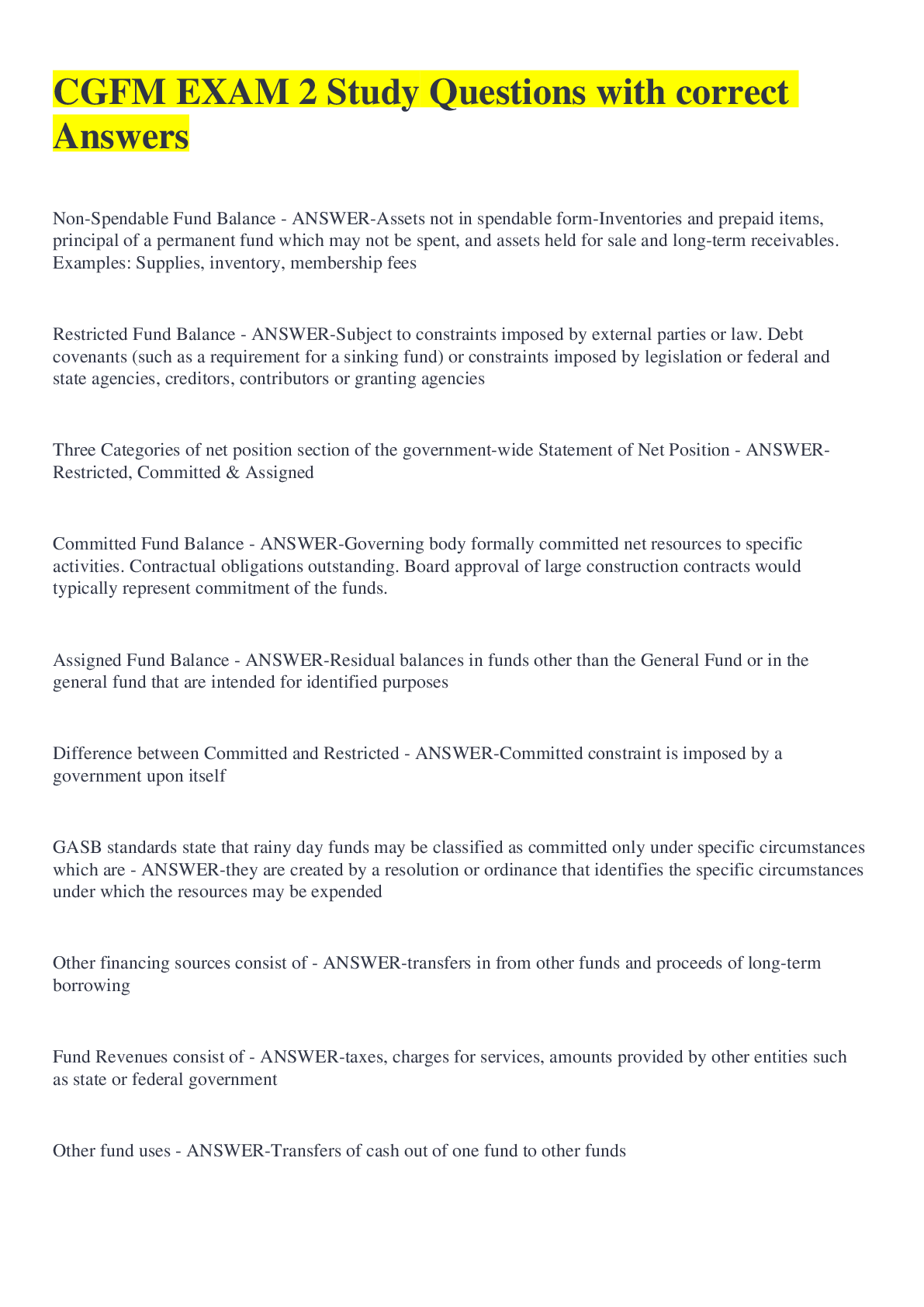

CGFM EXAM 2 Study Questions with correct Answers

Document Content and Description Below

Non-Spendable Fund Balance - ANSWER-Assets not in spendable form-Inventories and prepaid items, principal of a permanent fund which may not be spent, and assets held for sale and long-term receivables... . Examples: Supplies, inventory, membership fees Restricted Fund Balance - ANSWER-Subject to constraints imposed by external parties or law. Debt covenants (such as a requirement for a sinking fund) or constraints imposed by legislation or federal and state agencies, creditors, contributors or granting agencies Three Categories of net position section of the government-wide Statement of Net Position - ANSWER-Restricted, Committed & Assigned Committed Fund Balance - ANSWER-Governing body formally committed net resources to specific activities. Contractual obligations outstanding. Board approval of large construction contracts would typically represent commitment of the funds. Assigned Fund Balance - ANSWER-Residual balances in funds other than the General Fund or in the general fund that are intended for identified purposes Difference between Committed and Restricted - ANSWER-Committed constraint is imposed by a government upon itself GASB standards state that rainy day funds may be classified as committed only under specific circumstances which are - ANSWER-they are created by a resolution or ordinance that identifies the specific circumstances under which the resources may be expended Other financing sources consist of - ANSWER-transfers in from other funds and proceeds of long-term borrowing Fund Revenues consist of - ANSWER-taxes, charges for services, amounts provided by other entities such as state or federal government Other fund uses - ANSWER-Transfers of cash out of one fund to other funds To recognize revenue from the General Fund transferred to a debt service fund to record payments of interest and principal on general obligation debt - ANSWER-Credit General Fund Tax Revenue Debit General Fund Other Financing Uses-Transfers Out Debit Debt Service Fund Other Financing Sources - Transfer In Credit Debt Service Fund Expenditures Fund Budgetary Accounts - ANSWER-Estimated Revenues, Appropriations, Estimated Other Financing Sources, Estimated Other Financing Uses, Encumbrances Fund Activity Accounts - ANSWER-Revenues, Expenditures, Other Financing Sources, Other Financing Uses Fund Revenues - ANSWER-Tax Revenues, Charges for Services Fund Expenditures - ANSWER-Current, Capital Outlay, Debt Service Other Financing Sources - ANSWER-Transfers In, Debt Proceeds Other Financing Uses - ANSWER-Transfers Out When a PO or Contract is issued as authorized by an appropriation the government recognizes this commitment as - ANSWER-An encumbrance (not yet a liability) JE for City Council approves fiscal year budget for General Fund JE for Financial Statement Accounts - ANSWER-DR Estimated Revenues CR Appropriations Budgetary Fund Balance is a CR NONE JE for City Departments issue PO for goods and services JE for Financial Statement Accounts - ANSWER-DR Encumbrances Control CR Budgetary Fund Balance Reserve for Encumbrances (To Establish the Encumbrance) NONE JE for Goods and Services are received and invoices are presented for payment JE for Financial Statement Accounts - ANSWER-DR Budgetary Fund Balance Reserve for Encumbrances CR Encumbrances Control DR Expenditures (Current) CR Accounts Payable (to Record the Liability) Common form of nonexchange transactions - ANSWER-tax revenue and intergovernmental grants Nonexchange transaction eligibility requrements - ANSWER-Characteristics/Time/Reimbursement/Contingencies-Matching funds Imposed nonexchange transactions - ANSWER-taxes and other assessments imposed by governemnts not derived from underlying