Financial Accounting > QUESTIONS & ANSWERS > Strayer University, WashingtonACC 557ACC Analytics - Week 2 HW (All)

Strayer University, WashingtonACC 557ACC Analytics - Week 2 HW

Document Content and Description Below

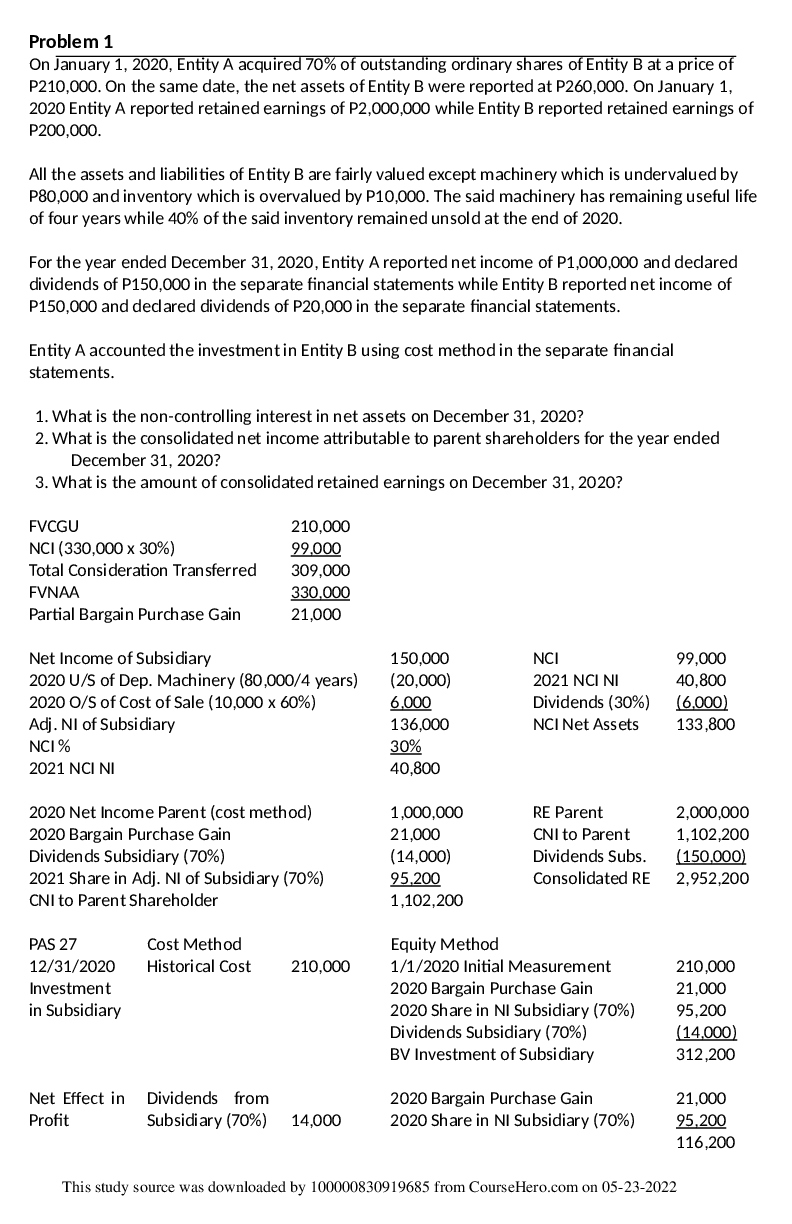

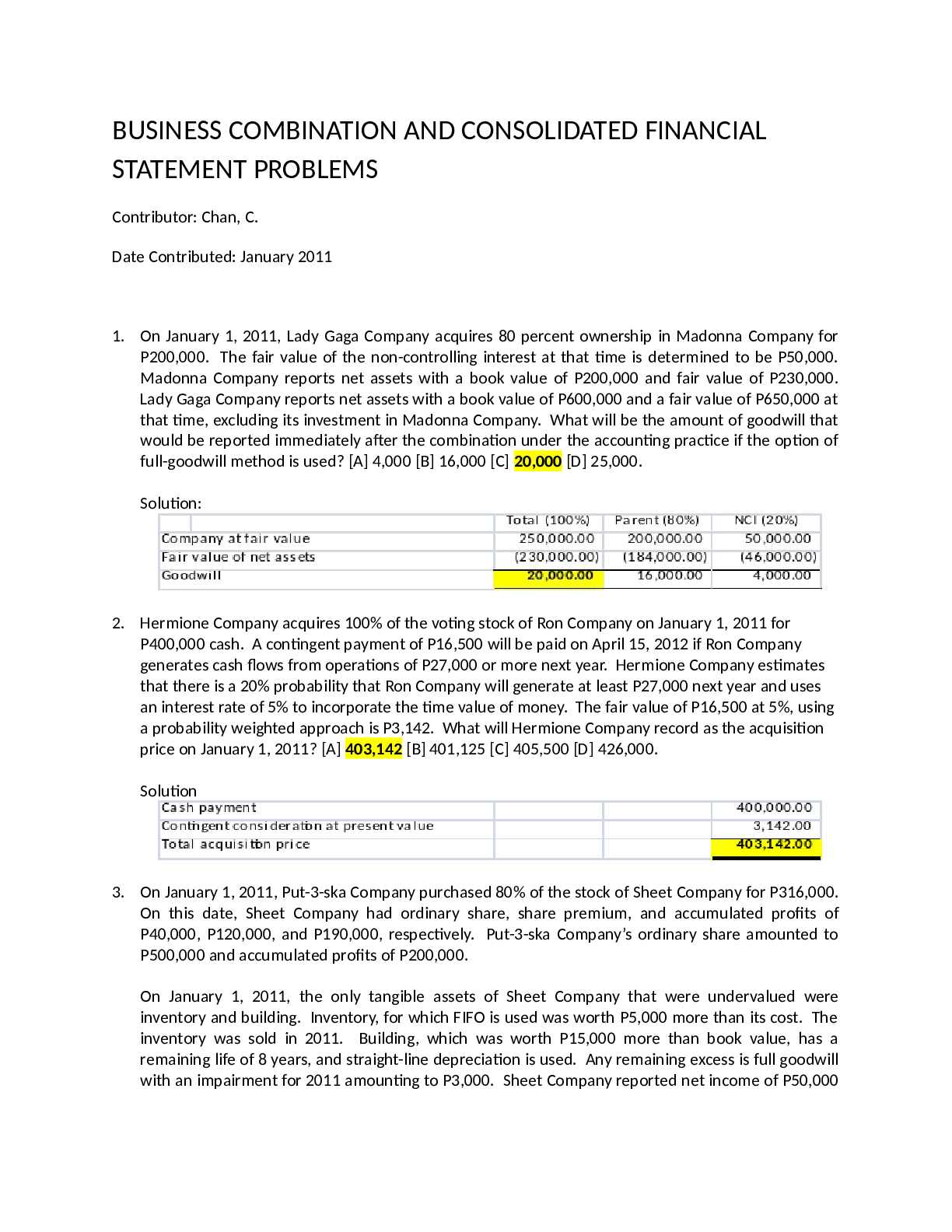

Week 2 1. Which of the following are possible motives for managers to manipulate their earnings higher (I.e., make reported earnings greater than unmanaged earnings)? (check all that apply) Congres... s is planning a vote on extending tax credits to company’s industry due its poor recent performance Unmanaged earnings would exceed security analysts’ forecasts of earnings Company is close to violating a debt covenant on its public bond issue because of low earnings Potential customer is deciding whether to sign a long-term contract with the company and will only do so only if it thinks the company has strong profitability Government is investigating potential monopolistic practices by the company because of it high levels of profitability 2. Which of the following actions would be examples of “accrual-based earnings management”? (check all that apply) Delay an employee training program to the next period Reduce the expected percentage of this period’s sales that will be uncollectible Reduce the expected percentage of this period’s sales that will result in warranty claims Delay the write-off of a building that has dramatically