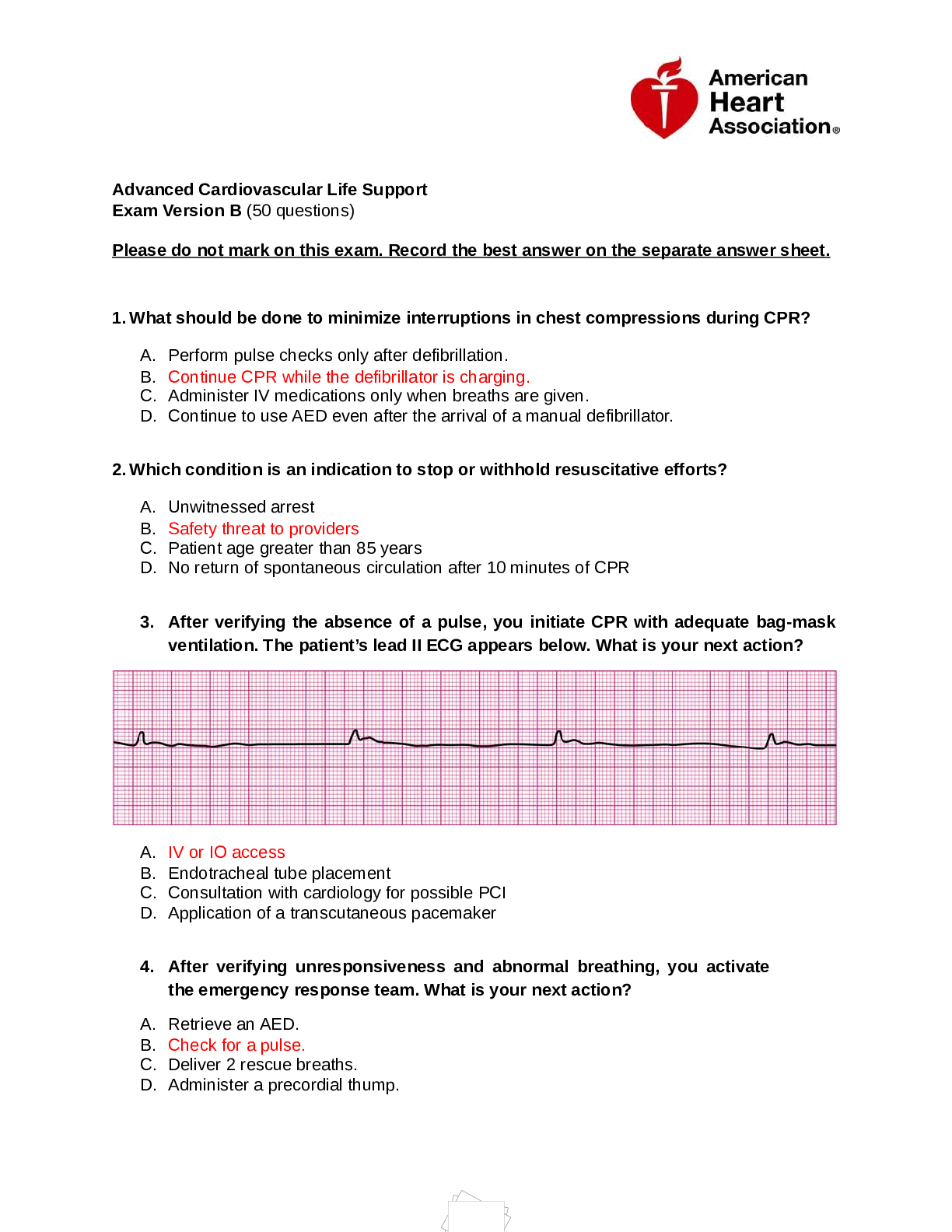

Risk Management and Insurance > QUESTIONS & ANSWERS > NYS Insurance Licensing Exam Latest 2023 Graded A (All)