transactions. (Property Tax, special assessments, fines and forfeits) Deferred taxes are reported as what on the Balance Sheet - ANSWER-Reported as deferred inflows of resources What are deferred taxes - ANSWER-Taxes expected to be received more than 60 days after fiscal year end. Derived Taxes - ANSWER-taxes assessed on exchange transactions (sales taxes, income taxes, gasoline tax, excise tax) Revenues - ANSWER-Inflows of net financial resources from sources other than inter-fund transfers and debt proceeds. Recognized when they are both measurable and available to finance current expenditures Expenditures - ANSWER-Outflows of net financial resources from sources other than inter-fund transfers that are recognized when a governmental fund incurs a liability pursuant to budgetary authority provided by appropriation Fund Balance - ANSWER-The net position (assets less liabilities) of a governmental fund, which can be classified as non-spendable, restricted, committed, assigned, or unassigned. Estimated revenues are recorded as DR or CR - ANSWER-Debit Actual Revenues are recorded as DR or CR - ANSWER-Credit Estimated Revenue not yet Realized recorded as DR or CR - ANSWER-Generally net DR balance When are appropriations considered to be expended - ANSWER-When authorized liabilities are incurred When does a PO or contract result in liability - ANSWER-When the goods or services are received or a contract is executed What is the JE for PO or Contract issued - ANSWER-DR Encumbrances Control Account CR Budgetary Fund Balance-Reserve for Encumbrances Account What JEs are necessary when goods or services are received or contracts are executed - ANSWER-DR Budgetary Fund Balance - reserve for Encumbrances Account CR Encumbrances Control Account DR Expenditures Control CR Liability Account (for amount to be paid) Character classification - ANSWER-Separates expenditures by the fiscal period they are assumed to benefit and include current, capital outlay, and debt service Functional classification - ANSWER-Reflect major activities or programs of the government. Often performed by more than one department such as public safety, which might include the police and fire departments Classification methods - ANSWER-Character, functional, organizational unit (public safety, education), activity, and object Activity classification - ANSWER-Specific lines of work performed within a department (solid waste collection, waste disposal) Object classification - ANSWER-Item or service used (supplies, personnel services, contracted services) Is encumbrance procedure always needed? - ANSWER-No salaries and wages are often not recorded as encumbrances Permanent Funds - ANSWER-Account for resources provided under trust agreements that are restricted so that only earnings may be expended for purposes that benefit the public Capital Projects Funds - ANSWER-Account for and report financial resources taht are restricted, committed, or assigned to expenditure for capital outlays. Debt Service Funds - ANSWER-Account for and report financial resources that are restricted, committed, or assigned to expenditure for principal and interest Special Revenue Funds - ANSWER-Account for and report the proceeds of special revenue sources that are restricted or committed to expenditure for a specified purpose other than debt service or capital projects General Fund - ANSWER-Accounts for and reports all financial resources not accounted for and reported in other funds Inter-fund transfers - ANSWER-transfer flows of cash or other assets without a requirement for repayment. Annual transfer of resources from the General Fund to a debt service fund - ANSWER-Inter-fund transfer classified as other financing sources (debt service fund) and other financing uses (General fund) Inter-fund services provided and used - ANSWER-transactions involving sales and purchases of goods and services between funds. Sale of water from water utility (enterprise) fund to the General Fund - ANSWER-Enterprise fund records a revenue General fund records an expenidture Inter-fund reimbursements - ANSWER-repayments to the funds that initially recorded expenditures or expenses by the funds responsible General fund buys stamps that should have been charged to the special revenue fund. Show reimbursement - ANSWER-DR Expenditure (Special revenue fund) CR Cash DR Cash (General Fund) CR Expenditure Tax anticipation note (TAN) is received from local bank. Record JE for 200,000 TAN - ANSWER-DR Cash 200,000 CR Tax Anticipation Notes Payable 200,000 Payment of Liabilities for Accounts Payable (135,000) and Amount due Federal Government (30,000) as of the end of previous year Record JE - ANSWER-DR Accounts Payable 135,000 DR Due to Federal Government 30,000 CR Cash 165,000 Record entry of PO for materials and supplies for 826,000 - ANSWER-DR Encumbrances Control 826,000 CR Budgetary Fund Bal-Reserve for Encumbrances 826,000 Record Property Tax Levy of $3,265,306. It is estimated that 2% will be noncollectable considering local economic conditions - ANSWER-DR Taxes Receivable 3,265,306 CR Estimated Uncollectible Taxes 65,306 CR Revenues Control 3,200,000 Current year delinquent taxes in amount of $330,000 are collected on which interest and penalties of $20,000 had been accrued last period and $3,000 was collected for the period from first day current period until collection. JE - ANSWER-DR Interest and Penalties Receivable 3,000 CR Revenues Control 3,000 To record additional interest of current period DR Cash 353,000 CR Taxes Receivable 330,000 CR Interest & Penalties Receivable 23,000 Record Collection of Current Taxes - ANSWER-DR Cash 2,700,000 CR Taxes Receivable 2,700,000 Record Sales Tax during 2017 of $1,350,000 and $60,000 of sales tax during final week of 2016 received Jan 2017 - ANSWER-DR Cash 1,350,000 DR Due from State Gov 60,000 CR Revenues Control 1,410,000 Record Revenue from collection for year of $1,450.000 - ANSWER-DR Cash 1,450,000 CR Revenue Control 1,450,000 Repayment of Tax Anticipation Notes (TAN) & Interest - ANSWER-DR Tax Anticipation Notes Payable 200,000 DR Expenditures Control (Int pay) 5,000 CR Cash 205,000 Record receipt of materials and supplies encumbered with PO issued for 821,000. Invoices total 820,300. Part of invoices are for 45,000 issued prior year - ANSWER-DR Budgetary Fund Balance-reserved for encumbrances 821,000 CR Encumbrances Control 821,000 (To remove encumbrance for PO) DR Expenditures Control (prior year) 45,000 DR Expenditures Control 775,300 CR Accounts Payable 820,300 Gross pay is charged against the appropriations of the individual departments through a subsidiary ledger (not presented). Deductions from gross pay for the period amounted to $78,000 for employees' state income tax withholding and $686,000 due to the federal government ($430,000 for federal income tax withholding and $256,000 for the employees' share of Social Security and Medicare taxes) - ANSWER-DR Expenditures Control......3,345,000 CR Due to Federal Government..... 686,000 (430000+256000) CR Due to State Government.............. 78,000 CR Wages Payable............................... 2,581,000 DR Wages Payable................. 2,581,000 CR Cash.............................................. 2,581,000 Entity is liable for the employer's share of Social Security tax and Medicare tax ($256,000) and for contributions to additional retirement funds established by state law (assumed to amount to $167,000 for the year). - ANSWER-DR Expenditures Control................... 423,000 CR Due to Federal Government................. 256,000 CR Due to State Government......................... 167,000 [Show More]

