Financial Accounting > TEST BANK > Federal Tax Research 12th Edition by Roby Sawyers, Steven Gill-|Test bank| Reviewed/Updated for 2021 (All)

Federal Tax Research 12th Edition by Roby Sawyers, Steven Gill-|Test bank| Reviewed/Updated for 2021

Document Content and Description Below

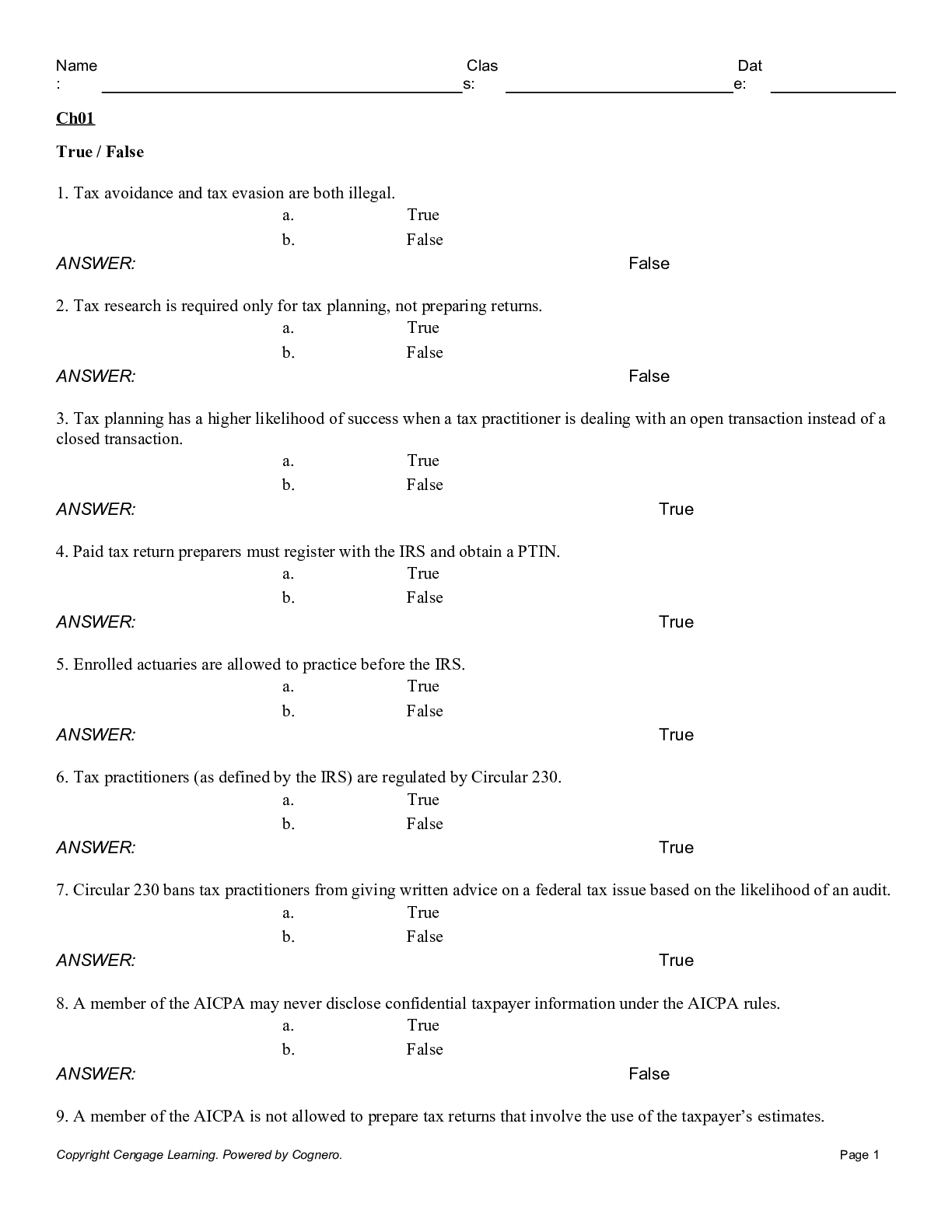

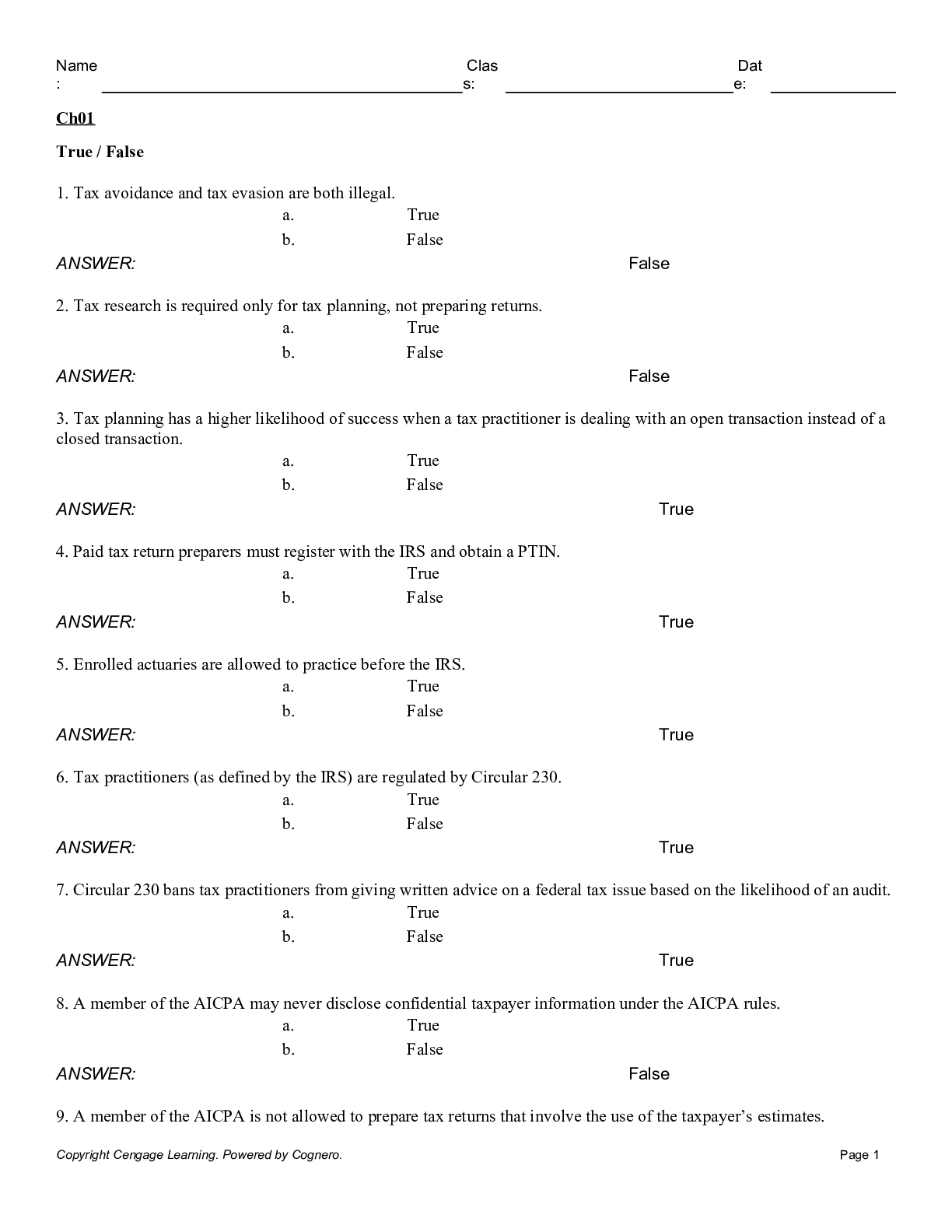

Federal Tax Research 12th Edition by Roby Sawyers, Steven Gill-|Test bank| Reviewed/Updated for 2021The Test bank borrows from the elaborated text book fielding questions specially tailored to the tex... t book topics to equip the student with what questions to expect in the quiz’s tests and exams. Gain a thorough understanding of tax research today with the hands-on practice you need to succeed in class and on the job. Sawyers/Gill's market-leading FEDERAL TAX RESEARCH, 12E's step-by-step approach uses current examples and engaging discussions to focus on the most important elements of federal tax law and tax practices. You work with the latest versions of today's most popular online tax research tools, including Thomson Reuters Checkpoint, CCH IntelliConnect, and BNA Bloomberg. Significant updates address ethical challenges in taxation today, qualified business income deductions and other legislative changes enacted by the Tax Cuts and Jobs Act of 2017 as well as how Congress enacts technical changes. Coverage of professional and legal responsibilities and IRS practices and procedures helps you prepare for the CPA exam : Federal Tax Research 12th Edition by Roby Sawyers, Steven Gill-|Test bank| Reviewed/Updated for 20211. Tax compliance is the process of: a. filing necessary tax returns b. gathering the financial information necessary