Finance > TEST BANK > University of Illinois, Chicago - FIN 494 CH 25 ( 450 QUESTIONS WITH ALL ANSWERS 100% CORRECT ) (All)

University of Illinois, Chicago - FIN 494 CH 25 ( 450 QUESTIONS WITH ALL ANSWERS 100% CORRECT )

Document Content and Description Below

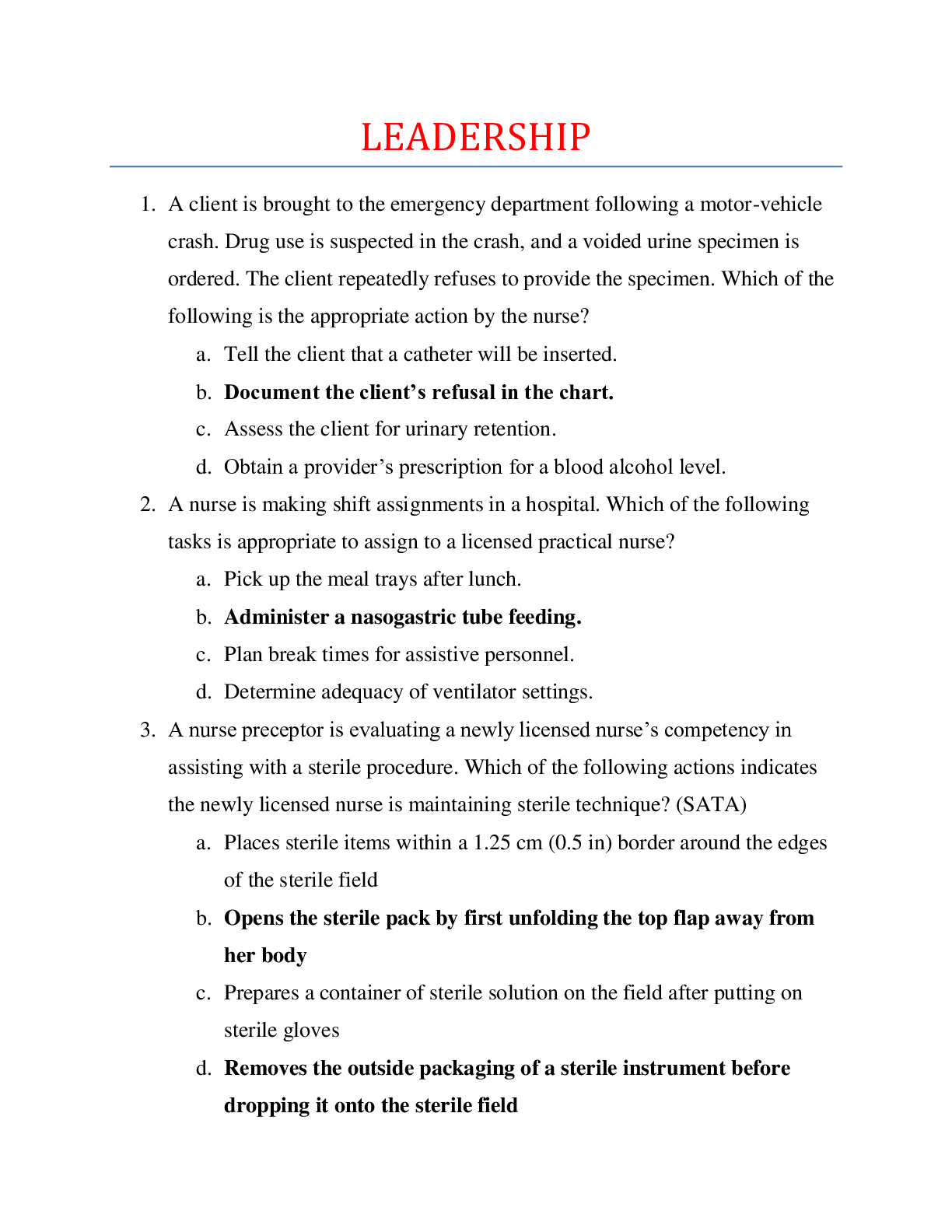

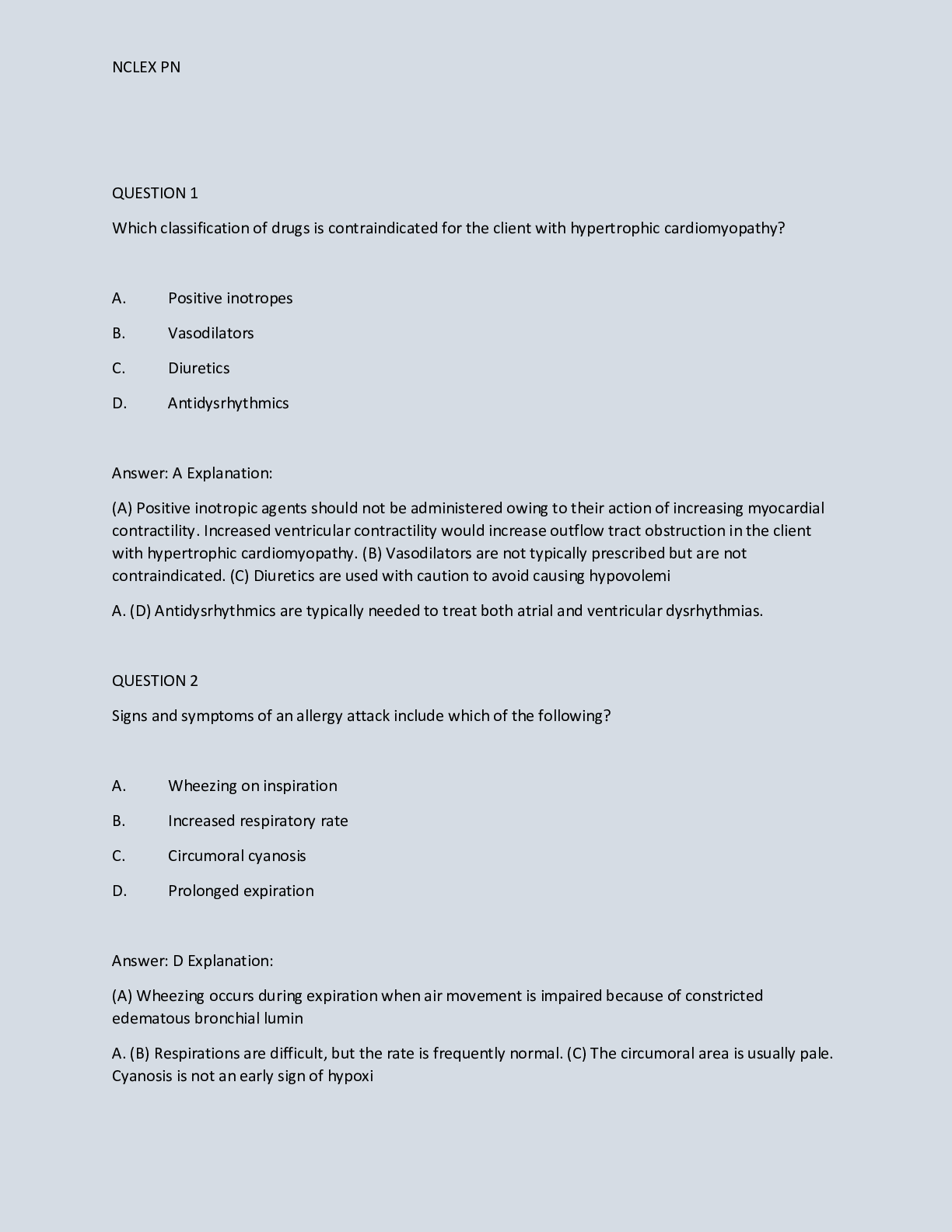

TRUE/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. 1) The value of a call increases when the volatility of the price of the underlying stock increases. Answer: True Fa... lse 2) The value of a put decreases as the exercise price increases. Answer: True False 3) An increase in the underlying stock price will increase the value of a call option. Answer: True False 4) An increase in the exercise price will increase the value of a call option. Answer: True False 5) An increase in the time to expiration will increase the value of a call option. Answer: True False 6) When the exercise price is increased, it would unambiguously decrease the value of an American put option. Answer: True False 7) When the market interest rates increase, it would unambiguously decrease the value of an American put option. Answer: True False 8) When the variance of the underlying asset increases, it would unambiguously decrease the value of an American put option. Answer: True False 9) The strike price is the price the owner of a call pays per share to purchase shares of stock. Answer: True False 10) The expiration date is the only date the owner of a European option can exercise the option. Answer: True False 11) The seller of a put agrees to purchase shares of stock if the option is exercised. Answer: True False 12) Buying a call option gives you the right to purchase shares. Answer: True False 13) Selling a call option may give you the obligation to sell shares. Answer: True False 14) Buying