Last updated: 1 year ago

Preview 1 out of 17 pages

Reviews( 0 )

Recommended For You

*NURSING> EXAM > How is descriptive data valuable to the nurse researcher? Module 5 Quiz complete test with correct answers (All)

How is descriptive data valuable to the nurse researcher? Module 5 Quiz complete test with correct answers

Module 5 Quiz Question 1 0.2 / 0.2 pts How is descriptive data valuable to the nurse researcher? Question 2 0.2 / 0.2 pts Which of the following would be an example of descriptive data...

By Stuvia , Uploaded: Jan 12, 2021

$12

*NURSING> EXAM > NURS 6521 FINAL EXAM TEST PREP(TEST BANK ) 78 PAGES WITH OVER 300 Questios All With Correct Answers Graded A ;LATEST SOLUTIONS (All)

NURS 6521 FINAL EXAM TEST PREP(TEST BANK ) 78 PAGES WITH OVER 300 Questios All With Correct Answers Graded A ;LATEST SOLUTIONS

NURS 6521 FINAL EXAM TEST PREP

By Good grade , Uploaded: Aug 23, 2020

$15

HESI Exit RN> EXAM > PN HESI EXIT EXAM [STUDY OF LPN/LVN] LATEST UPDATE 2023-2024 QUESTIONS WITH CORRECT ANSWERS A+ GRADE (All)

PN HESI EXIT EXAM [STUDY OF LPN/LVN] LATEST UPDATE 2023-2024 QUESTIONS WITH CORRECT ANSWERS A+ GRADE

PN HESI EXIT EXAM [STUDY OF LPN/LVN] LATEST UPDATE 2023-2024 QUESTIONS WITH CORRECT ANSWERS A+ GRADE 1. The LPN/LVN is planning care for the a client who has fourth degree midline laceration that o...

