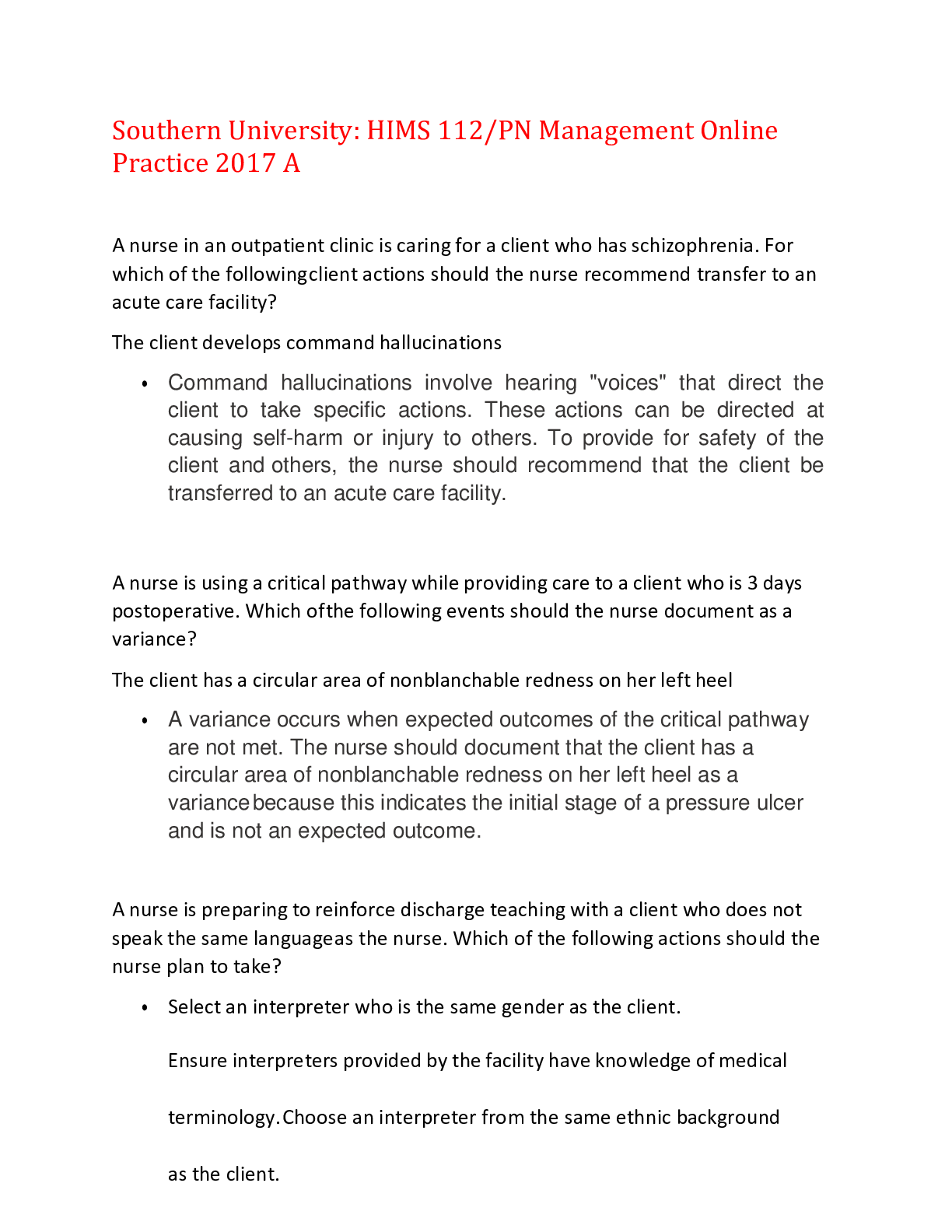

Finance > QUESTIONS & ANSWERS > FINANCING_201 FSA 3e_Test Bank B_Mod01 _042612 2. All Answers Provided with Solution Calculation and (All)

FINANCING_201 FSA 3e_Test Bank B_Mod01 _042612 2. All Answers Provided with Solution Calculation and Explanations.

