Business > CASE STUDY > BUS 3030 Chapter 11 Case 1/ Case Study 1: Digital Wallets on Mobile Devices: Apple and Google (All)

BUS 3030 Chapter 11 Case 1/ Case Study 1: Digital Wallets on Mobile Devices: Apple and Google

Document Content and Description Below

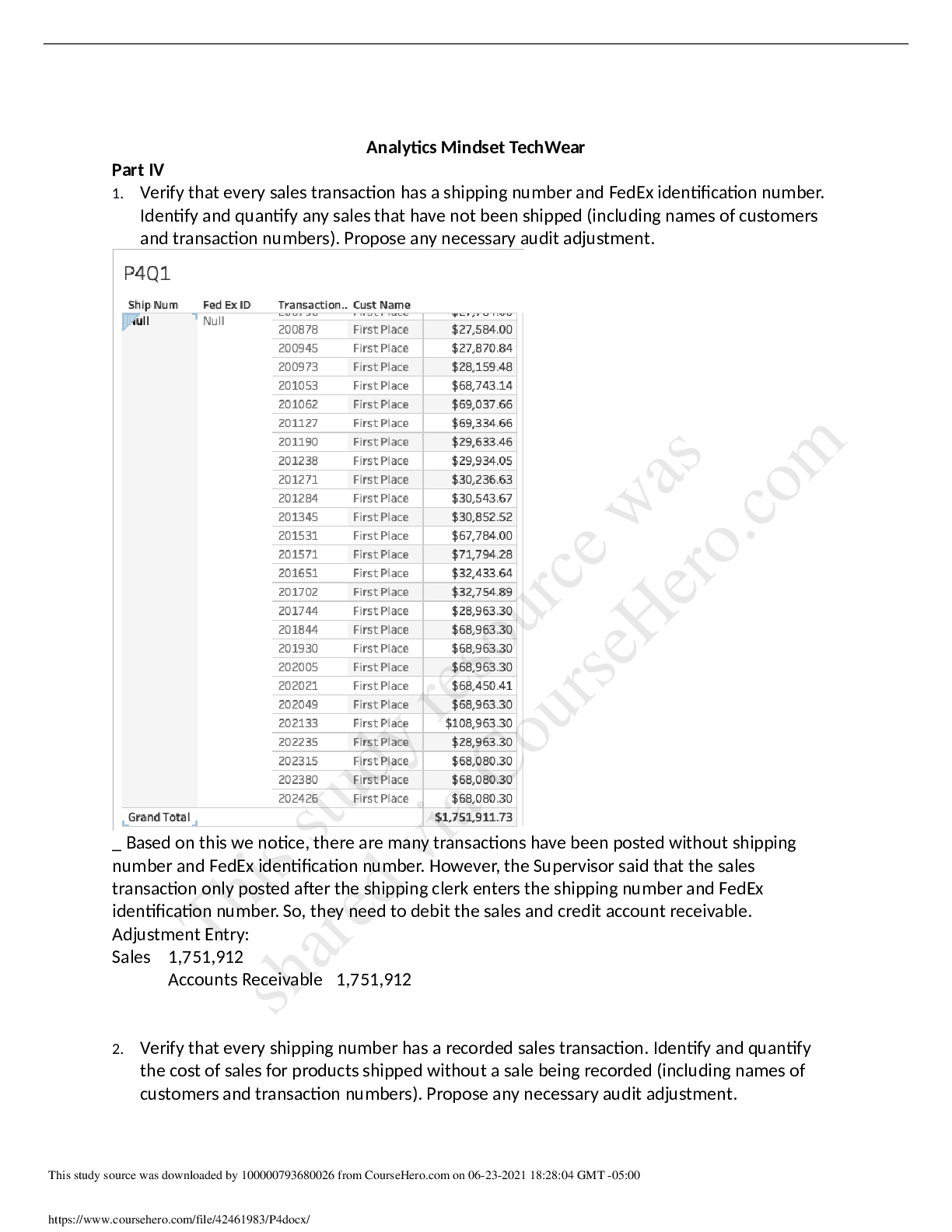

Case Study 1: Digital Wallets on Mobile Devices: Apple and Google One of the fastest-growing segments of the online payments business is mobile payments. U.S. mobile payments are expected to reach $14... 0 billion by 2019 and purchases using mobile devices could account for half of all online retail sales by 2017.Google introduced one of the first digital wallet products that would work on a mobile device in 2011 when it also introduced support for the operation of NFC chips in its Android mobile operating system. Google Wallet stores a MasterCard account for users that agree to maintain a cash balance with the card’s issuing bank, so it operates essentially as a debit card. Google Wallet does not charge a fee to merchants or the MasterCard issuing banks, nor does it charge a transaction fee. Instead, it generates revenue from advertisers who pay to display ads, offer coupons or other promotions (specific ads are displayed based on the mobile device’s proximity to the stores that are making the offers). Google Wallet has been slow to catch on with users.In 2014, Apple introduced a digital wallet product for its mobile devices called Apple Pay. In operation, Apple Pay is similar to Google Wallet; however, the infrastructure and revenue model is different. Apple Pay charges the issuing banks a fee of 0.05 percent of the transaction amount and guarantees each transaction; that is, if the transaction is fraudulent, Apple will cover the loss. Credit card companies normally charge merchants a fee ranging between 2 and 3 percent of the transaction amount, so the additional Apple Pay fee serves as a low-priced insurance plan for them. Consumers will not be charged at all for using Apple Pay and will not be given advertising messages. Further, Apple has stated that it does not collect information about consumer buying habits from Apple Pay data. Apple arranged for American Express, Discover, MasterCard, and Visa credit cards to be included in their system, along with a group of large card-issuing banks. They also included major retailers such as Bloomingdales, Disney, Staples, Walgreens and Whole Foods. These participants will be able to collect data on consumer buying habits, but only on those consumers that use their card or shop at their stores. Apple reported that more than a million credit cards were registered with Apple Pay in the first three days it was available. After Apple Pay’s introduction, an increase in the number of retailers that accept NFC payments (as you learned in this chapter, NFC technology is used by both Google Wallet and Apple Pay) caused an increase in the use of Google Wallet. (Schneider 499) Schneider, Gary. Electronic Commerce, 12th Edition. Cengage Learning, . [Show More]

Last updated: 1 year ago

Preview 1 out of 7 pages

.png)

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 08, 2021

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

Sep 08, 2021

Downloads

0

Views

39

.png)