Financial Accounting > EXAM > ACC 560 Week 8 Assignment. Questions and Verified Solutions. (All)

ACC 560 Week 8 Assignment. Questions and Verified Solutions.

Document Content and Description Below

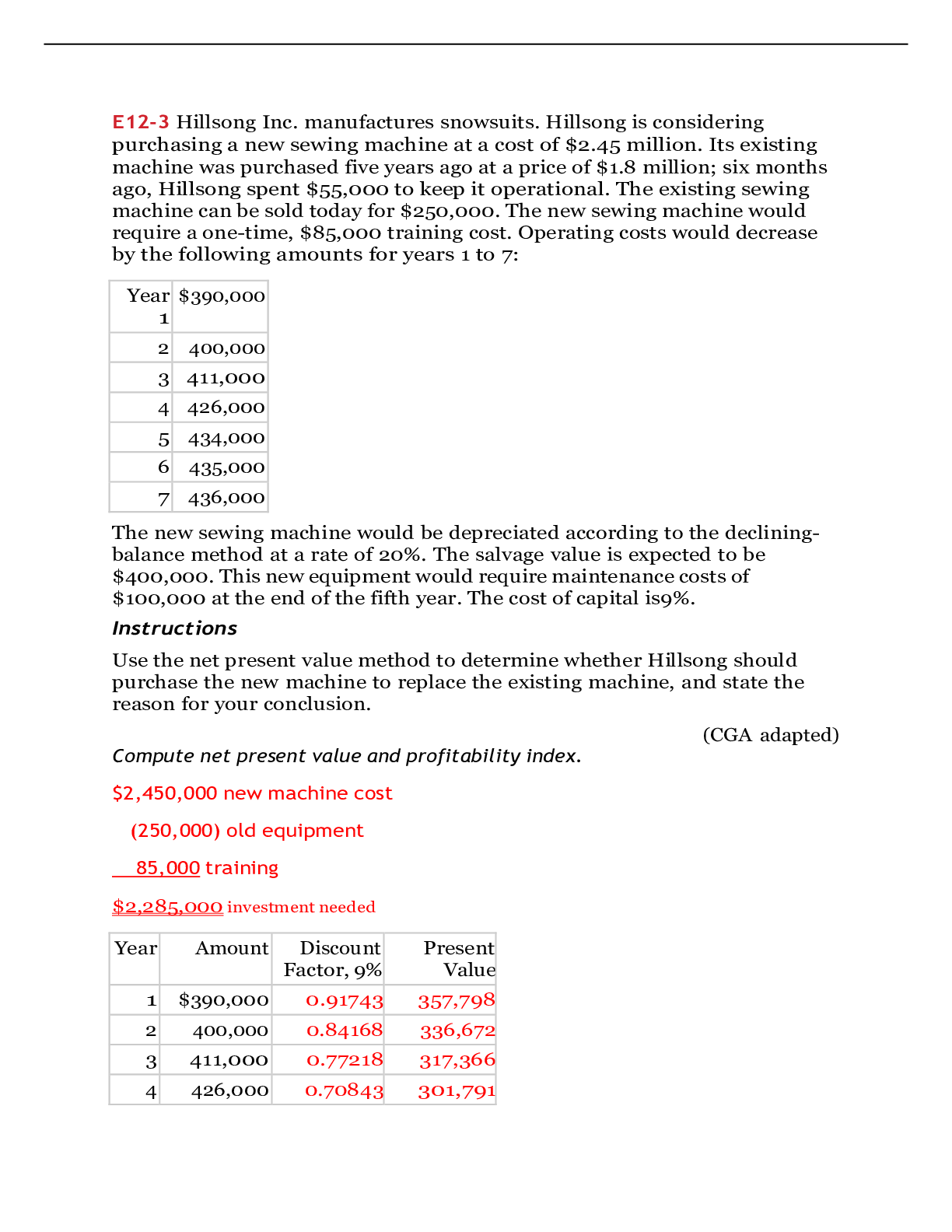

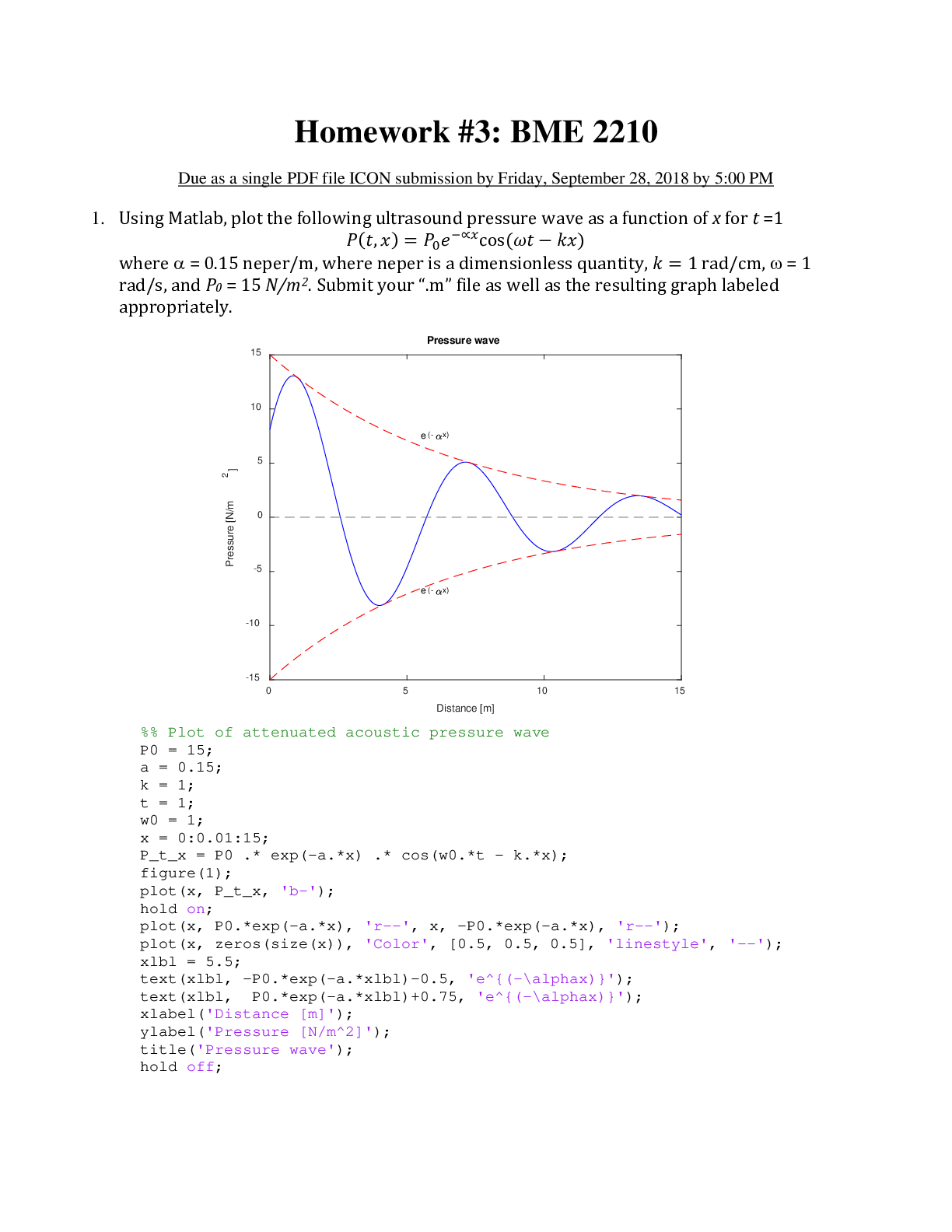

E12-3 Hillsong Inc. manufactures snowsuits. Hillsong is considering purchasing a new sewing machine at a cost of $2.45 million. Its existing machine was purchased five years ago at a price of $1.8 mil... lion; six months ago, Hillsong spent $55,000 to keep it operational. The existing sewing machine can be sold today for $250,000. The new sewing machine would require a one-time, $85,000 training cost. Operating costs would decrease by the following amounts for years 1 to 7: Year 1 $390,000 2 400,000 3 411,000 4 426,000 5 434,000 6 435,000 7 436,000 The new sewing machine would be depreciated according to the declining- balance method at a rate of 20%. The salvage value is expected to be $400,000. This new equipment would require maintenance costs of $100,000 at the end of the fifth year. The cost of capital is9%. Instructions Use the net present value method to determine whether Hillsong should purchase the new machine to replace the existing machine, and state the reason for your conclusion. (CGA adapted) Compute net present value and profitability index. E12-5 Bruno Corporation is involved in the business of injection molding of plastics. It is considering the purchase of a new computer-aided design and manufacturing machine for $430,000. The company believes that with this new machine it will improve productivity and increase quality, resulting in an