Document Content and Description Below

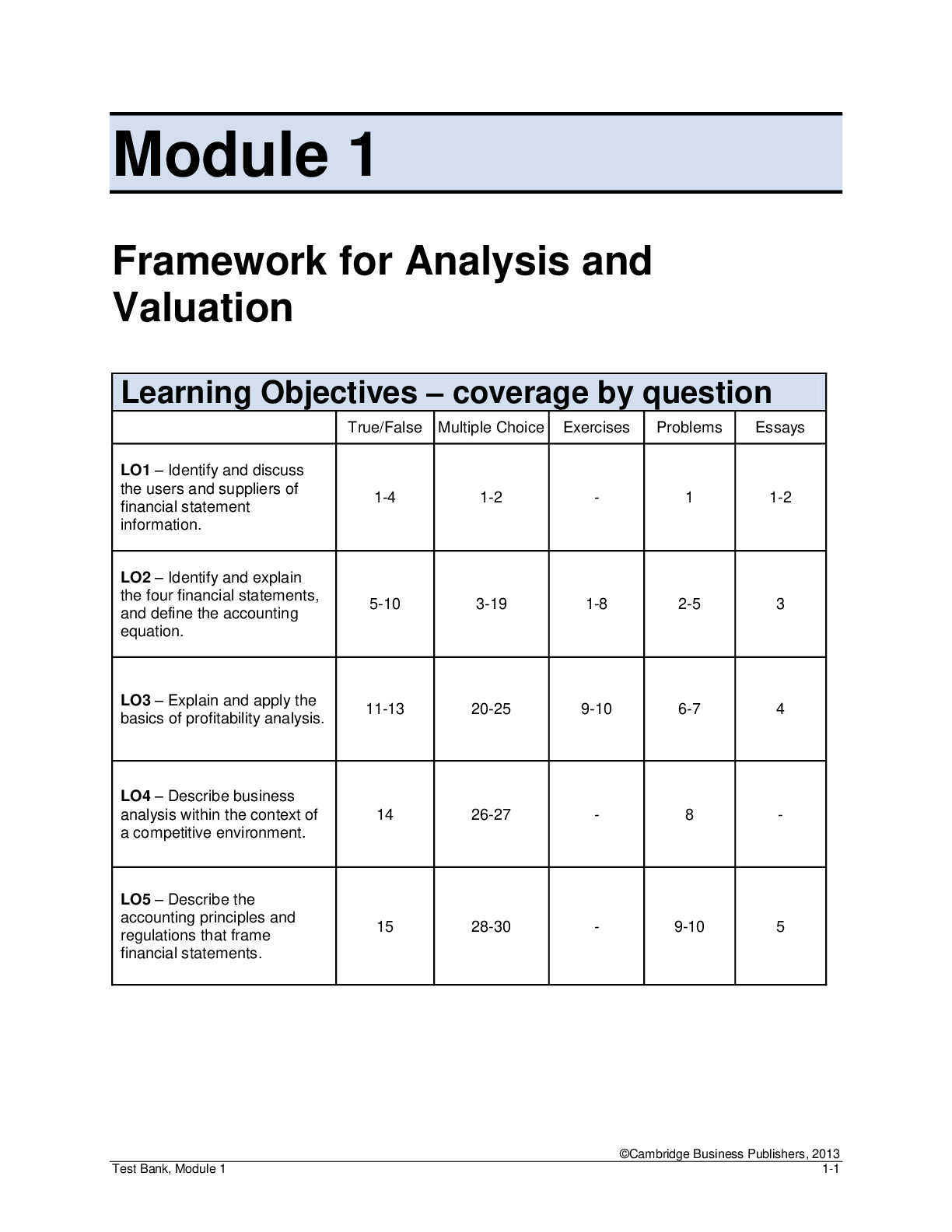

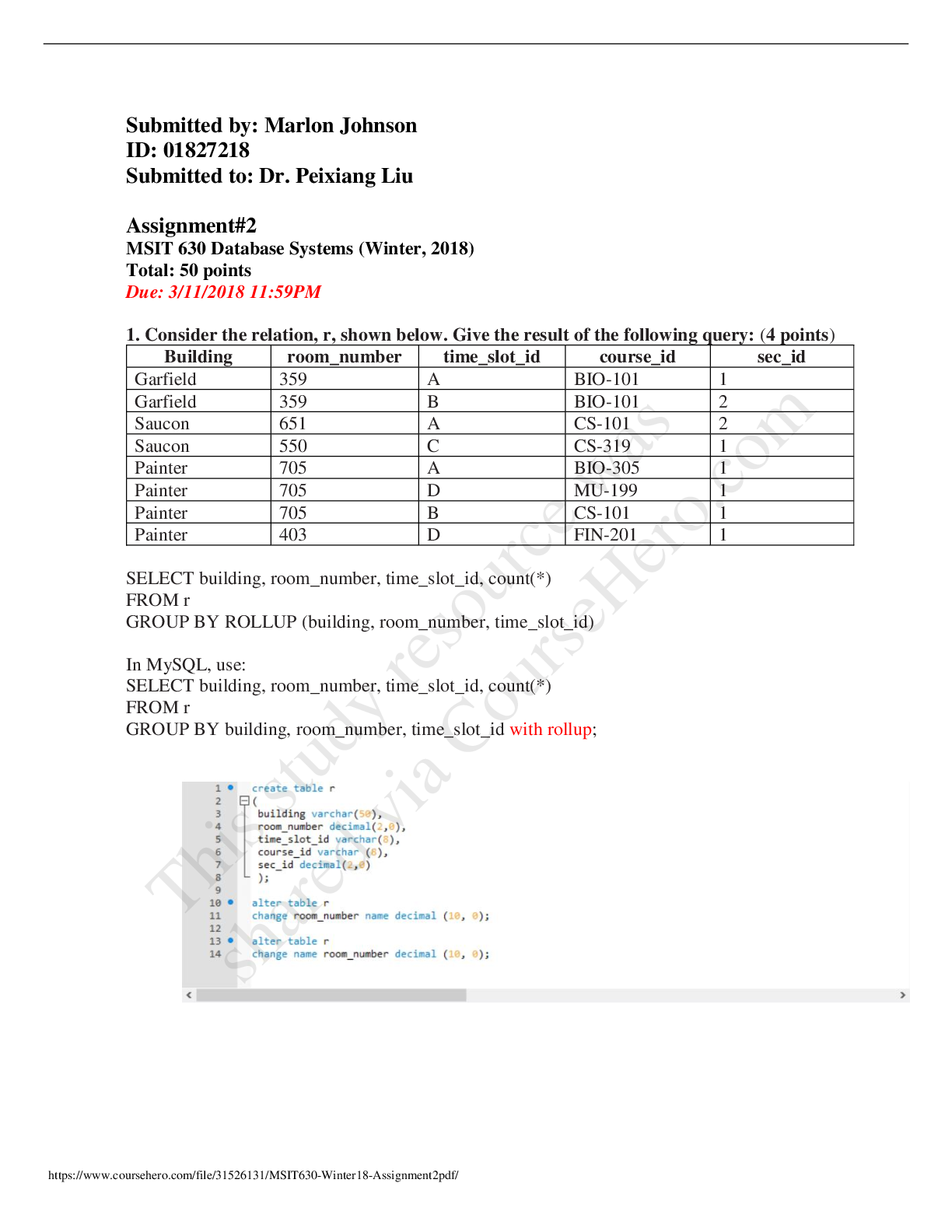

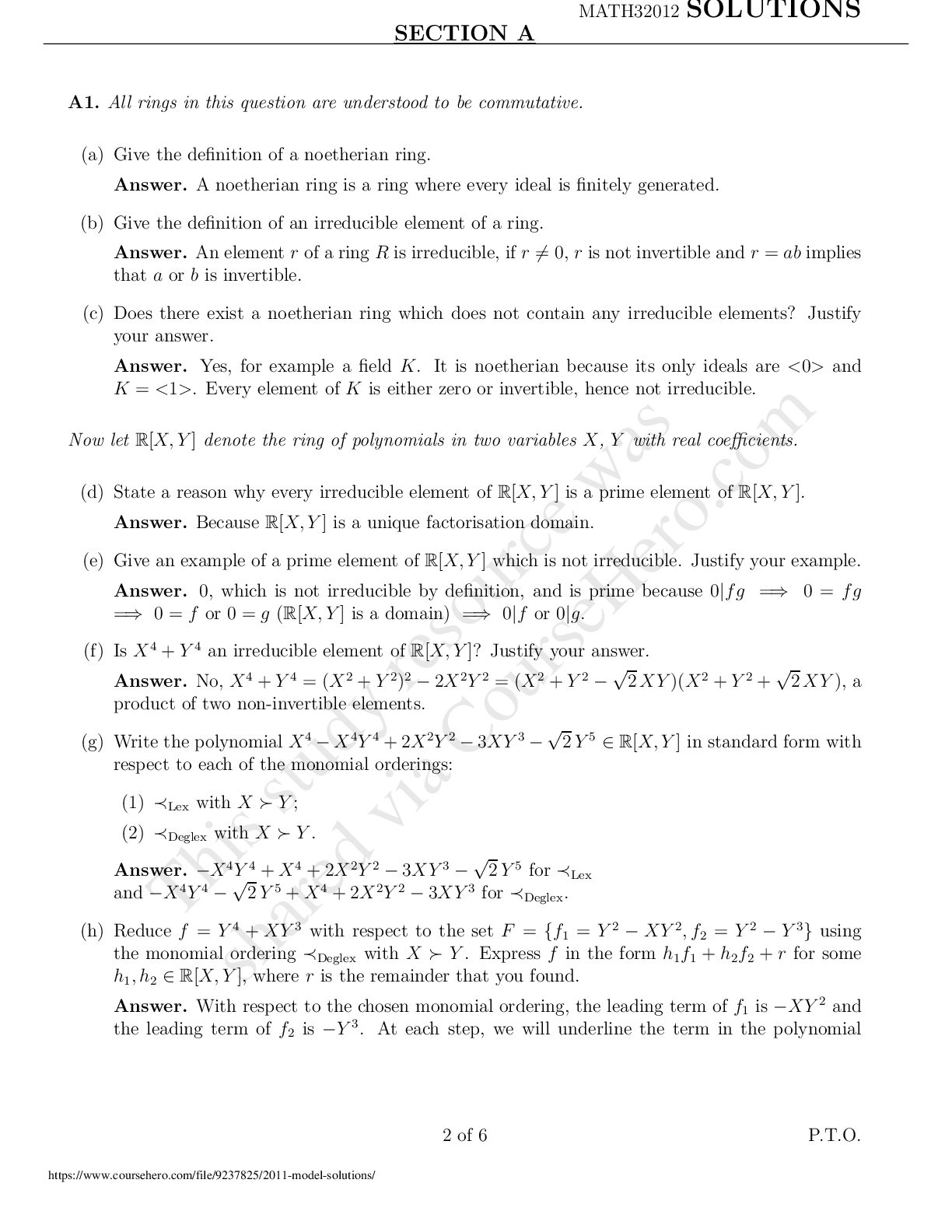

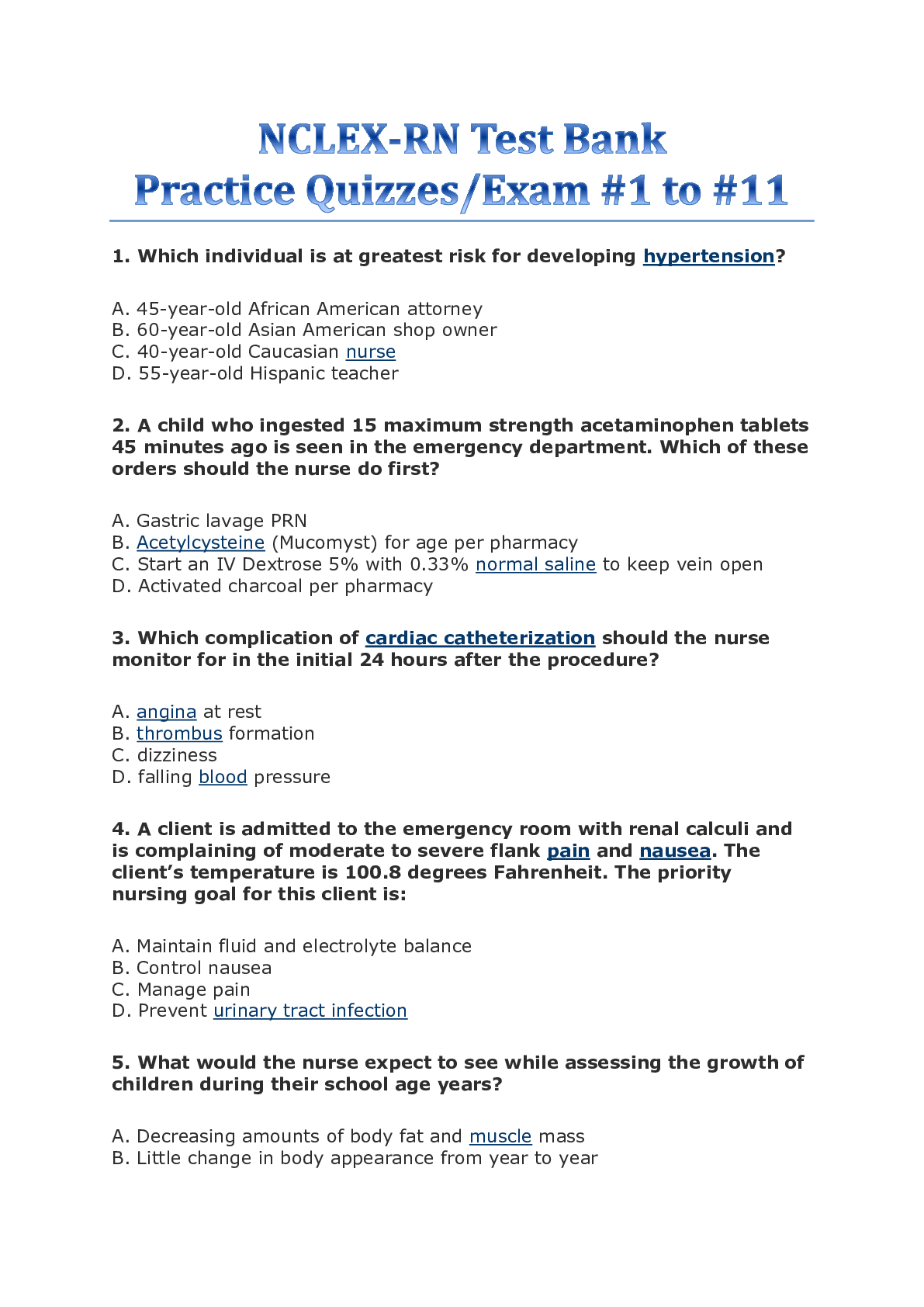

Module 1 Framework for Analysis and Valuation Learning Objectives – coverage by question True/False Multiple Choice Exercises Problems Essays LO1 – Identify and discuss the users and su... ppliers of financial statement information. 1-4 1-2 - 1 1-2 LO2 – Identify and explain the four financial statements, and define the accounting equation. 5-10 3-19 1-8 2-5 3 LO3 – Explain and apply the basics of profitability analysis. 11-13 20-25 9-10 6-7 4 LO4 – Describe business analysis within the context of a competitive environment. 14 26-27 - 8 - LO5 – Describe the accounting principles and regulations that frame financial statements. 15 28-30 - 9-10 5 Module 1: Framework for Analysis and Valuation True/False Topic: Users of Financial Statement Information LO: 1 1. Shareholders demand financial information primarily to assess profitability and risk whereas bankers demand information primarily to assess cash flows to repay loan interest and principal. Topic: Publicly Available Financial Reports LO: 1 2. Publicly traded companies are required to provide quarterly financial reports directly to the public. Topic: Users of Financial Statement Information LO: 1 3. Publicly traded companies provide financial information primarily to satisfy the SEC and the tax authorities (that is, the Internal Revenue Service). Topic: SEC Filings LO: 1 4. Publicly traded companies must provide to the Securities Exchange Commission annual audited financial statements (10K reports) and quarterly audited financial statements (10Q reports). Topic: Balance Sheet LO: 2 5. If a company reports retained earnings of $175.3 million on its balance sheet, it must also report $175.3 million in cash. Topic: Balance Sheet LO: 2 6. A balance sheet shows a company’s position over a period of time, whereas an income statement, statement of stockholders’ equity, and statement of cash flows show its position at a point in time. Topic: Accounting Equation L: O2 7. Assets must always equal liabilities plus equity. Answer: True Rationale: The accounting equation is Assets = Liabilities + Equity. This relation must always hold. Topic: Income Statement LO: 2 8. The income statement reports net income which is defined as the company’s profit after all expenses and dividends have been paid. Topic: Statement of Cash Flows LO: 2 9. A statement of cash flows reports on cash flows for operating, investing and financing activities at a point in time. Topic: Statement of Stockholders’ Equity LO: 2 10. An increase in treasury stock would be reflected in the statement of stockholders’ equity. Topic: Return on Assets LO: 3 11. Return on Assets (ROA) measures the profit the company makes on each dollar of total assets it uses. Topic: Return on Assets LO: 3 12. Return on Assets (ROA) = Net Income / Sales × Asset Turnover Topic: Asset Turnover LO: 3 13. Consider two companies (A and B) with equal profit margins of 15%. Company A has an asset turnover of 1.2 and Company B has an asset turnover of 1.5. If all else is equal, Company B with its’ higher asset turnover, is less profitable because it is expensive to turn assets over. Topic: Financial Accounting and Business Analysis LO: 4 14. Financial statements are influenced by five important forces that determine a company’s competitive intensity: (A) industry competition, (B) buyer power, (C) supplier