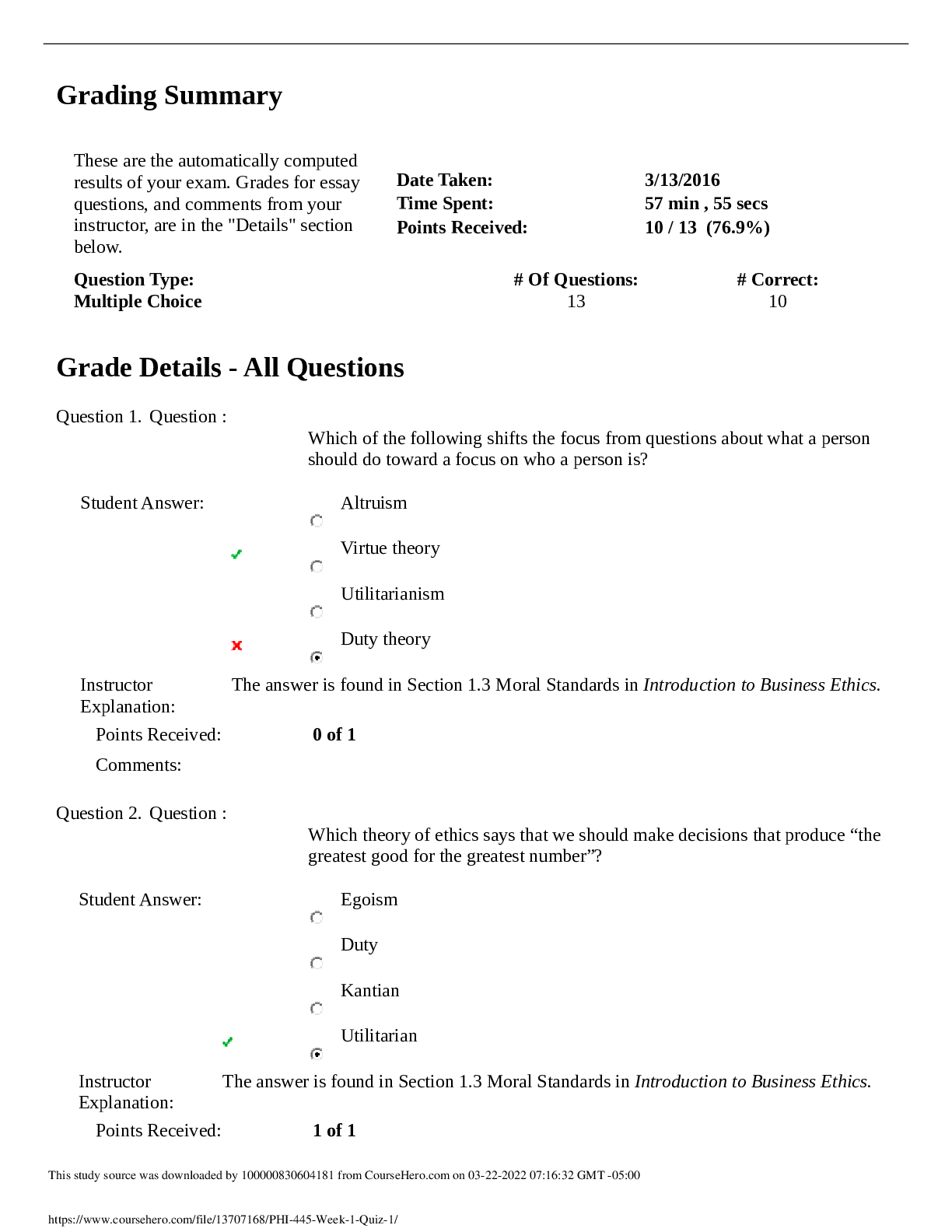

Finance > QUESTIONS & ANSWERS > FIN 100 Chapter 6 Cash flow in Caital Budgeting Quiz 2021/2022 | Rated A (All)