By Claire symon , Uploaded: Feb 03, 2024

$18

*NURSING> EXAM > MEDSURG ATI PROCTORED EXAM WITH CORRECT ANSWERS 2019 (All)

MEDSURG ATI PROCTORED EXAM WITH CORRECT ANSWERS 2019

MEDSURG ATI PROCTORED EXAM WITH CORRECT ANSWERS 2019 1. A nurse in an emergency department is preparing to perform an ocular irrigation for a client. Which of the following actions should the nurse p...

By tutorcwakuthii , Uploaded: Aug 18, 2023

$7

*NURSING> EXAM > RN VATI Adult Medical Surgical Questions with correct Answers 100% 2023 (All)

RN VATI Adult Medical Surgical Questions with correct Answers 100% 2023

RN VATI Adult Medical Surgical Questions with correct Answers 100% 2023 1. A nurse is caring for a client who has atopic dermatitis and a prescription for triamcinolone ointment. The nurse shou...

By tutorcwakuthii , Uploaded: Oct 01, 2023

$15

*NURSING> EXAM > HESI RN EXIT EXAM WITH CORRECT ANSWERS 2023 (All)

HESI RN EXIT EXAM WITH CORRECT ANSWERS 2023

HESI RN EXIT EXAM WITH CORRECT ANSWERS 2023 1. The nurse is has just admitted a client with severe depression. From which focus should the nurse identify a priority nursing diagnosis? A)...

By tutorcwakuthii , Uploaded: Oct 01, 2023

$13

*NURSING> EXAM > NR 601 Midterm Exam with correct answers (All)

NR 601 Midterm Exam with correct answers

NR 601 Midterm Exam with correct answers 1. A client is newly diagnosed with type 2 diabetes mellitus. Which diagnostic test will best evaluate the management plan prescribed for this client? Quart...

By tutorcwakuthii , Uploaded: Sep 21, 2023

$10

*NURSING> EXAM > RN ADULT MEDICAL SURGICAL 2023 EXAM WITH CORRECT ANSWERS. (All)

RN ADULT MEDICAL SURGICAL 2023 EXAM WITH CORRECT ANSWERS.

RN ADULT MEDICAL SURGICAL 2023 EXAM WITH CORRECT ANSWERS. 1. A nurse is assessing a client who has a diagnosis on colon cancer which of the following should the nurse expect? a) Statorrhea b)...

By tutorcwakuthii , Uploaded: Sep 21, 2023

$9

*NURSING> EXAM > PN Hesi Exit V1 2023 Questions with correct answers (All)

PN Hesi Exit V1 2023 Questions with correct answers

PN Hesi Exit V1 2023 Questions with correct answers 1) The LPN/LVN is planning care for the a client who has fourth degree midline laceration that occurred during vaginal delivery of an 8 pound 1...

By tutorcwakuthii , Uploaded: Sep 22, 2023

$10

*NURSING> EXAM > NR 503 REVIEW EXAM QUESTIONS WITH CORRECT ANSWERS (All)

NR 503 REVIEW EXAM QUESTIONS WITH CORRECT ANSWERS

NR 503 REVIEW EXAM QUESTIONS WITH CORRECT ANSWERS 1. The nurse practitioner is reviewing a recent study that utilizes analytic epidemiology by means of a cohort study design. The cohort study desi...

By tutorcwakuthii , Uploaded: Oct 01, 2023

$5

Document information

Connected school, study & course

About the document

Uploaded On

Jan 13, 2023

Number of pages

17

Written in

Additional information

This document has been written for:

Uploaded

Jan 13, 2023

Downloads

0

Views

43