power, (D) product substitutes, and (E) threat of entry. Topic: Audit Report LO: 5 15. A “clean” audit report asserts – among other things – that (a) the auditor has prepared all necessary financial statements and (b) management has expressed its opinion that they are prepared in conformity with GAAP. Multiple Choice Topic: Users of Financial Statement Information LO: 1 1. Which of the following groups would likely not be interested in the financial statements of a large public company such as Berkshire Hathaway? A) Shareholders B) Employees C) Competitors D) Taxing agencies E) None of the above Topic: Users of Financial Statement Information LO: 1 2. The SEC adopted Regulation FD, to curb public companies’ practice of: A) Routinely filing extensions for annual reports (Form 10-K) B) Selectively disclosing information C) Reporting pro forma (non-GAAP) numbers D) Hiring auditors for non-audit services such as consulting engagements E) None of the above Topic: Components of the Balance Sheet LO: 2 3. A list of assets, liabilities and equity can be found on which of the following? A) Balance Sheet B) Income Statement C) Statement of Assets and Liabilities D) Statement of Cash Flows E) Statement of Stockholders’ Equity Topic: Balance Sheet LO: 2 4. Which of the following items would not be found on a balance sheet? (Select all that apply) A) Stockholders’ Equity B) Property, plant and equipment C) Nonowner financing D) Sales E) Cost of Goods Sold Topic: Profit and Cash Flow LO: 2 5. A company’s net cash flow will equal its net income … A) Almost always B) Rarely C) Occasionally D) Only when the company has no investing cash flow for the period E) Only when the company has no investing or financing cash flow for the period Topic: Financial Statement Information LO: 2 6. Which of the following statements are correct (select all that apply): A) A balance sheet reports on investing and financing activities. B) An income statement reports on financing activities. C) The statement of equity reports on changes in the accounts that make up equity. D) The statement of cash flows reports on cash flows from operating, investing, and financing activities over a period of time. E) A balance sheet reports on a company’s assets and liabilities over a period of time. Topic: Balance Sheet – Numerical calculations required LO: 2 7. The Goodyear Tire & Rubber Company’s December 31, 2011 financial statements reported the following (in millions) Total assets $17,629 Total liabilities 16,005 Total shareholders’ equity 1,624 Net income (loss) 343 Retained earnings, December 31, 2010 $ 866 What did Goodyear report for Retained earnings at December 31, 2011? A) $1,624 million B) $1,209 million C) $ 523 million D) $2,833 million E) There is not enough information to determine the answer. Topic: Balance Sheet – Numerical calculations required LO: 2 8. American Airlines’ 2011 balance sheet reported the following (in millions) Total Assets $23,589 Total Liabilities 32,626 Contributed Capital $ 4,455 What was American Airlines’ Total liabilities and Stockholders’ Equity at December 31, 2011? A) $23,589 million B) $32,626 million C) $37,081 million D) $ 4,455 million E) There is not enough information to determine the answer. Topic: Balance Sheet – Numerical calculations required LO: 2 9. On October 2, 2011 Starbuck’s Corporation reported, on its Form 10-K, the following (in millions): Total assets $7,360.4 Total stockholders’ equity 4,387.3 Total current liabilities 2,075.8 What did Starbuck’s report as