Human Resource Management > EXAM REVIEW > San Jose State University Hospitality HM 270. EXAM 2 REVIEW-1. 100 Questions and Answers (All)

San Jose State University Hospitality HM 270. EXAM 2 REVIEW-1. 100 Questions and Answers

Document Content and Description Below

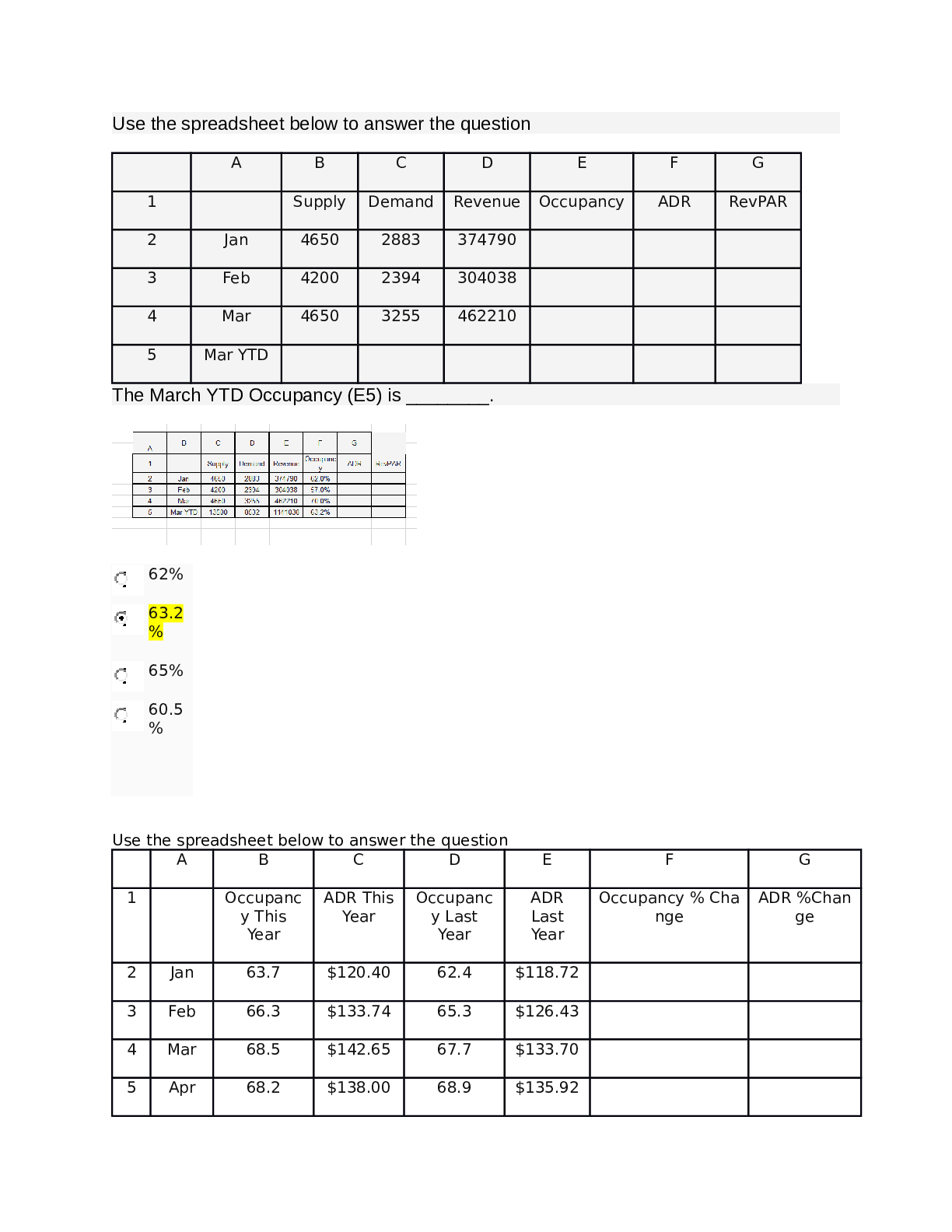

Use the spreadsheet below to answer the question The March YTD Occupancy (E5) is ________. 62% 63.2 % 65% 60.5 % Use the spreadsheet below to answer the question The Average Daily Rate perc... ent change for April (G5) is _____. Percent change = (this year - last year)/ last year * 100 2.1 % - 2.1 % 1.5 % 1.4 % Key Performance Indicators (KPI) for the Competitive Set (for example the average Occupancy) are: Always based upon the aggregated raw data of each member of the competitive set Always based upon a straight average of the metrics, for example the Occupancies, of each member of the competitive set The comp set methodology differs inside and outside of North America The comp set methodology differs by hotel company When you receive your STAR report, your ADR for the month was $100 and the competitive set ADR was $90. What can you tell? You had the highest ADR of all of the members of the competitive set Your ADR was $10 higher than the average of all of the members of the competitive set There was one hotel that had a higher ADR than you Your RevPAR will be higher than the RevPAR of the competitive set Use the spreadsheet below to answer the following two questions regarding the methodology used to calculate KPIs for a competitive set. The competitive set Occupancy (E6) for May is _____. When you receive your STAR report your ADR index was 110 and your Occupancy index was 90. What do you know? The RevPAR index will be in the neighborhood of 115 The RevPAR index will be in the neighborhood of 100 The RevPAR index will be in the neighborhood of 105 The RevPAR index will be in the neighborhood of 85 When you receive your STAR report, you see that your RevPAR index was 90 this year compared to 80 last year. What do you know for sure? Your hotel outperformed the competitive set when it comes to RevPAR both years Your hotel outperformed the comp set this year when it comes to RevPAR, but not last year Your hotel will have a positive RevPAR Index Percent Change Your hotel would have a positive RevPAR Percent Change When you receive your STAR report you see that your ADR Rank for the current month is "3 of 7". What do you know? The ADR for your hotel is higher than the competitive set ADR Your hotel has the 3rd highest ADR among the members of your competitive set Your hotel had an ADR higher than three other members of your competitive set The ADR for your hotel was higher than the competitive set ADR for 3 of the last 7 months Use the spreadsheet below to answer the following two questions regarding the methodology used to calculate Index. The occupancy Index for November (H3) is _____. 119.2 Index Numbers • Subject Value / Comp Set Value * 100 The ADR Index percent change for June (I4) is _____. Percentage Change = (This year- Last year)/ Last year The number of Rooms Available in a total market can change over time due to what four factors? New hotel openings, Hotel closings, Brand conversions, and Renovations New hotel openings, Brand Conversions, Hotel room additions, and Hotel room drops Hotel closings, Brand conversions Hotel Room additions, and Hotel Room drops New hotel openings, Hotel closings, Hotel room additions, and Hotel room drops What is the future value of the following cash flows? $1,500 payments, received at the end of each year for the next 10 years. Interest rate is 8%. =FV(8%,10,-1500) $25,2 60 $23,4 70 $21,7 30 $18,3 95 Regular Annuity A cash flow at the end of the time line =FV(rate, nper, pmt) Annuity Due A cash flow at the beginning of the time line =FV(rate, nper, pmt, , type) What is the present value of $1,420 in year 2, at a 10% annual interest