Financial Accounting > TEST BANK > ACCOUNTING 316 TEST BANK. 96427308-All-Chapters-Test-Bank-1. COMPLETE QUESTIONS AND ANSWERS. LATEST. (All)

ACCOUNTING 316 TEST BANK. 96427308-All-Chapters-Test-Bank-1. COMPLETE QUESTIONS AND ANSWERS. LATEST. DOWNLOAD TO SCORE A+

Document Content and Description Below

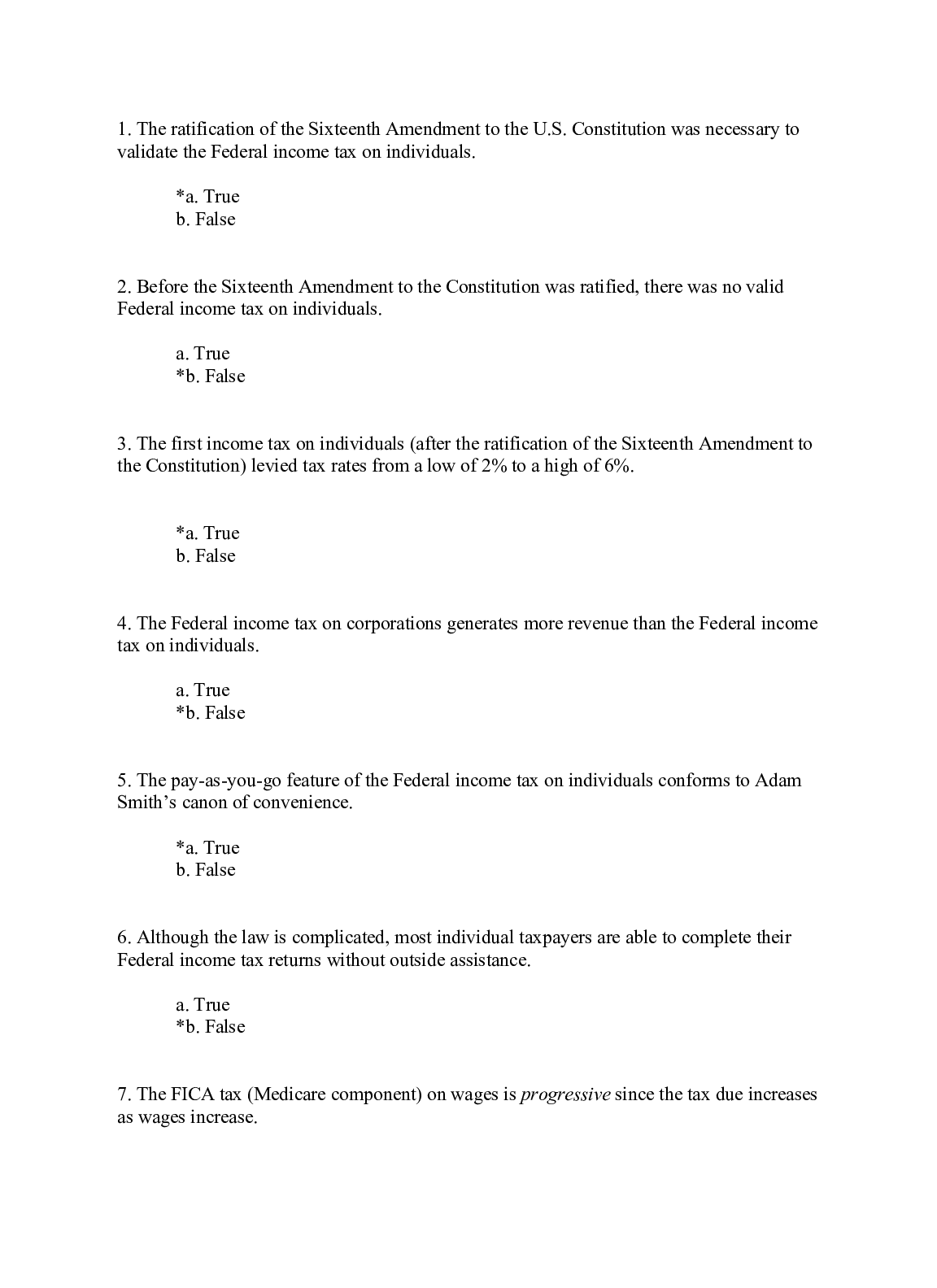

1. The ratification of the Sixteenth Amendment to the U.S. Constitution was necessary to validate the Federal income tax on individuals. *a. True b. False 2. Before the Sixteenth Amendment to the ... Constitution was ratified, there was no valid Federal income tax on individuals. a. True *b. False 3. The first income tax on individuals (after the ratification of the Sixteenth Amendment to the Constitution) levied tax rates from a low of 2% to a high of 6%. *a. True b. False 4. The Federal income tax on corporations generates more revenue than the Federal income tax on individuals. a. True *b. False 5. The pay-as-you-go feature of the Federal income tax on individuals conforms to Adam Smith’s canon of convenience. *a. True b. False 6. Although the law is complicated, most individual taxpayers are able to complete their Federal income tax returns without outside assistance. a. True *b. False 7. The FICA tax (Medicare component) on wages is progressive since the tax due increases as wages increase. a. True *b. False 8. The Federal estate and gift taxes are examples of progressive taxes. *a. True b. False 9. The Federal excise tax on cigarettes is an example of a proportional tax. *a. True b. False 10. Currently, the Federal income tax is more progressive than it ever has been in the past. a. True *b. False 11. Mona inherits her mother’s personal residence, which she converts to a furnished rent house. These changes should affect the amount of ad valorem property taxes levied on the properties. *a. True b. False 12. A fixture will be subject to the ad valorem tax on personalty rather than the ad valorem tax on realty. a. True *b. False 13. Even if property tax rates are not changed, the ad valorem taxes imposed on realty may not remain the same. *a. True b. False 14. The ad valorem tax on business use personalty is more often avoided by taxpayers than the ad valorem tax on personal use personalty. a. True *b. False 15. Federal excise tax is no longer imposed on cosmetics. *a. True b. False 16. The tax on hotel occupancy is subject to both Federal and state excise taxes. a. True *b. False 17. The Federal gas-guzzler tax applies only to automobiles manufactured overseas and imported into the U.S. a. True *b. False 18. Like the Federal counterpart, the amount of the state excise taxes on gasoline do not vary from state to state. a. True *b. False 19. The states that impose a general sales tax also have a use tax. *a. True b. False 20. Sales made by mail order are not exempt from the application of a general sales (or use) tax. *a. True b. False 21. Two persons who live in the same state but in different counties may not be subject to the same general sales tax rate. *a. True b. False 22. States impose either a state income tax or a general sales tax, but not both types of taxes. a. True *b. False 23. A safe and easy way for a taxpayer to avoid local and state sales taxes is to have the purchase sent to an address in another state that levies no such taxes. a. True *b. False 24. On transfers by death, the Federal government relies on an estate tax, while states use only an inheritance tax. a. True *b. False 25. An inheritance tax is a tax on a decedent’s right to pass property at death. a. True *b. False 26. One of the major reasons for the enactment of the Federal estate tax was to prevent large amounts of wealth from being accumulated within the family unit. *a. True b. False 27. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE27 Under Clint’s will, all of his property passes to either the Lutheran Church or to his wife. No Federal estate tax will be due on Clint’s death in 2011. *a. True b. False 28. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE28 Under a state inheritance tax, two heirs, a cousin and a son of the deceased, would be taxed at the same rate. a. True *b. False 29. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE29 The annual exclusion, currently $13,000, is available for gift but not estate tax purposes. *a. True b. False 30. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE30 In 2011, José, a widower, sells land (fair market value of $100,000) to his daughter, Linda, for $50,000. José has made a taxable gift of $37,000. *a. True b. False 31. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE31 Julius, a married taxpayer, makes gifts to each of his six children. A maximum of six annual exclusions could be allowed as to these gifts. a. True *b. False 32. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE32 One of the motivations for making a gift is to save on income taxes. *a. True b. False 33. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE33 The formula for the Federal income tax on corporations is not the same as that applicable to individuals. *a. True b. False 34. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE34 A state income tax can be imposed on nonresident taxpayers who earn income within the state or on an itinerant basis. *a. True b. False 35. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE35 For state income tax purposes, all states allow a deduction for Federal income taxes. a. True *b. False 36. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE36 Some states use their state income tax return as a means of collecting unpaid sales and use taxes. *a. True b. False 37. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE37 No state has offered an income tax amnesty program more than once. a. True *b. False 38. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE38 For Federal income tax purposes, there never has been a general amnesty period. *a. True b. False 39. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE39 Under state amnesty programs, all delinquent and unpaid income taxes are forgiven. a. True *b. False 40. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE40 When a state decouples from a Federal tax provision, it means that this provision will not apply for state income tax purposes. *a. True b. False 41. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE41 The principal objective of the FICA tax is to provide some measure of retirement security. *a. True b. False 42. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE42 Currently, the tax base for the Medicare component of the FICA is not limited to a dollar amount. *a. True b. False 43. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE43 A parent employs his twin daughters, age 19, in his sole proprietorship. The daughters are not subject to FICA coverage. a. True *b. False 44. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE44 Unlike FICA, FUTA requires that employers comply with state as well as Federal rules. *a. True b. False 45. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE45 A major disadvantage of a flat tax type of income tax is its complexity. a. True *b. False 46. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE46 The value added tax (VAT) has had wide acceptance in the international community. *a. True b. False 47. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE47 Recently, more IRS audits are producing a greater number of no change results. This indicates increased compliance on the part of taxpayers. a. True *b. False 48. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE48 The amount of a taxpayer’s itemized deductions will increase the chance of being audited by the IRS. *a. True b. False 49. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE49 In a field audit, the audit by the IRS takes place at the office of the IRS. a. True *b. False 50. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE50 The IRS agent auditing the return will issue an RAR even if the taxpayer owes no additional taxes. *a. True b. False 51. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE51 If a “special agent” becomes involved in the audit of a return, this indicates that the IRS suspects that fraud is involved. *a. True b. False 52. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE52 If a taxpayer files early (i.e., before the due date of the return), the statute of limitations on assessments begins on the date the return is filed. a. True *b. False 53. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE53 For omissions from gross income in excess of 25% of that reported, there is no statute of limitations on additional income tax assessments by the IRS. a. True *b. False 54. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE54 If an income tax return is not filed by a taxpayer, there is no statute of limitations on assessments of tax by the IRS. *a. True b. False 55. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE55 If fraud is involved, there is no time limit on the assessment of a deficiency by the IRS. *a. True b. False 56. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE56 The IRS is required to redetermine the interest rate on underpayments and overpayments once a year. a. True *b. False 57. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE57 A calendar year taxpayer files his 2010 Federal income tax return on March 3, 2011. The return reflects an overpayment of $6,000, and the taxpayer requests a refund of this amount. The refund is paid on May 18, 2011. The refund must include interest. a. True *b. False 58. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE58 For individual taxpayers, the interest rate for income tax refunds (overpayments) is not the same as that applicable to assessments (underpayments). a. True *b. False 59. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE59 During any month in which both the failure to file penalty and the failure to pay penalty apply, the failure to file penalty is reduced by the amount of the failure to pay penalty. *a. True b. False 60. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE60 When interest is charged on a deficiency, any part of a month counts as a full month. a. True *b. False 61. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE61 For the negligence penalty to apply, the underpayment must be caused by intentional disregard of rules and regulations with intent to defraud. a. True *b. False 62. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE62 Upon audit by the IRS, Faith is assessed a deficiency of $40,000 of which $25,000 is attributable to negligence. The 20% negligence penalty will apply to only $25,000. *a. True b. False 63. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE63 If the tax deficiency is attributable to fraud, the negligence penalty will not be imposed. *a. True b. False 64. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE64 The civil fraud penalty can entail large fines and possible incarceration. a. True *b. False 65. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE65 Even though a client refuses to correct an error on a past return, it may be possible for a practitioner to continue to prepare returns for the client. *a. True b. False 66. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE66 In preparing an income tax return, the use of a client’s estimates is permitted. *a. True b. False 67. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE67 In preparing a tax return, all questions on the return must be answered. a. True *b. False 68. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE68 A CPA firm in California sends many of its less complex tax returns to be prepared by a group of accountants in India. If certain procedures are followed, this outsourcing of tax return preparation is proper. *a. True b. False 69. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE69 The objective of pay-as-you-go (paygo) is to achieve revenue neutrality. *a. True b. False 70. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE70 When Congress enacts a tax cut that is phased in over a period of years, revenue neutrality is achieved. a. True *b. False 71. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE71 A tax cut enacted by Congress that contains a sunset provision will make the tax cut permanent. a. True *b. False 72. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE72 The tax law provides various tax credits, deductions, and exclusions that are designed to encourage taxpayers to obtain additional education. These provisions can be justified on both economic and social grounds. *a. True b. False 73. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE73 Various tax provisions encourage the creation of certain types of retirement plans. Such provisions can be justified on both economic and equity grounds. a. True *b. False 74. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE74 To lessen, or eliminate, the effect of multiple taxation, a taxpayer who is subject to both foreign and U.S. income taxes on the same income is allowed either a deduction or a credit for the foreign tax paid. *a. True b. False 75. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE75 To mitigate the effect of the annual accounting period concept, the tax law permits the carryback and carryforward to other years of the net operating loss of a particular year. *a. True b. False 76. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE76 Jason’s business warehouse is destroyed by fire. As the insurance proceeds exceed the basis of the property, a gain results. If Jason shortly reinvests the proceeds in a new warehouse, no gain is recognized due to the application of the wherewithal to pay concept. *a. True b. False 77. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE77 Congress has enacted a provision to allow a deduction for state and local sales taxes. Such a provision can be justified on social grounds. a. True *b. False 78. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE78 As it is consistent with the wherewithal to pay concept, the tax law requires a seller to recognize gain in the year the installment sale took place. a. True *b. False 79. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE79 Stealth taxes have the effect of generating additional taxes from higher income taxpayers. *a. True b. False 80. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE80 A provision in the law that compels accrual basis taxpayers to pay a tax on prepaid income in the year received and not when earned is consistent with generally accepted accounting principles. a. True *b. False 81. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE81 As a matter of administrative convenience, the IRS would prefer to have Congress increase (rather than decrease) the amount of the standard deduction allowed to individual taxpayers. *a. True b. False 82. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE82 In cases of doubt, courts have held that tax relief provisions should be narrowly construed in against taxpayers. *a. True b. False 83. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE83 On occasion, Congress has to enact legislation that clarifies the tax law in order to change a result reached by the U.S. Supreme Court. *a. True b. False 84. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FE84 Which, if any, of the following statements best describ [Show More]

Last updated: 1 year ago

Preview 1 out of 773 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 19, 2022

Number of pages

773

Written in

Additional information

This document has been written for:

Uploaded

Mar 19, 2022

Downloads

0

Views

42

.png)

.png)

.png)

.png)

.png)

.png)