Total liabilities on October 2, 2011? A) $7,360.4 million B) $2,075.8 million C) $2,973.1 million D) $2,311.5 million E) None of the above Topic: Balance Sheet – Numerical calculations required LO: 2 10. In its 2011 annual report, Snap-On Incorporated reported the following (in millions): Current assets $1,530.7 Total shareholders’ equity $1,547.3 Total liabilities $2,125.6 What did Snap-On report as total assets at year-end 2011? A) $3,078.8 million B) $1,530.7 million C) $3,656.3 million D) $3,672.9 million E) None of the above Topic: Balance Sheet – Numerical calculations required LO: 2 11. In its 2011 annual report, Kohl’s Corporation reported the following (in millions): Total assets $14,094 Total shareholders’ equity $ 6,508 Total liabilities $ 7,586 What proportion of Kohl’s Corporation is financed by nonowners? A) 86% B) 54% C) 46% D) 73% E) None of the above Topic: Balance Sheet – Numerical calculations required (more challenging – requires calculation of total assets before ratio can be calculated.) LO: 2 12. In its 2011 annual report, Mattel Inc. reported the following (in millions): Total liabilities $3,061 Total shareholders’ equity $2,611 What proportion of Mattel is financed by nonowners? A) 54% B) 37% C) 85% D) 46% E) None of the above Topic: Income Statement – Numerical calculations required LO: 2 13. The Goodyear Tire & Rubber Company’s December 31, 2011 financial statements reported the following (in millions) Sales $22,767 Cost of sales $18,821 Other expenses (excluding cost of sales) $ 3,529 What did Goodyear report for Net income for the year ending December 31, 2011? A) $ 3,946 million B) $ (417) million C) $ 417 million D) $19,238 million E) There is not enough information to determine the answer. Topic: Income Statement – Numerical calculations required LO: 2 14. Intel Corporation reported the following on its 2007 income statement (in millions) Sales revenue $38,334 Gross profit $19,904 Total expenses $12,928 What did Intel report for Cost of goods sold during 2007? A) $25,406 million B) $ 5,502 million C) $18,430 million D) $ 2,988 million E) None of the above Topic: Income statement – Numerical calculations required LO: 2 15. On October 2, 2011, Starbucks Corporation reported, on its Form 10-K, the following (in millions): 2011 2010 Total expenses $10,452.4 $9,759.1 Operating income 1,728.5 1,419.4 Net earnings 1,248.0 948.3 What amount of revenues did Starbucks report for the year ending October 2, 2011? A) $10,452.4 B) $ 8,723.9 C) $11,700.4 D) $12,180.9 E) None of the above Topic: Income Statement – Numerical calculations required (more challenging, requires calculation of negative “growth” rate.) LO: 2 16. On October 2, 2011, Starbucks Corporation reported, on its Form 10-K, the following (in millions): 2011 2010 Operating income $ 1,728.5 $1,419.4 Net earnings $ 1,248.0 $ 948.3 Calculate year-over-year increase in Net earnings, in percentage terms. A) 22% B) 32% C) 72% D) 67% E) None of the above Topic: Income Statement – Numerical calculations required (more challenging – requires calculation of gross profit and ratios for two years.) LO: 2 17. In its 2010 annual report, Caterpillar Inc. reported the following (in millions): 2010 2009 Sales $39,867 $29,540 Cost of goods sold 30,367 23,886 As a percentage of Sales, did Caterpillar’s Gross profit increase or decrease during 2011? A) Gross profit increased from 19% to 24% B) Gross profit decreased from 24% to 19% C) Gross profit increased from 76% to 81% D) Gross profit decreased from 81% to 76% E) There