Education > QUESTIONS & ANSWERS > Liberty University ACCT 211 learnsmart assignment 9 Accounting for Current Liabilities complete solu (All)

Liberty University ACCT 211 learnsmart assignment 9 Accounting for Current Liabilities complete solutions answers and more!

Document Content and Description Below

Liberty University ACCT 211 learnsmart assignment 9 Accounting for Current Liabilities complete solutions answers and more! Cadie Construction Co. signed a note promising to pay a cement supplier $1,... 000 60-days from now. As a result of this transaction, Cadie would record a(n) on her balance sheet. Boyd’s Bicycle Sales and Repairs Co. offers a 6-month warranty on all new bicycle purchases. Based on history, Boyd determines that warranty repairs are equal to approximately 2% of sales. During the month, Boyd sales total $20,000. Boyd will record Warranty Expense in the amount of for the month. Which of the following situations would not be required to be recorded in the financial statements or reported as a note to the financial statements? Perez Co. sells automotive supplies and warranties them for a three-month period. Perez sold $10,000 of supplies during the month and anticipates that warranty repairs for these sales will total $250. The adjusting entry that Perez will make to record the warranty expense will include which of the following? A is a probable future payment of assets or services that a company is presently obligated to make as a result of past transactions or events. Bryne Co. sells merchandise and collects a 5% sales tax. The tax is recorded on Bryne’s general ledger as a(n) KRS Co. sells merchandise for $120 and collects sales tax of $12. KRS would record the $12 sales tax with a credit to the Sales Tax Mary's Magazine Sales sells popular magazine subscriptions. During January, Mary collected $1,200 from various customers to provide magazines over the next 12 months. At the end of February, Mary would make an adjusting entry to record one month of magazines subscriptions earned. This transaction would include which of the following entries? On June 1, Grey Co. borrows $15,000 cash from the National Bank by signing a 120-day, 10% interest-bearing note. Grey will record interest during the year totaling . Using a 360 day year, round your final answer to the nearest whole dollar. A company sells 12-month subscriptions to popular magazines. During the month of May, the company sells $10,000 in magazines, which will start in June. The journal entry to record the sales not yet earned will include a credit to which account? When recording a liability, a company may not know: (Check all that apply.) The of a note is the amount that the signer of a note agrees to pay back when it matures, not including interest. Star Co. reported $10,000 of net income during the month of January. Star estimates that it owes income taxes of $2,000 for the month. The month-end adjusting entry to record this estimate would require which of the following entries? Amounts received in advance from customers for future products or services are typically recorded in a liability account called On July 1, Scene Co. borrowed $15,000 cash from First Bank by signing a 30-day, 5% interest- bearing note. Scene will record this entry with a credit to Notes Payable in the amount of On November 1, Lance Co. borrowed $90,000 cash from First Bank by signing a 90-day, 5% interest-bearing note. One December 31, Lance will record an adjusting entry by crediting is the charge for using money (or other assets) loaned from one entity to another. Niwa Co. replaced a $3,000 account payable balance to Fiona Co. with a 60-day, $3,000 note bearing 5% annual interest. Niwa’s entry to record this transaction would include which of the following entries? On June 1, Sawyer Co. borrowed $5,000 by extending their past-due account payable with a 45-day, 12% interest-bearing note. On July 16, the due date, Sawyer pays the amount due in full. Sawyer would record this payment with a On December 1, Campbell Co. borrowed $10,000 cash from Second Bank by signing a 90-day, 6% interest-bearing note. On December 31, Campbell accrued interest expense of $50. Campbell does not use reversing entries. On March 1, the due date of the note, Campbell will record the payment with debit entries to which of the following accounts? Tire Co. collected $2,000 in sales tax during the month of October. The entry that shows the remittance of this sales tax to the state government in November would include a credit to the account. During December 2017, Marci Lane opens a computer sales store selling new computers and offering a six-month warranty on all new sales. During December, Lane makes three sales totaling $4,000. Lane estimates warranty repairs will total 15% of sales. In January 2018, a customer submits a warranty claim requiring $300 of work. Lane will record a debit to Estimated Warranty Liability in the amount in January 2018 for the warranty work. During the second quarter of the year, Francisco Co. accrued $8,000 of income taxes. On July 15, Francisco will send in the second quarterly payment. To record this payment, Francisco will enter which of the following entries? Victor’s Vacuum Sales Co. sells high quality vacuums and provides a one-year warranty on all new sales. Based on history, Victor anticipates that 3% of vacuums will be returned at a cost of $30 per vacuum. During the month, Victor sold 100 vacuums for a total of $35,000. At the end of the month, Victor will record in Warranty Expense. Coolidge Company owes $1,000 for merchandise inventory purchased from Ross Company during April. The amount owed is now past-due. On June 15, 2015, Coolidge meets with Ross and convinces Ross to accept $400 cash and a 30-day, 10 percent, $600 note payable to replace the account payable. Prepare the June 15 journal entry for Coolidge by selecting the account names and dollar amounts from the drop-down menus. On September 1, 2015, Vicario, Inc., borrows $100,000 from First National Bank at 6 percent annual interest. This note is due in 90 days. Prepare the September 1 journal entry for Vicario by selecting the account names and dollar amounts from the drop-down menus. Lyon Co. collected $1,200 in sales tax from customers during the month of March. In April, Lyon sent $1200 sales tax to the state government. The entry to record payment to the state would include John Grey owns Grey's Snow Plowing. In October, Grey's collects $12000 cash for 6 commercial accounts for which he will provide snowplowing for the entire season. To record this transaction, what will Grey enter? As of December 31, Marr, Inc., has accrued benefits to its employees for medical insurance (in the amount of $12,000) and a contribution to a retirement program (at 10% of the employees' $200,000 gross salary). Prepare the December 31 entry for Marr by selecting the account names and dollar amounts from the drop-down menus. As of December 31, Bayer, Inc., agrees to provide a bonus of $50,000 to its employees (to be equally shared by all). The bonus