Business > QUESTIONS & ANSWERS > [Solved] ACC 577 WEEK 8 STUDY (All)

[Solved] ACC 577 WEEK 8 STUDY

Document Content and Description Below

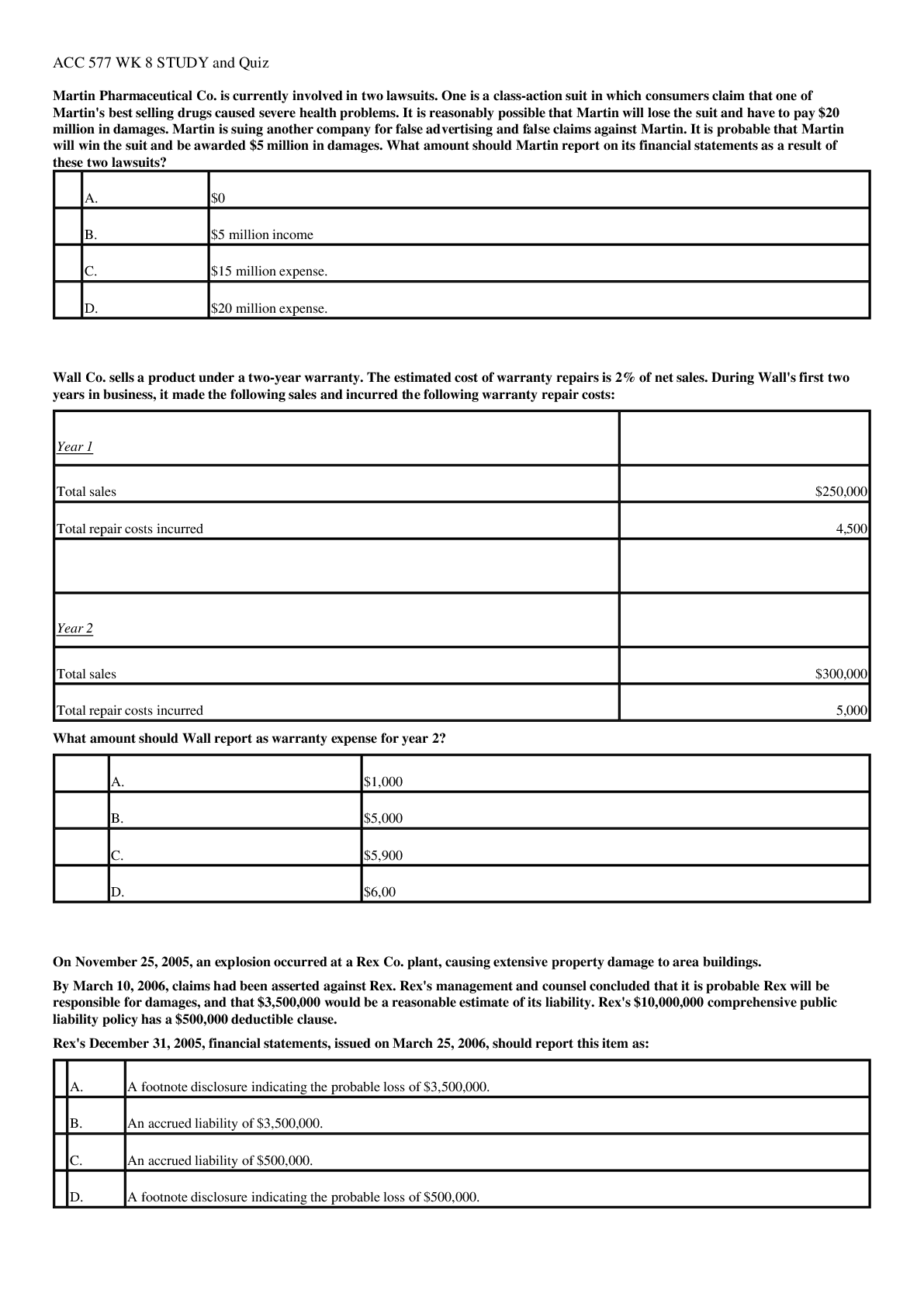

ACC 577 WEEK 8 STUDY ACC 577 WK 8 STUDY and Quiz Martin Pharmaceutical Co. is currently involved in two lawsuits. One is a class-action suit in which consumers claim that one of Martin's best se... lling drugs caused severe health problems. It is reasonably possible that Martin will lose the suit and have to pay $20 million in damages. Martin is suing another company for false advertising and false claims against Martin. It is probable that Martin will win the suit and be awarded $5 million in damages. What amount should Martin report on its financial statements as a result of these two lawsuits? A. $0 B. $5 million income C. $15 million expense. D. $20 million expense. Wall Co. sells a product under a two-year warranty. The estimated cost of warranty repairs is 2% of net sales. During Wall's first two years in business, it made the following sales and incurred the following warranty repair costs: Year 1 Total sales $250,000 Total repair costs incurred 4,500 Year 2 Total sales $300,000 Total repair costs incurred 5,000 What amount should Wall report as warranty expense for year 2? A. $1,000 B. $5,000 C. $5,900 D. $6,00 On November 25, 2005, an explosion occurred at a Rex Co. plant, causing extensive property damage to area buildings. By March 10, 2006, claims had been asserted against Rex. Rex's management and counsel concluded that it is probable Rex will be responsible for damages, and that $3,500,000 would be a reasonable estimate of its liability. Rex's $10,000,000 comprehensive public liability policy has a $500,000 deductible clause. Rex's December 31, 2005, financial statements, issued on March 25, 2006, should report this item as: A. A footnote disclosure indicating the probable loss of $3,500,000. B. An accrued liability of $3,500,000. C. An accrued liability of $500,000. D. A footnote disclosure indicating the probable loss of $500,000. Bell Co. is a defendant in a lawsuit that could result in a large payment to the plaintiff. Bell's attorney believes that there is a 90% chance that Bell will lose the suit, and estimates that the loss will be anywhere from $5,000,000 to $20,000,000 and possibly as much as $30,000,000. None of the estimates is better than the others. What amount of liability should Bell report on its balance sheet related to the lawsuit? A. $ -0- B. $5,000,000 C. $20,000,000 D. $30,000,000 Snelling Co. did not record an accrual for a contingent loss, but disclosed the nature of the contingency and the range of the possible loss. How likely is the loss? A. Remote. B. Reasonably possible. C. Probable. D. Certain. What is the underlying concept that supports the immediate recognition of a contingent loss? A. Substance over form. B. Consistency. C. Matching. D. Conservatism. Brite Corp. had the following liabilities at December 31, 2004: Accounts payable $ 55,000 Unsecured notes, 8%, due 7-1-05 400,000 Accrued expenses 35,000 Contingent liability 450,000 Deferred income tax liability 25,000 Senior bonds, 7%, due 3-31-05 1,000,000 The contingent liability is an accrual for possible losses on a $1,000,000 lawsuit filed against Brite. Brite's legal counsel expects the suit to be settled in 2006 and has estimated that Brite will be liable for damages in the range of $450,000 to $750,000. The deferred income tax liability is not related to an asset for financial reporting and is expected to reverse in 2006. What amount should Brite report in its December 31, 2004 balance sheet for current liabilities? A. $515,000 B. $940,000 C. $1,490,000 D. $1,515,000 In 2003, a personal injury lawsuit was brought against Halsey Co. Based on counsel's estimate, Halsey reported a $50,000 liability in its December 31, 2003, balance sheet. In November 2004, Halsey received a favorable judgment, requiring the plaintiff to reimburse Halsey for expenses of $30,000. The plaintiff has appealed the decision, and Halsey's counsel is unable to predict the outcome of the appeal. In its December 31, 2004, balance sheet, Halsey should report what amounts of asset and liability related to these legal actions? Asset Liability $30,000 $50,000 $30,000 $0 $0 $20,000 $0 $0 At December 31, 2004, Date Co. awaits judgment on a lawsuit for a competitor's infringement of Date's patent. Legal counsel believes