market Stock prices Stock price, interest rate and risk premium Bond and stock risks Stock risk generally > govt bond risk Dividends and expectations of future price (and, hence, current stock price) vary with specific information about a single company. Bond prices vary with interest rates, i.e. specific information about a whole economy. Thus, desired rate of return on stocks greater than for bonds – risk premium. Other things equal, extra risk will reduce stock prices. Bond and stock market: the benefits of diversification Diversification: it is a risk management strategy that mixes a wide variety of investments within a portfolio. Diversification helps investors ride out the ups and downs of financial markets by spreading their savings across different asset classes. Diversification reduces overall investment risk and reduces volatility of returns on an investment portfolio as a whole. Bond and stock markets help reduce risk by giving savers a means to diversify their financial investment. Money Money has 3 uses: Medium of exchange Unit of account Store of value How is money measured Currency: notes & coins Base Money : currency + reserves. M1: currency + current bank deposits M3: M1 + deposits of private non-banks Broad money: M3 + other AFI borrowings Money supply growth Money supply growth Money aggregates Banks and money creation (book) Money supply: currency + deposits Bank assets: currency + reserves + loans Bank liabilities: deposits Reserve-deposit ratio = Bank Reserves/Bank Deposits If reserve-deposit ratio < 1, then can lend out rest. But loans return to bank balance sheets as deposits. Money supply expands … Currency, reserves, deposits, R-D ratio and the money supply Desired R-D ratio: banks reserves/deposits Deposits: banks reserves/R-D ratio Money supply: currency held by public+ deposits Money supply: currency held by public+ bank reserves/R-D ratio [Show More]

Last updated: 1 year ago

Preview 1 out of 76 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Nov 28, 2019

Number of pages

76

Written in

Additional information

This document has been written for:

Uploaded

Nov 28, 2019

Downloads

0

Views

57

.png)