will be paid in January. Prepare the December 31 adjusting entry for Bayer by selecting the account names and dollar amounts from the drop-down menus. Maas, Inc., sells washers and dryers that include a maximum one- year warranty covering parts. On January 20, 2016, a customer returned a washer for warranty repairs. Maas performs this work by replacing parts costing $16. Prepare the January 20 journal entry for Maas by selecting the account names and dollar amounts from the drop-down menus. On December 16, 2015, Carboy, Inc., borrows $120,000 cash from Third National Bank at 9 percent annual interest. The note is due in 45 days. Carboy's year-end is December 31, 2015. Prepare the necessary December 31 adjusting entry for Carboy by selecting the account names and dollar amounts from the drop-down menus. On December 15, 2015, Carboy, Inc., borrows $120,000 cash from Third National Bank at 9 percent annual interest. The note is due in 45 days. At December 31, 2015, Carboy records any unpaid interest with an adjusting entry. On January 30, 2016, Carboy pays the principal and interest owed on the bank note.Prepare the January 30 entry by Carboy for the payment (maturity) of the note plus interest by selecting the account names and dollar amounts from the drop- down menus. (Note that the account names must follow the order in the illustration in the text.) Bushra Co. replaced a $1000 account payable balance to Elin Co. with a 120-day, $1000 note bearing 8% annual interest. Bushra's entry to record this transaction would include a credit to which account? On November 30, 2015, Vicario, Inc., paid the principal and interest owed on a 90-day, 6 percent, $100,000 note to First National Bank that was dated September 1, 2015. Prepare the necessary journal entry for Vicario when this note matures by selecting the account names and dollar amounts from the drop-down menus. Lopez Company has a single employee, who earns a salary of $192,000 per year. That employee is paid on the 15th and last day of each month. On January 15, Lopez is subject to the following payroll taxes: FICA-Social Security Taxes (at 6.2% of the first $117,000 each employee earns in the calendar year), FICA-Medicare Taxes (at 1.45%), FUTA (at 0.8% of the first $7,000 each employee earns in the calendar year), and SUTA (at 5.4% of the first $7,000 each employee earns in the calendar year). The journal entry to record the employer's payroll tax expense and related liabilities would include a debit to: In order for a contingent liability to be recorded as a journal entry in the financial statements, it must be Lopez Company has a single employee. The employee's gross pay is $2,500. After withholding the following amounts from this employee's paycheck: FICA—Social Security Taxes ($155), FICA—Medicare Taxes ($36.25), Federal Income Taxes ($400), State Income Taxes ($25), and Employee Medical Insurance ($100), a check in the amount of $1,783.75, which is the amount of the employee's net pay, is prepared on February 1. Prepare the February 1 journal entry for Lopez by selecting the account names and dollar amounts from the drop-down menus. Assume that salaried employees of Mayer, Inc., earn 2 weeks of vacation per year. The salaried employees are paid annual salaries totaling $208,000. Mayer's first payroll of the year is on January 7. Prepare the January 7 journal entry for Mayer by selecting the account names and dollar amounts from the drop-down menus. Maas, Inc., sells washers and dryers that include a maximum one-year warranty covering parts. Past experience shows that warranty expense averages about 2 percent of the selling price of each washer and dryer. Net sales totaled $400,000 during the year ending December 31, 2015. Prepare the December 31 adjusting entry for Maas by selecting the account names and dollar amounts from the drop-down menus. ace company borrowed $10,000 from fair rates bank by signing a two- 1. year note payable. ace's operating cycle is 14 months. this note would be considered a _ on the balance sheet 2. computing interest formula during december 2009, marci lane opens a computer sales store selling new computers and offering a six-month warranty on all new sales. during december, lane makes three sales totaling $4,000. Lane 3. estimates warranty repairs will total 15% of sales. in january 2010, a customer submits a warranty claim requiring $300 of work. lane will record a debit to estimated warranty liability in the amount of $ in January 2010 for the warranty work employers must pay employee taxes in addition to those paid by the employees. which of the following is paid only by the employer insurance premiums 4. federal taxes state taxes SUTA FICA long-term liability initial amount x percent x (days/360) 300 SUTA 5. Formula for warranty expense 6. the formula to compute the times interest earned is income before interest expense and income taxes divided by fortiz co. receives $85 for the sale of merchandise with a sale price of 7. $80 and sales tax of $5. The entry to record the $5 sales tax would require a number sold x percent x warranty cost per item interest expense credit sales tax payable 8. a is a seller's obligation to replace or correct a product (or service) that fails to perform as expected within a specified period Leo Calvin is required to have taxes withheld from his pay 9. in order to cover the cost of future retirement, disability, and survivor ship and medical expenses Niwa co. replaced a $3,000 account payable balance to Fiona Co. 11. with a 60-day, $3,000 note bearing 5% annual interest. Niwa's entry to record this transaction would include a debit/credit to 12. the of a note is the amount that a signer of a note agrees to payback when it matures, not including interest. on july 1, scene co. borrowed $15,000 cash from First Bank by 13. signing a 30-day, 5% interest-bearing note. scene will record this entry with a credit to Notes Payable in the amount of $ On June 1, Button Co. borrowed $1,000 cash from National Bank by 14. signing a 120-day, 6% interest-bearing note. Button will record this transaction with a credit to in the amount of on march 1, young co. $1,000 cash from superior banks by signing a 15. 120-day, 6% interest-bearing note. on june 29, young pays the amount due in full. this entry would be recorded by young with a warranty FICA credit to notes payable and debit to accounts payable principal 15000 notes payable; $1,000 cash, $1020 credit to in the amount of - on november 1, lance co. borrows $90,000 cash from Fist Bank by 16. signing a 90-day, 5% interest-bearing note. On december 31, lance interest payable; will record an adjusting entry by crediting amount of in the $750 On November 1, Wright Co. borrowed $20,000 cash from Third Bank by signing a 90-day, 6% interest-bearing note. On December 17. 