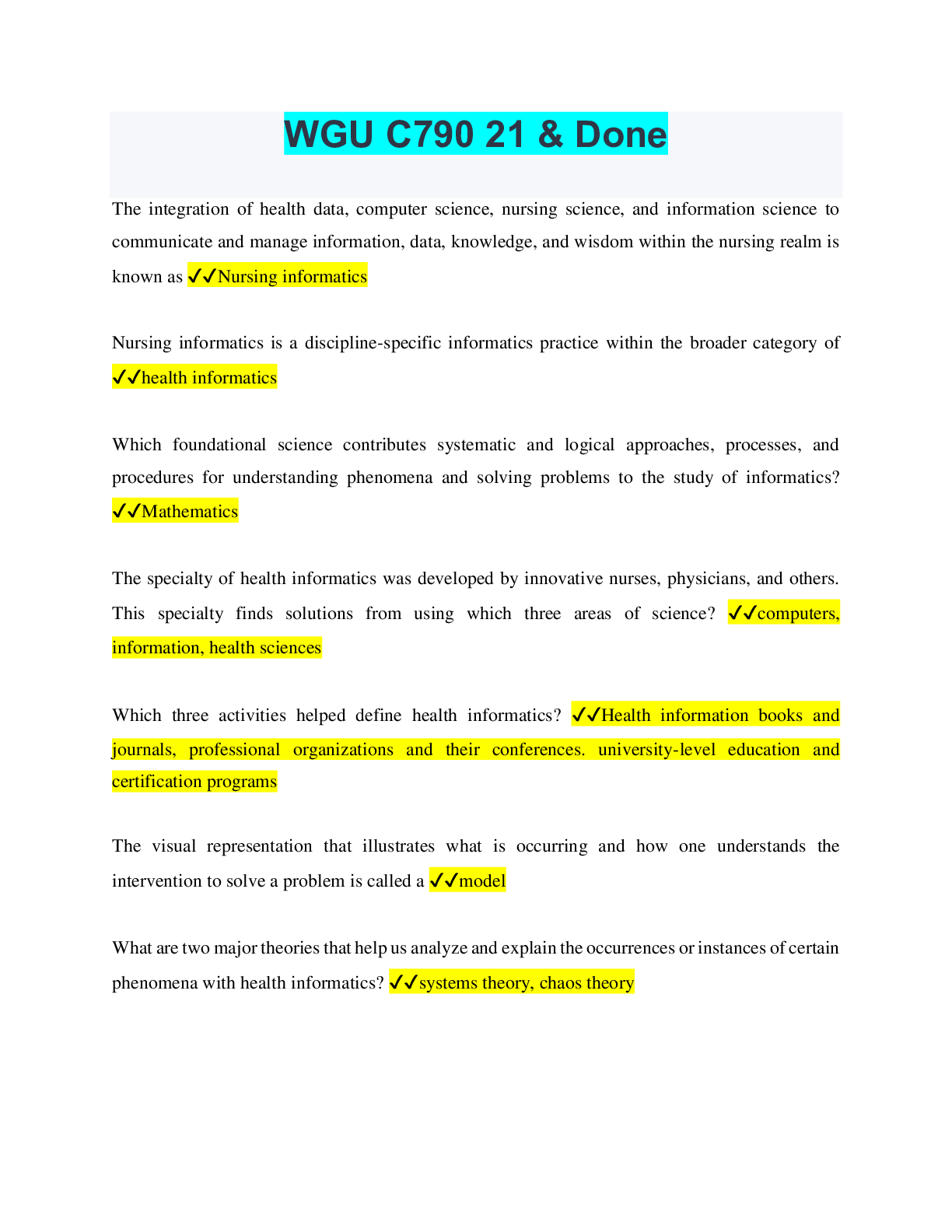

Auditing > QUESTIONS & ANSWERS > Semester: 172 (4th Level)Course Title: Auditing Assignment # 1 | Download for quality grades | (All)

Semester: 172 (4th Level)Course Title: Auditing Assignment # 1 | Download for quality grades |

