Financial Accounting > EXAM > DeVry University, South Florida ACCT 212Week Eight Homework. Week Eight Homework. (All)

DeVry University, South Florida ACCT 212Week Eight Homework. Week Eight Homework.

Document Content and Description Below

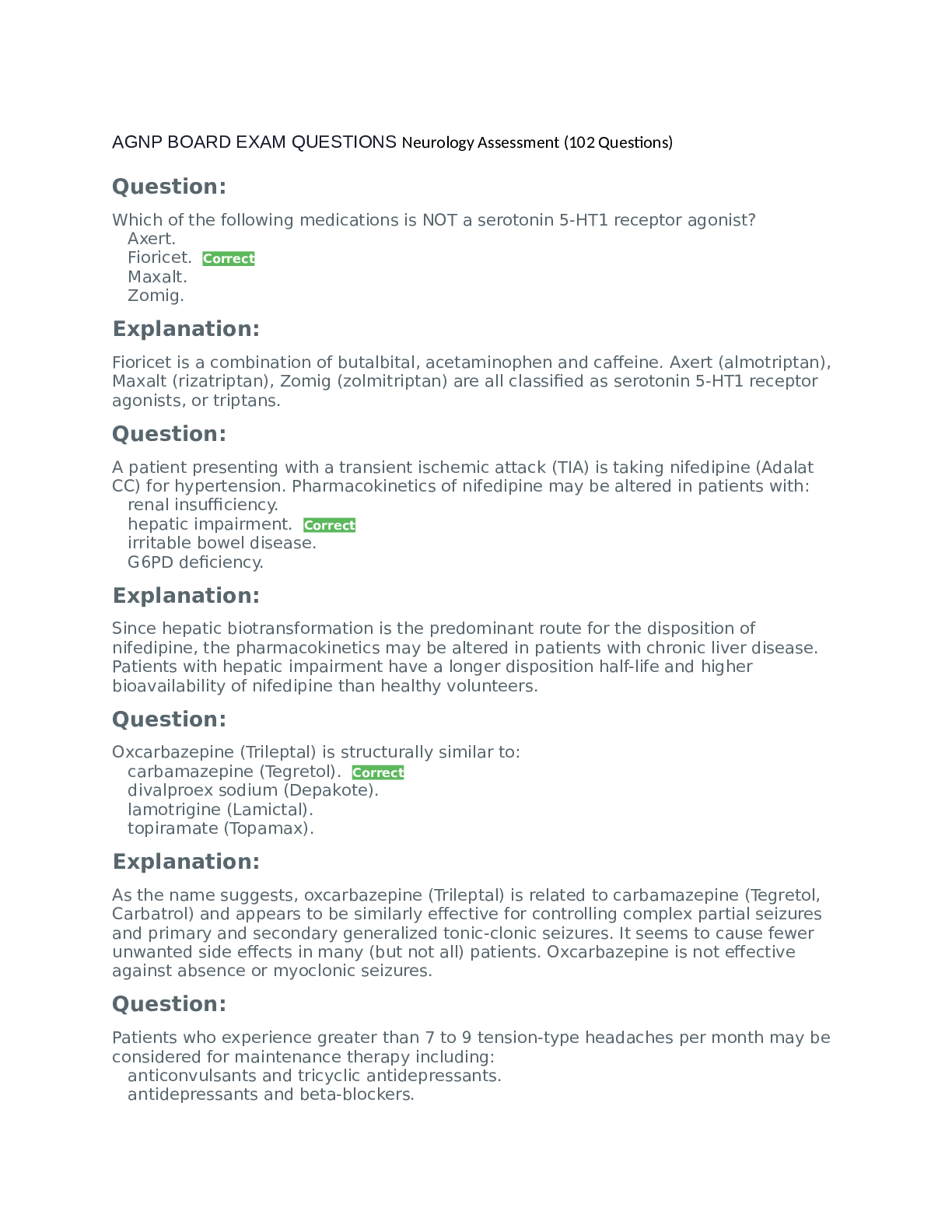

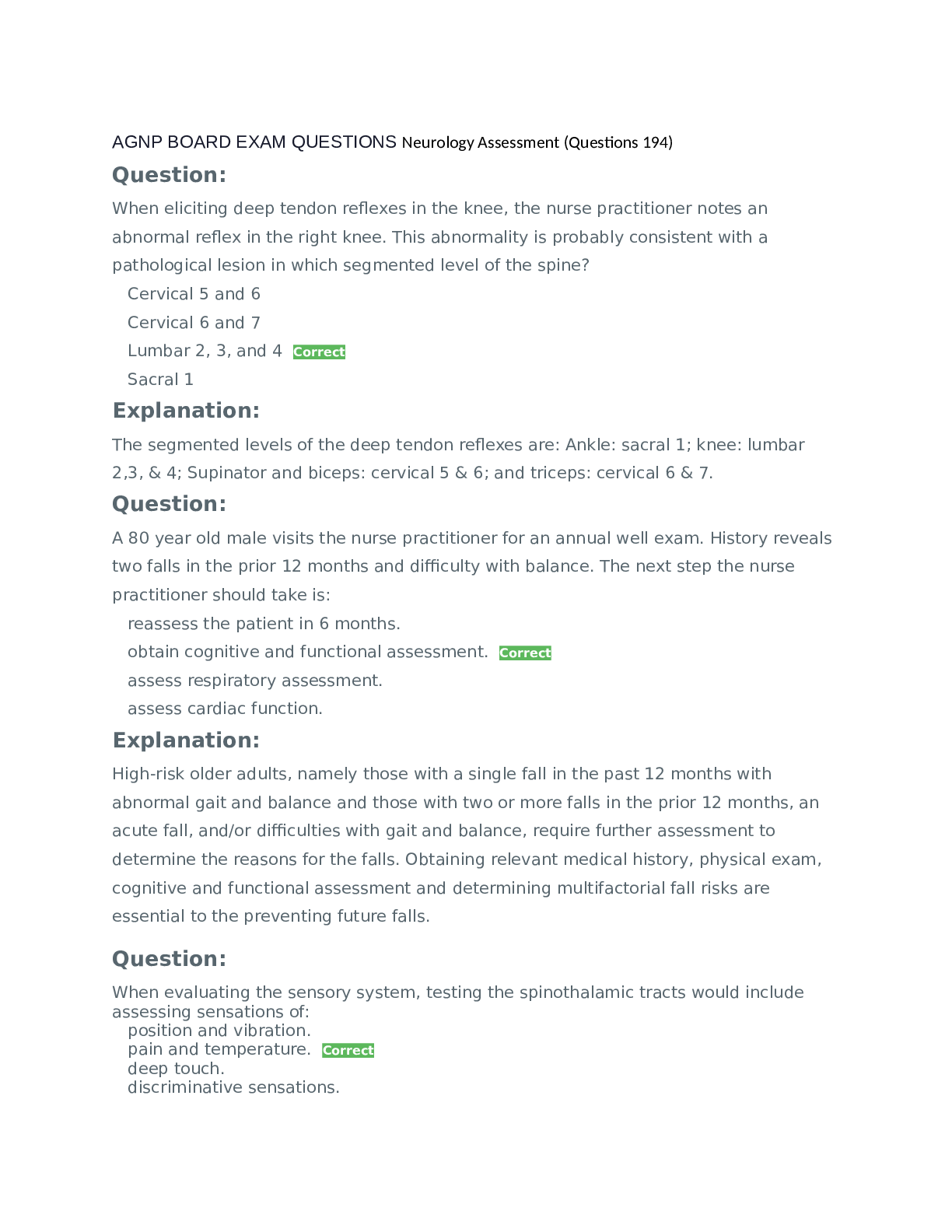

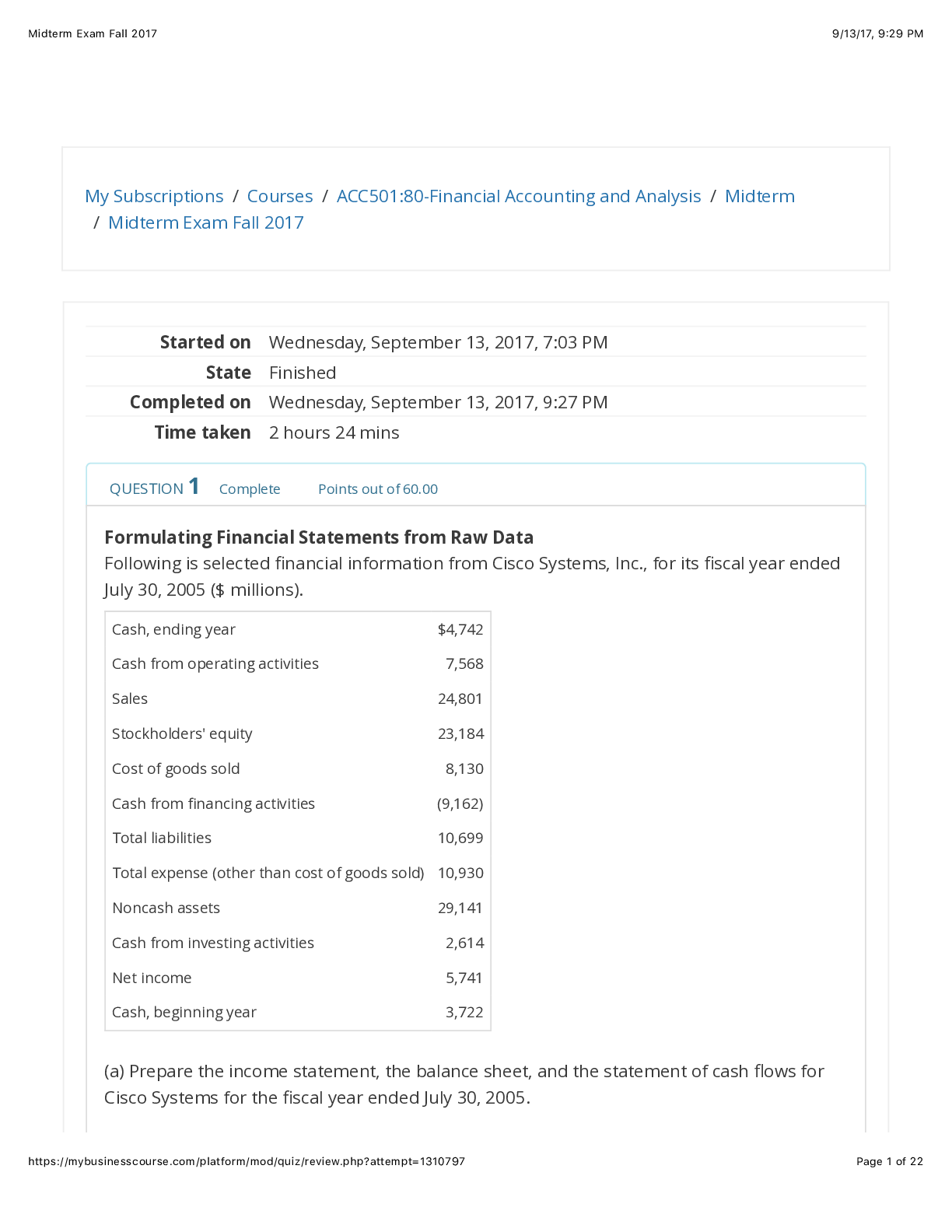

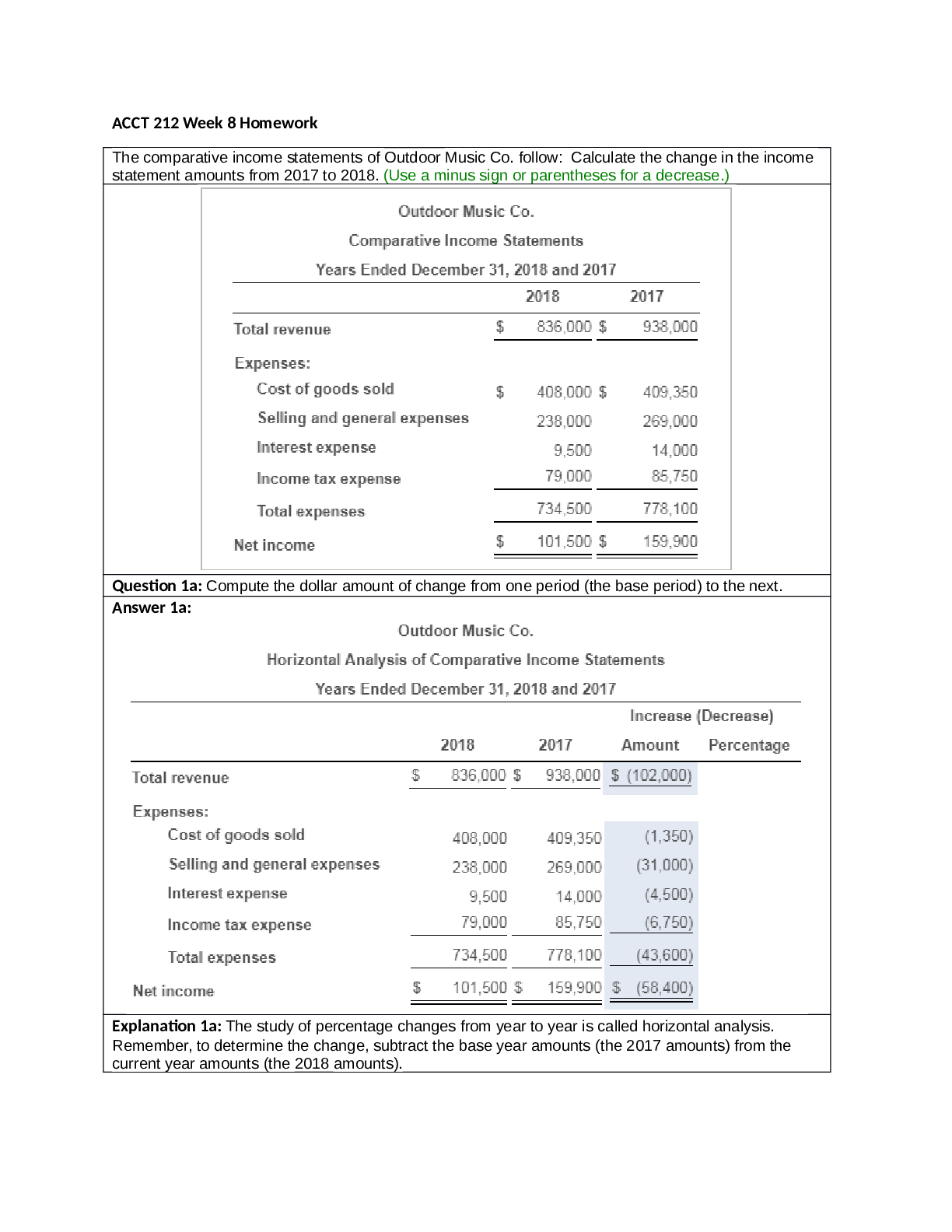

Homework Week 8: 1. Required: a. Prepare a vertical analysis of the balance sheet data for 2022 and 2021. Express each amount as a percentage of total assets. (Amounts to be deducted should be ind... icated by a minus sign. Round your answers to 1 decimal place.) Year 2021 Cash = Year 2021 $800,000/ total assets $13,700,000 = 5.8% Accounts receivable = Year 2021 $1,200,000 / total assets $13,700,000 = 8.8% Inventory = Year 2021 $1,700,000 / total assets $13,700,000 = 12.4% Buildings = Year 2021 $11,000,000 / total assets $13,700,000 = 80.3% Accumulated depreciation = Year 2021 $1,000,000 / total assets $13,700,000 = (7.3%) Accounts payable = Year 2021 $1,700,000 / total assets $13,700,000 = 12.4% Contingent liability = Year 2021 $0 / total assets $13,700,000 = 0% Common stock = Year 2021 $8,000,000 / total assets $13,700,000 = 58.4% Retained earnings = Year 2021 $4,000,000 / total assets $13,700,000 = 29.2% Year 2022 Cash = Year 2022 $2,300,000 / total assets $15,600,000 = 14.7% Accounts receivable = Year 2021 $1,500,000 / total assets $15,600,000 = 9.6% Inventory = Year 2021 $2,800,000 / total assets $15,600,000 = 17.9% Buildings = Year 2021 $11,000,000 / total assets $15,600,000 = 70.5% Accumulated depreciation = Year 2021 $2,000,000 / total assets $15,600,000 = (12.8%) Accounts payable = Year 2021 $1,450,000 / total assets $15,600,000 = 9.3% Contingent liability = Year 2021 $1,500,000 / total assets $15,600,000 = 9.6% Common stock = Year 2021 $8,000,000 / total assets $15,600,000 = 51.3% Retained earnings = Year 2021 $4,650,000 / total assets $15,600,000 = 29.8% 2. b. Prepare a horizontal analysis for 2022 using 2021 as the base year. (Note: If the percentage increase or decrease cannot be calculated, then leave the cell blank. Decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) Cash $2,300,000 - $800,000 = $1,500,000 / $800,000 = 187.5% Accounts receivable $1,500,000 - $1,200,000 = $300,000 / $1,200,000 = 25% Inventory $2,800,000 - $1,700,000 = $1,100,000 / $1,700,000 = 64.7% Buildings $11,000,000 - $11,000,000 = $0 / $11,000,000 = 0% Accumulated depreciation ($2,000,000) – ($1,000,000) = ($1,000,000) / ($1,000,000) = 100% Total assets $15,600,000 - $13,700,000 = $1,900,000 / $13,700,000 = 13.9 Accounts payable $1,450,000 - $1,700,000 = ($250,000) / $1,700,000 = (14.7%) Contingent liability $1,500,000 – 0 = $1,500,000 / 0 = 0% Common Stock $8,000,000 - $8,000,000 = 0 / $8,000,000 = 0% Retained earnings $4,650,000 - $4,000,000 = $650,000 / $4,000,000 = 16.3% Total liabilities and stockholders’ equity $15,600,000 - $13,700,000 = $1,900,000 / $13,700,000 = 13.9% [Show More]

Last updated: 1 year ago

Preview 1 out of 16 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 27, 2022

Number of pages

16

Written in

Additional information

This document has been written for:

Uploaded

Apr 27, 2022

Downloads

0

Views

64

.png)

.png)