Finance > TEST BANK > TEST BANK FOR FINANCE 640 -REVIEWED AND EDITED BY EXPERTS-ALL ANSWERS CORRECT (All)

TEST BANK FOR FINANCE 640 -REVIEWED AND EDITED BY EXPERTS-ALL ANSWERS CORRECT

Document Content and Description Below

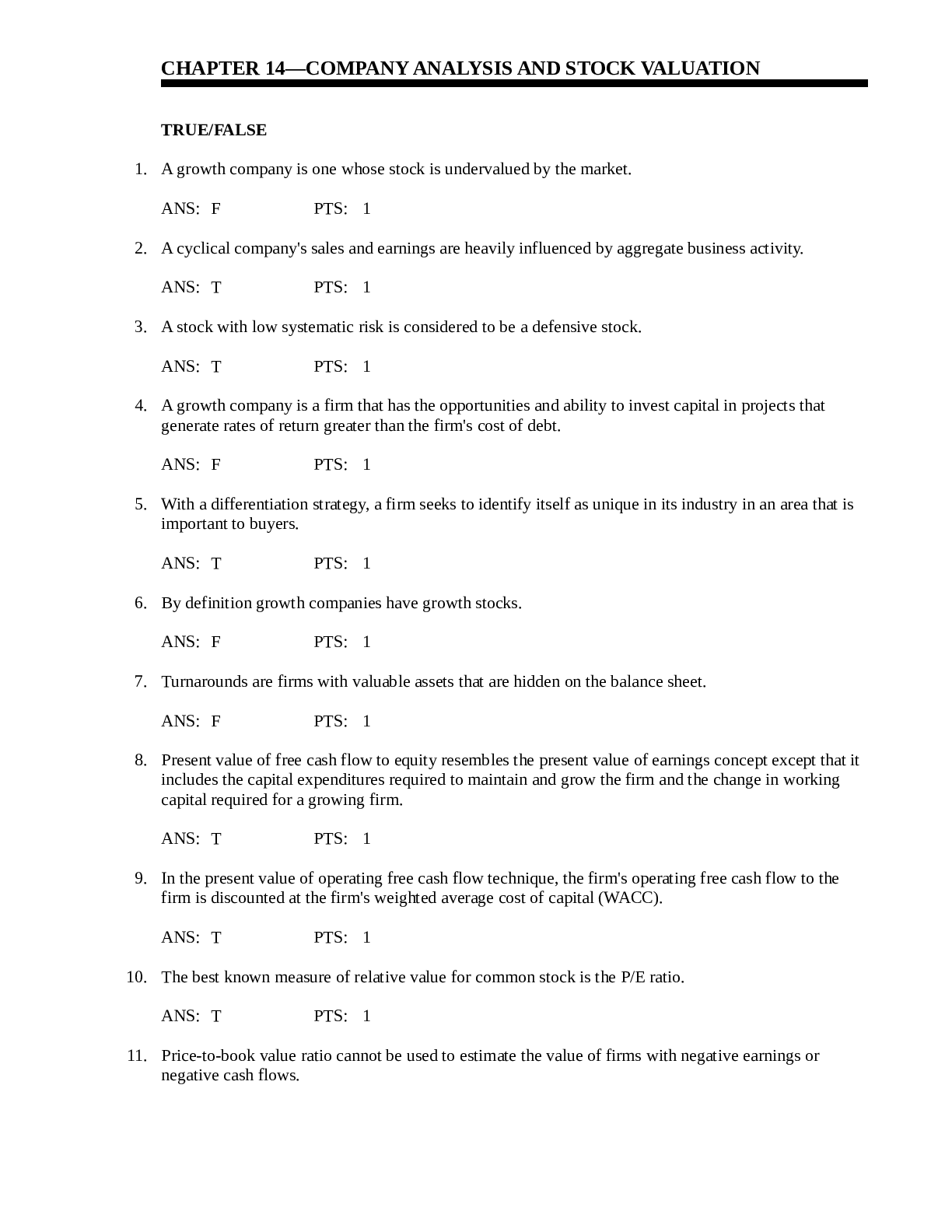

CHAPTER 14—COMPANY ANALYSIS AND STOCK VALUATION TRUE/FALSE 1. A growth company is one whose stock is undervalued by the market. ANS: F PTS: 1 2. A cyclical company's sales and earnings are heavi... ly influenced by aggregate business activity. ANS: T PTS: 1 3. A stock with low systematic risk is considered to be a defensive stock. ANS: T PTS: 1 4. A growth company is a firm that has the opportunities and ability to invest capital in projects that generate rates of return greater than the firm's cost of debt. ANS: F PTS: 1 5. With a differentiation strategy, a firm seeks to identify itself as unique in its industry in an area that is important to buyers. ANS: T PTS: 1 6. By definition growth companies have growth stocks. ANS: F PTS: 1 7. Turnarounds are firms with valuable assets that are hidden on the balance sheet. ANS: F PTS: 1 8. Present value of free cash flow to equity resembles the present value of earnings concept except that it includes the capital expenditures required to maintain and grow the firm and the change in working capital required for a growing firm. ANS: T PTS: 1 9. In the present value of operating free cash flow technique, the firm's operating free cash flow to the firm is discounted at the firm's weighted average cost of capital (WACC). ANS: T PTS: 1 10. The best known measure of relative value for common stock is the P/E ratio. ANS: T PTS: 1 11. Price-to-book value ratio cannot be used to estimate the value of firms with negative earnings or negative cash flows.ANS: F PTS: 1 12. The price/cash flow ratio has grown in prominence and use for valuing firms because many analysts contend that a firm's cash flow is less subject to manipulation than the firm's earnings per share. ANS: T PTS: 1 13. Price-to-sales ratio is still considered the predominant firm valuation technique. ANS: F PTS: 1 [Show More]

Last updated: 1 year ago

Preview 1 out of 30 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 07, 2021

Number of pages

30

Written in

Additional information

This document has been written for:

Uploaded

May 07, 2021

Downloads

0

Views

42