is not enough information to answer the question. Topic: Statement of Cash Flows – Numerical calculations required LO: 2 18. The Goodyear Tire & Rubber Company’s December 31, 2011, financial statements reported the following (in millions). Cash December 31, 2011 $ 2,772 Cash from operating activities 773 Cash from investing activities (902) Cash from financing activities 896 What did Goodyear report for Cash on its December 31, 2010 balance sheet? A) $2,772 million B) $3,539 million C) $767 million D) $2,005 million E) None of the above Topic: Statement of Cash Flows – Numerical calculations required LO: 2 19. Procter & Gamble’s June 30, 2011, financial statements reported the following (in millions): Cash, beginning of year $ 2,879 Cash, end of year 2,768 Cash from operating activities 13,231 Cash from investing activities (3,482) What did Procter & Gamble report for Cash from financing activities for the year ended June 30, 2011? A) $(12,628) million B) $ 15,396 million C) $ (15,396) million D) $ 9,860 million E) $ (9,860) million Topic: Return on Assets LO: 3 20. A company’s return on assets (ROA) can be disaggregated to reveal which of the following (select all that apply): A) Financial leverage B) Profit margin C) Sales growth D) Asset growth E) Asset turnover Topic: Return on Equity LO: 3 21. The ratio of net income to equity is also known as: A) Total net equity ratio B) Profit margin C) Return on equity D) Net income ratio E) None of the above Topic: Return on Equity – Numerical calculations required LO: 3 22. Sales for the year = $108,229, Net Income for the year= $13,144, Income from equity investments = $3,309, and average Equity during the year = $47,556. Return on equity (ROE) for the year is: A) 12.1% B) 27.6% C) 43.9% D) 227.6% E) There is not enough information to answer the question. Topic: Return on Assets – Numerical calculations required LO: 3 23. Sales for the year = $82,229, Net Income for the year= 8,186, and average Assets during the year = $52,445. Return on Assets (ROA) for the year is: A) 63.8% B) 1 0.0% C) 15.6% D) There is not enough information to calculate ROA. E) None of the above Topic: Return on Assets – Numerical calculations required (more challenging because net income is not provided, must be calculated.) LO: 3 24. Sales for the year = $277,022, Profit margin = 16%, and average Assets during the year = $259,108. Return on Assets (ROA) for the year is: A) 17.1% B) 16.0% C) 84.0% D) There is not enough information to calculate ROA. E) None of the above Topic: Return on Assets – Numerical calculations required (more challenging because average assets are not provided; must be calculated.) LO: 3 25. On December 31, 2010, Harley-Davidson, Inc., reported, on its Form 10-K, the following (in millions): 2010 2009 Total assets $9,431 $9,156 Total sales 4,859 4,782 Net income 147 (55) Calculate return on assets (ROA) for 2010. A) 1.6% B) 51.5% C) 71.5% D) 9.7% E) None of the above Topic: Five Forces of Competitive Industry LO: 4 26. Which of the following are not one of the five forces that determine a company’s competitive intensity? (select as many as apply) A) Bargaining power of suppliers B) Threat of substitution C) Ability to obtain financing D) Threat of entry E) Threat of regulatory intervention Topic: Business Environment LO: 4 27. Which of the following are relevant in an analysis of a company’s business environment? (select as many as apply) A) Financing B) Labor C) Buyers D) Governance E) All of the above Topic: Clean Audit Opinion