FIN 100 Chapter 6 Cash flow in Caital Budgeting Quiz 2021/2022 | Rated A

Document Content and Description Below

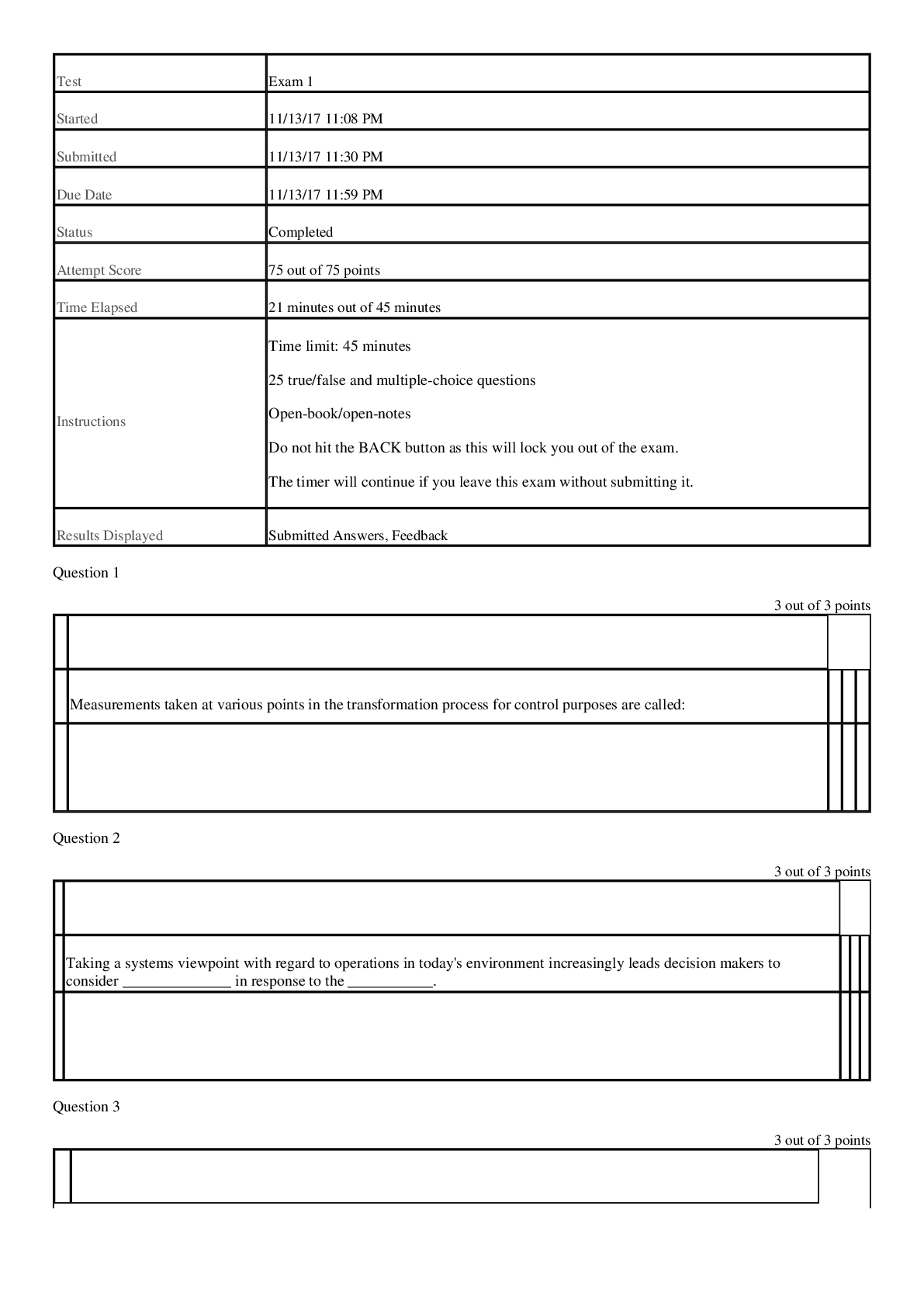

Cash Flow and Other Topics in Capital Budgeting True/False 1. Because installment costs of a new asset are a current cash expense, they are excluded from the initial outlay. ANSWER: False DIFFICU... LTY: Moderate KEYWORDS: initial outlay 2. When an old asset is sold for exactly its depreciated value, the only taxable income is the difference between the initial cost of the machine and the selling price. ANSWER: False DIFFICULTY: Moderate KEYWORDS: selling old asset 3. The capital rationing problem can be correctly solved by ranking projects according to the profitability index. ANSWER: False DIFFICULTY: Moderate KEYWORDS: capital rationing 4. The capital budgeting decision-making process involves measuring the incremental cash flows of an investment proposal and evaluating the attractiveness of these cash flows relative to the project’s cost. ANSWER: True DIFFICULTY: Easy KEYWORDS: capital budgeting decision process 5. Working capital for a project includes investment in fixed assets. ANSWER: False DIFFICULTY: Easy KEYWORDS: working capital 6. The initial outlay involves the immediate cash outflow necessary to purchase the asset and put it in operating order. ANSWER: True DIFFICULTY: Moderate KEYWORDS: initial outlay 7. When replacing an existing asset, the cash inflow associated with the sale of the old asset and any related tax effects must be considered and accounted for in the analysis. ANSWER: True DIFFICULTY: Moderate KEYWORDS: replacing asset cash flows 8. In measuring cash flows we are interested only in the incremental or differential after-tax cash flows that are attributed to the investment proposal being evaluated. ANSWER: True DIFFICULTY: Moderate KEYWORDS: incremental cash flows 9. Cash flows associated with a project’s termination generally include the salvage value of the project plus or minus any taxable gains or losses associated with its sale. ANSWER: True DIFFICULTY: Moderate KEYWORDS: terminal cash flows 10. Since depreciation is a sunk cost, it is not necessary to consider depreciation in estimating cash flows for a new capital project. ANSWER: False DIFFICULTY: Moderate KEYWORDS: depreciation expense, sunk cost 11. Projects are said to be mutually exclusive when undertaking one prevents doing the other(s). ANSWER: True DIFFICULTY: Easy KEYWORDS: mutually exclusive 12. The initial outlay of an asset does not include installation costs. ANSWER: False DIFFICULTY: Moderate KEYWORDS: initial outlay 13. Additional cash needed to fill increased working capital requirements should be included in the initial cost of a product when analyzing an investment. ANSWER: True DIFFICULTY: Moderate KEYWORDS: working capital requirements 14. To be conservative, capital budgeting analysis assumes that projects cannot add sales to existing lines of business. ANSWER: False DIFFICULTY: Moderate