rate? =PV(10%,2, (NO PAYMENT), -1420) $1,17 4 $1,29 1 $1,09 1 $1,20 0 rate (%), Num of period (how many year involve), PMT (payment), PV(Present value) Brian opens a savings account that pays 4% of interest annually. How much must Brian deposit each year in order to have $50,000 five years from now? First deposit is scheduled one year from now. $8,32 1 $9,23 1 $8,63 6 $9,14 0 =PMT(4%,5,,-50000) How much do you have to invest today at a 5% annual rate to end up with $6,500 in one year? $6,18 5 $6,19 1 $6,82 5 $6,83 2 =PV(5%,1,,-6500) In purchasing a major piece of kitchen equipment costing $50,000, you pay a 20% down payment and finance the remaining. If the loan is at 8%, what is your monthly payment if you are financing it for 3 years? $986.79 $1,253. 45 $1,566. 82 $4,267. 23 =PMT(8%/12,36,-40000) In purchasing a major piece of kitchen equipment costing $50,000, you pay a 20% down payment and finance the remaining. If the loan is at 8%, what is your monthly payment if you are financing it for 3 years? $986.79 $1,253. 45 $1,566. 82 $4,267. 23 Question 2 Which statement is true regarding RevPAR? It is almost always higher than ADR It can be thought of as a combination of Supply and Demand When a hotel or GM is evaluated, the RevPAR metric is rarely considered It can be thought of as a combination of Occupancy and ADR Question 1 In which of the following situations will occupancy increase? Supply increases 10% and demand increases 5% Supply decreases 5% and demand increases 10% Supply increases 5% and demand decreases 5% None of these situations will result in an occupancy increase Question 1 You are planning to buy 2018 MINI Cooper on a loan. Price of the car is $26,000. You are planning to make monthly payments for two years and your bank says they can offer the annual interest rate of 12%, compounded monthly. The first payment starts at the end of the first month. How much is your monthly payment? $855 $964 $1,2 23 $1,37 5 =PMT(12%/12,24,-26000) Question 2 How much do you have to invest today at a 5% annual rate to end up with $6,500 in one year? $6,18 5 $6,19 1 $6,82 5 $6,83 2 =PV(5%,1,,-6500) Question 3 In purchasing a major piece of kitchen equipment costing $50,000, you pay a 20% down payment and finance the remaining. If the loan is at 8%, what is your monthly payment if you are financing it for 3 years? $986.79 $1,253. 45 $1,566. 82 $4,267. 23 =PMT(8%/12,36,-40000) =50,000*20%= ? – 50,000 Question 1 There is a “hot deal” scheme on a new truck of $3,500 a year, paid at the end of each of the next 5 years, with no down payment. What is the truck really costing you? Suppose the interest rate is 5%. $3,46 5 $15,1 53 $15,9 11 $3,50 0 =PV(5%,5,-3500) Your restaurant is purchasing a heavy duty grill for producing huge amount of barbecue. It costs $200,000, you pay a 5% down payment and finance the rest. If the loan is at 12% interest rate, what is your monthly payment if you are financing it for 2.5 years? $7,36 2 $7,75 0 $23,5 87 $24,8 29 =PMT(12%/12,30,-190000) Month Beginning Balance Payment Interest Principal Ending Balance 1 100,000 3,875 388 3,487 96,513 2 96, 513 3,875 388 3,487 93,026 Month Beginning Balance Payment Interest Principal Ending Balance 1 100,000 3,875 388 3,487 96,125 2 96,125 3,875 388 3,487 92,250 Monthly Beginning Balance Payment Interest Principal Ending Balance 1 100,000 3,875 1,000 2,875 97,125 2 97,125 3,875 971 2,904 94,221 Monthly Beginning Balance Payment Interest Principal Ending Balance 1 100,000 3,875 1,000 2,875 96,125 2 96,125 3,875 773 3,102 93,023 Question 4 John’s personal financial consultant tells him that a hotel development opportunity with the following proposal is a good investment. $2,000,000 investment with a return of $3,000,000 at the end of 3-year period. John’s hurdle rate of 20%. Is the financial consultant correct? No. Because in 3 years, at 20% rate, the investment amount should be doubled up. No. Because in 3 years, at 