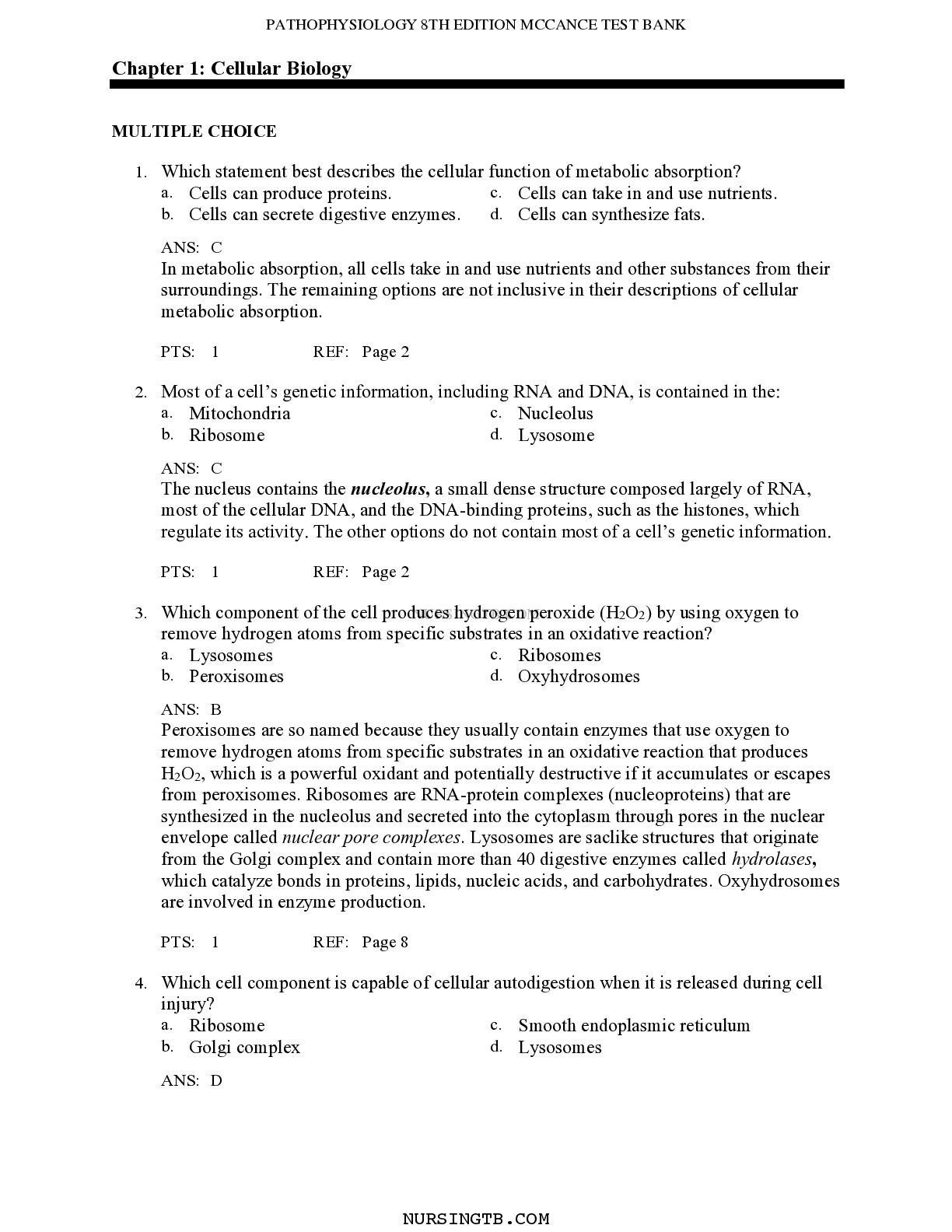

Financial Accounting > TEST BANK > Audit combined test bank. ALL EXAMINABLE QUESTIONS AND ANSWERS. GRADED A+ masterpiece , 531 pages (All)

Audit combined test bank. ALL EXAMINABLE QUESTIONS AND ANSWERS. GRADED A+ masterpiece , 531 pages

