Project Management > Presentation > The Management of Project Cost Financial Project Appraisal (All)

The Management of Project Cost Financial Project Appraisal

Document Content and Description Below

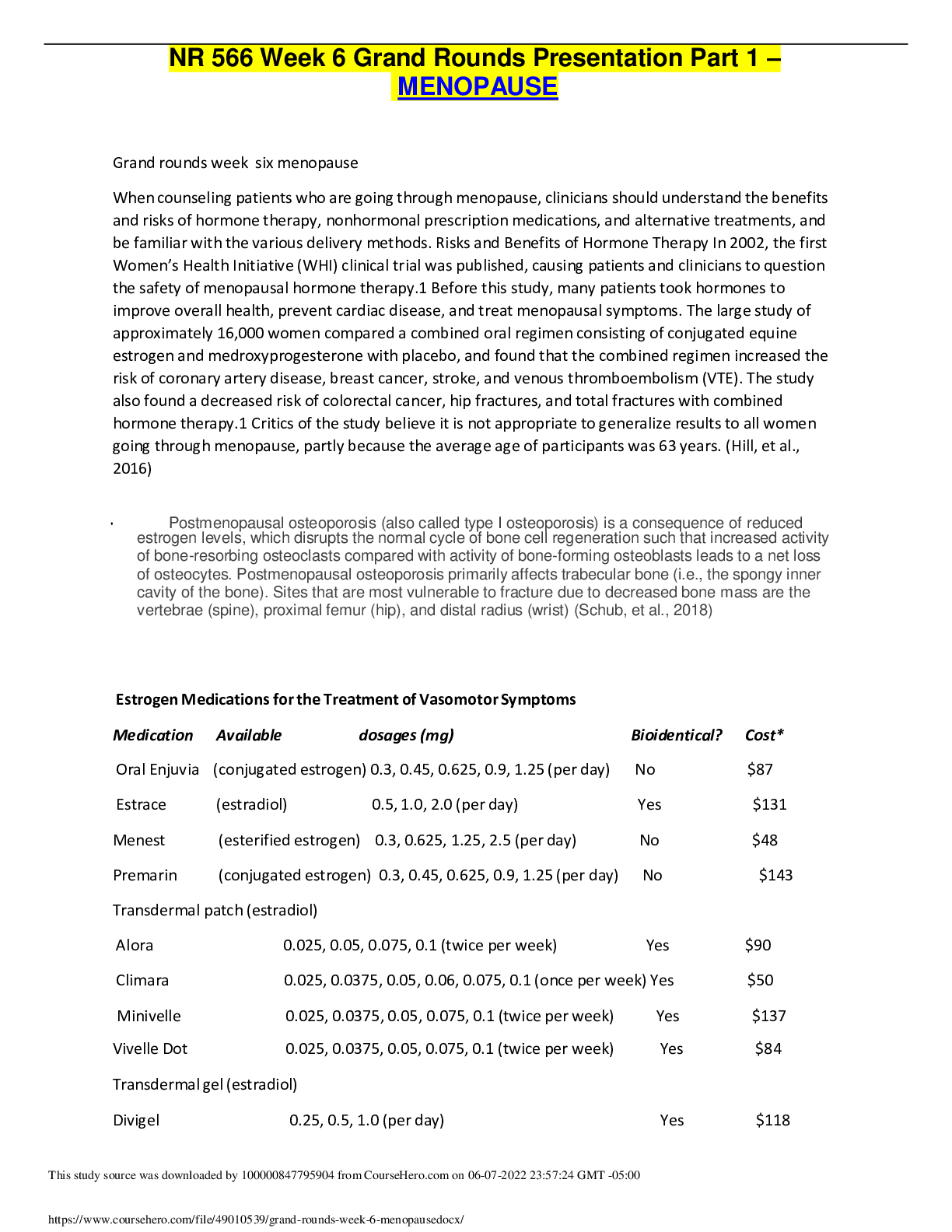

• • • Module Leader, SIM 335. • University of Sunderland. • [email protected] SIM sim 335 Managing Projects Planning and Monitoring Tools and Techniques ◦ Project ... Feasibility ◦ Project Life Cycle ◦ Project Objectives ◦ Planning the Project ◦ SequencingActivities ◦ PCs and Project Management SoftwareThe Management of Project Cost Financial Project Appraisal Payback Net Present Value (NPV) The Internal Rate of Return Estimating Methods Putting Together the Detailed Project Budget Common Causes of Cost Problems Unit 5 StructureFinancial Project Appraisal •Clear project objectives and a project definition document are essential to the success of the project. • Investment decision, is a decision on: • Whether or not to undertake an investment. •When there are alternative choices for an investment, selecting which of the mutual exclusive investment to undertake. •When capital for spending is in short supply, deciding which investments to undertake with the money that is available.Financial Project Appraisal • Investment decisions need to be considered in the light of strategic and tactical plans of the company. • Most companies have a formal business case system in place that includes a financial appraisal of the project in one form or another. • Financial appraisal techniques include; • Payback. • Net Present Value (NPV) • Internal Rate of Return (IRR)• Payback period • Time taken to break even • i.e. payback initial investment • Projects with short payback periods are preferred nowadays • Does not consider income or expenditure after break even point is reachedPayback period Year Project 1 Project 2 Project 3 Project 4 0 -100,000 -1,000,000 -100,000 -120,000 1 10,000 200.000 30,000 30,000 2 10,000 200.000 30,000 30,000 3 10,000 200.000 30,000 30,000 4 20,000 200.000 30,000 30,000 5 100,000 300.000 30,000 75,000 Net Profit 50,000 100,000 50,000 75,000 Payback in 5th year Payback in 4th year Time taken to ‘break even’ i.e. payback initial investmentYear Project A Project B 0 (£35,000) (£35,000) 1 £20,000 £10,000 2 £15,000 £10,000 3 £10,000 £15,000 4 £10,000 £20,000 Payback Period 2 years 3 yearsMethod Advantages Disadvantages Payback Simple and easy to understand and use Objective – using cash flows Liquidity – commercially realistic Cautious & risk averse – ignores later cash flows Ignores the time value of money Ignores cash flows after the payback period Cost-Benefit Evaluation TechniquesDiscounted cash flow methods (DCF) NPV & IRR • Take into account the change in value of money over time due to inflation • If this is not carried out, future cash flows are distorted and do not reflect the true value of the return • Two main methods ‘net present value’ NPV and ‘internal rate of return’ IRR.