LO: 5 28. A clean audit opinion includes which of the following assertions: (select as many as apply) A) Financial statements present fairly the company’s financial condition B) The auditor certifies the financials to be error free C) The financial statements are management’s responsibility D) Management has handled transactions efficiently in all material respects E) All of the above Topic: Auditor Report LO: 5 29. The audit report is addressed to: A) The audit committee B) The board of directors C) The shareholders D) The board of directors and the shareholders E) The Securities and Exchange Commission (SEC) Topic: GAAP LO: 5 30. Generally Accepted Accounting Principles (GAAP) are created by: (select all that apply) A) The Securities and Exchange Commission B) The Generally Accepted Accounting Principles Task Force C) The Sarbanes Oxley Act D) The Financial Accounting Standards Board E) The Emerging Issues Task Force Exercises Topic: Financial Accounting Vocabulary LO: 2 1. Match the item on the left to a numbered item on the right to complete each sentence. A) Resources that a company owns or controls are called _________________. 1. liabilities B) The difference between a company’s assets and its equity is equal to _______________. 2. return on assets C) Net income divided by average assets is known as ____________. 3. assets D) Sales, cost of goods sold and all other expenses are necessary to calculate a company’s ______________. 4. income statement 5. net income Topic: Financial Accounting Vocabulary LO: 2 2. Match the item on the left to a numbered item on the right to complete each sentence. A) Companies report assets, liabilities, and equity on the _________________. 1. income statement B) Sales, cost of goods sold, and net income are found on the _______________. 2. balance sheet C) Changes in contributed capital during the period are explained on the ____________. 3. statement of cash flows D) The _______________ reports cash from financing activities. 4. statement of shareholders’ equity 5. financial statements Topic: Income Statement Components LO: 2 3. Fill in the blanks to complete Whole Foods’ Income Statement ($ thousands). Whole Foods Income Statement For Year Ended September 26, 2010 Sales $9,005,794 Cost of goods sold and occupancy costs ? Gross profit 3,135,401 Operating expenses ? Operating income $ 437,975 Topic: Income Statement Components LO: 2 4. Fill in the blanks to complete Procter & Gamble’s Income Statement ($ millions). Procter & Gamble Income Statement For Year Ended June 30, 2011 Sales $ ? Expenses 67,370 Earnings before income taxes 15,189 Income taxes ? Net earnings $ 11,797 Topic: Statement of Cash Flow Components LO: 2 5. Fill in the blanks to complete Whole Food’s Statement of Cash Flow ($thousands). Whole Foods Statement of Cash Flows For Year Ended September 26, 2010 Net cash provided by operating activities $585,285 Net cash used in investing activities (715,406) Net cash provided by financing activities (168,013) Net change in cash ? Cash at beginning of year ? Cash at end of year $131,996 Topic: Balance Sheet Components LO: 2 6. Fill in the blanks to complete Whole Foods’ Balance Sheet ($thousands). Whole Foods Balance Sheet September 26, 2010 Cash $ 131,996 Current liabilities $ 747,872 Non-cash assets ? Long-term liabilities ? Stockholders’ equity 2,373,258 Total assets $3,986,540 Total liabilities and equity $ ? Topic: Balance Sheet Components LO: 2 7. Fill in the blanks to complete the Procter & Gamble Balance Sheet ($ millions). Procter & Gamble Balance Sheet June 30, 2011 Cash $ 2,768 Current liabilities $ ? Non-cash assets ? Long-term liabilities 43,060 Shareholders’ equity 68,001 Total assets $ ? Total liabilities and equity $138,354 Topic: Retained Earnings Reconciliation LO: 2 8. Whole Foods reports the following balances in its stockholders’ equity accounts. Fill in the blanks. ($ millions) 2010 2009 2008 Retained earnings beginning of year ? ? $208,949 Net income ? 