20% rate, the return should be more than $450,000 than suggested $3,000,000. Yes. Because present value of the $3,000,000 with 20% discount rate is $2,500,000. Yes. Because $3,000,000 is $1,000,000 more than initial investment, which is a significant amount of money. • Question 1 10 out of 10 points There is a “hot deal” scheme on a new truck of $3,500 a year, paid at the end of each of the next 5 years, with no down payment. What is the truck really costing you? Suppose the interest rate is 5%. • Question 2 10 out of 10 points Your restaurant is purchasing a heavy duty grill for producing huge amount of barbecue. It costs $200,000, you pay a 5% down payment and finance the rest. If the loan is at 12% interest rate, what is your monthly payment if you are financing it for 2.5 years? • Question 3 10 out of 10 points The new generator that your company just replaced has a cost of $100,000. You were able to negotiate a loan with your bank with no down payment, 12% annual interest rate, and 30 months. Please complete the amortization schedule for the first two months of this loan. • Question 4 0 out of 10 points John’s personal financial consultant tells him that a hotel development opportunity with the following proposal is a good investment. $2,000,000 investment with a return of $3,000,000 at the end of 3-year period. John’s hurdle rate of 20%. Is the financial consultant correct? • Question 1 10 out of 10 points In which of the following situations will occupancy increase? Supply decreases 5% and demand increases 10% Response Feedback: Start from the formula: Occupancy = Demand / Supply And think how combination of demand and supply changes will make the occupany to change. • Question 2 10 out of 10 points Which statement is true regarding RevPAR? • Question 3 10 out of 10 points Use the spreadsheet below to answer the question The March YTD Occupancy (E5) is ________. 63.2 % Resp onse Feed back: For YTD KPI calculation, first sum supply, demand and/or Revenue, then use the summed numbers to For this question, sum the supply from Jan to Mar (4650+4200+4650), sum the demand (2883+2394 summed demand by summed supply. • Question 4 10 out of 10 points Use the spreadsheet below to answer the question The Average Daily Rate percent change for April (G5) is _____. 1.5 % Response Feedback: Percent Change = {(current # - past #)} / past # In this case, {(ADR 2016 Apr - ADR 2015 Apr)} / ADR 2015 Apr = {(138-135.92)} / 135.92 • Question 5 10 out of 10 points Key Performance Indicators (KPI) for the Competitive Set (for example the average Occupancy) are: Always based upon the aggregated raw data of each member of the competitive set • Question 6 10 out of 10 points When you receive your STAR report, your ADR for the month was $100 and the competitive set ADR was $90. What can you tell? Your ADR was $10 higher than the average of all of the members of the competitive set Response Feedback: Please note that the competitive set KPIs are the "average" of the competitiors. • Question 7 10 out of 10 points Use the spreadsheet below to answer the following two questions regarding the methodology used to calculate KPIs for a competitive set. The competitive set Occupancy (E6) for May is _____. 72.6 % Response Feedback: For Competitive Set KPI calculation, always sum supply, demand, and/or revenue first, then use the summed numbers for calculation. In this particular case, first sum supply (4650+5642+5425+6045), sum demand (3348+3837+3961+4655), and divide summed demand by summed supply. • Question 8 10 out of 10 points When you receive your STAR report your ADR index was 110 and your Occupancy index was 90. What do you know? The RevPAR index will be in the neighborhood of 100 Response Feedback: ADR Index of 110 means that the subject hotel's ADR was 110% of comp set ADR. Occupancy Index of 90 means that the subject hotel's Occupancy was 90% of comp set Occupancy. Considering RevPAR = ADR x Occupancy, we know the RevPAR index will be 99 (in the neighborhood of 100). 