31, Wright recorded an adjusting entry to interest expense of $200. On January 30, the due date of the note, Wright will record the payment with a debit to Interest Expense in the amount of $ patel paving collected $1,000 cash in advance from a customer to 18. provide paving services next month. the entry to record this cash receipt would include Patel Paving collected $1,000 cash in advance from a customer to 19. provide paving services next month. the entry to record this cash receipt would include debit/credit 100 debit to cash, credit to unearned paving fees debit cash, credit unearned paving fees the ratio of income before interest expense divided by interest expense 20. - which reflects the risk of covering interest commitments when income varies - is called the ratio 21. the reports that employers are required to prepare to explain how they compute local, state and federal payroll taxes are called reports simar sales co. sells and installs kitchen appliances. simar guarantees 22. parts and labor for one year after installation. simar would record potential claims in a(n) _ account star co. reported $10,000 of net income during the moth of January. 23. Star estimates that it owes income taxes of $2000 for the month. the month-end adjusting entry to record this estimate would require debit/credit 24. state unemployment taxes imposed on employers in order to provide unemployment benefits to qualified workers are known as tire co. collected $2,000 in sales tax during the month of october. the 25. entry that shows the remittance of this sales tax to the state government in November would include a credit to the account to compute the amount of taxes withheld from each employee's wages, 26. an employer needs to determine both the employee's wages earned and the employee's number of withholding allowances. the employer will determine the number of withholding allowances using the trighton's trailer co. sells all kinds of trailers and provides a one-year warranty on all new trailer sales. Based on history, trighton anticipates 27. that 2% of trailers will be returned and will have a warranty cost of $100 per trailer. during the month, victor sold 300 trailers for a total of $255,000. at the end of the month, trighton will record $ in warranty expense times interest earned payroll estimated warranty liability debit income tax expense, credit income taxes payable SUTA cash form w-4 600 vance co. allows employees to take a two week vacation each year. a newly hired employee will earn $20,800 per year. To account for 28. the two weeks off each year, Dante will accrue $16 in each of the 50 weeks. this accrual will be recorded to which debit/credit accounts the wage and tax statement, or , is a report that is required to be given to employees by January 31 following the year covered 29. by the report. This report details the employees wages subject to FICA and federal income taxes, along with the amount of these taxes witheld debit vacation benefits expense, credit vacation benefits payable form w-2 30. when recording a liability, a company may not know: whom, when, how much to pay which of the following is not a payroll deduction? FICA taxes 31. Net Pay Federal Income Tax Employee Income Tax net pay Arnold Co. allows each employee to take two weeks vacation during each year. A newly hired employee will 1. earn annual pay of $31,200. to accuse for the two weeks off each year, Arnold will accrue approximately $ to the Vacation Benefits account to each of the 50 weeks. Bina Consulting Co. collected $500 from a customer in advance to provide consulting fees for the next two 2. months. The $500 would be recorded with a debit to Cash and a credit to the Unearned Revenues, which is a account. Bursha Co. replaced a $1,000 account payable balance to 3. Elin Co. with a 120-day $1,00 note bearing 8% annual interest. Bushra's entry to record this transaction would include a credit to which account? During the first quarter of the year, Trina Co. accrued 4. $6,00 of income taxes. On April 15, Trina will send in the first quarterly payment. The entry to record this payment will include a debit to the account. During the second quarter of the year, Francisco Co. accrued $8,00 of income taxes. On July 15, Francisco will 5. send in the second quarterly payment. To record this payment, Francisco will enter which of the following entries? 6. Employers use a special account for payroll for which of the following reasons? Examples of employee voluntary deductions may include all of the following except: 7. - unemployment taxes - pension contributions - charitable giving - medical premiums Fortiz Co. receives $85 for the sale of merchandise with a 8. sales price of $80 and a sales tax of $5. The entry to record the $5 sales tax would require what action? In order for a continent liability to be recorded as a journal 9. entry in the financial statements, it must be and reasonably estimable. Jorge Lopez worked 40 hours this week and earned 6. $1,000 gross salary. Federal and state taxes and other withholdings totaled $350. Jorge's gross pay totals $ . Obligations not due to be paid within one year or one 12. operating cycle, whichever is longer, are considered to be: On December 2, 2010, Wayne Co. borrows $25,000 cash 13. from Secure Bank by signing a 120-day, 6% interest- bearing note. Wayne will record interest expense of on December 31. On January 8, Lee Co. borrows $100,000 cash from 14. National Bank by signing a 90-dy, 6% interest-bearing note. On April 8, Lee Co. will pay National Bank a total of $101,500. Principal on the note totals $ . On March 1, Young Co. borrowed $1,00 cash from Superior Bank by signing a 120-day, 6% interest-bearing 17. note. Jone June 29, Young pays the amount due in full. This entry would be recorded by Young with a credit to in the amount of Third Bank by signing a 90-day , 6% interest-bearing note. 19. On December 31, Wright recorded an adjusting entry to interest expense of $200. On January 30, the due date of the notes, Wright will record the payment with a debit to Interest Expense in the amount of $ . 20. Paid absences that are accrued throughout the year are recorded in the account. Simar Sales Co. sells and installs kitchen appliances. Simar 21. guarantees parts and labor for one year after installation. Simar would record potential claims in a(n) account. Spot Co. purchases office supplies from Sally Supplies, 22. Inc.. Spot does not pay cash for the purchase, and now owes the amount to Sally. This transaction would typically be recorded in which account in Spot's books? Stalz Co. collected $2,500 in sales tax from customers 23. during the month of February. In March, Stallon sends the $2,500 to the state government. The payment to the state would be recorded with a debit to which account? $20000 x .06 (30/360) = $100 vacation benefit expense Estimated Warranty Liability accounts payable sales tax payable Teva Co. has current period employee salary expense of $2,000. 25. Employee withholdings total $850. To accrue the current period payroll, Salaries Payable will be in the amount of . 