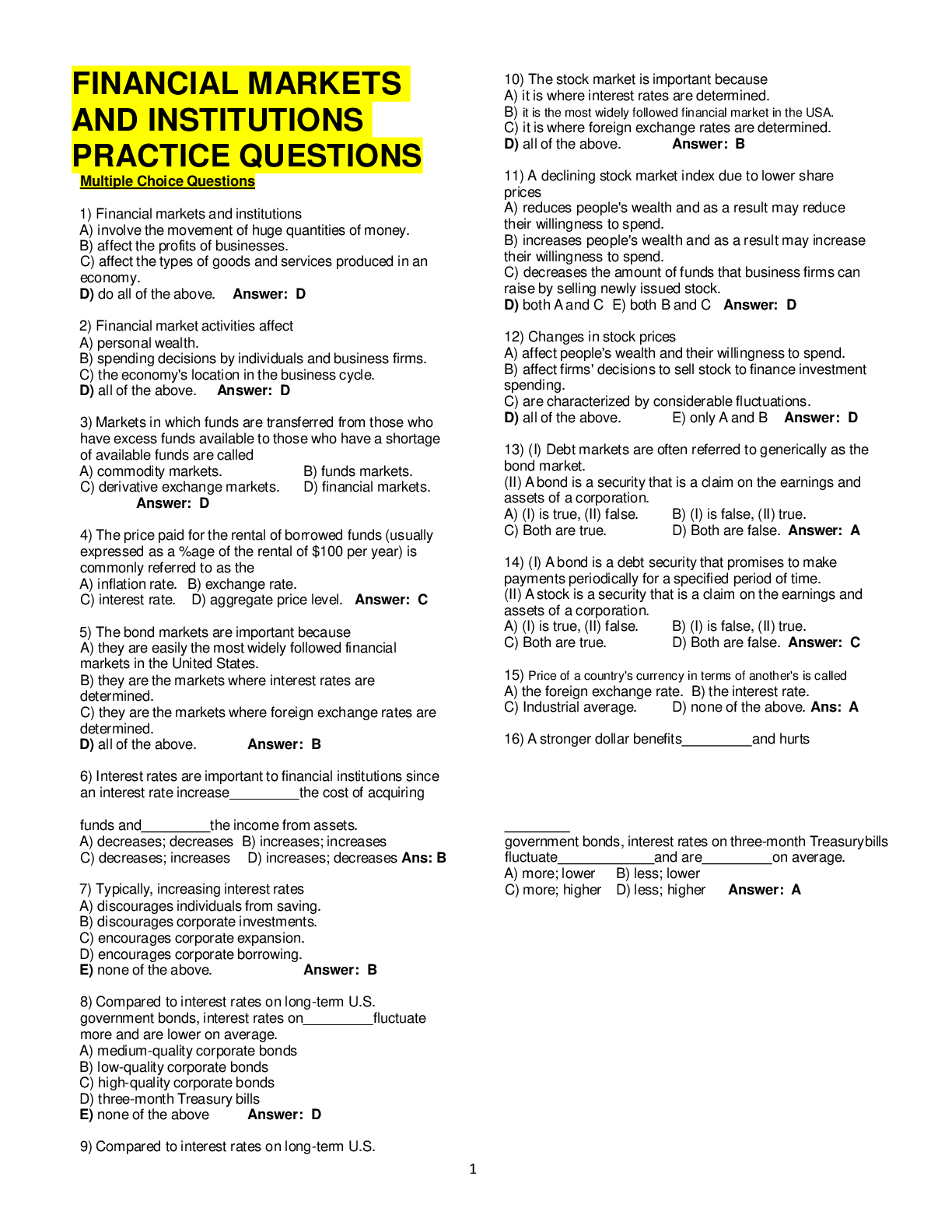

FINANCIAL MARKETS AND INSTITUTIONS PRACTICE QUESTIONS

Document Content and Description Below

FINANCIAL MARKETS AND INSTITUTIONS PRACTICE QUESTIONS 1) Every financial market performs the following function: A) It determines the level of interest rates. B) It allows common stock to be traded. C... ) It allows loans to be made. D) It channels funds from lenders-savers to borrowers- spenders 2) Financial markets have the basic function of A) bringing together people with funds to lend and people who want to borrow funds. B) assuring that the swings in the business cycle are less pronounced. C) assuring that governments need never resort to printing money. D) both A and B E) both B and C 3) Which of the following can be described as involving direct finance? A) A corporation's stock is traded in an over-the-counter market B) People buy shares in a mutual fund. C) A pension fund manager buys commercial paper in the secondary market. D) An insurance company buys shares of common stock in the over-the-counter markets. E) None of the above 4) Which of the following can be described as involving direct finance? A) A corporation's stock is traded in an over-the-counter market B) A corporation buys commercial paper issued by another corporation. C) A pension fund manager buys commercial paper from the issuing corporation. D) Both A and B E) Both B and C 5) Which of the following can be described as involving indirect finance? A) A corporation takes out loans from a bank. B) People buy shares in a mutual fund. C) A corporation buys commercial paper in a secondary market. D) All of the above. E) Only A and B 6) Financial markets improve economic welfare because A) they allow funds to move from those without productive investment opportunities to those who have such opportunities. B) they allow consumers to time their purchases better. C) they weed out inefficient firms. D) they do all of the above. E) they do A and B of the above. 7) A country whose financial markets function poorly is likely to A) efficiently allocate its capital resources. B) enjoy high productivity. C) experience economic hardship and financial crises. D) increase its standard of living 8) Which of the following are securities? A) A certificate of deposit B) A share of Texaco common stock C) A Treasury bill D) All of the above 9) Which of the following statements about the characteristics of debt and equity are true? A) They both can be long-term financial instruments. B) They both involve a claim on the issuer's income. C) They both enable a corporation to raise funds. D) All of the above 10) The money market is the market in which are traded. A) new issues of securities B) previously issued securities C) short-term debt instruments D) long-term debt and equity instruments 11) Long-term debt and equity instruments are traded in the market. A) primary B) secondary C) capital D) money 12) Which of the following are primary markets? A) The New York Stock Exchange B) The U.S. government bond market C) The over-the-counter stock market D) The options markets E) None of above 13) Which of the following are secondary markets? A) The New York Stock Exchange B) The U.S. government bond market C) The over-the-counter stock market D) The options markets E) All of the above 14) A corporation acquires new funds only when its securities are sold in the A) secondary market by an investment bank. B) primary market by an investment bank. C) secondary market by a stock exchange broker. D) secondary market by a commercial bank 15) Intermediaries who are agents of investors and match buyers with sellers of securities are called A) investment bankers. B) traders. C) brokers. D) dealers 16) Intermediaries who link buyers and sellers by buying and selling securities at stated prices are called A) investment bankers. B) traders. C) brokers. D) dealers 17) An important financial institution that assists in the initial sale of securities in the primary market is the A) investment bank. B) commercial bank. C) stock exchange. D) brokerage house 18) Which of the following statements about financial