Economics > TEST BANK > South-Western Federal Taxation 2018 Essentials of Taxation Individuals and Business Entities William (All)

South-Western Federal Taxation 2018 Essentials of Taxation Individuals and Business Entities William A. Raabe, James C. Young, Annette Nellen, David M. Maloney| Test Bank| Reviewed/Updated for 2021. All Chapters included 1-18(1340 pages)

Document Content and Description Below

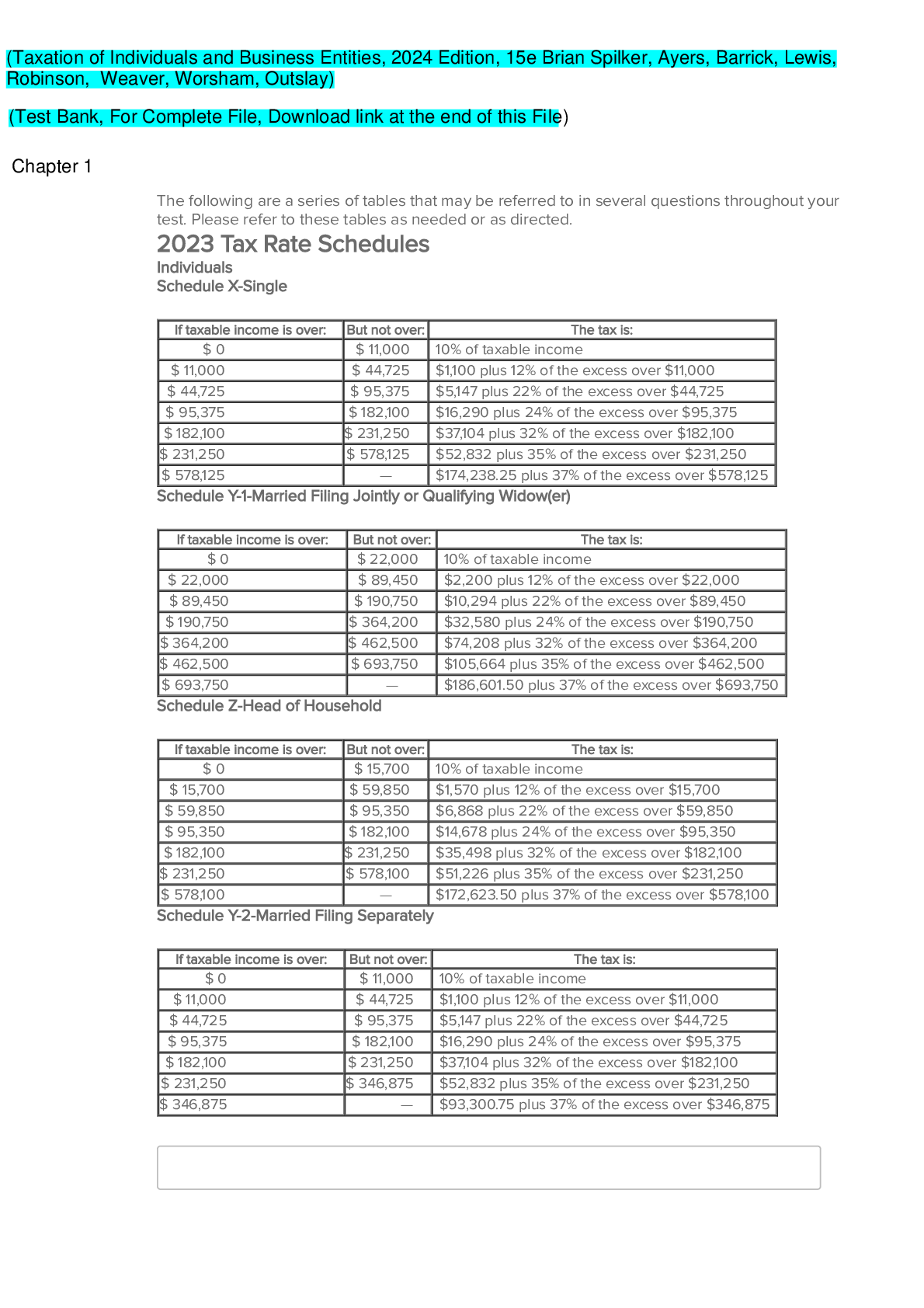

The Test bank borrows from the elaborated text book fielding questions specially tailored to the text book topics to equip the student with what questions to expect in the quiz’s tests and exams ... This concise guide focuses on the most recent tax laws impacting individuals, corporations, partnerships, estates, trusts and financial statements. Updates emphasize the latest tax changes and 2021 developments, including coverage of the Tax Cuts and Jobs Act of 2017 with guidance from the treasury department. Recent examples, updated summaries and tax scenarios clarify concepts and sharpen critical-thinking, writing and research skills, while sample questions from Becker C.P.A. Review assist in study South-Western Federal Taxation 2018 Essentials of Taxation Individuals and Business Entities William A. Raabe, James C. Young, Annette Nellen, David M.Which, if any, of the following transactions will increase a taxing jurisdiction’s revenue from the ad valorem tax imposed on real estate? a. A resident dies and leaves his farm to his church. b. A large property owner issues a conservation easement as to some of her land. c. A tax holiday issued 10 years ago has expired. d. A bankrupt motel is acquired by the Red Cross and is to be used to provide housing for homeless persons. e. None of these.Which, if any, of the following transactions will decrease a taxing jurisdiction’s ad valorem tax revenue imposed on real estate? a. A tax holiday is granted to an out-of-state business that is searching for a new factory site. b. An abandoned church is converted to a restaurant. c. A public school is razed and turned into a city park. d. A local university sells a dormitory that will be converted for use as an apartment building. e. None of these. Federal excise taxes that are no longer imposed include: a. Tax on air travel. b. Tax on wagering. c. Tax on the manufacture of sporting equipment. d. Tax on alcohol. e. None of these.Taxes not imposed by the Federal government include: a. Tobacco excise tax. b. Customs duties (tariffs on imports). c. Tax on rental cars. d. Gas guzzler tax. e. None of these.Taxes levied by both states and the Federal government include: a. General sales tax. b. Custom duties. c. Hotel occupancy tax. d. Franchise tax. e. None of these [Show More]

Last updated: 11 months ago

Preview 1 out of 1340 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 24, 2021

Number of pages

1340

Written in

Additional information

This document has been written for:

Uploaded

Aug 24, 2021

Downloads

0

Views

41