Finance > EXAM > Money, Financial Markets, and Monetary Policy Exam 1 with complete solution(Graded A Exam) (All)

Money, Financial Markets, and Monetary Policy Exam 1 with complete solution(Graded A Exam)

Document Content and Description Below

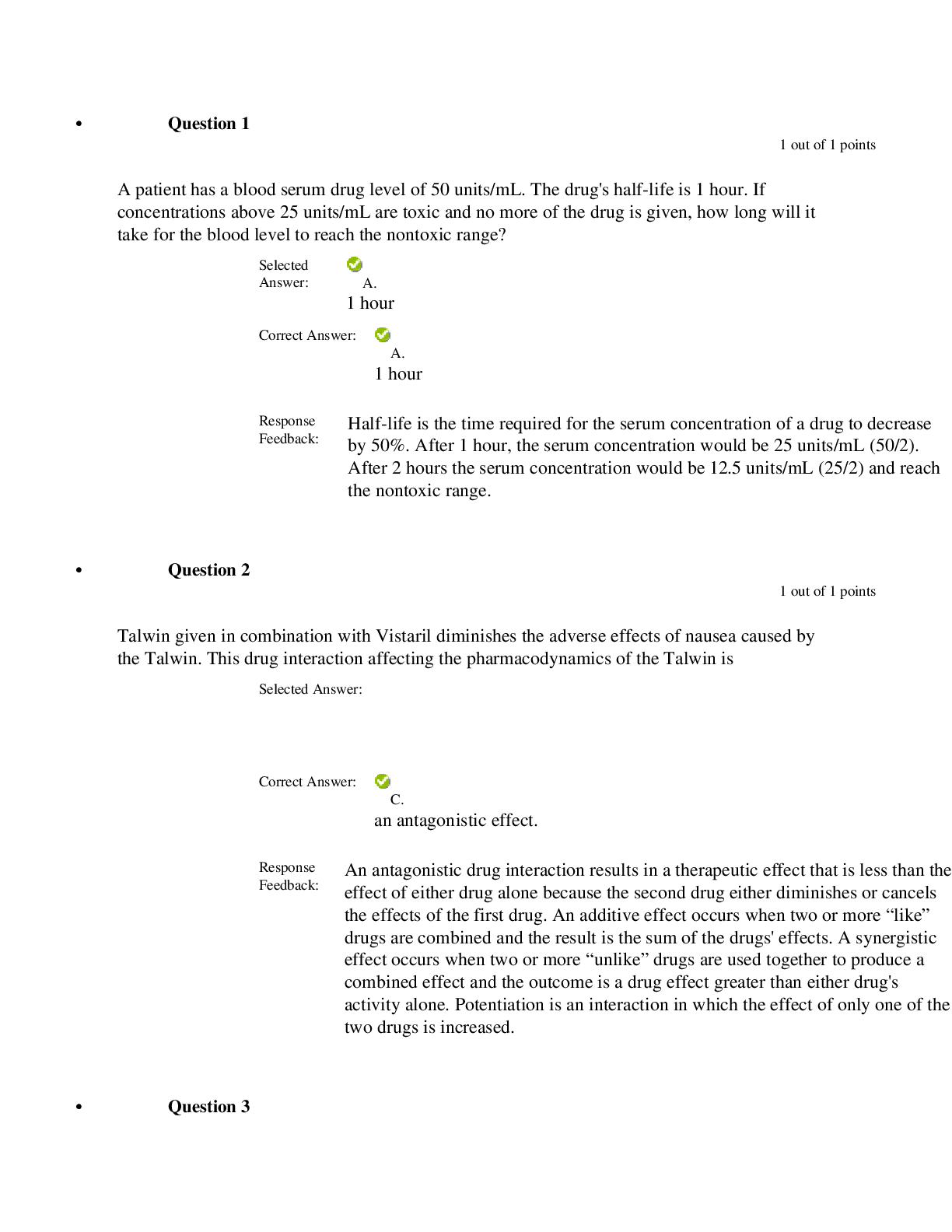

Money, Financial Markets, and Monetary Policy Exam 1 Question 1 of 28 Which of the following is considered money in our economy? Currency Savings account Hourly wage Car loan Question 2 of 28 ... True or false. Fiat money is counterfeit money. True False Question 3 of 28 The M2 definition of the money supply includes all of the following, except money market accounts. currency. savings accounts. U.S. savings bonds. Question 4 of 28 As a result of the National Banking Act of 1863, state-chartered banks ____________ (dropped state charters and obtained federal charters/increased interest rates/increased the usage of checking accounts/increased the usage of banknotes). dropped state charters and obtained federal charters increased the usage of checking accounts increased interest rates increased the usage of banknotes Question 5 of 28 True or false. One reason why individuals hold on to money is that it allows you to complete transactions. True False Question 6 of 28 "Fill in the blank" question: select the correct answer. Federal reserve policy affects the money supply curve. Question 7 of 28 What is the effect on interest rates if the Federal Reserve decides to decrease the money supply? Interest rates will decrease. The Federal Reserve cannot change the money supply. Interest rates will not change. Interest rates will increase. Question 8 of 28 True or false. If the Federal Reserve decides to raise interest rates, it will now be more costly for businesses to borrow money and invest in new opportunities, and the aggregate demand curve will decrease. True False Question 9 of 28 An increase in the money supply would result in no change in the economy. economic growth. economic decline. an increase in money demand. Question 10 of 28 "Fill in the blank" question: select the correct answer. Wall Street National Bank makes a loan to Appleseed Lawncare for $15,000. The effect on the Wall Street National Bank’s balance sheet is that assets increase by $15,000 and reserves decrease by $15,000 . Question 11 of 28 True or false. If there is a $20,000 increase in checkable deposits at a bank, with a reserve ratio of 0.25, the total effect on the money supply is $5,000. True False Question 12 of 28 "Fill in the blank" question: select the correct answer. One of the functions of the Federal Reserve is to the “lender of last resort,” which means that banks can always borrow money from the Federal Reserve. Question 13 of 28 The Federal Open Market Committee (FOMC) is in charge of conducting monetary policy that the Federal Reserve directs. Which of the following are members of the FOMC? The President of the United States Secretary of the Treasury Chairman of the Federal Reserve Question 14 of 28 The Federal Reserve is in charge of interest rates in the United States. However, it is not in charge of government spending. reserve ratio. monitoring banks. bank regulation. Question 15 of 28 Which agency controls the money supply? The Federal Reserve The FDIC Banks The U.S. government Question 16 of 28 Suppose the FOMC (Federal Open Market Committee) decides to buy bonds from banks. What is the effect on the interest rate? There is no change in interest rates. Interest rates decrease. Interest rates rise. The FOMC cannot buy bonds