it is probable that Date will win the suit and indicated the most likely award together with a range of possible awards. How should the lawsuit be reported in Date's 2004 financial statements? A. In note disclosure only. B. By accrual for the most likely award. C. By accrual for the lowest amount of the range of possible awards. D. Neither in note disclosure nor by accrual. Vadis Co. sells appliances that include a three-year warranty. Service calls under the warranty are performed by an independent mechanic under a contract with Vadis. Based on experience, warranty costs are estimated at $30 for each machine sold. When should Vadis recognize these warranty costs? A. Evenly over the life of the warranty. B. When the service calls are performed. C. When payments are made to the mechanic. D. When the machines are sold. On February 5, 2005, an employee filed a $2,000,000 lawsuit against Steel Co. for damages suffered when one of Steel's plants exploded on December 29, 2004. Steel's legal counsel expects the company will lose the lawsuit and estimates the loss to be between $500,000 and $1,000,000. The employee has offered to settle the lawsuit out of court for $900,000, but Steel will not agree to the settlement. In its December 31, 2004, balance sheet, what amount should Steel report as liability from lawsuit? A. $2,000,000 B. $1,000,000 C. $900,000 D. $500,000 In May 2000, Caso Co. filed suit against Wayne, Inc. seeking $1,900,000 in damages for patent infringement. A court verdict in November 2003 awarded Caso $1,500,000 in damages, but Wayne's appeal is not expected to be decided before 2005. Caso's counsel believes it is probable that Caso will be successful against Wayne for an estimated amount in the range between $800,000 and $1,100,000, with $1,000,000 considered the most likely amount. What amount should Caso record as income from the lawsuit in the year ended December 31, 2003? A. $ -0- B. $800,000 C. $1,000,000 D. $1,500,000 On April 1, 2003, Ash Corp. began offering a new product for sale under a one-year warranty. Of the 5,000 units in inventory at April 1, 2003, 3,000 had been sold by June 30, 2003. Based on its experience with similar products, Ash estimated that the average warranty cost per unit sold would be $8. Actual warranty costs incurred from April 1 through June 30, 2003, were $7,000. At June 30, 2003, what amount should Ash report as estimated warranty liability? A. $9,000 B. $16,000 C. $17,000 D. $33,000 Management can estimate the amount of loss that will occur if a foreign government expropriates some company assets. If expropriation is reasonably possible, a loss contingency should be: A. Disclosed but not accrued as a liability. B. Disclosed and accrued as a liability. C. Accrued as a liability but not disclosed. D. Neither accrued as a liability nor disclosed. East Corp. manufactures stereo systems that carry a two-year warranty against defects. Based on past experience, warranty costs are estimated at 4% of sales for the warranty period. During 2005, stereo system sales totaled $3,000,000, and warranty costs of $67,500 were incurred. In its income statement for the year ended December 31, 2005, East should report warranty expense of: A. $52,500 B. $60,000 C. $67,500 D. $120,000 Hudson Corp. operates several factories that manufacture medical equipment. The factories have a historical cost of $200 million. Near the end of the company's fiscal year, a change in business climate related to a competitor's innovative products indicated to Hudson's management that the $170 million carrying amount of the assets of one of Hudson's factories may not be recoverable. Management identified cash flows from this factory and estimated that the undiscounted future cash flows over the remaining useful life of the factory would be $150 million. The fair value of the factory's assets is reliably estimated to be $135 million. The change in business climate requires investigation of possible impairment. Which of the following amounts is the impairment loss? A. $15 million B. $20 million C. $35 million D. $65 million During 2004, a former employee of Dane Co. began a suit against Dane for wrongful termination in November 2003. After considering all of the facts, Dane's legal counsel believes that the former employee will prevail and will probably receive damages between $1,000,000 and $1,500,000, with $1,300,000 being the most likely amount. Dane's financial