110% x 90% x 100 (to make it an index, we multiply by 100) or 1.1 x 0.9 x 100 • Question 9 0 out of 10 points When you receive your STAR report, you see that your RevPAR index was 90 this year compared to 80 last year. What do you know for sure? Your hotel will have a positive RevPAR Index Percent Change Response Feedback: With this year's RevPAR index and last year's RevPAR index, we can calculate percent change of the RevPAR index. • Question 10 10 out of 10 points When you receive your STAR report you see that your ADR Rank for the current month is "3 of 7". What do you know? Your hotel has the 3rd highest ADR among the members of your competitive set Response Feedback: For ranking, STR would calculate each of the competitor's KPI and rank properties from the highest to the lowest. Please note that STAR report provides the ranking of the subject hotel while each competitor's KPIs are hidden. • Question 11 10 out of 10 points Use the spreadsheet below to answer the following two questions regarding the methodology used to calculate Index. The occupancy Index for November (H3) is _____. 119. 2 Response Feedback: KPI Index = (Subject hotel's KPI / Comp Set KPI) x 100 In this case, (98.2 / 82.4) x 100 • Question 12 10 out of 10 points Use the spreadsheet below to answer the following two questions regarding the methodology used to calculate Index percent change. The ADR Index percent change for June (I4) is _____. 1.7 % Response Feedback: Percent Change = {(Current # - Past #)} / Past # In this case, {(104.3 - 102.6)} / 102.6 • Question 13 10 out of 10 points The number of Rooms Available in a total market can change over time due to what four factors? New hotel openings, Hotel closings, Hotel room additions, and Hotel room drops Response Feedback: Brand conversions do not affect the room supply. • Question 1 4 out of 4 points You are opening a Mexican restaurant in the midtown. Given below financial information of your company, please answer the following questions, 1 through 5. - Loan amount: $400,000 - Interest expenses: $50,000 - Tax rate: 20% - Equity financing: $400,000 - Equity partner share: 40% - Net income: $200,000 How much is the weighted average of cost (WACC)? 0.5*0.125*0.8+0.5*0.2=0.15 15 % • Question 2 4 out of 4 points You are opening a Mexican restaurant in the midtown. Given below financial information of your company, please answer the following questions, 1 through 5. - Loan amount: $400,000 - Interest expenses: $50,000 - Tax rate: 20% - Equity financing: $400,000 - Equity partner share: 40% - Net income: $200,000 How much is the weight of equity? 400000/(400000+400000) 50 % • Question 3 4 out of 4 points You are opening a Mexican restaurant in the midtown. Given below financial information of your company, please answer the following questions, 1 through 5. - Loan amount: $400,000 - Interest expenses: $50,000 - Tax rate: 20% - Equity financing: $400,000 - Equity partner share: 40% - Net income: $200,000 How much is the cost of debt? 50000/400000 12.5 % • Question 4 4 out of 4 points You are opening a Mexican restaurant in the midtown. Given below financial information of your company, please answer the following questions, 1 through 5. - Loan amount: $400,000 - Interest expenses: $50,000 - Tax rate: 20% - Equity financing: $400,000 - Equity partner share: 40% - Net income: $200,000 How much is the weight of debt? 400000/(400000+400000) 50 % • Question 5 4 out of 4 points You are opening a Mexican restaurant in the midtown. Given below financial information of your company, please answer the following questions, 1 through 5. - Loan amount: $400,000 - Interest expenses: $50,000 - Tax rate: 20% - Equity financing: $400,000 - Equity partner share: 40% - Net income: $200,000 How much is the cost of equity? 