Financial Accounting > EXAM > ACC 100 Final Exam Milestone Sophia Course with Answers. (All)

ACC 100 Final Exam Milestone Sophia Course with Answers.

Document Content and Description Below

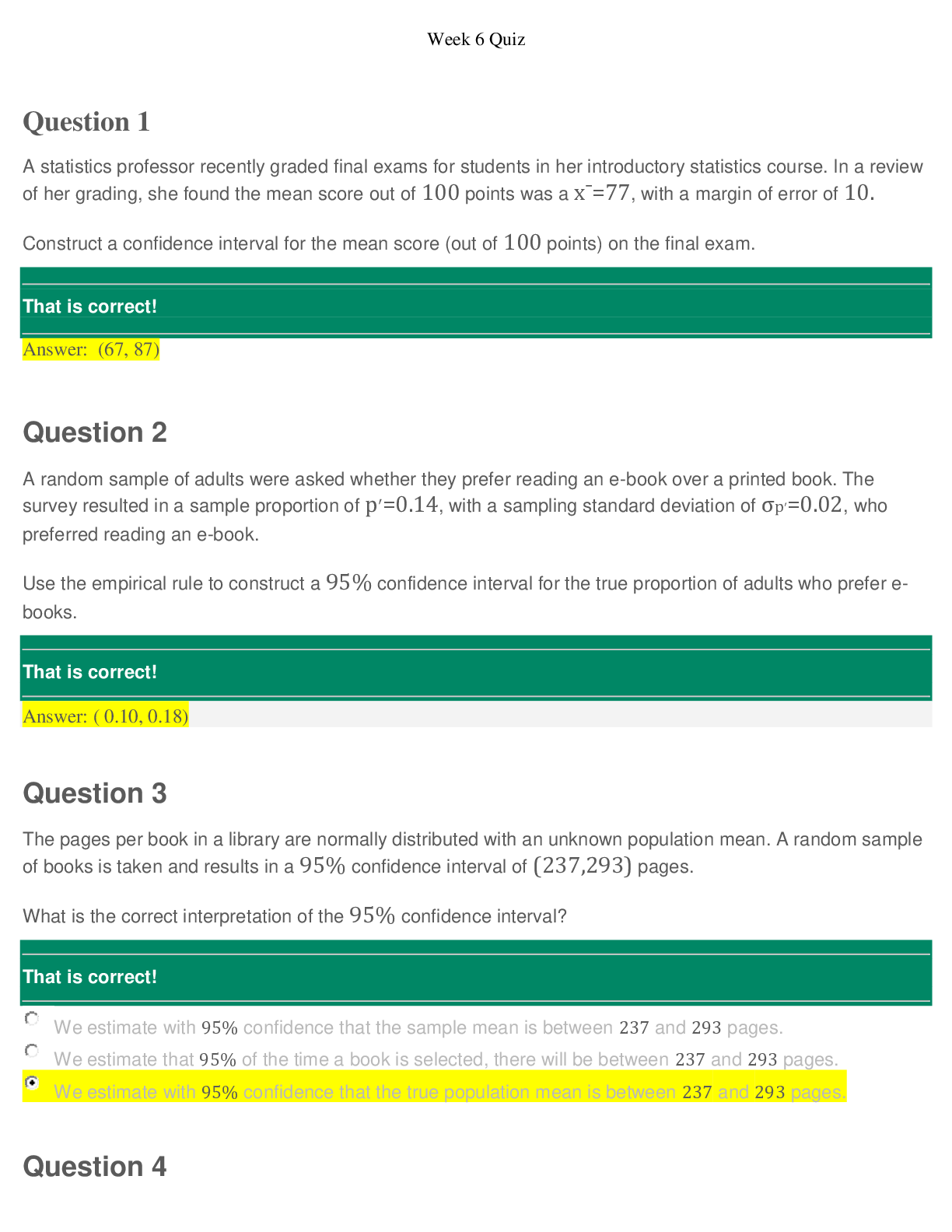

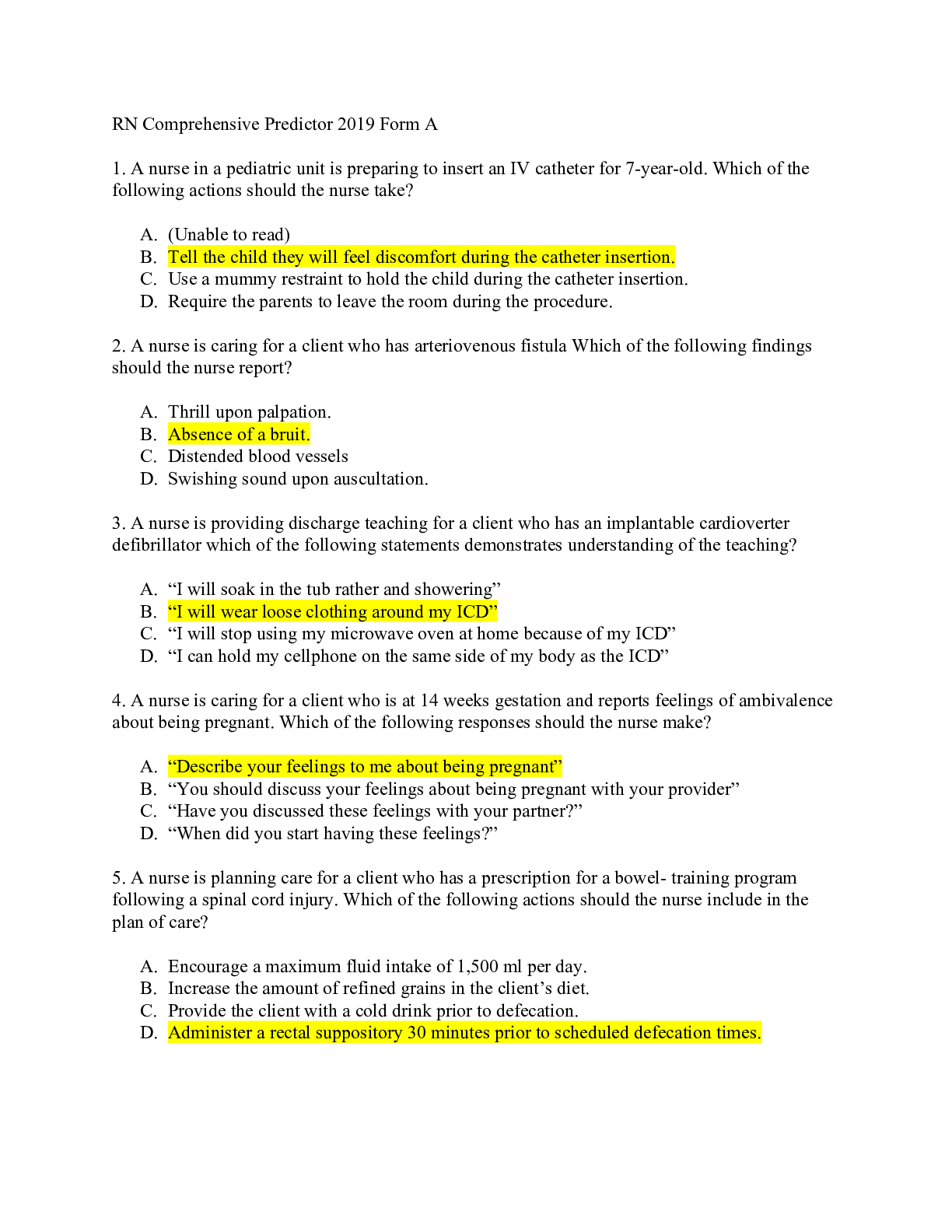

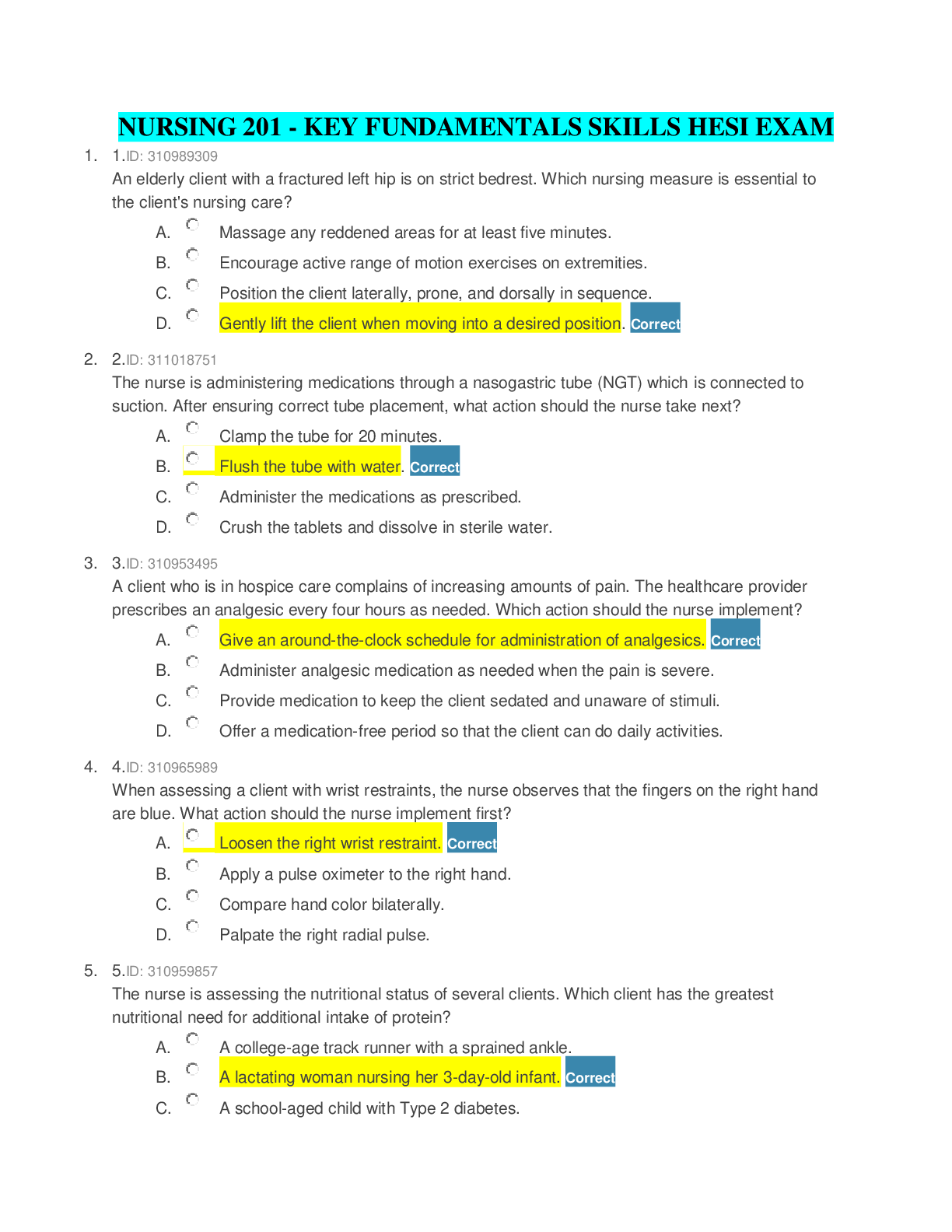

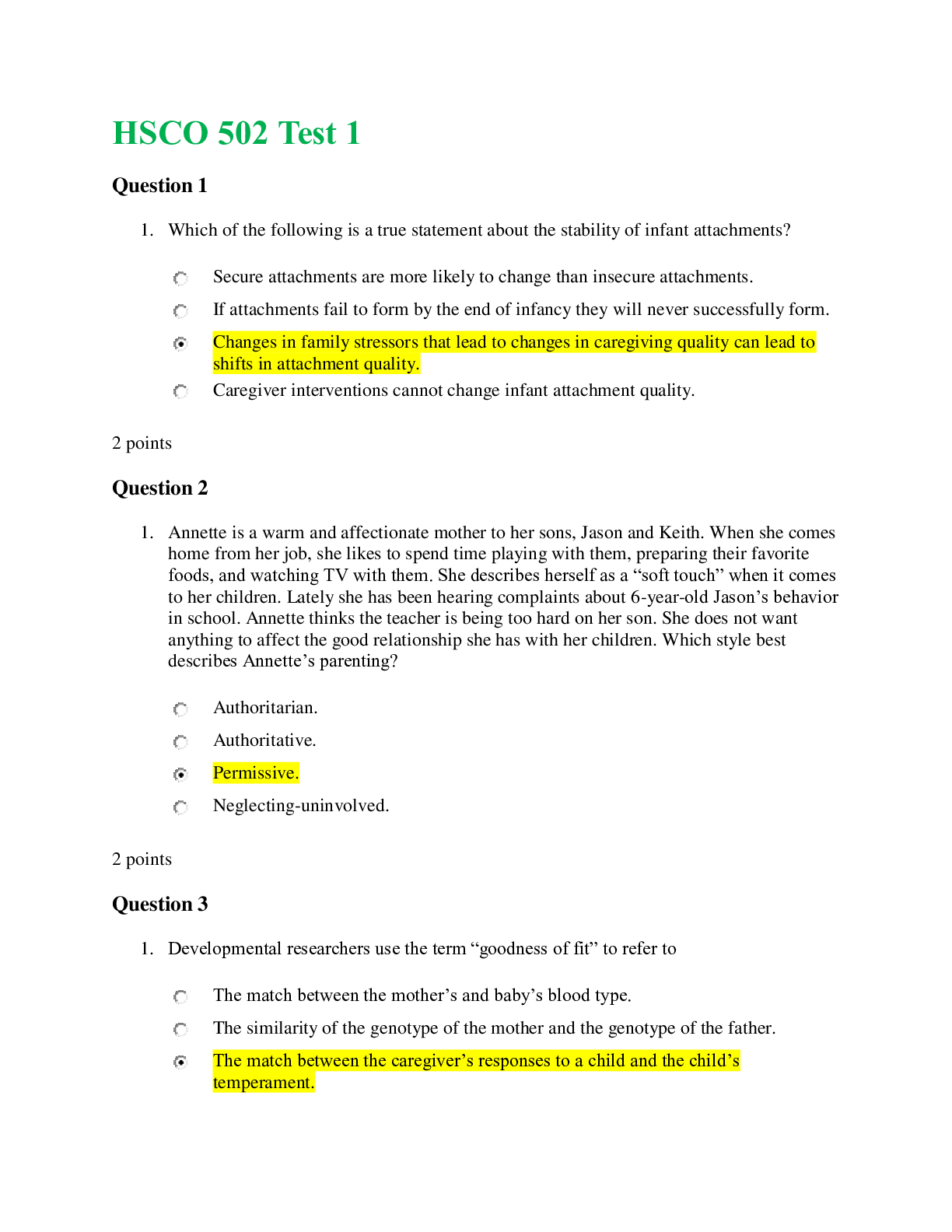

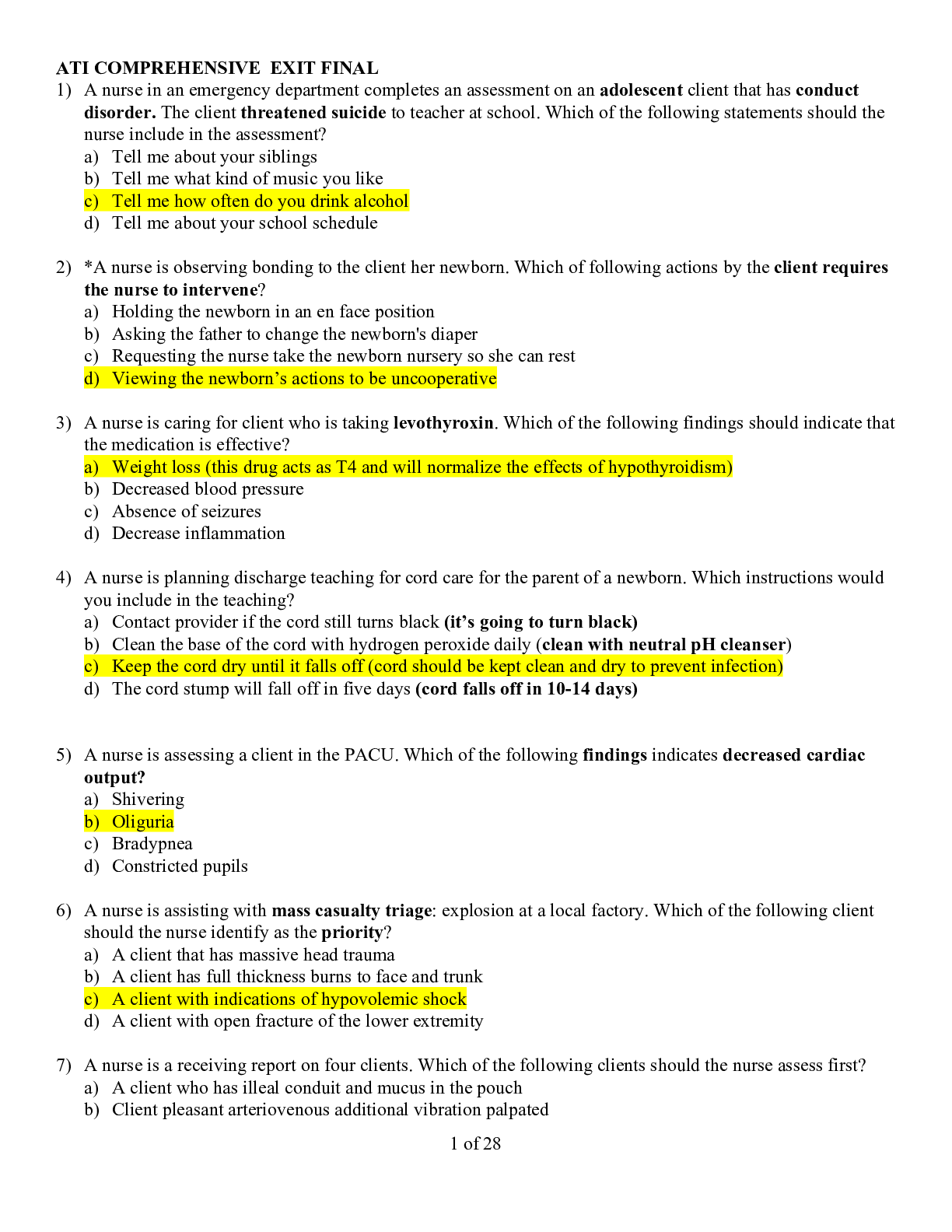

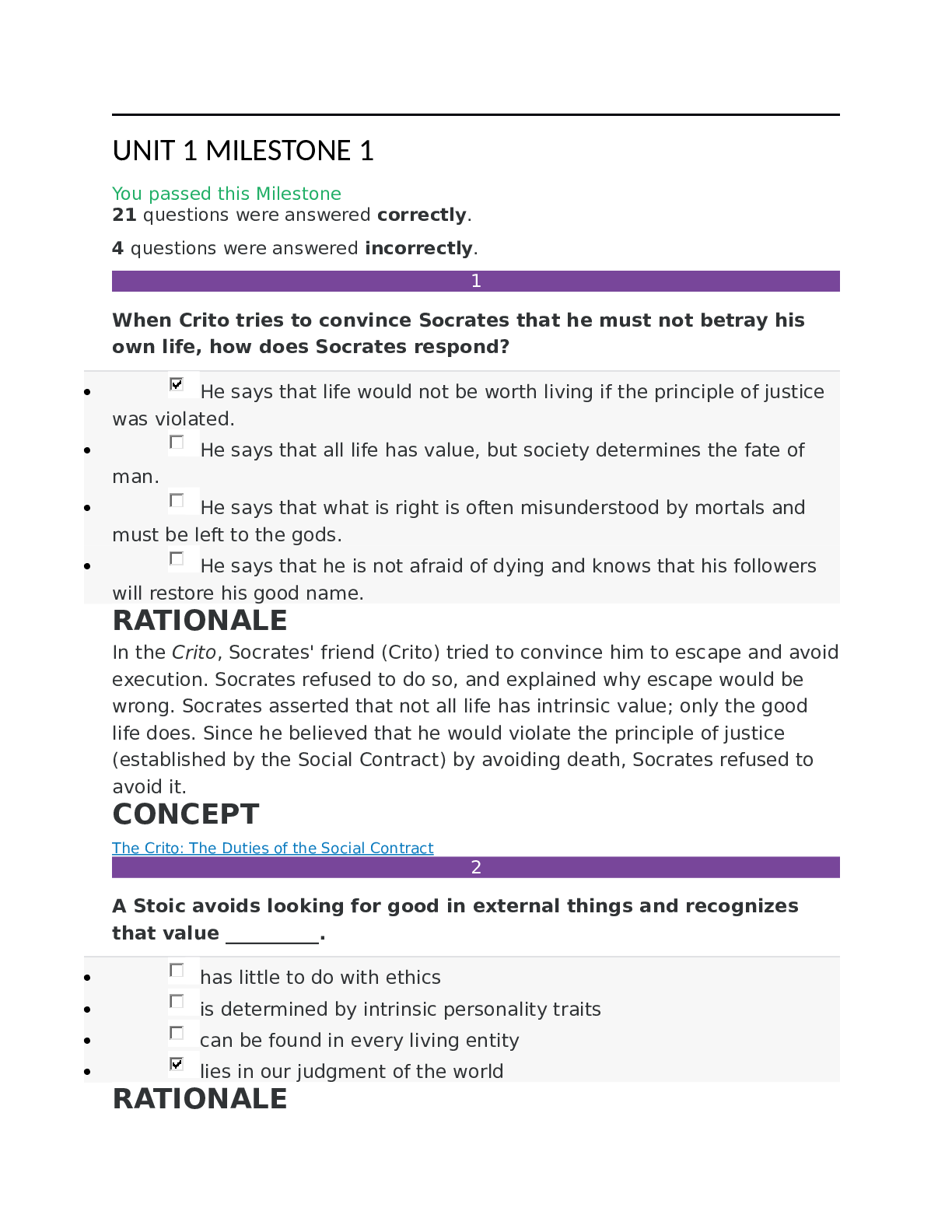

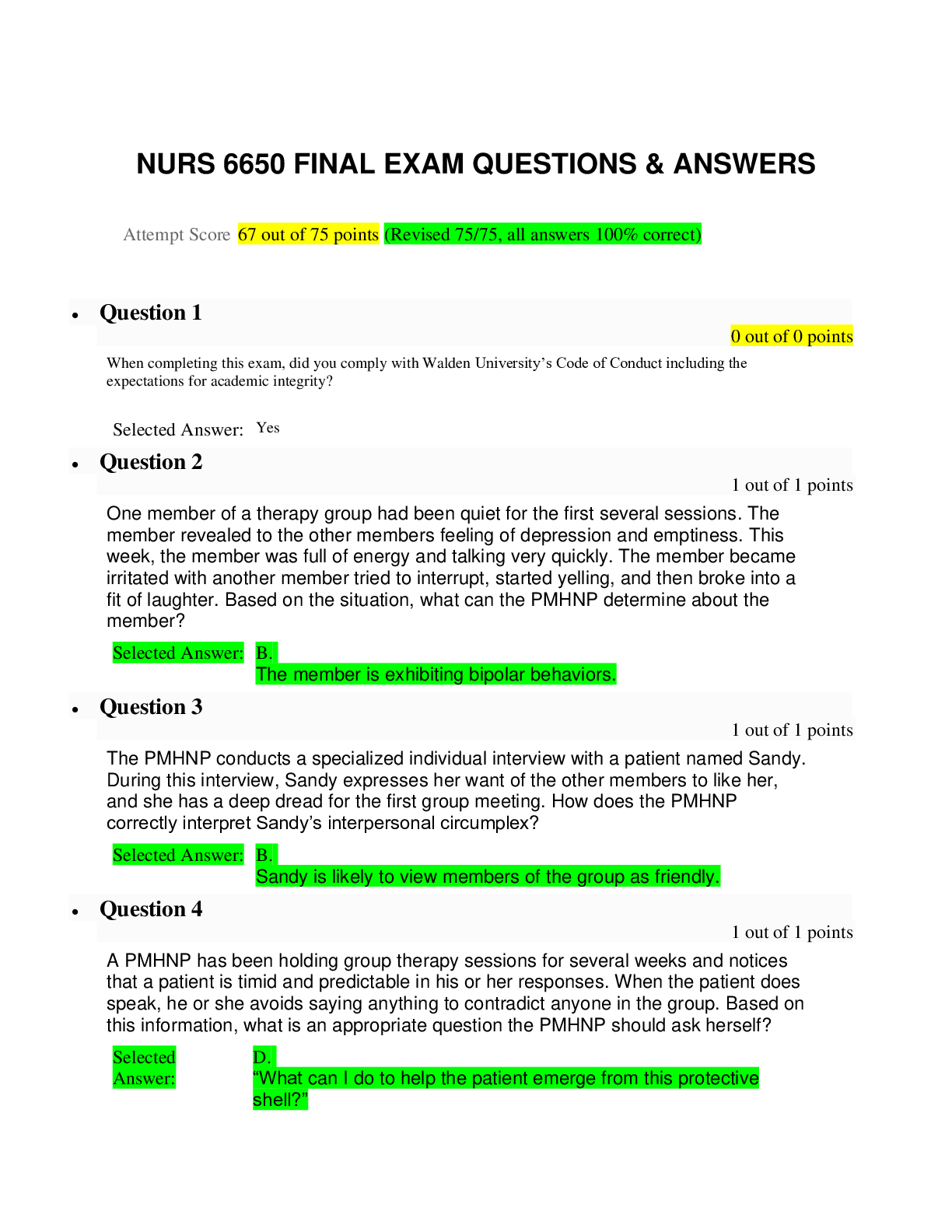

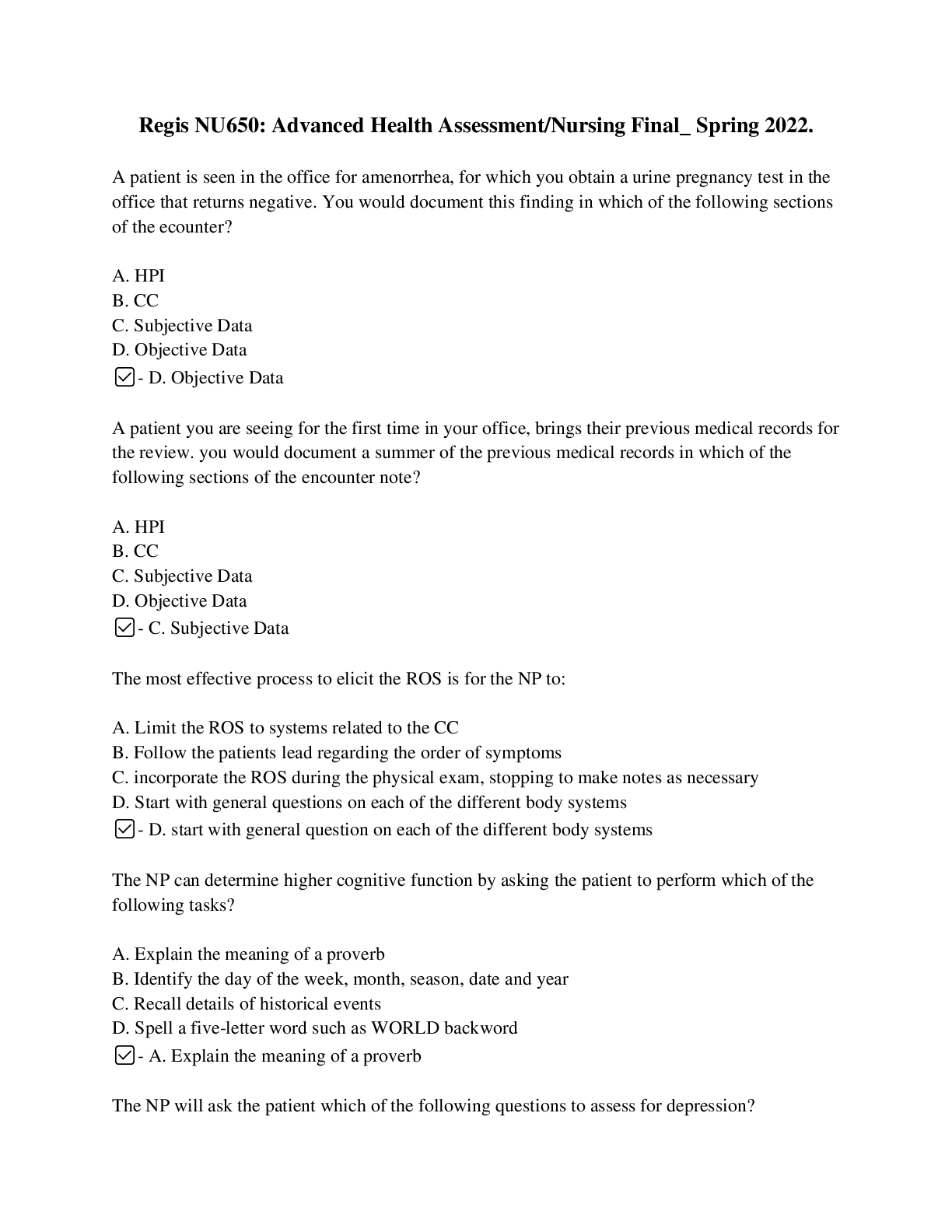

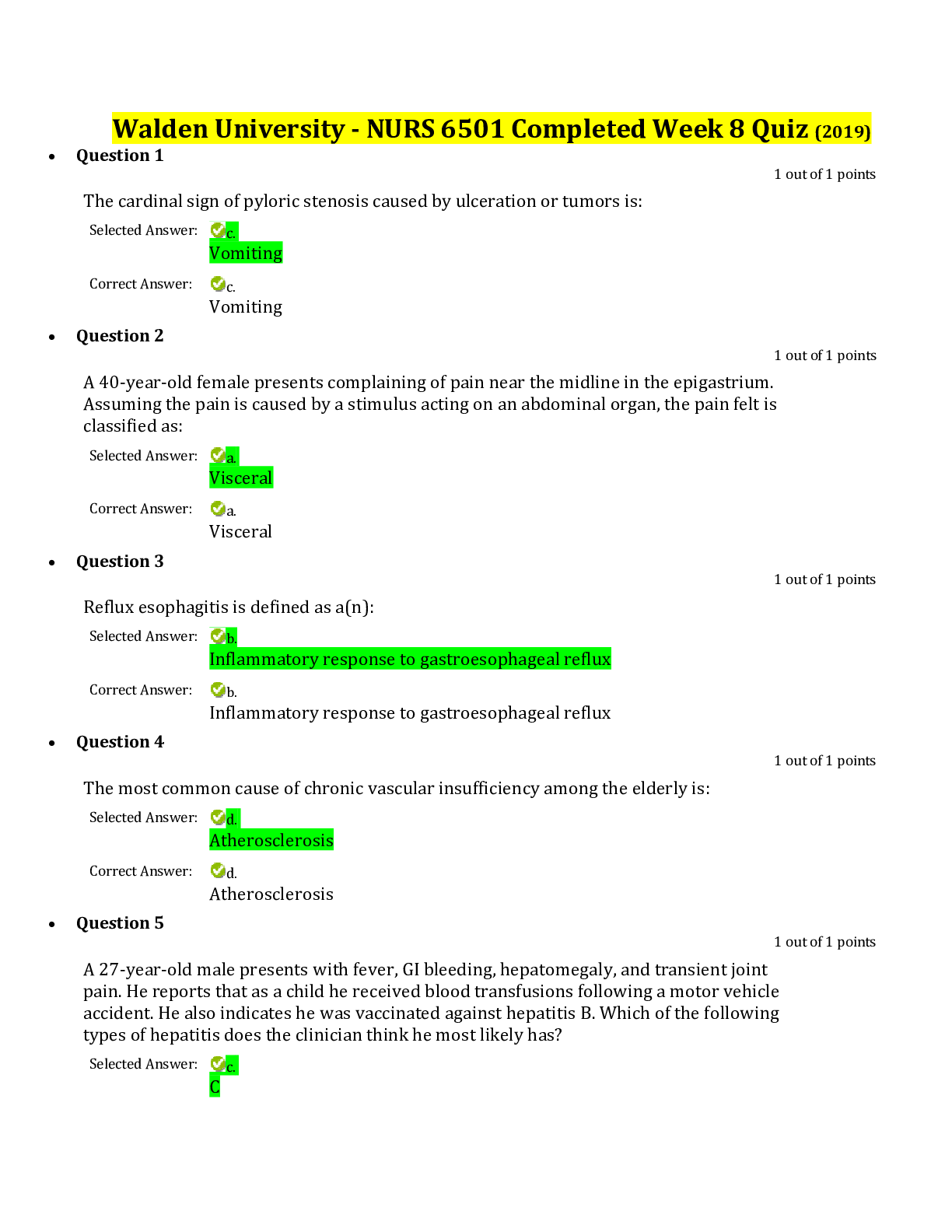

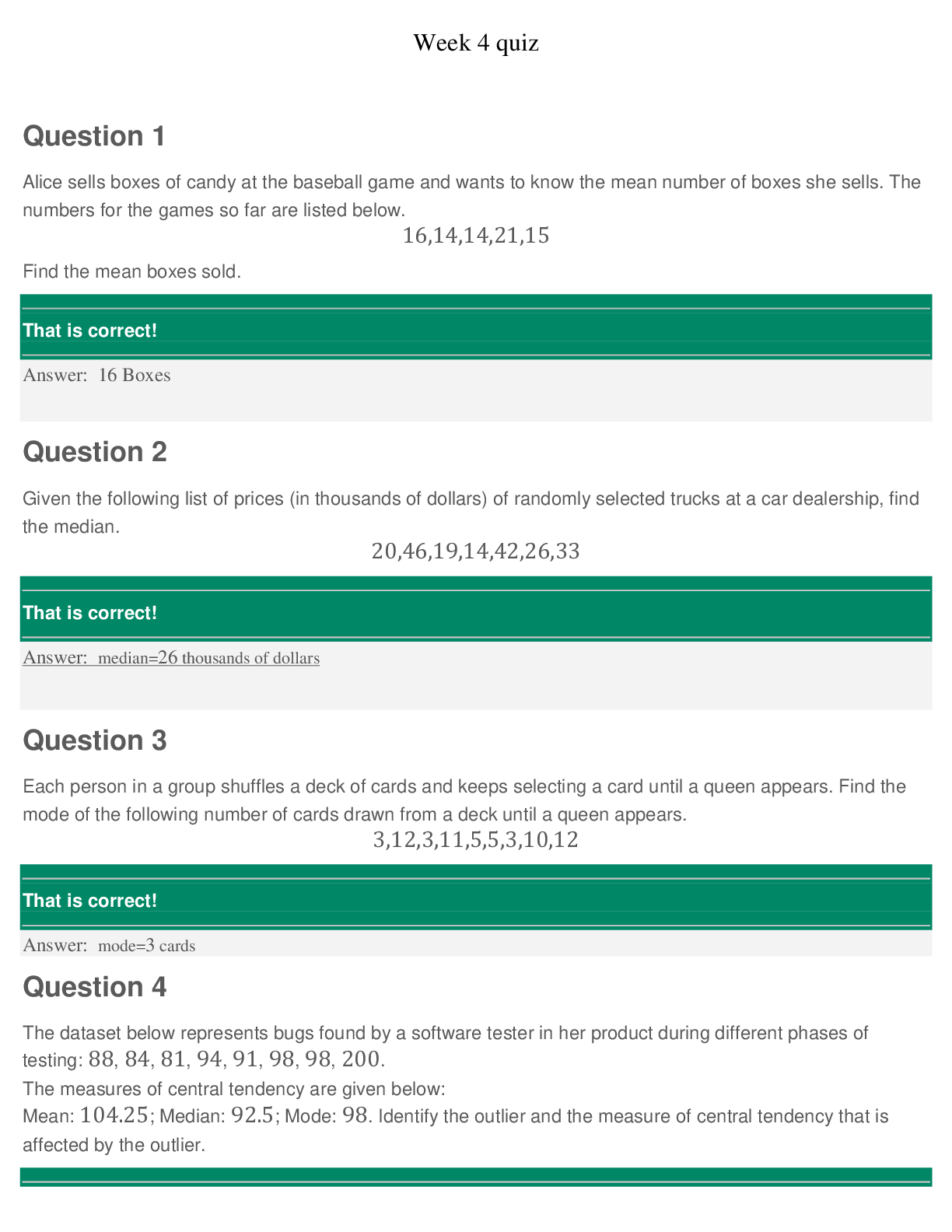

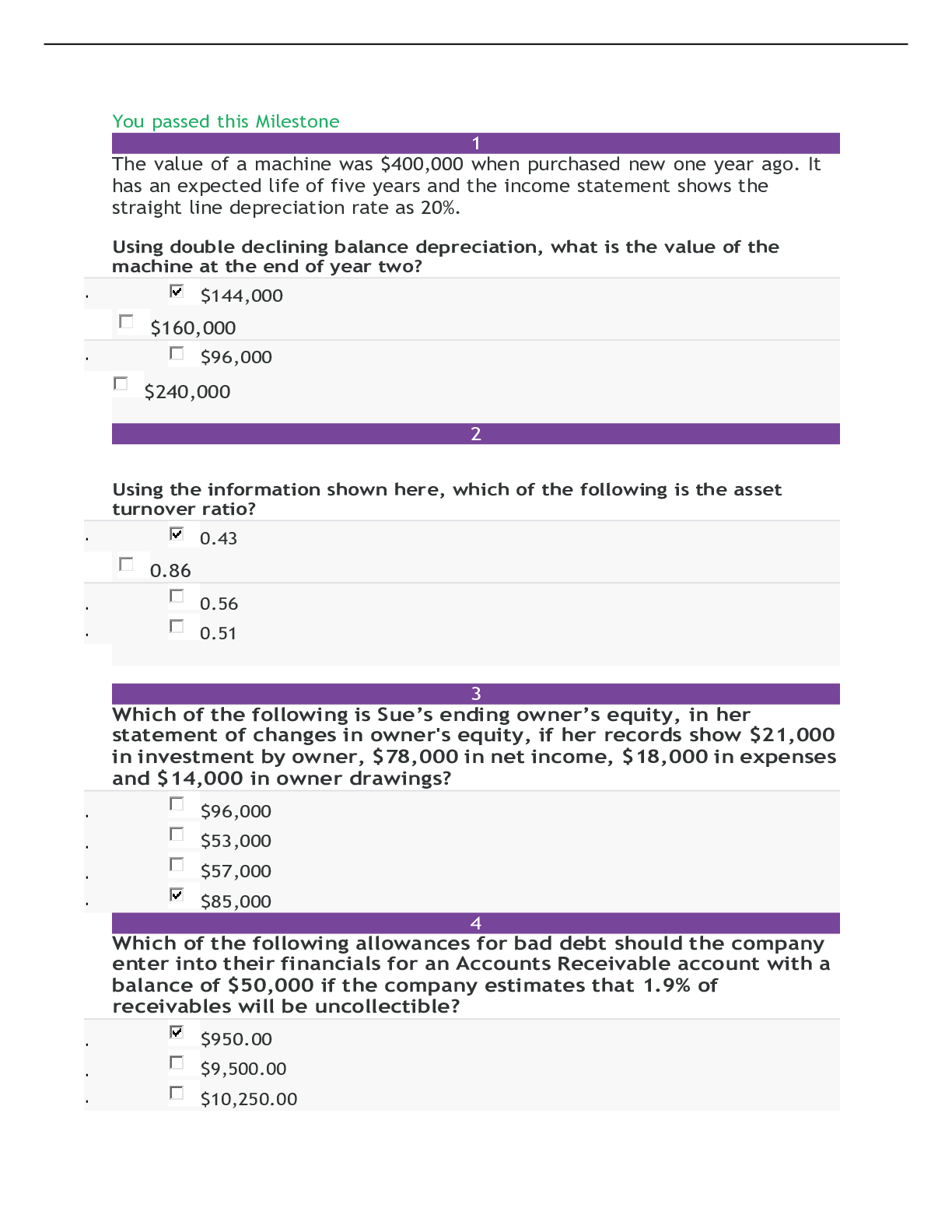

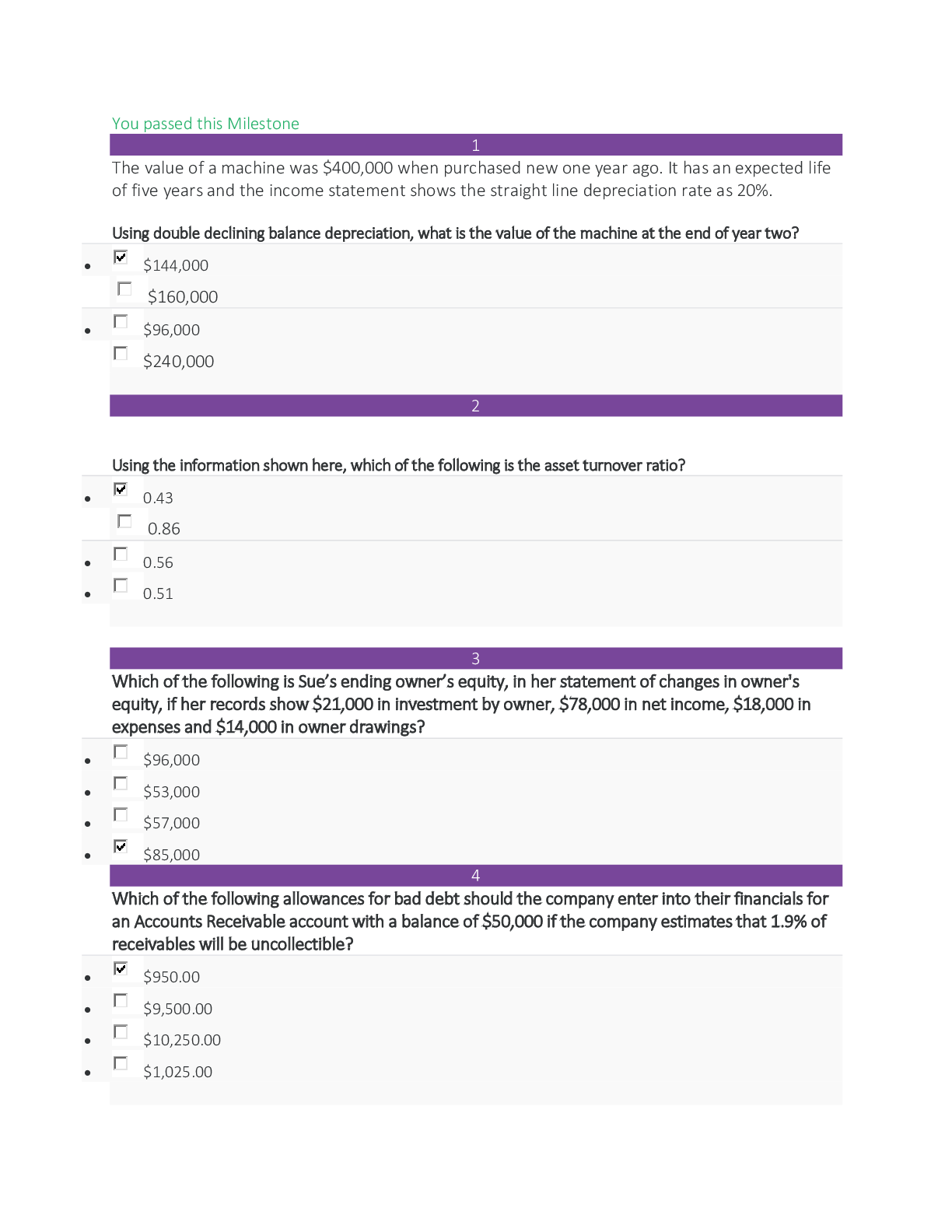

You passed this Milestone 1 The value of a machine was $400,000 when purchased new one year ago. It has an expected life of five years and the income statement shows the straight line depreciation ... rate as 20%. Using double declining balance depreciation, what is the value of the machine at the end of year two? $144,000 $160,000 $96,000 $240,000 2 Using the information shown here, which of the following is the asset turnover ratio? 0.43 0.86 0.56 0.51 3 Which of the following is Sue’s ending owner’s equity, in her statement of changes in owner's equity, if her records show $21,000 in investment by owner, $78,000 in net income, $18,000 in expenses and $14,000 in owner drawings? $96,000 $53,000 $57,000 $85,000 4 Which of the following allowances for bad debt should the company enter into their financials for an Accounts Receivable account with a balance of $50,000 if the company estimates that 1.9% of receivables will be uncollectible? $950.00 $9,500.00 $10,250.00 $1,025.005 What is the correct time of the month to make an adjusting entry? At the end of the month At the beginning of the month Whenever the accounts need to be brought into balance After preparing the balance sheet 6 A company's year-end financial statements lists the following figures. Net income $49,500 Net sales $550,000 Current assets $1,050,000 Current liabilities $115,000 Total assets $2,200,000 Based on this information, what is the company's rate of return on sales? 25% 2.32% 9% 1.91% 7 Which of the following organizations might Daniel be interested in joining if he recently passed his certified public accountancy exams? IRS AICPA FASB GAO 8 Which of the following is a violation of the Sarbanes-Oxley Act? Declaring bankruptcy Giving shares of stock to employees Merging with a competitor Not reporting financial information about a business9 Using the aging schedule above, which of the following is the total uncollectible amount? $4,745 $3,975 $5,105 $4,610 10 ____________ is