a put option gives you the right to sell shares. Answer: True False 115) Selling a put option may give you the obligation to buy shares. Answer: True False 16) A put option is a wasting asset; i.e., its value declines with the passage of time, all else equal. Answer: True False 17) A protective put entails the purchase of a put option on a stock to limit the downside risk associated with owning that stock. Answer: True False 18) The relationship between the prices of the underlying stock, a call option, a put option, and a riskless asset is referred to as a protective put. Answer: True False 19) The primary purpose of a protective put is to limit the downside risk of asset ownership. Answer: True False 20) The risk-free rate of return is a variable that determines the value of an option. Answer: True False 21) The underlying stock price is a variable that determines the value of an option. Answer: True False 22) The time to expiration is a variable that determines the value of an option. Answer: True False 23) When the value of the underlying asset increases, it would unambiguously decrease the value of an American put option. Answer: True False 24) Stock beta is a variable that is included in the Black-Scholes call option pricing formula. Answer: True False 25) Stock price is a variable that is included in the Black-Scholes call option pricing formula. Answer: True False 26) Exercise price is a variable that is included in the Black-Scholes call option pricing formula. Answer: True False 27) Standard deviation of the return on a stock is a variable that is included in the Black-Scholes call option pricing formula. Answer: True False 28) The intrinsic value of a call is always equal to zero if the call is currently out of the money. Answer: True False 229) The formula C0 = S0 correctly describes the boundary values