increase in net annual cash flows of $101,000 for the next 6 years. Management requires a 10% rate of return on all new investments. Instructions Calculate the internal rate of return on this new machine. Should the investment be accepted? Calculate cash payback period, internal rate of return, and apply decision rules E12-8 Pierre's Hair Salon is considering opening a new location in French Lick, California. The cost of building a new salon is $300,000. A new salon will normally generate annual revenues of $70,000, with annual expenses (including depreciation) of $41,500. At the end of 15 years the salon will have a salvage value of $80,000. Instructions Calculate the annual rate of return on the project. Compute cash payback period and annual rate of return. P12-4A Jane's Auto Care is considering the purchase of a new tow truck. The garage doesn't currently have a tow truck, and the $60,000 price tag for a new truck would represent a major expenditure. Jane Austen, owner of the garage, has compiled the estimates shown below in trying to determine whether the tow truck should be purchased. Initial cost $60,000 Estimated useful life 8 years Net annual cash flows from towing $8,000 Overhaul costs (end of year 4) $6,000 Salvage value $12,000 Jane's good friend, Rick Ryan, stopped by. He is trying to convince Jane that the tow truck will have other benefits that Jane hasn't even considered. First, he says, cars that need towing need to be fixed. Thus, when Jane tows them to her facility, her repair revenues will increase. Second, he notes that the tow truck could have a plow mounted on it, thus saving Jane the cost of plowing her