Financial Accounting > QUESTIONS & ANSWERS > ACC 372 Problem Set1 (Chapters1-5). 150 Questions and Answers. (All)

ACC 372 Problem Set1 (Chapters1-5). 150 Questions and Answers.

Document Content and Description Below

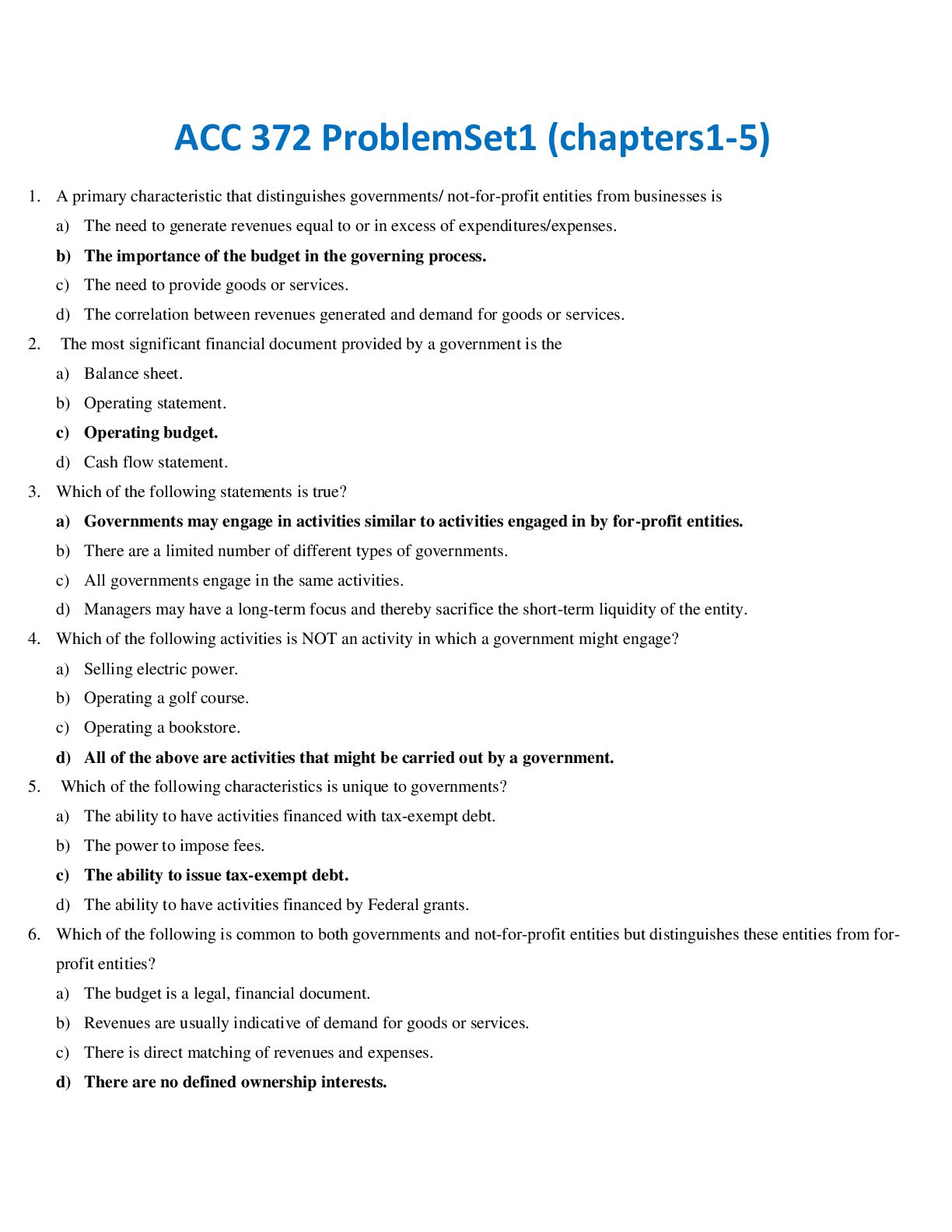

ACC 372 ProblemSet1 (chapters1-5) 1. A primary characteristic that distinguishes governments/ not-for-profit entities from businesses is a) The need to generate revenues equal to or in excess of ex... penditures/expenses. b) The importance of the budget in the governing process. c) The need to provide goods or services. d) The correlation between revenues generated and demand for goods or services. 2. The most significant financial document provided by a government is the a) Balance sheet. b) Operating statement. c) Operating budget. d) Cash flow statement. 3. Which of the following statements is true? a) Governments may engage in activities similar to activities engaged in by for-profit entities. b) There are a limited number of different types of governments. c) All governments engage in the same activities. d) Managers may have a long-term focus and thereby sacrifice the short-term liquidity of the entity. 4. Which of the following activities is NOT an activity in which a government might engage? a) Selling electric power. b) Operating a golf course. c) Operating a bookstore. d) All of the above are activities that might be carried out by a government. 5. Which of the following characteristics is unique to governments? a) The ability to have activities financed with tax-exempt debt. b) The power to impose fees. c) The ability to issue tax-exempt debt. d) The ability to have activities financed by Federal grants. 6. Which of the following is common to both governments and not-for-profit entities but distinguishes these entities from for-profit entities? a) The budget is a legal, financial document. b) Revenues are usually indicative of demand for goods or services. c) There is direct matching of revenues and expenses. d) There are no defined ownership interests. 7. Which of the following is NOT generally considered a main user of government and not-for-profit entity external financial statements? a) Investors and creditors. b) Taxpayers. c) Donors. d) Internal managers. 8. Which of the following objectives is considered the cornerstone of financial reporting by a state or local government? a) Accountability. b) Budgetary compliance. c) Interperiod equity. d) Service efforts and accomplishments. 9. Which of the following is an objective of financial reporting by nongovernmental not-for-profit entities as established by the FASB? Financial reporting should provide information that is useful to present and potential resource providers and other users in: a) Assessing the types of services provided and the need for those services. b) Assessing the services provided and the entity’s ability to earn a profit. c) Making rational decisions about the allocation of resources to those organizations. d) Assessing how managers have managed personnel. 10. As used by the GASB, interperiod equity refers to which of the following? Financial reporting should: a) Demonstrate compliance with finance-related contractual requirements. b) Provide information to determine whether current-year revenues were sufficient to pay for current-year services. c) Demonstrate whether resources were obtained and used in accordance with the government’s legally adopted budget. d) Provide information to assist users in assessing the government’s economy, efficiency, and effectiveness. 11. The Governmental Accounting Standards Board is the primary standard-setting body for: a) All governments. b) All state and local governments. c) All governments and all not-for-profit entities. d) All state and local governments and all not-for-profit entities. 12. The purpose of the FASAB is to establish accounting standards for a) Not-for-profit entities. b) Federal government. c) All governments. d) Non-federal governments. 13. What is the primary reason that governmental entities use fund accounting? a) Fund accounting is required by law. b) Fund accounting is required by GAAP. c) Fund accounting promotes control and accountability over restricted resources. d) Fund accounting promotes better control over operating activities. 14. Basis of accounting determines which of the following? a) When transactions and events are recognized. b) What transactions and events will be reported. c) Where transactions and events will be reported. d) Why transactions and events will be reported. 15. A fund is a) A separate legal entity. b) A separate fiscal and accounting entity. c) A separate self-balancing set of accounts for inventory purposes. d) None of the above. 16. Which of the following funds is a fiduciary fund? a) Permanent fund. b) Agency fund. c) Capital projects fund. d) Debt service fund. 17. A city receives a donation from a citizen who specifies that the principal must be invested and the earnings must be used to support operations of a city-owned recreational facility. The principal of this gift should be accounted for in which of the following funds? a) Trust fund. b) Special revenue fund. c) Permanent fund. d) Internal service fund. 18. Which of the following is NOT a governmental fund? a) City hall debt service fund. b) City utilities enterprise fund. c) Gasoline tax special revenue fund. d) City hall capital projects fund. 19. Which of the following funds is a proprietary fund? a) Internal service fund. b) Special revenue fund. c) Capital projects fund. d) Permanent fund. 20. Which of the following funds is a governmental fund? a) Enterprise fund. b) Debt service fund. c) Internal service fund. d) Agency fund. 21. Which of the following activities conducted by a city-owned junior college should be accounted for in an agency fund? a) Receipt of tuition payments. b) Receipt of revenues belonging to the student accounting club. c) Receipt of state monies appropriated for general operations. d) Receipt of donations in support of the university’s athletic program. 22. Which of the following transactions should the City of Highland account for in a trust fund? a) General fund contributions received by the city pension plan. b) Greens fees received from golfers at the city-owned golf course. c) Grants received from the Federal government to purchase buses to be used for public transit. d) Proceeds of bonds issued to construct a new city hall building. 23. The state collects a gasoline tax that must be used to support highway construction and maintenance. The gasoline tax revenue should be accounted for in which of the following funds? a) General fund. b) Special revenue fund. c) Debt service fund. d) Internal service fund. 24. The City of San Jose built a new city hall and financed construction by issuing bonds due in installments over the next 30 years. The bond principal and interest will be paid by a special tax levied on property in the city. The revenue received from this special tax should be accounted for in which of the following funds? a) General fund. b) Internal service fund. c) Capital projects fund. d) Debt service fund. 25. Riverside Golf Course is a city-owned golf course that collects greens fees in amounts sufficient to cover its expenses. Riverside Golf Course should be accounted for in which of the following funds? a) Internal service fund. b) Enterprise fund. c) General fund. d) Special revenue fund. 26. To fulfill the printing needs of its various departments and agencies, the City has established a Central Print Shop, which bills the various departments and agencies of the city for printing services rendered. The Central Print Shop should be accounted for in which of the following funds. a) Internal service fund. b) Enterprise fund. c) General fund. d) Special revenue fund. 27. Which of the following sections is NOT required in the comprehensive annual financial report of a city? a) Financial section. b) Introductory section. c) Statistical section. d) Historical section. 28. The basic financial statements of a city do NOT include which of the following? a) Government-wide statement of net position. b) Government-wide statement of activities. c) Government-wide statement of cash flows. d) Separate balance sheets for governmental and proprietary funds. 29. Which of the following funds is accounted for on the modified accrual basis of accounting? a) General fund. b) Internal service fund. c) Proprietary fund. d) Pension trust fund. 30. Which of the following assets would NOT be found in the general fund balance sheet of the City of Harrison? a) Cash. b) Capital assets. c) Due from special revenue fund. d) Due from state government. 