correcting errors and omissions and matching expenses with the correct revenue period. Analyzing Adjusting Reporting Posting 11 Which of the following is true of an LLC? All members of the LLC are liable for the actions of the others. An LLC is terminated at any member's choice. An LLC itself pays no taxes. An LLC is required to have more than five members. 12 Which of the following is NOT true of a natural balance? An account increase occurs on the opposite side of the account's natural balance. Each account group has a natural balance. Each individual account has a natural balance. Each account is associated with only one account group. 13 As she prepared financial documents to be discussed at her company's annual shareholders' meeting, Linda added an appendix to the financial overview that details all financial transactions in the last fiscal year. Which of the accounting principles below is she observing? Matching Principle Time Period Principle Full Disclosure Principle Measurement Principle 14 Which group of assets contains ONLY personal property? Vehicle, landscaping and office equipment Land, supplies and vehicle Landscaping, supplies and factory equipment Vehicle, supplies and factory equipment 15 Beginning Assets Beginning Revenues Beginning Balance Liabilities Capital Added/Investment During the Period Net Income/Net Loss Drawings Expenses Ending Balance/Owner's Capital Which of the above accounts would be included in the Statement of Changes in Owner's Equity? Beginning Balance Capital Added/Investment During the Period Net Income/Net Loss Drawings Ending Balance/Owner's Capital Beginning Assets Capital Added/Investment During the Period Liabilities Ending Balance/Owner's Capital Beginning Balance Expenses Ending Balance/Owner's Capital Beginning