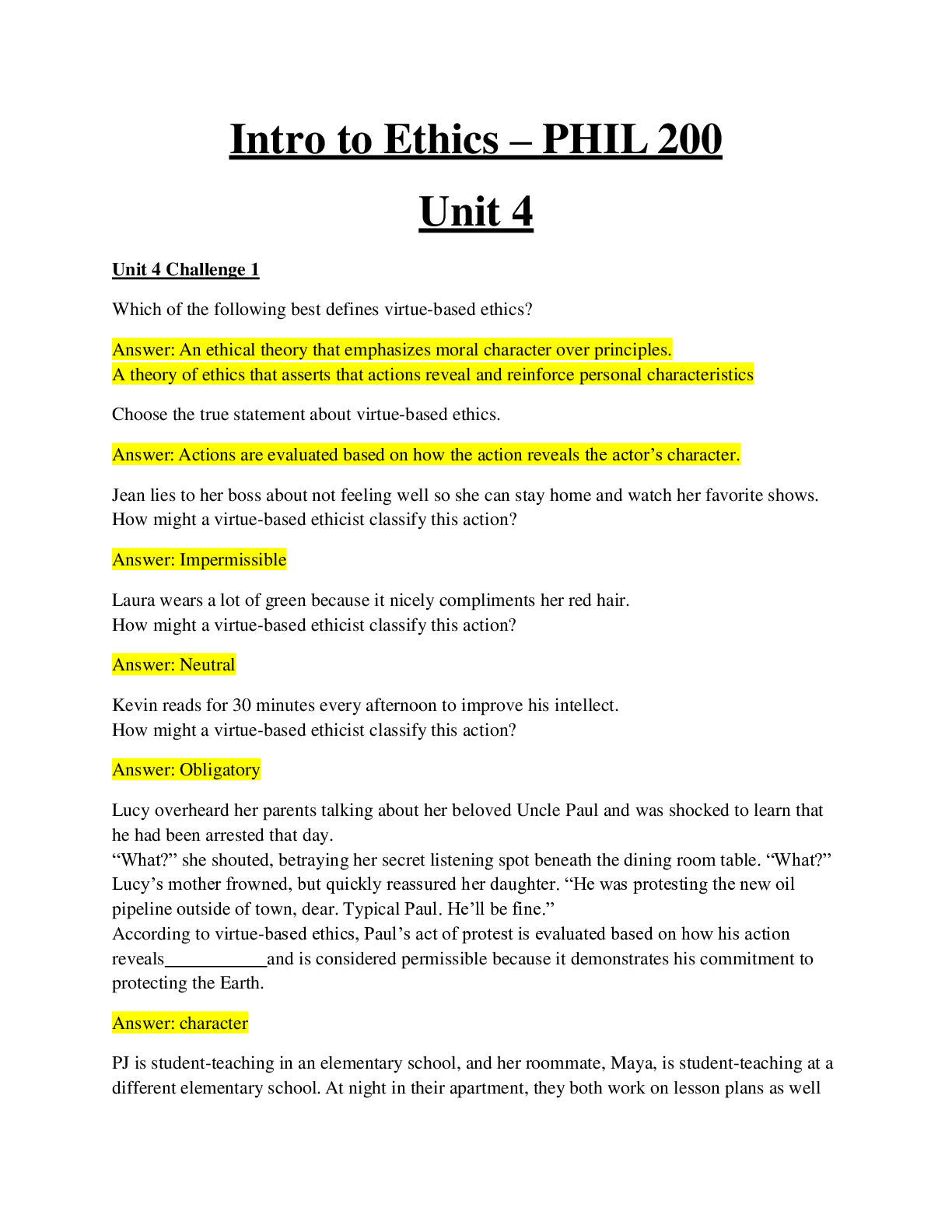