31. Which of the following liabilities would NOT be found in the general fund balance sheet of the City of Marmaduke? a) Accounts payable. b) Due to special revenue fund. c) Deferred revenue. d) Bonds payable, due in 5 years. 32. The number of governmental units in the United States is approximately a) 895 b) 8,950 c) 895,000 d) 89, 000 33. Which of the following statements is NOT required in the financial reports of an Enterprise Fund? a) Statement of net position. b) Statement of restricted funds. c) Statement of cash flows. d) Statement of Revenues, Expenses, and Changes In Fund Position 34. Which of the following fund is Not required to prepare Statement of Changes in Fiduciary Net Position? a) Pension Fund. b) Private-Purpose Trust Fund. c) Investment Trust Fund d) Agency Fund. 35. Under the GASB Statement No. 34 reporting model, which of the following is required? a) Only one set of financial statements, prepared on the full accrual basis of accounting. b) Only one set of financial statements, prepared on the modified accrual basis of accounting. c) Two sets of financial statements. One set views the government as a collection of separate funds and uses the current financial resources measurement focus and modified accrual basis of accounting for governmental funds. The other set views the government as a whole by combining all governmental activities in one column and all business-type activities in another column and uses the full accrual basis of accounting for both columns. d) Two sets of financial statements. One set views the government as a whole and uses the current financial resources measurement focus and modified accrual basis of accounting. The other set views the government by function, combines all governmental activities in one column and all business-type activities in another column, and uses the full accrual basis of accounting for both columns. 36. Under the GASB Statement No. 34 reporting model (as amended by GASB Statement No. 63), the government-wide statement of net position will display which of the following? a) Assets, liabilities, and net position. b) Assets, liabilities, and fund balances. c) Assets, liabilities, and fund equity. d) Assets, liabilities, and owners' equity. 37. When a governmental entity adopts a basis of accounting other than full accrual and a measurement focus that excludes long-lived assets and liabilities in its governmental fund types: a) It has reported in accordance with GAAP for governmental fund financial statements. b) It is in violation of the law. c) It is in violation of GAAP. d) It has the ability to better measure the results of operations. 38. Which of the following funds of Chessie City would be consolidated to form the governmental activities column in the city’s government-wide financial statements? a) General fund, special revenue fund, and agency fund. b) General fund, debt service fund, and capital projects fund. c) General fund, enterprise fund, and fiduciary fund. d) Enterprise fund and internal service fund. 39. Which fund type would all governments normally include in their fund financial statements? a) Capital projects funds b) Special revenue funds c) General fund d) Fiduciary funds 40. Under the GASB Statement No. 34 reporting model, fund financial statements include separate sets of financial statements for: a) Each major function of the government. b) Governmental funds, proprietary funds, and fiduciary funds. c) Governmental funds, enterprise funds, and internal service funds. d) Governmental funds, special revenue funds, and debt service funds. 41. When a fax machine purchased by a governmental entity is received, it should be recorded in the general fund as a(n) a) Expense b) Encumbrance c)Expenditure d) capital asset 42. Which of the following is NOT included in the financial section of a comprehensive annual financial report? a) Required supplementary information b) Letter of transmittal c) Financial statements d) Notes to the statements 43. During the current fiscal year, Mountain View City’s water utility, an enterprise fund, rendered billings for water supplied to the general fund. Which of the following accounts should be debited by the general fund? a) Transfer-out to enterprise fund b) Due to water utility enterprise fund c) Appropriations d) Expenditures 44. Lakeside Art Center, a nongovernmental not-for-profit entity, receives a contribution of $5 million. The donor stipulates that the contribution must be used to acquire paintings by local artists. Lakeside should classify the contribution as a) Permanently restricted b) Temporarily restricted c) Committed d) Unrestricted 45. Wigmore City receives a donation of $10 million from a wealthy citizen who stipulates that the funds be used to acquire and install park benches in the city's Veterans Park. The city should report the donation as an increase in a) Unassigned fund balance b) Assigned fund balance c) Committed fund balance d) Restricted fund balance 46. The accounting equation applied by state and local governments is a) Assets + deferred inflows of resources - liabilities = fund balance b) Assets + deferred outflows of resources - liabilities - deferred inflows of resources = fund balance c) Assets + deferred inflows of resources = liabilities + deferred outflows of resources + fund balance d) Assets - deferred outflows of resources - liabilities + deferred inflows of resources = fund balance Kayla Township issued the following bonds during the year: ● Ten-year bonds to acquire equipment for a data processing service reported in an internal service fund $2,000,000 ● Bonds to construct a new police station $9,000,000 ● Bonds to increase the capacity of the water treatment plant reported in an enterprise fund $4,800,000 47. The amount of debt reported in the Township’s general fund is: a) $0 b) $9,000,000 c) $11,000,000 d) $15,800,000 48. The township should report depreciation expense on related new capital assets in: a) General fund b) Enterprise fund c) Enterprise and internal service funds d) Capital projects fund 49. The bonds issued to construct the new police station should be reported as: a) Debt proceeds in the general fund b) Long-term debt in a debt service fund c) Debt proceeds in a capital projects fund d) None of the above 50. In accordance with bond covenants the township sets aside $1,000,000 to help ensure that it is able to meet its first payment of principal and interest on the police station debt due one year from the date the bonds were issued. The amount of liability that the township should report in its debt service fund is: a) $0 b) $1,000,000 c) $9,000,000 d) $8,000,000 51. The City of Lakeview adopts its budget on a basis of accounting that permits outstanding purchase commitments to be charged against the budget in the year that the goods are ordered instead of in the year they are received. During the year the city ordered and received $4,000 of supplies (of which $3,000 had been paid and $1,000 was unpaid) and had $500 of outstanding purchase commitments for supplies at year-end. In the budget-to-actual comparison, the expenditures for supplies would be: a) $3,000. b) $3,500. c) $4,000. d) $4,500. 52. A governmental entity has formally integrated the budget into its accounting records. At year-end the ledger account “Revenues from property taxes” has a debit balance. Which of the following is the best explanation for the debit balance? a) The entity overestimated property tax revenue when preparing its budget. b) The entity underestimated property tax revenue when preparing its budget. c) The entity collected more in property taxes than it anticipated. d) There is no logical explanation; revenue accounts usually do not have debit balances. 53. A governmental entity has formally integrated the budget into its accounting records and uses encumbrance accounting. During the year the government ordered but had not yet received a new police car. What effect will this event have on the unencumbered balance in the account “Expenditures—capital outlay, police department”? a) The balance in the account will not be affected until the police car is received. b) The balance in the account will be increased. c) The balance in the account will be decreased. d) Purchase orders never affect any budgetary account balances. 