Revenues Expenses Ending Balance/Owner's capital 16If a company had a beginning balance of $69,000 on its statement of changes in owner's equity, the owner had drawings of $15,000 and the ending balance was $76,000, how much net income was recorded? $61,000 $22,000 $76,000 $91,000 17 Roberta sold goods costing $35,500, her expenses totaled $2,500 and her freight in totaled $750. Her company's average stock of goods during the same period was $9,500. The inventory turnover ratio for Roberta's company is __________. 3.39 3.74 3.55 3.47 18 Based on this information in this partial income statement, what is the total of the Goods Available for Sale? $87,800 $65,300 $90,000 $83,000 19 If James' records show $70,000 in revenue, $34,000 in liabilities, $90,000 in assets and $19,000 in equity, which of the figures should be included on his income statement? $19,000 $70,000 $90,000 $34,00020 Using the LIFO method and the information in this image, what is the Cost of Goods Sold during December? $105,000 $60,000 $80,000 $95,000 21 Which asset below is a current asset? Commercial kitchen Office building Prepaid insurance premium Delivery truck 22 With respect to financial statements, which of the following statements is true of depreciation? Land is depreciated on a 25-year schedule. Accumulated depreciation is credited below the referenced asset. The residual value of the asset is determined by the government. Depreciation can be taken beyond the residual value of the asset. 23 Which one of the following statements is true regarding permanent accounts? They are associated with financial transactions for the life of the company. They track specific assets during an exact fiscal timeframe. They document resources for longer than one fiscal timeframe. They are associated with one product for the life of the product. 24 A men's store offered a discount for each purchase of a set of pants (regularly $95 each), and suit coat (regularly $215 each). If Mark bought two pairs of pants and two suit coats for a total of $558, what percentage did the store offer for each set purchased? 10% 5% 12% 15% 25 Brett agreed to the freight on board (FOB) destination method for an order of t-shirts that is ready to ship. The freight is in New York, at the port of distribution, to be delivered to Brett's clothing store in Pennsylvania. Who owns the freight at the loading docks in New York? The supplier Brett's customer The shipping company Brett [Show More]

Last updated: 1 month ago

Preview 1 out of 7 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 04, 2020

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

Aug 04, 2020

Downloads

1

Views

309