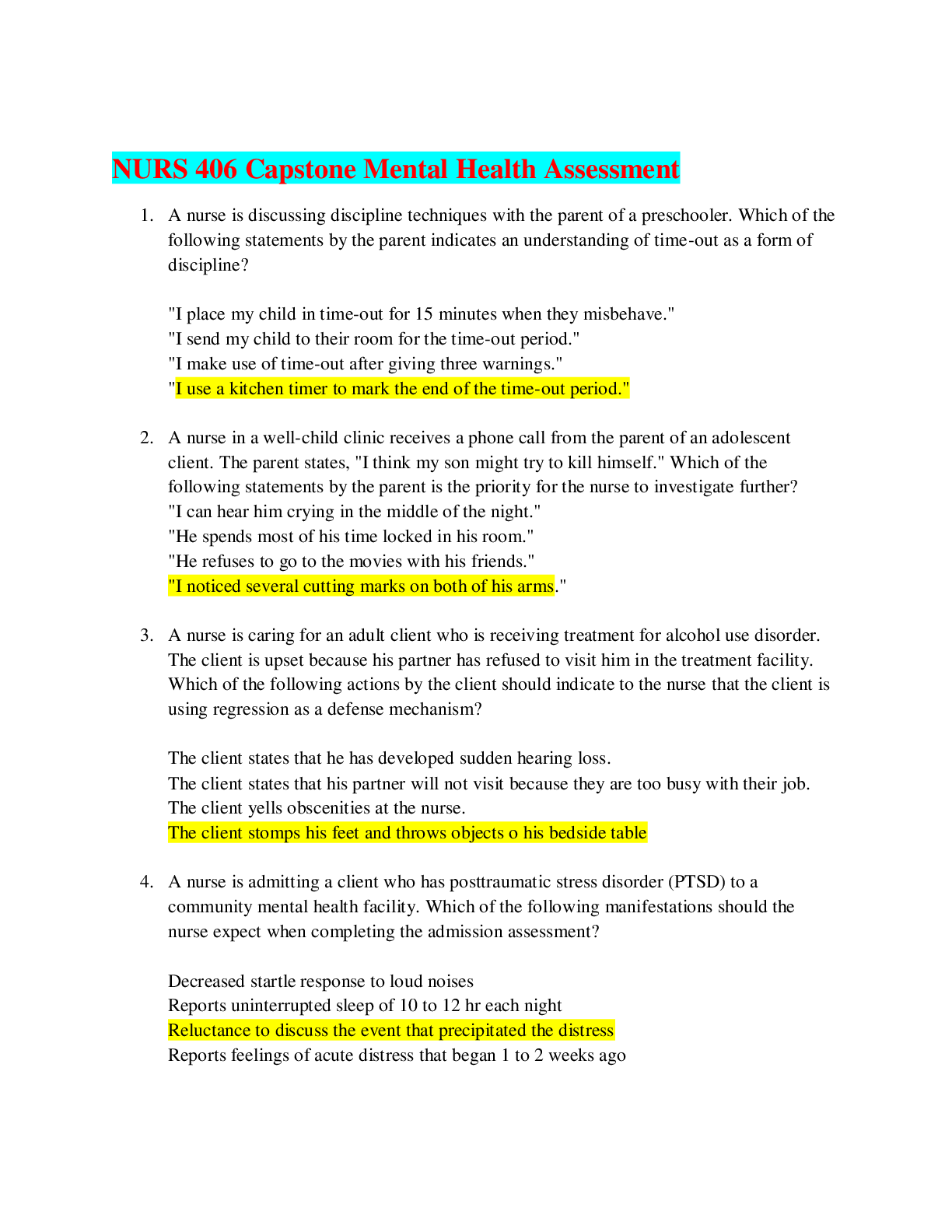

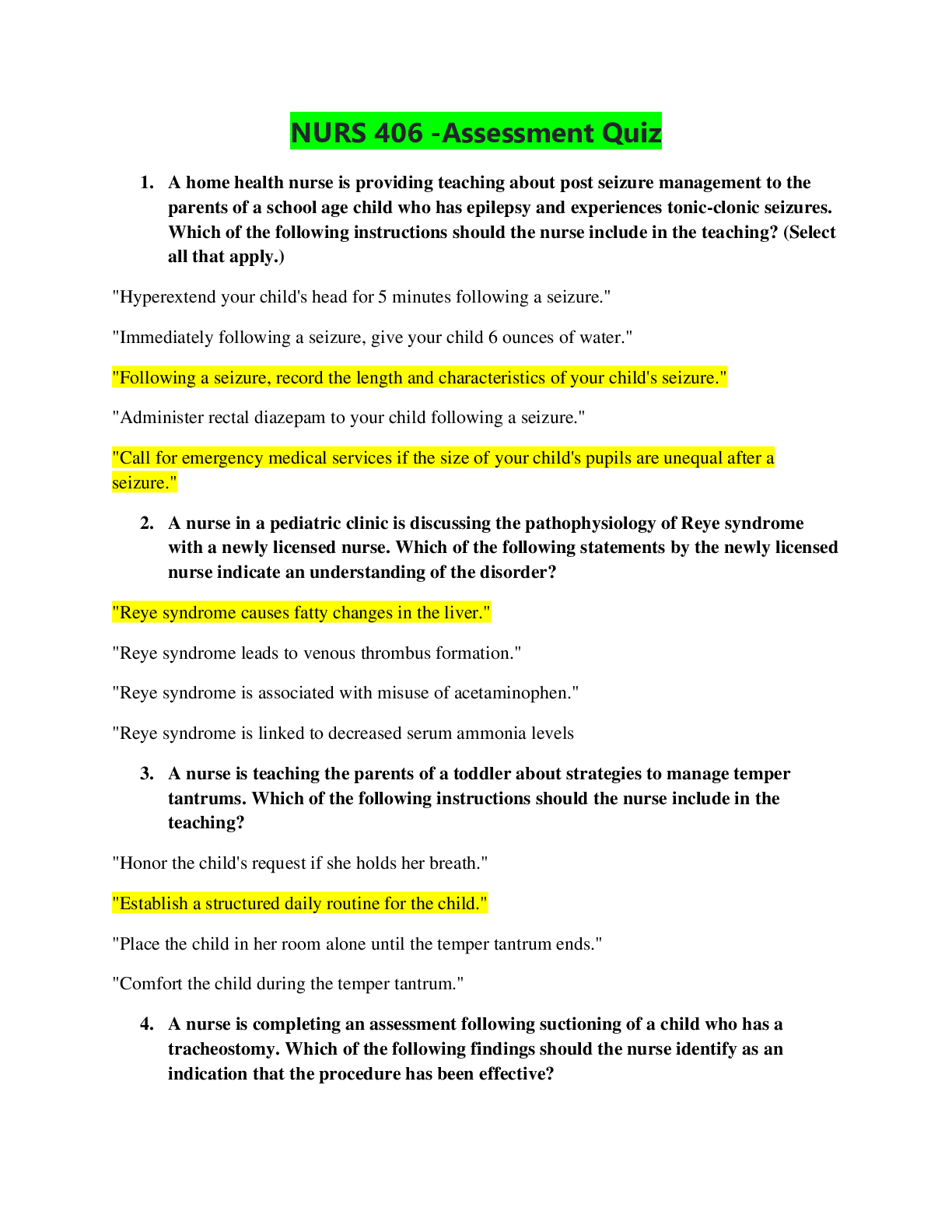

