Finance > QUESTIONS & ANSWERS > FIN 100 Chapter 5 Capital Budgeting Techniques Quiz 2021/2022 | Rated A (All)

FIN 100 Chapter 5 Capital Budgeting Techniques Quiz 2021/2022 | Rated A

Document Content and Description Below

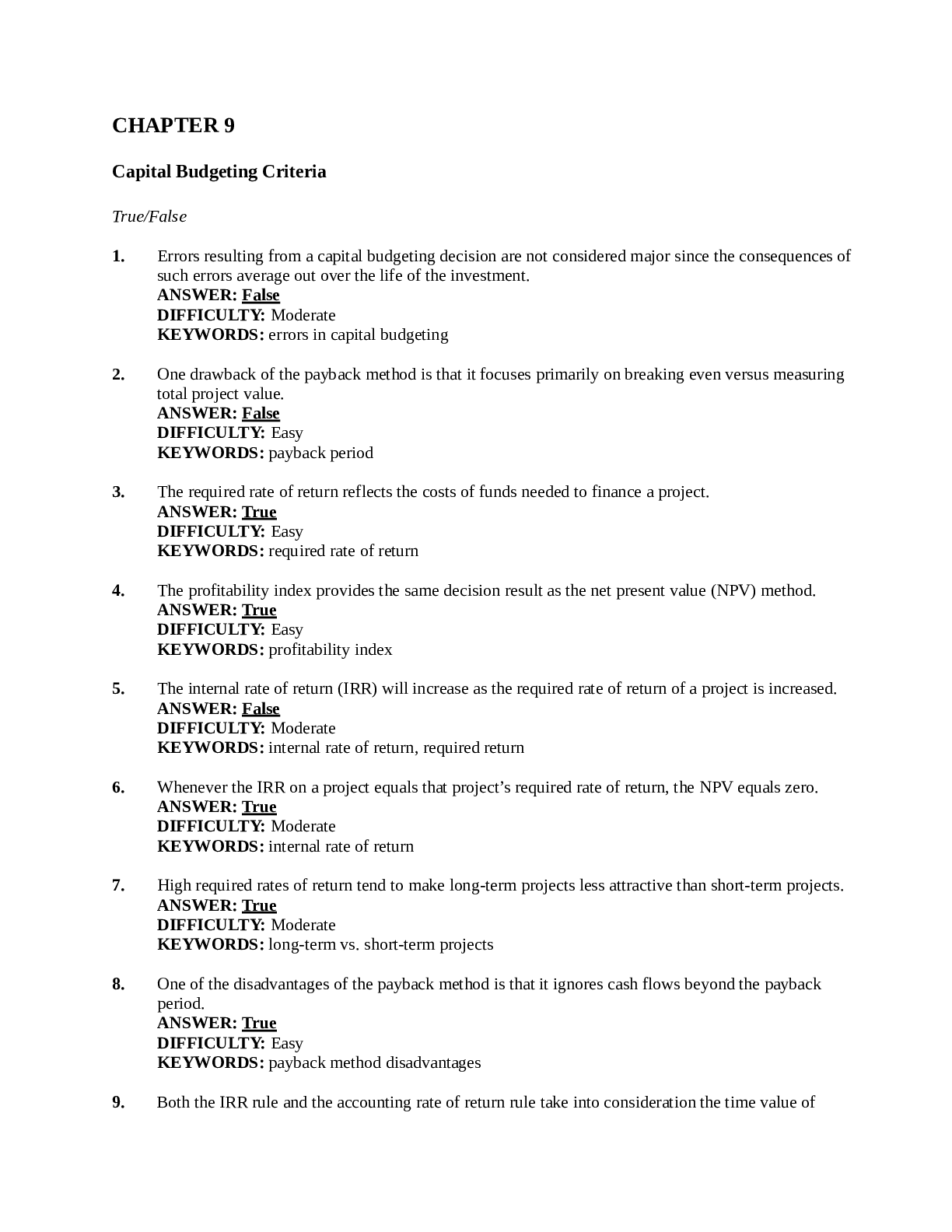

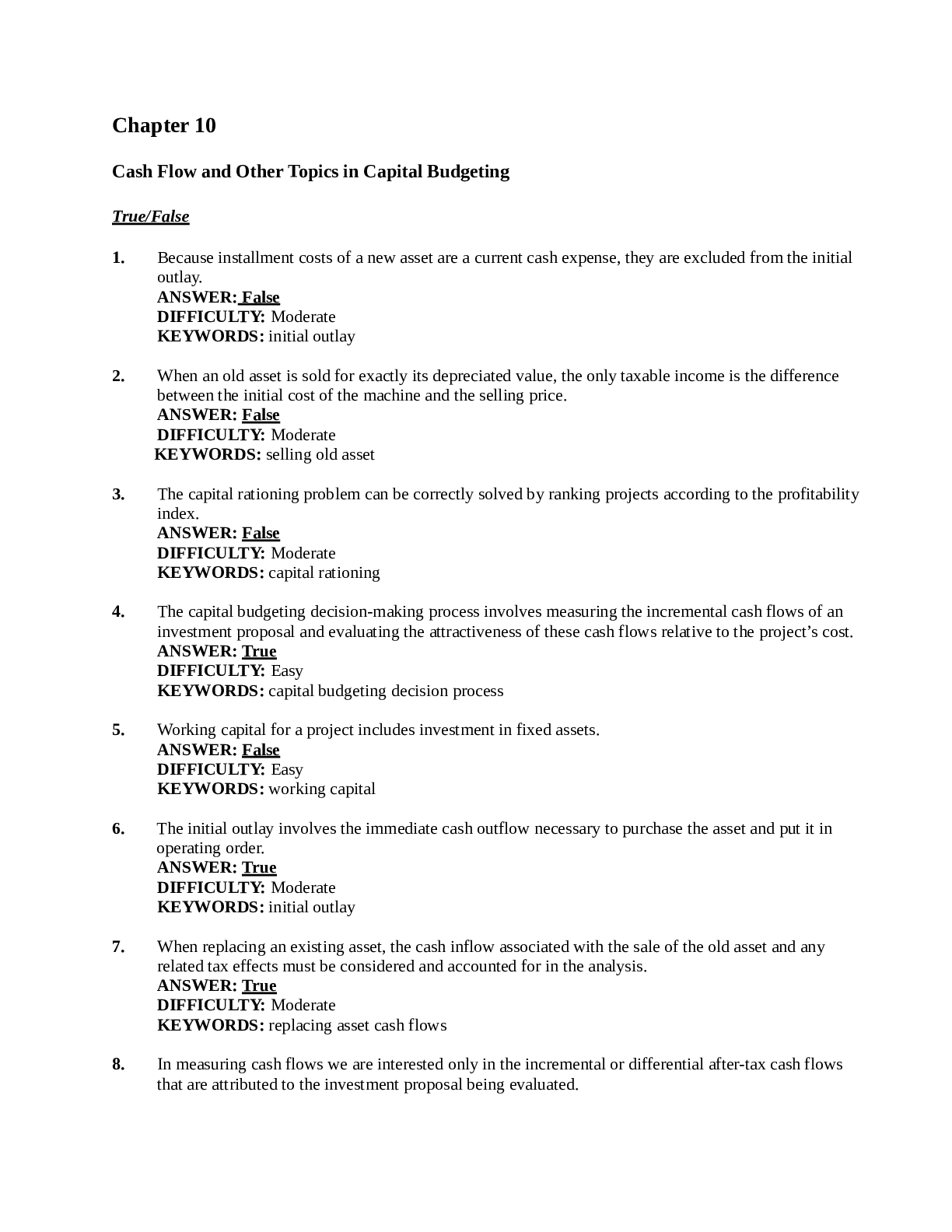

CHAPTER 9 Capital Budgeting Criteria True/False 1. Errors resulting from a capital budgeting decision are not considered major since the consequences of such errors average out over the life of th... e investment. ANSWER: False DIFFICULTY: Moderate KEYWORDS: errors in capital budgeting 2. One drawback of the payback method is that it focuses primarily on breaking even versus measuring total project value. ANSWER: False DIFFICULTY: Easy KEYWORDS: payback period 3. The required rate of return reflects the costs of funds needed to finance a project. ANSWER: True DIFFICULTY: Easy KEYWORDS: required rate of return 4. The profitability index provides the same decision result as the net present value (NPV) method. ANSWER: True DIFFICULTY: Easy KEYWORDS: profitability index 5. The internal rate of return (IRR) will increase as the required rate of return of a project is increased. ANSWER: False DIFFICULTY: Moderate KEYWORDS: internal rate of return, required return 6. Whenever the IRR on a project equals that project’s required rate of return, the NPV equals zero. ANSWER: True DIFFICULTY: Moderate KEYWORDS: internal rate of return 7. High required rates of return tend to make long-term projects less attractive than short-term projects. ANSWER: True DIFFICULTY: Moderate KEYWORDS: long-term vs. short-term projects 8. One of the disadvantages of the payback method is that it ignores cash flows beyond the payback period. ANSWER: True DIFFICULTY: Easy KEYWORDS: payback method disadvantages 9. Both the IRR rule and the accounting rate of return