dropped in value to the next period Cut spending on R&D this period Reduce …uncollectable + Delay the write-off Delay the write + Delay an employeeReduce uncollectable + Reduce claims Cut spending+ Delay an employee Cut spending + Delay the write -off Reduce uncollectable + Cut spending Reduce warranty claims+ Cut spending Reduce uncollectable + Delay the write Reduce uncollectable + Delay an employee Reduce +Red + Cap 3. Below is two years of quarterly data for Norwegian Elkhound Ltd. How much cash did Norwegian Elkhound collect in Q4 of This Year? 99.650 73.293 9.067 95.679 83.1704. Which of the following companies is the most likely suspect for managing earnings higher in Q4 of This Year? Jack Russell Pty ActiveLab Inc Akita Ltd HealthyDog Corp Pugporium Co 5. Below is two years of quarterly data for Devo Whippet Corp. Calculate Devo Whippet’s Bookings for Q4 of This Year?871.733 760.000 716.282 915.451 815.866 6. Which of the following actions would increase a company’s earnings during the period? (check all that apply) Decrease the amortization period for capitalized costs Increase the amortization period for capitalized costs Capitalize a greater percentage of cash cost [Show More]

Last updated: 1 year ago

Preview 1 out of 10 pages

Instant download

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 30, 2021

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

May 30, 2021

Downloads

0

Views

36

.png)