148,804 114,524 Dividends 5,478 28,050 ? Retained earnings end of year $598,570 $358,215 ? Topic: Return on Assets LO: 3 9. Procter & Gamble reports the following items in their financial statements. Fill in the blanks. ($ millions) 2011 2010 Average assets $133,263 $131,503 Net earnings 11,797 ? Return on assets ? 9.68% 8.85% 9.68% Topic: Return on Assets LO: 3 10. Whole Foods reports the following items in their financial statements. Fill in the blanks. ($ thousands) 2010 Average assets $3,884,964 Sales 9,005,794 Net income 245,833 Return on assets ? Profit margin ? Asset turnover ? Problems Topic: Other Financial Information LO: 1 1. In addition to the four financial statements, list three sources of financial information available to external stakeholders? Answer: Any three from the list below • Management Discussion and Analysis (MD&A) • Management’s report on internal controls • Annual corporate report • Auditor’s report and opinion • Notes to financial statements • Proxy statements • Various regulatory filings for SEC and IRS, etc. Topic: Constructing Financial Statements LO: 2 2. In its October 2, 2011 annual report, Starbucks Corporation reports the following items. ($ millions) 2011 Cash flows from operations $ 1,612.4 Total revenues 11,700.4 Shareholders’ equity 4,387.3 Cash flows from financing (608.8) Total liabilities 2,973.1 Cash, ending year 1,148.1 Expenses 10,452.4 Noncash assets 6,212.3 Cash flows from investing (1,019.5) Net earnings 1,248.0 Cash, beginning year $ 1,164.0 a. Prepare the balance sheet for Starbucks for October 2, 2011. b. Prepare the income statement for Starbucks for the year ended October 2, 2011. c. Prepare the statement of cash flows for Starbucks for the year ended October 2, 2011. Topic: Constructing Financial Statements LO: 2 3. In its December 31, 2011 annual report, Mattell, Inc. reports the following items. ($ thousands) 2011 Net cash flows from operating activities $ 664,693 Net sales 6,266,037 Stockholders’ equity 2,610,603 Net cash flows from financing activities (402,199) Total assets 5,671,638 Cash, ending year 1,369,113 Expenses 5,497,529 Noncash assets 4,302,525 Net cash flows from investing activities (174,504) Net income 768,508 Cash, beginning year $1,281,123 a. Prepare the balance sheet for Mattel, Inc. for December 31, 2011. b. Prepare the income statement for Mattel, Inc. for the year ended December 31, 2011. c. Prepare the statement of cash flows for Mattel, Inc. for the year ended December 31, 2011. Topic: Statement of stockholders’ equity from raw data LO: 2 4. In its December 31, 2010, annual report, Mattel, Inc. reports the following items: ($ thousands) 2010 Retained earnings, December 31, 2009 $ 2,339,506 Treasury stock, December 31, 2009 (1,555,046) Treasury stock, December 31, 2010 (1,880,692) Net income for 2010 684,863 Contributed capital, December 31, 2009 2,126,063 Dividends during 2010 303,724 Stock issued during 2010 21,767 Prepare the statement of stockholders’ equity for Mattel, Inc. for the year ended December 31, 2010. Topic: Balance Sheet Relations LO: 2 