statements for the year ended December 31, 2003, will not be issued until February 2004. In its December 31, 2003, balance sheet, what amount should Dane report as a liability with respect to the suit? A. $ -0- B. $1,000,000 C. $1,300,000 D. $1,500,000 Management can estimate the amount of the loss that will occur if a foreign government expropriates some company assets. If expropriation is reasonably possible, a loss contingency should be: A. Neither accrued as a liability nor disclosed. B. Accrued as a liability but not disclosed. C. Disclosed and accrued as a liability. D. Disclosed but not accrued as a liability. During 2004, Gum Co. introduced a new product carrying a two-year warranty against defects. The estimated warranty costs related to dollar sales are 2% within 12 months following the sale and 4% in the second 12 months following the sale. Sales and actual warranty expenditures for the years ended December 31, 2004 and 2005 are as follows: Sales Actual warranty expenditures 2004 $150,000 $2,250 2005 250,000 7,500 $400,000 $9,750 ========= ========= What amount should Gum report as estimated warranty liability in its December 31, 2005, balance sheet? A. $2,500 B. $4,250 C. $11,250 D. $14,250 During 2005, Haft Co. became involved in a tax dispute with the IRS. At December 31, 2005, Haft's tax advisor believed that an unfavorable outcome was probable. A reasonable estimate of additional taxes was $200,000 but could be as much as $300,000. After the 2005 financial statements were issued, Haft received and accepted an IRS settlement offer of $275,000. What amount of accrued liability should Haft have reported in its December 31, 2005 balance sheet? A. $200,000 B. $250,000 C. $275,000 D. $300,000 In 2003, a contract dispute between Dollis Co. and Brooks Co. was submitted to binding arbitration. In 2003, each party's attorney indicated privately that the probable award in Dollis' favor could be reasonably estimated. In 2004, the arbitrator decided in favor of Dollis. When should Dollis and Brooks recognize their respective gain and loss? Dollis' gain Brooks' loss 2003 2003 2003 2004 2004 2003 2004 2004 On January 3, 2005, Ard Corp. owned a machine that had cost $60,000. The accumulated depreciation was $50,000, estimated salvage value was $5,000, and fair market value was $90,000. On January 4, 2005, this machine was irreparably damaged by Rice Corp. and became worthless. In October 2005, a court awarded damages of $90,000 against Rice in favor of Ard. At December 31, 2005, the final outcome of this case was awaiting appeal and was, therefore, uncertain. However, in the opinion of Ard's attorney, Rice's appeal will be denied. At December 31, 2005, what amount should Ard accrue for this gain contingency? A. $90,000 B. $80,000 C. $75,000 D. $ -0- During 2005, Smith Co. filed suit against West, Inc. seeking damages for patent infringement. At December 31, 2005, Smith's legal counsel believed that it was probable that Smith would be successful against West for an estimated amount in the range of $75,000 to $150,000, with all amounts in the range considered equally likely. In March 2006, Smith was awarded $100,000 and received full payment thereof. In its 2005 financial statements, issued in February 2006, how should this award be reported? A. As a receivable and revenue of $100,000. B. As a receivable and deferred revenue of $100,000. C. As a disclosure of a contingent gain of $100,000. D. As a disclosure of a contingent gain of an undetermined amount in the range of $75,000 to $150,000. Grim Corporation operates a plant in a foreign country. It is probable that the plant will be expropriated. However, the foreign government has indicated that Grim will receive a definite amount of compensation for the plant. The amount of compensation is less than the fair market value but exceeds the carrying amount of the plant. The contingency should be reported: A. As a valuation allowance as a part of stockholders' equity. B. As a fixed asset valuation allowance account. C. In the notes to the financial statements. D. In the income statement. In June 2004, Northan Retailers sold refundable merchandise coupons. Northan received $10 for each coupon redeemable from July 1 to December 31, 2004, for merchandise with a retail price of $11. At June 30, 2004, how should Northan report these coupon transactions? A. Unearned revenues at the merchandise's retail price. B. Unearned