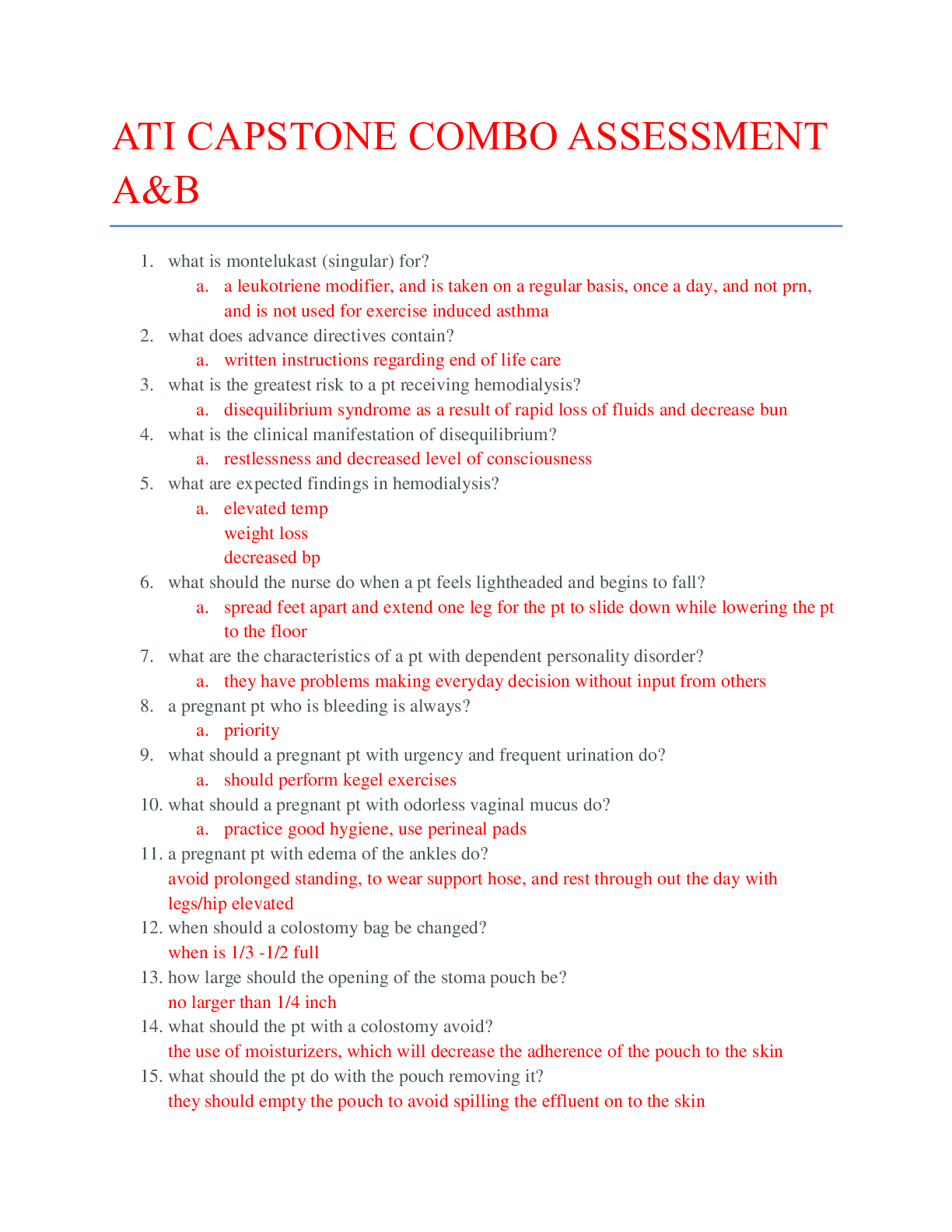

Finance > QUESTIONS & ANSWERS > University of Alabama, BirminghamMBA 601 EXAM 2 Practice Questions with Answers/ Acc&Finance Assignm (All)

University of Alabama, BirminghamMBA 601 EXAM 2 Practice Questions with Answers/ Acc&Finance Assignment Horizontal and Vertical Analysis Copy. QnA. 100/100 Score

