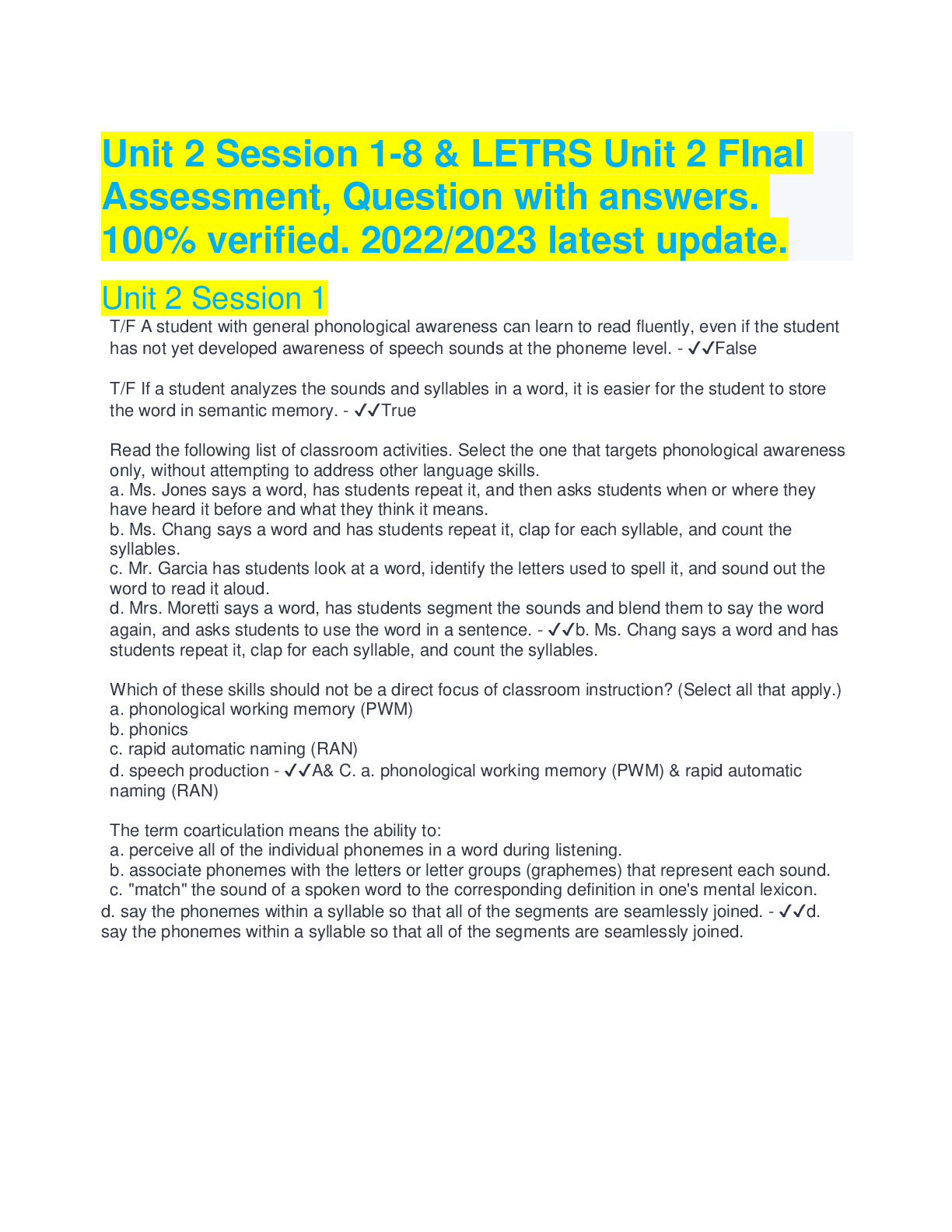

Financial Accounting > QUESTIONS & ANSWERS > ACCT 301 Quiz 2 Power answer (All)