revenues at the cash received amount. C. Revenues at the merchandise's retail price. D. Revenues at the cash received amount. On January 17, 2005, an explosion occurred at a Sims Co. plant, causing extensive property damage to area buildings. Although no claims had yet been asserted against Sims by March 10, 2005, Sims' management and counsel concluded that it is likely that claims will be asserted and that it is reasonably possible Sims will be responsible for damages. Sims' management believed that $1,250,000 would be a reasonable estimate of its liability. Sims' $5,000,000 comprehensive public liability policy has a $250,000 deductible clause. In Sims' December 31, 2004, financial statements, which were issued on March 25, 2005, how should this item be reported? A. As an accrued liability of $250,000. B. As a footnote disclosure indicating the possible loss of $250,000. C. As a footnote disclosure indicating the possible loss of $1,250,000. D. No footnote disclosure or accrual is necessary. At December 31, 2005, Creole Co. was suing a competitor for patent infringement. The award from the probable favorable outcome could be reasonably estimated. Creole's 2005 financial statements should report the expected award as a: A. Receivable and revenue. B. Receivable and reduction of patent. C. Receivable and deferred revenue. D. Disclosure by footnote only. During 2004, Leader Corp. sued Cape Co. for patent infringement. On December 31, 2004, Leader was awarded a $500,000 favorable judgment in the suit. On that date, Cape offered to settle out of court for $300,000 and not appeal the judgment. In February 2005, after the issuance of its 2004 financial statements, Leader agreed to the out-of-court settlement and received a certified check for $300,000. In its 2004 financial statements, how should Leader have reported these events? A. As a gain of $300,000. B. As a receivable and deferred credit of $300,000. C. As a disclosure in the notes to the financial statements only. D. It should not be reported in the financial statements. Dunn Trading Stamp Co. records stamp service revenue and provides for the cost of redemptions in the year stamps are sold to licensees. Dunn's past experience indicates that only 80% of the stamps sold to licensees will be redeemed. Dunn's liability for stamp redemptions was $6,000,000 at December 31, 2005. Additional information for 2006 is as follows: Stamp service revenue from stamps sold to licensees $4,000,000 Cost of redemptions (stamps sold prior to 1/1/06) 2,750,000 If all the stamps sold in 2006 were presented for redemption in 2007, the redemption cost would be $2,250,000. What amount should Dunn report as a liability for stamp redemptions at December 31, 2006? A. $7,250,000 B. $5,500,000 C. $5,050,000 D. $3,250,000 During 2005, Tedd Co. became involved in a tax dispute with the IRS. At December 31, 2005, Tedd's tax advisor believed that an unfavorable outcome was probable. A reasonable estimate of additional taxes was $400,000 but could be as much as $600,000. After the 2005 financial statements were issued, Tedd received and accepted an IRS settlement offer of $450,000. What amount of accrued liability should Tedd have reported in its December 31, 2005 balance sheet? A. $400,000 B. $450,000 C. $500,000 D. $600,000 Baker Co. sells consumer products that are packaged in boxes. Baker offered an unbreakable glass in exchange for two box tops and $1 as a promotion during the current year. The cost of the glass was $2.00. Baker estimated at the end of the year that it would be probable that 50% of the box tops will be redeemed. Baker sold 100,000 boxes of the product during the current year, and 40,000 box tops were redeemed during the year for the glasses. What amount should Baker accrue as an estimated liability at the end of the current year, related to the redemption of box tops? A. $ -0- B. $5,000 C. $20,000 D. $25,000 On November 1, 2004, Beni Corp. was awarded a judgment of $1,500,000 in connection with a lawsuit. The decision is being appealed by the defendant, and it is expected that the appeal process will be completed by the end of 2005. Beni's attorney feels that it is highly probable that an award will be upheld on appeal, but that the judgment may be reduced by an estimated 40%. In addition to footnote disclosure, what amount should be reported as a receivable in Beni's balance sheet at December 31, 2004? A. $1,500,000 