26. Trighton's Trailer Co. sells all kinds of trailers and provides a one- year warranty on all new trailer sales. Based on history, Trighton credited, $1,150 $600 anticipates that 2% of trailers will be returned and will have a warranty cost of $100 per trailer. During the month, Victor sold 300 trailers for a total of $255,000. At the end of the month Trighton will record $ in warranty expense. Vance Co. allows employees to take a two week vacation each year. A newly hired employee will earn $20,800 per year. To account for the 27. two weeks off each year, Dante will accrue $16 in each of the 50 weeks. This accrual will be recorded to which of the following accounts? Which of the following items would be considered a current liability? 28. - wages payable - notes payable, due in 3 months - accounts payable, terms n/30 - notes payable, due in 14 months 29. Which of the following situations would required a journal entry to record the continent liability in the financial statements? Zilo Co. has accrued employee salary expense of $1,000 which 30. includes employee withholdings that total $300. On payday, Zilo will record the payment with which of the following entries? 31. Zion Co. sells $1000 of merchandise and collects $10 sales tax. The sales tax is recorded to which account? When a company has a current obligation to make a future payment to their supplier due to a shipment of supplies that were received last week, the company would record this transaction with an increase to an asset account and a liability account. The following items would be considered a current liability -Noted payable, due in 3 months….Accounts payable, terms n/30….wages payable Ace Company borrowed $10,000 from Fair Rates Bank by signing a two-year note payable. Ace’s operating cycle is 14 months. This note would be considered a long-term liability on the balance sheet. A liability can be recorded, even if there is uncertainty of when to pay, how much to pay, or whom to pay. A liability created by buying goods or services on credit, is typically recorded to accounts payable. Zion Co. sells $100 of merchandise and collects $10 sales tax. The sales tax is recorded to the sales tax payable account. Fortiz Co. receives $85 for the sale of merchandise with a sales price of $80 and sales tax of $5. The entry for the $5 sales tax would be Credit to sales tax payable. Stalz Co. collected $2,500 in sales tax from customers during the month of February. In March, Stallon sends the $2,500 to the state government. The payment to the state would be recorded with a debit to the sales tax payable account. Bina Consulting Co. collected $500 from a customer in advance to provide consulting fees for the next two months. The $500 would be recorded with a debit to Cash and a credit to the Unearned Revenues, which is a liability account. A company sells 12-month popular magazine subscriptions. During the month of May, the company sells $12,000 in magazines, which will start in June. The adjusting entry to record the $1,000 of subscriptions earned in June will include a debit to the Unearned Subscription Revenue. Patel Paving collected $1,000 cash in advance from a customer to provide paving services next month. The entry to record this cash receipt would be Debit to Cash and Credit to Unearned Paving Fees. John Grey owns Grey’s Snow Plowing. In October, he collects $12,000 cash for 6 commercial accounts for which he will provide snowplowing for the next three months. John recorded the cash collection as an unearned liability. To record the adjusting entry in November, when $4,000 has been earned, Grey will enter these entries. –Debit to Unearned Plowing Revenue and Credit to Plowing Revenue Earned A written promise to pay a specified amount on a definite future date within one year or the company’s operating cycle, whichever is longer, is considered a short-term note payable. On January 1, Avers Co. borrowed $10,000 cash from Main St. Bank by signing a 60-day, 8% interest- bearing note. On March 1, Avers pays the amount due in full. This entry would be recorded by Avers with a debit to Notes Payable in the amount of $10,000. On December 1,2010, Wayne Co. borrows $25,000 cash from Secure Bank by signing a 120-day, 6% interest-bearing note. Wayne will record interest expense of $125 on December 31. $25,000x.06x(30/360)=$125 On June 1, Button Co. borrowed $1,000 cash from National Bank by signing a 120-day, 6% interest- bearing note. Button will record this transaction with a credit to Notes Payable in the amount of $1,000. On January 1, KC Co. borrowed $10,000 cash from Lake St. Bank by signing a 90-day, 8% interest- bearing note. The amount of interest will be $200. On December 1, Hansen Co. borrowed $100,000 cash from National Bank by signing a 90-day, 6% interest-bearing note. On December 31, Hansen recorded an adjusting entry to record interest expense of $500. On March 1, the due of the note, Hansen will record interest expense as a debit in the amount of $1,000. $100,000 x .06x (60-360)= $1,000 debit interest expense for $1,000. On November 1, Wright Co. borrowed $20,000 cash from the Third Bank by signing a 90-day, 6% interest-bearing note. On December 31, Wright recorded an adjusting entry to interest expense of $200. On January 30, the due date of the note, Wright will record the payment with a debit to Interest Expense in the amount of $100. Leeroy’s Lawn Mowers offers a one-year warranty on all new mower sales. During 2009, Leeroy sold $200,000 in mowers and accrued $2,000 of related warranty expense. In January 2010, a customer brought in a mower covered under warranty that required $500 in labor. The journal entry for this repair is Debit Estimated Warranty Liability The following situations would require a journal entry to record the contingent liability in the financial statements-The liability is probably and estimated to be $10,000 Cadie Construction Co. signed a note promising to pay a cement supplier $1,000 60-days from now. This transaction would be recorded as a short-term note payable on the balance sheet. On January 8th, Lee Co. borrows $100,000 cash from National Bank by signing a 90-day, 6% interest- bearing note. On April 8th, Lee Co. will pay National Bank a total of $101,500. The difference between the amount paid back to National Bank of $101,500 and the amount borrowed of $100,000 (or $1,500) represents interest expense. A current liability is an obligation due to be paid or settled within one year or the company’s operating cycle, whichever is longer. On January 1st, Ayers Co. borrowed $10,000 cash from Main St. Bank by signing a 60-day, 8% interest-bearing note. On March 1, Avers pays the amount due in full. This entry would be recorded by Ayers: o Debit Notes Payable $10,000 o Debit Interest Expense o Credit Cash A company sells 12-month subscriptions to popular magazines. During the month of May, the company sells $10,000 in magazines, which will start in June. The journal entry to record the sale: o Debit Cash $10,000 o Credit Unearned Subscription Revenue $10,000 Ace Co. borrowed $10,000 from Fair Rates Bank by signing a two-year note payable. Ace’s operating cycle is 14 months. This note would be considered a long-term liability on the balance sheet. Bina Consulting