Document Content and Description Below

Chapter 08 Acquisition and Expenditure Cycle Answer Key True / False Questions 1. The basic acquisition and expenditure activities are (1) purchasing goods and services, (2) receiving the goods or... services, (3) recording the asset or expense and related liability, and (4) paying the vendors. TRUE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-02 Describe the acquisition and expenditure cycle; including typical source documents and controls. Topic: Acquisition and Expenditure Cycle: Typical Activities 2. Purchases are ordered by a purchasing department that seeks the best prices and quality. TRUE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-02 Describe the acquisition and expenditure cycle; including typical source documents and controls. Topic: Acquisition and Expenditure Cycle: Typical Activities 3. Checks are signed by the accounts payable department after assembling the invoice, purchase order, and receiving report. FALSE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-02 Describe the acquisition and expenditure cycle; including typical source documents and controls. Topic: Acquisition and Expenditure Cycle: Typical Activities 4. Purchase orders are "open" from the time they are issued until the goods are received. TRUE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-02 Describe the acquisition and expenditure cycle; including typical source documents and controls. Topic: Acquisition and Expenditure Cycle: Typical Activities 5. Normally, liabilities should be recorded on the date the goods are received and accepted. TRUE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-02 Describe the acquisition and expenditure cycle; including typical source documents and controls. Topic: Acquisition and Expenditure Cycle: Typical Activities 6. Auditors' "search for unrecorded liabilities" should emphasize the large balances, especially for regular vendors. FALSE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-04 Explain the importance of the completeness assertion for the audit of accounts payable and list some procedures for a search for unrecorded liabilities. Topic: Substantive Procedures in the Acquisition and Expenditure Cycle 7. Auditors can inspect the "unmatched invoice file" and compare it to the "unmatched receiving report" file to determine whether liabilities are unrecorded. FALSE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-02 Describe the acquisition and expenditure cycle; including typical source documents and controls. Topic: Acquisition and Expenditure Cycle: Typical Activities 8. Proper separation of duties involves authorization of purchases by persons who do not have custody, recording, or reconciliation duties. TRUE Reference: Question also found in study guide AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Topic: Control Risk Assessment 9. If personnel in the organization are not performing their control activities very well, auditors will need to design substantive procedures to try to detect whether control failures have produced misleading financial statement account balances. TRUE Reference: Question also found in study guide AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Topic: Control Risk Assessment 10. If the risk of material misstatement is assessed as very low, it is likely that additional substantive procedures will be required. FALSE Reference: Question also found in study guide AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Topic: Control Risk Assessment 11. The emphasis is on the existence assertion because financial statement users tend to be more concerned about understated expenses and liabilities than overstated. FALSE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-04 Explain the importance of the completeness assertion for the audit of accounts payable and list some procedures for a search for unrecorded liabilities. Topic: Substantive Procedures in the Acquisition and Expenditure Cycle 12. Evidence is much easier to obtain to verify the completeness assertion for liabilities than the existence assertion for assets. FALSE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-04 Explain the importance of the completeness assertion for the audit of accounts payable and list some procedures for a search for unrecorded liabilities. Topic: Substantive Procedures in the Acquisition and Expenditure Cycle 13. The search for unrecorded liabilities should normally be performed up to the last day of fieldwork in the period following the audit client's balance sheet date. TRUE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-04 Explain the importance of the completeness assertion for the audit of accounts payable and list some procedures for a search for unrecorded liabilities. Topic: Substantive Procedures in the Acquisition and Expenditure Cycle 14. The principal goal of the physical inspection of property, plant, and equipment is to determine actual existence and condition of property. TRUE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-05 Discuss audit procedures for other accounts affected by the acquisition and expenditure cycle. Topic: Substantive Procedures in the Acquisition and Expenditure Cycle 15. All pay base data (hours, job