to report taxable income c. representing a taxpayer at an IRS audit d. all of these are correctTax evasion is: a. a fraudulent act involving illegal nonpayment of taxes b. one of the objectives of tax planning c. an act of deferring tax payments to future periods d. the same as tax avoidance as both of them result in nonpayment of taxesTax litigation is a process of: a. participating in an administrative audit b. settling tax-related disputes in a court of law c. filing amended tax returns as prescribed by tax laws d. arranging a taxpayer’s affairs to minimize tax liabilitiesRegarding open transactions, which of the following statements is INCORRECT? a. The transaction is not yet completed. b. The practitioner can suggest changes to achieve a better tax result. c. A tax practitioner has some degree of control over the client’s tax liability. d. The practitioner can fix the problem by amending the client’s tax return.Which of the following statements best describes Circular 230? a. Circular 230 has been adopted by the AICPA as its set of rules of practice for CPAs. b. Circular 230 is a set of Treasury Department ethical and legal standards for those engaging in practice before the IRS. c. Circular 230 is a set of internal rules at the IRS designed to protect tax practitioners from unfair discipline by the IRS. d. Circular 230 is a set of ethical rules for taxpayers. [Show More]

Last updated: 11 months ago

Preview 1 out of 367 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 26, 2021

Number of pages

367

Written in

Additional information

This document has been written for:

Uploaded

Aug 26, 2021

Downloads

0

Views

43

,by Frank Kardes Maria Cronley Thomas Cline (TEST BANK).png)