markets and securities are true? A) Most common stocks are traded over-the-counter, although the largest corporations have their shares traded at organized stock exchanges such as the NYS Exchange. B) A corporation acquires new funds only when its securities are sold in the primary market. C) Money market securities are usually more widely traded than longer-term securities and so tend to be more liquid. D) All of the above are true. E) Only A and B of the above are true 19) Which of the following statements about financial markets and securities are true? A) A bond is a long-term security that promises to make periodic payments called dividends to the firm's residual claimants. B) A debt instrument is intermediate term if its maturity is less than one year. C) A debt instrument is long term if its maturity is ten years or longer. D) The maturity of a debt instrument is the time (term) that has elapsed since it was issued 20) Which of the following statements about financial markets and securities are true? A) Few common stocks are traded over-the-counter, although the over-the-counter markets have grown in recent years. B) A corporation acquires new funds only when its securities are sold in the primary market. C) Capital market securities are usually more widely traded than longer-term securities and so tend to be more liquid. D) All of the above are true. 21) Which of the following markets is sometimes organized as an over-the-counter market? A) The stock market B) The foreign exchange market C) The bond market D) The federal funds market E) all of the above 22) Bonds that are sold in a foreign country and are denominated in that country's currency are known as A) foreign bonds. B) Eurobonds. C) Eurocurrencies. D) Eurodollars 23) Bonds that are sold in a foreign country and are denominated in a currency other than that of the country in which they are sold are known as A) foreign bonds. B) Eurobonds. C) Eurocurrencies. D) Eurodollars 24) Financial intermediaries A) exist because there are substantial information and transaction costs in the economy. B) improve the lot of the small saver. C) are involved in the process of indirect finance. D) do all of the above 25) The main sources of financing for businesses, in order of importance, are A) financial intermediaries, issuing bonds, issuing stocks. B) issuing bonds, issuing stocks, financial intermediaries. C) issuing stocks, issuing bonds, financial intermediaries. D) issuing stocks, financial intermediaries, issuing bonds. 26) The presence of transaction costs in financial markets explains, in part, why A) financial intermediaries and indirect finance play such an important role in financial markets. B) equity and bond financing play such an important role in financial markets. C) corporations get more funds through equity financing than they get from financial intermediaries. D) direct financing is more important than indirect financing as a source of funds. 27) Financial intermediaries can substantially reduce transaction costs per dollar of transactions because their large size allows them to take advantage of A) poorly informed consumers. B) standardization. C) economies of scale. D) their market power 28) The purpose of diversification is to A) reduce the volatility of a portfolio's return. B) raise the volatility of a portfolio's return. C) reduce the average return on a portfolio. D) raise the average return on a portfolio. 29) An investor who puts all her funds into one asset her portfolio's . A) increases; diversification B) decreases; diversification C) increases; average return D) decreases; average return 30) Through risk-sharing activities, a financial intermediary its own risk and the risks of its customers. A) reduces; increases B) increases; reduces C) reduces; reduces D) increases; increases 31) The presence of in financial markets leads to adverse selection and moral hazard problems that interfere with the efficient functioning of financial markets. A) noncollateralized risk B) free-riding C) asymmetric information D) costly state verification 32) When the lender and the borrower have different amounts of