Finance > TEST BANK > Solution Manual For Financial Management Theory and Practice 4CE Eugene F. BrighamMichael C. Ehrhar (All)

Solution Manual For Financial Management Theory and Practice 4CE Eugene F. BrighamMichael C. EhrhardtJerome GessaroliRichard R. Nason

Document Content and Description Below

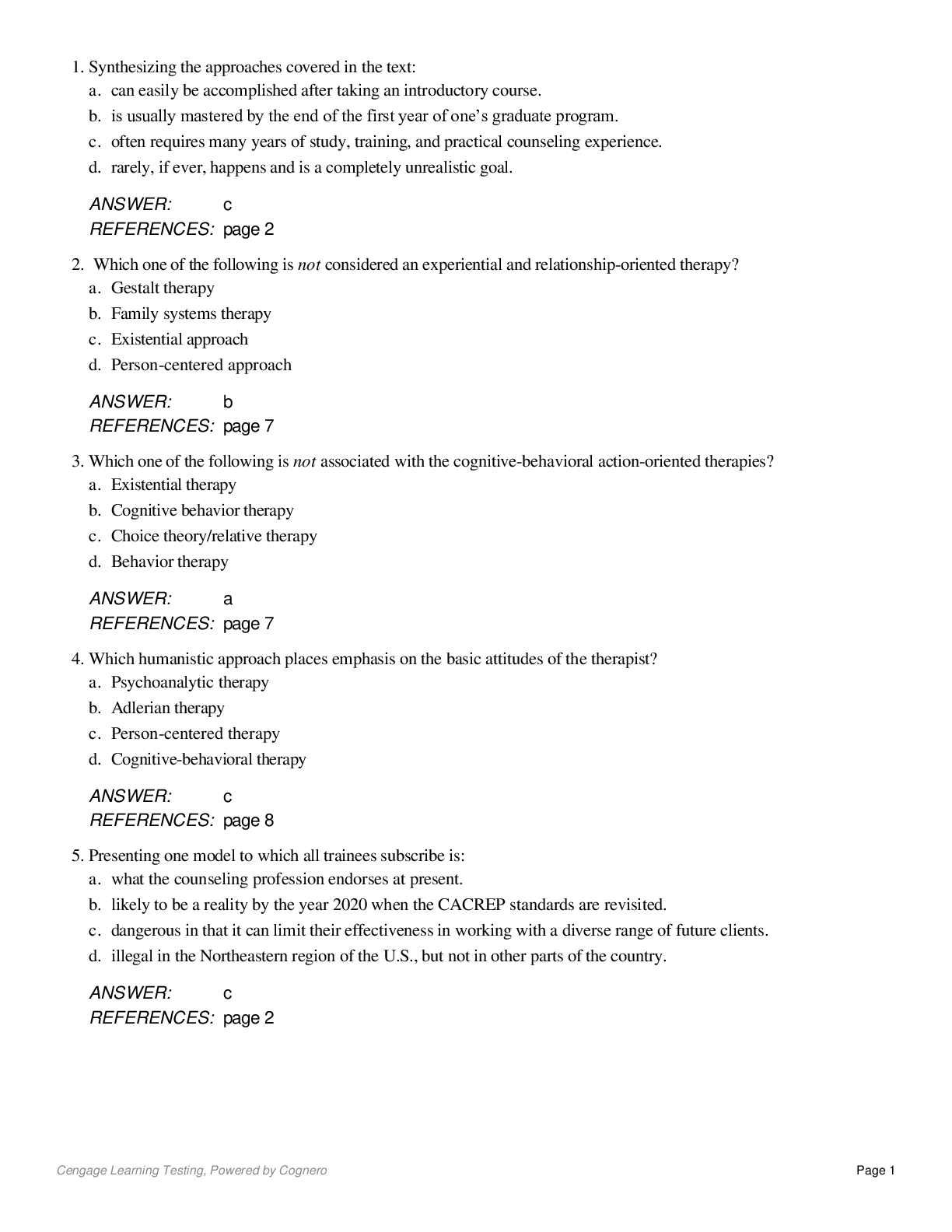

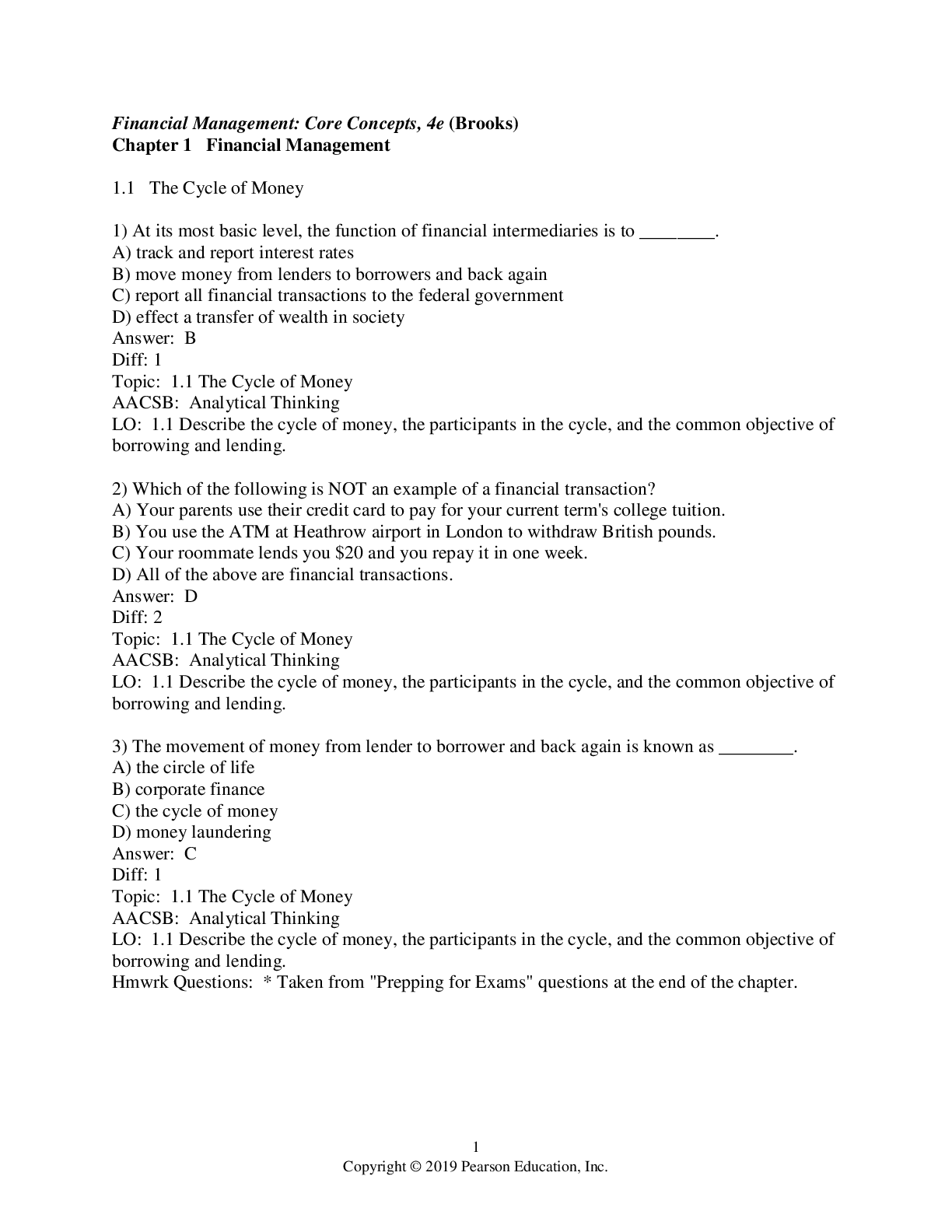

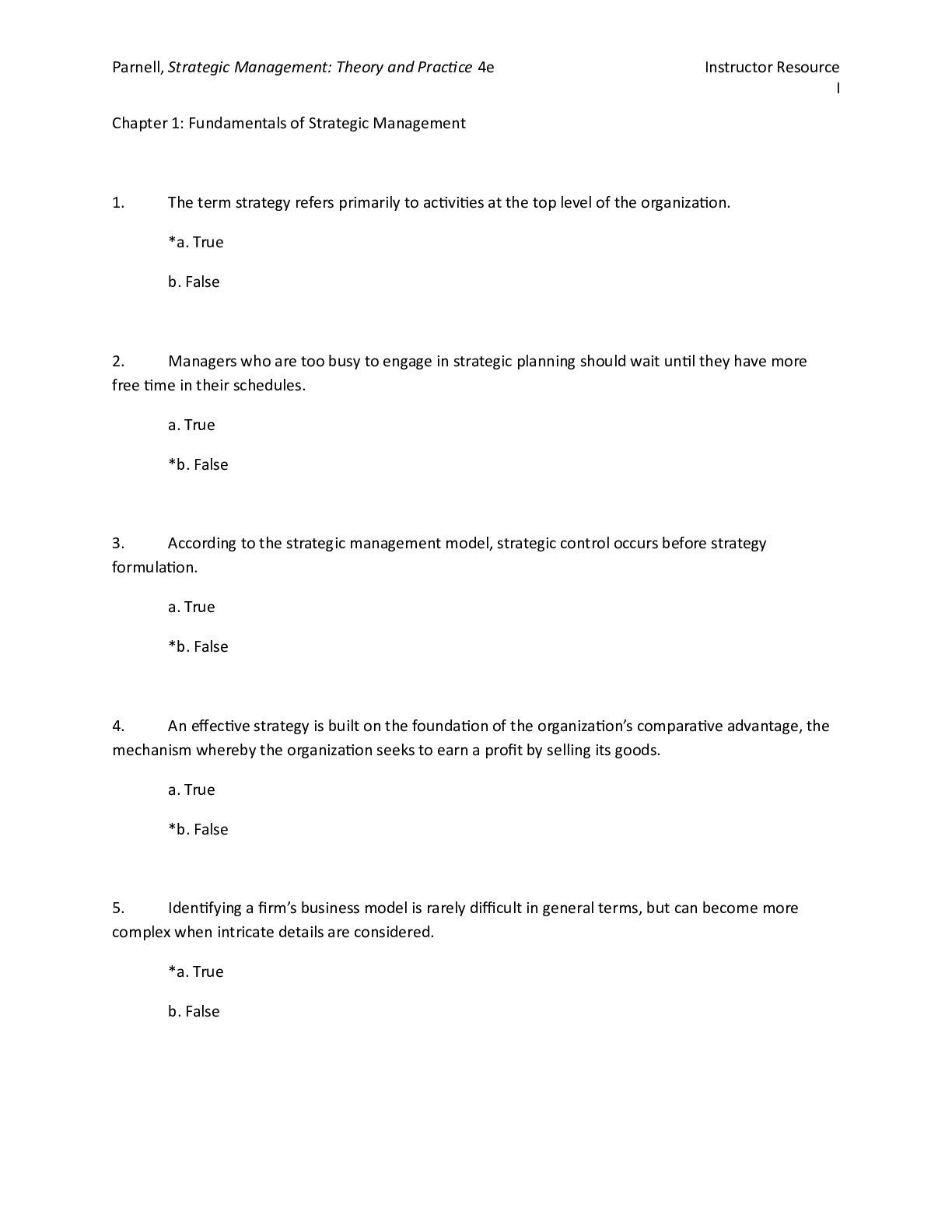

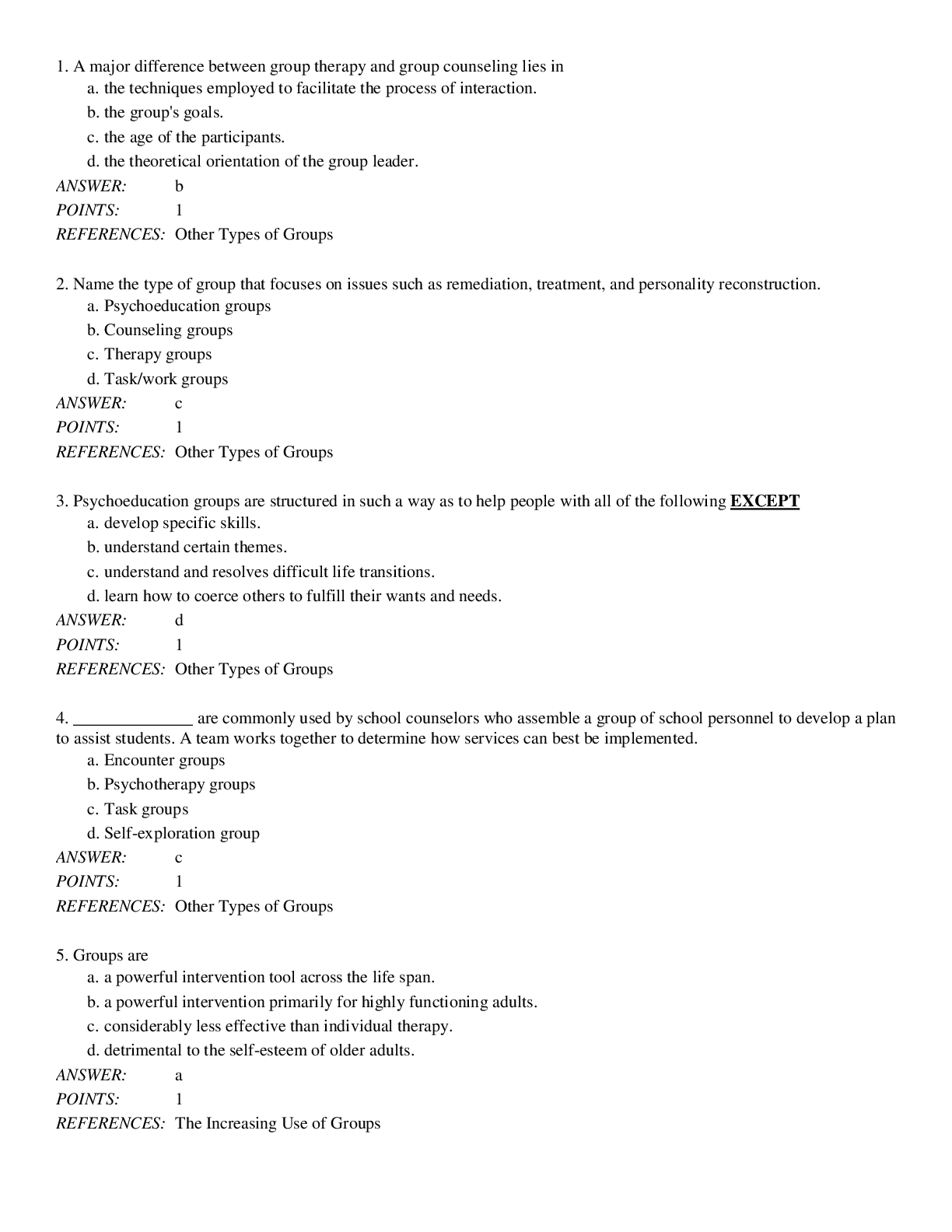

Solution Manual For Financial Management Theory and Practice 4CE Eugene F. Brigham Michael C. Ehrhardt Jerome Gessaroli Richard R. Nason Chapter 1-24 Chapter 1 An Overview of Financial Manageme... nt and the Financial Environment