B. $900,000 C. $600,000 D. $ -0- Eagle Co. has cosigned the mortgage note on the home of its president, guaranteeing the indebtedness in the event that the president should default. Eagle considers the likelihood of default to be remote. How should the guarantee be treated in Eagle's financial statements? A. Disclosed only. B. Accrued only. C. Accrued and disclosed. D. Neither accrued nor disclosed. Invern, Inc. has a self-insurance plan. Each year, retained earnings is appropriated for contingencies in an amount equal to insurance premiums saved less recognized losses from lawsuits and other claims. As a result of a 2005 accident, Invern is a defendant in a lawsuit in which it will probably have to pay damages of $190,000. What are the effects of this lawsuit's probable outcome on Invern's 2005 financial statements? A. An increase in expenses and no effect on liabilities. B. An increase in both expenses and liabilities. C. No effect on expenses and an increase in liabilities. D. No effect on either expenses or liabilities. Conlon Co. is the plaintiff in a patent-infringement case. Conlon has a high probability of a favorable outcome and can reasonably estimate the amount of the settlement. What is the proper accounting treatment of the patent infringement case? A. A gain contingency for the minimum estimated amount of the settlement. B. A gain contingency for the estimated probable settlement. C. Disclosure in the notes only. D. No reporting is required at this time. Case Cereal Co. frequently distributes coupons to promote new products. On October 1, 2004, Case mailed 1,000,000 coupons for $.45 off each box of cereal purchased. Case expects 120,000 of these coupons to be redeemed before the December 31, 2004, expiration date. It takes 30 days from the redemption date for Case to receive the coupons from the retailers. Case reimburses the retailers an additional $.05 for each coupon redeemed. As of December 31, 2004, Case had paid retailers $25,000 related to these coupons and had 50,000 coupons on hand that had not been processed for payment. What amount should Case report as a liability for coupons in its December 31, 2004, balance sheets? A. $35,000 B. $29,000 C. $25,000 D. $22,500 During 2003, Manfred Corp. guaranteed a supplier's $500,000 loan from a bank. On October 1, 2004, Manfred was notified that the supplier had defaulted on the loan and filed for bankruptcy protection. Counsel believes Manfred will probably have to pay between $250,000 and $450,000 under its guarantee. As a result of the supplier's bankruptcy, Manfred entered into a contract in December 2004 to retool its machines so that Manfred could accept parts from other suppliers. Retooling costs are estimated to be $300,000. What amount should Manfred report as a liability in its December 31, 2004, balance sheet? A. $250,000 B. $450,000 C. $550,000 D. $750,000 A firm considers its regular warranty liability to be an existing liability of uncertain amount. At year-end, the firm estimates that the amount required to extinguish its warranty liability in the future is in the range of $20 to $60 million, with no amount more likely than any other. Under the two sets of standards, what amount will be recognized? International U.S. 40 40 40 20 20 20 0 40 Which of the following is not a contingent liability under international accounting standards? A. A provision with a 60% chance of requiring an outflow of benefits, amount is estimable. B. A provision with a 40% chance of requiring an outflow of benefits, amount is estimable. C. A provision with a 90% chance of requiring an outflow of benefits, amount not estimable. D. A possible obligation. Which of the following is a recognized liability for both international accounting standards and U.S. standards? A. Regular warranty liability, 60% probability of occurring. B. Obligation to provide rebates to customers, 90% probability of occurring. C. Possible loss due to lawsuit, 60% probability of occurring. D. Possible loss due to lawsuit, 40% probability of occurring. Choose the correct statement about international accounting standards as they relate to contingent liabilities and similar items. A. A provision that has a reasonably possible chance of requiring the outflow of benefits is treated as a contingent liability. B. Provisions are recognized only when there is greater than a 90% probability of an outflow of benefits occurring. C. A recognized provision is