KEYWORDS: incremental sales, existing lines of business 15. In making a capital budgeting decision we only include the incremental cash flows resulting from the investment decision. ANSWER: True DIFFICULTY: Moderate KEYWORDS: incremental cash flows 16. By examining cash flows, we are correctly able to analyze the timing of the benefits. ANSWER: True DIFFICULTY: Moderate KEYWORDS: timing of cash flows 17. The opportunity cost of using a resource in some way is the amount the resource could earn if used in an alternative way. ANSWER: True DIFFICULTY: Moderate KEYWORDS: opportunity cost 18. If the firm decides to impose a capital constraint on investment projects, the appropriate decision criterion is to select the set of projects that has the highest net present value subject to the capital constraint. ANSWER: True DIFFICULTY: Moderate KEYWORDS: capital rationing 19. The size disparity problem occurs when extremely large mutually exclusive projects are being examined. ANSWER: False DIFFICULTY: Moderate KEYWORDS: mutually exclusive projects 20. Capital rationing can occur when profitable projects must be rejected because of shortage of capital. ANSWER: True DIFFICULTY: Moderate KEYWORDS: capital rationing 21. A financial manager had his choice between two mutually exclusive investments, one with a distribution skewed to the right and one with a distribution skewed to the left. Both distributions have the same expected value and same standard deviation. The financial manager would prefer the one skewed to the left. ANSWER: False DIFFICULTY: Moderate KEYWORDS: mutually exclusive projects 22. A project’s equivalent annual annuity (EAA) is calculated by dividing the project’s NPV by the PVIFAi,n where i is the appropriate discount rate and n is the project’s life. ANSWER: True DIFFICULTY: Moderate KEYWORDS: equivalent annual annuity 23. A project’s equivalent annual annuity (EAA) is the annuity cash flow that yields the same present value as the project’s NPV. ANSWER: True DIFFICULTY: Moderate KEYWORDS: equivalent annual annuity 24. An infinite life replacement chain allows projects of different length lives to be compared. ANSWER: True DIFFICULTY: Moderate KEYWORDS: infinite replacement chain 25. In selecting projects when there is capital rationing, the payback period method should be used. ANSWER: False DIFFICULTY: Moderate KEYWORDS: capital rationing 250 26. Accounting profits represents free cash flows that are available for reinvestment. ANSWER: False DIFFICULTY: Easy KEYWORDS: accounting profits, free cash flows 27. Working capital requirements are considered a cash flow even though they do not leave the company. ANSWER: True DIFFICULTY: Moderate KEYWORDS: working capital requirements 28. Sunk costs are a type of incremental cash flow that should be included in all capital-budgeting decisions. ANSWER: False DIFFICULTY: Moderate KEYWORDS: sunk costs 29. The pertinent issue for determining whether overhead costs should be part of a project’s relevant