Business Analytics > EXAM > The University of Manila College of Business Administration and Accountancy Integrated CPA Review an (All)

The University of Manila College of Business Administration and Accountancy Integrated CPA Review and Refresher Program TAXATION. Exam. 100 MCQ

Document Content and Description Below

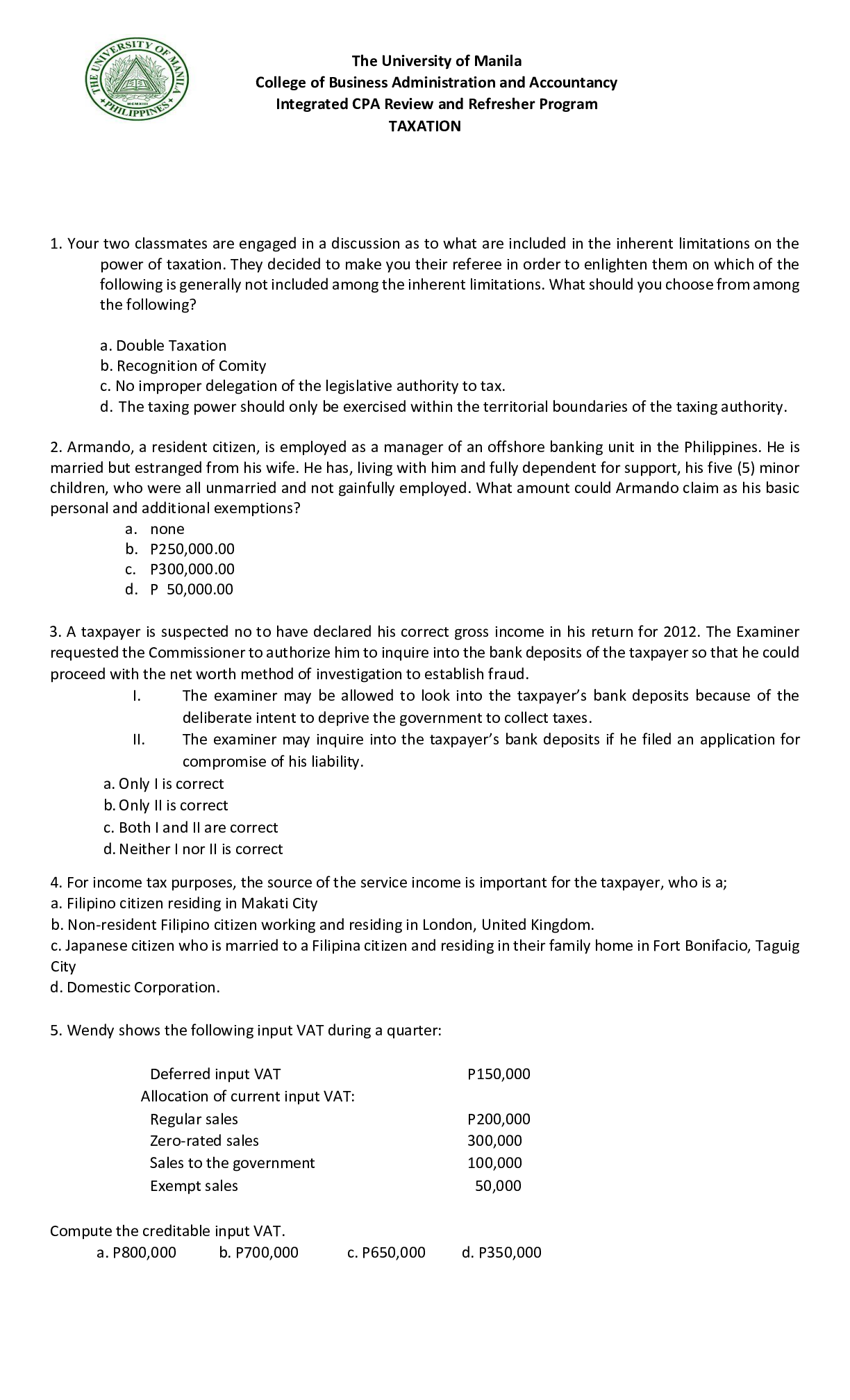

The University of Manila College of Business Administration and Accountancy Integrated CPA Review and Refresher Program TAXATION 1. Your two classmates are engaged in a discussion as to what are i... ncluded in the inherent limitations on the power of taxation. They decided to make you their referee in order to enlighten them on which of the following is generally not included among the inherent limitations. What should you choose from among the following? a. Double Taxation b. Recognition of Comity c. No improper delegation of the legislative authority to tax. d. The taxing power should only be exercised within the territorial boundaries of the taxing authority. 2. Armando, a resident citizen, is employed as a manager of an offshore banking unit in the Philippines. He is married but estranged from his wife. He has, living with him and fully dependent for support, his five (5) minor children, who were all unmarried and not gainfully employed. What amount could Armando claim as his basic personal and additional exemptions? a. none b. P250,000.00 c. P300,000.00 d. P 50,000.00 3. A taxpayer is suspected no to have declared his correct gross income in his return for 2012. The Examiner requested the Commissioner to authorize him to inquire into the bank deposits of the taxpayer so that he could proceed with the net worth method of investigation to establish fraud. I. The examiner may be allowed to look into the taxpayer’s bank deposits because of the deliberate intent to deprive the government to collect taxes. II. The examiner may inquire into the taxpayer’s bank deposits if he filed an application for compromise of his liability. a. Only I is correct b. Only II is correct c. Both I and II are correct d. Neither I nor II is correct 4. For income tax purposes, the source of the service income is important for the taxpayer, who is a; a. Filipino citizen residing in Makati City b. Non-resident Filipino citizen working and residing in London, United Kingdom. c. Japanese citizen who is married to a Filipina citizen and residing in their family home in Fort Bonifacio, Taguig City d. Domestic Corporation. 5. Wendy shows the following input VAT during a quarter: [Show More]

Last updated: 1 year ago

Preview 1 out of 24 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 23, 2023

Number of pages

24

Written in

Additional information

This document has been written for:

Uploaded

Mar 23, 2023

Downloads

0

Views

62