Document Content and Description Below

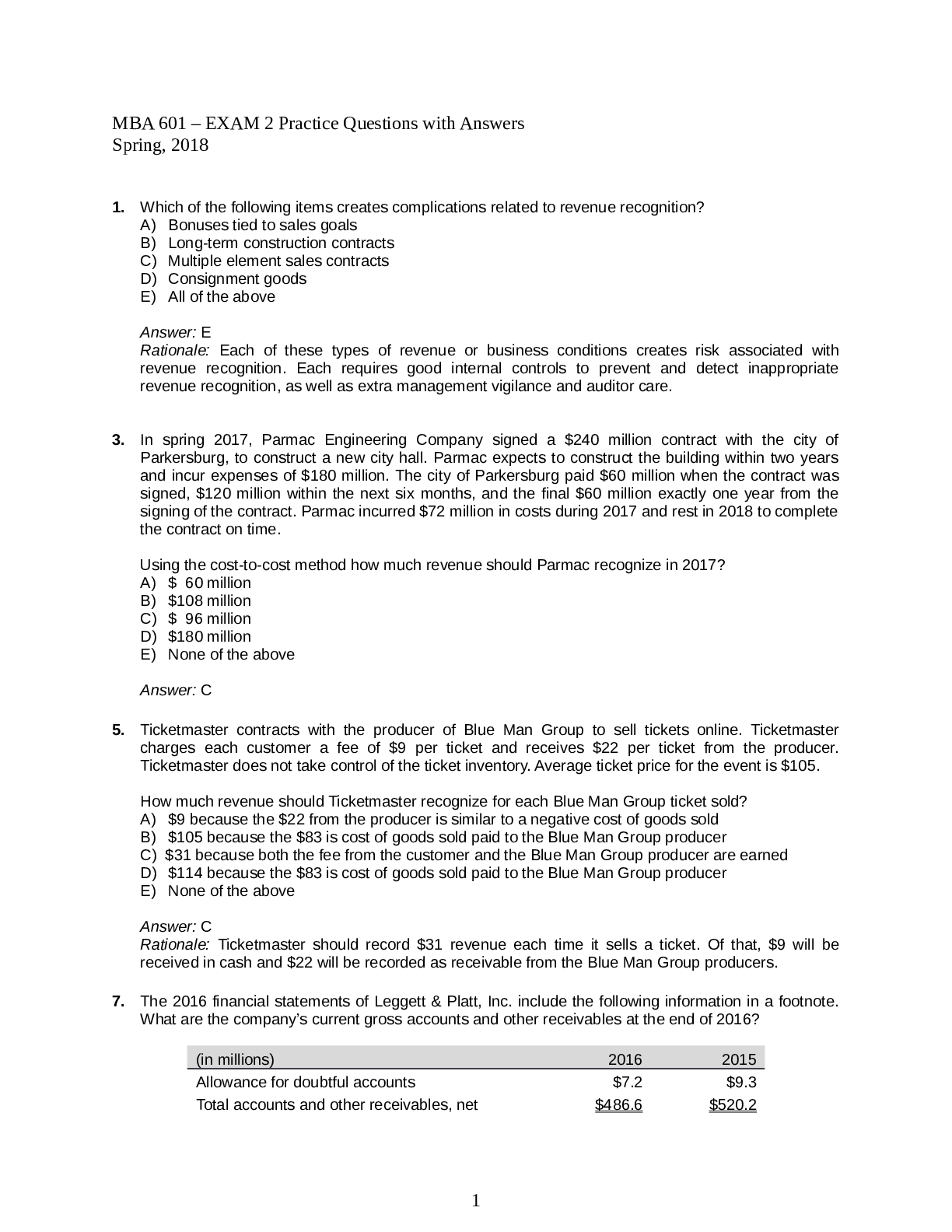

University of Alabama, BirminghamMBA 601 Acc&Finance Assignment Horizontal and Vertical Analysis Copy MBA 601 – EXAM 2 Practice Questions with Answers Spring, 2018 1. Which of the following it... ems creates complications related to revenue recognition? A) Bonuses tied to sales goals B) Long-term construction contracts C) Multiple element sales contracts D) Consignment goods E) All of the above Answer: E Rationale: Each of these types of revenue or business conditions creates risk associated with revenue recognition. Each requires good internal controls to prevent and detect inappropriate revenue recognition, as well as extra management vigilance and auditor care. 3. In spring 2017, Parmac Engineering Company signed a $240 million contract with the city of Parkersburg, to construct a new city hall. Parmac expects to construct the building within two years and incur expenses of $180 million. The city of Parkersburg paid $60 million when the contract was signed, $120 million within the next six months, and the final $60 million exactly one year from the signing of the contract. Parmac incurred $72 million in costs during 2017 and rest in 2018 to complete the contract on time. Using the cost-to-cost method how much revenue should Parmac recognize in 2017? A) $ 60 million B) $108 million C) $ 96 million D) $180 million E) None of the above Answer: C 5. Ticketmaster contracts with the producer of Blue Man Group to sell tickets online. Ticketmaster charges each customer a fee of $9 per ticket and receives $22 per ticket from the producer. Ticketmaster does not take control of the ticket inventory. Average ticket price for the event is $105. How much revenue should Ticketmaster recognize for each Blue Man Group ticket sold? A) $9 because the $22 from the producer is similar to a negative cost of goods sold B) $105 because the $83 is cost of goods sold paid to the Blue Man Group producer C) $31 because both the fee from the customer and the Blue Man Group producer are earned D) $114 because the $83 is cost of goods sold paid to the Blue Man Group producer E) None of the above Answer: C Rationale: Ticketmaster should record $31 revenue each time it sells a ticket. Of that, $9 will be received in cash and $22 will be recorded as receivable from the Blue Man Group producers. 7. The 2016 financial statements of Leggett & Platt, Inc. include the following information in a footnote. What are the company’s current gross accounts and other receivables at the end of 2016? (in millions) 2016 2015 Allowance for doubtful accounts $7.2 $9.3 Total accounts and other receivables, net $486.6 $520.2 1A) $486.6 million B) $479.4 million C) $452 million D) $493.8 million E) None of the above Answer: D Rationale: $486.6 million + $7.2 million = $493.8 million 8. The 2016 financial statements of Leggett & Platt include the accounts receivable footnote: Total accounts and other receivables at December 31 consisted of the following: (in millions) 2016 2015 Total accounts and other receivables $493.8 $529.5 Allowance for doubtful accounts (7.2) (9.3) Total accounts and other receivables, net $486.6 $520.2 The balance sheet reports total assets of $2,984.1 million at December 31, 2016. The common-size amount for gross accounts and other receivables are: A) $486.6 million B) $493.8 million C) 16.5% D) 5.0% E) None of the above Answer: C Rationale: $493.8 / $2,984.1 = 16.5% 9. The 2016 income statements of Leggett & Platt, Inc. reports net sales of $3,749.9 million. The balance sheet reports accounts receivable, net of $486.6 million at December 31, 2016 and $520.2 million at December 31, 2015. The days sales outstanding in 2016 was: A) 