200000*40=80000, 80000/400000=0.2 20 % • Question 1 10 out of 10 points You are opening a Mexican restaurant in the midtown. Given below financial information of your company, please answer the following question. - Loan amount: $400,000 - Interest expenses: $50,000 - Tax rate: 20% - Equity financing: $400,000 - Equity partner share: 40% - Net income: $200,000 How much is the cost of debt? 12.5 % Response Feedback: Cost of Debt = Interest rate = Interest expense (annual) / Loan amount • Question 2 10 out of 10 points You are opening a Mexican restaurant in the midtown. Given below financial information of your company, please answer the following question. - Loan amount: $600,000 - Interest expenses: $50,000 - Tax rate: 20% - Equity financing: $400,000 - Equity partner share: 40% - Net income: $200,000 How much is the weight of equity? 40 % Response Feedback: Weight of Equity = Equity Financing / Total Costs = Equity Financing / (Debt Financing + Equity Financing) = Equity Financing / (Loan Amount + Equity Financing) • Question 3 10 out of 10 points You are opening a Mexican restaurant in the midtown. Given below financial information of your company, please answer the following question. - Loan amount: $600,000 - Interest expenses: $50,000 - Tax rate: 20% - Equity financing: $400,000 - Equity partner share: 40% - Net income: $200,000 How much is the weight of debt? 60 % Response Feedback: Weight of Debt = Loan amount / Total cost = Loan amount / (Loan amount + Equity financing) • Question 4 10 out of 10 points Mike and Marianne pulled their resources together to open a coffee place. They each put $20,000 and also took a bank loan of $20,000. Interest rate the bank charges is 8% and estimated tax rate is 30% for their business. If they both want a 12% return on their investment, what is the weighted average cost of capital? 9.9 % Response Feedback: WACC = Weighted Cost of Debt with Tax Effect + Weighted Cost of Equity = (20000/60000)*8%*(1-30%) + (40000/60000)*12% • Question 5 10 out of 10 points You are considering a $30 million project. Your capital is made of 35% equity and 65% debt. Your cost of equity is 15% and after tax cost of debt is 6%. What is your WACC? 9.2 % Response Feedback: WACC = Weighted Cost of Debt with Tax Effect + Weighted Cost of Equity = (65%*6%) + (35%*15%) Wednesday, March 20, 2019 8:13:17 PM CDT • Question 1 5 out of 5 points You are planning to buy 2018 MINI Cooper on a loan. Price of the car is $26,000. You are planning to make monthly payments for two years and your bank says they can offer the annual interest rate of 12%, compounded monthly. The first payment starts at the end of the first month. How much is your monthly payment? $1,22 3 Response Feedback: Excel: =PMT(1%, 24, -26000) Factor table: 26000/factor from table 4 with 1% and 24 periods • Question 2 5 out of 5 points How much do you have to invest today at a 5% annual rate to end up with $6,500 in one year? $6,19 1 Response Feedback: Excel: =PV(5%, 1, -6500) Factor table: 6500 * factor from table 2 with 5% and 1 period • Question 3 5 out of 5 points In purchasing a major piece of kitchen equipment costing $50,000, you pay a 20% down payment and finance the remaining. If the loan is at 12%, what is your monthly payment if you are financing it for 2 and half years? $1,542. 92 Response Feedback: Excel: =PMT(1%, 30, -40000) Factor table: 40000/factor from table 4 with 1% and 30 periods • Question 4 5 out of 5 points Sarah is desperately trying to have you as one of her investors in her new restaurant concept, The Goldfish. The proposal is to return you a single sum of $100,000 at the end of three years. If she promises a 8% rate compounded quarterly, which is higher than your hurdle rate, the equity investment asked is $78,850. Should you invest? Yes, because the present value is of $78,850 is the right amount with the interest and compounding and it is higher than your hurdle rate. Response Feedback: PV=78850 8% annual interest rate = 2% quarterly rate 3 years = 12 quarters