Business > TEST BANK > Test Bank for Auditing and Assurance Services 17th Edition Arens, Answered (FULL TESTBANK) (All)

Test Bank for Auditing and Assurance Services 17th Edition Arens, Answered (FULL TESTBANK)

Document Content and Description Below

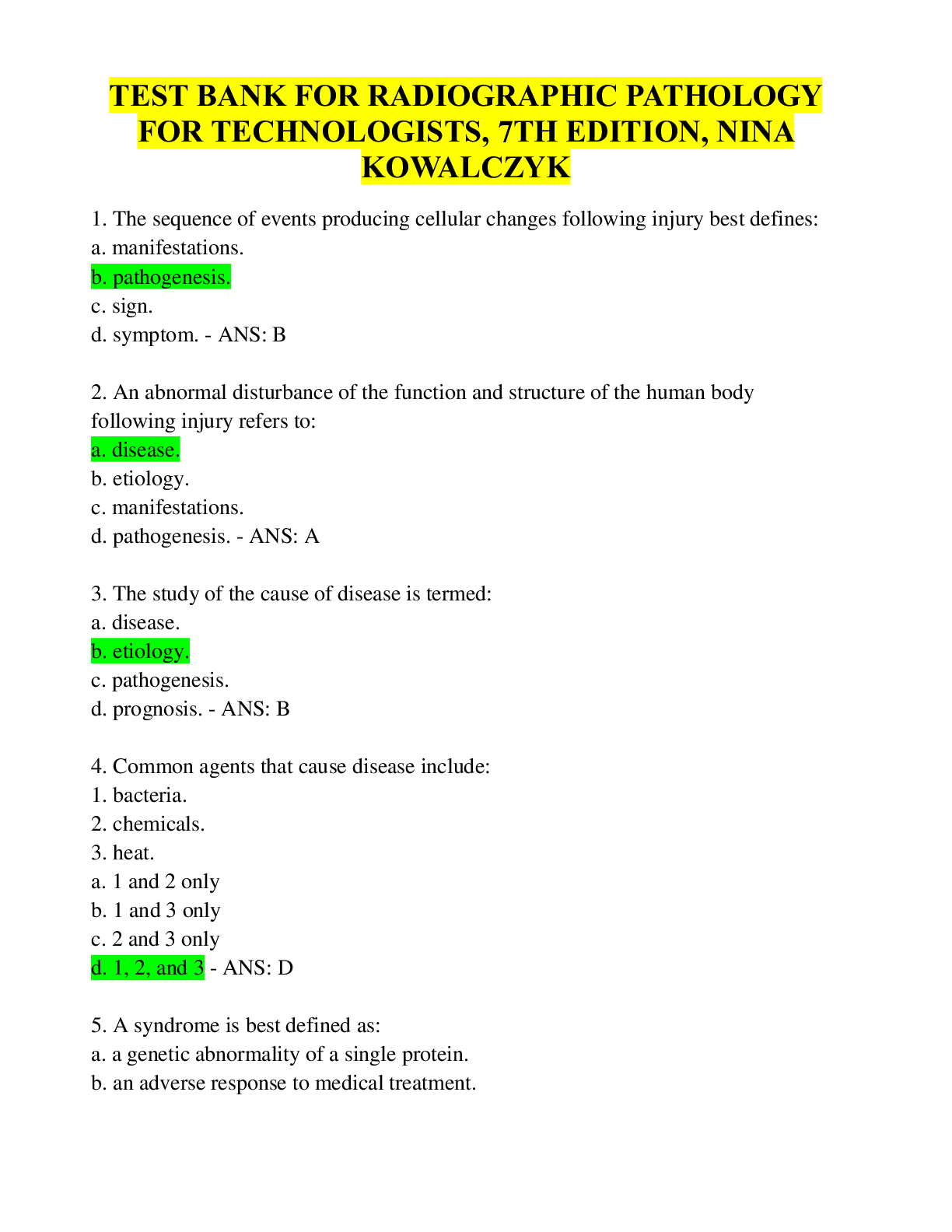

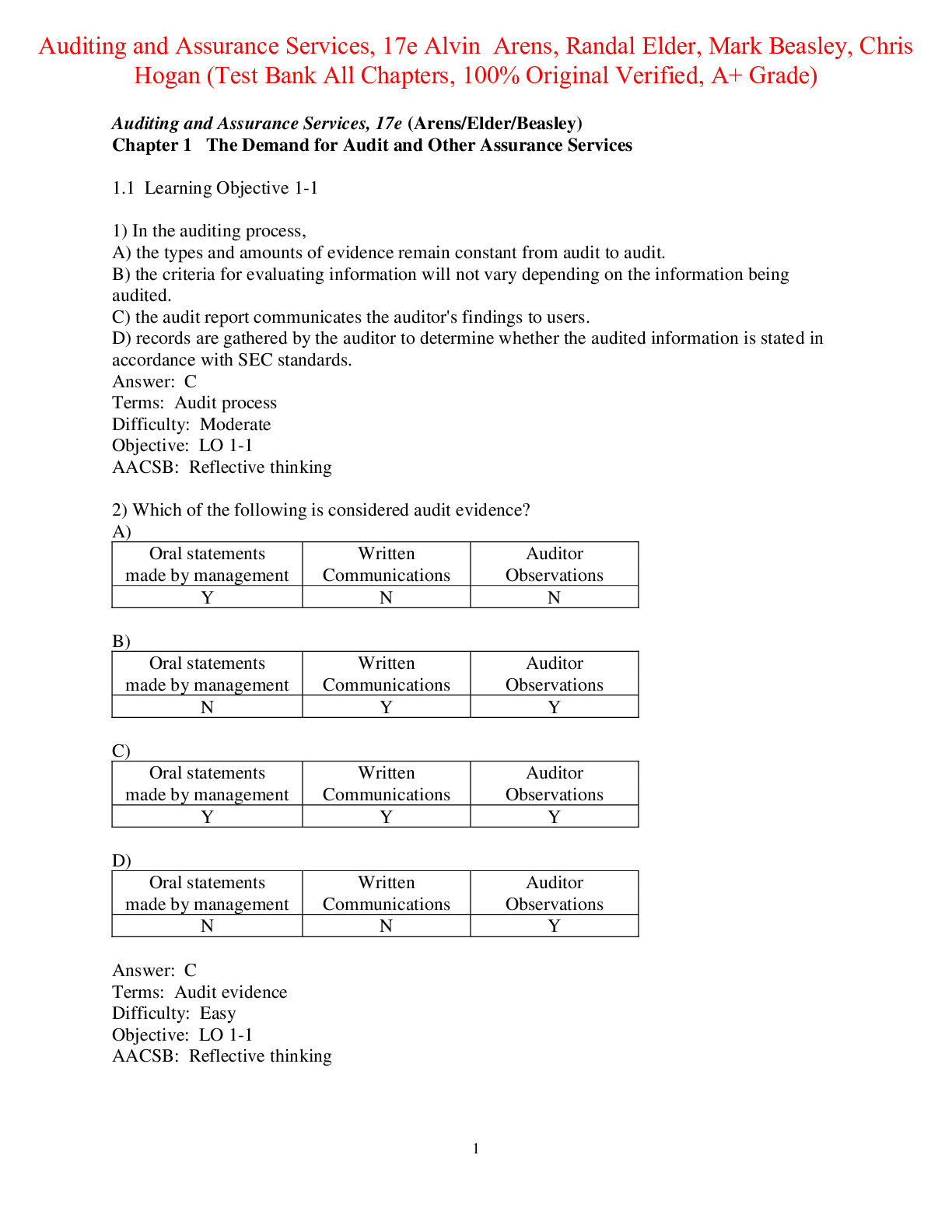

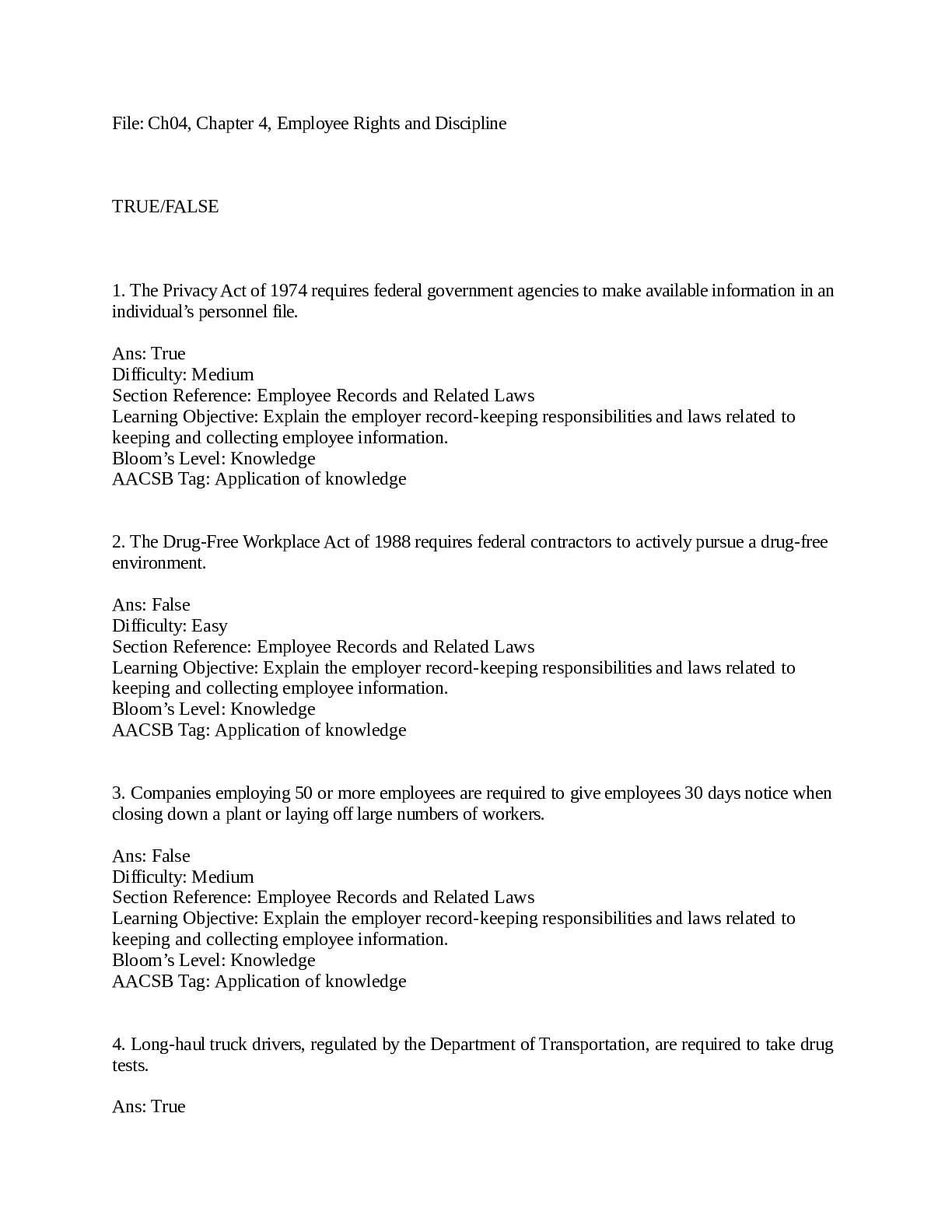

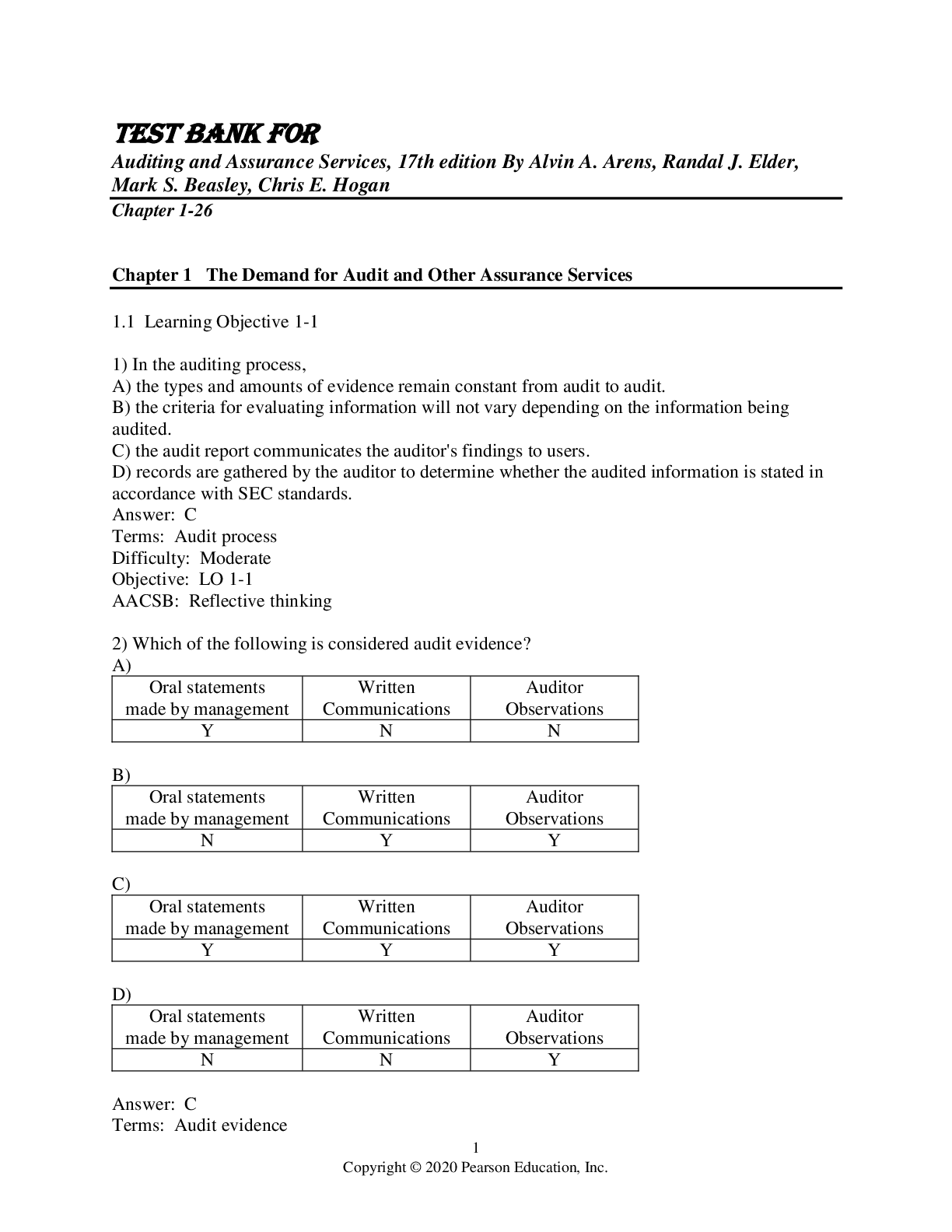

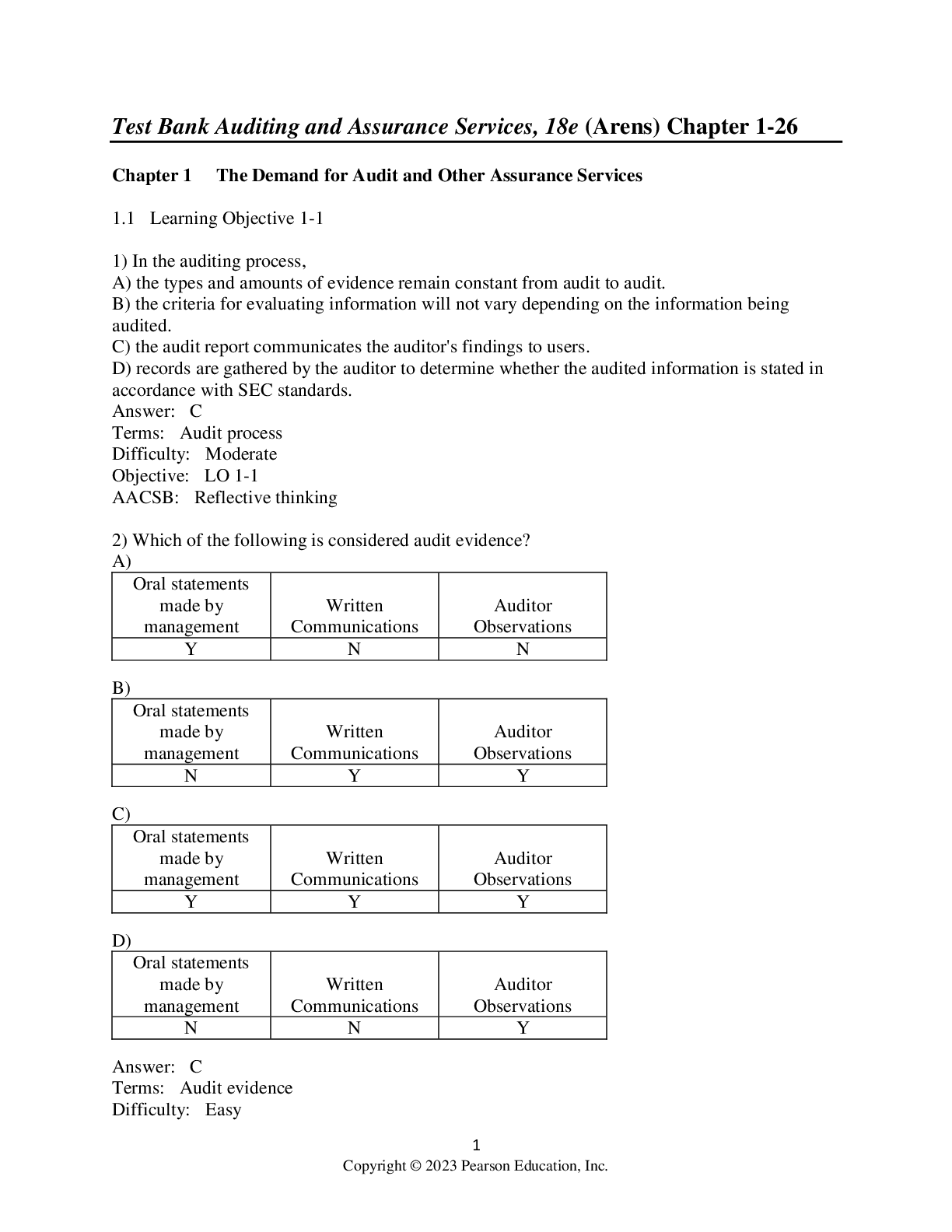

Test Bank for Auditing and Assurance Services 17th Edition Arens, Answered (FULL TESTBANK)-Learning Objective 1-1 1) The Sarbanes-Oxley Act applies to which of the following companies? A) All comp... anies B) Privately held companies C) Public companies D) All public companies and privately held companies with assets greater than $500 million Answer: C Terms: Sarbanes-Oxley Act Diff: Easy Objective: LO 1-1 AACSB: Reflective thinking skills Topic: SOX 2) Which of the following is considered audit evidence? A) Oral statements made by management Written Communications Auditor Observation Y N N B) Oral statements made by management Written Communications Auditor