ACCT 301 Quiz 2 Power answer

Document Content and Description Below

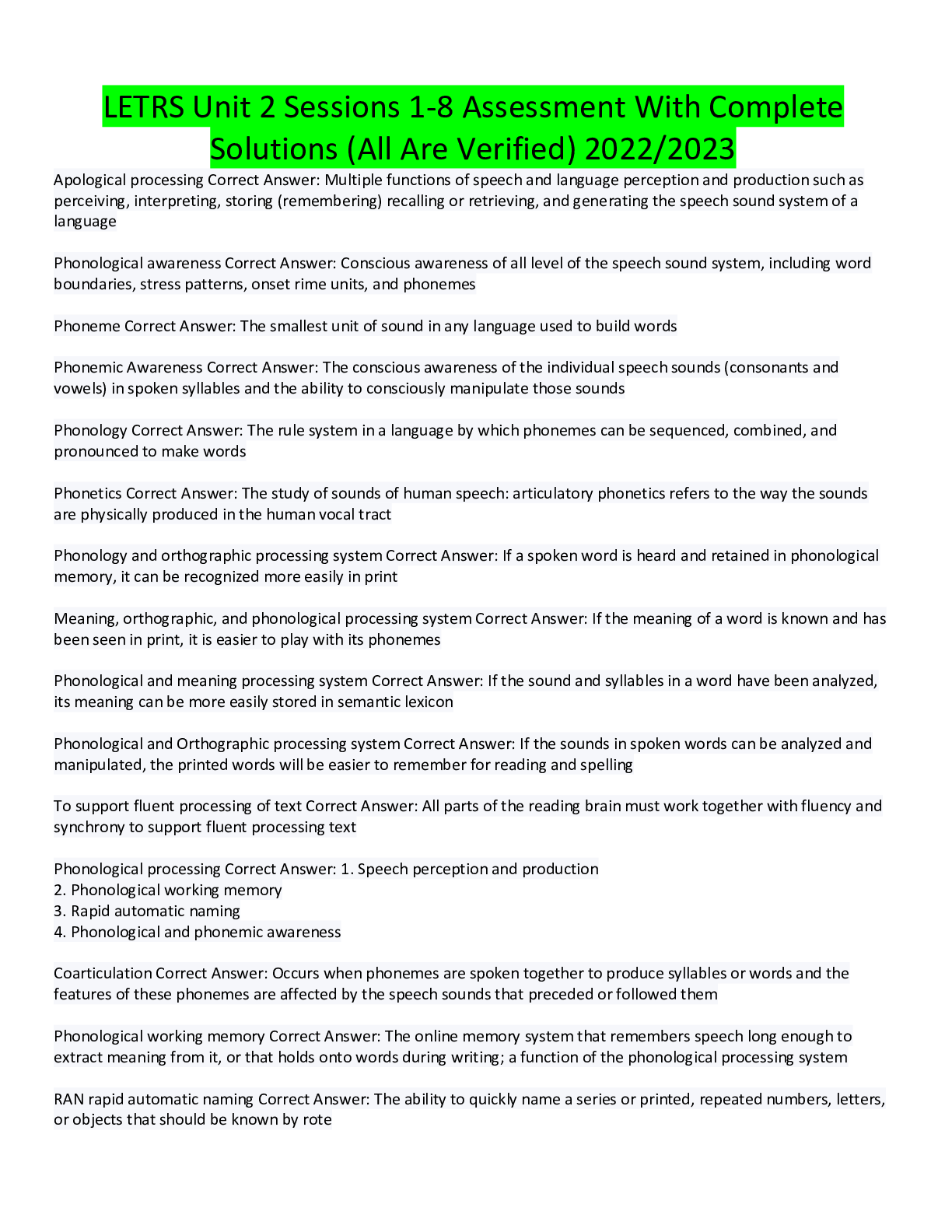

On May 1, Tango Co. agreed to sell the assets of its Formal Wear Division to Top Hat Inc. Suppose that the Formal Wear Division's assets had not been sold by December 31, 2021, but were considered ... held for sale. Assume that the fair value of these assets was $40 million at December 31, 2021. In the income statement for the year ended December 31, 2021, Tango Co. would report discontinued operations of: On August 1, 2021, Rocket Retailers adopted a plan to discontinue its catalog sales division, which qualifies as a separate component of the business according to GAAP regarding discontinued operations. The disposal of the division was expected to be concluded by June 30, 2022. On January 31, 2022, Rocket's fiscal year-end, the following information relative to the discontinued division was accumulated: In its income statement for the year ended January 31, 2022, Rocket would report a before-tax loss on discontinued operations of: Major Co. reported 2021 income of $311,000 from continuing operations before income taxes and a before-tax loss on discontinued operations of $69,000. All income is subject to a 25% tax rate. In the income statement for the year ended December 31, 2021, Major Co. would show the following line-item amounts for income tax expense and net income: The Filzinger Corporation’s December 31, 2021 year-end trial balance contained the following income statement items: Calculate the company’s operating income for the year using a single-step income statement format. ABC Company will issue $6,700,000 in 6%, 10-year bonds when the market rate of interest is 8%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Determine how much cash ABC Company will realize from the bond issue. (Round your final answer to nearest whole dollar.) Jimmy has $552,814 accumulated in a 401K plan. The fund is earning a low, but safe, 3% per year. The withdrawals will take place at the end of each year starting a year from now. How soon will the fund be exhausted if Jimmy withdraws $71,000 each year? At the end of the next four years, a new machine is expected to generate net cash flows of $8,000, $12,000, $10,000, and $15,000, respectively. What are the (rounded) cash flows worth today if a 3% interest rate properly reflects the time value of money in this situation? Rosie's Florist borrows $350,000 to be paid off in three years. The loan payments are semiannual with the first payment due in six months, and interest is at 6%. What is the amount of each payment? Price Mart is considering outsourcing its billing operations. A consultant estimates that outsourcing should result in cash savings of $9,400 the first year, $15,400 for the next two years, and $18,400 for the next two years. Interest is at 11%. Assume cash flows occur at the end of the year. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Calculate the total present value of the cash flows. (Do not round intermediate calculations. Round your final answer to nearest whole dollar.) [Show More]

Last updated: 1 year ago

Preview 1 out of 57 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 18, 2021

Number of pages

57

Written in

Additional information

This document has been written for:

Uploaded

May 18, 2021

Downloads

0

Views

48

.png)

.png)

.png)

.png)

.png)

.png)

.png)