ANSWERS TO END-OF-CHAPTER QUESTIONS 1-1 a. A proprietorship, or sole proprietorship, is a business owned by one individual. A partnership exists when two or more persons associate to conduct a business. In contrast, a corporation is a legal entity created by provincial or federal laws. The corporation is separate and distinct from its owners and managers. b. In a limited partnership, limited partners’ liabilities, investment returns, and control are limited, while general partners have unlimited liability and control. The primary benefit of a limited liability partnership (LLP) is the protection it offers partners to liability exposure from their other partners’ professional negligence. Individual partners still maintain unlimited liability for their own negligence or negligence of those they directly supervise. A professional corporation (PC) has most of the benefits of incorporation but the participants are not relieved of professional (malpractice) liability. c. Shareholder wealth maximization is the appropriate goal for management decisions. The risk and timing associated with expected earnings per share and cash flows are considered in order to maximize the price of the firm’s common stock. d. A money market is a financial market for debt securities with maturities of less than one year (short-term). The New York money market is the world’s largest. Capital markets are the financial markets for long-term debt and corporate stock. The New York Stock Exchange and Toronto Stock Exchange are examples of capital markets. Primary markets are the markets in which newly issued securities are sold for the first time. Secondary markets are where securities are resold after initial issue in the primary market. The New York Stock Exchange and Toronto Stock Exchange are secondary markets [Show More]

Last updated: 1 week ago

Preview 1 out of 345 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 19, 2024

Number of pages

345

Written in

Additional information

This document has been written for:

Uploaded

Apr 19, 2024

Downloads

0

Views

8

.png)

.png)

.png)