parking lot. (Rick will give her a used plow blade for free if Jane will plow Rick's driveway.) Third, he notes that the truck will generate goodwill; people who are rescued by Jane's tow truck will feel grateful and might be more inclined to use her service station in the future or buy gas there. Fourth, the tow truck will have “Jane's Auto Care” on its doors, hood, and back tailgate—a form of free advertising wherever the tow truck goes. Rick estimates that, at a minimum, these benefits would be worth the following. Additional annual net cash flows from repair work $3,000 Annual savings from plowing 750 Additional annual net cash flows from customer “goodwill” 1,000 Additional annual net cash flows resulting from free advertising 750 The company's cost of capital is 9%. Instructions 1. Calculate the net present value, ignoring the additional benefits described by Rick. Should the tow truck be purchased? (a) NPV $(13,950) 2. Calculate the net present value, incorporating the additional benefits suggested by Rick. Should the tow truck be purchased? 3. Suppose Rick has been overly optimistic in his assessment of the value of the additional benefits. At a minimum, how much would the additional benefits have to be worth in order for the project to be accepted? Compute net present value and internal rate of return with sensitivity analysis [Show More]

Last updated: 1 year ago

Preview 1 out of 5 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 07, 2021

Number of pages

5

Written in

Additional information

This document has been written for:

Uploaded

Apr 07, 2021

Downloads

0

Views

42

HESI VI EXIT EXAM.png)

(2).png)

.png)