• Net present value (NPV) • Considers the profitability of a project • Takes account of the time element • NPV discounts future cash flows to current money values it does this using a percentage rate called the discount ratePV - Receiving a £1000 now, would be worth more than receiving a £1000 in 5 years as this could be reinvested with an additional rate of return being received over the five years. FV – Value of cash at a specified date in the future that is equivalent in value to a specified sum today A present value is the amount that would need to be invested now to earn the future cash flow if the money is invested at the “cost of capital”• NPV - The formula for net present values of future cash flows is :- • Present value = value in year t / (1+r)t • where r is the discount expressed as a decimal value • and t is the number of years in the future • but it is simpler to use discount tables • Present value = value in year t x discount factorAssuming a 10% discount rate, what is the NPV for project 1. Year Project 1 cash flow (£) Discount factor @ 10% Discounted cash flow (£) 0 -100,000 1.0000 -100,000 1 10,000 0.9091 9,091 2 10,000 0.8264 8,264 3 10,000 0.7513 7,513 4 20,000 0.6830 13,660 5 100,000 0.6209 62,090 Net Profit 50,000 NPV:£618And for a 12% discount factor, the NPV for project 1 was -£6560 Year Project 1 cash flow (£) D iscount factor @ 5 % D iscounted cash flow (£) 0 -100,000 1.0000 -100,000 1 10,000 0.893 8930 2 10,000 0.797 7970 3 10,000 0.712 7120 4 20,000 0.636 12720 5 100,000 0.567 56700 Net Profit 50,000 N P V : -£6560The NPV for all four projects. Year Discount factor @ 10% Project 1 Discounted Project 2 Cash flo Project 3 w (£) Project 4 0 1.0000 -100,000 -1,000,000 -100,000 -120,000 1 0.9091 9,091 181,820 27,273 27,273 2 0.8264 8,264 165,280 24,792 24,792 3 0.7513 7,513 150,260 22,539 22,539 4 0.6830 13,660 136,600 20,490 20,490 5 0.6209 62,090 186,270 18,627 46,568 NPV 618 -179,770 13,721 21,662• This example clearly shows the benefit of NPV: • Project 4 provides the best rate of return. • Projects 1 and 2 would not be considered any further • Benefits • Introduces time value of money into decision making process • Expresses future cash-flows in today’s values • Looks at whole project • Tables exist for discounting factors • Disadvantages • Limited accuracy due to forecast of interest/inflationrates • Not comparable with other investments/cost of borrowing capital • An alternative would be to use Internal Rate of Return - IRR What’s the difference between £1 now and £1 in a year’s time? Factors change the value of money Interest cost Inflation Time Value of MoneyMethod Advantages Disadvantages NPV Takes account of the time value of money Concerns of shareholder wealth Takes account of risk Looks at the whole life of the project Difficult to be understood by managers Adverse effects on accounting profits in the short run How to choose discount rate?