a contingent liability. D. A provision for which it is probable that an outflow of benefits will be required is recognized, even if it is not of estimable amount. Choose the correct statement regarding international accounting standards and U.S. standards as they relate to contingent liabilities and similar items. A. All provisions under international accounting standards are contingent liabilities under U.S. standards. B. Both sets of standards require discounting of estimated liabilities. C. A possible obligation that requires a future event for confirmation is treated as a contingent liability under both sets of standards. D. Both sets of standards are essentially the same with regard to recognition of contingent assets. Wood Co.'s dividends on noncumulative preferred stock have been declared but not paid. Wood has not declared or paid dividends on its cumulative preferred stock in the current or the prior year and has reported a net loss in the current year. For the purpose of computing basic earnings per share, how should the income available to common stockholders be calculated? A. The current-year dividends and the dividends in arrears on the cumulative preferred stock should be added to the net loss, but the dividends on the noncumulative preferred stock should NOT be included in the calculation. B. The dividends on the noncumulative preferred stock should be added to the net loss, but the current-year dividends and the dividends in arrears on the cumulative preferred stock should NOT be included in the calculation. C. The dividends on the noncumulative preferred stock and the current-year dividends on the cumulative preferred stock should be added to the net loss. D. Neither the dividends on the noncumulative preferred stock nor the current-year dividends and the dividends in arrears on cumulative preferred stock should be included in the calculation. During the current year, Comma Co. had outstanding: 25,000 shares of common stock, 8,000 shares of $20 par, 10% cumulative preferred stock, and 3,000 bonds that are $1,000 par and 9% convertible. The bonds were originally issued at par, and each bond was convertible into 30 shares of common stock. During the year, net income was $200,000, no dividends were declared, and the tax rate was 30%. What amount was Comma's basic earnings per share for the current year? A. $3.38 B. $7.36 C. $7.55 D. $8.00 Jen Co. had 200,000 shares of common stock and 20,000 shares of 10%, $100 par value cumulative preferred stock. No dividends on common stock were declared during the year. Net income was $2,000,000. What was Jen's basic earnings per share? A. $9.00 B. $9.09 C. $10.00 D. $11.11 Balm Co. had 100,000 shares of common stock outstanding as of January 1. The following events occurred during the year: 4/1 Issued 30,000 shares of common stock. 6/1 Issued 36,000 shares of common stock. 7/1 Declared a 5% stock dividend. 9/1 Purchased as treasury stock 35,000 shares of its common stock. Balm used the cost method to account for the treasury stock. What is Balm's weighted average of common stock outstanding at December 31? A. 131,000 B. 139,008 C. 150,675 D. 162,342 A company had the following outstanding shares as of January 1, year 2: Preferred stock, $60 par, 4%, cumulative 10,000 shares Common stock, $3 par 50,000 shares On April 1, year 2, the company sold 8,000 shares of previously unissued common stock. No dividends were in arrears on January 1, year 2, and no dividends were declared or paid during year 2. Net income for year 2 totaled $236,000. What amount is basic earnings per share for the year ended December 31, year 2? A. $3.66 B. $3.79 C. $4.07 D. $4.21 Chape Co. had the following information related to common and preferred shares during the year: Common shares outstanding, 1/1 700,000 Common shares repurchased, 3/31 20,000 Conversion of preferred shares, 6/30 40,000 Common shares repurchased, 12/1 36,000 Chape reported net income of $2,000,000 at December 31. What amount of shares should Chape use as the denominator in the computation of basic earnings per share? A. 684,000 B. 700,000 C. 702,000 D. 740,000 Strauch Co. has one class of common stock outstanding and no other securities that are potentially convertible into common stock. During 2005, 100,000 shares of common stock were outstanding. In 2006, two distributions of additional common shares occurred: On April 1, 20,000 shares of treasury stock were sold, and on July 1, a 2-for-1 stock split was issued. Net income was $410,000 in 2006 and $350,000 in 2005. What amounts should Strauch report as earnings per share in its 2006 and 2005 comparative income statements? 