Accounting > EXAM > ACCT 346 Week 8 Final Exam v2 (100% correct answers) (All)

ACCT 346 Week 8 Final Exam v2 (100% correct answers)

Document Content and Description Below

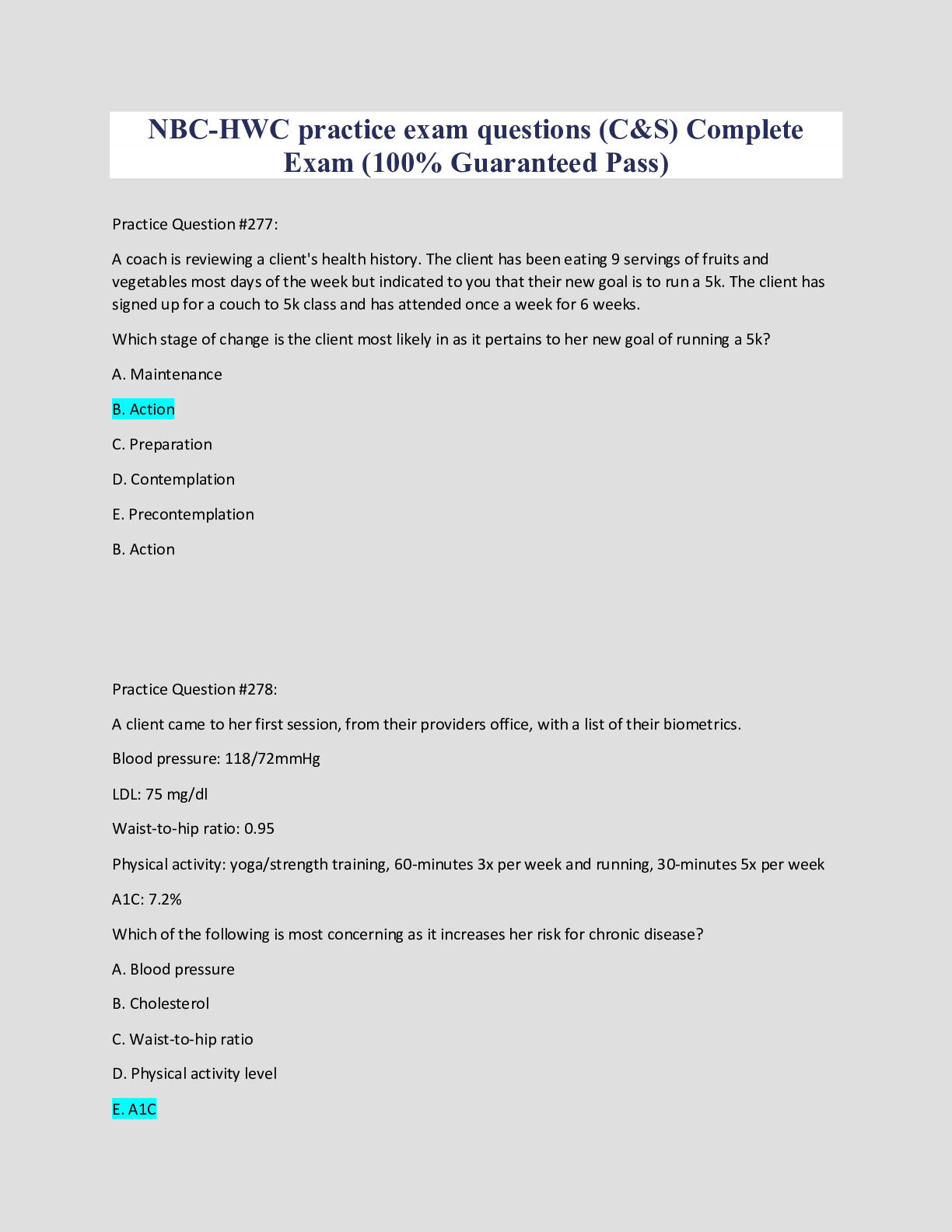

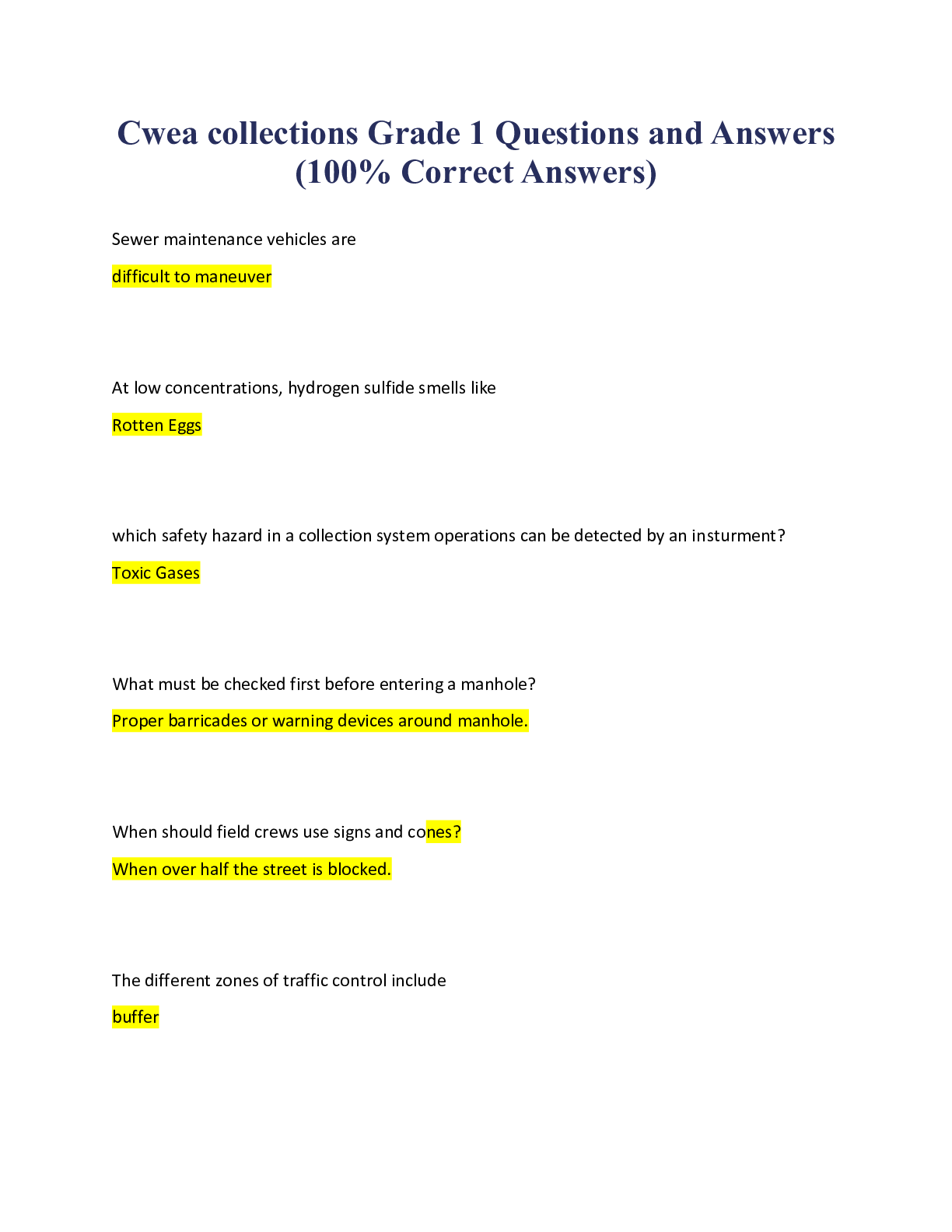

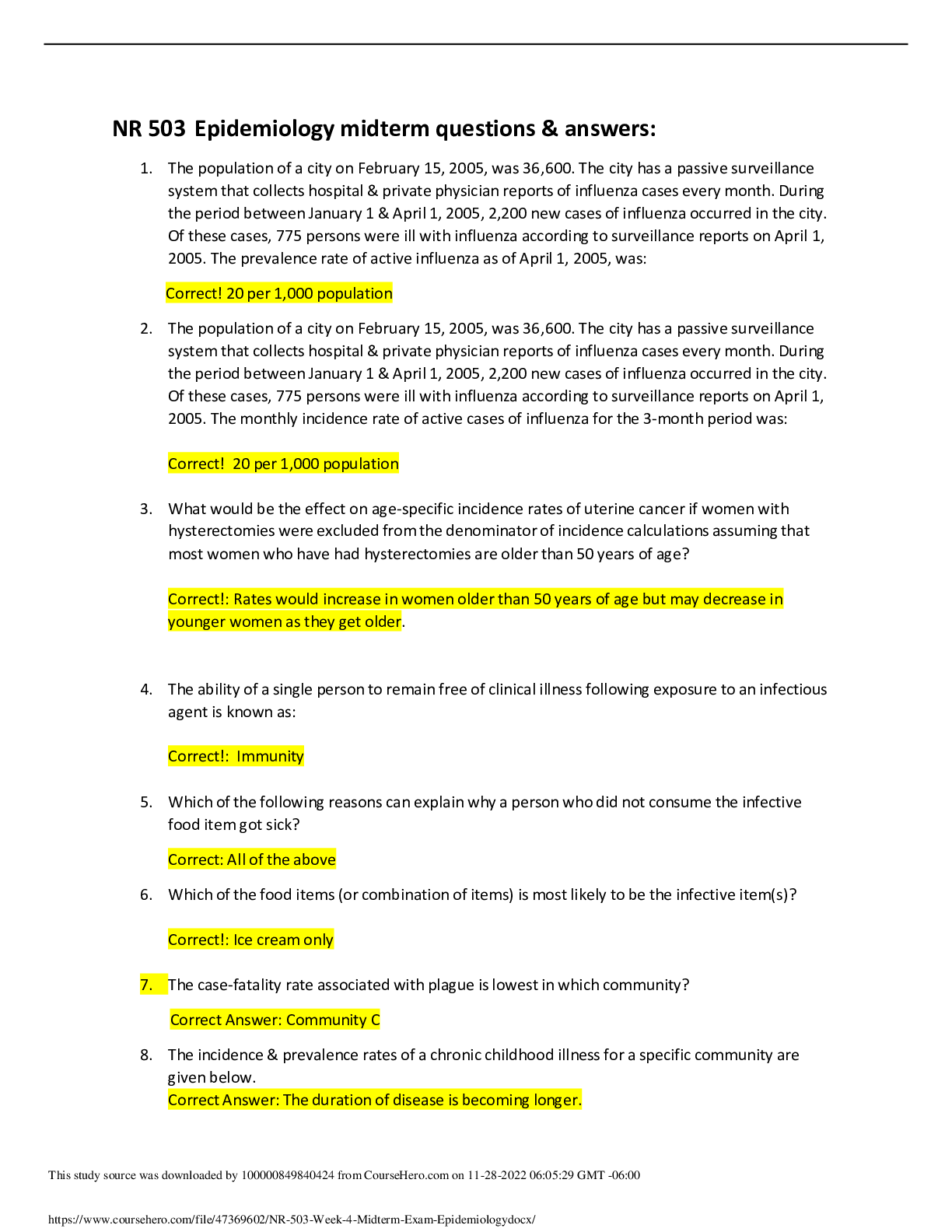

ACCT 346 Week 8 Final Exam (TCO 6) Preparing purchase orders is a(n) unit-level batch-level facility-level product-level (TCO 4) When the activity level is expected to decr... ease within the relevant range, what effects would be anticipated with respect to each of the following? Fixed costs per unit decrease and variable costs in total decrease Fixed costs per unit increase and variable costs in total increase Fixed costs per unit increase and variable costs per unit decrease Fixed costs per unit increase and variable costs per unit do not change (TCO 2) For which situation(s) below would an organization be more likely to use a job-order costing system of accumulating product costs rather than a process costing system? Potato chip manufacturer Computer consulting firm Oil refinery A factory that processes sugar and other ingredients into candy (TCO 1) Which of the following is a fixed inventorial product cost? Commissions paid to sales representatives Direct labor Advertising costs Factory rent (TCO 1) Which of the following IMA Statement of Ethical Professional Practice standards is violated if a managerial accountant steals property from his neighbor? Integrity Credibility Confidentiality Competence (TCO 1) Management accountants continually face ethical challenges as do all accountants. If a managerial accountant is unable to resolve an ethical dilemma following his or her company’s guidelines, what does the IMA Statement of Ethical Professional Practice recommend? If the accountant cannot resolve the conflict following the company's guidelines then they should follow the below steps: They could discuss the situation with the immediate supervisor unless the supervisor is involved. If the supervisor is involved then notify the supervisor at the next higher managerial level. If the immediate supervisor involved is the CEO, notify the audit committee or board of directors. They could discuss the situation with an objective adviser, such as an IMA ethics counselor. According to our book The IMA offers a confidential “Ethics Hotline” to