rule take into consideration the time value of money. ANSWER: False DIFFICULTY: Moderate KEYWORDS: internal rate of return, accounting rate of return 10. In general, all discounted cash flow criteria are consistent and will give similar accept-reject decisions. ANSWER: True DIFFICULTY: Moderate KEYWORDS: discounted cash flow criteria, accept-reject decisions 11. When several sign reversals in the cash flow stream occur, the IRR equation can have more than one positive IRR. ANSWER: True DIFFICULTY: Moderate KEYWORDS: multiple internal rates of return 12. Many firms today continue to use the payback method but employ the NPV or IRR methods as secondary decision methods of control for risk. ANSWER: False DIFFICULTY: Moderate KEYWORDS: payback, net present value, internal rate of return 13. The required rate of return represents the cost of capital for a project. ANSWER: True DIFFICULTY: Easy KEYWORDS: required rate of return, cost of capital 14. The IRR assumes that cash flows are reinvested at the cost of capital. ANSWER: False DIFFICULTY: Easy KEYWORDS: internal rate of return, reinvestment assumption 15. According to the modified internal rate of return (MIRR) technique, when a project’s MIRR is greater than its cost of capital, the project should be accepted. ANSWER: True DIFFICULTY: Moderate KEYWORDS: MIRR acceptance criteria 16. If the NPV of a project is zero, then the profitability index should equal one. ANSWER: True DIFFICULTY: Moderate KEYWORDS: net present value, profitability index 17. The net present value profile is a graph showing how a project’s NPV changes as the IRR changes. ANSWER: False DIFFICULTY: Moderate KEYWORDS: net present value profile 18. If the NPV of a project is positive, the profitability index must be greater than one. ANSWER: True DIFFICULTY: Moderate KEYWORDS: net present value, profitability index 19. It