2006 2005 $1.78 $3.50 $1.78 $1.75 $2.34 $1.75 $2.34 $3.50 On January 31, 2004, Pack, Inc. split its common stock 2 for 1, and Young, Inc. issued a 5% stock dividend. Both companies issued their December 31, 2003, financial statements on March 1, 2004. Should Pack's 2003 earnings per share (EPS) take into consideration the stock split, and should Young's 2003 EPS take into consideration the stock dividend? Pack's 2003 EPS Young's 2003 EPS Yes No No No Yes Yes No Yes The following information pertains to Jet Corp. outstanding stock for 2004: Common stock, $5 par value Shares outstanding, 1/1/04 20,000 2-for-1 stock split, 4/1/04 20,000 Shares issued, 7/1/04 10,000 Preferred stock, $10 par value, 5% cumulative Shares outstanding, 1/1/04 4,000 What are the number of shares Jet should use to calculate 2004 earnings per share? A. 40,000 B. 45,000 C. 50,000 D. 54,000 Ian Co. is calculating earnings per share amounts for inclusion in the Ian's annual report to shareholders. Ian has obtained the following information from the controller's office as well as shareholder services: Net income from January 1 to December 31 $125,000 Number of outstanding shares: January 1 to March 31 15,000 April 1 to May 31 12,500 June 1 to December 31 17,000 In addition, Ian has issued 10,000 incentive stock options with an exercise price of $30 to its employees and a year-end market price of $25 per share. What amount is Ian's diluted earnings per share for the year ended December 31? A. $4.63 B. $4.85 C. $7.35 D. $7.94 The treasury stock method of entering stock options into the calculation of diluted EPS: A. Is used only for dilutive treasury stock. B. Computes the increase in common shares outstanding from assumed exercise of options to be the number of shares under option. C. Is called the treasury stock method because the proceeds from assumed exercise are assumed to be used to purchase treasury stock. D. Assumes the treasury shares are purchased at year-end. A firm has basic earnings per share of $1.29. If the tax rate is 30%, which of the following securities would be dilutive? A. Cumulative 8%, $50 par preferred stock. B. Ten percent convertible bonds, issued at par, with each $1,000 bond convertible into 20 shares of common stock. C. Seven percent convertible bonds, issued at par, with each $1,000 bond convertible into 40 shares of common stock. D. Six percent, $100 par cumulative convertible preferred stock, issued at par, with each preferred share convertible into four shares of common stock. A firm with a net income of $30,000 and weighted average actual shares outstanding of 15,000 for the year also had the following two securities outstanding the entire year: (1) 2,000 options to purchase one share of stock for $12 per share. The average share price during the year was $20, (2) cumulative convertible preferred stock with an annual dividend commitment of $4,500. Total common shares issued on conversion are 2,900. Compute diluted EPS for this firm. A. $1.70 B. $1.60 C. $1.55 D. $1.61 The following information pertains to Ceil Co., a company whose common stock trades in a public market: Shares outstanding at 1/1 100,000 Stock dividend at 3/31 24,000 Stock issuance at 6/30 5,000 What is the weighted average number of shares Ceil should use to calculate its basic earnings per share for the year ended December 31? A. 120,500 B. 123,000 C. 126,500 D. 129,000 AB Company reported earnings per share of $10.50 on income before discontinued operations, ($2.00) on income (loss) attributed to discontinued operations, and $8.50 on net income. Which EPS figure is more relevant to a potential investor? A. ($2.00) B. $7.50 C. $8.50 D. $10.50 LM Company has net income of $130,000, weighted average shares of common stock outstanding of 50,000, and preferred dividends for the period of $20,000. What is LM’s earnings per share of common stock? A. $2.60 B. $2.50 C. $2.20 D. $0.40 For which of the following income statement sections is earnings per share calculated? A. Sales. B. Gross profit. C. Income before discontinued operations. D. Dividends paid to common shareholders. Why do preferred stock dividends appear in the calculation of earnings per share (EPS)? A. Preferred stock may be converted