its members. Members can call the hotline and discuss their ethical dilemma. The ethics counselor will not provide a specific resolution but will clarify how the dilemma relates to the IMA’s Statement of Ethical Professional Practice. They then could consult an attorney regarding legal obligations and rights. We have a similar way to deal with things at my job and I would think it would be the same at any other job too. If you can't resolve the issue then just know that there are other steps that you can take to get the issue resolved. (TCO 10) (a) What is a standard cost (5 points)? (b) Provide an example of a manufacturing standard cost (5 points). (c) What is an ideal standard (5 points)? (d) What is a practical standard (5 points)? (e) Should ideal or practical standards be used (5 points)? a. A standard cost can probably be best described as cost that is related to the manufacturing process and is determined to be a budgeted or planned cost. Standard costs are used as target costs and are usually developed from historical data analysis. b. Manufacturing costs are all costs associated with converting the materials into the actual product and they are typically divided into three categories: direct materials, direct labor & manufacturing overhead. So an example of a manufacturing standard cost would be the cost of wood if you are making a table or something like that. c. Ideal standards are standards that are based on perfect or ideal conditions, that do not allow for any waste in the production process, machine breakdown, or other inefficiencies. d. Practical standards are the standards that can be achieved by the average worker. e. Yes, they both set the standard and every employee should try to meet them. If you don't set standards then your goals wouldn't be attainable. (TCO 2) Cindy Inc. estimates that its employees will utilize 125,000 machine hours during the coming year. Total overhead costs are estimated to be $4,500,000 and direct labor hours are estimated to be 100,000. Actual machine hours are 120,000. Actual labor hours are 75,000. If Cindy Inc. allocates overhead based on machine hours, what is the predetermined manufacturing overhead rate? Predetermined manufacturing overhead rate = Total overhead costs / Total estimated machine hours 4,500,000 / 125,000 = 36 $36 machine hour (TCO 4) Simpson Company produces and