Document Content and Description Below

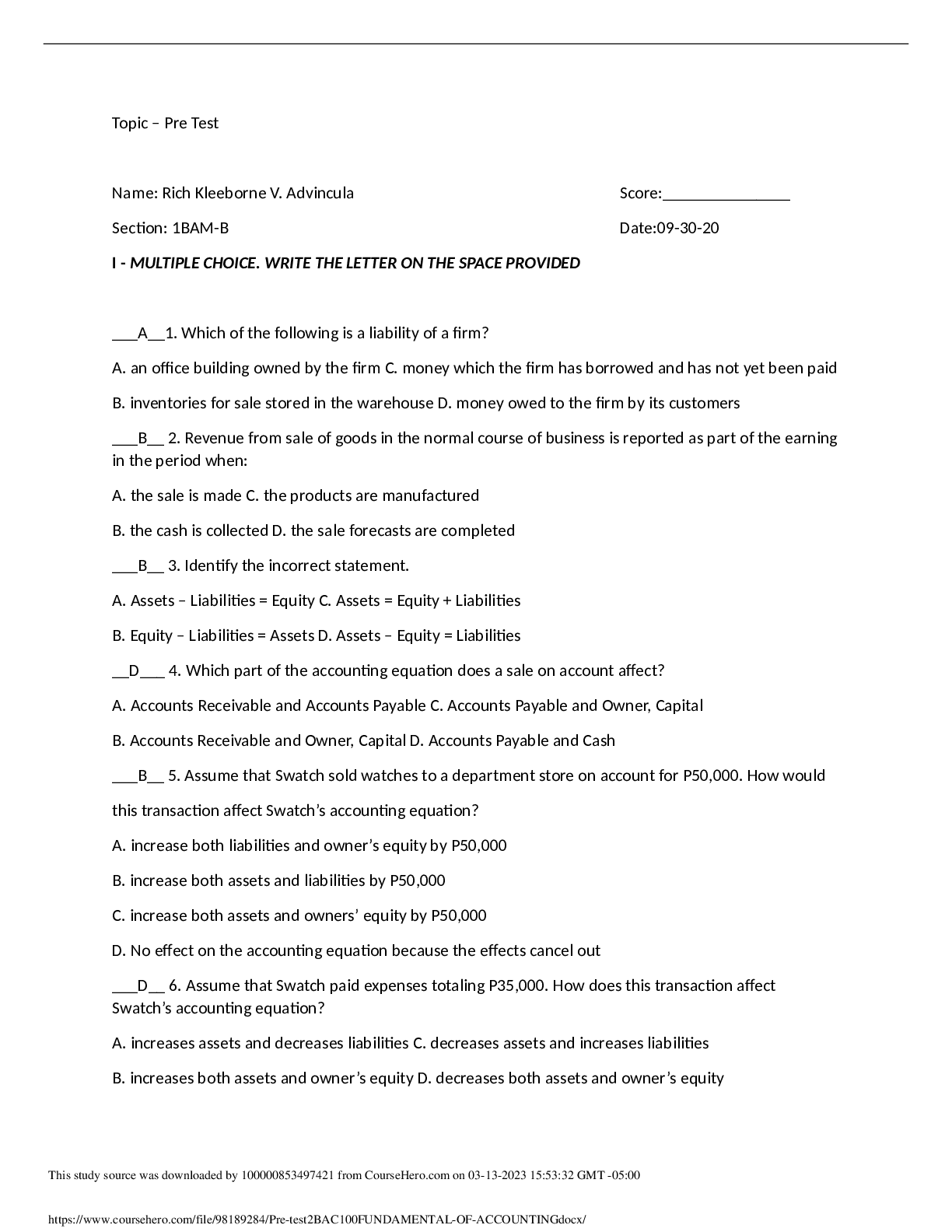

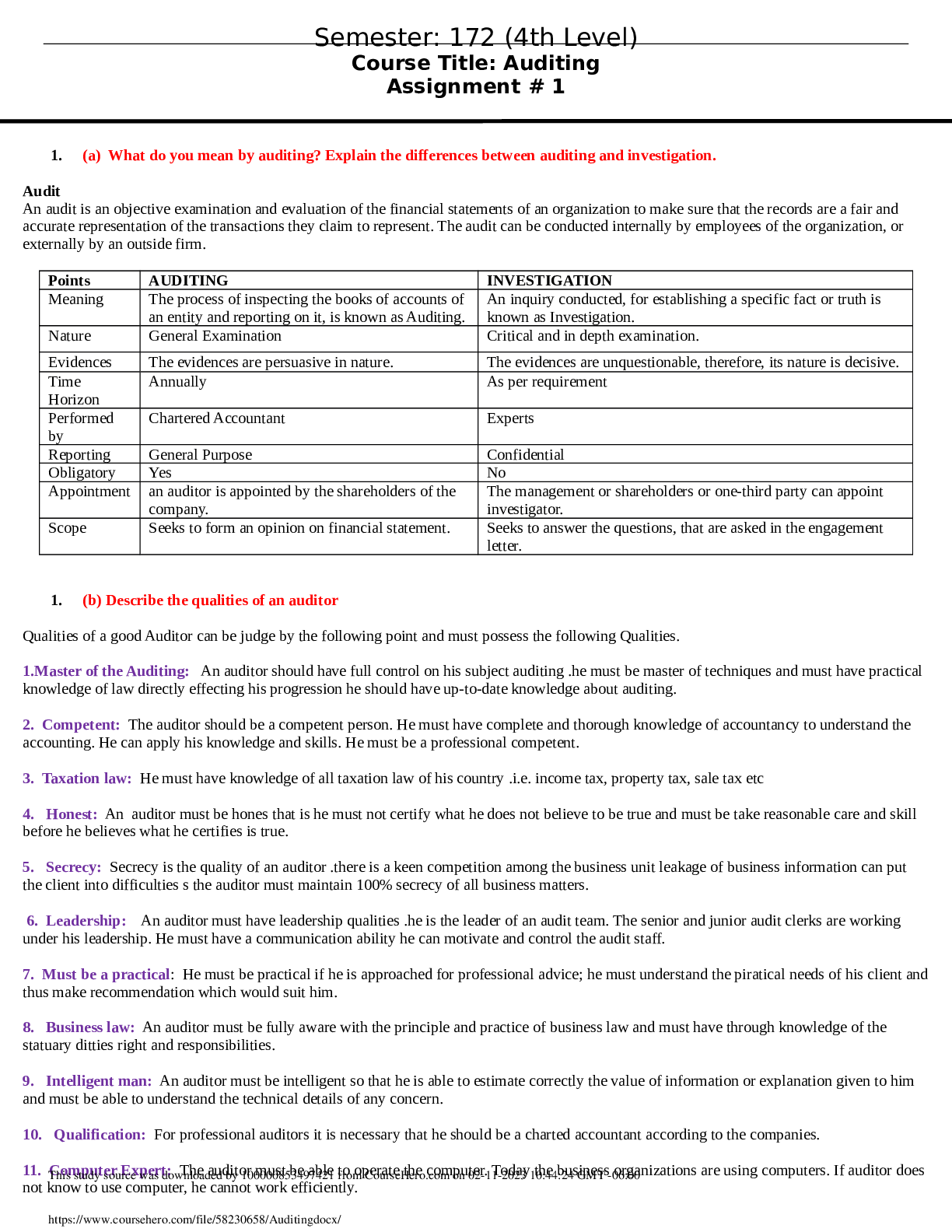

1. (a) What do you mean by auditing? Explain the differences between auditing and investigation. Audit An audit is an objective examination and evaluation of the financial statements of an organizat... ion to make sure that the records are a fair and accurate representation of the transactions they claim to represent. The audit can be conducted internally by employees of the organization, or externally by an outside firm. Points AUDITING INVESTIGATION Meaning The process of inspecting the books of accounts of an entity and reporting on it, is known as Auditing. An inquiry conducted, for establishing a specific fact or truth is known as Investigation. Nature General Examination Critical and in depth examination. Evidences The evidences are persuasive in nature. The evidences are unquestionable, therefore, its nature is decisive. Time Horizon Annually As per requirement Performed by Chartered Accountant Experts Reporting General Purpose Confidential Obligatory Yes No Appointment an auditor is appointed by the shareholders of the company. The management or shareholders or one-third party can appoint investigator. Scope Seeks to form an opinion on financial statement. Seeks to answer the questions, that are asked in the engagement letter. 1. (b) Describe the qualities of an auditor Qualities of a good Auditor can be judge by the following point and must possess the following Qualities. 1.Master of the Auditing: An auditor should have full control on his subject auditing .he must be master of techniques and must have practical knowledge of law directly effecting his progression he should have up-to-date knowledge about auditing. 2. Competent: The auditor should be a competent person. He must have complete and thorough knowledge of accountancy to understand the accounting. He can apply his knowledge and skills. He must be a professional competent. 3. Taxation law: He must have [Show More]

Last updated: 1 year ago

Preview 1 out of 3 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Feb 11, 2023

Number of pages

3

Written in

Additional information

This document has been written for:

Uploaded

Feb 11, 2023

Downloads

0

Views

57

.png)