number, absences, etc.) should be approved by an employee's immediate supervisor. TRUE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-08 Describe the payroll cycle; including typical source documents and controls. [Appendix 8C] Topic: Audit Issues in the Expense and Acquisition Cycle 16. The main feature of custody in the payroll cycle is the possession of the payroll checks. TRUE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-08 Describe the payroll cycle; including typical source documents and controls. [Appendix 8C] Topic: Audit Issues in the Expense and Acquisition Cycle 17. Persons in charge of authorization and custody payroll functions should not prepare the payroll. TRUE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-08 Describe the payroll cycle; including typical source documents and controls. [Appendix 8C] Topic: Audit Issues in the Expense and Acquisition Cycle 18. The payroll bank account cannot be reconciled like the other bank accounts. FALSE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-08 Describe the payroll cycle; including typical source documents and controls. [Appendix 8C] Topic: Audit Issues in the Expense and Acquisition Cycle 19. Record keeping is performed by payroll and cost accounting personnel who do not make authorizations or distribute pay. TRUE Reference: Question also found in study guide AACSB: Analytic AICPA BB: Industry AICPA FN: Decision Making Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-08 Describe the payroll cycle; including typical source documents and controls. [Appendix 8C] Topic: Audit Issues in the Expense and Acquisition Cycle Multiple Choice Questions 20. When confirming accounts payable, emphasis should be put on what kind of accounts? A.Accounts with small or zero balances. B. All accounts should be equally emphasized. C. Accounts with large balances. D. Accounts listed in the accounts payable subsidiary. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-04 Explain the importance of the completeness assertion for the audit of accounts payable and list some procedures for a search for unrecorded liabilities. Source: Original Topic: Expenditure Assertions 21. "Recorded vouchers (accounts payable entries) in the voucher register (e.g., purchases journal) supported by completed voucher documentation" is a specific example of which management assertion? A. Classificatio n. B.Occurrenc e. C. Completenes s. D. Cuto ff. AACSB: Analytic AICPA BB: Legal AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Source: Original Topic: Expenditure Controls 22. "All purchase orders are supported by requisitions from proper persons" is a specific example of which management assertion? A.Occurrenc e. B. Completenes s. C. Cuto ff. D. Classificatio n. AACSB: Analytic AICPA BB: Legal AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-02 Describe the acquisition and expenditure cycle; including typical source documents and controls. Source: Original Topic: Expenditure Cycle 23. Cash disbursements are authorized by A. Purchase orders. B. Invoice s. C. Receiving reports. D.A complete voucher package. AACSB: Analytic AICPA BB: Legal AICPA FN: Research Blooms: Remember Difficulty: 2 Medium Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Source: Original Topic: Expenditure Controls 24. For the copy of the purchase order that goes to the receiving department, it is best to A. Leave off the description of the goods ordered. B. Leave off the quantity of the goods ordered. C. Leave off the name of the vendor. D. Have the receiving department forward all copies of the purchase order to accounts payable. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 3 Hard Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Source: Original Topic: Expenditure Controls 25. Vouchers should be stamped PAID to A.Prevent duplicate payment. B. Generate a new purchase order. C. Indicate posting in the voucher register. D. Facilitate preparation of the bank reconciliation. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Source: Original Topic: Expenditure Controls 26. A voucher package is used to A. Document receipt of inventory. B. Document completion of services. C. Document a purchase contract. D.Provide a source document for recording the purchase of a good or service. AACSB: Analytic AICPA BB: Legal AICPA FN: Research Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-02 Describe the acquisition and expenditure cycle; including typical source documents and controls. Source: Original Topic: Expenditure Cycle 27. An auditor traced a sample of purchase orders and the related receiving reports to the purchases journal. The purpose of this substantive audit procedure most likely was to A. Identify usually large purchases that should be investigated further. B. Verify that cash disbursements were for goods actually received. C. Determine that purchases were properly recorded. D. Test whether payments were for goods actually ordered. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Source: AICPA Topic: Expenditure Controls 28. The usual source for journal entries posted to the general ledger to record the purchase of inventory is A. Sales invoices updated with cost data from the inventory records department. B. Purchase invoices updated with cost data from the inventory records department. C. Receiving reports updated with cost data from the accounts payable department. D.Vouchers payable journal from the accounts payable department. AACSB: Analytic AICPA BB: Legal AICPA FN: Research Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Source: Original Topic: Expenditure Controls 29. Which of the following would detect the understatement of a purchase discount? A. Verify the arithmetic accuracy of the purchases journal. B.Compare purchase disbursement records and checks with invoice terms. C. Compare approved purchase orders to receiving reports. D. Verify the receipt of items ordered and invoiced. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 3 Hard Learning Objective: 08-05 Discuss audit procedures for other accounts affected by the acquisition and expenditure cycle. Source: Original Topic: Expenditure Substantive Testing 30. Which of the following situations indicates a potential material weakness in internal control over acquisition and expenditure? A. Purchase orders are not prepared for services acquired directly under authorization of department heads. B.The same person authorizes voucher packages and signs checks. C. Unacceptable goods are not scheduled on receiving reports. D. The same person signs checks and stamps vouchers PAID. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Source: Original Topic: Expenditure Controls 31. Which of the following client control activities is not usually performed in the vouchers payable (accounts payable) department? A. Determining the mathematical accuracy of the vendors' invoices. B. Writing checks for the treasurer's signature to take advantage of purchase discounts. C.Controlling the mailing of the check and remittance advice. D. Checking the prices on the vendor's invoice. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-02 Describe the acquisition and expenditure cycle; including typical source documents and controls. Source: Original Topic: Expenditure Cycle 32. When auditing merchandise inventory at year-end, the auditor performs a purchase cutoff test to obtain evidence that A. All goods purchased before year-end are received before the physical inventory count. B. No goods held on consignment for customers are included in the inventory balance. C. No goods observed during the physical count are pledged or sold. D.All goods owned at year-end are included in the inventory balance. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 3 Hard Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Source: Original Topic: Expenditure Controls 33. Auditors may conclude that depreciation charges are too small by noting A. Insured values much larger than book values. B. Large numbers of fully depreciated assets. C. Frequent trade-ins of relatively new assets. D.Large and frequent losses on assets retired. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-07 Describe some common errors and frauds in the acquisition and expenditure cycle and design some audit and investigation procedures for detecting them. Source: Original Topic: Expenditure Error and Fraud Detection 34. The auditor decided to test accounts payable by sending open-ended (blank) confirmations to selected vendors. The auditor's best approach in selecting the vendor accounts to confirm is to A. Select vendor accounts with large balances. B. Select vendor accounts at random in order to apply a statistical sampling procedure. C. Select vendor accounts based on the number of purchases from vendors during the year. D. Select vendor accounts that are past due. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 3 Hard Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Source: Original Topic: Expenditure Controls 35. What evidence is appropriate to determine whether recorded purchase transactions are valid and the vendors charged the correct prices? A. Purchase requisitions and accounts payable entries. B.Receiving reports and purchase orders. C. Purchase requisitions and purchases orders. D. Purchase orders and bid quotes. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 3 Hard Learning Objective: 08-02 Describe the acquisition and expenditure cycle; including typical source documents and controls. Source: Original Topic: Expenditure Cycle 36. Purchase cutoff procedures should be designed to produce evidence of whether merchandise is included in the inventory of the client company if the company A. Has paid for the merchandise. B. Has physical possession of the merchandise. C. Holds legal title to the merchandise. D. Holds the shipping documents for the merchandise issued in the company's name. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 3 Hard Learning Objective: 08-04 Explain the importance of the completeness assertion for the audit of accounts payable and list some procedures for a search for unrecorded liabilities. Source: Original Topic: Expenditure Substantive Testing 37. Which of the following accounts would most likely be reviewed by the auditor to gain reasonable assurance that additions to the equipment account are not understated? A. Depreciation expense. B. Gain on disposal of equipment. C. Accounts payable. D.Repairs and maintenance expense. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-05 Discuss audit procedures for other accounts affected by the acquisition and expenditure cycle. Source: Original Topic: Expenditure Audit Procedures 38. Which of the following would not be included in the supporting documents for a voucher? A. Purchase order. B. Vendor invoice. C. Receiving report. D.Blank check. AACSB: Analytic AICPA BB: Legal AICPA FN: Research Blooms: Remember Difficulty: 1 Easy Learning Objective: 08-02 Describe the acquisition and expenditure cycle; including typical source documents and controls. Source: Original Topic: Expenditure Cycle 39. A voucher would typically contain A.A purchase requisition, purchase order, vendor invoice, receiving report, and check copy. B. A purchase requisition, purchase order, sales invoice, receiving report, and check copy. C. A purchase requisition, sales order, sales invoice, receiving report, and check copy. D. A purchase requisition, sales order, vendor invoice, receiving report, and check copy. AACSB: Analytic AICPA BB: Legal AICPA FN: Research Blooms: Remember Difficulty: 1 Easy Learning Objective: 08-02 Describe the acquisition and expenditure cycle; including typical source documents and controls. Source: Original Topic: Expenditure Cycle 40. When using confirmations to provide evidence about the completeness assertion for accounts payable, the appropriate population most likely would be A.Vendors with whom the entity has previously done business. B. Amounts recorded in the accounts payable subsidiary ledger. C. Payees of checks drawn in the month after the year-end. D. Invoices filed in the entity's open invoice file. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-04 Explain the importance of the completeness assertion for the audit of accounts payable and list some procedures for a search for unrecorded liabilities. Source: AICPA Topic: Expenditure Substantive Testing 41. Which of the following procedures would an auditor most likely perform in searching for unrecorded payables? A. Reconcile receiving reports with related cash payments made just prior to year-end. B. Contrast the ratio of accounts payable to purchases with the prior year's ratio. C. Vouch a sample of creditor balances to supporting invoices, receiving reports, and purchase orders. D.Compare cash payments occurring after the balance sheet date with the accounts payable trial balance. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-04 Explain the importance of the completeness assertion for the audit of accounts payable and list some procedures for a search for unrecorded liabilities. Source: AICPA Topic: Expenditure Substantive Testing 42. An entity's internal control structure requires for every check request that there be an approved voucher, supported by a prenumbered purchase order and a prenumbered receiving report. To determine whether checks are being issued for unauthorized expenditures, an auditor most likely would select items for testing from the population of all A. Purchase orders. B.Canceled checks. C. Receiving reports. D. Approved vouchers. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Source: AICPA Topic: Expenditure Controls 43. An auditor wishes to perform tests of controls on a client's purchasing procedures. If the control activities leave no audit trail of documentary evidence, the auditor most likely will test the procedures by A. Confirmation and observation. B.Observation and inquiry. C. Analytical procedures and confirmation. D. Inquiry and analytical procedures. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Source: AICPA Topic: Expenditure Controls 44. Which of the following audit procedures is best for identifying unrecorded accounts payable? A.Reviewing cash disbursements recorded subsequent to the balance sheet date to determine whether the related payables apply to the prior period. B. Investigating payables recorded just prior to and just subsequent to the balance sheet date to determine whether they are supported by receiving reports. C. Examining unusual relationships between monthly accounts payable balances and recorded cash payments. D. Reconciling vendors' statements to the file of receiving reports to identify items received just prior to the balance sheet date. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 3 Hard Learning Objective: 08-04 Explain the importance of the completeness assertion for the audit of accounts payable and list some procedures for a search for unrecorded liabilities. Source: AICPA Topic: Expenditure Substantive Testing 45. To provide assurance that each voucher is submitted and paid only once, an auditor most likely would examine a sample of paid vouchers and determine whether each voucher is A. Supported by a vendor's invoice. B.Stamped "paid" by the check signer. C. Prenumbered and accounted for. D. Approved for authorized purchases. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 3 Hard Learning Objective: 08-03 Give examples of tests of controls over purchases of inventory and services. Source: AICPA Topic: Expenditure Controls 46. Cutoff tests designed to detect purchases made before the end of the year that have been recorded in the subsequent year most likely would provide assurance about management's assertion of A. Valuation or allocation. B. Existence or occurrence. C.Completenes s. D. Rights and obligations. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-04 Explain the importance of the completeness assertion for the audit of accounts payable and list some procedures for a search for unrecorded liabilities. Source: AICPA Topic: Expenditure Substantive Testing 47. When auditing PP&E, the auditor's approach is generally to A. Examine evidence supporting the amounts in the ending balance. B.Examine evidence supporting additions during the year. C. Follow a reliance strategy, testing internal controls and analytical procedures. D. Concentrate on finding unrecorded assets. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-05 Discuss audit procedures for other accounts affected by the acquisition and expenditure cycle. Source: Original Topic: Expenditure fraud 48. Which of the following procedures would an auditor most likely perform in searching for unrecorded liabilities? A. Trace a sample of accounts payable entries recorded just before year-end to the unmatched receiving report file. B. Compare a sample of purchase orders issued just after year-end with the year-end accounts payable trial balance. C. Vouch a sample of cash disbursements recorded just after year-end to receiving reports and vendor invoices. D. Scan the cash disbursements entries recorded just before year-end for indications of unusual transactions. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-04 Explain the importance of the completeness assertion for the audit of accounts payable and list some procedures for a search for unrecorded liabilities. Source: AICPA Topic: Expenditure Substantive Testing 49. In performing a search for unrecorded retirements of fixed assets, an auditor most likely would A.Inspect the property ledger and the insurance and tax records, and then tour the client's facilities. B. Tour the client's facilities, and then inspect the property ledger, and the insurance and tax records. C. Analyze the repair and maintenance account, and then tour the client's facilities. D. Tour the client's facilities, and then analyze the repair and maintenance account. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 3 Hard Learning Objective: 08-05 Discuss audit procedures for other accounts affected by the acquisition and expenditure cycle. Source: AICPA Topic: Expenditure fraud 50. A weakness in internal control over recording retirements of equipment may cause an auditor to A. Inspect certain items of equipment in the plant and trace those items to the accounting records. B. Review the subsidiary ledger to ascertain whether depreciation was taken on each item of equipment during the year. C. Trace additions to the "other assets" account to search for equipment that is still on hand but no longer being used. D.Select certain items of equipment from the accounting records and locate them in the plant. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 3 Hard Learning Objective: 08-05 Discuss audit procedures for other accounts affected by the acquisition and expenditure cycle. Source: AICPA Topic: Expenditure fraud 51. Failure to record a liability generally results in A. An understatement of profit. B. An understatement of current ratio. C. An overstatement of profit. D. An overstatement of assets. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-01 Identify significant inherent risks in the acquisition and expenditure cycle. Source: Original Topic: Expenditure risks 52. Improperly capitalizing an expense item results in. A. Understatement of profit in the current year and overstatement in future years. B. Understatement of profit in the current year and in future years. C. Overstatement of profit in the current year and understatement in future years. D. Overstatement of profit in the current year and in future years. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-02 Describe the acquisition and expenditure cycle; including typical source documents and controls. Source: Original Topic: Expenditure risks 53. A liability for a long-term purchase contract should generally be recognized when A. The contract is signed. B. The goods are shipped. C. The goods are received. D. The goods are sold to match the cost. AACSB: Analytic AICPA BB: Legal AICPA FN: Research Blooms: Understand Difficulty: 2 Medium Learning Objective: 08-02 Describe the acquisition and expenditure cycle; including typical source documents and controls. Source: Original Topic: Expenditure Cycle 54. Which of the following expense accounts would not normally be tested by listing all debits and examining any significant items? A. Legal expense. B. Miscellaneous expense. C. Repairs and Maintenance. D.Payroll expense. AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Risk Analysis Blooms: Apply Difficulty: 2 Medium Learning Objective: 08-05 Discuss audit procedures for other accounts a [Show More]

Last updated: 11 months ago

Preview 1 out of 531 pages

.png)

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 19, 2022

Number of pages

531

Written in

Additional information

This document has been written for:

Uploaded

Mar 19, 2022

Downloads

0

Views

30

.png)

.png)

.png)

.png)

.png)