is possible for a project to have more than one IRR if there is more than one sign change in the aftertax cash flows due to the project. ANSWER: True DIFFICULTY: Moderate KEYWORDS: multiple IRRs 20. The higher the discount rate, the more valued is the proposal with the early cash flows. ANSWER: True DIFFICULTY: Moderate KEYWORDS: discount rate and value 21. If the project’s payback period is greater than or equal to zero, the project should be accepted. ANSWER: False DIFFICULTY: Moderate KEYWORDS: payback period 22. The NPV of a project will equal zero whenever the payback period of a project equals the required rate of return. ANSWER: False DIFFICULTY: Moderate KEYWORDS: net present value, payback period 23. The NPV of a project will equal zero whenever the average rate of return equals the required rate of return. ANSWER: False DIFFICULTY: Moderate KEYWORDS: net present value, required rate of return 24. The IRR is the discount rate that equates the present value of the project’s future net cash flows with the project’s initial outlay. ANSWER: True DIFFICULTY: Moderate KEYWORDS: internal rate of return 25. If a project’s profitability index is less than 0.0, then the project should be rejected. ANSWER: False DIFFICULTY: Moderate KEYWORDS: profitability index 26. A single project can only have one NPV, PI, and IRR. ANSWER: False DIFFICULTY: Moderate KEYWORDS: multiple IRRs 27. Competitive market forces make it imperative for a firm to have a systematic strategy for generating capital-budgeting projects. ANSWER: True DIFFICULTY [Show More]

Last updated: 1 year ago

Preview 1 out of 27 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 31, 2021

Number of pages

27

Written in

Additional information

This document has been written for:

Uploaded

Aug 31, 2021

Downloads

0

Views

39

.png)

.png)

.png)

.png)

.png)

.png)

.png)