information regarding a transaction, is said to exist. A) asymmetric information B) adverse selection C) moral hazard D) fraud 33) When the potential borrowers who are the most likely to default are the ones most actively seeking a loan, is said to exist. A) asymmetric information B) adverse selection C) moral hazard D) fraud 34) When the borrower engages in activities that make it less likely that the loan will be repaid, is said to exist. A) asymmetric information B) adverse selection C) moral hazard D) fraud 35) The concept of adverse selection helps to explain A) which firms are more likely to obtain funds from banks and other financial intermediaries, rather than from the securities markets. B) why indirect finance is more important than direct finance as a source of business finance. C) why direct finance is more important than indirect finance as a source of business finance. D) only A and B E) only A and C 36) Adverse selection is a problem associated with equity and debt contracts arising from A) the lender's relative lack of information about the borrower's potential returns and risks of his investment activities. B) the lender's inability to legally require sufficient collateral to cover a 100 % loss if the borrower defaults. C) the borrower's lack of incentive to seek a loan for highly risky investments. D) none of the above 37) When the least desirable credit risks are the ones most likely to seek loans, lenders are subject to the A) moral hazard problem. B) adverse selection problem. C) shirking problem. D) free-rider problem. E) principal-agent problem 38) Successful financial intermediaries have higher earnings on their investments because they are better equipped than individuals to screen out good from bad risks, thereby reducing losses due to A) moral hazard. B) adverse selection. C) bad luck. D) financial panics 39) Which of the following are not investment intermediaries? A) A life insurance company B) A pension fund C) A mutual fund D) Only A and B 40) Which of the following are investment intermediaries? A) Finance companies B) Mutual funds C) Pension funds D) All of the above E) Only A and B of the above 41) The government regulates financial markets for two main reasons: A) to ensure soundness of the financial system and to increase the information available to investors. B) to improve control of monetary policy and to increase the information available to investors. C) to ensure that financial intermediaries do not earn more than the normal rate of return and to improve control of monetary policy. D) to ensure soundness of financial intermediaries and to prevent financial intermediaries from earning less than the normal rate of return 42) Asymmetric information can lead to widespread collapse of financial intermediaries, referred to as a A) bank holiday. B) financial panic. C) financial disintermediation. D) financial collapse 43) Foreign currencies that are deposited in banks outside the home country are known as A) foreign bonds. B) Eurobond. C) Eurocurrencies. D) Eurodollars 44) U.S. dollars deposited in foreign banks outside the U.S. or in foreign branches of U.S. are referred to as A) Eurodollars. B) Eurocurrencies. C) Eurobonds. D) foreign bonds 45) Banks providing depositors with checking accounts that enable them to pay their bills easily is known as A) liquidity services. B) asset transformation. C) risk sharing. D) transaction costs 46) A is when one party in a financial contract has incentives to act in its own interest rather than in the interests of the other party. A) moral hazard B) risk C) conflict of interest D) financial panic 47) Fire and casualty insurance companies are what type of intermediary? A) Contractual savings institution B) Depository institutions C) Investment intermediaries D) None of the above CONTINUED....................DOWNLOAD FOR BEST SCORES [Show More]

Last updated: 1 year ago

Preview 1 out of 33 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jun 04, 2021

Number of pages

33

Written in

Additional information

This document has been written for:

Uploaded

Jun 04, 2021

Downloads

0

Views

66

.png)