54. A governmental entity has formally integrated the budget into its accounting records. At the end of the third quarter the ledger account “Expenditures--salaries” has a $100,000 debit balance. Which of the following is a true statement? a) The entity has $100,000 available to spend on salaries. b) The entity has incurred salaries in the amount of $100,000. c) The entity had paid salaries in the amount of $100,000. d) The entity has overspent its budget for salaries by $100,000. 55. A public school district formally adopted a budget with estimated revenues of $800 and approved expenditures of $780. Which of the following is the appropriate entry to record the budget? a) Debit Estimated revenues $800; credit Appropriations $780; credit Fund balance $20. b) Debit Appropriations $780; Debit Fund balance $20; credit Estimated revenues $800. c) Debit Encumbrances $780; Debit Fund balance $20; credit Estimated revenues $800. d) Memorandum entry only. 56. A city formally adopted a budget at the beginning of the current year. Budgeted revenues were $500 and budgeted expenditures were $490. During the year actual revenues were $520 and actual expenditures were $480. Which of the following statements is true?Fund balance at the end of the current year in comparison to fund balance at the end of the preceding year will be a) $10 greater. b) $30 greater. c) $40 greater. d) $50 greater. 57. A county general fund budget includes budgeted revenues of $900 and budgeted expenditures of $890. Actual revenues for the year were $915. To close the estimated revenues account at the end of the year a) Debit Estimated revenues $15 b) Credit Estimated revenue $15 c) Debit Estimated revenues $900 d) Credit Estimated revenues $900 58. A university that formally integrates the budget in the accounting system and uses encumbrance accounting orders some new computers that will cost approximately $20,000. To recognize this event the university should make which of the following entries? a) Debit Expenditures $20,000; credit Encumbrances $20,000 b) Debit Encumbrances $20,000; credit Reserve for encumbrances $20,000 c) Debit Encumbrances $20,000; credit Accounts payable $20,000 d) No entry required when the order is placed. 59. A county previously encumbered $15,000 for the acquisition of supplies. The supplies were received at a total cost of $14,700. To recognize this event the county should make which of the following entries? a) Debit Reserve for encumbrances $15,000; credit Encumbrances $15,000. b) Debit Reserve for encumbrances $14,700; credit Encumbrances $14,700. c) Debit Encumbrances $15,000; credit Reserve for encumbrances $15,000. d) Debit Encumbrances $14,700; credit Reserve for encumbrances $14,700. 60. A city received supplies that had been previously encumbered. The supplies were encumbered for $5,000 and had an actual cost of $4,900. To recognize this event the county should make which of the following entries? a) Debit Reserve for encumbrances $5,000 and Supplies $4,900; credit Encumbrances $5,000 and Vouchers payable $4,900. b) Debit Encumbrances $5,000 and Supplies $4,900; credit Reserve for encumbrances $5,000 and Vouchers payable $4,900. c) Debit Reserve for encumbrances $4,900 and Supplies $4,900; credit Encumbrances $4,900 and Vouchers payable $4,900. d) Debit Encumbrances $4,900 and Supplies $4,900; credit Reserve for encumbrances $4,900 and Vouchers payable $4,900. 61. To close Encumbrances at the end of the year which of the following entries should be made? a) Debit Encumbrances; credit Fund balance. b) Debit Reserve for encumbrances; credit Encumbrances. c) Debit Fund balance; credit Encumbrances. d) No closing entry needed. 62. To close Reserve for encumbrances at the end of the year which of the following entries should be made? a) Debit Reserve for encumbrances; credit Fund balance. b) Debit Reserve for encumbrances; credit Encumbrances. c) Debit Fund balance; credit Reserve for encumbrances. d) No closing entry needed. 63. During the previous year, Bane County closed its Encumbrances account. At the end of the previous year there was $5,000 of outstanding purchase commitments. To restore these commitments to the accounts, which of the following entries would be required? a) Debit Reserve for encumbrances $5,000; credit Encumbrances $5,000. b) Debit Encumbrances $5,000; credit Reserve for encumbrances $5,000. c) Debit Encumbrances $5,000; credit Fund balance $5,000 d) Debit Fund balance $5,000; credit Reserve for encumbrances $5,000. 64. When Spruce City receives goods at a cost of $9,700 that were encumbered in the prior year for $10,000, which of the following entries are required (assume that encumbrances lapse at year end)? a) Debit Expenditures $9,700; credit Accounts payable $9,700; no entry for Encumbrances. b) Debit Expenditures $9,700 and Reserve for encumbrances $10,000; credit Accounts payable $9,700 and Encumbrances $10,000. c) Debit Expenditures $10,000 and Reserve for encumbrances $10,000; credit Accounts payable $10,000 and Encumbrances $10,000. d) Debit Reserve for encumbrances $10,000; credit Encumbrances $10,000; no entry for Expenditures. 65. At year-end Oakland County had $3,000 of outstanding purchase commitments on the books. After the appropriate closing entries are made, what is the effect on the total fund balance of Oakland County? a) It is $3,000 greater than it would have been if the purchase commitments had been fulfilled by year-end. b) It is $3,000 less than it would have been if the purchase commitments had been fulfilled by year-end. c) It is the same as it would have been if the purchase commitments had been fulfilled by year-end; it will be reduced by $3,000 next year. d) It is the same as it would have been if the purchase commitments had been fulfilled by year-end; it will not change next year. 66. Hill City uses encumbrance accounting to control expenditures. However, it charges the cost of outstanding purchase commitments to expenditures in the year they are received, not in the year they are ordered. If Hill City had $10,000 of purchase commitments outstanding at the end of Year 1 and received those goods during Year 2 at a cost of $9,800, what would be the impact on total fund balance for Year 2? a) Total fund balance at the end of Year 2 would be $9,800 less than at the end of Year 1. b) Total fund balance at the end of Year 2 would be $200 less than at the end of Year 1. c) Total fund balance at the end of Year 2 would be $200 greater than at the end of Year 1. d) Total fund balance at the end of Year 2 would be same as it was at the end of Year 1. 67. The City of Denton uses encumbrance accounting to control expenditures. It charges the cost of outstanding purchase commitments to expenditures in the year they are received, not in the year they are ordered. If the city had $11,000 of purchase commitments outstanding at the end of Year 1 and received those goods during Year 2 at a cost of $11,700, what would be the impact on total fund balance for Year 2? a) Total fund balance at the end of Year 2 would be $11,700 less than at the end of Year 1. b) Total fund balance at the end of Year 2 would be $700 less than at the end of Year 1. c) Total fund balance at the end of Year 2 would be $700 greater than at the end of Year 1. d) Total fund balance at the end of Year 2 would be same as it was at the end of Year 1. 68. Lincoln County uses encumbrance accounting to control expenditures. It charges the cost of outstanding purchase commitments to expenditures in the year they are ordered, not in the year they are received. If the county had $7,000 of purchase commitments outstanding at the end of Year 1 and received those goods during Year 2 at a cost of $7,800, what would be the impact on total fund balance for Year 2? a) Total fund balance at the end of Year 2 would be $7,800 less than at the end of Year 1. b) Total fund balance at the end of Year 2 would be $800 less than at the end of Year 1. c) Total fund balance at the end of Year 2 would be $800 greater than at the end of Year 1. d) Total fund balance at the end of Year 2 would be the same as it was at the end of Year 1 69. Which of the following is the primary reason why governments formally integrate their legally adopted budget into their accounting systems? a) It is required by GASB. b) It enables the government to better control its expenditures. c) It keeps the government from overspending its budget. d) It helps a government by letting it know when it is in danger of overspending its budget. 