FV=(2%, 12, -78850)=100000; therefore, what she is saying is correct. Plus, it's greater than my hurdle rate. Therefore, invest. • Question 5 5 out of 5 points The new truck your catering company just purchased has a cost of $75,000 with all the movable carts, storage, and refrigeration built in. You are able to negotiate a loan with your bank with no down payment, 12%, 2 years, with a monthly mortgage. Please complete the amortization schedule for the first two months of this loan. Response Feedback: Interest = beginning balance * monthly interest rate Principal = Payment - Interest Ending balance = Beginning balance - Principal • Question 1 10 out of 10 points There is a “hot deal” scheme on a new truck of $3,500 a year, paid at the end of each of the next 5 years, with no down payment. What is the truck really costing you? Suppose the interest rate is 5%. $15,1 53 Response Feedback: The question is to identify present value of the cash flows. Excel: PV=(5%, 5, -3500) Factor table: 3500 * factor from table 4 with 5% and 5 periods • Question 2 10 out of 10 points Your restaurant is purchasing a heavy duty grill for producing huge amount of barbecue. It costs $200,000, you pay a 5% down payment and finance the rest. If the loan is at 12% interest rate, what is your monthly payment if you are financing it for 2.5 years? $7,36 2 Response Feedback: Excel: =PMT(1%, 30, -200000*0.95) Factor table: (200000*0.95) / Factor from table 4 with 1% and 30 periods • Question 3 10 out of 10 points The new generator that your company just replaced has a cost of $100,000. You were able to negotiate a loan with your bank with no down payment, 12% annual interest rate, and 30 months. Please complete the amortization schedule for the first two months of this loan. Monthly Beginning Balance Payment Interest Principal Ending Balance 1 100,000 3,875 1,000 2,875 97,125 2 97,125 3,875 971 2,904 94,221 Response Feedback: Interest = Beginning balance * monthly interest rate Principal = Payment - Interest Ending balance = Beginning balance - Principal • Question 4 10 out of 10 points John’s personal financial consultant tells him that a hotel development opportunity with the following proposal is a good investment. $2,000,000 investment with a return of $3,000,000 at the end of 3-year period. John’s hurdle rate of 12%. Is the financial consultant correct? Yes. Because future value of the $2,000,000 with 12% return is $2,809,856, where suggested $3,000,000 is greater than the future value with 12% of return.. Response Feedback: With 12% return on investment, future value of $2,000,000 is Excel: =FV(12%, 3, ,-2000000) Factor table: = 2000000 * factor from table 1 with 12% and 3 period =$2,809,856 < $3,000,000 • • Question 1 10 out of 10 points There is a “hot deal” scheme on a new truck of $3,500 a year, paid at the end of each of the next 5 years, with no down payment. What is the truck really costing you? Suppose the interest rate is 5%. $15,1 53 Response Feedback: The question is to identify present value of the cash flows. Excel: PV=(5%, 5, -3500) Factor table: 3500 * factor from table 4 with 5% and 5 periods • Question 2 10 out of 10 points Your restaurant is purchasing a heavy duty grill for producing huge amount of barbecue. It costs $200,000, you pay a 5% down payment and finance the rest. If the loan is at 12% interest rate, what is your monthly payment if you are financing it for 2.5 years? $7,36 2 Response Feedback: Excel: =PMT(1%, 30, -200000*0.95) Factor table: (200000*0.95) / Factor from table 4 with 1% and 30 periods • Question 3 10 out of 10 points The new generator that your company just replaced has a cost of $100,000. You were able to negotiate a loan with your bank with no down payment, 12% annual interest rate, and 30 months. Please complete the amortization schedule for the first two months of this loan. Selecte d Monthly Beginning Balance Payment Interest Principal Ending Balance 