sells a single product whose selling price is $90.00 per unit and whose variable expense is $40.50 per unit. The company's fixed expense is $1,138,500 per month. (a) What is the CM ratio (express your answer as a percentage to two decimal places)? (5 points) (b) How many units must be sold to break-even for the month? (10 points) (c) How many units do we need to sell to earn a profit of $495,000 for the month? (10 points) a. Contribution Margin = 90.00 - 40.50 = 49.50 Contribution Margin Ratio = 49.50/90.00*100 = 55% b. Break-even in Units = 1,138,500 / (90.00-40.50) 1,138,500 / 49.50 = 23,000 units c. Units to Earn Profit = (495,000 / 49.50) +23,000 = 33,000 Units (TCO 3) XYZ Company uses process costing to track its costs in two sequential production departments: Forming and Finishing. The following information is provided regarding the Forming department. Forming Department Month Ended June 30 Unit information Beginning work in process, June 1 --- 6,000 Started into production during June --- 30,000 Completed and transferred to Finishing department during June --- 22,000 Ending work in process, June 30 (25% complete as to direct materials and 40% complete as to conversion costs) --- 14,000 Cost information Beginning work in process as of June 1 consists of $10,000 of direct materials costs and $5,500 of conversion costs) --- $15,500 Direct materials used in June --- $27,000 Conversion costs incurred in June --- $14,850 Required (a) Calculate the equivalent units for conversion costs. (Show your work) (b) Calculate the cost per equivalent unit for conversion costs. (Show your work) a. 22,000*100% = 22,000 14,000*25% = 3,500 22,000+3,500 = 25,500 Equivalent Unit Materials 22,000*100% = 22,000 14,000*40% = 5,600 22,000+5,600 = 27,600 Equivalent Unit Conversion b. 10,000+27,000 = 37,000 37,000/25,500 = $1.45 Equivalent Unit Materials 5,500+14,850 = 20,350 20,350 / 27,600 = $0.74 Equivalent Unit Conversion (TCO 5) Vernon Inc. manufactures and sells one product. Sales and production information is contained below. • Selling price per unit $50 • Variable manufacturing costs per unit produced (DM, DL, and variable MOH) $24 • Variable operating expenses per unit sold $5 • Fixed manufacturing overhead (MOH) in total for the year $135,000 • Fixed operating expenses in total for the year $55,000 • Units produced during the year 15,000 • Units sold during the year 13,000 (a) Prepare the income statement using variable costing. (10 points) (b) Prepare the income statement using absorption costing. (10 points) (c) Please explain the difference in operating income between the two methods. (5 points) a. Income Statement – Variable Cost Units Sold 13,000 Total Sales (13,000x50) 650,000 Less: Variable Costs Variable Manufacturing Cost (13,000x24) (312,000) Variable Operating Expenses (13,000x5) (65,000) Contribution 273,000 Less: Fixed Cost Fixed Manufacturing Overhead (135,000) Fixed Operating Expenses (55,000) Operating Income $83,000 b. Income Statement -Absorption Costing Sales (13,000x50) 650,000 Less: Cost of Goods Sold(13000x33) (429,000) Gross Profit 221,000 Less: Total Operating Expenses (120,000) Operating Income 101,000 c. The net operating income under absorption costing is $18,000 more than the net operating income under variable costing. In this example, production is more than sales, the fixed manufacturing overhead is deferred in inventory which causes higher net operating income under absorption costing than under variable costing. (TCO 8) Palmer Company manufactures and sells trophies for winners of athletic events. The company normally charges $60 per trophy. The average costs for a trophy is shown below. Direct materials $22 Direct labor 12 Variable manufacturing overhead 8 Variable marketing expenses 4 Fixed manufacturing overhead 16 ($2,000,000 fixed manufacturing overhead/125,000 trophies) Total costs $62 Palmer Company has enough idle capacity to accept a one-time only special order for 10,000 trophies at $50 per trophy. Palmer Company will not incur any variable marketing expenses for this order and no additional fixed costs. Required Should the company accept this special order? Please state your decision and provide numerical support for your decision. Total Trophies = 10,000 Sell Price Rate = $50 per trophy Total Sales = 10,000x50 = $500,000 Direct Materials = 10,000x22 = $220,000 Direct Labor = 10,000x12 = 120,000 Variable Manufacturing Overhead = 10,000x8 = 80,000 Total Cost = DM + DL + VMO = 220,000 +120,000 + 80,000 = $420,000 Profit = Total Sales – Total Cost = 500,000 – 420,000 = $80,000 Yes the company should accept the order because there will be a profit (TCO 7) Pearl Inc. makes 20,000 units per year of Part Y for use in one of its