Co. collected $500 from a customer in advance to provide consulting fees for the next two months. The $500 would be recorded with a debit to Cash and a credit to Unearned Revenues, which is a liability account. A warranty is a seller’s obligation to replace or correct a product (or service) that fails to perform as expected within a specified period. Pyott Co. sells small appliances and offers warranties on all new sales. Duting the month of December, Pyott’s sales were $30,000 and accrued related warranties totaled $300. During January, a customer made a repair claim under the warranty requiring $200 of labor. The journal entry related to the January repair would include: o Debit Estimated Warranty Liability $200 o Credit Repair Parts Inventory $200 John Grey owns Grey’s Snow Plowing. In October, he collects $12,000 cash for 6 commercial accounts for which he will provide snowplowing for the next three months. John recorded the cash collection as an unearned liability. To record the adjusting entry in November, when $4,000 has been earned: o Debit Unearned Plowing Revenue o Credit Plowing Revenue Earned Spot Co. purchases office supplies from Sally Supplies, Inc. Spot does not pay cash for the purchase, and now owes the amount to Sally. This transaction would be recorded in the Accounts Payable account in Spot’s books. On January 8th, Lee Co. borrows $100,000 cash from National Bank by signing a 90-day, 6% interest- bearing note. On April 8th, Lee Co. will pay National Bank a total of $101,500. Principal on the note totals $100,000. When a company has a current obligation to make a future payment to their supplier due to a shipment of supplies that were received last week, the company would record this transaction with an increase to an asset and a liability account. Bushra Co. replaced a $1,000 account payable balance to Elin Co. with a 120-day, $1,000 note bearing 8% annual interest. Bushra’s entry would credit Notes Payable. Employers are required to prepare and submit payroll reports to explain how they compute state, local, and federal taxes. Trighton’s Trailor Co. sells all kinds of trailers and provides a one-year warranty on all new trailer sales. Based on history, Trighton anticipates that 2% of trailers will be returned and will have a warranty cost of $100 per trailer. During the month, Victor sold 300 trailers for a total of $255,000. At the end of the month, Trighton Co. will record $600 (300 x .02 x $100 = $600) in warranty expense. The form that an employee uses to indicate the number of withholding allowances filed with the employer is called Form W-4. Employers often withhold other amounts from an employee’s earnings which arise from employee requests, contracts, unions, or other agreements. These withholdings are called employee voluntary deductions and include items such as medical premiums. Federal government taxes implemented on employers in order to provide unemployment benefits to qualified workers are known as Federal Unemployment Taxes (FUTA). Abby Co. allows each employee two weeks of paid time off during each calendar year. Since employees are working for 50 weeks, rather than 52 weeks, Abby must accrue the paid time off during the 50 weeks that the employees work. This accrual is recorded under the Vacation Benefits Payable account. Gross pay minus all deductions—including federal and state taxes, FICA , and any voluntary deductions—equals net pay. Employers use a special account for payroll because of internal control and the ease of reconciling. Employer taxes, such as State Unemployment Taxes (SUTA), are recorded with a debit to Employer Tax Expense and a credit to SUTA Payable until payments are submitted to the state. When a liability is probable and estimable, the situation requires a journal entry to record the contingent liability in the financial statements. Employee benefits include pension plans and medical insurance. Rachel Ryder is an employee working at Brand-Mart. Rachel earns $35,000 per year and claims three withholding allowances. The amount withheld from her paycheck, using this information, is called federal income taxes. Leo Calvin is required to have Federal Insurance Contributions Act (FICA) taxes withheld from his pay in order to cover the cost of future retirement, disability, and survivorship and medical expenses. Vance Co. allows employees to take a two week vacation each year. A newly hired employee will earn $28,000 per year. To account for the two weeks off each year, Dante will accrue $16 in each of the 50 weeks. o Debit Vacation Benefits Expense o Credit Vacation Benefits Payable Employee benefits that are paid by the employer are recorded in the Employee Benefit Expense account. State Unemployment Taxes (SUTA) are imposed on employers in order to provide unemployment benefits to qualified workers. A payroll register is a report that shows the pay period dates, hours worked, gross pay, deductions, and net pay of each employee for each pay period. FICA and unemployment taxes are examples of employer taxes. Notes Payable and Unearned Subscription Revenues are liabilities that could be known as a multi- period known liability. Employers are required to give each employee an annual report of his or her wages subject to FICA and federal income taxes, along with the amounts of these taxes withheld. This report is called a Wage and Tax Statement, or W-2 Form. Amounts withheld from an employee’s gross pay are called payroll deductions Harvey Co. has current period employee salary expenses of $800. Employee withholdings total $300. The entry to accrue current period payroll will include a credit to Salaries Payable in the amount of $500 ($800 - $300 = $500) Angela Bennett is an employee of Marks Co. This part year, Angela received 1% of Marks net income in addition to her annual salary. This added benefit is called a bonus plan. Jorge Lopez worked 40 hours this week and earned $1,000 gross salary. Federal and state taxes and other withholdings totaled $350. Jorge’s gross pay totals $1,000. Its net pay is $650 ($1000 - $350 = $650). Camelot Co. expects that net income before bonuses for the year will be $100,000. At year-end, Camelot will accrue 2% of net income for employee bonuses to be paid in January. The 12/31 entry will require a debit to the Employee Bonus Expense account in the amount of $1,961 (.02(100,000 – B) = $2,000 - .02B = 1.02B = $2,000/1.02 = $1,961) Arnold Co. allows each employee to take two weeks’ vacation during each year. A newly hired employee will earn annual pay of $31,200. To accrue for the two weeks off each year, Arnold will accrue approximately $24 ($31,200 / 52 = $600, $31,200 / 50 = $624, $624 - $600 = $24) to the Vacation Benefits account in each of the 50 weeks. Times interest earned = income before interest expense and income taxes / interest expense Zilo Co. has accrued employee salary expense of $1,000 which includes employee withholdings that total $300. On payday, Zilo will record the payment with the following entries: o Debit Salaries Payable $700 o Credit Cash $700 Debt guarantees and potential legal claims represent reasonably possible contingent liabilities. Woods Co. has a note payable due in monthly installments over the next five years. This note will be reported under the current liabilities and long-term liabilities categories of the balance sheet. A known liability arises from a situation with little uncertainty, with set agreements, contracts, or laws. They are measurable and include accounts payable, notes payable, payroll, sales taxes, unearned revenues, and leases. Contingent Liabilities: debt guarantee of owner, possible legal claim against a company, probable legal claim against a company On January 1, KC Co. borrowed $10,000 cash from Lake St. Bank by signing a 90-day, 8% interestbearing note. How much interest will result from this note? 200 Victor’s vacuum sales co. sells high quality vacuum and provide a one -year warranty on all new sales. Based on history, Victor anticipates that 3% of vacuums will be returned at a cost of $ 30 per vacuum. During the month, Victor sold 100 vacuum for a total of $ 35000. At the end of the month, Victor will record $90 in warranty Expense 100x0.3xx3=$90 John Grey owns Grey’s snow plowing . In October, he collects $12000 cash for 6 commercial accounts for which he will provide snowplowing for the next 3 months. John recorded the cash collection as an unearned liability. To record the adjusting entry in 11 , when $ 4000 has been earned; debit income taxes payable; credit cash Bina cosulting co. collected $ 500 from a customer in advance to provide consulting fees for the next two months. The $500 would be recorded with a debit to cash and a credit to the Unearned Revenue, which is a liability account Handy Holly Co. provides a variety of household repairs and warranties her work for a six-month period. Holly provided $13,000 of service fees during the month and anticipates that warranty repairs for these sales will total $400. The entry that Holly will make to record the estimated warranty expense will include a credit which account? Ans: Estimated warranty Liability During the second quarter of the year, Francisco Co. accrued $8,000 of income taxes. On July 15, Francisco will send In the second quarterly payment. To record this payment, Francisco wlll enter which of the following entries? (Check all that apply.) Ans: Debit to Income Taxes Payable; Credit to Gash when a company has a current obligation to make a future payment to their supplier due to a shipment of supples that were received last week, the company would record this transaction with an increase to an asset account and a liability account Which of the following items would be considered a current liability? {Check all that apply.) Ans: wages payable ; accounts payable, term n/30 ; notes payable, due in 3months obligations not due to be paid within one year or the operating cycle whichever is longer, ans: long term liabilities in order for a contingent liability to be recorded in the financial statements it must be probable and reasonably estimable Simar sales co sells and installs kitchen appliances. Simar guarantees parts and labor for one year after installation. Simar would record potential claims a estimated warranty liability Fortiz Co. receives $85 for the sale of merchandise with a sales price of $80 and sales tax of $5. The entry to record the $5 sales tax would require which of the following? ans: credit to sales Tax payable On March 1, Young Co. borrowed $1,000 cash from Superior Bank by signing a 120-day, 6% interestbearing note. On June 29, Young pays the amournt due In full. This entry would be recorded by Young with a credit to In the amount of Cash; $1,020 Interest is computed for 120 days. $1,000 x .06 x (120/360) = $20. Gas will be credited for $j,,OQO t 20. Zion Co. sells $100 of merchandise and collects $10 sales tax. The sales tax is recorded to which account? Sales tax payable A contingent liability can be ignored (not recorded in the financial statements or notes to the financial statements) if it is considered to be (probable/reasonably possible/remote) remote possibility. Patel Paving collected $1,000 cash In advance from a customer to provide paving serv1ces next month. The entry to record this cash receipt would include the following entries? (Check all that apply.) Ans debit to cash ; credit to unearned paving fees Employers often withhold other amounts from employees' earnings which arise from employee requests, contracts, unions, or other agreements. These withholdings are called employee and include items such as medical premiums. Ans: voluntary deductions Employee benefits that are paid by the employer are recorded in the Employee Benefit Expense account employers are required to prepare and submit payroll report to explain how they compute which of the following taxes? State taxes; federal taxes; local taxes A payroll register shows the pay period dates, hours worked, gross pay, deductions, and net pay of each employee for each pay period. Employers use a special account for payroll for which of the following reasons? (Check all that apply.) Ans ease of reconciling; internal control Jorge Lopez worked 40 hours this week and earned $1,000 gross salary. Federal and state taxes and other withholdings totaled $350. Jorge's gross pay totals $ 1000. The federal government require that employers are taxed on employee wages to provide unemployment benefits to qualified. These taxes are known as FUTA The reports that employers are required to prepare to explain how they compute local, state and federal payroll taxes are called payroll reports. Zito Co. has accrued employee salary expense of $1,000 which Includes employee withholdings that total $300. On payday, Zilo will record the payment with which of the following entries? (Check all that apply.) Debit to Salaries Payable for $700; Credit to Cash for $700. Employers must pay employee taxes in addition to those paid by the employees. Which of the fol lowing is paid only by the employer? SUTA Which of the following items are considered employee benefits? (Check all that apply.) Pension; medical insurance Gross pay minus all deductions-including federal and state taxes, FICA and any voluntary deductions-equals net pay. Employer taxes, such as SUTA, are recorded with a debit to Employer Tax Expense and a credit to SUTA (expense/payable)Payable until payments are submitted to the state. Which of the following liabilities could be a multi-period known liability? (Check all that apply.) Ans: Unearned Subscription Revenues; Notes Payable State unemployment taxes imposed on employers in order to provide unemployment benefits to qualified workers are known as (use acronym) SUTA amounts with help from an employee's gross pay are called: payroll deductions Arnold Co. allows each employee to take two weeks vacation during each year. A newly hired employee will earn annual pay of $31,200. To accrue for the two weeks off each year, Arnold will accrue approximately $24 to the Vacation Benefits account in each of the 50 weeks. [Show More]