NYS Insurance Licensing Exam Latest 2023 Graded A

Document Content and Description Below

NYS Insurance Licensing Exam Latest 2023 Graded A insurance transfers ✔✔the risk of an loss for an individual or business to an insurance company which spreads out the costs to many individuals... agency contract ✔✔a contract that is held between insurer and an agent/producer containing the expressed authority given to the agent/producer, and the duties/responsibilities to the principal, any agent in violation of the agency contract may be held personally liable to the insurer agent ✔✔legal representative of a an insurance company that acts for another person or entity known as the principal with regard to contractual arrangements beneficiary ✔✔receives benefits from the insurance death benefit ✔✔the amount paid when a claim is issued against policy of insurance insurance policy ✔✔a contact b/w insured and insurance company that agrees to pay the insured in the event of unforseen events caused by specific events risk ✔✔is the uncertainty or chance of loss occurring only two types of risks exist which are speculative and pure and only one is insurable pure risk ✔✔is the the certainty that loss or no change will occur with no financial gain to be sought only this type of risk is insurable speculative ✔✔the type that may either lead to loss or gain. example gambling. these are NOT insurable exposure ✔✔the unit of measure used to determine the premiums for insurance coverage hazards ✔✔broken into 2 subtypes (physical, moral, morale); conditions that increase the probability of the insured to experience a loss physical hazard ✔✔hazards arising from material, structural, and operational features moral hazard ✔✔hazards to applicants that may lie or provide fraudulent information to insurance companies morale ✔✔hazard derived from complacent (If broken the insurance will fix it ) state of mind perils ✔✔are CAUSES of the loss that are covered in insurance policies loss ✔✔is defined as the reduction , decrease, or disappearance of value of property or person insured in the policy caused by a name peril Pure Death protection ✔✔(Term/temporary protection) if the insured dies during this term, the beneficiary receives the pay out; if policy is cancelled/expires prior to insured death, there is nothing payable at the end; NO cash value; maximum age that coverage is not offered is 80 3 basic types of Term Coverage ✔✔determined by how the face amount or death benefit changes throughout coverage (Level, Increasing, Decreasing) however, premiums usually stay constant the only thing that changes is the death benefit Level Term Insurance ✔✔refers to most common type of temporary protection in which death benefit does not change throughout duration of policy Annually Renewal Term -ART ✔✔the purest form of term insurance, in which death benefit remains level and the policy may be guaranteed to be renewable each year without proof of insurability, but the premium increases annually according to attained age , as the probability of death increases Level Premium Term ✔✔provides a level death benefit and a level premium during policy term Convertible Term ✔✔provision provides the policy owner with the right to convert the to a permanent insurance policy without PROOF OF INSURABILITY. The premium will be based on the insured's attained age at time of conversion Increasing Term ✔✔features level premiums and a death benefit that increases each year over the duration of the policy term. The amount of the increase in the death benefit is usually expressed as a specific amount or percentage of the original amount. Often used by insurance companies to fund certain riders that provide A REFUND OF PREMIUMS OR A GRADUAL INCREASE IN TOTAL COVERAGE Decreasing Term Policy ✔✔policy that features a level premium and a death benefit that decreases each year over the duration of the policy. Primarily used when the amount of the needed protection is time sensitive or decreases in time (eg---to insure the payment of a mortgage or other debts if the insured dies prematurely b/c amount of coverage decreases as outstanding bal. dec. each year; usually not RENEWABLE Return of Premium Term-ROP ✔✔form of increasing insurance policy that pays an additional death benefit equal to the premiums paid to the beneficiary. It's paid if the death occurs within a specific time or if the insured outlives the policy. Permanent insurance ✔✔general term used to refer to various forms of life insurance that build in cash value and stay in effect until age 100 or the life of the insured as long as the premium is paid; most common is whole life Whole life insurance ✔✔build in cash value in which the policy owner can borrow against. cash value does not accumulate until third year in policy. policyowner pays a level premium over the life of the contract. At age 100, benefit is paid to policy/owner or insured or if person dies before beneficiary receives benefit 3 types of Whole life insurance ✔✔straight, limited pay, and single premium Continuous Premium ( Straight Life) Whole Life Insurance ✔✔basic whole life policy in which policyowner pays premium until the insured's death or age 100. has the lowest annual premium Limited Payment Whole Life insurance ✔✔designed so premiums for coverage will be completely paid up well before the age of 100 (eg- 20-pay or LP-65 where its completely paid up at age 20 or 65). For people who don't want to pay premiums after a certain age however willing to pay for slightly higher premiums Single Premium whole life (SPWL) ✔✔designed to provide a level death benefit to the insured age 100 for a one time lump sum payment. This policy is completely paid-up after one premium and it generates immediate cash; usually requires a minimum premium Modified Whole Life ✔✔type of whole life insurance that charges a lower premiums (similar to term rates) in the first few policy years, eg 3-5 years and then a higher premium for the remainder of the insureds life. The higher subsequent premium is higher than a straight life premium would be for the same age and amount of coverage. For individuals that are just starting out with low fin. means but will eventually grow in future Adjustable Life ✔✔best of both worlds ( perm. and term coverage). Can assume either form; insured usually determines how much coverage is needed and the affordable amount of premium. THen insurer will determine type of insurance needed to meet insured needs. As needs change the policyowner may make changes; cash value only develops when premiums are more than the cost of policy provisions ✔✔stipulte the rights and obligations of an insurance contract and are fairly universal from one policy to the next Riders ✔✔modify provision that already exist and to increase or decrease policy benefits and premiums [Show More]

Last updated: 1 year ago

Preview 1 out of 7 pages

.png)

Also available in bundle (1)

.png)

NY State Insurance License Bundled Exams Questions and Answers Already Passed

NY State Insurance License Bundled Exams Questions and Answers Already Passed

By Nutmegs 1 year ago

$20

13

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Feb 20, 2023

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

Feb 20, 2023

Downloads

0

Views

84

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)