from banks. Question 17 of 28 When interest rates are lowered by the Federal Reserve, what must banks do? Lend out more money. Make their own lending decisions. Lend out less money. Raise interest rates. Question 18 of 28 Which of the following is one of the tools that the Federal Reserve utilizes to implement monetary policy? Investment demand Money supply Tax rates on individuals Money demand Question 19 of 28 If the Federal Reserve is selling bonds in the open market, what is its objective for the economy? Increasing GDP Increasing the price level Keeping the GDP the same Decreasing GDP Question 20 of 28 What is the fundamental difference in the Classical and Keynesian viewpoints on monetary policy? Changes in the money supply affect net exports rather than investment. GDP decreases only when the interest rate decrease. GDP increases only when the interest rates increase. Changes in the money supply affect spending directly versus indirectly. Question 21 of 28 Based on the investment demand curve, which group of people feel that the businesses and consumers are responsive to changes in the interest rates? Democrats Republicans Classical economists Keynesian economists Question 22 of 28 What is the average length of time it takes for monetary policy to have its full impact on an economy? 6 months 1 ½ - 2 years 5 years 10 years Question 23 of 28 What is the effect of expansionary monetary policy on major trading partners? The United States will buy less imports. The United States will buy more imports. Major trading partners will buy fewer exports. There is no change with major trading partners. Question 24 of 28 What were the results of monetary policy during the 1980s and 1990s? Decreased nominal interest rates and increased real interest rates Increased nominal interest rates and decreased real interest rates Decreased nominal interest rates and decreased real interest rates Increased inflation rates and increase nominal interest rates Question 25 of 28 If the Federal Reserve has a target of interest rates to be at 4% when they are currently at 6%, can the Federal Reserve decrease high levels of inflation, and if so, how? Yes, by pursuing contractionary monetary policy Yes, by pursuing expansionary monetary policy Yes, the Federal Reserve could require Congress to cut spending. No, the Federal Reserve cannot reduce inflation and hit their interest rate target. Question 26 of 28 If the federal funds rate is at 2% and the target is for 5%, what is the effect on prime rate? Prime rate would also be at 5%. Prime rate would increase to 8%. Prime rate would increase by 5%. Prime rate does not change as the federal funds rate changes. Question 27 of 28 Which policy is more effective: targeting the money supply or interest rates? Targeting the money supply is more effective. It depends upon who is the Chairman of the Federal Reserve. Both policies can be effective or ineffective. Targeting the interest rate is more effective. Question 28 of 28 What policy does the Federal Reserve need to pursue if the targeted money supply is greater than the current money supply? No change in policy; just allow time for the money supply to increase naturally. Expansionary monetary policy Expansionary fiscal policy Contractionary monetary policy [Show More]

Last updated: 1 year ago

Preview 1 out of 8 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jan 26, 2021

Number of pages

8

Written in

Additional information

This document has been written for:

Uploaded

Jan 26, 2021

Downloads

0

Views

43

.png)