for an American call option. Answer: True False 30) The formula C0 ≥ 0 if (S0 - E) correctly describes the boundary values for an American call option. Answer: True False 31) The formula C0 ≥ (S0 + E) if (S0 + E) ≥ 0 correctly describe the boundary values for an American call option. Answer: True False 32) The effect on an option's value of a small change in the value of the underlying asset is called the option theta. Answer: True False 33) Delta is the effect on an option's value of a small change in the value of the underlying asset is called the option. Answer: True False 34) The sensitivity of an option's value to a change in the option's time to expiration is measured by the option theta. Answer: True False 35) Gamma is the sensitivity of an option's value to a change in the risk-free rate. Answer: True False 36) The sensitivity of an option's value to a change in the risk-free rate is measured by the option rho. Answer: True False 37) An increase in the variance of the return on the underlying asset will increase the value of a call option. Answer: True False 38) According to the Black-Scholes model, when the expiration date is extended, it results in a decrease in the value of a call option. Answer: True False 39) Put-call parity is the relationship between the prices of the underlying stock, a call option, a put option, and a riskless asset. Answer: True False 40) According to the Black-Scholes model, when the exercise price is increased, it results in a decrease in the value of a call option. Answer: True False [Show More]

Last updated: 11 months ago

Preview 1 out of 76 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 15, 2021

Number of pages

76

Written in

Additional information

This document has been written for:

Uploaded

Apr 15, 2021

Downloads

0

Views

29

.png)

.png)

.png)

as.png)