• The IRR method of discounted cash flow involves finding the percentage rate of interest which, when used to discount the future cash flows, will produce a zero net present value for a capital investmentproject, • Provides a profitability measure as a percentage return • This is directly comparable to an interest rate • IRR is used in conjunction with NPV• The interest rate is determined by trial and error to achieve a zero NPV. The higher the percentage used to discount the lower will be the present value. • Calculation of IRR is by trial and error • It can also be estimated using a graphical approach• The idea here is to work out two values of NPV for a given project, ones which are +ve and -ve • And then plot these co-ordinates on a graph • So, for the Project 1 example• Using the graphical method NPV (£) 5 6 7 8 9 10 11 12 13 14 15 16 17 -2000 -1000 0 1000 2000 4000 3000 PROJECT 1 IRR (%) -3000 - 4000 - 5000 - 6000 - 7000 IRR for project 1 approximately 10.2% The process of gathering data to develop an estimate for the Project. Estimating Methods include: Parametric Modelling: Uses mathematical techniques to help with costing estimates; for example, in the building industry square metre (£ per square metre) metrics are used. Bottom Up: Estimates the activities at the bottom of the WBS first and then works up through the WBS. Analogous Method: Looks at the costs of similar projects and other historical information Simulation: Used on large or complex projects, software calculates many costs or durations with different assumptions. The process of allocating the cost estimates to work items to establish a cost baseline for measuring project performance. Top Down Budgeting. Based on collective judgments and experiences of top and middle managers. Overall project cost estimated by estimating costs of major tasks. Bottom-Up Budgeting: WBS or action plan identifies elemental tasks. Those responsible for executing these tasks estimate resource requirements. Detailed estimation of cost is called budgeting and is the process of allocating the cost estimates to the activities To prepare a project budget do the following: Total the costs from each activity. Total the direct costs from each activity estimate sheet. Remember to include project management costs Total indirect costs (overhead costs if your organisation requires they be included in your budget). Total cumulative costs. Basing estimates on poor information rather than detailed specifications of the project at hand. Failure to allow contingency, failure to correctly estimate research and development activities. Indiscriminate use of the contingency budget by activities or people, who overrun their budget. Receiving information too late to take corrective action. Burke, R. (2003) Project Management, Planning and Control Techniques. John Wiley and Sons. Field, M., Keller, L. (2007) Project Management. Open University Jordan, E.W. and Machesky, J.J. (1990) Evaluation, Design, and Implementation, Boston, MA, PWS-Kent Pinto, J. K. (2013) Project Management: Achieving Competitive Advantage. Harlow: Pearson Education Richman, L. (2002) Project Management Step-by-Step. AMACOM. Weiss, J and Wysocki, R. (1992) 5 Phase Project Management:APractical Planning and Implementation Guide. Cambridge MA: Perseus BooksThank You [Show More]

Last updated: 1 year ago

Preview 1 out of 29 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 18, 2019

Number of pages

29

Written in

Additional information

This document has been written for:

Uploaded

Dec 18, 2019

Downloads

1

Views

99

.png)