5. Nike, Inc. has a fiscal year-end of May 31. On May 31, 2010, Nike, Inc. reported $14,419 million in assets and $9,754 million in equity. During fiscal 2011, Nike’s assets increased by $579 million while its equity increased by $89 million. What were Nike’s total liabilities at May 31, 2010, and May 31, 2011? Topic: Calculating ROA LO: 3 6. Use Southwest Airlines’ 2011 financial statement information, below to answer the following: a. Calculate Southwest Airlines’ return on assets (ROA) for the year ending December 31, 2011. b. Disaggregate Southwest Airlines’ ROA into profit margin (PM) and asset turnover (AT). Explain what each ratio measures. In millions Total operating revenues $15,658 Net income 178 Total assets, beginning of year 15,463 Total assets, end of year 18,068 Equity, end of year 6,877 Topic: Calculating ROA and ROE LO: 3 7. Below are several financial statement items for two grocery chains, Whole Foods Market, an upscale organic grocer, and The Kroger Co. a mainstream grocer. ($ millions) a. Calculate each company’s return on assets (ROA) and return on equity (ROE). Comment on any differences you observe. b. Disaggregate the ROA for each company into profit margin (PM) and asset turnover (AT). Explain why Whole Foods has a higher ROA, is it because of PM or AT or both? Whole Foods Market The Kroger Co. Net income $ 246 $ 1,133 Sales 9,006 82,189 Average assets 3,885 23,316 Average stockholders’ equity 2,001 5,112 Topic: Competitive Analysis LO: 4 8. List three of the five competitive forces that confront the company and determine its competitive intensity. Briefly explain each force that you list. Topic: The Role of Auditors in Financial Reporting LO: 5 9. What potential conflicts of interests do auditing firms face in conducting audits of publicly traded companies? Topic: The Effect of the Sarbanes-Oxley Act LO: 5 10. Accounting debacles, such as in the case of Enron, brought to light the necessity of accuracy in financial reporting and accountability of management. Describe how the introduction of the Sarbanes-Oxley Act has changed the requirements of financial reporting. Essay Questions Topic: Costs and Benefits of Disclosure LO: 1 1. Explain the benefits and costs associated with a company's disclosure of information. Topic: Demand for Financial Accounting Information LO: 1 2. List three users of financial accounting information and explain how each might use financial information. Topic: Owner vs. Nonowner Financing LO: 2 3. Businesses rely on financing activities to fund their operating and investments. Explain the difference between owner and nonowner financing, and explain the benefits and risks involved in relying more heavily on each type of financing. Topic: Usefulness of ROA for Managers LO: 3 4. Investors and lenders place significant importance on management’s effectiveness in generating a high return on assets (ROA). Explain how ROA is also important for managers’ analysis of its own performance, particularly when ROA is disaggregated. Topic: Corporate Governance LO: 5 5. Describe three corporate governance mechanisms that are in place to protect users of financial information. [Show More]

Last updated: 1 year ago

Preview 1 out of 31 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 12, 2020

Number of pages

31

Written in

Additional information

This document has been written for:

Uploaded

Oct 12, 2020

Downloads

0

Views

58

STUDY GUIDE.png)

Exam Prep Guide.png)

STUDY GUIDE.png)

Exam Prep Guide.png)

.png)

.png)

.png)

.png)

.png)