49 days B) 10 days C) 44 days D) 8 days E) None of the above Answer: A Rationale: [365 x (($486.6 + $520.2)/2)] / $3,749.9 = 49 days 10. The 2017 Form 10-K of Oracle Corporation, for the May 31, 2017 year-end, included the following information relating to their allowance for doubtful accounts: Balance in allowance at the beginning of the year $327 million, accounts written off during the year of $137 million, balance in allowance at the end of the year $319 million. What did Oracle Corporation report as bad debt expense for the year? 2A) $27 million B) $129 million C) $118 million D) $151 million E) None of the above Answer: B Rationale: Balance in allowance at the beginning of the year + Bad debt expense – Accounts written off during the year = Balance in allowance at the end of the year. Bad debt expense = $319 million – $327 million + $137 million = $129 million. 12. Thomas Company receives information that requires the company to increase its expectations of uncollectible accounts receivable. Which of the following does not occur on the company’s financial statements? A) Bad debt expense is increased B) Accounts receivables (gross) is reduced C) Net income is reduced D) The allowance account is increased E) None of the above Answer: B Rationale: Both bad debt and the allowance account are increased, resulting in lower NET accounts receivable and lower net income. The gross amount of receivables is unchanged. 14. The 2016 financial statements of BNSF Railway Company report total revenues of $19,829 million, accounts receivable of $1,272 million for 2016 and $1,198 million for 2015. The company’s accounts receivable turnover for the year is: A) 17.0 times B) 8.9 times C) 16.1 times D) 17.9 times E) None of the above Answer: C Rationale: Receivables turnover = Sales / Average AR = $19,829 / [($1,272 + $1,198) / 2] = 16.1 times per year. 317. Apple Inc. and Microsoft Corporation are competitors in the computer industry. Following is a table of Total revenue and R&D expenses for both companies. Apple Inc. Microsoft Corporation (in millions) 2016 2015 2014 2016 2015 2014 Total revenue $215,639 $233,715 $182,795 $85,320 $93,580 $86,833 R&D expenses $10,045 $8,067 $6,041 $11,988 $12,046 $11,381 Which of the following is true? A) Apple Inc. is the more R&D intensive company of the two. B) Apple Inc. has become less R&D intensive over the three years. C) Microsoft Corporation is less R&D intensive in 2016 than in 2015. D) Microsoft Corporation is more R&D intensive in 2016 than in 2015. E) None of the above Answer: D Rationale: To make comparisons, we need to determine the common size amount for the R&D expenditures of both firms by scaling by total revenues. Apple Inc. Microsoft Corp. 2016 2015 2014 2016 2015 2014 Common size R&D 4.66% 3.45% 3.30% 14.05% 12.87% 13.11% Microsoft Corporation spends proportionately more on R&D than Apple Inc. Microsoft Corporation is more R&D intensive thus, (A) is not true. Apple Inc. has spent more on R&D (and increased the percentage spent) in 2016 than in 2015 and 2014, thus, (B) is not true. Microsoft Corporation increased R&D from 12.87%% in 2015 to 14.05% in 2016, thus (D) is true, but not (C). 21. Heller Company offers an unconditional return policy to its customers. During the current period, the company records total sales of $850,000, with a cost of merchandise to Heller of $340,000. Based on past experience, Heller Company expects 4% of sales to be returned. [Show More]

Last updated: 1 year ago

Preview 1 out of 15 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 30, 2022

Number of pages

15

Written in

Additional information

This document has been written for:

Uploaded

Apr 30, 2022

Downloads

0

Views

41

.png)

.png)

.png)

.png)