70. Washington County received goods that had been approved for purchase but for which payment had not yet been made. Should the following accounts be increased? Expenditures Encumbrances _ a) No No b) Yes Yes c) Yes No d) No Yes 71. In which of the following cases would the reserve for encumbrances account be decreased? a) Budget revisions are made, decreasing appropriations b) Payment is made for goods received c) Goods, related to purchase orders, are received d) Purchase orders are issued 72. A review of Park City’s books shows the following information: I. $2,500 of outstanding vouchers payable II. $3,000 of outstanding purchase order amounts Which of these amounts would you expect to see in the general fund’s encumbrances account? a) $2,500 b) $3,000 c) $5,500 d) $500 73. Per GASB standards, a budget-to-actual comparison must include columns for the actual results and a) The original budget only. b) The final budget only. c) Both the original and the final budget. d) Both the amended and the final budget. 74. Carolina City places an order for a specific item of equipment and encumbers $6,000 for that item. The equipment arrives with an invoice for $5,700. Which of the following entries should the city make upon receipt of the equipment? a) A debit to expenditures for $5,700, a debit to accounts payable for $300, and a credit to encumbrances for $6,000. b) A debit to expenditures for $5,700, a debit to reserve for encumbrances for $6,000, a credit to accounts payable for $5,700, and a credit to encumbrances for $6,000. c) A debit to expenditures for $5,700, a debit to reserve for encumbrances for $300, and a credit to accounts payable for $6,000. d) A debit to expenditures for $300, a debit to reserve for encumbrances for $5,700, and a credit to encumbrances for $6,000. 75. As used in governmental accounting, interperiod equity refers to a concept of a) providing the same level of services to citizens each year. b) measuring whether current year revenues are sufficient to pay for current year services. c) levying property taxes at the same rate each year. d) requiring that general fund budgets be balanced each year. 76. For fund financial statements, the measurement focus and basis of accounting used by governmental fund types are a) current financial resources and modified accrual accounting. b) economic resources and modified accrual accounting. c) financial resources and full accrual accounting. d) economic resources and full accrual accounting. 77. As used in defining the modified accrual basis of accounting, the term “available” means a) received in cash. b) will be received in cash within 60 days after year-end. c) collection in cash is reasonably assured. d) collected within the current period or expected to be collected soon enough thereafter to be used to pay liabilities of the current period. 78. Under the modified accrual basis of accounting, derived nonexchange revenues are recognized when a) they are earned. b) they are measurable and available to finance the expenditures of the current period. c) the underlying exchange transaction occurs. d) the underlying exchange transaction occurs and they are measurable and available to finance the expenditures of the current period. 79. Under the accrual basis of accounting, property tax revenues are recognized a) when they are received in cash. b) in the year for which they were levied. c) in the year for which they were levied and when collection in cash is reasonably assured. d) when they are available to finance expenditures of the fiscal period. 80. Under the modified accrual basis of accounting, the amount of property tax revenues that should be recognized by a government in the current year related to the current-year levy will be a) the total amount of the levy. b) the expected collectible portion of the levy. c) the portion of the levy collected. d) the portion of the levy collected in the current year or within sixty days after the end of the fiscal period. 81. Under the modified accrual basis of accounting, investment revenues for the current period should include a) only interest and dividends received. b) all interest and dividends received during the period plus all accruals of interest and dividends earned. c) all interest and dividends received plus gains and losses on securities that were sold during the period. d) all interest and dividends received, all gains and losses on securities sold, and all changes in market values on securities held in the portfolio at year-end. 82. Under the accrual basis of accounting used by governments, investment revenues for the current period should include a) only interest and dividends received. b) all interest and dividends received during the period plus all accruals of interest and dividends earned. c) all interest and dividends received plus gains and losses on securities that were sold during the period. d) all interest and dividends received, all gains and losses on securities sold, and all changes in market values on securities held in the portfolio at year-end. 83. Under the modified accrual basis of accounting, gains and losses on disposal of capital assets a) are not recognized. b) are recognized when the proceeds (cash) of the sale are received (on the installment basis). c) are recognized only if there is a gain. d) are recognized when the sale occurs, regardless of when the cash is collected. 84. . Under the accrual basis of accounting, gains and losses on disposal of capital assets a) are not recognized. b) are recognized when the proceeds (cash) of the sale are received (on the installment basis). c) are recognized only if there is a gain. d) are recognized when the sale occurs, regardless of when the cash is collected. 85. A city that has a 12/31 fiscal year end has adopted a policy of recognizing the maximum amount of property tax revenue allowable under GAAP. Property taxes of $720,000 (of which 10 percent are estimated to be uncollectible) are levied in October 2013 to finance the activities of the fiscal year 2014. During 2014, cash collections related to property taxes levied in October 2013 were $600,000. In 2015 the following amounts related to the property taxes levied in October 2013 were collected: January $30,000; March, $6,000. For the fiscal year ended 12/31/14, what amount should be recognized as property tax revenues related to the 2013 levy on the governmental fund financial statements? a) $720,000. b) $648,000. c) $630,000. a) $600,000. 86. A city that has a 12/31 fiscal year end has adopted a policy of recognizing the maximum amount of property tax revenue allowable under GAAP. Property taxes of $720,000 (of which 10 percent are estimated to be uncollectible) are levied in October 2013 to finance the activities of the fiscal year 2014. During 2014, cash collections related to property taxes levied in October 2013 were $600,000. In 2015the following amounts related to the property taxes levied in October 2013 were collected: January $30,000; March $6,000. For the fiscal year ended 12/31/14, what amount should be recognized as property tax revenues related to the 2013 levy on the government-wide financial statements? a) $720,000. b) $648,000. c) $630,000. d) $600,000. 87. A city that has a 12/31 fiscal year end has adopted a policy of recognizing property tax revenue consistent with the 60-day rule allowable period under GAAP. Property taxes of $600,000 (of which none are estimated to be uncollectible) are levied in October 2013 to finance the activities of fiscal year 2014. Property taxes are due in two installments June 20 and December 20. Cash collections related to property taxes are as follows: 1/15/14 for property taxes levied in 2012, due in 2013 $ 25,000 2/15/14 for property taxes levied in 2012, due in 2013 $ 15,000 3/15/14 for property taxes levied in 2012, due in 2013 $ 10,000 6/20/14 First installment of taxes levied in 2013, due 6/20/14 $350,000 12/20/14 Second installment of taxes levied in 2013, due 12/20/14 $150,000 1/15/15 for property taxes levied in 2013, due in 2014 $ 15,000 2/15/15 for property taxes levied in 2013, due in 2014 $ 10,000 3/15/15 for property taxes levied in 2013, due in 2014 $ 5,000 The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2014 is: a) $600,000. b) $575,000. c) $535,000. d) $525,000. 