Last updated: 1 year ago

Preview 1 out of 25 pages

Reviews( 0 )

Recommended For You

Accounting> QUESTIONS & ANSWERS > Baruch College, CUNYACCT 3000 Quiz complete solutions answers graded A+ (All)

.png)

Baruch College, CUNYACCT 3000 Quiz complete solutions answers graded A+

1. Property, plant, and equipment and intangible assets are long-term, revenue producing assets. True False 2. Sales tax paid on equipment acquired for use in the business is not capitalized. True...

By renurse , Uploaded: Aug 21, 2021

$9.5

*NURSING> QUESTIONS & ANSWERS > NCSBN TEST BANK for the NCLEX-RN & NCLEX-PN. Contains More than 2000 Q&A Plus Review and Rationale in 517 PAGES. (All)

NCSBN TEST BANK for the NCLEX-RN & NCLEX-PN. Contains More than 2000 Q&A Plus Review and Rationale in 517 PAGES.

NCSBN TEST BANK -for the NCLEX-RN & NCLEX-PN. Updated 2022/2023. Contains More than 2000 Q&A Plus Review and Rationale in 517 PAGES. (All Testable Questions for NCLEX-RN & NCLEX-PN)

By Expert1 , Uploaded: Jul 28, 2020

$20

Business> QUESTIONS & ANSWERS > CLM 031 EXAM (All)

CLM 031 EXAM

CLM 031 = 100% Question 1: 5b Select the statement that is correct concerning performance work statement (PWS) requirements: - All answers are correct. - PWS should describe requirements necessary...

By Book Worm, Certified , Uploaded: Nov 03, 2022

$5

*NURSING> QUESTIONS & ANSWERS > PHIL 347 Week 6 Checkpoint Quiz. Score 100/100 (All)

PHIL 347 Week 6 Checkpoint Quiz. Score 100/100

Question: What are the three fundamental reasoning strategies listed in the text? Question: What is comparative reasoning? On what skill is it based? Question: We learned four tests for evaluating...

By Amanda Rosales , Uploaded: Mar 24, 2021

$7

Business> QUESTIONS & ANSWERS > BUSINESS 1007 (All)

BUSINESS 1007

BUSINESS 1007 07 Key 1. (p. 178) Managers utilize organizational resources such as employees, information, and equipment to accomplish goals. 2. (p. 178) The main job of managers today is to w...

By Kirsch , Uploaded: Oct 19, 2019

$6

Anthropology> QUESTIONS & ANSWERS > KOR 352 FA19 101 week 8 Quiz. Already Graded A (All)

KOR 352 FA19 101 week 8 Quiz. Already Graded A

KOR 352 FA19 101: Week 8 Quiz Question 1 (0.25 points) Which of the following is not true of Kim and Finch’s observations during their field research in South Korea from 1997 to 2000? Question 1 o...

By Kirsch , Uploaded: Oct 17, 2019

$9

E-Commerce> QUESTIONS & ANSWERS > ESOC 316 Digital Commerce - University Of Arizona. Midterm Quiz. 20 Q&A. 100% Score (All)

ESOC 316 Digital Commerce - University Of Arizona. Midterm Quiz. 20 Q&A. 100% Score

ESOC 316 Digital Commerce - University Of Arizona. Midterm Quiz. 20 Q&A. 100% Score ESOC316 MIDTERM QUIZQuestion 6 (1 point) Saved Information has several properties that make information goods...