1 100,000 3,875 1,000 2,875 97,125 2 97,125 3,875 971 2,904 94,221 Response Feedback: Interest = Beginning balance * monthly interest rate Principal = Payment - Interest Ending balance = Beginning balance - Principal • Question 4 10 out of 10 points John’s personal financial consultant tells him that a hotel development opportunity with the following proposal is a good investment. $2,000,000 investment with a return of $3,000,000 at the end of 3-year period. John’s hurdle rate of 12%. Is the financial consultant correct? Yes. Because future value of the $2,000,000 with 12% return is $2,809,856, where suggested $3,000,000 is greater than the future value with 12% of return.. Response Feedback: With 12% return on investment, future value of $2,000,000 is Excel: =FV(12%, 3, ,-2000000) Factor table: = 2000000 * factor from table 1 with 12% and 3 period =$2,809,856 < $3,000,000 • Question 1 3 out of 3 points Use the spreadsheet below to answer the following question regarding the methodology used to calculate KPIs for a competitive set. The competitive set Occupancy (E6) for July is _____. 72.6 % • Question 2 4 out of 4 points In which of the following situations will occupancy decrease? Supply increases 10% and demand increases 5% • Question 3 3 out of 3 points Use the spreadsheet below to answer the following question regarding the methodology used to calculate Index percent change. The ADR Index percent change for June (I4) is _____. 1.7 % • Question 4 3 out of 3 points $133. 7 • Question 5 3 out of 3 points Use the spreadsheet below to answer the following question regarding the methodology used to calculate Index. The occupancy Index for November (H3) is ____. 119. 2 • Question 6 4 out of 4 points When you receive your STAR report your ADR index was 110 and your Occupancy index was 90. What do you know? The RevPAR index will be in the neighborhood of 100 • Question 1 4 out of 4 points The new truck your catering company just purchased has a cost of $75,000 with all the movable carts, storage, and refrigeration built in. You are able to negotiate a loan with your bank with 10% down payment, 12%, 2 years, with a monthly mortgage. Please find amortization schedule with correct numbers for the first two months of this loan. Select ed Answe r: Month Beginning Balance Payment Interest Principal Ending Balance • Question 2 4 out of 4 points You are planning to buy 2019 MINI Cooper on a loan. Price of the car is $26,000. You are planning to make monthly payments for two years and your bank says they can offer the annual interest rate of 12%, compounded monthly. The first payment starts at the end of the first month. How much is your monthly payment? =PMT(12%/12,24,-26000) $1,22 3 • Question 3 4 out of 4 points In purchasing a major piece of kitchen equipment costing $50,000, you pay a 20% down payment and finance the remaining. With 2% monthly interest rate, what is your monthly payment if you are financing it for 2 and half years? =PMT(2%,30,- 40000) $1,78 6 • Question 4 4 out of 4 points Sarah is desperately trying to have you as one of her investors in her new restaurant concept, The Goldfish. The proposal is to return you a single sum of $100,000 at the end of three years. If she promises a 8% rate compounded quarterly, which is higher than your hurdle rate, the equity investment asked is $78,850. Should you invest? Yes, because the present value is of $78,850 is the right amount with the interest and compounding and it is higher than your hurdle rate • Question 5 4 out of 4 points How much do you have to invest today at a 5% annual rate to end up with $6,500 in one year? =PV(5%,1,,-6500) $6,19 1 [Show More]

Last updated: 1 year ago

Preview 1 out of 29 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 19, 2022

Number of pages

29

Written in

Additional information

This document has been written for:

Uploaded

Apr 19, 2022

Downloads

0

Views

51

(1).png)

.png)

.png)