88. A city that has a 12/31 fiscal year end has adopted a policy of recognizing property tax revenue consistent with the 60-day rule allowable period under GAAP. Property taxes of $600,000 (of which none are estimated to be uncollectible) are levied in October 2013 to finance the activities of fiscal year 2014. Property taxes are due in two installments June 20 and December 20. Cash collections related to property taxes are as follows: 1/15/14 for property taxes levied in 2012, due in 2013 $ 25,000 2/15/14 for property taxes levied in 2012, due in 2013 $ 15,000 3/15/14 for property taxes levied in 2012, due in 2013 $ 10,000 6/20/12 First installment of taxes levied in 2013, due 6/20/14 $350,000 12/20/14 Second installment of taxes levied in 2013, due 12/20/14 $150,000 1/15/15 for property taxes levied in 201, due in 2014 $ 15,000 2/15/15 for property taxes levied in 2013, due in 2014 $ 10,000 3/15/12 for property taxes levied in 2013, due in 2014 $ 5,000 The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2014 is: a) $600,000. b) $575,000. c) $535,000. d) $525,000. 89. Under GAAP, property taxes levied in one fiscal period to finance the activities of the following fiscal period are recognized as revenue in the governmental fund financial statements a) in the year levied. b) in the year for which they are intended to finance the activities. c) when collected, regardless of when levied. d) in the year for which they are intended to finance the activities, if collected within that period or within a period no greater than 60 days after the close of the fiscal year. 90. A city levies a 2 percent sales tax. Sales taxes must be remitted by the merchants to the City by the twentieth day of the month following the month in which the sale occurred. Cash received by the city related to sales taxes is as follows: Amount received 1/20/14, applicable to December 2013 sales $100 Amount received 2/20/14, applicable to January 2014 sales $ 30 Amount received during 2014 related to February-November 2014 sales $400 Amount received 1/20/15 for December 2014 sales $110 Amount received 2/20/15 for January 2015 $ 40 Assuming the city uses the same period to define “available” as the maximum period allowable for property taxes, what amount should it recognize in the governmental fund financial statements as sales tax revenue for the fiscal year ended 12/31/14? a) $430. b) $530. c) $540. d) $550. 91. A city levies a 2 percent sales tax. Sales taxes must be remitted by the merchants to the city by the twentieth day of the month following the month in which the sale occurred. Cash received by the city related to sales taxes is as follows: Amount received 1/20/14, applicable to December 2013 sales $100 Amount received 2/20/14, applicable to January 2014 sales $ 30 Amount received during 2014 related to February-November 2014 sales $400 Amount received 1/20/15 for December 2014 sales $110 Amount received 2/20/15 for January 2015 $ 40 Assuming the city uses the same period to define “available” as the maximum period allowable for property taxes, what amount should it recognize in the government-wide financial statements as sales tax revenue for the fiscal year ended 12/31/14? a) $430. b) $530. c) $540. d) $550. 92. A city levies a 2 percent sales tax that is collected for them by the state. Sales taxes must be remitted by the merchants to the state by the 20th day of the month following the month in which the sale occurred. The state has a policy of remitting sales taxes to the city within 30 days of collection by the state. Cash received by the state related to sales taxes is as follows: Amount received 1/20/14, applicable to December 2013 sales $100 Amount received 2/20/14, applicable to January 2014 sales $ 30 Amount received 3/20/14, applicable to February 2014 sales $ 20 Amount received during 2014 related to March-November 2014 sales $380 Amount received 1/20/15 for December 2014 sales $110 Amount received 2/20/15 for January 2015 $ 40 Amount received 3/20/15 for February 2015 $ 10 Assuming the city uses the same period to define “available” as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its governmental fund financial statements for the fiscal year ended 12/31/14? a) $430. b) $530. c) $540. d) $550. 93. A city levies a 2 percent sales tax that is collected for them by the state. Sales taxes must be remitted by the merchants to the state by the twentieth day of the month following the month in which the sale occurred. The state has a policy of remitting sales taxes to the city within 30 days of collection by the state. Cash received by the state related to sales taxes is as follows: Amount received 1/20/14, applicable to December 2013 sales $100 Amount received 2/20/14, applicable to January 2014 sales $ 30 Amount received 3/20/14, applicable to February 2014 sales $ 20 Amount received during 2014 related to March-November 2014 sales $380 Amount received 1/20/15 for December 2014 sales $110 Amount received 2/20/15 for January 2015 $ 40 Amount received 3/20/15 for February 2015 $ 10 Assuming the city uses the same period to define “available” as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its government-wide financial statements for the fiscal year ended 12/31/14? a) $430. b) $530. c) $540. d) $550. 94. During 2014, a state has the following cash collections related to state income taxes Payroll withholdings and estimated payments related to 2014 income $360 4/15/14 Balance of 2013 (net of $10 refunds) income taxes $ 40 1/15/15 payroll withholdings and estimated payments related to 2014 income $ 30 2/15/15 payroll withholdings and estimated payments related to 2014 income $ 35 3/15/15 payroll withholdings and estimated payments related to 2015 income $ 25 4/15/15 Balance of 2014 (net of $5 refunds) income taxes $ 45 Assuming that the state defines “available” as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2014 governmental fund financial statements related to state income taxes? a) $400. b) $405. c) $430. d) $465. 95. During 2014, a state has the following cash collections related to state income taxes Payroll withholdings and estimated payments related to 2014 income $360 4/15/14 Balance of 2013 (net of $10 refunds) income taxes $ 40 1/15/15 payroll withholdings and estimated payments related to 2014 income $ 30 2/15/15 payroll withholdings and estimated payments related to 2014 income $ 35 3/15/15 payroll withholdings and estimated payments related to 2014 income $ 25 4/15/15 Balance of 2014 (net of $5 refunds) income taxes $ 45 Assuming that the state defines “available” as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2014 government-wide financial statements related to state income taxes? a) $400. b) $475. c) $430. d) $465. E) 495 96. A city with a 12/31 fiscal year-end requires that restaurants buy a license, renewable yearly. Proceeds of the license fees are intended to pay the salaries of inspectors in the health department. Licenses are issued for a fiscal year from October 1 to September 30. During 2014, cash collections related to licenses were as follows Licenses issued during 2013 for the 10/1/13-9/30/14 fiscal year $ 30 Licenses issued during 2014 for the 10/1/14-9/30/15 fiscal year $180 It is anticipated that during 2015 the amount collected on licenses for the 10/1/14-9/30/15 fiscal year will be $45. In September 2013 the amount collected related to 10/1/13-9/30/14 licenses was $144. What amount should be recognized as revenue in the fund financial statements for the fiscal year ended 12/31/14? a) $180. b) $183. c) $210. d) $225. 97. During 2014, the city issued $300 in fines for failure to keep real property in ‘acceptable’ condition. During that period the city spent $200 to mow and clean up the unoccupied properties for which the fines were assessed. The city estimates that $30 of the fines issued in 2014 will be uncollectible. During 2014 the city collected $230 related to 2014 fines and $20 related to 2013 fines. The amount of revenue that the city should recognize in its 2014 governmental fund financial statements related to fines is a) $230. b) $250. c) $270. d) $300. 98. Last year a city received notice of a $150,000 grant from the state to purchase vehicles to transport physically challenged individuals. During the current year the city received the entire $150,000, purchased a bus for $65,000, and issued a purchase order for a van for $60,000. The grant revenue that the city should recognize on the government-wide financial statements in the current year is a) $-0-. b) $ 65,000. c) $125,000. d) $150,000. 