By Kirsch , Uploaded: Oct 15, 2019

$9.5

Marketing> QUESTIONS & ANSWERS > Marketing Management Chapter 2 to Chapter 10 Q&A (All)

Marketing Management Chapter 2 to Chapter 10 Q&A

Chapter 2 to Chapter 10 Chapter 2: Developing Marketing Strategies and Plans GENERAL CONCEPT QUESTIONS Multiple Choice 66 Chapter 1: Marketing: Managing Profitable Customer Relationships...

By Kirsch , Uploaded: Oct 14, 2019

$10

Marketing> QUESTIONS & ANSWERS > MKT 530 Customer Relationship Management. 155 Questions and Answers (All)

MKT 530 Customer Relationship Management. 155 Questions and Answers

MKT 530 All Questions and Answers MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) As the manager of an organization that is att...

By Kirsch , Uploaded: Oct 14, 2019

$10

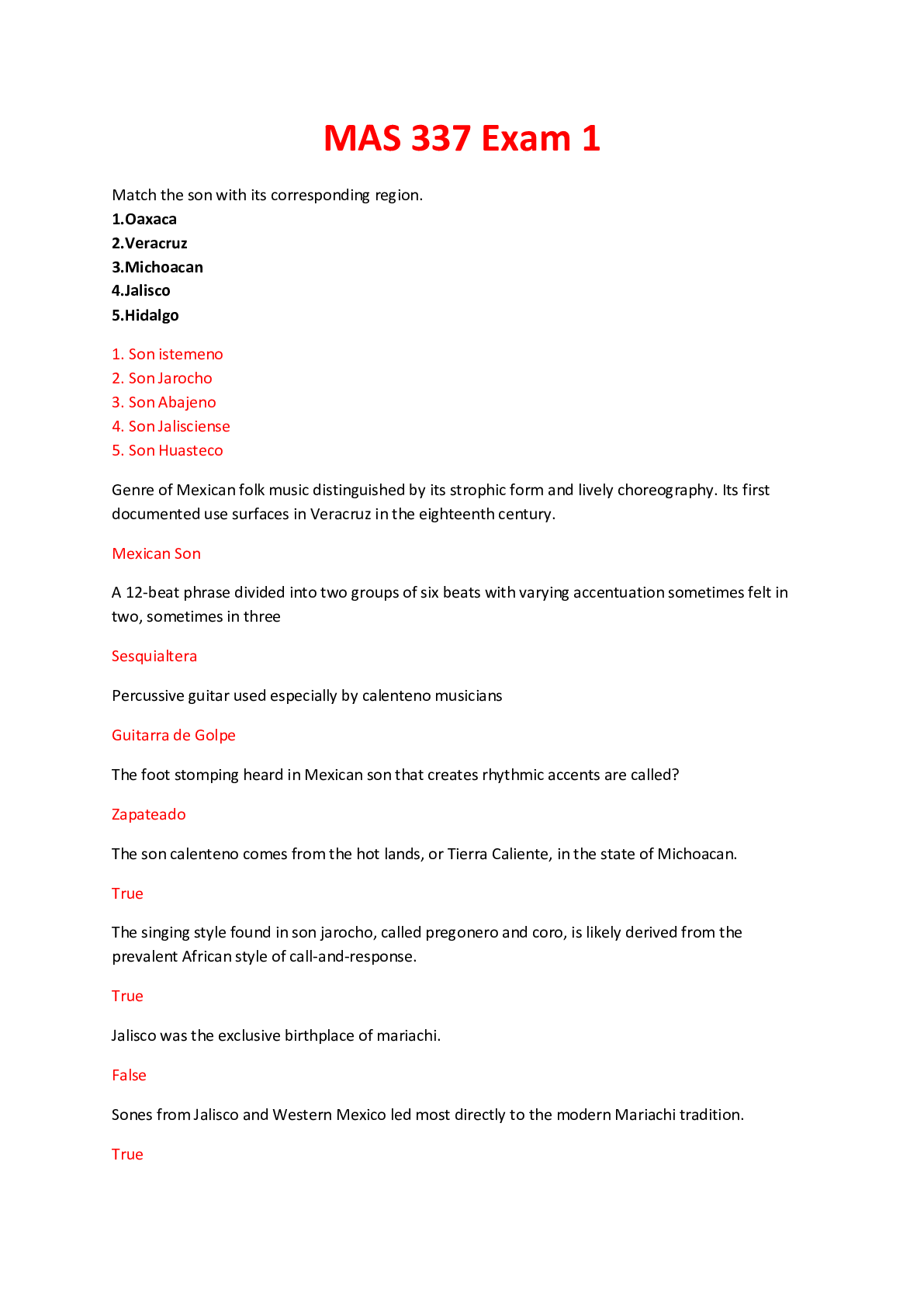

Art> QUESTIONS & ANSWERS > MAS 337 Exam 1. Graded A (All)

MAS 337 Exam 1. Graded A

MAS 337 Exam 1 Match the son with its corresponding region. 1.Oaxaca 2.Veracruz 3.Michoacan 4.Jalisco 5.Hidalgo 1. Son istemeno 2. Son Jarocho 3. Son Abajeno 4. Son Jalisciense 5. Son Huast...

By Kirsch , Uploaded: Oct 14, 2019

$6

Document information

Connected school, study & course

About the document

Uploaded On

Sep 02, 2019

Number of pages

25

Written in

Additional information

This document has been written for:

Uploaded

Sep 02, 2019

Downloads

0

Views

517