Observation N Y Y C) Oral statements made by management Written Communications Auditor Observation Y Y Y D) Oral statements made by management Written Communications Auditor Observation N N Y Answer: C Terms: Audit evidence Diff: Moderate Objective: LO 1-1 AACSB: Reflective thinking skills 3) Evidence is paramount to audit and attestation engagements. List the four basic types of audit evidence. Answer: The four types of audit and attestation evidence include: 1. Electronic and documentary data about transactions 2. Written and electronic communications with outsiders 3. Observations by the auditor 4. Oral testimony of the auditee (client) Terms: Basic types of audit evidence Diff: Easy Objective: LO 1-1 AACSB: Reflective thinking skills 4) The criteria by which an auditor evaluates the information under audit may vary with the information being audited. A) True B) False Answer: A Terms: Criteria which an auditor evaluates information Diff: Easy Objective: LO 1-1 AACSB: Reflective thinking skills 5) The criteria used by an external auditor to evaluate published financial statements are known as generally accepted auditing standards. A) True B) False Answer: B Terms: Criteria used by external auditor to evaluate published financial statements Diff: Easy Objective: LO 1-1 AACSB: Reflective thinking skills 6) The Sarbanes-Oxley Act establishes standards related to the audits of privately held companies. A) True B) False Answer: B Terms: Sarbanes-Oxley Act Diff: Easy Objective: LO 1-1 AACSB: Reflective thinking skills Topic: SOX 7) The Sarbanes-Oxley Act is widely viewed as having ushered in sweeping changes to auditing and financial reporting. A) True B) False Answer: A Terms: Sarbanes-Oxley Act Diff: Easy Objective: LO 1-1 AACSB: Reflective thinking skills Topic: SOX 8) An auditor must be competent and have an independent mental attitude. A) True B) False Answer: A Terms: Competence and independent mental attitude Diff: Easy Objective: LO 1-1 AACSB: Reflective thinking skills Learning Objective 1-2 1) Recording, classifying, and summarizing economic events in a logical manner for the purpose of providing financial information for decision making is commonly called: A) finance. B) auditing. C) accounting. D) economics. Answer: C Terms: Recording, classifying, and summarizing economic events Diff: Easy Objective: LO 1-2 AACSB: Reflective thinking skills 2) An accountant: A) must possess expertise in the accumulation of audit evidence. B) must decide the number and types of items to test. C) must have an understanding of the principles and rules that provide the basis for preparing the accounting information. D) must be a CPA. Answer: C Terms: Distinguishes auditors from accountants Diff: Moderate Objective: LO 1-2 AACSB: Reflective thinking skills 3) In "auditing" financial accounting data, the primary concern is with: A) determining whether recorded information properly reflects the economic events that occurred during the accounting period. B) determining if fraud has occurred. C) determining if taxable income has been calculated correctly. D) analyzing the financial information to be sure that it complies with government requirements. Answer: A Terms: Auditing financial accounting data primary concern Diff: Moderate Objective: LO 1-2 AACSB: Reflective thinking skills 4) The trait that distinguishes auditors from accountants is the: A) auditor's ability to interpret accounting principles generally accepted in the United States. B) auditor's education beyond the Bachelor's degree. C) auditor's ability to interpret FASB Statements. D) auditor's accumulation and interpretation of evidence related to a company's financial statements. Answer: D Terms: Distinguishes auditors from accountants Diff: Challenging Objective: LO 1-2 AACSB: Reflective thinking skills 5) Discuss the differences and similarities between the roles of accountants and auditors. What additional expertise must an auditor possess beyond that of an accountant? Answer: The role of accountants is to record, classify, and summarize economic events in a logical manner for the purpose of providing financial information for decision making. To provide relevant information, accountants must have a thorough understanding of the principles and rules that provide the basis for preparing the accounting information. In addition, accountants must develop a system to ensure that the entity's economic events are properly recorded on a timely basis and at a reasonable cost. The role of auditors is to determine whether the recorded information prepared by accountants properly reflects the economic events that occurred during the accounting period. Because U.S. or international standards provide the criteria for evaluating whether financial information is properly recorded, auditors must thoroughly understand those accounting standards. In addition to understanding accounting, the auditor must possess expertise in the accumulation and interpretation of audit evidence. It is this expertise that distinguishes auditors from accountants. Determining the proper audit procedures, deciding the number and types of items to test, and evaluating the results are unique to the auditor. Terms: Roles of accountants and auditors Diff: Moderate Objective: LO 1-2 AACSB: Reflective thinking skills [Show More]

Last updated: 9 months ago

Preview 1 out of 798 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 03, 2023

Number of pages

798

Written in

Additional information

This document has been written for:

Uploaded

Aug 03, 2023

Downloads

0

Views

79

Including NCLEX Exam Q&As With Rationales.png)

Test Bank With Rationales.png)