99. A city receives notice of a $150,000 grant from the state to purchase vans to transport physically challenged individuals. Although the city did not receive any of the grant funds during the current year, the city purchased a bus for $65,000 and issued a purchase order for a van for $60,000. The grant revenue that the city should recognize in the government-wide financial statements in the current year is a) $-0-. b) $ 65,000. c) $125,000. d) $150,000. 100. At the beginning of its fiscal year, a local government owned an investment with a historical cost of $85 and a fair value of $95. During the year, dividends of $2 were received. At the end of the year, the investment had a fair value of $100. The amount that should be recognized on the governmental fund financial statements for the year as investment income is a) $-0-. b) $7. c) $15. d) $17. 101. A local government began the year with a portfolio of securities with an historical cost of $1,200 and a fair value of $1,240. During the year the government acquired an additional security at a cost of $260 and sold for $200 a security that had an historical cost of $172 and a fair value at the beginning of the year of $190. At the end of the year, the securities portfolio had a fair value of $1,330. The amount that should be recognized on the financial statements for the year as investment income is a) $10. b) $20. c) $28. d) $30. 102. Under GAAP, investment income for governments must include a) only dividends and interest received during the period. b) only dividends and interest earned during the period. c) only realized gains and losses. d) dividends and interest received during the period and both realized and unrealized gains and losses 103. A government is the recipient of a bequest of a multi-story office building that the government intends to use as a new city hall. The building has a historical cost of $850,000; a book value in the hands of the benefactor of $700,000; and a fair value of $1,050,000. The city should recognize on its governmental fund financial statements donations revenue of a) $-0-. b) $700,000. c) $850,000. d) $1,050,000. 104. A government is the recipient of a bequest of a multi-story office building that the government intends to sell to support program activities. The building has a historical cost of $850,000, a book value in the hands of the benefactor of $700,000, and a fair value of $1,050,000. The city had not yet begun to try to sell the building when its annual financial statements were issued. The city should recognize on its governmental fund financial statements, donations revenue of a) $-0-. b) $700,000. c) $850,000. d) $1,050,000. 105. Which of the following funds would use the modified accrual basis of accounting in preparing its fund financial statements? a) City Electric Utility Enterprise Fund. b) City Hall Capital Projects Fund. c) City Motor Pool Internal Service Fund. d) City Employee Pension Trust Fund. 106. Which of the following funds would use the accrual basis of accounting in preparing its fund financial statements? a) City General Fund. b) City Hall Capital Projects Fund. c) City Motor Pool Internal Service Fund. d) None of the above. 107. As used in government accounting, expenditures are decreases in a) Net assets. b) Net current financial resources. c) Net cash. d) Net economic resources. 108. Assume that the City of Juneau maintains its books and records to facilitate the preparation of its fund financial statements. The city pays its employees bi-weekly on Friday. The fiscal year ended on Wednesday, June 30. Employees had been paid on Friday, June 25. The employees paid from the general fund had earned $90,000 on Monday, Tuesday, and Wednesday (June 28, 29, and 30). What entry, if any, should be made in the city’s general fund on June 30? a) Debit Expenditures $90,000; credit Wages and salaries payable $90,000. b) Debit Expenses $90,000; credit Wages and salaries payable $90,000. c) Debit Expenditures $90,000; credit Encumbrances $90,000. d) No entry is required. 109. Assume that the City of Juneau maintains its books and records to facilitate the preparation of its government-wide financial statements. The city pays its employees bi-weekly on Friday. The fiscal year ended on Wednesday, June 30. Employees had been paid on Friday, June 25. The employees paid from the general fund had earned $90,000 on Monday, Tuesday, and Wednesday (June 28, 29, and 30). They will earn $60,000 on Thursday and Friday (July 1 and 2). What entry, if any, should be made on June 30? a) Debit Expenditures $90,000; credit Wages and salaries payable $90,000. b) Debit Expenditures $150,000; credit Wages and salaries payable $150,000. c) Debit Expenses $90,000; credit Wages and salaries payable $90,000. d) No entry is required. 110. Employees of the City of Orleans earn ten days paid leave for each 12 months of employment. The city has a policy that employees must take their vacation days during the year following the year in which they are earned. If they do not take vacation in the allotted period, they forfeit the vacation pay benefit. Traditionally, employees have taken 80 percent of the vacation days earned. During the current year, city employees earned $600,000 in vacation pay. Assuming the city maintains its books and records in a manner to facilitate the preparation of fund financial statements, which of the following entries should be made in the general fund to record the vacation pay earned during the current period? a) Debit Expenditures $600,000; credit Vacation pay payable $600,000. b) Debit Expenses $600,000; credit Vacation pay payable $600,000. c) Debit Expenditures $480,000; credit Vacation pay payable $480,000. d) No entry required. 111. Employees of the City of Orleans earn ten days paid leave for each 12 months of employment. The city has a policy that employees must take their vacation days during the year following the year in which they are earned. If they do not take vacation in the allotted period, they forfeit the vacation pay benefit. Traditionally, employees have taken 80 percent of the vacation days earned. During the current year, city employees earned $600,000 in vacation pay. Assuming the city maintains its books and records in a manner to facilitate the preparation of government-wide financial statements, which of the following entries should be made to record the vacation pay earned during the current period? a) Debit Expenditures $600,000; credit Vacation payable $600,000. b) Debit Expenses $600,000; credit Vacation payable $600,000. c) Debit Expenses $480,000; credit Vacation pay payable $480,000. d) No entry required. 112. Employees of the general fund of Scott City earn ten days of vacation for each 12 months of employment. The city permits employees to carry the vacation days forward as long as they wish. During the current year employees earned $800,000 of vacation benefits, of which the city estimates $500,000 will be taken in the next year and the balance will be carried forward. Assuming that the city maintains its books and records in a manner that facilitates the preparation of fund financial statements, which of the following entries should be made in the general fund to record the vacation pay earned during the current period? a) Debit Expenditures $800,000; credit Vacation pay payable $800,000. b) Debit Expenditures $500,000; credit Vacation pay payable $500,000. c) Debit Vacation expense $800,000; credit Vacation pay payable $800,000. d) No entry required. 113. Employees of the general fund of Scott City earn ten days of vacation for each 12 months of employment. The city permits employees to carry the vacation days forward as long as they wish. During the current year employees earned $800,000 of vacation benefits, of which the city estimates $500,000 will be taken in the next year and the balance will be carried forward. Assuming that the city maintains its books and records in a manner that facilitates the preparation of government-wide financial statements, which of the following entries should be made to record the vacation pay earned during the current period? a) Debit Expenditures $800,000; credit Vacation pay payable $800,000. b) Debit Expenditures $500,000; credit Vacation pay payable $500,000. c) Debit Vacation expense $800,000; credit Vacation pay payable $800,000. d) No entry required. 