into common stock at the option of the shareholder. B. Preferred stock dividends are not included in the calculation of EPS unless they have been outstanding for the entire year. C. The denominator includes the weighted average number of shares of both preferred and common shares outstanding. D. Preferred stock dividends are subtracted from the earnings for the period in the calculation of earnings per share. If everything else is held constant, earnings per share is increased by: A. Purchase of treasury stock. B. Issuance of new shares of common stock. C. Payment of a cash dividend to common stockholders. D. Payment of a cash dividend to both preferred and common stockholders. On April 30, 2005, Carty Corp. approved a plan to dispose of a segment of its business. The disposal loss is $480,000, including severance pay of $55,000 and employee relocation costs of $25,000, both of which are directly associated with the decision to dispose of the segment. The firm is a calendar-fiscal year firm, and the segment's operating loss for the entire year (2005) through the date of disposal was $120,000. Before income taxes, what amount should be reported in Carty's income statement for the year ended December 31, 2005, as the total income effect (loss) from discontinued operations? A. $600,000 B. $480,000 C. $120,000 D. $360,000 Which of the following transactions qualify as a discontinued operation? A. Disposal of a group of assets that are fully depreciated and have no remaining useful life. B. Approved sale of a segment that represents a strategic shift in the entities operations. C. Phasing out of a production line. D. Changes related to technological improvements. In 20x5, a firm decided to discontinue a segment with a book value of $200 million and a fair value of $250 million. The cost to dispose of the segment in 20x6 is estimated to be $10 million. In the 20x5 income statement, what amount of disposal gain or loss will be reported in the discontinued operations section? A. $ -0- B. $50 million loss. C. $50 million gain. D. $40 million gain. On May 15, 2003, Munn, Inc. approved a plan to dispose of a segment of its business. It is expected that the sale will occur on February 1, 2004, at a selling price of $500,000. The segment reported $195,000 in operating losses for 2003. The segment is expected to lose $30,000 from operations in 2004. The carrying amount of the segment at the date of sale was expected to be $850,000. Before income taxes, what amount should Munn report as a loss from discontinued operations in its 2003 income statement? A. $575,000 B. $225,000 C. $195,000 D. $545,000 A company decided to sell an unprofitable division of its business. The company can sell the entire operation for $800,000, and the buyer will assume all assets and liabilities of the operations. The tax rate is 30%. The assets and liabilities of the discontinued operation are as follows: Buildings $5,000,000 Accumulated depreciation 3,000,000 Mortgage on buildings 1,100,000 Inventory 500,000 Accounts payable 600,000 Accounts receivable 200,000 What is the after-tax net loss on the disposal of the division? A. $140,000 B. $200,000 C. $1,540,000 D. $2,200,000 During 20x8, a firm discontinued a component qualifying for separate disclosure within the income statement. The disposal was completed before the end of 20x8 and resulted in a $300 disposal gain. The component earned $400 in 20x7 but lost $100 (negative income) in 20x8. The 20x7 income statement reported income from continuing operations (IFCO) of $6,000. The 20x8 income statement reported $7,000 of net income. Determine the following two amounts: IFCO for 20x7 as it is reported comparatively in the 20x8 statements IFCO for 20x8 $6,000 $7,000 $6,000 $6,800 $5,600 $6,800 $5,600 $7,200 In open-market transactions, Gold Corp. simultaneously sold its long-term investment in Iron Corp. bonds and purchased its own outstanding bonds. The broker remitted the net cash from the two transactions. Gold's gain on the purchase of its own bonds exceeded its loss on the sale of the Iron bonds. Gold should report the: A. Net effect of [Show More]

Last updated: 1 year ago

Preview 1 out of 77 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Feb 08, 2021

Number of pages

77

Written in

Additional information

This document has been written for:

Uploaded

Feb 08, 2021

Downloads

0

Views

100

.png)

.png)

.png)

.png)

.png)

.png)

.png)