products. Pearl Inc. incurred the following manufacturing costs when producing the 20,000 units of Part Y. Direct materials $300,000 Direct labor 125,000 Variable manufacturing overhead 50,000 Fixed manufacturing overhead 175,000 Total $650,000 Required Assume Pearl Inc. has no alternative use for the facilities presently devoted to production of Part Y and that none of the fixed costs are avoidable. If the outside supplier offers to sell Part Y for $23 each, should Pearl Inc. accept the offer? Please clearly state your answer and support your answer with appropriate calculations. Cost to manufacture 20,000 units of Part Y = = Direct materials + Direct labor + Variable manufacturing overheads = $3,00,000 + $1,25,000 + $50,000 = $4,75,000. Cost per unit of Part Y = $4,75,000 / 20,000 units = $23.75 per unit. Yes we should accept this offer since it is higher than $23. (TCO 9) Melinda Corp buys equipment for $75,000 that will last for 5 years. The equipment will generate cash flows of $24,000 per year and will have no salvage value at the end of its life. Ignore taxes. Use 12% required rate of return. Required (a) What is the present value (PV) of this investment at 12%? (5 points) (b) What is the net present value (NPV) of this investment? Should Melinda Corp buy the equipment based on NPV? Justify your decision. (10 points) (c) What is the internal rate of return (IRR) of this investment? (5 points) (d) What is the payback period? (5 points) a. Present Value (PV) of this investment = 24000*PVIFA(12%,10) Present Value (PV) of this investment = 24,000*5.65022 Present Value (PV) of this investment = $ 135,605.28 b. NET Present Value = Present Value (PV) of annual cash flow - Initial Investment NET Present Value = 135,605.28 - 75,000 NET Present Value = $ 60,605.28 Decision : Yes, The Equipment should be bought as its NPV is positive c. IRR = rate(nper,pmt,pv,fv) IRR = rate(10,24000,-75000,0) IRR = 12%+60605 /196210*15% = 12.95 hence 13% d. Payback period = Initial Investment/Annual Cash flow Payback period = 75000/24000 Payback period = 3.125 Years [Show More]

Last updated: 1 year ago

Preview 1 out of 8 pages

(1).png)

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 13, 2022

Number of pages

8

Written in

Additional information

This document has been written for:

Uploaded

Sep 13, 2022

Downloads

0

Views

46

.png)

.png)