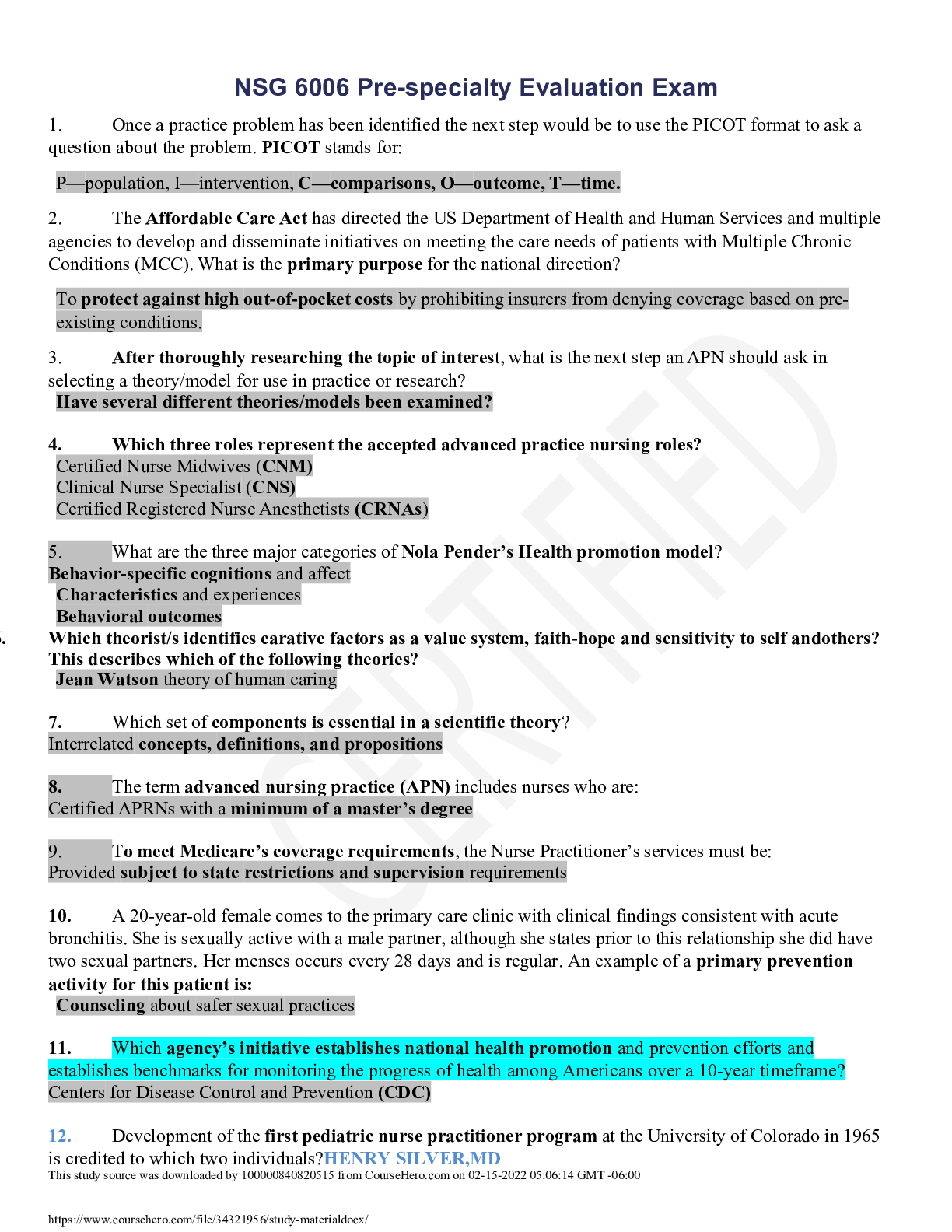

Financial Accounting > EXAM > ACC 280 Final Exam 9 (All)

