Liberty University BUSI 352 Final Exam complete solution,GRADED A.

Document Content and Description Below

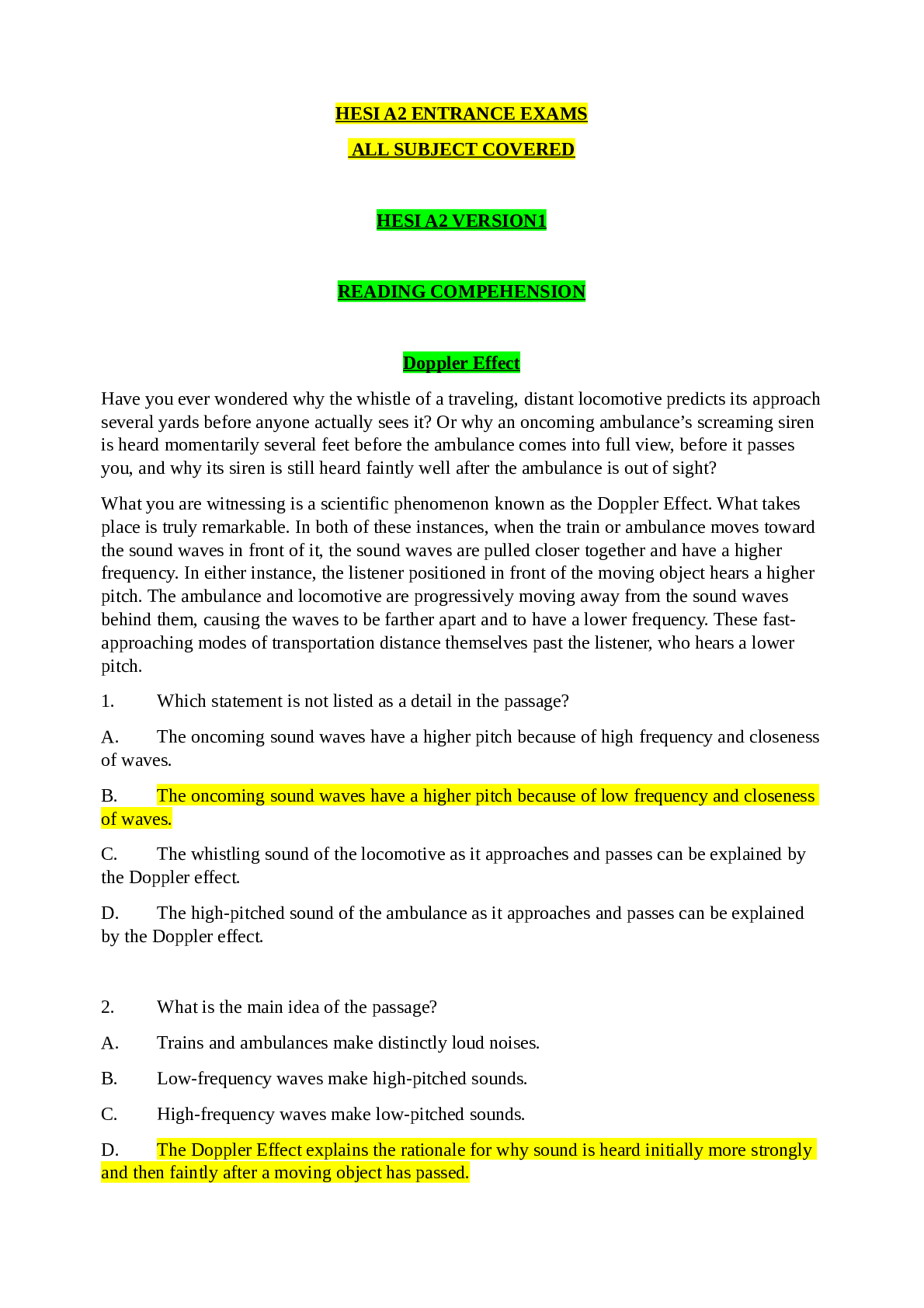

Janet, age 40, earns $95,000 annually; her wage replacement ratio has been determined to be 70%. She expects inflation will average 3% over her entire life expectancy. She expects to work until 67, an... d live until 95. She anticipates a 7.5% return on her investments. Allison does not expect to receive any Social Security retirement benefits. Calculate Allison’s capital needed at retirement age 67. Steven, age 43, earns $80,000 annually; and his wage replacement ratio has been determined to be 80%. He expects inflation will average 3% for his entire life expectancy. He expects to work until 68 and live until 90. He anticipates an 8% return on his investments. Additionally, Social Security Administration has notified him that his annual retirement benefit, in today’s dollars will be $26,000. Using the capital preservation model, calculate how much capital Steven needs, in order to retire at 68. The student loan interest deduction is not an above-the-line deduction. Some studies have suggested that up to 70% of lottery winners lose their winnings within as short of a period as seven years. Which of the following statements are correct regarding advice for a lottery winner? ONE: Principal protection is the most important issue. TWO: It is extremely important to invest lottery winnings quickly to take advantage of opportunities to grow the principal. The husband of one of your clients had his wallet stolen. He had five credit cards in his wallet when this occurred. He reported the cards as missing the next morning, but the following transactions had already occurred: (Discover Card - $350) (MasterCard - $100) (VISA - $425) (Sears - $25) (Marshall Fields - $685) What is the client’s liability for the fraudulent transactions on these cards? All of the following economic activities represent governmental fiscal policy EXCEPT: Stephanie wants to save for her daughter’s education. Tuition costs $10,000 per year in today’s dollars. Her daughter was born today and will go to school starting at age 18. She will go to school for 4 years. Stephanie can earn 12% on her investments and tuition inflation is 6%. How much must Stephanie save at the end of each year if she wants to make her last savings payment at the beginning of her daughter’s first year of college? Tricia, a new client for Stephan, a CFP® professional, has asked for Stephan’s help with her financial planning. Specifically, she wants a complete analysis of her retirement situation including retirement projections and wants Stephan to evaluate how much and what type of investments she should purchase. Which of the following is correct according to the Code and Standards? The recent bird flu caused the chicken mortality rate to increase significantly. As a result, what can you expect? All of the following are characteristics of PLUS loans, EXCEPT: Which of the following is not correct regarding the Federal Reserve? One of the challenges in retirement planning is that people are living longer and have been retiring early over the last 20 years with only a recent reversal in retirement age. Families with children with special needs have more complicated lives than traditional families. Which of the following is correct? Which of the following is not a principle in the CFP Board’s Code of Ethics? [Show More]

Last updated: 1 year ago

Preview 1 out of 23 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 03, 2021

Number of pages

23

Written in

Additional information

This document has been written for:

Uploaded

May 03, 2021

Downloads

0

Views

38