114. State Community College, a public college, grants faculty members a one-year sabbatical leave after each seven years of service. There are no requirements for research, study, or service during the compensated sabbatical leave. A particular faculty member earns $40,000 per year. Assuming that the college maintains its books and records in a manner that facilitates the preparation of fund financial statements and assuming that any appropriate accruals have been made, what is the appropriate entry to record the employee’s salary paid while on sabbatical? a) Debit Expenditures $40,000; Credit Cash $40,000. b) Debit Sabbatical leave payable $40,000; Credit Cash $40,000. c) Debit Expenditures $40,000; Credit Sabbatical leave payable $40,000. d) No entry required. 115. State University, a public university, has a policy of granting faculty members a one-year paid sabbatical leave after a period of seven years continuous employment. The leave is for further study, research, or public service. A particular faculty member earns $90,000 per year. Assuming that the college maintains its books and records in a manner that facilitates the preparation of fund financial statements and assuming that any appropriate accruals have been made, what is the appropriate entry to record the employee’s salary paid while on sabbatical leave? a) Debit Expenditures $90,000; Credit Cash $90,000. b) Debit Expenses $90,000; Credit Cash $90,000. c) Debit Sabbatical leave payable $90,000; Credit Cash $90,000. d) No entry required. 116. State University, a very large public university, has a policy of granting faculty members a one-year sabbatical leave after a period of seven years of continuous employment. The leave is to be used for further study, research, or service. During the fiscal year ended 6/30/15, the university paid $3 million to faculty members on sabbatical leave and estimated that faculty members currently not on sabbatical leave earned $3.5 million toward sabbatical leaves they are likely to take in the future. The amount of sabbatical expenditures for the year ended 6/30/15 should be a) $0 million. b) $3 million. c) $3.5 million. d) $6.5 million. 117. Culver City recognizes as revenues/expenditures those amounts collected/paid during the year or within 60 days of fiscal year-end. The city offers a pension benefit to its employees who meet certain age and years of employment criteria. The city participates in the State Pension Plan. Per its contractual arrangement, the city’s required contribution to the State Pension Plan for the fiscal year ended 6/30/15 is $5 million. Due to cash inflow shortages the city, which budgeted $5 million for pension contributions, paid only $4 million in the fiscal year ended 6/30/15. The city paid the remaining amount on September 30, 2015. Assuming the city maintains its books and records in a manner that facilitates the preparation of government-wide financial statements, how should the city record the pension contribution and any associated liability for the year ended 6/10/15? a) Debit Expenditures $5 million; Credit Cash $4 million and Pension contribution payable $1 million. b) Debit Expenses $5 million; Credit Cash $4 million and Pension contribution payable $1 million. c) Debit Expenditures $4 million; Credit Cash $4 million. d) Debit Expenses $4 million; Credit Cash $4 million. 118. The amount of pension expense that a government should recognize in its government-wide financial statements during the current year is a) The amount paid. b) The amount paid plus the amount that will be paid with available expendable financial resources. c) The amount paid so long as it does not exceed the contractually agreed amount. d) The contractually agreed amount. 119. Several years ago, Grant County was sued by a former county employee for wrongful discharge. Although it was to be contested by the county, at the time of the lawsuit the attorneys believed that the county was likely to lose the suit and the estimated amount of the ultimate judgment would be $100,000. This year, the case was finally settled with a judgment against the county of $150,000, which was paid. Assuming that the county maintains its books and records in a manner to facilitate the preparation of its fund financial statements, the entry in the current year should be a) Debit Expenditures $150,000; Credit Cash $150,000. b) Debit Expenses $150,000; Credit Cash $150,000. c) Debit Expenditures $50,000 and Claims payable $100,000; Credit Cash $150,000. d) Debit Expenses $50,000 and Claims payable $100,000; Credit Cash $150,000. 120. Bay City uses the purchases method to account for supplies. At the beginning of the year the city had no supplies on hand. During the year the city purchased $600,000 of supplies for use by activities accounted for in the general fund. The city used $400,000 of those supplies during the year. Assuming that the city maintains its books and records in a manner that facilitates the preparation of its fund financial statements, at fiscal year-end the appropriate account balances related to supplies expenditures and supplies inventory would be a) Expenditures $600,000; Supplies inventory $200,000. b) Expenditures $600,000; Supplies inventory $0. c) Expenditures $400,000; Supplies inventory $200,000. d) Expenditures $400,000; Supplies inventory $0. 121. Shoshone County uses the consumption method to account for supplies. At the beginning of the year the city had no supplies on hand. During the year the city purchased $450,000 of supplies for use by activities accounted for in the general fund. The city used $300,000 of those supplies during the year. At fiscal year-end, the appropriate account balances on the general fund financial statements would be a) Expenditures $450,000; Supplies inventory $150,000. b) Expenditures $450,000; Supplies inventory $0. c) Expenditures $300,000; Supplies inventory $150,000. d) Expenditures $300,000; Supplies inventory $0. 122. Sugar City uses the purchases method to record all prepayments. The city has a 6/30 fiscal year-end. On 12/31/14, the city purchased a three-year insurance policy covering all city owned vehicles acquired by the general fund to be used in general government activities. Cost of the policy was $360,000. After the 6/30/15 closing entries, the appropriate balance sheet accounts and balances in the city’s general fund associated with this transaction are a) Prepaid insurance $300,000; Expenditures $60,000. b) Prepaid insurance $300,000; Expenditures $360,000 c) Prepaid insurance $0; Expenditures $360,000. d) Prepaid insurance $0; Expenditures $60,000. 123. Campbell County uses the consumption method to record all inventories and prepayments. The County has a 9/30 fiscal year-end. On April 1, 2015, the county purchased a two-year insurance policy at a total cost of $400,000, paying for the policy out of the general fund. In the fund financial statements, the amount of insurance expenditures for the fiscal year ended 9/30/15 would be a) $400,000. b) $300,000. c) $200,000. d) $100,000. 124. The City of Roswell has a 6/30 fiscal year-end. The city uses the consumption method for recognizing inventories and prepayments. On July 1, 2014, the city leased computer equipment for use in the city’s general activities. The lease is a three-year lease that qualifies as an operating lease. The city prepaid the entire three-year rental fee of $45,000. At June 30, 2015, the appropriate account balances in the general fund associated with this transaction would be a) Prepaid lease $0; Expenditures $45,000; Fund balance-nonspendable $0. b) Prepaid lease $45,000; Expenditures $0; Fund balance-nonspendable $45,000. c) Prepaid lease $30,000; Expenditures $45,000; Fund balance-nonspendable $30,000. d) Prepaid lease $30,000; Expenditures $15,000; Fund balance-nonspendable $0. 125. Pocahontas School District, an independent public school district, financed the acquisition of a new school bus by signing a note for $105,000 plus interest on the unpaid balance at 6 percent. Annual principal payments of $35,000, plus interest, are due each July 1. Assuming that the district maintains its books and records in a manner that facilitates the preparation of the government-wide financial statements, the appropriate entry at the date of acquisition is a) Debit Expenditures $105,000; Credit Notes payable $105,000. b) Debit Capital assets $105,000; Credit Notes payable $105,000. c) Debit Expenditures $105,000; Credit Other financing sources $105,000. d) Debit Capital assets $105,000; Credit Other financing sources $105,000. 