ACC 280 Final Exam 9

Document Content and Description Below

ACC 280 Final Exam 9 1. Sources of increases to owner's equity are 2. A small neighborhood barber shop that is operated by its owner would likely be organized as a 3. An account consists of 4. A n... umbering system for a chart of accounts 5. The ledger should be arranged in 6. A debit to an asset account indicates Chapter 4 It is not true that current assets are assets that a company expects to After closing entries are posted, the balance in the owner's capital account in the ledger will be equal to When using a worksheet, adjusting entries are journalized Liabilities are generally classified on a balance sheet as Chapter 5 At the beginning of the year, Hinz Company had an inventory of $400,000. During the year, the company purchased goods costing $1,600,000. If Hinz Company reported ending inventory of $600,000 and sales of $2,000,000, the company's cost of goods sold and gross profit rate must be The Merchandise Inventory account is used in each of the following except the entry to record On a classified balance sheet, merchandise inventory is classified as The Sales Returns and Allowances account does not provide information to management about Chapter 6 Merchandise inventory is Lee Industries had the following inventory transactions occur during 2010: Units Cost/unit 2/1/10 Purchase 18 $45 3/14/10 Purchase 31 $47 5/1/10 Purchase 22 $49 The company sold 51 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using LIFO? (rounded to whole dollars) Shandy Shutters has the following inventory information. Nov. 1 Inventory 15 units @ $8.00 8 Purchase 60 units @ $8.60 17 Purchase 30 units @ $8.40 25 Purchase 45 units @ $8.80 A physical count of merchandise inventory on November 30 reveals that there are 50 units on hand. Assume a periodic inventory system is used. Ending inventory under FIFO is During July, the following purchases and sales were made by James Company. There was no beginning inventory. James Company uses a perpetual inventory system. Purchases Sales July 3 20 units @ $12 July 13 25 units 11 20 units @ $13 22 10 units 20 10 units @ $15 Under the FIFO method, the cost of goods sold for each sale is: Chapter 7 The one characteristic that all entries recorded in a multi-column purchases journal have in common is a The individual amounts in the Accounts Payable column in the cash payments journal are posted to the subsidiary ledger The individual amounts in the sales journal are posted to the accounts receivable subsidiary ledger In which journal would a cash purchase of merchandise inventory be recorded? Chapter 8 In large companies, the independent internal verification procedure is often assigned to Which of the following would not be reported on the balance sheet as a cash equivalent? If a petty cash fund is established in the amount of $250, and contains $150 in cash and $95 in receipts for disbursements when it is replenished, the journal entry to record replenishment should include credits to the following accounts A $100 petty cash fund has cash of $15 and receipts of $80. The journal entry to replenish the account would include a credit to Chapter 9 The maturity value of a $30,000, 8%, 3-month note receivable is The balance of Allowance for Doubtful Accounts prior to making the adjusting entry to record estimated uncollectible accounts The percentage of receivables basis for estimating uncollectible accounts emphasizes A note receivable is a negotiable instrument which Chapter 10 Depreciable cost is the Mather Company purchased equipment on January 1, 2010 at a total invoice cost of $224,000; additional costs of $4,000 for freight and $20,000 for installation were incurred. The equipment has an estimated salvage value of $8,000 and an estimated useful life of five years. The amount of accumulated depreciation at December 31, 2011 if the straight-line method of depreciation is used is: Hull Company acquires land for $86,000 cash. Additional costs are as follows: Removal of shed $300 Filling and grading 1,500 Salvage value of lumber of shed 120 Broker commission 1,130 Paving of parking lot 10,000 Closing costs 560 Hull will record the acquisition cost of the land as The factor that is not relevant in computing depreciation is Chapter 11 Lincoln Company sells 600 units of a product that has a one-year warranty on parts. The average cost of honoring one warranty contract is $50. During the year 30 contracts are honored at a cost of $1,500. It is estimated that 60 contracts will be honored in the following year. The adjusting entry at the end of the current year will include a The paid absence that is most commonly accrued is Most companies pay current liabilities The entry to record the issuance of an interest-bearing note credits Notes Payable for the note's Chapter 12 Which one of the following would not be considered an expense of a partnership in determining income for the period? Finney is admitted to a partnership with a 25% capital interest by a cash investment of $90,000. If total capital of the partnership is $390,000 before admitting Finney, the bonus to Finney is Mary Janane's capital statement reveals that her drawings during the year were $50,000. She made an additional capital investment of $25,000 and her share of the net loss for the year was $10,000. Her ending capital balance was $200,000. What was Mary Janane's beginning capital balance? The most appropriate basis for dividing partnership net income when the partners do not plan to take an active role in daily operations is Chapter 13 The following data is available for BOX Corporation at December 31, 2010: Common stock, par $10 (authorized 15,000 shares) $100,000 Treasury Stock (at cost $15 per share) 600 Based on the data, how many shares of common stock are outstanding? When stock is issued for legal services, the transaction is recorded by debiting Organization Expense for the The two ways that a corporation can be classified by ownership are On January 2, 2007, Pacer Corporation issued 30,000 shares of 6% cumulative preferred stock at $100 par value. On December 31, 2010, Pacer Corporation declared and paid its first dividend. What dividends are the preferred stockholders entitled to receive in the current year before any distribution is made to common stockholders? [Show More]

Last updated: 1 year ago

Preview 1 out of 16 pages

Also available in bundle (1)

ACC 280 FINAL EXAMS

ACC 280 Final Exam 9|ACC 280 Final Exam 7|ACC 280 Final Exam 6|ACC 280 Final Exam 5|ACC 280 Final Exam 4|ACC 280 Final Exam 2|ACC 280 Final Exam 1

By Ajay25 2 years ago

$50

7

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jun 23, 2021

Number of pages

16

Written in

Additional information

This document has been written for:

Uploaded

Jun 23, 2021

Downloads

0

Views

47