Financial Accounting > EXAM > ACCT 301 Quiz 1 complete solution (All)

ACCT 301 Quiz 1 complete solution

Document Content and Description Below

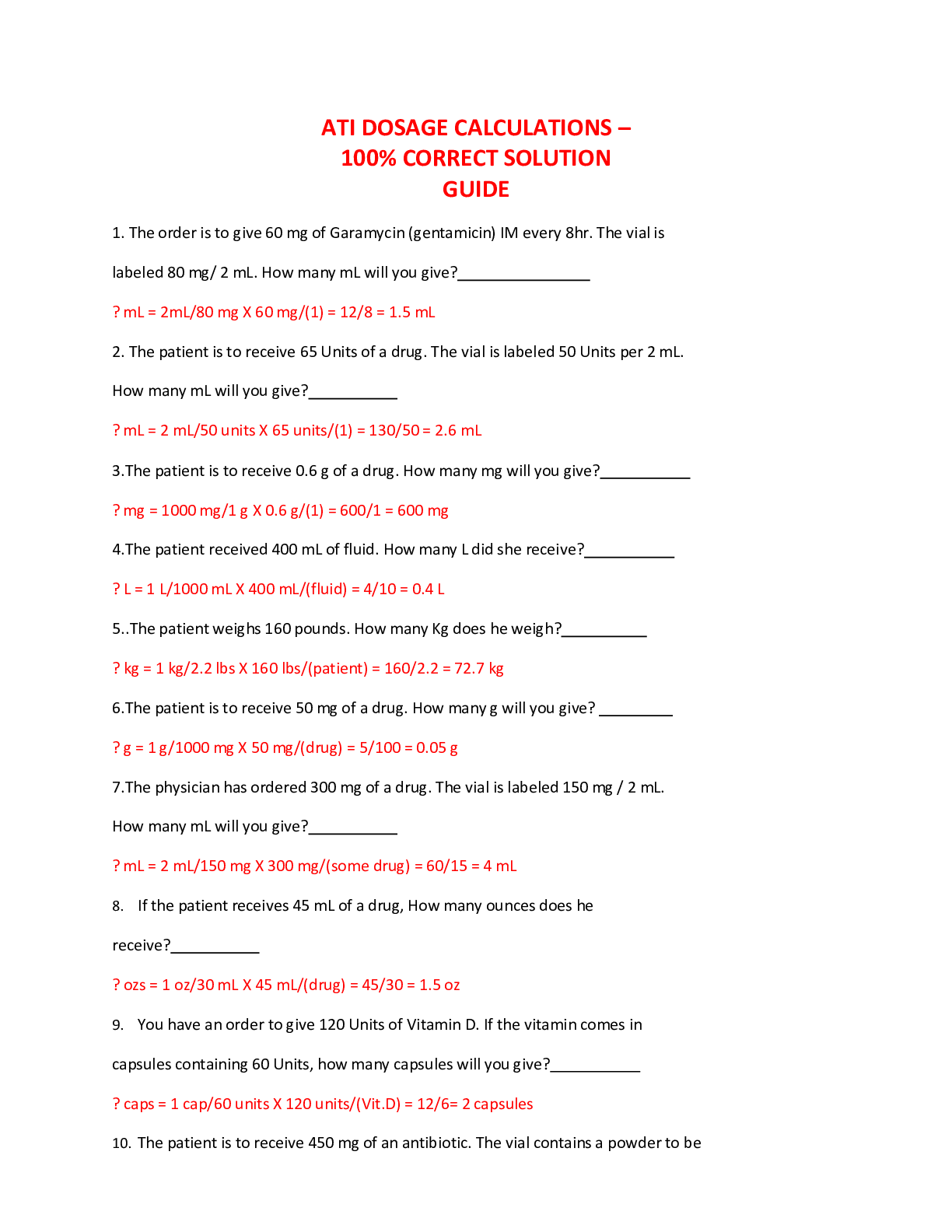

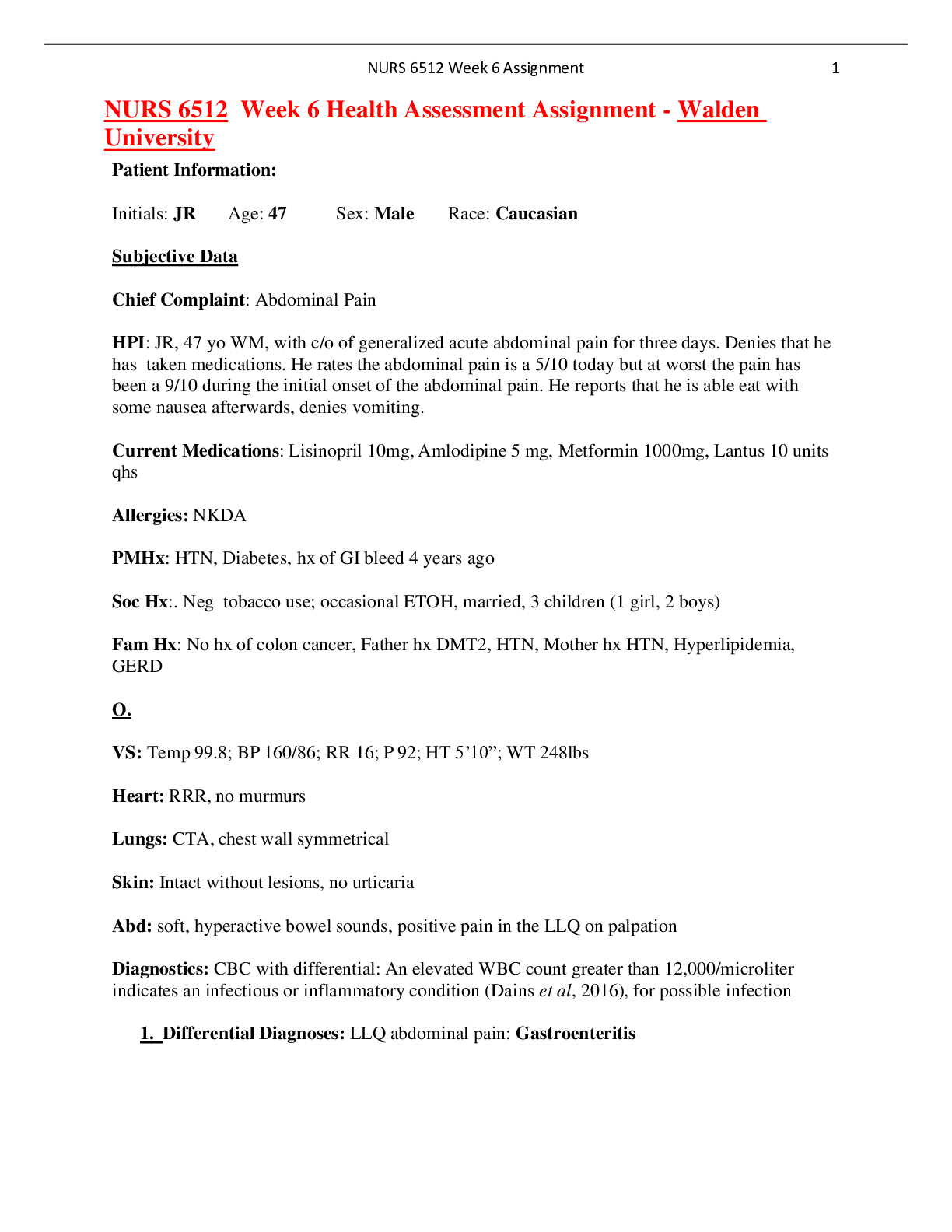

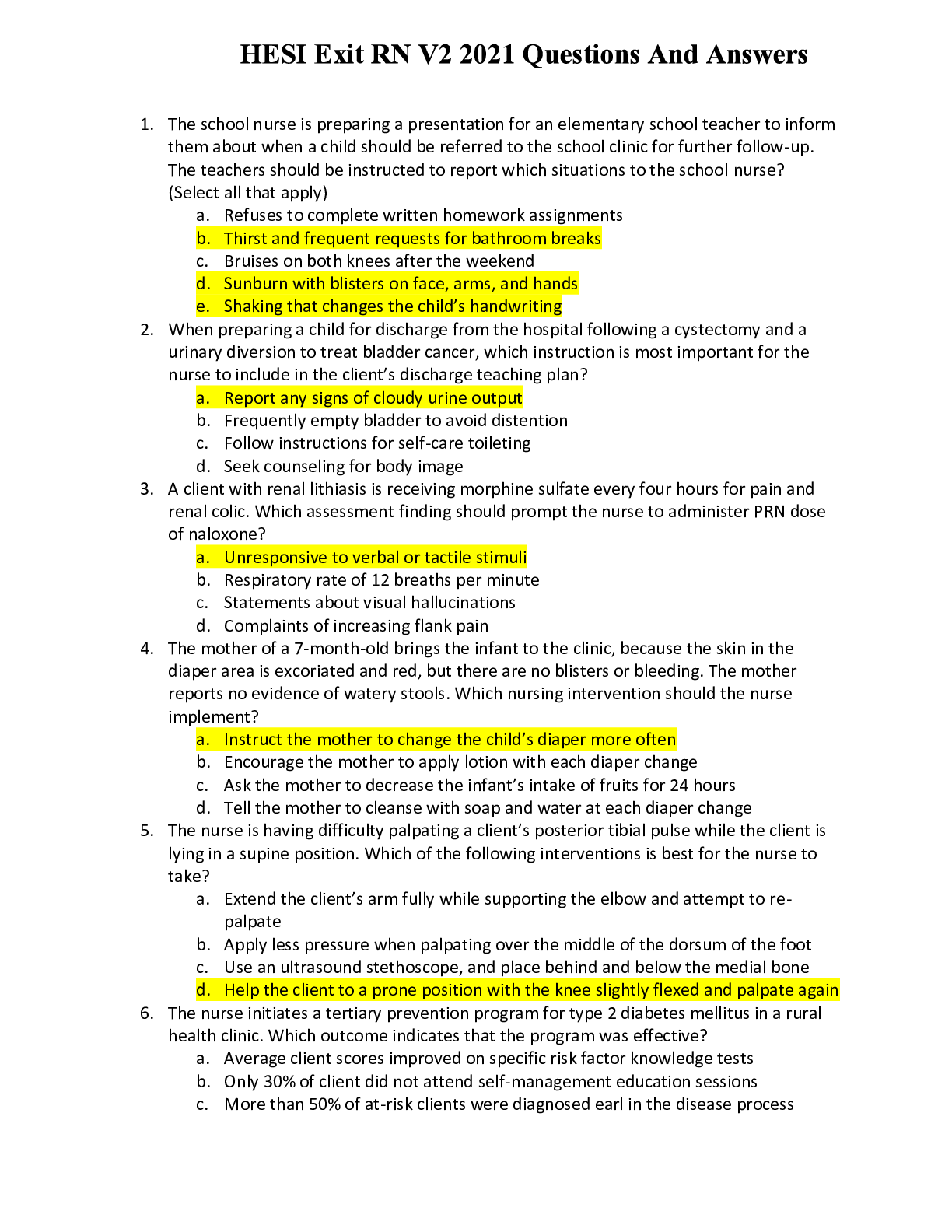

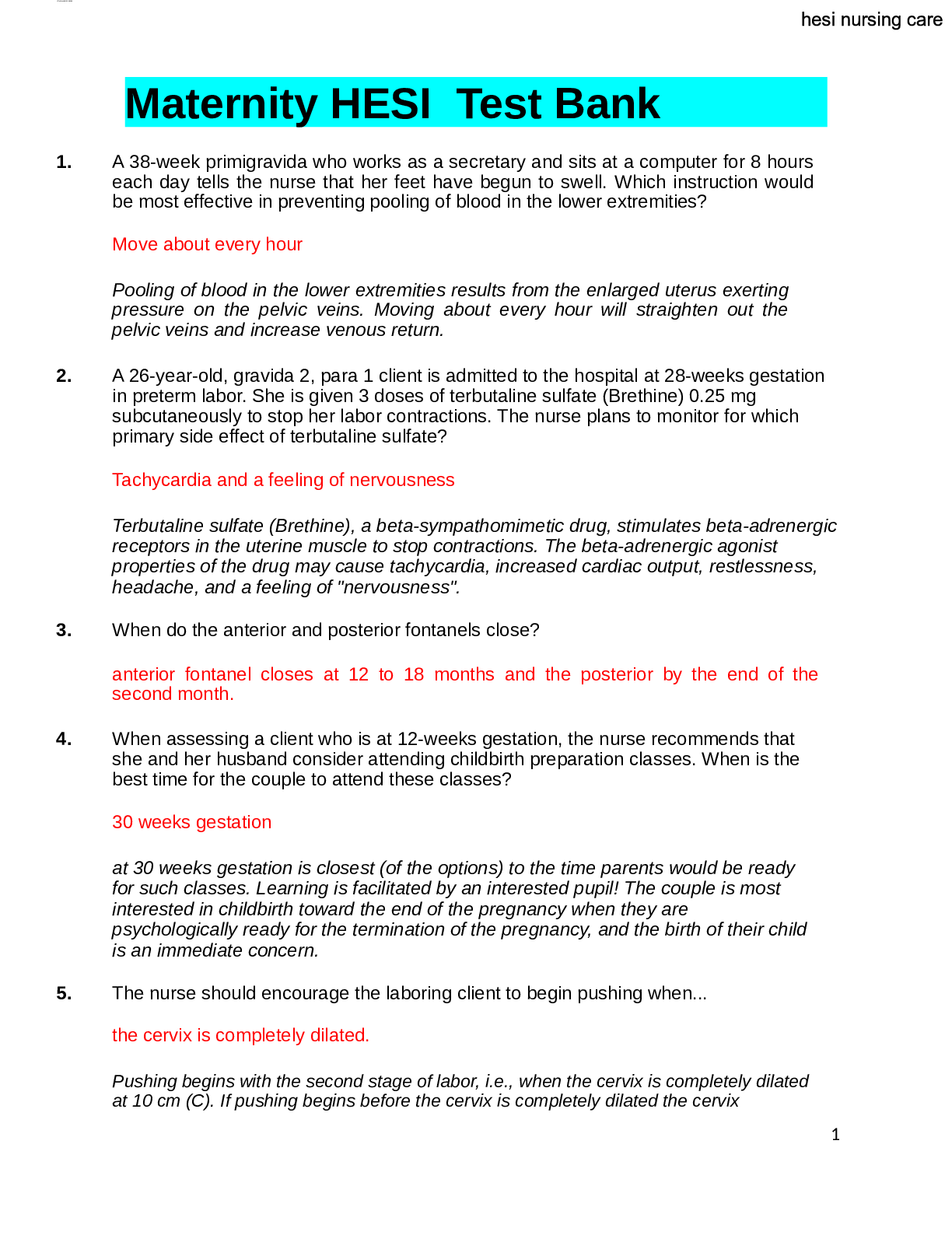

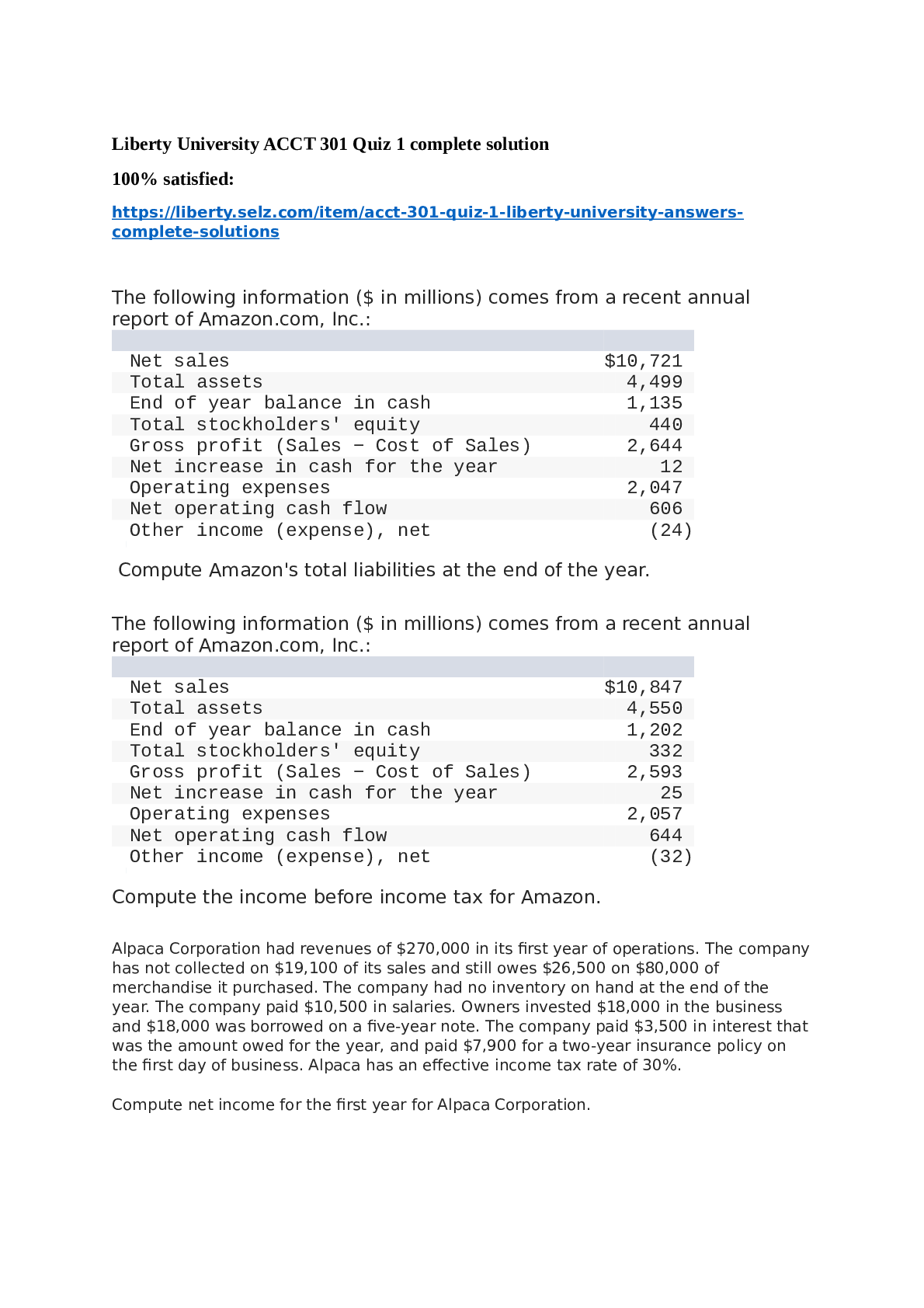

There are explanations for the questions needed calculation. The following information ($ in millions) comes from a recent annual report of Amazon.com, Inc.: Compute Amazon's total liabilities at ... the end of the year. Compute the income before income tax for Amazon. Alpaca Corporation had revenues of $270,000 in its first year of operations. The company has not collected on $19,100 of its sales and still owes $26,500 on $80,000 of merchandise it purchased. The company had no inventory on hand at the end of the year. The company paid $10,500 in salaries. Owners invested $18,000 in the business and $18,000 was borrowed on a five-year note. The company paid $3,500 in interest that was the amount owed for the year, and paid $7,900 for a two-year insurance policy on the first day of business. Alpaca has an effective income tax rate of 30%. Compute net income for the first year for Alpaca Corporation. The following information, based on the 12/31/2021 Annual Report to Shareholders of Krafty Foods ($ in millions): Based on the information presented above, prepare the Income Statement for Krafty Foods for the year ended December 31, 2021. (Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) Pat's Custom Tuxedo Shop maintains its records on the cash basis. During this past year Pat's collected $43,900 in tailoring fees, and paid $13,000 in expenses. Depreciation expense totaled $1,600. Accounts receivable increased $1,350, supplies increased $3,200, and accrued liabilities increased $1,800. Pat's accrual-basis net income was: The December 31, 2021 (pre-closing) adjusted trial balance for Kline Enterprises was as follows: Compute Kline's 12/31/2021 total current assets: The following is selected financial information for D. Kay Dental Laboratories for 2020 and 2021: Prepare a statement of shareholders' equity for D. Kay Dental Laboratories for the year ended December 31, 2021. Assuming no income taxes, compute Kline's 2021 net income (or loss): (Loss amount should be indicated with a minus sign.) Somerset Leasing received $57,600 for 12 months' rent in advance. How should Somerset record this transaction? Flint Hills, Inc. has prepared a year-end 2021 trial balance. Certain accounts in the trial balance do not reflect all activities that have occurred. Prepare adjusting journal entries, as needed, for the above items. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Presented below is a partial trial balance for the Messenger Corporation at December 31, 2021. Determine the company’s working capital at December 31, 2021. (Do not round your intermediate calculations.) The December 31, 2021, post-closing trial balance ($ in thousands) for Libby Corporation is presented below: Prepare a classified balance sheet for Libby Corporation at December 31, 2021. (Enter your answers in the order of their liquidity. Negative amounts should be entered by a minus sign. Enter your answers in thousands of dollars.) Listed below are year-end account balances ($ in millions) taken from the records of Symphony Stores. Bronco Electronics' current assets consist of cash, short-term investments, accounts receivable, and inventory. The following data were abstracted from a recent financial statement: [Show More]

Last updated: 1 year ago

Preview 1 out of 27 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 18, 2021

Number of pages

27

Written in

Additional information

This document has been written for:

Uploaded

May 18, 2021

Downloads

0

Views

55