126. Star City leased a bulldozer for use in activities accounted for in the general fund. The city paid $40,000 and agreed to pay $40,000 per year for 3 years. The bulldozer has a useful life of six years. The lease qualified as a capital lease. Assuming that the city maintains is books and records in a manner that facilitates the preparation of the government-wide financial statements, the appropriate entry at the date of acquisition would be a) Debit Expenditures $160,000; Credit Cash $40,000 and Other financing sources $120,000. b) Debit Expenditures $53,333 and Prepaid lease $106,667; Credit Cash $40,000 and Other financing sources $120,000. c) Debit Equipment $160,000; Credit Cash $40,000 and Lease payable $120,000. d) Debit Expenditures $160,000; Credit Cash $40,000 and Lease payable $120,000. 127. Banker County has outstanding $4 million of term bonds that bear interest at 6 percent payable semiannually each January 30 and July 30. The county’s fiscal year-end is 12/31. On December 28, 2015, the County transferred $240,000 to a debt service fund. At December 31, the maximum amount the debt service fund may recognize as interest expenditure is a) $120,000 b) $240,000. c) $100,000. d) $0. 128. A city is the recipient of a cash bequest of $500,000 that must be used to plant flowers and shrubs in the city parks. During the year only $200,000 is actually received from the bequest and $150,000 is spent on shrubs. The amount that should be recognized as revenue by the city in its government-wide financial statements in the current year is a) $-0-. b) $150,000. c) $200,000. d) $500,000. 129. Governments should recognize revenue from donated capital assets that will be sold to support the government’s programs at which amount in their government-wide financial statements? a) historical cost to the donor. b) book value in the hands of the donor. c) fair value of the donated assets. d) zero. 130. State governments should recognize food stamp revenue a) when they receive the food stamps. b) when food stamps are distributed by the state to eligible recipients. c) when the recipient uses the food stamps d) never. Food stamps are not financial resources. 131. Endowments are provided to governments with the specification that only the revenues generated from—not the contributed assets—may be used to finance specific programs. A government should recognize revenue from the initial endowment when a) it receives the assets (cash). b) when it receives the pledge. c) ratably over 30 years. d) never. The contributions themselves cannot be used to support the government’s programs. 132. Which of the following are not characterized as non-exchange revenues? a) Sales taxes. b) Property taxes. c) Fines and forfeits. d) Charges for services. 133. Which of the following are derived tax revenues? a. Income taxes. b. Sales taxes. c. Both of the above. d. Neither of the above Released CPA Questions: 134. In applying the criteria used for determination of major funds required for reporting in a government's fund financial statements, a government would consider which of the following statistics? Aggregate Revenues Aggregate Assets Aggregate Fund or Expenditures/Expenses or Liabilities Balance/Equity a. Yes Yes Yes b. Yes Yes No c. Yes No No d. No Yes Yes 135. Cal City maintains se-..eral major fund types. The following were among Cal's cash receipts during the current year: Unrestricted state grant $1,000,000 Interest on bank accounts held for employees' pension plan 200,000 What amount of these cash receipts should be accounted for in Cal's general fund? a. $1,200,000 b. $1,000,000 c. $200,000 d. $0 136. Sample City has elected to adopt the standards of GASB #34 early relative to the preparation of their financial statements. The city has identified the non-major funds within its fund types. In its financial report, Sample City: a. Must include combining financial statements for non-major funds for each fund type in the basic financial statements. b. Must include combining financial statements for non-major funds for each fund type in the required supplementaryinformation. c. May include combining financial statements for non-major funds for each fund type in the supplementary information. d. Must include combining financial statement disclosures for non-major funds for each fund type in the notes to the financial statements. 137. Which of the following funds would be reported as a fiduciary fund in Pine City's financial statements? a. Special revenue. b. Permanent. c. Private-purpose trust. d. Internal service. 138. Kenn City obtained a municipal landfill and passed a local ordinance that required the city to operate the landfill so that the costs of operating the landfill, as well as the capital costs, are to be recovered with charges to customers. Which of the following funds should Kenn City use to report the activities of the landfill? a. Enterprise. b. Permanent. c. Special revenue. d. Internal service. 139. A government makes a contribution to its pension plan in the amount of $10,000 for year 1. The actuarially-determined annual required contribution for year 1 was $13,500. The pension plan paid benefits of $8,200 and refunded employee contributions of $800 for year 1. What is the pension expenditure for the general fund for year 1? a. $8,200 b. $9,000 c. $10,000 d. $13,500 140. Which of the following is one of the three standard sections of a governmental comprehensive annual financial report? a. Investment. b. Actuarial. c. Statistical. d. Single audit. 141. Which of the following financial categories are used in a nongovernmental not-for-profit organization's statement of financial position? a. Net assets, income, and expenses. b. Income, expenses, and unrestricted net assets. c. Assets, liabilities, and net assets. d. Changes in unrestricted, temporarily restricted, and permanently restricted net assets. 142. When a purchase order is released, a commitment is made by a governmental unit to buy a computer to be manufactured to specifications for use in property tax administration. This commitment should be recorded in the general fund as a (an): a. Appropriation. b. Encumbrance. c. Expenditure. d. Fixed asset. 143. A county's balances in the general fund included the following: Appropriations $745,000 Encumbrances 37,250 Expenditures 298,000 Vouchers payable 55,875 What is the remaining amount available for use by the county? a. $353,875 b. $391,125 c. $409,750 d. $447,000 144. Which event(s) is(are) supportive of interperiod equity as a financial reporting objective of a governmental unit? I. A balanced budget is adopted. II. Residual equity transfers out equals residual equity transfers in. a. I only. b. II only. c. Both I and II. d. Neither I nor II. 145. Which account should Spring Township credit when it issues a purchase order for supplies? a. Appropriations control. b. Vouchers payable. c. Encumbrance control. d. Reserve for encumbrances. 146. Receipts from a special tax levy to retire and pay interest on general obligation bonds should be recorded in which fund? a. General. b. Capital projects. c. Debt service. d. Special revenue. 147. Interfund transfers received by a governmental-type fund should be reported in the Statement of Revenues, Expenditures, and changes in Fund balance as a (an): a. Addition to contributed capital. b. Addition to net assets. c. Other financing source. d. Reimbursement. 148. Cedar City issues $1,000,000, 6% revenue bonds were issued at par on April 1, to build a new water line for the water enterprise fund. Interest is payable every six months. What amount of interest expense should be reported for the year ended December 31? a. $0 b. $30,000 c. $45,000 d. $60,000 149. When equipment was purchased with general fund resources, which of the following accounts would have been increased in the general fund? a. Due from general fixed asset account group. b. Expenditures. c. Appropriations. d. No entry should be made in the general fund. 150. Fund accounting is used by governmental units with resources that must be: a. Composed of cash or cash equivalents. b. Incorporated into combined or combining financial statements. c. Segregated for the purpose of carrying on specific activities or attaining certain objectives. d. Segregated physically according to various objectives. [Show More]

Last updated: 1 year ago

Preview 1 out of 35 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 13, 2020

Number of pages

35

Written in

Additional information

This document has been written for:

Uploaded

Oct 13, 2020

Downloads

1

Views

93

.png)

.png)

.png)

Complete 150 Questions and Answers Provided Exam Study Guide.png)

Complete 150 Questions and Answers Provided Exam Study Guide.png)

.png)