aftertax cash flow is whether the project benefits from the overhead items. ANSWER: False DIFFICULTY: Moderate KEYWORDS: overhead 30. The hardest step in capital budgeting analysis is calculating the cash flows of a project. ANSWER: True DIFFICULTY: Moderate KEYWORDS: cash flow calculations 31. Since depreciation is a non-cash expense, it should not be included as part of a project’s relevant aftertax cash flow. ANSWER: False DIFFICULTY: Moderate KEYWORDS: depreciation expense 32. A marketing survey completed last year to determine a project’s feasibility would be included as part of the project’s initial cash outflow. ANSWER: False DIFFICULTY: Moderate KEYWORDS: relevant cash flows, sunk costs 33. Expenses incurred to install an asset are part of the asset’s initial cash outflow. ANSWER: True DIFFICULTY: Moderate KEYWORDS: initial outlay 34. Sales captured from the firm’s competitors can be relevant to the capital-budgeting decision. ANSWER: True DIFFICULTY: Moderate KEYWORDS: lost sales 35. Any capital rationing that rejects projects with positive net present values is contrary to the firm’s goal of shareholder wealth maximization. ANSWER: True DIFFICULTY: Moderate KEYWORDS: capital rationing 36. NPV and IRR can provide ranking inconsistencies when projects have unequal lives. ANSWER: True DIFFICULTY: Moderate KEYWORDS: project ranking Multiple Choice 37. Incremental cash flows include all of the following EXCEPT: a. labor and material savings. b. sunk costs. c. interest to bondholders. d. both b & c. ANSWER: a DIFFICULTY: Easy KEYWORDS: incremental cash flows 38. The net present value always provides the correct decision provided that: a. cash flows are constant over the asset’s life. b. the required rate of return is greater than the internal rate of return. c. capital rationing is not imposed. d. the internal rate of return is positive. ANSWER: c DIFFICULTY: Moderate KEYWORDS: capital rationing and NPV 39. If the federal income tax rate were increased, the result would be an increase in the: a. discounted payback period. b. internal rate of return. c. net present value. d. profitability index. ANSWER: a DIFFICULTY: Easy KEYWORDS: discounted payback period, taxes 40. Which of the following techniques may not consider ALL cash flows of a project? a. Net present value b. Internal rate of return c. Payback period d. Modified internal rate of return ANSWER: c DIFFICULTY: Easy KEYWORDS: payback period 41. Which of the following cash flows are not considered in the calculation of the initial outlay for a capital 252 investment proposal? a. Training expense b. Working capital investments c. Installation costs of an asset d. Before-tax selling price of old machine [Show More]

Last updated: 1 year ago

Preview 1 out of 31 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 31, 2021

Number of pages

31

Written in

Additional information

This document has been written for:

Uploaded

Aug 31, 2021

Downloads

0

Views

80

.png)

.png)

.png)

.png)